The Foreign Exchange Market and Inflation

Income and the price of products are vastly different to what […]

How to Build a Forex Trading Plan: A Compilation of Parts 1-4.

Without a trading plan, successful trading is unlikely – you’re effectively driving blind. The problem is new traders fail to recognise the significance of a trading plan. This may address why many traders find it difficult to accomplish their goals in this business.

Money: How Much Do You Need to Begin Trading?

From institutional investors hedging portfolio risk to independent retail speculation, the foreign exchange (FX) market caters to a diverse community. Dependent on financial circumstances, time constraints and trading experience, starting capital varies for retail traders.

5 Common Trading Errors and How to Avoid Them

Over the years technology has revolutionised our world, creating irreplaceable tools […]

A Primer to Understanding Basic Chart Patterns

Do technical trading patterns exist and are they profitable? This is […]

Candlestick Patterns Every Trader Should Know

Traders and investors who adopt technical analysis typically use price charts […]

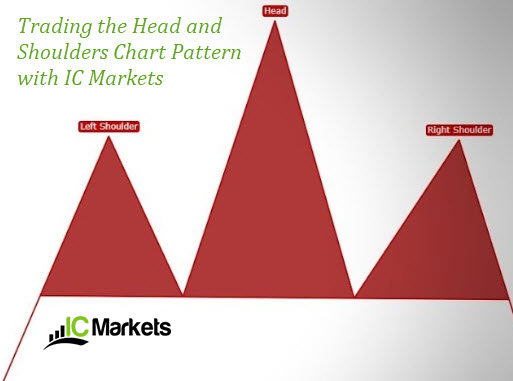

Trading the Head and Shoulders Chart Pattern

Technical analysis is an efficient technique used to study price movements […]

An Introduction to the Stochastic Oscillator with IC Markets

In the right hands, oscillators offer an additional opinion on market […]

Become a Professional Retail Trader in 2019

Over the years technology has revolutionised our world, producing invaluable tools […]