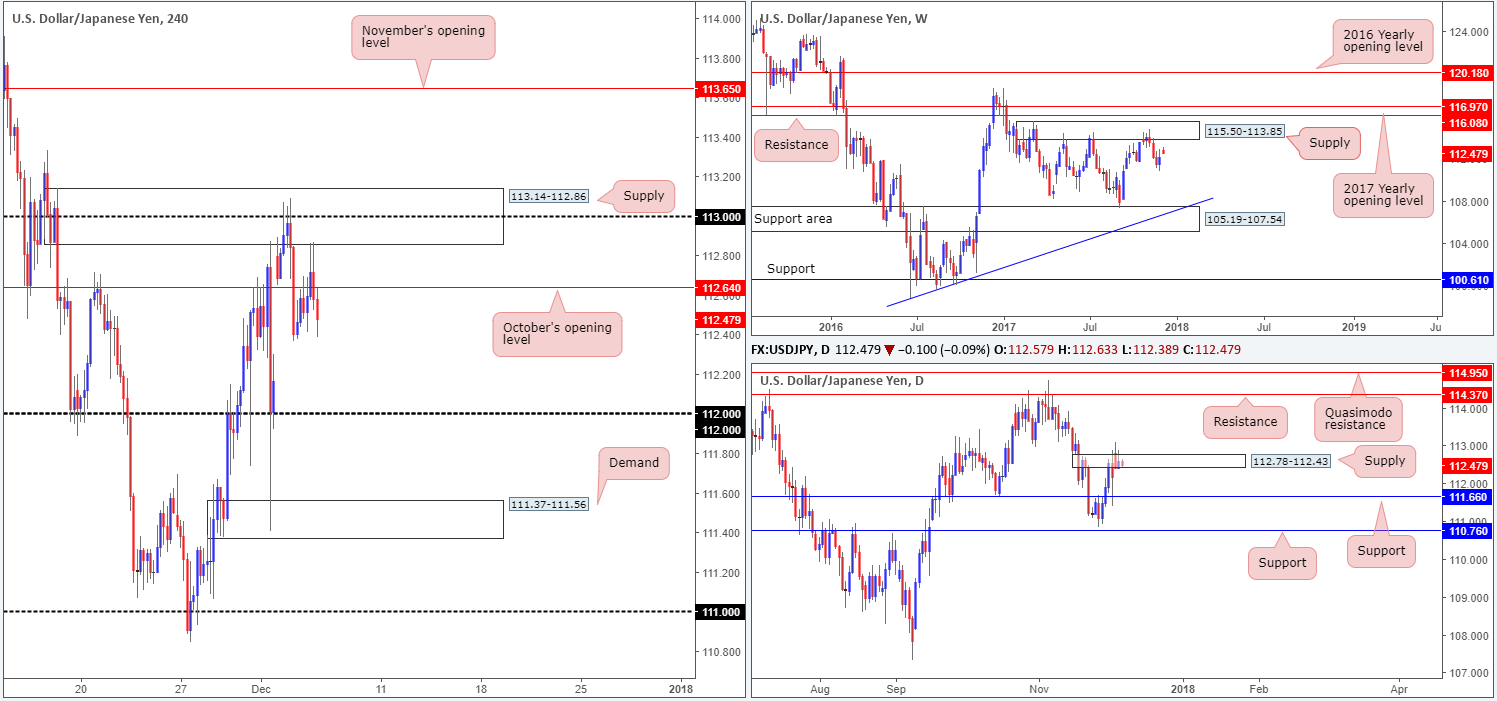

EUR/USD:

Early Asia, as you can see, swiftly lost steam around 1.1876 after a modest advance from the 1.1850 region. London lunchtime saw the H4 candles breach the H4 mid-level support at 1.1850, consequently attracting fresh sellers into the market. The pair attempted to recover following the release of lower-than-expected US ISM non-manufacturing PMI figures, but failed to make much headway beyond the 1.1842 neighborhood. H4 action did, however, chalk up a nice-looking H4 bull candle a few pips ahead of the 1.18 handle going into the close (buying tail seen on H1).

Recent selling likely has something to do with the daily resistance level in play at 1.1878. Although this barrier has seen its share of fakeouts over the past few days, it boasts a reasonably strong history so it is certainly not a level to overlook. As for the weekly timeframe, the unit remains trading inside the walls of a weekly supply-turned support zone at 1.1880-1.1777. In the event that euro continues to dig lower, the next base of weekly support can be seen at 1.1616.

