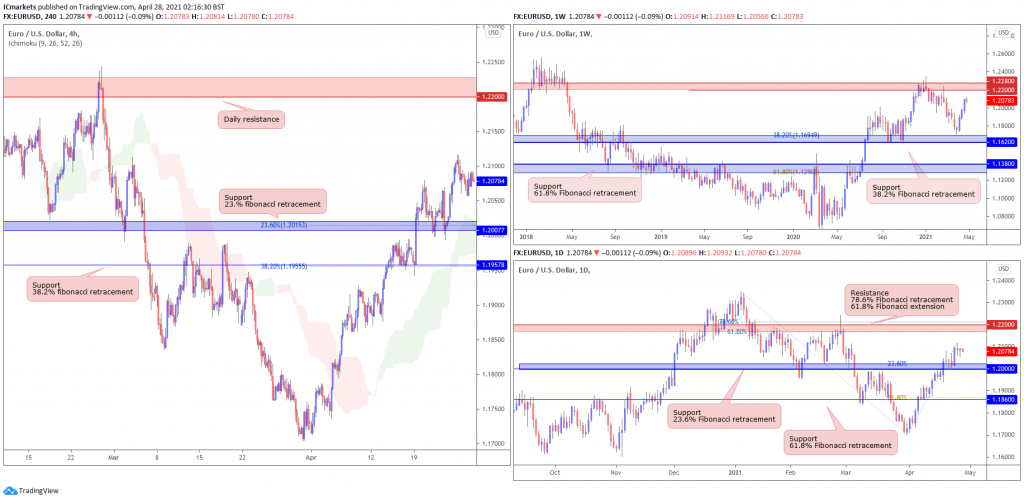

EUR/USD:

Looking at the weekly chart, we can see that prices are seeing further limited upside before it reaches our resistance area at 1.22000 – 1.22800. On the daily chart, it echoes the same bullish view as well, where prices are facing bullish pressure from our support level at 1.2000, in line with the 23.6% fibonacci retracement where we might see more upside above this level.

On the H4 timeframe, prices are facing bullish pressure from our support level in line with our 23.6% fibonacci retracement where we could see a further upside above this level, with 1.22000 as the resistance target, in line with the daily resistance level. Failure to hold above 1.20077 support could see price swing lower towards the 1.19578 level, in line with the 38.2% fibonacci retracement.

Areas of consideration:

- 22000 resistance area found on H4 time frame

- 20077 support area found on H4 time frame

GBP/USD:

Looking at the weekly chart, we can see that prices are trading within our support and resistance levels at 1.36622 and 1.43000 respectively. On the daily time frame, prices are approaching our resistance level at 1.4000 level, in line with 61.8% Fibonacci retracement.

On the H4 timeframe, prices are facing bearish pressure from our resistance at 1.39121, in line with our 50% fibonacci retracement where we could see a reversal below this level, with 1.37946 as our support target. Failure to hold below our resistance level at 1.39121 could see a swing towards our next resistance level at 1.4000, in line with the resistance level found on the daily time frame.

Areas of consideration:

- 39121 resistance area found on H4 time frame

- 37946 support area found on H4 timeframe

AUD/USD:

From the Weekly timeframe, price is displaying a consistent bullish move where it may find resistance at 78.6% fibonacci retracement level of 0.79018. From the daily timeframe, we see price reversing from previous swing high where it may find support at 0.76734, in line with 61.8% fibonacci retracement.

On the H4 timeframe, price has shown a strong pull back towards 0.77209, in line with 78.6% fibonacci retracement. If price bounces from this level we may potentially see a further push towards the upside. However, if price fails to hold above that level, we may see a swing towards 0.76602 where the Daily support is.

Areas of consideration:

- H4 may return to 0.77209 before pushing higher.

- Daily and weekly timeframes show more room for upside.

USD/JPY

From the weekly timeframe, prices are facing resistance from horizontal swing high resistance which coincides with 50% Fibonacci retracement and 78.6% Fibonacci extension, taking support from 104.224 level which is in line with 78.6% FIbonacci retracement and 78.6% FIbonacci extension. On the daily time frame, prices are facing resistance from horizontal swing high resistance in line with 78.6% Fibonacci retracement.

On the H4 timeframe, prices are facing bearish pressure from descending trendline resistance. Prices are coming back to retest the descending trendline resistance, in line with horizontal swing high resistance in line with 50% Fibonacci retracement and 61.8% Fibonacci extension. Prices might push down lower towards resistance turned support which coincides with 61.8% Fibonacci retracement and 161.8% Fibonacci extension. Stochastics is also approaching 96.65 level, potential for further downside.

