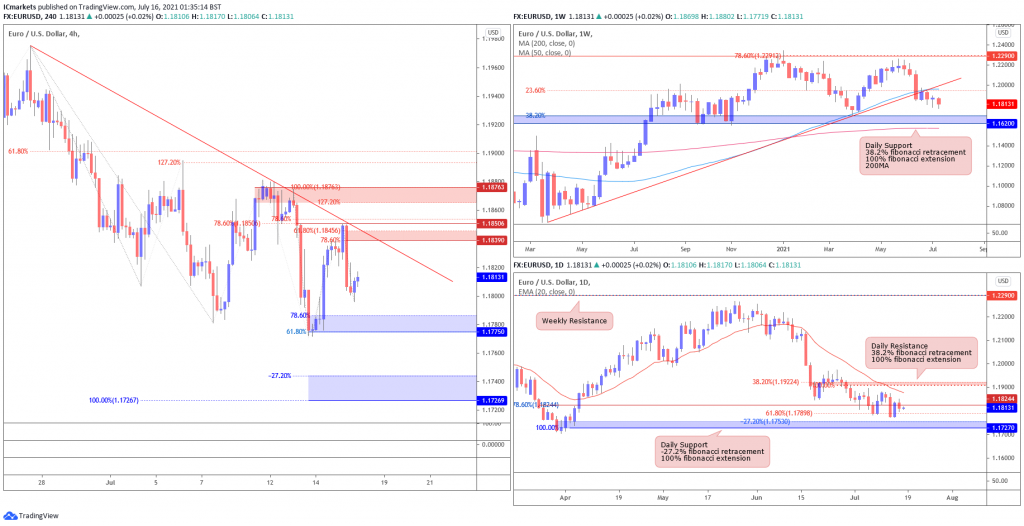

EUR/USD:

Looking at the weekly chart we can see that prices face bearish pressure from the ascending trendline support-turned-resistance and 23.6% Fibonacci retracement. On the daily chart, prices found support and bounced at 1.17898, in-line with 61.8% Fibonacci extension.

On the H4 timeframe, price faced bearish pressure at 1.18506, in-line with 78.6% Fibonacci retracement, 78.6% Fibonacci extension and descending trendline resistance. We see a low-probability scenario where the price faces further bearish pressure and swings towards first support at 1.17750, in-line with 78.6% Fibonacci retracement and 61.8% Fibonacci extension. The next support level will be at 1.17269, in-line with -27.2% Fibonacci retracement and 100% Fibonacci extension.

If price bounces from this level, it will swing towards first resistance at 1.18390, in-line with 78.6% Fibonacci retracement and 61.8% Fibonacci extension and descending trendline resistance. The next resistance will be at 1.18763, in-line with 127.2% Fibonacci retracement and 100% Fibonacci extension.

Areas of consideration:

- H4 time frame, support level at 1.17750 and 1.17269

- H4 time frame, resistance level at 1.18390 and 1.18763

GBP/USD:

Looking at the weekly chart, we can see that the price bounced from our support level at 1.36780, in-line with 23.6% Fibonacci retracement and 78.6% Fibonacci extension. On the daily time frame, prices faced bearish pressure at psychological level of 1.39000, in-line with 23.6% Fibonacci retracement and 20 EMA. We could potentially see the price facing further bearish pressure to support level at 1.36780, in-line with 61.8% and 100% Fibonacci extension and 200MA.

On the H4 timeframe, prices faced bearish pressure and broke below the ascending triangle trendline. The price is now retesting the ascending trendline support-turned-resistance. We could possibly see a low-probability scenario where the price faces further bearish pressure and swings towards first support at 1.37544, in-line with 78.6% Fibonacci retracement and 100% Fibonacci extension. Stochastic is also indicating bearish momentum for further downside. The next level of support will be at 1.36854, in-line with 78.6% and 127.2% Fibonacci extensions.

If price bounces from this level, it will swing towards first resistance at 1.39040, in-line with 61.8% and 127.2% Fibonacci extensions. The next level of resistance will be at 1.39435, in-line with 78.6% Fibonacci retracement, 161.8% Fibonacci extension and daily 200MA.

Areas of consideration:

- H4 time frame, 37544 and 1.36854 support level

- H4 time frame, 1.39040 and 1.39435 resistance level

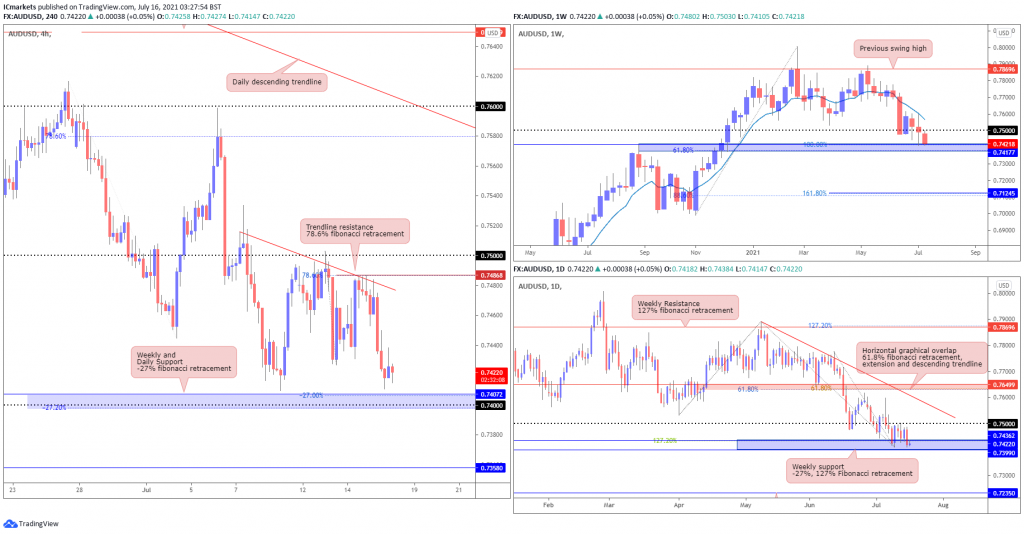

AUD/USD:

Looking at the weekly chart, we can see that the price is testing the support level of 0.74177, in line with 61.8% fibonacci retracement and 100% fibonacci extension. If price breaks beneath this level we may see a push down towards 0.71245. On the daily time frame, we are seeing a similar picture where price is trending in a bearish momentum under the descending trendline, and is testing the support level indicated on the weekly timeframe. If price rejects the area of support, we may see it push higher towards 0.76499 level, in line with Horizontal graphical overlap, 61.8% fibonacci retracement, extension and descending trendline.

Lastly, on the H4 timeframe, price is showing bearish momentum by creating a descending trendline and reversing from 78.6% fibonacci retracement level, however, the bullish pressure from Weekly and Daily support in line with major level 0.74 are strong. Therefore the market may take more consolidation in this area before a clear direction.

Areas of consideration:

- H4 time frame, price may continue to find support at Weekly and Daily support.

- Weekly and Daily time frame showing bearish momentum

USD/JPY

From the weekly timeframe, prices are pushing down towards the horizontal swing low support of 107.477, in line with 50% Fibonacci Retracement and 100% Fibonacci Extension, where we might see a bounce from this level. In the case that price pushes up, prices may face resistance at horizontal swing high resistance of 112.322, in line with 61.8% Fibonacci extension and 127.2% Fibonacci retracement. On the daily timeframe, prices have broken the ascending trendline support, and resisted the 110.699 level, which is in line with 50% Fibonacci retracement, and prices might push down towards 108.559, in line with 78.6% Fibonacci retracement and 100% Fibonacci extension. A break above the 110.699 level may see prices push up towards the112.322 level.

On the H4 timeframe, prices are trading sideways and are looking to push down to the horizontal swing low support of 109.229, in line with the 61.8% Fibonacci extension and 127.2% Fibonacci retracement. If prices push up, prices may face resistance from 110.699 daily resistance, in line with 78.6% Fibonacci extension. Moreover, EMA is above prices, indicating a bearish pressure on prices.

Areas of consideration:

- 229 support level on the H4 timeframe

- 699 resistance level on the H4 and daily timeframes

USD/CAD:

On the Weekly timeframe, price has broken the descending trendline resistance-turned-support and is currently testing the long term moving average and MACD indicator is below 0, showing bearish momentum. Price is currently holding between long term resistance at 1.25470 and long term support at 1.20068. On the Daily timeframe, we see that the indicators are showing a build up in bullish momentum. Price managed to break above the Weekly Resistance and is now testing the previous swing high from 21st April 2021. On the H4, price is broken above the Weekly resistance turned-support, and is currently testing the previous swing high level. We may wait for a pullback towards the 1.25470 level, in line with Weekly resistance turned-support and 61.8% fibonacci retracement.

Areas of consideration:

- H4 shows potential pullback towards the previous graphical level.