Direction: Buying this market, although weekly price is sited within a weekly support zone, may be a chancy move. Not only is there nearby H4 resistance in the form of 1.1850, let’s also remember that daily resistance at 1.1878 is in motion. This does not give one a lot of wiggle room to play with.

Selling is just as awkward unfortunately. Yes, there’s room for the daily candles to trade as far south as the daily demand base at 1.1712-1.1757, but this would involve selling into H4 buyers off 1.18 and possible weekly buyers from the noted weekly support area!

In essence, whatever direction one selects will require going against some form of higher-timeframe flow.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: weekly supply-turned support zone at 1.1880-1.1777; 1.18 handle.

Resistances: H4 mid-level resistance at 1.1850; daily resistance at 1.1878.

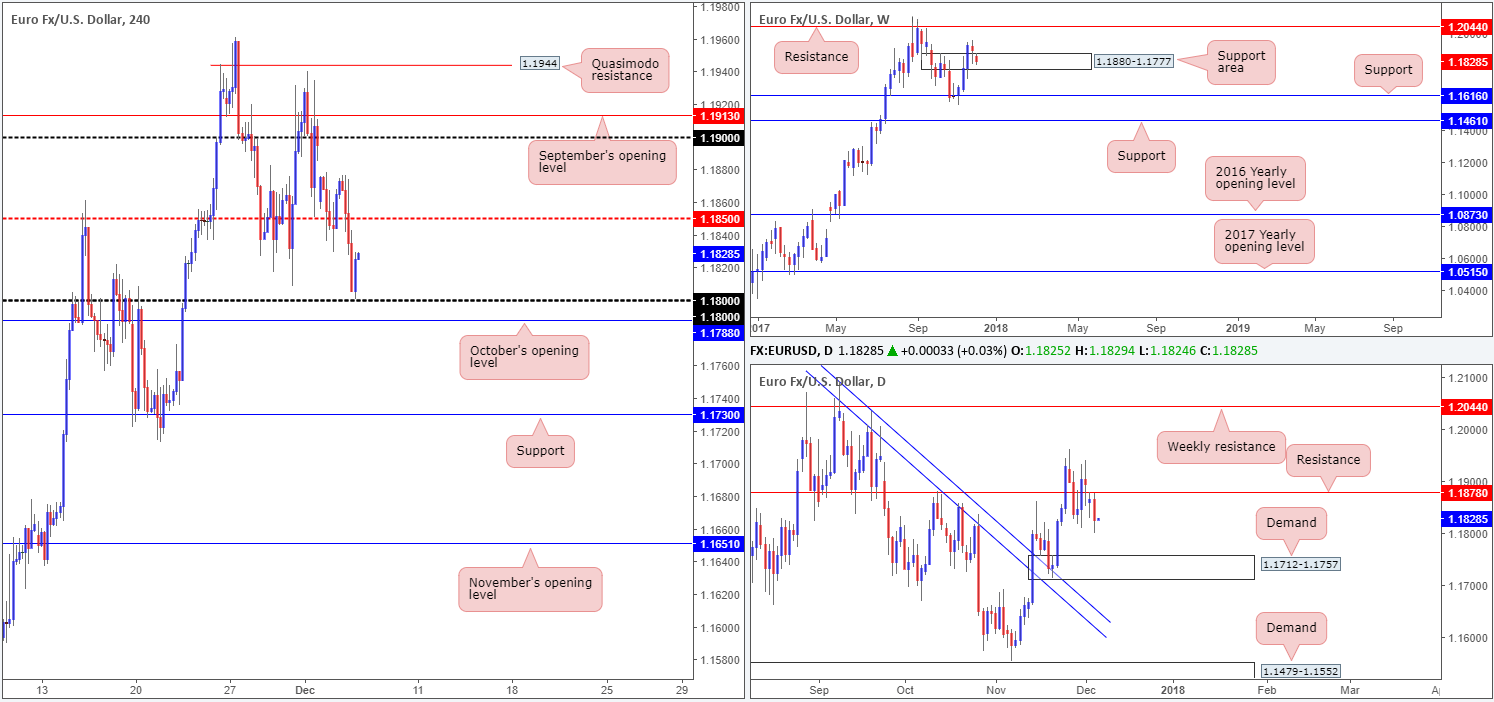

GBP/USD:

Kicking this morning’s report off from the top, weekly price shows that upside is beginning to wane after shaking hands with a weekly channel resistance taken from the high 1.2673. Regardless of the fact that this barrier was breached back in September, this ascending line has proved worthy in the past and, therefore, may continue to help suppress buying and send the British pound lower.

