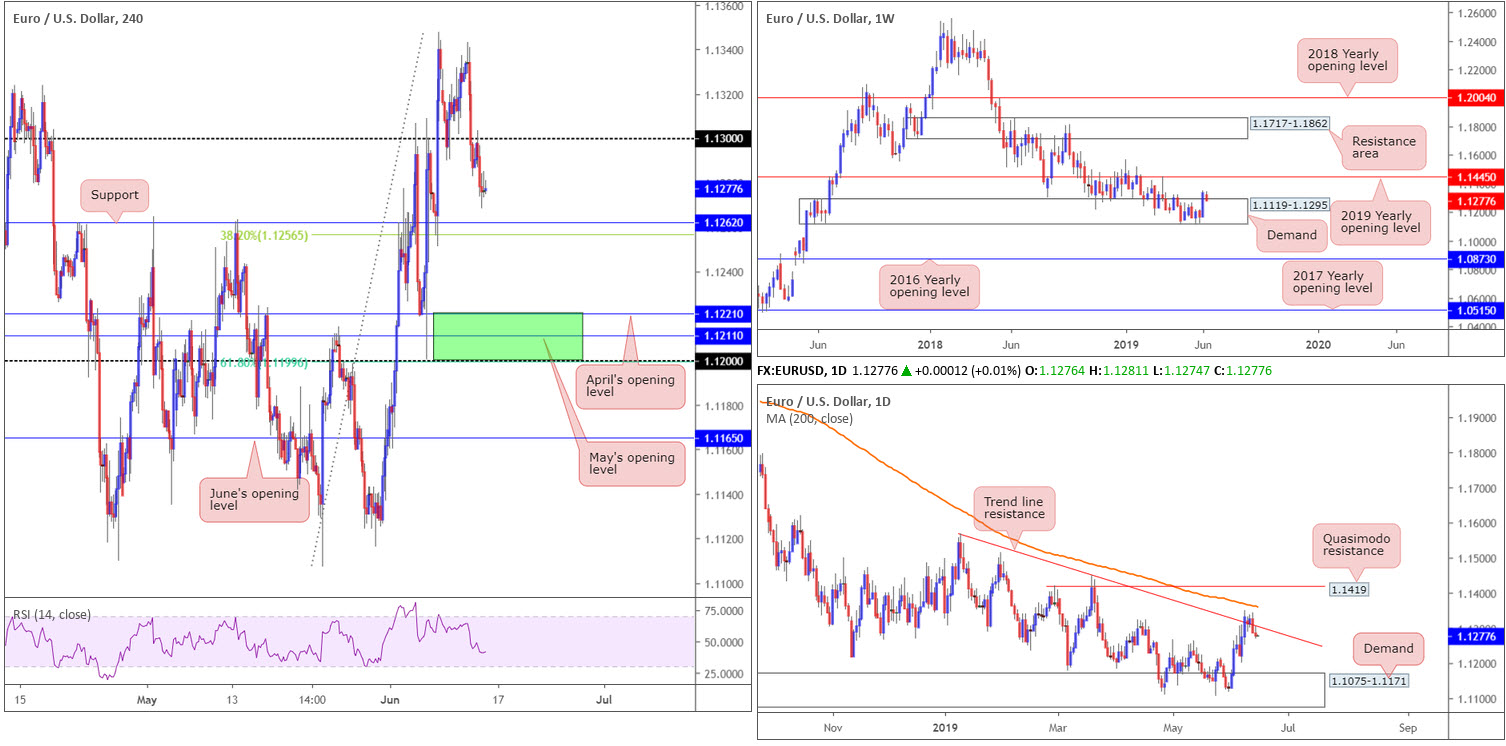

EUR/USD:

With upside attempts being limited at the 1.13 handle during early European hours Thursday, the euro declined further against the greenback, down 0.09% on the day. As is evident from the H4 timeframe, the next downside obstacle falls in around support at 1.1262, which happens to align closely with a 38.2% Fibonacci retracement at 1.1265. However, the more appealing area of support is likely between the round number 1.12 (and a 61.8% Fibonacci value), May’s opening level at 1.1211 and April’s opening level at 1.1221 (green).

