EUR/USD:

Looking at the weekly chart we can see that price have bounced back and is currently re-testing the 23.6% Fibonacci retracement and ascending trendline support-turned-resistance. There would be limited upside from this level before bearish pressure resumes. On the daily chart, we are seeing a low-probability continuation of the bounce to retest resistance level at 1.20073, in-line with 38.2% Fibonacci retracement and 200MA. RSI is also rebounding from the oversold level and is in-line with our short-term bullish outlook.

On the H4 timeframe, prices reached our first resistance at 1.19490, in-line with 38.2% and 61.8% Fibonacci retracement. We are seeing a low-probability continuation of the bounce to our first resistance at 1.19800, in-line with 50% and 78.6% Fibonacci retracement.. RSI is also indicating bullish momentum supporting our short-term bullish outlook. The next level of psychological resistance will be at 1.20000, in-line with -61.8% Fibonacci retracement and 161.8% Fibonacci extension.

If price faces further bearish pressure from current level, it would come back to retest support at 1.18630, in-line with 78.6% Fibonacci retracement and 61.8% Fibonacci extension. The next level of support will be at 1.18032, in-line with -27.2% Fibonacci retracement and 100% Fibonacci extension.

Areas of consideration:

- H4 time frame, support level at 1.18630 and 1.18032

- H4 time frame, resistance level at 1.19800 and 1.20000

GBP/USD:

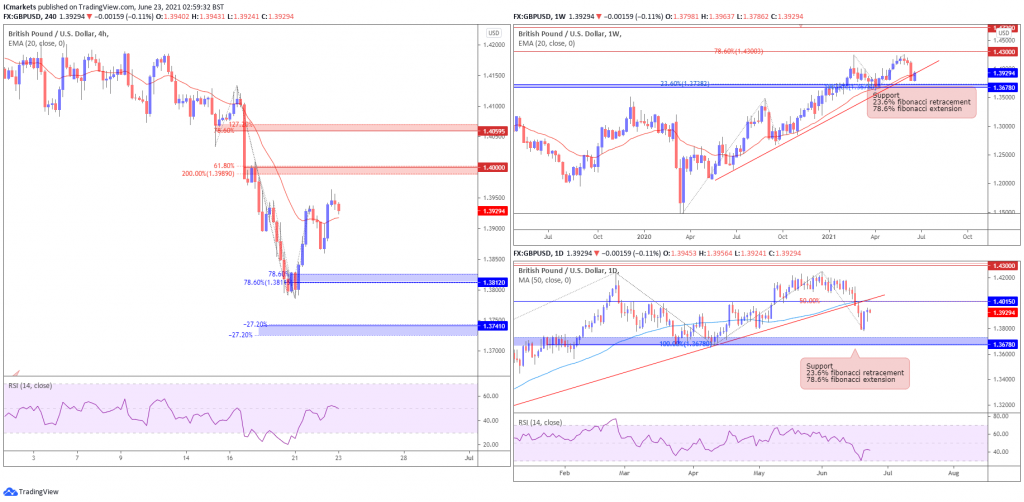

Looking at the weekly chart, we can see that prices have bounced back to retest 20EMA, ascending trendline support-turned-resistance. On the daily time frame, prices rebound and and we expect a short-term bounce to 1.40150, in-line with 50MA , ascending trendline support-turned-resistance and 50% Fibonacci retracement. RSI is also rebounding from the oversold level and is in-line with our short-term bullish outlook.

On the H4 timeframe, prices are consolidating above 20EMA. We are seeing a low-probability continuation of the bounce to psychological resistance level at 1.400000, in-line with 61.8% Fibonacci retracement & 200% Fibonacci extension. RSI is indicating bullish momentum supporting our short-term bullish outlook. The next resistance level will be at 1.40595, in-line with 78.6% and 127.2% Fibonacci retracement.

If price faces further bearish pressure from current level, we could see the price coming back to test 1.38120, in-line with 78.6% Fibonacci retracement & 78.6% Fibonacci extension. The next level of support will be at 1.3740, in-line with 100% and 127.2% Fibonacci extension. The next level of support will be at 1.38120, in-line with -27.2% Fibonacci retracement & 161.8% Fibonacci extension.

Areas of consideration:

- H4 time frame, 38120 and 1.37410 support level

- H4 time frame, 1.40000 and 1.40595 resistance level

AUD/USD:

From the Weekly timeframe, we see price under 0.76073, in line with previous swing low, where we may see a continuation of push down towards 0.74063, in line with 61.8% fibonacci retracement, 100% fibonacci extension and horizontal graphical overlap. From the daily timeframe, we see a similar action where price is pushing down towards the 0.74362 level, in line with Weekly support, -27% and 127% fibonacci retracement.