Sliding down to the daily timeframe, nevertheless, support at 1.3371 was recently forced into the mix. A to-the-pip reaction from here lifted daily price and printed a notable buying tail. For all that though, it’s difficult to judge whether further buying will be seen from here, since weekly sellers are also in the frame!

The British pound shrugged off less-than-stellar UK data on Tuesday on ‘Brexit’ hopes. The GBP was further bid following the release of disappointing US data which led to a break of the H4 mid-level resistance at 1.3450. H4 price, as you can see though, failed to sustain gains beyond this point and began selling off into the US segment. The next area of support can be seen at the 1.34 handle, followed closely by October’s opening level seen on the H4 timeframe at 1.3367 (at which point the unit will be trading back around daily support again).

Direction: Weekly structure indicates further selling could be on the horizon, while daily structure suggests a pullback is a possibility. Aside from this, there is very little to hang one’s hat on in regard to H4 structure i.e. not much in the way of levels with confluence.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: 1.34 handle; October’s opening level at 1.3367; daily support at 1.3371.

Resistances: weekly channel resistance taken from the high 1.2673; H4 mid-level resistance at 1.3450.

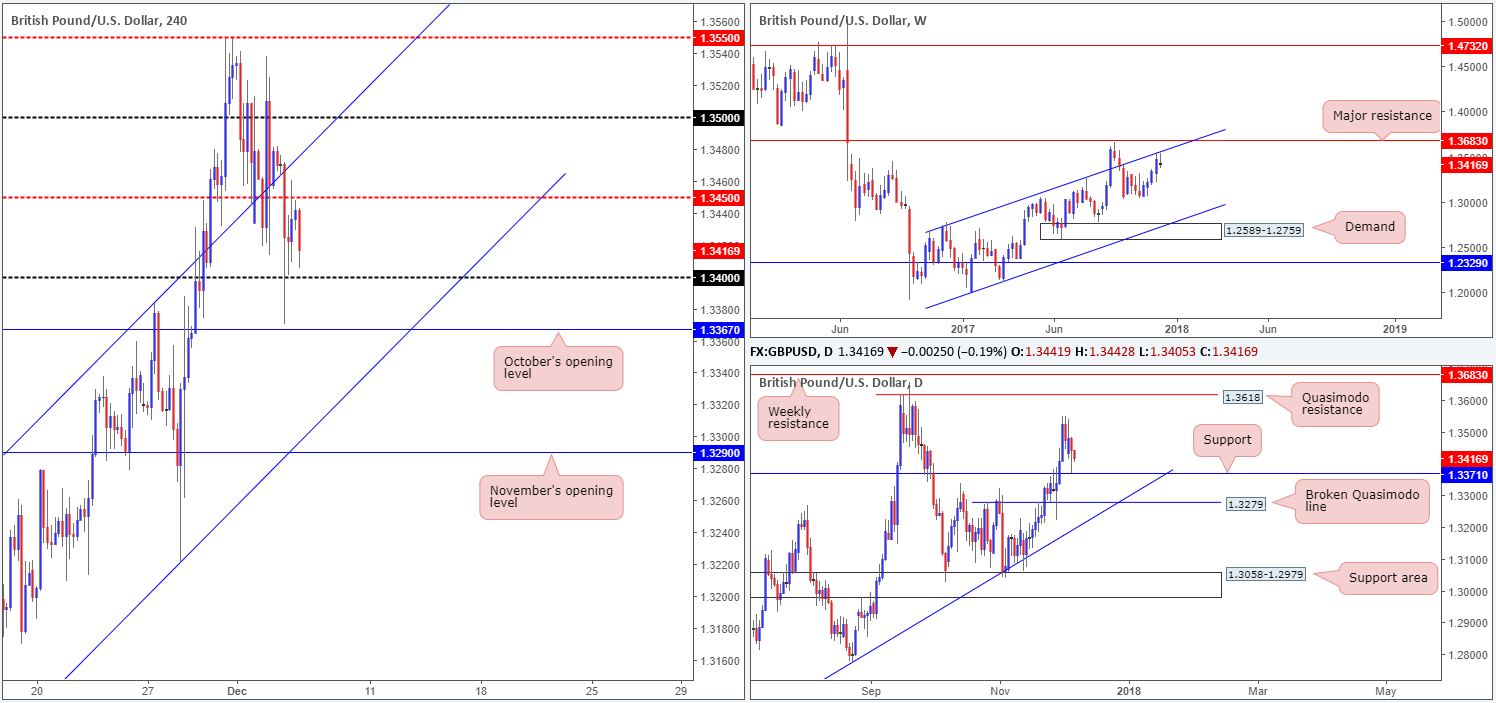

AUD/USD:

The impact of Tuesday’s stronger-than-expected Aussie retail sales revived demand for the AUD, lifting the unit beyond H4 resistance at 0.7632. Shortly after this, the RBA announced that the bank decided to keep its official cash rate on hold at 1.5%, as expected. This further boosted demand for the AUD, reaching highs of 0.7653. However, with the US dollar preserving its bullish tone, the pair failed to sustain gains, despite disappointing US economic data. The day concluded with H4 price crashing back into the 0.76 handle, up just 0.05% on the day.