Daily movement, as highlighted in Thursday’s report, recently crossed back beneath trend line resistance extended from the high 1.1569 by way of a bearish engulfing candle. Interestingly, yesterday’s price action retested the underside of the said trend line before closing marginally lower in the shape of a reasonably strong bearish candle.

Weekly timeframe analysis remains unchanged from previous reports:

EUR/USD bulls remain underlining an offensive state out of a long-standing weekly demand zone at 1.1119-1.1295. Despite the overall trend still facing a southerly bearing since topping in early 2018, the recently formed near-full-bodied weekly bull candle displays scope for extension to as far north as the 2019 yearly opening level at 1.1445.

Areas of consideration:

Having observed weekly players continue to engage with demand, the H4 support areas underlined above: 1.1265/1.1262 and 1.12/1.1221 both carry weight as potential reversal zones today. The only grumble, of course, is the fact daily price recently reclaimed trend line resistance and displays scope to press as far south as demand at 1.1075-1.1171. As a result of this, conservative traders may elect to wait for additional confirmation to form at the said H4 supports before committing funds to a position. This could be anything from a H4 or H1 bullish candlestick configuration, a lower-timeframe MA crossover or even drilling down to the lower timeframes and attempting to trade local (price action) structure within the zone. It is trader dependant.

Today’s data points: US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

GBP/USD:

Sterling encountered renewed selling out of 1.27 Thursday, as the prospect of no-deal showdown soured sentiment after frontrunner Boris Johnson emerged with larger-than-expected support from the first leadership ballot. With the H4 candles languishing south of 1.27, traders’ crosshairs are likely fixed on June’s opening level at 1.2626 as the next potential support, closely shadowed by the 1.26 region.

In Wednesday’s brief, the research team wrote about the following setup:

The H4 Quasimodo resistance at 1.2757 is a somewhat appealing sell zone to have eyes on today, due to its convergence with the daily trend line support-turned resistance, and also because weekly selling interest may develop a little lower on the curve around 1.2739.

Well done to any of our readers who managed to jump aboard the move from 1.2757 earlier this week. If not done so already, it might be a good opportunity to reduce risk to breakeven and take partial profits off the table.

As daily price recently overthrew support at 1.2697, possibly unlocking the door to the 1.2558 May 31 low, as well as weekly activity shaking hands with the underside of its 2019 yearly opening level at 1.2739, further downside is likely on the menu today.

Areas of consideration:

While there may be an opportunity to join the current sellers from the underside of 1.27, the next downside target on the H4 scale, as highlighted above, is seen close by at June’s opening level drawn from 1.2626, followed by the top edge of weekly demand at 1.2615 and then the round number 1.26. As such, ensure risk/reward conditions are favourable prior to pulling the trigger.

Today’s data points: BoE Gov. Carney Speaks; US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

AUD/USD:

Despite hotter-than-expected headline employment change out of Australia, the Aussie dollar turned lower Thursday, shedding 0.19% vs. the buck. Some trading desks reported that in spite of a better headline, the data still bolsters the case for RBA rate cuts, although timing is uncertain.

In the early hours of Thursday, the H4 candles dethroned June’s opening level at 0.6926, aided by resistance at 0.6936, and bottomed just north of the 0.69 handle into the close. Traders may also wish to acknowledge the area beyond 0.69 stretches as far south as daily support at 0.6866.

Daily flow, however, is visibly testing the lower limits of demand marked with a green arrow around the 0.6935ish region. On the weekly timeframe, we can see price action left the 2019 yearly opening level at 0.7042 unchallenged before turning lower, erasing all of last week’s gains.

Areas of consideration:

As daily demand appears to be hanging by a thread, and weekly price exhibits scope to test the waters around the 0.6828 support, the 0.69 handle on the H4 timeframe is unlikely to offer much of a bounce, with the most being a move to 0.6936-0.6926 (green). On account of this, the research team are watching for the following scenarios to emerge:

- A retest of the H4 resistance area at 0.6936-0.6926, followed by a move beneath 0.69 and ultimately to daily support mentioned above at 0.6866.

