Key risk events today:

Swiss CPI m/m; EUR CPI Flash Estimate y/y; Canada Trade Balance; US ISM Non-Manufacturing PMI.

EUR/USD:

EUR/USD buyers entered an offensive phase Monday, adding 35 points, or 0.34%. The pair gathered traction on the back of upbeat Eurozone services PMIs and a better-than-anticipated Sentix index, released early London. This lifted the H4 candles to the 1.12 handle, where price remained into the close. Also of interest is January’s opening level, hovering above 1.12 at 1.1222, and a nearby bearish ABCD correction (black arrows) around 1.1208.

On a wider perspective, weekly movement, as highlighted in Monday’s technical briefing, is testing channel resistance, extended from the high 1.1569. Noticeable downside objectives fall in around the 2016 yearly opening level at 1.0873 and channel support, taken from the low 1.1109. A break higher, on the other hand, has the 2019 yearly opening level to target at 1.1445. Overall, according to the weekly timeframe, the primary downtrend has remained south since early 2018.

A closer reading of price action on the daily time frame has the unit defending the top edge of its 200-day SMA (orange – 1.1141), positioned a few points north of the 50-day SMA (blue – 1.1092). We also remain compressing within a local (reasonably small) ascending channel configuration (1.0981/1.1199), formed inside a larger ascending channel formation taken from 1.0879/1.1179. In terms of support/resistance on this scale, Quasimodo resistance plotted at 1.1348 is in view, as is nearby support at 1.1072 (boasts an incredibly strong history since early August 2019) and another layer of support coming in at 1.0990.

Areas of consideration:

As weekly price tests channel resistance, long-term sellers may look to make an appearance this week, potentially overthrowing the current 200-day SMA on the daily timeframe. A possible scenario, therefore, may be a ‘run of stops’ (a fakeout) through 1.12 to 1.1222 on the H4 timeframe. A decisive close beneath 1.12 from 1.1222 could be considered a healthy sell signal, knowing we have local buy stops above 1.12 acting as liquidity to sell into, along with weekly sellers potentially looking to explore lower ground. A move lower from 1.12 may target the 200-day SMA and noted local daily channel support as the initial port of call, followed by the 1.11 handle on the H4 timeframe.

A fakeout formed by way of a H4 bearish candlestick configuration is also something worth watching out for at 1.12, a shooting star candlestick pattern, for example (see chart for a visual). This helps identify seller intent and provides entry/risk levels to work with.

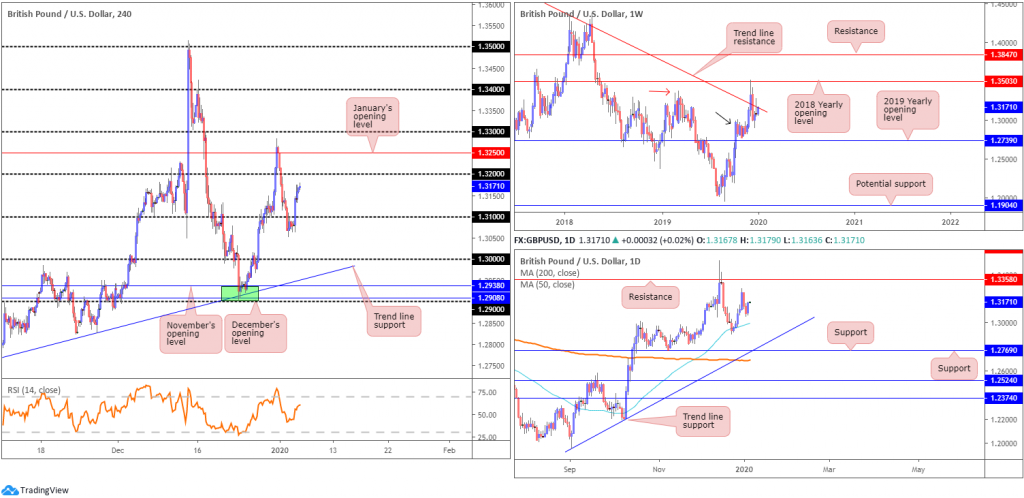

GBP/USD:

The British pound thrived vs. the buck Monday, reclaiming Friday’s losses and adding more than 90 points, or 0.69%. The dollar’s downbeat tone, amidst escalating US-Iran tensions, as well as independent impetus derived from upbeat final UK services PMI that beat consensus, GBP/USD advanced to highs just shy of the 1.32 handle. Beyond 1.32, resistance lies in the form of January’s opening level at 1.3250, whereas a turn lower at current price may lead to a revisit at 1.31.