Over on the daily timeframe, recent action saw daily price come within a hair of the underside of daily supply located at 0.7695-0.7657. Also notable on this timeframe is the potential daily AB=CD bearish formation (see black arrows) that completes around the 127.2% daily Fib ext. point at 0.7685. On the weekly timeframe, however, downside is still favored it seems, as there is room for price to trade as far south as the weekly channel support extended from the low 0.6827 (merges with a weekly 50.0% value at 0.7475 taken from the high 0.8125 and a nice-looking weekly AB=CD [see black arrows] 161.8% Fib ext. point situated at 0.7496).

Direction: Potential selling opportunities exist within the aforesaid daily supply, specifically around the noted daily AB=CD completion point. On the buy side, the 0.75 handle is the area that continues to stand out, due to its weekly/daily confluence.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: 0.76 handle; 0.75 handle; weekly channel support extended from the low 0.6827; weekly 50.0% value at 0.7475 taken from the high 0.8125; weekly AB=CD 161.8% Fib ext. point situated at 0.7496.

Resistances: H4 resistance at 0.7632; daily supply located at 0.7695-0.7657; daily AB=CD bearish formation that completes around the 127.2% daily Fib ext. point at 0.7685.

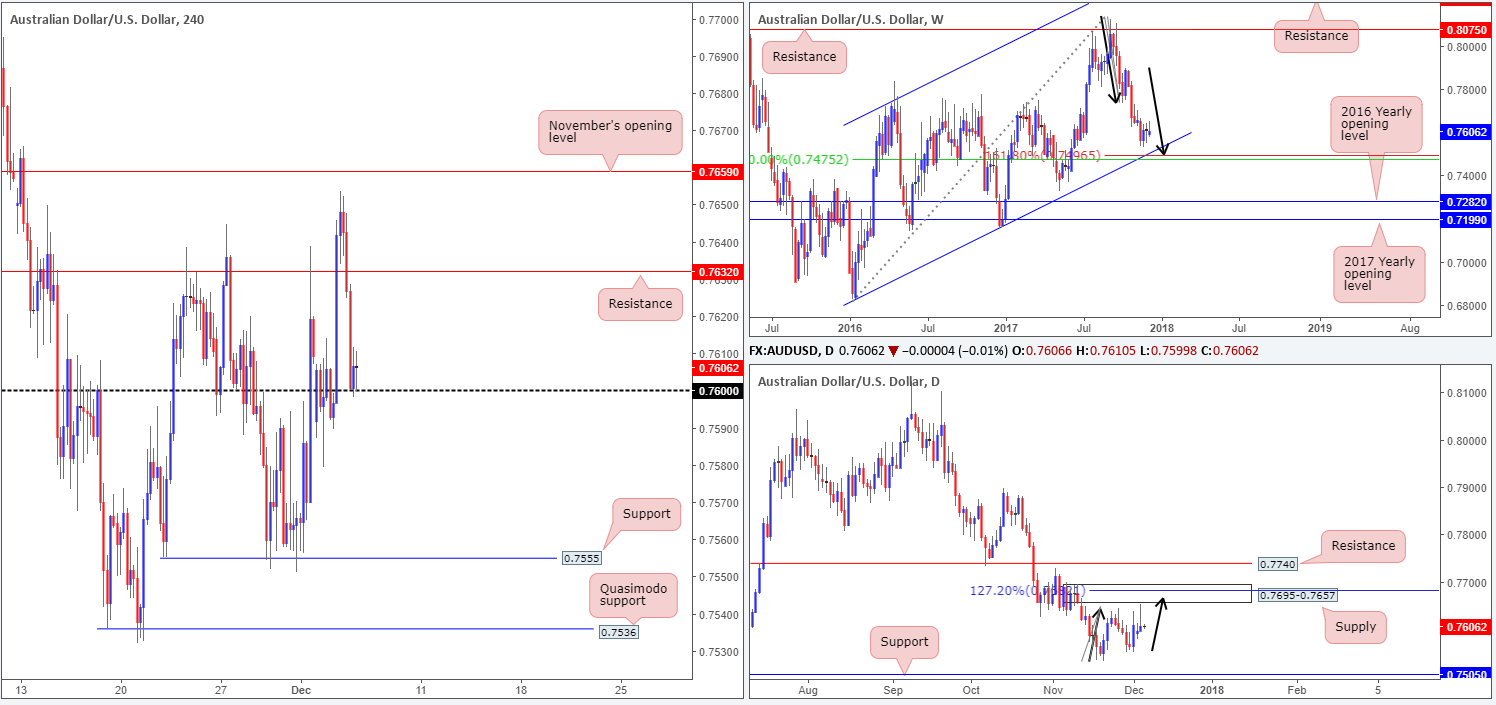

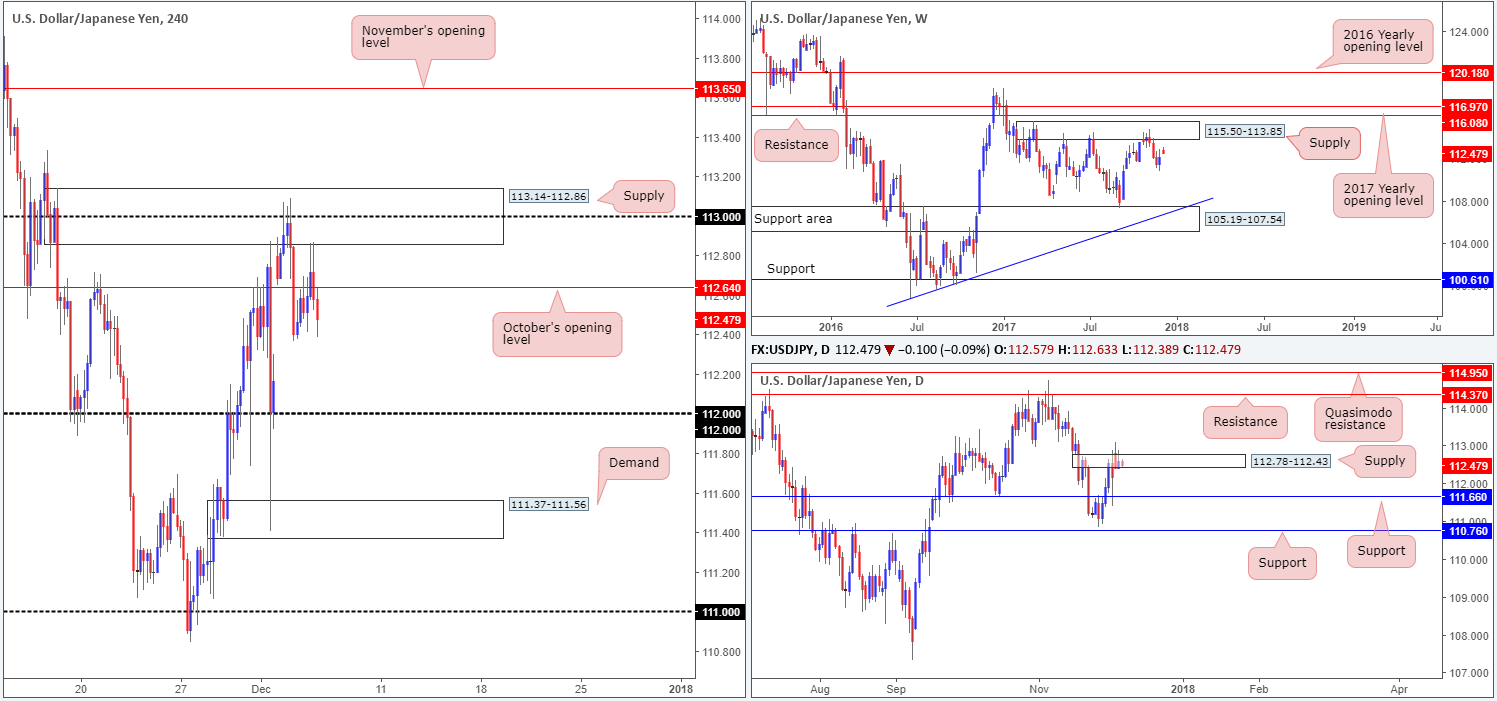

USD/JPY:

During the course of yesterday’s sessions, the USD/JPY whipsawed through October’s opening level at 112.64 and shook hands with the underside of a H4 supply base at 113.14-112.86. The selloff from this region has so far been dominant. Should 112.36, the 4th Dec low, be consumed, the next downside target on the H4 scale can be seen around the 112 handle. A move down to here will also fill the weekend gap.