- If 0.6936-0.6926 fails to enter the fold and the H4 candles engulf 0.69, a short either on the back of the breakout candle or a retest of the underside of 0.69 could be an option, targeting the aforementioned daily support.

Irrespective of the area selected today, if any, traders are urged to consider waiting for additional confirmation before pulling the trigger, particularly on the retest of 0.69 due to potential whipsaws.

Confirmation techniques are trader dependant, though some of the more common methods include waiting for a bearish candlestick signal, an MA crossover, or even indicator overbought signals (or divergences). Waiting for confirmation not only identifies seller intent, it can, in some instances, help provide entry and risk levels to work with, especially in the case of a bearish candlestick formation.

Today’s data points: China Fixed Asset Investment ytd/y; China Industrial Production y/y; US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

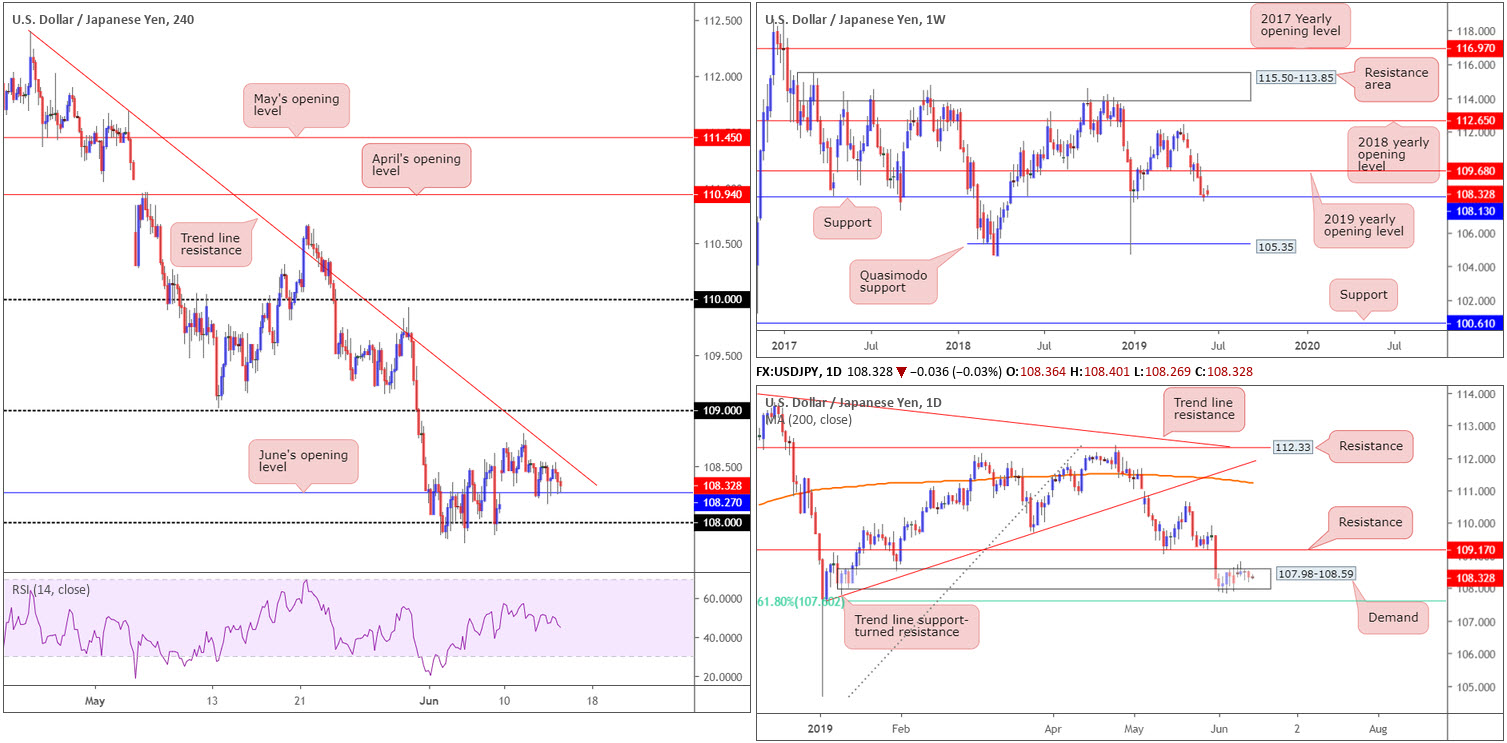

USD/JPY:

In Thursday’s briefing the research team had the following to say regarding the higher-timeframe picture:

Longer-term flow on the USD/JPY appears to be holding at weekly support drawn from 108.13, though has yet to draw in much bullish enthusiasm. In the event buyers regain consciousness, the next upside objective is the 2019 yearly opening level at 109.68.

Daily demand at 107.98-108.59 is struggling to maintain a presence. Despite boasting a connection to weekly support mentioned above at 108.13, the odds of daily price rushing the lower edge of the said demand is high, targeting a 61.8% Fibonacci support value at 107.60.

The research team also noted the following levels to keep eyes on for potential short-term trades on the H4 timeframe:

A long from June’s opening level on the H4 timeframe at 108.27 could be worth considering, targeting the current H4 trend line resistance (112.40). On the same note, a sell from the trend line resistance could also be a consideration.

As you can see from the H4 chart this morning, price action remains bolstered by June’s opening level, though has struggled to print much bullish enthusiasm.

Areas of consideration:

Technically, at current price, a response from the aforementioned H4 trend line resistance is likely on the cards today, as June’s opening level and the said trend line structure converges.

Due to its history as a declining resistance, and also because both weekly and daily support structures emphasise a fragile state at present, the trend line resistance is likely to offer a strong ceiling. Conservative traders concerned about higher-timeframe structure, despite recent weakness, may opt to wait and see how H4 action behaves before pulling the trigger. A H4 bearish candlestick configuration, for example, would likely be enough evidence to validate a short, targeting at least the 108 handle.

Today’s data points: US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

USD/CAD:

The Canadian dollar rose Thursday, snapping a three-day losing streak against the greenback. The attacks on two oil tankers in the Gulf of Oman drove crude prices higher and took the Canadian dollar along for the ride.

In terms of the technical landscape on the H4 timeframe, the candles retested 1.33, to-the-point, and pressed higher amid US hours to close just south of April’s opening level at 1.3351, closely trailed by a 38.2% Fibonacci resistance at 1.3363.

On a wider perspective, daily price remains on a northerly trajectory following the rebound from the 200-day SMA and merging 61.8% Fibonacci support value at 1.3260 at the beginning of the week. While daily flow exhibits scope to press as far north as resistance at 1.3382, weekly movement recently shook hands with a trend line support-turned resistance extended from the low 1.2247.

Areas of consideration:

For those who read Thursday’s briefing the piece aired the following:

The research team favours April’s opening level at 1.3351 (and the 38.2% Fibonacci resistance at 1.3363) as a potential sell zone, as it boasts a close connection to the weekly trend line support-turned resistance. In order to avoid being taken out on a whipsaw (as daily players may choose to draw price action to resistance at 1.3382), traders are urged to consider waiting for additional confirmation to form before committing funds to a position. This not only helps identify seller intent, it also generally provides traders entry and risk levels to work with, particularly when employing a bearish candlestick signal as a means of confirmation.

Today’s data points: US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

USD/CHF:

Breaking a three-day bullish phase Thursday, USD/CHF movement hugged the underside of April’s opening level at 0.9952 on the H4 timeframe, with the next downside target still open for a test at 0.99.

However, as stated in yesterday’s analysis, the more appealing zone of resistance comes in by way of the 1.0000 level (parity) along with June’s opening level at 1.0010.

Yesterday’s report also went on to write:

In terms of where the currency pair is located on the higher timeframes, daily flow is trading within close proximity to its 200-day SMA, currently trading around 0.9965. In conjunction with this movement, weekly activity is also seen within a few points of connecting with a trend line support-turned resistance etched from the low 0.9187. The combination of these two barriers is likely to add a bearish tone to this market, should we reach this high.