Despite forming a shooting star candlestick pattern last week from long-standing trend line resistance, pencilled in from the high 1.5930, recent buying lifted weekly price back to its said trend line resistance. What’s also interesting from a technical perspective on the weekly time frame is the fact buyers are also attempting to defend nearby demand around the 1.2939 region (black arrow), likely seduced by the recent break of the notable high at 1.3380 (red arrow).

The 50-day SMA (blue – 1.2995) remains reasonably dominant support on the daily timeframe. Another layer of support that may enter the fight this week, though, is 1.2769, which happens to merge closely with trend line support, pencilled in from the low 1.1958 and the 200-day SMA (orange – 1.2687). With respect to resistance, the only level of interest right now sits at 1.3358, capping upside since mid-June 2019.

Areas of consideration:

1.32 is an obvious point of direction for many traders this morning, and could serve the market as resistance. There is not really much to hang our hat on in terms of confluence here, however, therefore waiting for additional candlestick confirmation might be a better path to explore before pulling the trigger.

A retest of 1.31 is also a possibility as support. The fact the H4 candles broke below the barrier and failed to follow through implies a fakeout occurred. As a result, unfilled buy orders may be lurking nearby 1.31, given the swift push back above the level. Like 1.32, though, additional candlestick confirmation is certainly something to consider here before committing to a position.

AUD/USD:

Limited movement was observed in AUD/USD Monday, represented in the shape of a daily doji indecision candle.

Daily support at 0.6927, nonetheless, moved into view as the US session got underway. A break of this level, based on the H4 time frame, exposes H4 trend line support, taken from the low 0.6754, the 0.69 handle and November’s opening level at 0.6892.

On more of a broader perspective, weekly action, since registering a bottom in late September at 0.6670, has been busy carving out what appears to be a rising wedge formation, typically considered a continuation pattern. As the 2019 yearly opening level at 0.7042 came within a few points of entering the fight last week, the upper boundary of the aforementioned rising wedge could potentially hold prices lower this week. The primary downtrend, visible from this timeframe, has also been in play since early 2018, consequently adding weight to a move south possibly emerging.

In conjunction with weekly action, daily price shaped an AB=CD bearish correction (blue arrows) around the 0.7017 neighbourhood that held price lower, seen a touch south of Quasimodo resistance at 0.7047. What’s also notable is the 200-day SMA (orange – 0.6897), trailed closely by the 50-day SMA (blue – 0.6865). It might also be worth acknowledging that traders short the harmonic AB=CD pattern highlighted above will likely be looking to take partial profit around the 38.2% Fibonacci retracement of legs A-D at 0.6893, followed by a final take-profit target around the 61.8% Fibonacci retracement at 0.6806.

Areas of consideration:

The point the current H4 trend line support merges with daily support at 0.6927 may be of interest for a bounce higher. That is assuming price action remains north of the daily level until the area is tested.

0.69 on the H4 timeframe is also a support worthy of attention, given its close connection to the daily 38.2% Fibonacci retracement mentioned above at 0.6893 and the 200-day SMA.

The concern regarding longs from the above supports, however, is weekly price threatening a move lower from the upper edge of its rising wedge pattern. As such, any long positions initiated off either 0.6927 or 0.69 may be best alongside additional candlestick confirmation. A H4 bullish engulfing pattern, for example, not only highlights buyer intent, it provides entry and risk levels to work with, therefore making it easier to calculate risk/reward.