On the H4 timeframe, we see price bouncing upwards after tapping on the major level of 0.75 in line with 61.8% fibonacci retracement, we may expect price to push higher to 0.76078, in line with Weekly and Daily resistance, 61.8% fibonacci retracement and 127% fibonacci extension.

Areas of consideration:

- H4 timeframe showing short-term bullish pressure, where price may push higher towards 0.76072

- Daily and weekly time frames showing bearish pressure.

USD/JPY

From the weekly timeframe, prices are facing resistance from horizontal swing high resistance which coincides with 50% Fibonacci retracement and 78.6% Fibonacci extension. Prices seem to be more bullish and might break through the resistance. If price breaks out, the next target on the weekly would be the 114.665 level in line with 127.2% Fibonacci retracement. On the daily time frame, prices are holding nicely above the 21 period EMA. Prices are approaching resistance at 110.978 in line with the weekly level. A reversal from that level could mean prices would take support on 108.425 level. A continued push up could mean the next target is weekly resistance of 114.665 in line with 100% Fibonacci extension level.

On the H4 timeframe, prices are showing the same picture. Prices are approaching the daily/weekly resistance level of 110.978. A break above the level could see prices pushing up towards 112.148, a short term resistance in line with 161.8% Fibonacci extension. Prices are bouncing off support on 109.786 which is in line with ascending trendline support, 61.8% Fibonacci retracement and 100% Fibonacci extension. 34 Period EMA is also below prices, showing a bullish pressure for prices.

Areas of consideration:

- 148 resistance level on the H4 timeframe might be next upside target

- 978 level on every time frame

- 786 support level on the H4 timeframe

USD/CAD:

From the Weekly timeframe, we saw a break above the longer term descending trendline resistance turned support drawn from 23rd March 2020, and 61.8% fibonacci retracement is being tested, we may see a push down from here. On the daily timeframe, we are seeing a similar move, however, price is trending under the daily descending trendline resistance where a reversal occurred, and may push down towards 1.22730, in line with weekly support and 50% fibonacci retracement.

The H4 timeframe shows price pulling back towards level 1.22749, in line with major level 1.2300, weekly, daily support and 61.8% fibonacci retracement. From here we may see a push up towards major level 1.2500, in line with Daily resistance.

Areas of consideration:

- The weekly and daily time frame shows the price reversing from the key resistance area.

- On H4, price may bounce towards 1.2500

USD/CHF:

USD/CHF has shown a strong bounce from the weekly 0.89500 support, in line with 61.8% Fibonacci retracement and 78.6% Fibonacci extension. The daily chart shows that price is now testing the key daily 0.92300 support-turned-resistance and ascending trendline support-turned-resistance. We could potentially see a reversal at 0.92300 resistance.

On the H4 chart, we can see that price has shown a reversal at the 0.92300 resistance level, in line with 61.8% Fibonacci retracement level. The 0.92300 weekly resistance is a key intraday level to watch. We note that RSI has also broken below the ascending trendline support-turned-resistance. In this scenario, we could see price face further downside towards 0.90500 support, in line with 61.8% Fibonacci retracement, 161.8% Fibonacci extension and horizontal pullback resistance. However, should price break and close above the 0.92300 resistance, we could see price push higher to test the subsequent weekly resistances.

Areas of consideration:

- The 0.92300 resistance is a key intraday level to watch.

- We could see price drop towards the next 0.90500 support level.

Dow Jones Industrial Average:

On the weekly chart, prices traded lower, spooked by inflation fears and the Federal Reserve looking to raise interest rates as early as 2023. With price approaching 32765 support, we might see bullish pressure above this level. On the daily chart, price is bouncing above the weekly support at 32765. Buyers may look to add their longs to push price higher towards possible target at 35090 resistance. Stochastic is testing support as well where price bounced in the past.

On the H4, price pushed higher above 33475 support. With stochastic testing support where price bounced in the past, we see a possibility where buyers may add to their longs with an upside target at 35090 resistance. Otherwise, failure to hold above 33475 should see the price swing the other way towards weekly support at 32765.

Areas of consideration:

- Weekly key level at 32765 support is of key interest

XAU/USD (GOLD):

On the weekly timeframe, pulled back lower and is testing key trendline pullback support at 1764. On the daily, price tested and reacted above 1764 weekly support. While 1764 support looks fragile, as long as we do not have a daily close below this support, we may see price bounce towards 1855 resistance. Otherwise, breaking below 1764 support, price could drop lower towards 1677 support next.

On the H4, price is still holding between 1808 resistance and 1764 support. With no good levels for entry that offers good risk to reward, we prefer to stay neutral. However with stochastic testing support where price bounced in the past, we maintain a slight bullish bias on the intraday for Gold. Breaking above 1808 will see price push higher towards 1855 resistance.

Areas of consideration:

- 1764 support is the key level to watch.

- 1808 resistance on H4 to watch.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.