Areas of consideration:

- On the H4, prices might push up to descending trendline in line with horizontal swing high resistance

- Price facing resistance from 110.978 on weekly and daily

USD/CAD:

The weekly chart shows price respecting the descending trendline, and pushed away from the weekly 1.26464 resistance. The daily chart shows that priceis holding above the support level showing signs of reversal, however, if price manages to break below, we may see a swing towards the daily support at 1.23238.

The H4 chart, price is showing a sideways trend slightly bullish as it is creating higher highs and lows. We may continue to wait for the bigger time frame pull back towards 1.24392 in line with 61.8% fibonacci retracement before deciding the next port of call.

Areas of consideration:

- The weekly and daily time frame a respect of the descending trendline.

- On H4, price may pull back towards 1.24392 before pushing lower.

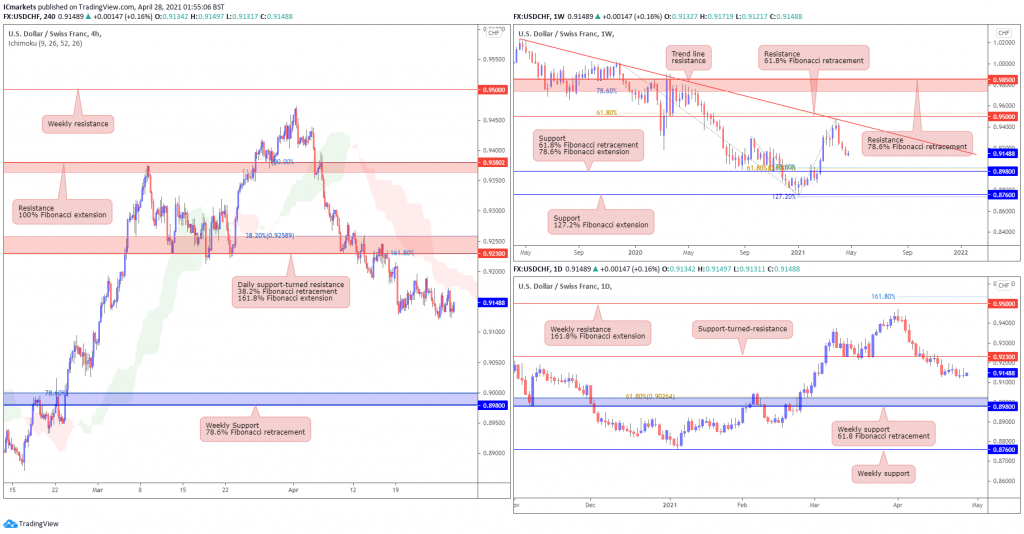

USD/CHF:

USD/CHF has seen a reversal at the descending trendline resistance and is now approaching the weekly 0.89800 support, in line with 61.8% Fibonacci retracement and 78.6% Fibonacci extension. The daily chart shows that price is now holding below the key daily 0.92300 support-turned-resistance. We could potentially see further downside from here towards the next daily 0.89800 support level.

On the H4 chart, we can see that price is now holding below the Ichimoku cloud, showing bearish pressure in line with our bearish bias. Price is also now holding below the daily 0.92300 support-turned-resistance area, which is in line with our 38.2% Fibonacci retracement and 161.8% Fibonacci extension, where we could potentially see further downside from here towards our weekly 0.89800 support in line with 78.6% Fibonacci retracement. Otherwise, should price break above the daily 0.92300 level, it could swing towards the 0.93802 resistance instead, in line with 100% Fibonacci extension.

Areas of consideration:

- Price is facing bearish pressure as it holds below the Ichimoku cloud.

- We could potentially see price swing towards the next 0.89800 weekly support.

