Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

EUR/USD:

After dropping sharply over the past couple of days, the euro went on the offensive in recent sessions. Reclaiming all of Friday’s losses and chalking up a H4 close beyond supply at 1.1643-1.1630 (now acting support area); this may have provided a launchpad for a fresh upside assault to the 1.17 neighborhood today.

Over on the bigger picture, weekly price chewed its way through a support level at 1.1714 last week (now acting resistance), and possibly cleared the trail south for further selling down to support penciled in at 1.1461. The story on the daily timeframe, nonetheless, shows that the buyers recently made a stand ahead of a strong-looking demand area at 1.1479-1.1552, which happens to unite beautifully with a channel support etched from the low 1.1717.

Suggestions: Given the current landscape, there’s a strong chance that the recently engulfed H4 supply at 1.1643-1.1630 may be used as a support area today for a move up to 1.17.

Data points to consider: EUR CPI flash estimate y/y and EUR prelim flash GDP q/q at 10am; US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm GMT.

Levels to watch/live orders:

- Buys: 1.1643-1.1630 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

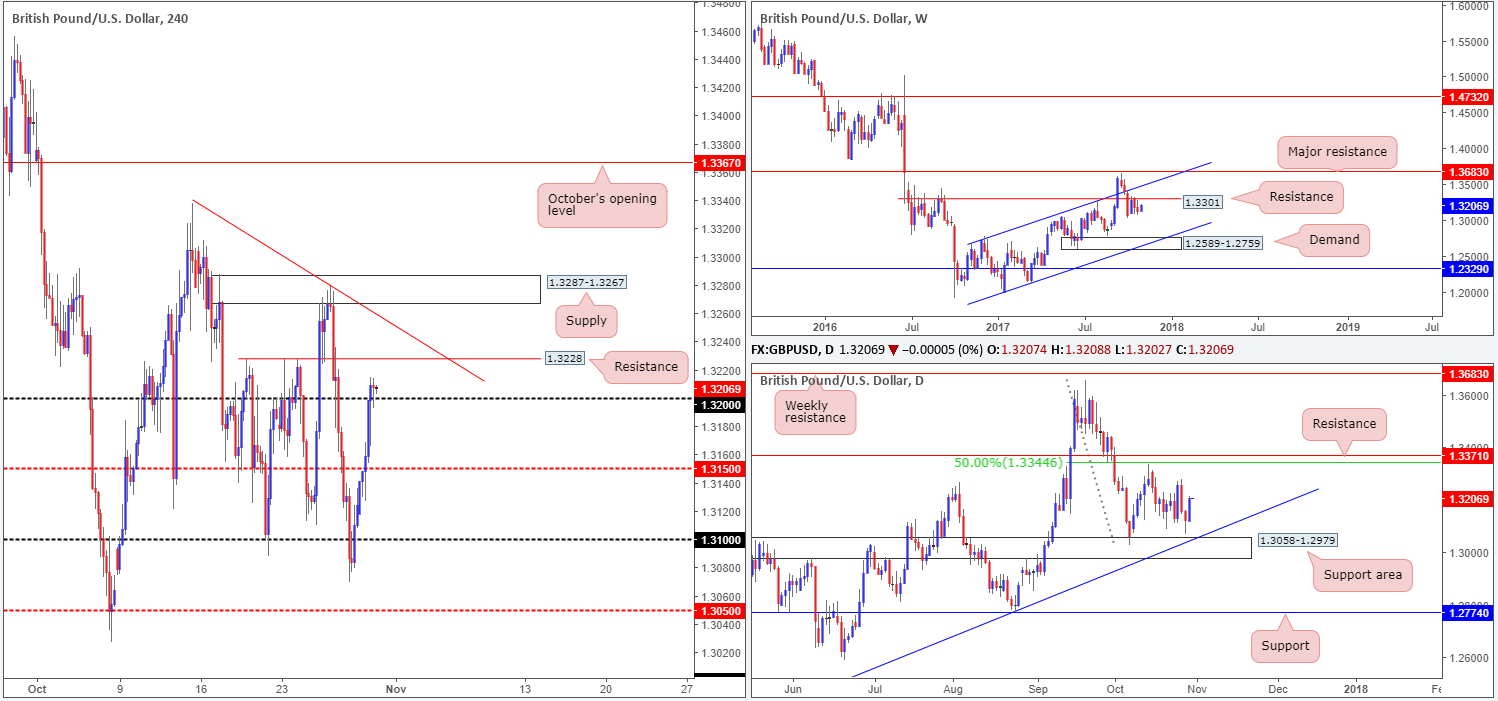

GBP/USD:

The British pound made considerable ground against its US counterpart on Monday, breaking through both the H4 mid-level resistance 1.3150 and the 1.32 handle. The next upside target on the H4 timeframe is 1.3228: a resistance level, followed closely by a trendline resistance extended from the high 1.3338.