Daily supply at 112.78-112.43 had its top edge challenged on Monday, but is somehow managing to survive. A continued push lower from here brings the daily support at 111.66 into the spotlight, which is positioned directly above a H4 demand at 111.37-111.56.

Direction: A break of 112.36 will likely confirm downside to 112. Selling on the retest of Oct’s opening level (H4 timeframe) could then be something to consider, targeting 112, followed by daily support at 111.66.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: 112 handle; H4 demand at 111.37-111.56; daily support at 111.66; 4th Dec low at 112.36.

Resistances: H4 supply at 113.14-112.86; October’s opening level at 112.64; daily supply at 112.78-112.43.

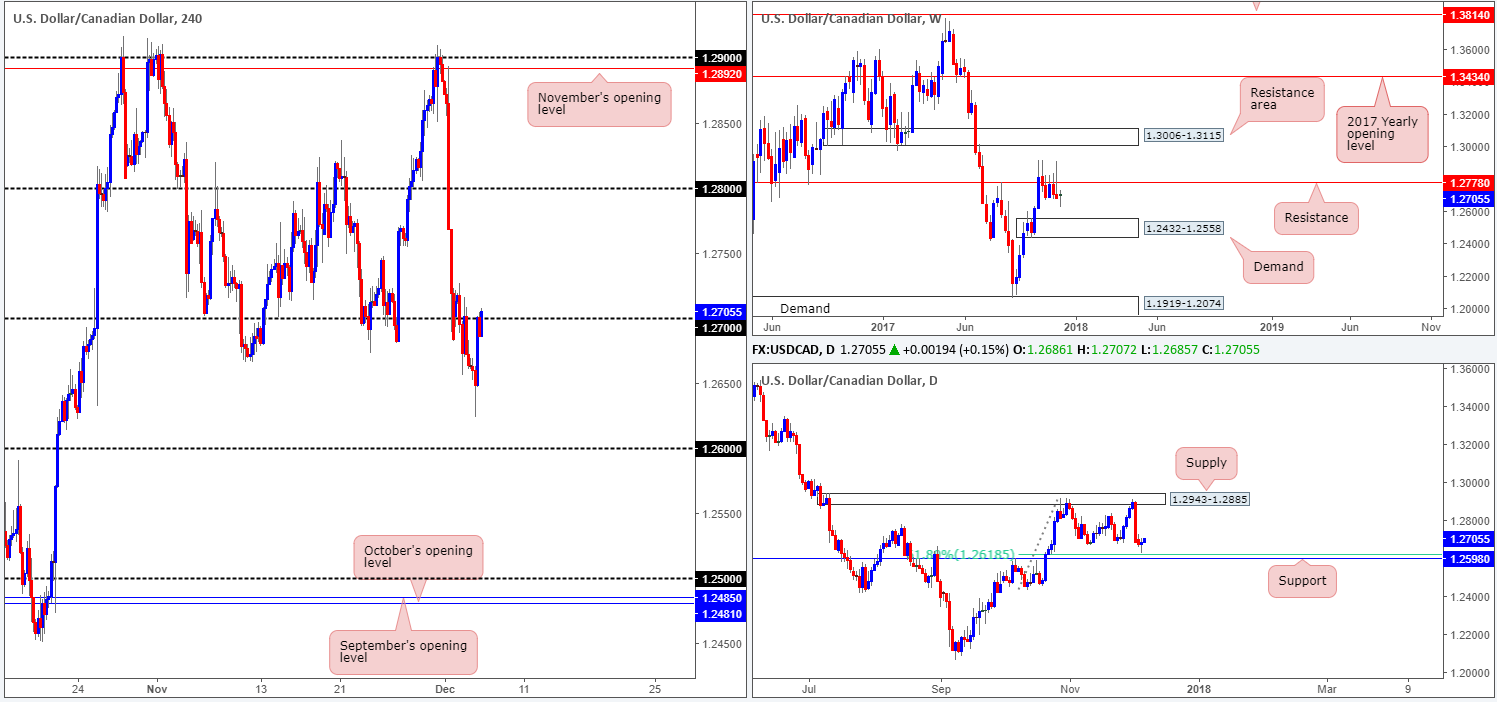

USD/CAD:

Following the retest of 1.27 (in the shape of a near-full-bodied bearish H4 candle) the USD/CAD probed lower and managed to score a low of 1.2623 on Tuesday. Further selling beyond 1.2623, as you can see, proved to be a difficult feat since a few pips below was a 61.8% daily Fib support at 1.2618 taken from the low 1.2432. As a result, the pair pulled back and is now facing the 1.27 handle again. Eliminating 1.27could see H4 price find its way back up to the H4 resistance area coming in at 1.2754-1.2770.