USD/JPY:

The safe-haven Japanese yen underperformed against the dollar Monday, despite the Iran/US threat. USD/JPY was bid in early US hours, overthrowing H4 resistance at 108.26 (now serving support) and reaching highs of 108.50. January’s opening level at 108.62 rests as the next upside target on the H4 scale, assuming the pair can dethrone both daily resistance at 108.43 and H4 trend line support-turned resistance, extended from the low 108.24.

Another point worth stressing is the relative strength index (RSI) trades just south of its 50.0 point, with the approach formed by way of a ABCD corrective wave.

In terms of the weekly timeframe, USD/JPY printed a decisive 130-point move lower last week off notable resistances, comprised of a 127.2% Fibonacci extension at 109.56 (taken from the low 104.44), the 2019 yearly opening level at 109.68 and trend line resistance, extended from the high 114.23. Aside from the 106.48 September 30 swing low, limited support is evident until shaking hands with Quasimodo support at 105.35. Regarding the market’s primary trend, the pair has been entrenched within a long-term range since March 2017, spanning 115.50/105.35.

Areas of consideration:

Weekly action nosediving from notable resistance around 109.68, and daily price retesting resistance at 108.43 as well as H4 price testing trend line support-turned resistance, highlights shorts might be on the table.

Conservative sellers, those who wish to add a little more confirmation to the mix, may either look for H4 candlestick confluence off the noted trend line resistance or wait for a H4 close below 108.26 to form. Waiting for additional confirmation will also help avoid a potential whipsaw to January’s opening level at 108.62.

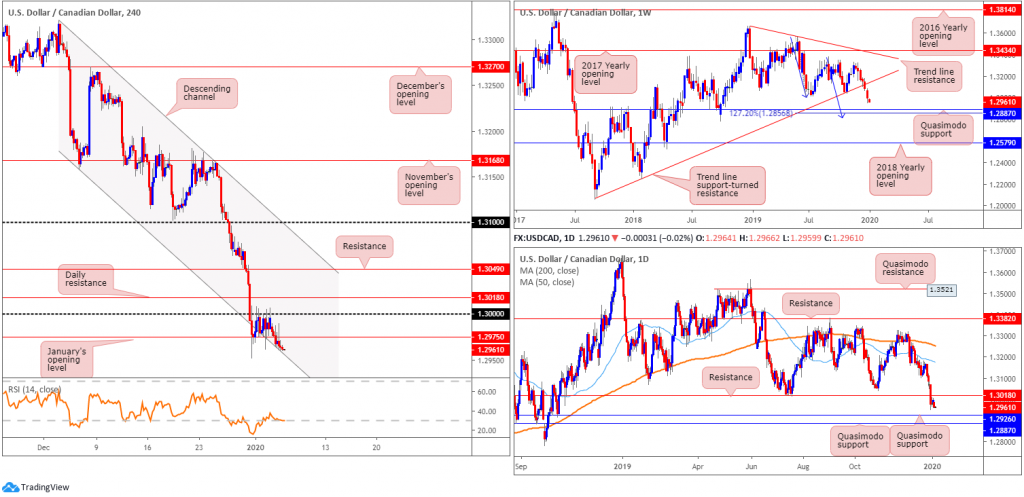

USD/CAD:

The US dollar concluded Monday a shade lower against the Canadian dollar, down more than 30 points, or 0.24%. Crude benchmarks gapped higher at the open amid US/Iran concerns, though finished the day a touch lower.

Technical updates, as far as the H4 timeframe is concerned, shows January’s opening level at 1.2975 ceded ground, with price now challenging channel support, taken from the low 1.3158. Continued selling from this point has the 1.29 handle to target. Before reaching this base, though, sellers must contend with daily Quasimodo support at 1.2926, closely shadowed by a weekly Quasimodo support at 1.2887. Weekly price also boasts a 127.2% AB=CD bullish correction (blue arrows) at 1.2856. As such, 1.2856/1.2887 on the weekly timeframe is likely a base active buyers reside.

The immediate trend, according to the weekly timeframe, has faced north since bottoming in September 2017; however, this move could also be considered a deep pullback in a larger downtrend from the 1.4689 peak in early January 2016.

Areas of consideration:

Overall, higher-timeframe chart studies signify further losses, at least until reaching 1.2926.