While H4 price action is currently seen confined between 1.32 and the aforementioned resistance, weekly price remains trading beneath a resistance level coming in at 1.3301. Further losses from this region would likely place weekly demand at 1.2589-1.2759 in the spotlight, along with its merging weekly channel support drawn from the low 1.1986. Down on the daily timeframe, nevertheless, price is seen trading mid-range between a support area at 1.3058-1.2979 (converges with a trendline support etched from the low 1.2108) and resistance at 1.3370/50.0% resistance at 1.3344 taken from the high 1.3657.

Suggestions: Despite the recent upside move, there’s still very little drawing our attention to this market at the moment.

- By entering long, you’d effectively be going up against potential weekly sellers and the nearby H4 resistance at 1.3228.

- Selling would make sense from the weekly timeframe, but it’d be difficult according to the H4 timeframe given the 1.32 handle and recent bullish strength.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

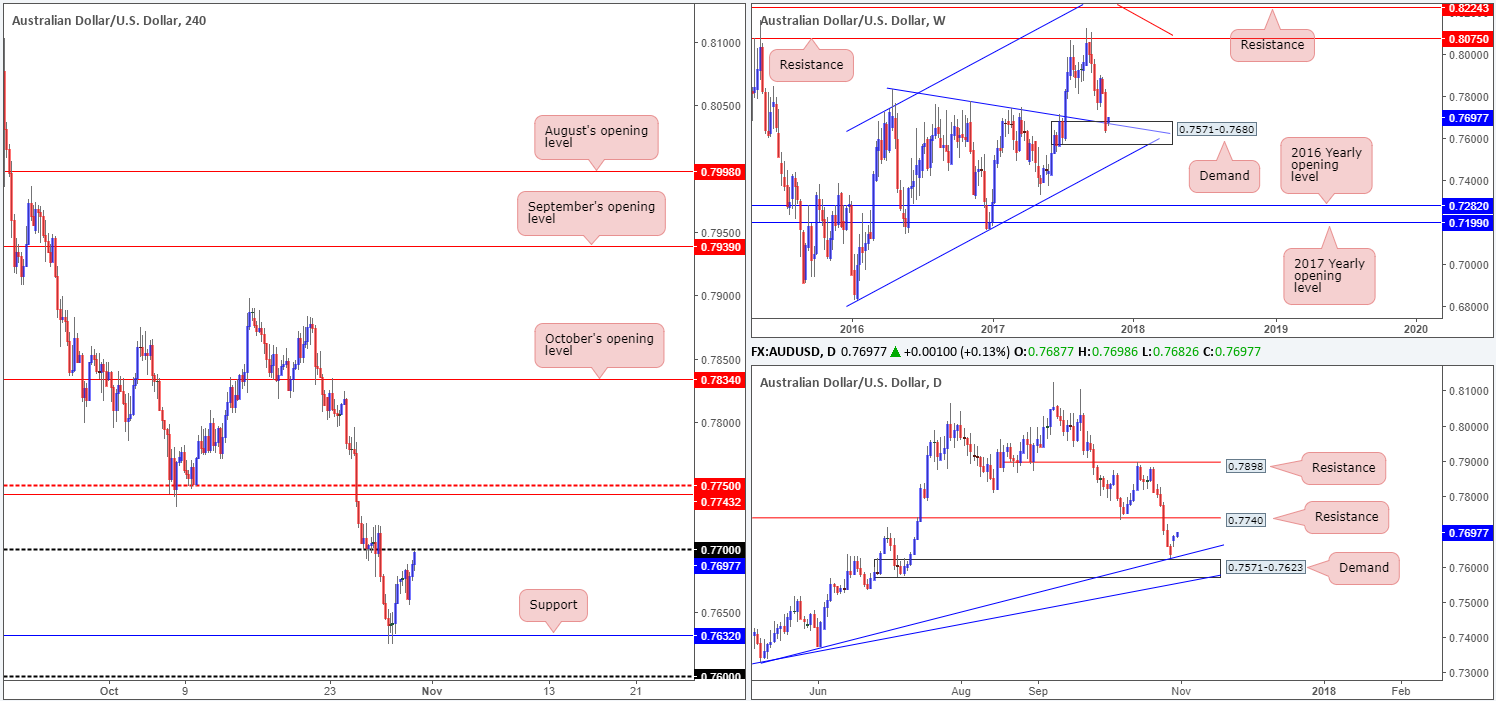

AUD/USD:

The Aussie dollar is trading with a reasonably strong bias to the upside right now, as H4 price nears the 0.77 handle. For those who read our recent reports you may recall that the team highlighted a possible buy zone at 0.76/0.7632. Comprised of the psychological band 0.76 and a H4 support at 0.7632, this area was a high-probability reversal zone. Not only because of the H4 structures, but also due to weekly demand at 0.7571-0.7680 that intersects with a trendline support taken from the high 0.7835, and a daily demand at 0.7571-0.7623, which also happened to merge nicely with a daily trendline support extended from the low 0.7328.

Suggestions: As we’re currently long the DJIA (in drawdown mind you), taking a long on the AUD/USD was not of interest due to its correlation to the DOW. Should any of our readers have taken the Aussie long call, we would strongly recommend having your stops at breakeven right now and some profits taken off the table. Ultimately though, we would be watching for the H4 sticks to close above 0.77 and head to the broken Quasimodo line at 0.7742 (conveniently positioned around daily resistance at 0.7740). This would be an ideal location to liquidate the remainder of the position.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