While daily price appears to be establishing a base of support from the noted Fib level, weekly action shows potential to the downside. Upside remains capped on the weekly timeframe at 1.2778. The current weekly resistance level on the USD/CAD shares a strong history that dates back to early 2004, so it is not one to ignore! Couple this with the fact that last week’s weekly action chalked up a strong-looking bearish selling wick (likely capturing the attention of candlestick traders), further selling could be in the offing. In the event that the market continues to dip south from here, traders’ crosshairs will likely be fixed on the weekly demand at 1.2432-1.2558. Boasting a strong base, this demand area communicates strength and, therefore, will likely hold back sellers should the area come into play.

Direction: Buying above 1.27 (preferably on a retest) could be an option given where the unit is located on the daily timeframe. However, in doing so, you’ll have to be prepared for possible weekly selling opposition.

Alternatively, a rejection off 1.27 could be considered a sell signal, targeting 1.26, which, as you may recall, is positioned directly below the current daily Fib level at 1.2618 (and just above daily support at 1.2598).

Data points to consider: US ADP non-farm employment change at 1.15pm; BoC rate statement and interest rate decision at 3pm; Crude oil inventories at 3.30pm GMT.

Areas worthy of attention:

Supports: 1.26 handle; Daily support at 1.2598; 61.8% daily Fib support at 1.2618 taken from the low 1.2432; weekly demand at 1.2432-1.2558.

Resistances: 1.27 handle; H4 resistance area at 1.2754-1.2770; weekly resistance level at 1.2778.

USD/CHF:

Recent action shows that the USD/CHF extended its bounce from the weekly support level at 0.9770 on Tuesday, bidding daily price above resistance at 0.9864.This has potentially opened up the path north for further buying up to at least the daily supply base coming in at 0.9946-0.9914. Traders should expect some selling pressure to be seen from here. Not only is base well built, it also boasts strong momentum to the downside, therefore communicating strength.

Across the pond on the H4 timeframe, yesterday’s advance dragged H4 price above a H4 trendline resistance extended from the high 1.0017, and is now see crossing swords with a H4 resistance level plotted at 0.9879.

Directions: While the current H4 resistance seems attractive for a short given its history, both weekly and daily timeframes suggest further upside is on the cards. Therefore, sell this level WITH CAUTION!

Assuming that H4 price closes above the current H4 resistance, a long on the retest of this base could be something to think about. Be that as it may, upside, according to the H4 scale, only offers around 40 pips of wiggle room until price reaches H4 resistance at 0.9945, which basically represents the underside of the aforementioned daily supply.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: daily support at 0.9864; weekly support at 0.9770.

Resistances: H4 resistance level at 0.9879; daily supply at 0.9946-0.9914; H4 resistance at 0.9945.