Areas of consideration:

Given limited change was observed Thursday, the outlook remains unchanged…

Although H4 action is expressing a somewhat bearish air around resistance at 0.9952, selling this level, when higher-timeframe movement may be targeting resistances overhead, is a chancy move, according to our technical studies.

As a result of the above, the research team has labelled 1.0000 as a prime location to consider shorts from today/early next week.

We can also see we have higher-timeframe confluence supporting 1.0000, therefore a sizeable response is likely in store. Despite this, round numbers, particularly key levels such as 1.0000, are prone to sizeable whipsaws, or stop runs. Traders are, therefore, recommended to wait and see how H4 price responds from 1.0000 before initiating a position. Depending on the confirmation technique employed, this should help identify seller intent and also maybe set entry and risk levels to trade with.

Today’s data points: US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

Dow Jones Industrial Average:

US equity indexes advanced Thursday, led by gains in oil after an incident involving oil tankers in the Gulf of Oman sent oil prices northbound. The Dow Jones Industrial Average closed higher by 0.39%; the S&P 500 also added 0.43% and the tech-heavy Nasdaq 100 advanced 0.51%.

For folks who have been reading recent reports on the DJIA’s technical front you may recall focus remained around the daily resistance area at 26539-26200, more specifically the H4 supply zone at 26367-26207, for potential shorting opportunities. H4 action consumed April’s opening level at 26026, though was unable to overthrow H4 support nearby at 25957, consequently placing the H4 candles back within striking distance of the said H4 supply zone.

On more of a broader perspective, we can see daily flow chalked up a bullish engulfing formation around the underside of the aforementioned daily resistance area. This places a question mark on additional selling and adds credence to the possibility further upside may be observed on the weekly timeframe, targeting resistance at 26667.

Areas of consideration:

Despite weekly price proposing a move higher, the research team recommend a cautious tone in terms of buying this market, due to the current H4 and daily resistances in motion. In light of this, sellers from the H4 supply earlier this week will likely be taken out at breakeven today.

In the absence of clearer price action whereby all three timeframes foretell a consistent opinion, opting to remain on the sidelines may be the better path to take today.

Today’s data points: US Core Retail Sales m/m; US Retail Sales m/m; US Prelim UoM Consumer Sentiment.

XAU/USD (GOLD):

For folks who remain long from H4 support at 1320.4, great work!

1320.4 was a selected buy zone due to the following:

Judging by the lack of enthusiasm out of the H4 support area at 1328.8-1325.4 (now deleted from the chart), a test of the H4 support level at 1320.4 could be on the cards today. This will likely trip sell stops and thus provide liquidity to traders looking to buy. To be on the safe side, the research team recommends waiting for additional confirmation to form before committing funds to a position.

Another point Tuesday’s piece made clear was daily support entered the fold around 1326.3, seen plotted within the said H4 support area. Further adding to this was the weekly timeframe fading the 1346.7 Feb 18 high, though also showing room to press beyond this point to resistance at 1357.6.

Areas of consideration:

As our analysis is playing out as expected, Wednesday’s report remains valid in terms of upside targets:

In the event we continue pushing for higher ground, the H4 Quasimodo resistance level at 1344.0 is a logical upside target, followed by the area between 1357.6 and 1350.7 (comprised of the weekly resistance level, the daily Quasimodo resistance level and also the H4 Quasimodo resistance level). The latter also makes for an ideal sell zone, too.

As you can see from the H4 chart, the Quasimodo resistance at 1344.0 was recently hit, with the unit poised to approach the next layer of Quasimodo resistance at 1350.7.

As 1357.6/1350.7 is somewhat small in range, traders are recommended to wait for additional confirmation before committing funds to any short positions, should we reach this high. This could be anything from a H4 bearish candlestick configuration, a lower-timeframe MA crossover or even drilling down to the lower timeframes and attempting to trade local (price action) structure within the zone.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.