The close below January’s opening level at 1.2975 likely enticed some sellers into the market yesterday, with protective stop losses positioned either above the 1.2990 high or the 1.30 handle. Ultimately, these sellers are likely looking for price to overpower the current H4 channel support and head for daily Quasimodo support at 1.2926.

Traders threatened by the possibility of buying emerging from the current H4 channel support may wish to wait and see if H4 price closes beneath this fence before considering shorts. Of course, by doing so, the risk/reward will be less favourable than for those who entered on the break of 1.2975.

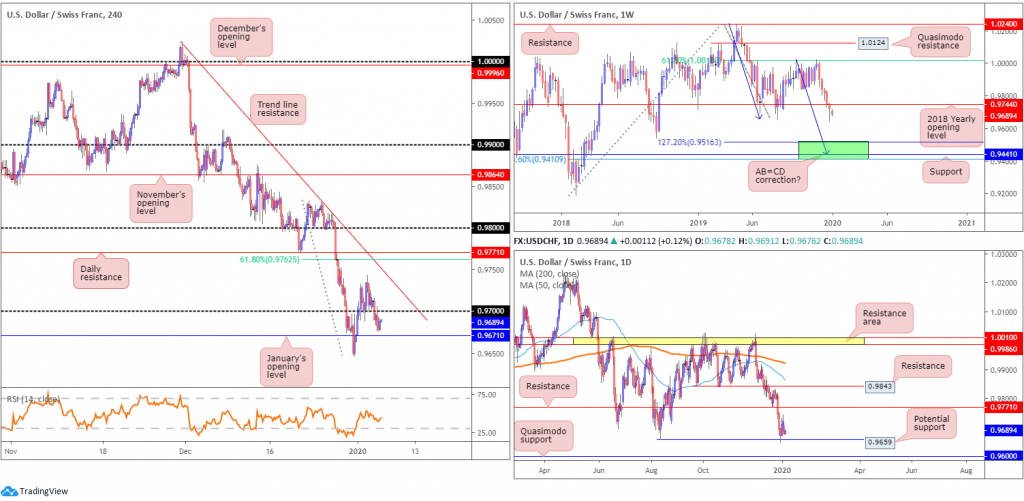

USD/CHF:

Growing market concerns over a major conflict in the Middle East benefited the safe-haven Swiss franc Monday. USD/CHF overpowered the 0.97 handle on the H4 timeframe and is, as of current price, meandering north of January’s opening level at 0.9671. South of this level, chart studies reveal limited support until shaking hands with the 0.96 handle.

Elsewhere, weekly price shows that since shaking hands with the underside of the 61.8% Fibonacci retracement ratio at 1.0018, last week chalked up its fifth consecutive bearish candle. The unit also activated sell stops south of the 2018 yearly opening level at 0.9744, which has capped downside since the beginning of 2019. In the event we continue navigating lower ground this week, the next downside target can be seen around the 0.9410/0.9516 region (comprised of a 78.6% Fibonacci retracement at 0.9410, support at 0.9441 and a 127.2% AB=CD bullish correction at 0.9516 – green).

The 0.9659 August 13 low held price north mid-week on the daily timeframe, reaching highs of 0.9733 by the week’s close. Whether this will be enough to test resistance at 0.9771 this week is difficult to tell as Friday’s action closed reasonably weak and Monday nudged lower. Areas of interest beyond the said zones can be found at resistance coming in at 0.9843 and a Quasimodo support at 0.9600. Both the 200-day SMA (orange – 0.9922) and 50-day SMA (blue – 0.9864) also face a southerly bearing, with the 50-SMA drifting south of the 200-SMA.

Weekly sellers defending ground beneath 0.9744 and H4 price crossing below 0.97 echoes a somewhat bearish vibe in this market. A H4 close below January’s opening level mentioned above at 0.9671 would likely be viewed as a strong bearish indication we’re heading for 0.96 (represents not only a round number but also a daily Quasimodo support).

The only concern, of course, is daily price defending 0.9659. Therefore, traders may consider waiting and seeing if a retest at 0.9671 occurs, following a break lower, preferably in the shape of a H4 bearish candlestick signal (entry and risk levels can then be calculated using the pattern’s structure).