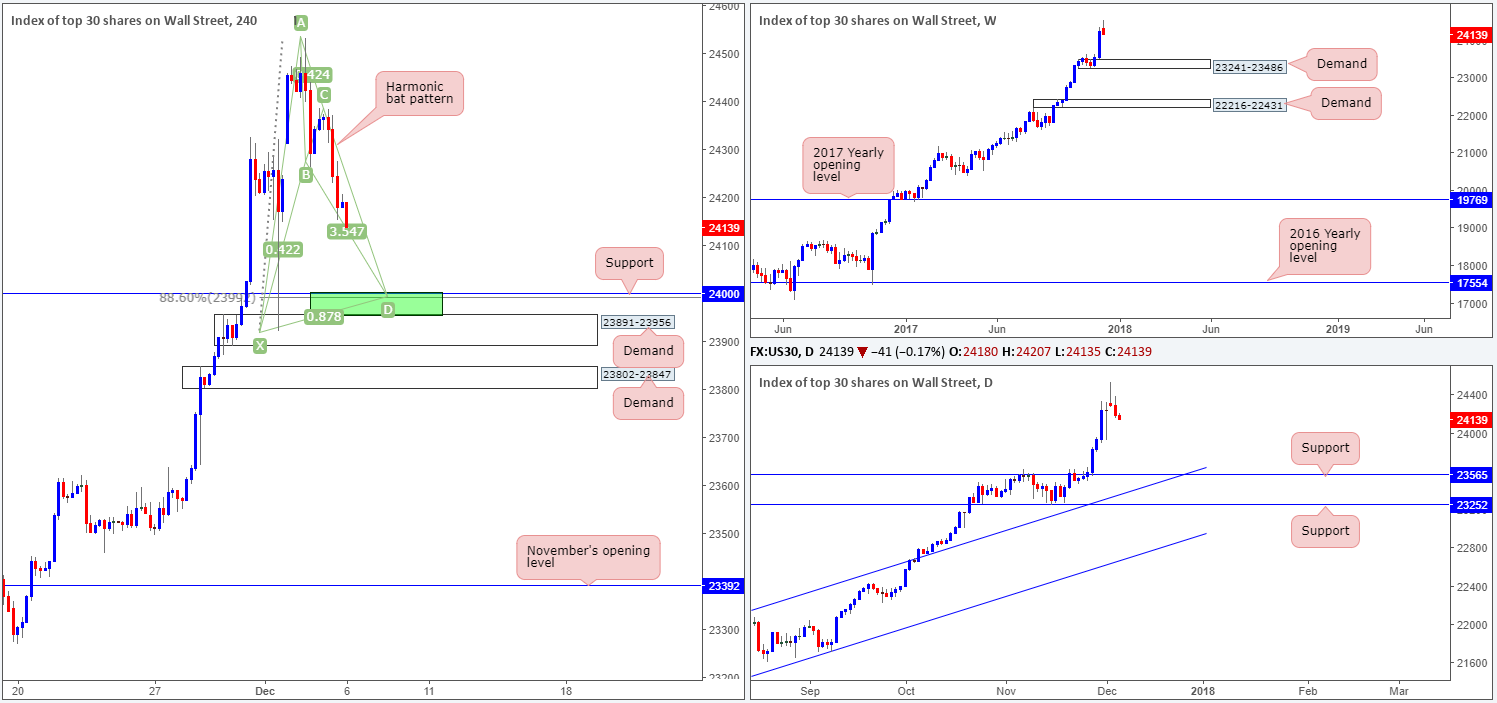

DOW 30:

US equities extended losses on Tuesday as investors continue to diversify their portfolios on their expectations of how the US tax reform will affect performance. Another thing that may be worth highlighting is the H4 harmonic bat pattern that completes around the 88.6% H4 Fib support at 23992. Coupled with the 24K round number acting as potential support and the top edge of a H4 demand at 23891-23956, this could be an area worthy of consideration for longs.

The only drawback is that the H4 harmonic pattern has no higher-timeframe confluence! The closest support can be seen on the daily timeframe at 23565.

Direction: Providing that the H4 harmonic bat pattern completes today, there’s a good chance that price action will bounce from here. One should pay attention to stop placement, however, since there is little stopping H4 price from faking below the upper H4 demand into the lower H4 base at 23802-23847.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT.

Areas worthy of attention:

Supports: H4 support at 24000; H4 88.6% Fib support at 23992 (harmonic completion point); H4 demand at 23891-23956; H4 demand at 23802-23847; Daily support at 23565.

Resistances: …

GOLD:

Weekly price recently entered the weekly demand base at 1251.7-1269.3 and is seen shaking hands with a weekly channel support etched from the low 1122.8. The ascending channel formation has been in motion for quite some time and on each occasion the limits have been challenged, it held beautifully. Therefore, history may repeat itself here.

The daily candles are also seen interacting with a daily demand base drawn from 1251.7-1265.2, which is not only positioned within the lower limits of the weekly demand mentioned above, it also houses a 61.8% daily Fib support at 1263.3.

Looking over to the H4 timeframe, August/November’s opening levels at 1269.3/1269.9 were chewed up amid yesterday’s selloff, as the USDX (US dollar index) printed fresh weekly highs. As can be seen from the chart, price only began finding refuge after bottoming around the 1260.7 region.

Direction: With a clear H4 AB=CD (black arrows) 161.8% ext. point nearby at 1259.7, this could be an ideal location to look for buying opportunities considering that its bolstered by both a weekly/daily demand and a weekly channel support! Just beyond the H4 AB=CD completion point, there’s also another layer of support at 1254.3: a H4 Quasimodo support formed back in early August (not seen on the screen).

Areas worthy of attention:

Supports: H4 AB=CD 161.8% ext. point nearby at 1259.7; H4 Quasimodo support at 1254.3; daily demand at 1251.7-1265.2; weekly demand at 1251.7-1269.3; weekly channel support extended from the low 1122.8.

Resistances: August/November’s opening levels seen on the H4 timeframe at 1269.3/1269.9.