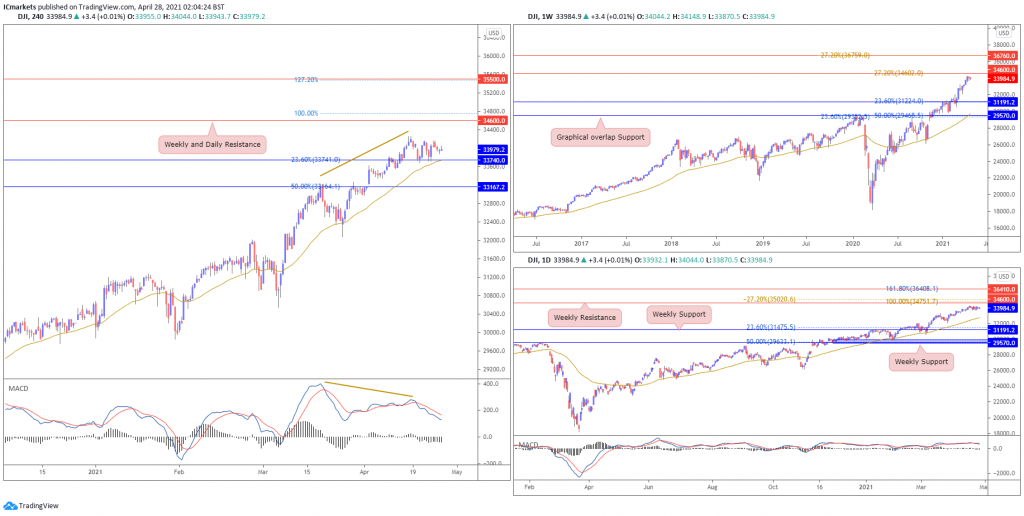

Dow Jones Industrial Average:

On the weekly chart, price is holding below key 34600 resistance. With price deviating so far from the moving average, we may expect to see some mean reversion in the Dow soon. Sellers may add to their shorts below 34600 resistance with a possible long term downside target at 31190 support. Otherwise a weekly break and close above 34600 resistance will see price swing higher. On the Daily, price is capped below 34600 weekly resistance as well facing bearish pressure. Traders should be cautious about any form of selling as technical indicators remain bullish.

On the H4, price continues to drift sideways and hold above 33740 support. We see a low probability bullish scenario where buyers may consider adding to their longs above 33740 support. However with technical indicators giving a mixed signal and divergence still noted on the H4, any long positions should be taken with caution.

Areas of consideration:

- Watch closely 33740 intraday support

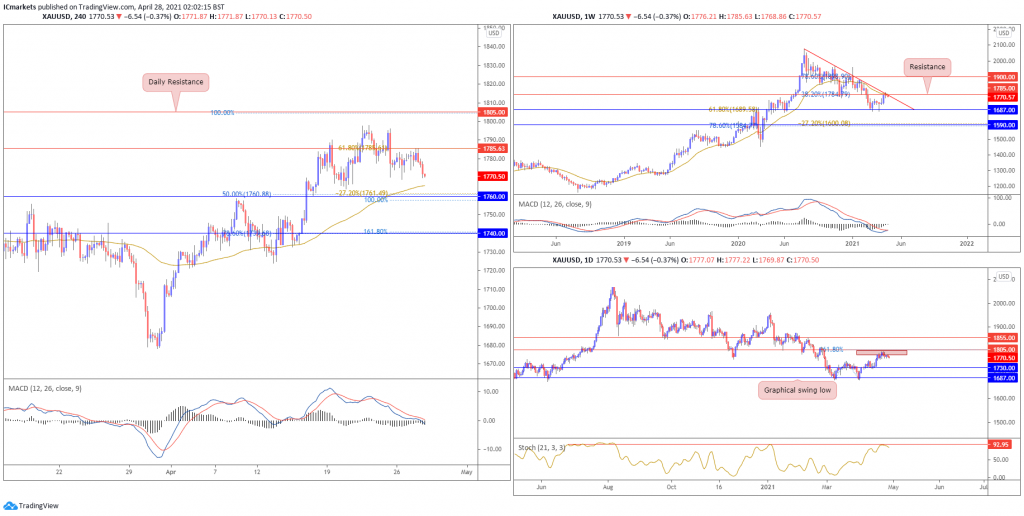

XAU/USD (GOLD):

On the weekly timeframe, gold is testing and holding below descending trendline resistance and long term moving average resistance at 1785. A weekly close below this resistance could see price pull back lower towards 1687 support. On the Daily timeframe, price is also testing the resistance zone at 1805. A short term drop towards support at 1730 could be likely. Otherwise, failure to hold below 1805 resistance could see price swing higher towards 1855 resistance next.

On the H4, price pushed lower breaking previous support. With price now holding between 1760 support (key confluence area) and 1785 resistance, we prefer to stay neutral and wait for a test or a break of either key levels. Technical indicators are mixed as well.

Areas of consideration:

- Bearish divergence forming on H4

- H4 technical indicators are mixed

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.