Exploring the Power Behind Trend Line Studies in Forex

Successful traders always follow the line of least resistance – Jesse […]

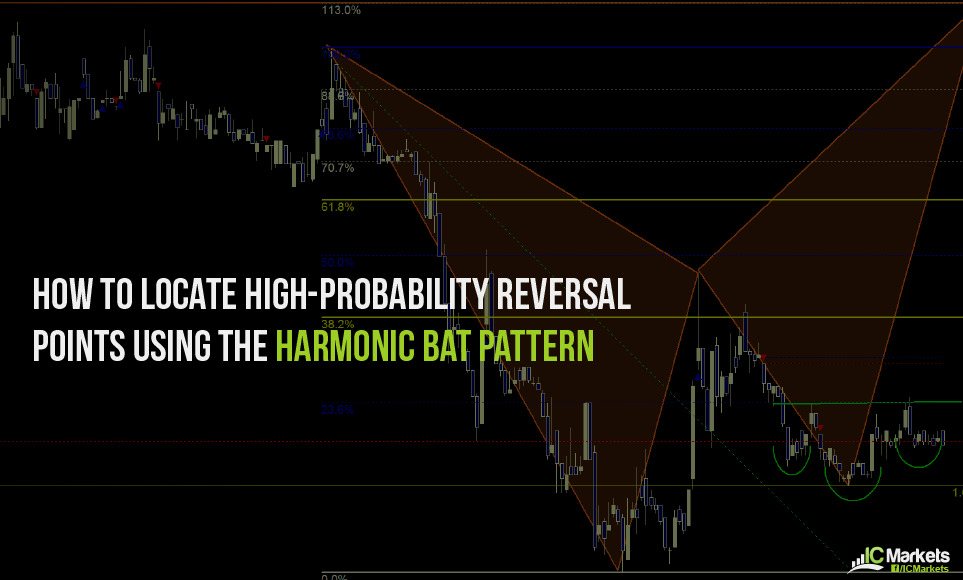

Locate High-Probability Reversals Using the Harmonic Bat Pattern

Developed by Scott Carney, the harmonic bat pattern, a variation of the Gartley harmonic pattern, is a 5-point retracement structure composed of Fibonacci measurements used to create a potential reversal zone, or PRZ.

Using a Multi-Timeframe Approach

‘It pays to know where you are in the bigger picture’. […]

Trading Confluence: a High-Probability Approach

Many of the best traders began their careers on a frustrating […]

How to Use Yearly, Monthly and Weekly Opening Points

Updated February 2020. Markets ebb and flow; they advance, decline and […]

Making Sense of Basic Order Types: A MUST For All Traders

Without a clear understanding of different order types, success within the […]

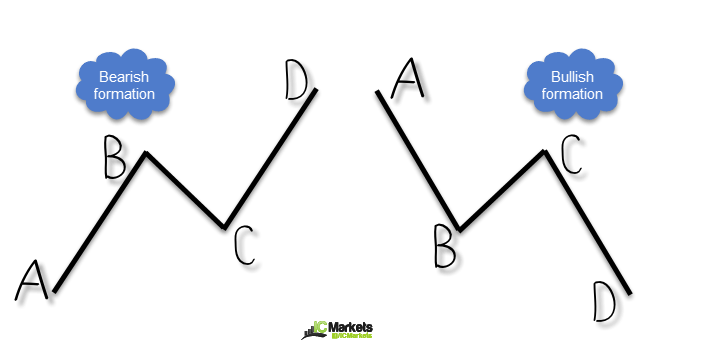

Harmonic Patterns: What is an AB=CD Formation?

Updated November 2020 All financial markets create trends and identifiable patterns. […]

Price Action: A Beginner’s Guide

Viewing a chart for the first time is generally both hypnotic […]

Identifying Support and Resistance in the Foreign Exchange Market

Markets move in the path of least resistance Two of the […]