- 24443 is the support level to watch on H4

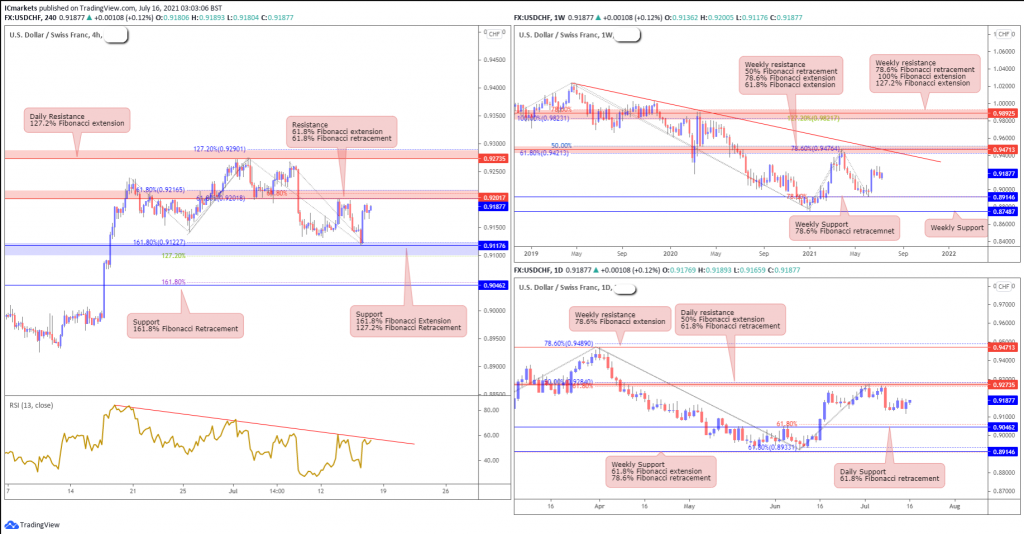

USD/CHF:

USD/CHF has shown a strong bounce from the weekly 0.89146 support, in line with 78.6% Fibonacci retracement, and price is now holding below the descending trendline resistance. The daily chart shows that price is now reversing below the key daily resistance of 0.92735. We could potentially see further downside towards the 0.90462 support.

On the H4 chart, we can see that price is now approaching the 0.92017 resistance area and could potentially reverse and take support at 0.91176, in line with 127.2% Fibonacci retracement level and 161.8% Fibonacci extension. We note that RSI is also holding below the descending trendline resistance, showing possible bearish pressure in line with our bearish bias.

Areas of consideration:

- Price could potentially face further bearish pressure.

- We could see price drop further towards the next 0.91176 support level.

Dow Jones Industrial Average:

On the weekly chart, prices bounced higher above 32765 support. With price holding 32765 support, we might see bullish pressure above this level. On the daily chart, price is currently trading sideways and testing resistance at 35090. With stochastic still testing resistance where price dropped in the past, we see price facing possible bearish pressure.

On the H4, price tested and is still holding below 35090 daily resistance. Stochastic is still testing resistance where price dropped in the past, we still see a low probability scenario where sellers might add to their shorts to push price lower towards 34358 support. Otherwise failure to hold below 35090 resistance should see price swing the other way towards 35485 resistance instead.

Areas of consideration:

- 35090 daily resistance is key level to watch

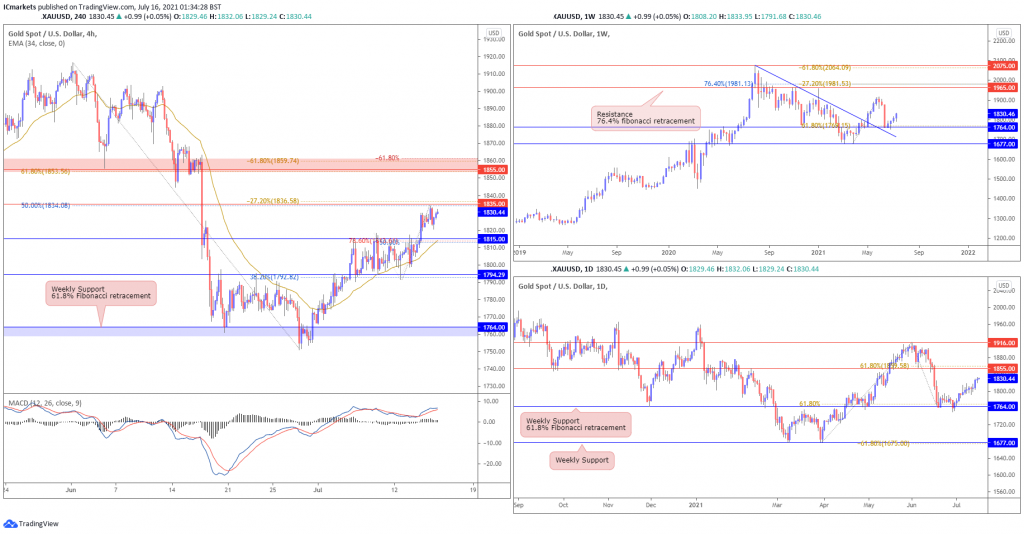

XAU/USD (GOLD):

On the weekly timeframe, price tested and bounced above key trendline pullback support at 1764. On the daily, price continues pushing higher towards the 1855 resistance, still holding above 1764 weekly support. We could potentially see further bullish momentum as price continues to approach the 1855 resistance.

On the H4, price pushed higher and tested the 1835 resistance. With technical indicators showing room for further bullish momentum, we could potentially see price break and close above the 1835 resistance, with the next key resistance level at 1855 being the next intraday target. Otherwise, price could also pull back to test the 1815 support, in line with 50% Fibonacci retracement, 78.6% Fibonacci extension, moving average support and horizontal pullback support.

Areas of consideration:

- 1835 H4 resistance level is the key level to watch.

- Should price pullback, it could bounce at the 1815 support.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.