Dow Jones Industrial Average:

US equities pencilled in a reasonably healthy recovery Monday, despite concerns regarding escalating tensions in the Middle East. The Dow Jones Industrial Average added 68.50 points, or 0.24%; the S&P 500 advanced 11.43 points, or 0.35% and the tech-heavy Nasdaq 100 rose 54.61 points, or 0.62%.

Technical research based on the H4 timeframe had the candles surpass January’s opening level at 28595, test Quasimodo support at 28441 and close the day a touch north of 28595.

Monday’s report had the following to say (italics):

Should a H4 bullish candlestick signal emerge from 28595, this would likely be enough to entice even the most conservative trader into the market, positioning entry and risk levels based on the candlestick signal.

The reason behind requiring additional candlestick confirmation is simple. H4 Quasimodo support at 28441 is just as likely to hold price higher in the event of a move lower. The same can be said for December’s opening level at 28074. Candlestick confirmation is a way of identifying levels of strength.

As evident from the H4 chart, an inside candle formation developed after testing Quasimodo support. Well done to any readers who managed to take advantage of yesterday’s move.

Higher-timeframe structure, nonetheless, is pretty much unchanged:

Following a weekly hammer candlestick pattern (considered a buy signal at troughs), formed five weeks back at the retest of support drawn from 27335, along with trend line support etched from the high 26670, the index tested fresh record peaks of 28925 last week.

Daily perspective:

Meanwhile, on the daily timeframe, trend line support, extended from the low 25710, remains intact, bolstered by additional support from the 50-day SMA (blue – 27971).

Areas of consideration:

Traders long from the H4 Quasimodo support level mentioned above at 28441 likely reduced risk to breakeven following the close back above 28595. Partial profit taking is also an option right now, as is moving the protective stop-loss level to just under 28595.

The next upside target from here resides at the all-time high of 28925.

Traders who missed the 28441 long entry may be given a second chance should H4 retest 28595 as support today. Although this level is positioned in line with the overall trend, traders are urged to consider waiting for additional candlestick confirmation to help avoid whipsaws (entry and risk levels can be determined according to the candlestick’s rules of engagement).

XAU/USD (GOLD):

Spot gold sported a strong bid tone in early trade Monday, kicking off the week gapping north and clocking a high of 1587.9, which is a 6-year peak for the safe haven.

Although bolstered on the back of escalating tensions in the Middle East and a waning greenback, European hours witnessed a phase of consolidation and culminated in a decline during the US session.

Weekly price had the room to run higher, as stated in Monday’s technical briefing here (italics):

Assuming buyers continue governing direction, supply at 1616.8-1592.2 could hamper upside in the event we reach this far north.

Daily price, after climbing above resistance at 1550.4, also displayed scope to explore higher ground, as highlighted in Monday’s piece (italics):

Resistance at 1518.0 gave way Thursday, prompting a higher run Friday to resistance at 1550.4. As evident from the chart, price marginally closed above this level into the close, though whether this is sufficient to convince traders that sellers are consumed is difficult to judge at this point. This can only be determined this week, based on price movement. A decisive close higher could be viewed as additional confirmation we’re heading to weekly supply mentioned above at 1616.8-1592.2, as this area is considered the next upside target on the daily timeframe, too.

Across the page on the H4 timeframe, we can see bullion approaching support at 1550.3, a Quasimodo resistance-turned support level. It might also interest some traders to note the relative strength index (RSI) recently exited overbought territory, following a peak of 91.35.

Areas of consideration:

With a strongly trending market void of higher-timeframe resistance (weekly supply has yet to enter the fight at 1616.8-1592.2), a retest at the H4 support level drawn from 1550.3, which merges with daily support at 1550.4, is certainly a possibility today.

In light of 1550.3’s confluence, some traders may buy this level without the need for additional candle confirmation, positioning protective stop-loss orders around the 1539.4ish region, and setting an ultimate take-profit objective at the noted weekly supply.

(Italics represents previous analysis)

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.