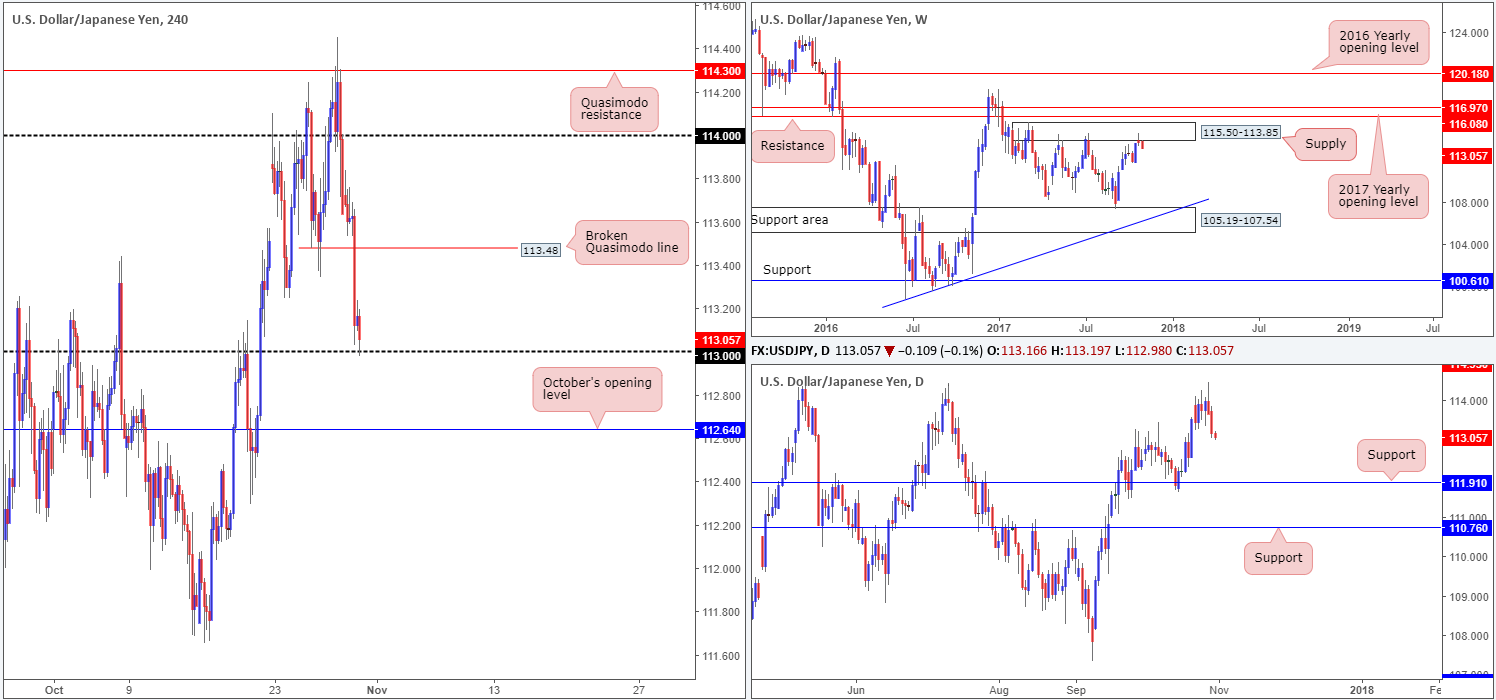

USD/JPY:

Kicking this report off from the top this morning, it is clear to see that the bears are showing some interest around the underside of a weekly supply zone at 115.50-113.85.This supply area has held price lower on two separate occasions so far this year. Therefore, there’s a chance that we may see history repeat itself. In conjunction with weekly price, daily structure shows room to push down as far as the support coming in at 111.91.

With a closer look at price action on the H4 timeframe, we can see that the unit pushed through the Quasimodo support at 113.48 on Monday, and mildly pared losses ahead of the 113 handle. With 113 recently brought into play, however, attempting to buy from this level would be risky work, in our opinion. This is largely down to where price is trading from on the bigger picture.

Suggestions: According to the technicals, a H4 close below 113 is likely on the cards. Should this move come to fruition, a potential short opportunity on any retest seen to the underside of 113 could be an option, targeting October’s opening level at 112.64 as an initial take-profit zone.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm; BoJ outlook report/monetary policy statement and interest rate decision at 3am GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 113 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bearish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

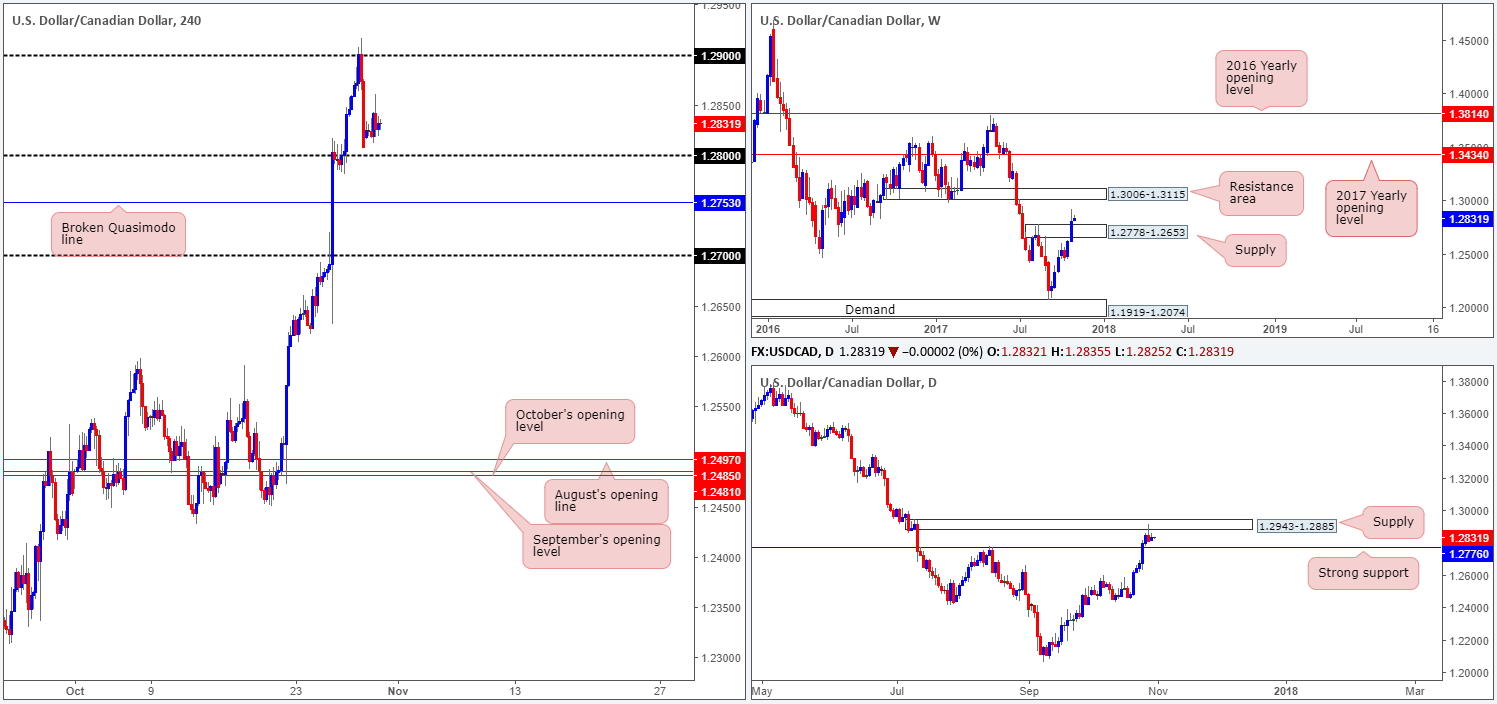

USD/CAD:

The USD/CAD is effectively unchanged this morning. Because of this, much of the following report will echo similar thoughts put forward in yesterday’s analysis…

Over the course of last week’s trading, the USD/CAD forced itself above a weekly supply zone at 1.2778-1.2653, reaching a high of 1.2916. As you can see, this has potentially opened up the path north to a resistance area at 1.3006-1.3115.

Before weekly buyers can lift price higher though, the daily supply at 1.2943-1.2885 will need to be consumed. This area, albeit a somewhat small zone, held price lower on Friday and penciled in a strong-looking selling wick. However, without a bearish close below nearby daily support at 1.2760, this holds little value, in our humble opinion.

Suggestions: A long from 1.28 could be an option today. Besides weekly price suggesting further upside might be at hand, there is a nearby daily support mentioned above at 1.2760. With that in mind though, do remain aware of the possibility of a fakeout being seen down to the noted daily support. Remember, psychological levels are prone to fakeouts due to the large amount of liquidity placed around these numbers.

To be on the safe side, why not consider waiting for H4 candle action to prove (a H4 full or near full-bodied candle) buyer intent exists from 1.28 before committing? This would help avoid any nasty fakeout seen to the downside.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm; CAD GDP m/m at 12.30pm; BoC Gov. Poloz speaks at 7.30pm GMT.

Levels to watch/live orders:

- Buys: 1.28 region ([waiting for a reasonably sized H4 bullish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

USD/CHF:

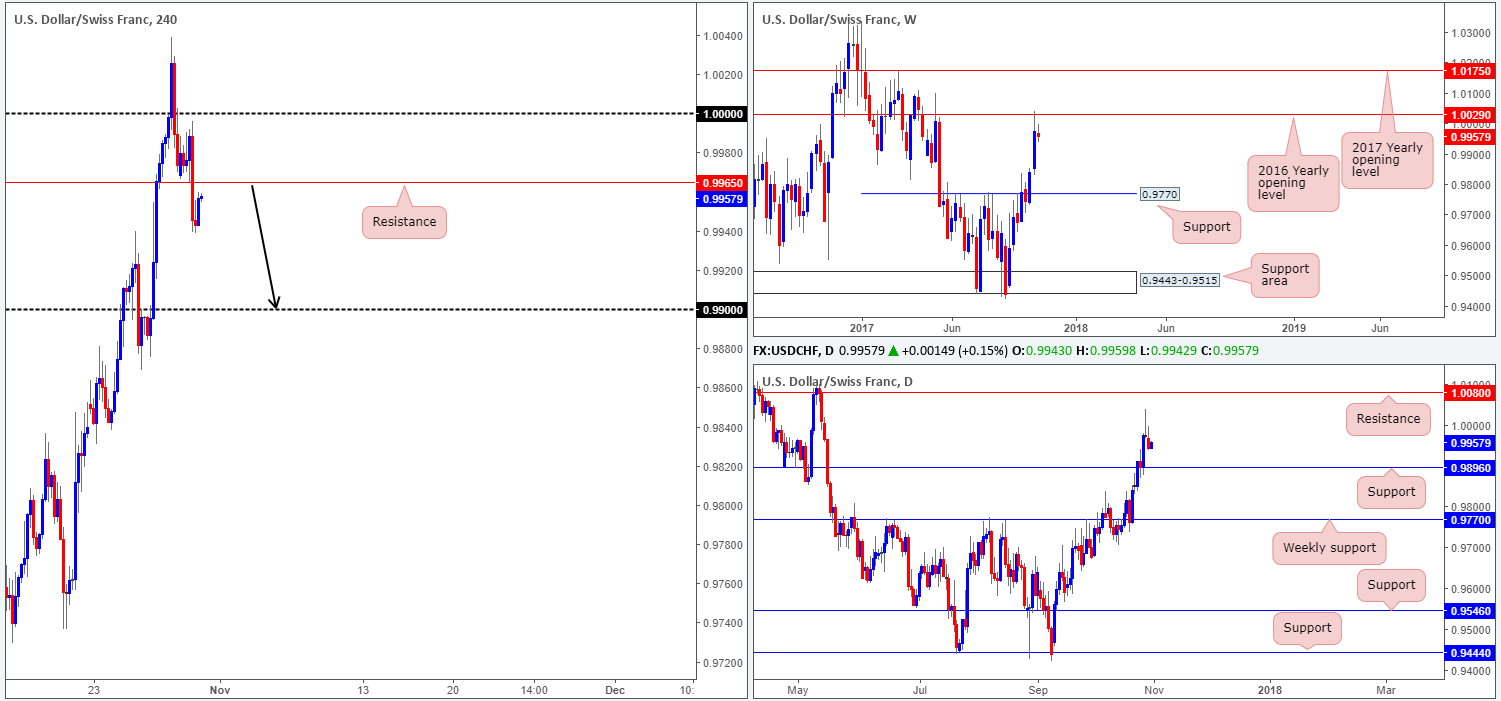

After recently connecting with the 2016 yearly opening level at 1.0029 (weekly chart), H4 support at 0.9965 was consumed during Monday’s sessions.

In Friday’s report, the desk highlighted possible shorts from the 1.0029/1.0000 area. We also emphasized the importance of waiting for H4 price to chalk up a reasonably sized bearish candle from here, preferably a full or near-full-bodied candle. As can be seen from the H4 chart, such a candle was seen on Friday and, in our opinion, was a nice-looking sell opportunity.

In Monday’s report, we advised anyone who managed to capture this short to hold their position since the H4 support at 0.9965 would likely be taken out, which it did. This has, according to our technicals, opened up the runway south down to 0.99, which happens to be positioned a few pips above the daily support at 0.9896.

Suggestions: For those who missed the sell opportunity at 1.0029/1.0000, you may get a second chance to enter short on a possible retest of 0.9965 today. Ideally, we’d be looking for H4 price to retest the resistance and chalk up a full or near-full-bodied bearish candle following the retest. This, in our view, would be enough to warrant an intraday short, targeting the 0.99 neighborhood.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.9965 region ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

DOW 30:

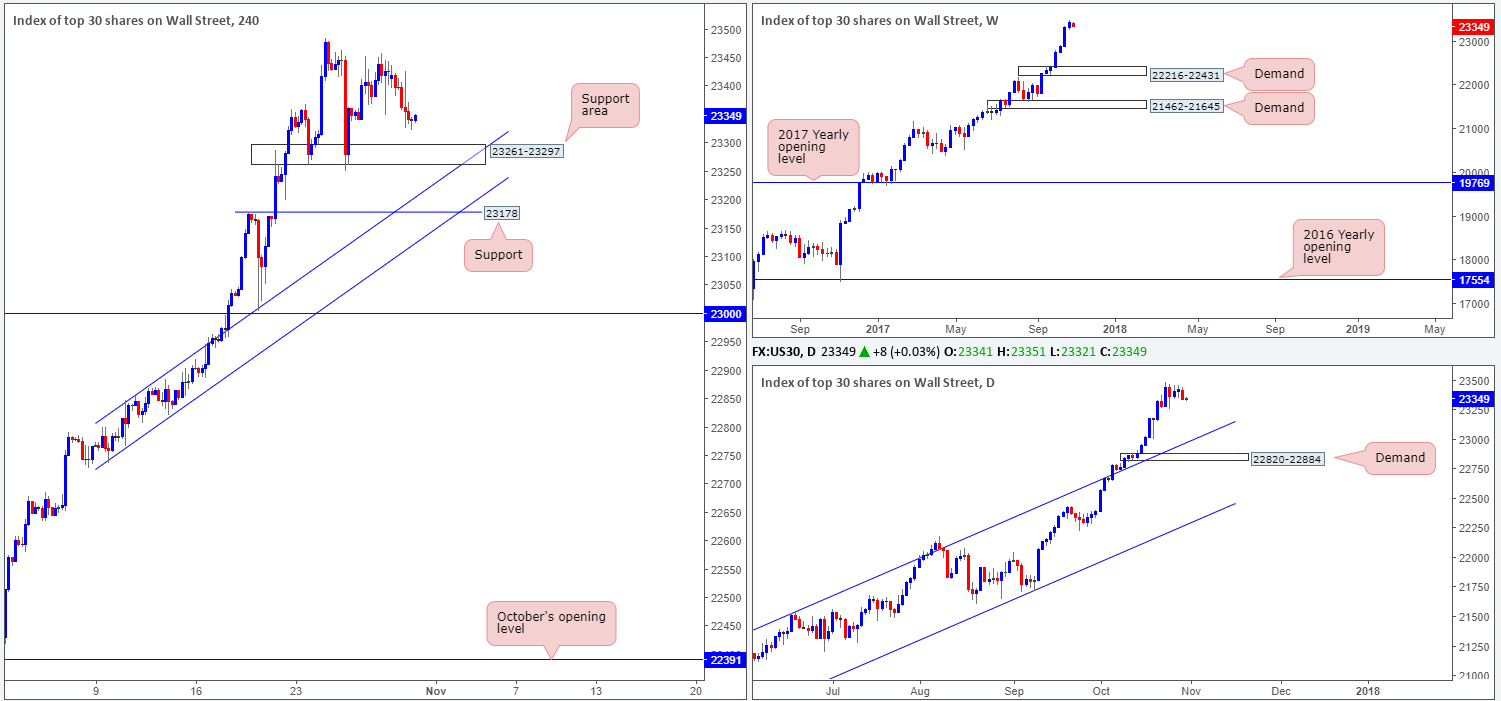

Down 0.36% on the day, the daily candle chalked up a nice-looking near-full-bodied bearish candle and has brought H4 price down to just ahead of a support area coming in at 23261-23297.

For those who read our previous reports you may recall that our desk recently entered long at 23356, with stops positioned below the noted H4 support area at 23240. The long was based on price responding from a H4 support area and forming a nice-looking near-full-bodied H4 bullish candle.

Suggestions: Despite the recent downturn, we’re still holding this position. What we’re looking for from here is a push up to fresh highs. This will be our cue to reduce risk to breakeven and begin thinking about taking some profits off the table.

Data points to consider: US employment cost index at 12.30pm; Chicago PMI at 1.45pm; US consumer confidence at 2pm GMT.

Levels to watch/live orders:

- Buys: 23356 ([live] stop loss: 23240).

- Sells: Flat (stop loss: N/A).

GOLD:

In Monday’s report, our desk highlighted a possible buy trade at 1269.3: August’s opening level. We also emphasized waiting for a full or near-full-bodied H4 bull candle to form following the retest to confirm buyer intent. As you can see, price responded to this line beautifully and gravitated north up to the first take-profit target 1279.1: October’s opening level. Well done to any of our readers who took part in this move!

Suggestions: Although the yellow metal is mildly paring recent gains beneath 1279.1 at the moment, we feel this could simply be price pausing before extending to the upside. Our reasoning lies within the higher timeframe structure. Weekly price is seen shaking hands with a demand base at 1251.7-1269.3, which happens to merge with a channel support etched from the low 1122.8. In addition to this, supporting the aforementioned weekly demand is a daily demand seen housed within the lower limits of the weekly zone at 1251.7-1265.2.

For those currently long the metal, stops should be firmly placed at breakeven now and partial profits in the bank. Ultimately, we would look at holding the remainder of this position since it is likely that 1279.1 will be taken out today. The next area of interest beyond here can be seen at a H4 resistance plotted at 1288.7. Given this, a long on any retest seen at 1279.1 (assuming price breaks higher) could also be an option.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 1279.1 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bullish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).