DXY:

On the H4 timeframe, prices are on a bullish momentum. We spot a trip bottom which could potentially signal a trend reversal. We see a potential entry at 1st support at 93.781 in line with 61.8% Fibonacci retracement to climb towards our 1st resistance at 94.147 in line with 61.8% Fibonacci extension. Technical indicators are showing bullish momentum. Breaking 1st resistance may find prices might climb higher to our 2nd resistance at 94.547 in line with 100% Fibonacci retracement.

Areas of consideration:

- H4 time frame, 1st resistance at 94.147

- H4 time frame, 1st support at 93.781

XAU/USD (GOLD):

On the H4 chart, prices are consolidating in a parallel channel. We see the potential for prices to experience a pullback at our 1st resistance at 1807.9 which is an area of Fibonacci confluences towards our 1st support at 1789.83 in line with 38.2% and 61.8% Fibonacci retracement, which is also a daily support and graphical overlap. RSI is close to a level where dips previously happened. Alternatively, breaking our 1st resistance might find prices climbing higher towards our 2nd resistance at 1825.38 in line with 127.2% and 161.8% Fibonacci projection.

Areas of consideration:

- 4h 1st support at 1789.83

- 4h 1st resistance at 1807.9

EUR/USD:

On the H4 chart , price has recently broken the ascending trendline and is looking for a retest at the first resistance level of 1.16224 which is also 38.2% retracement level and 61.8% projection level. If price were to fail the retest, price can potentially dip back to the first support level of 1.15758 which is also 61.8% Fibonacci retracement and graphical overlap support level. Our bearish bias is supported by RSI and MA indicators. Price is trading under the moving average and trading on a descending trendline on the RSI

Areas of consideration

H4 first support level – 1.15758

H4 first resistance level – 1.16224

USD/CHF:

On the H4, price is seen to be reacting in a potential triangle. In reference to yesterday’s analysis, price did make a bounce from the 1st Support in line with 61.8% Fibonacci retracement and 100% Fibonacci projection approaching the 1st Resistance in line with 38.2% Fibonacci retracement and 100% Fibonacci projection. We can now watch the levels and hold on for the next entry.

Areas of consideration:

- Watch 1st Support at 0.91531

- Watch 1st Resistance at 0.92281

GBP/USD:

On the H4 chart, price is trading in an ascending channel and has recently bounced from the first support level of 1.37189 which is also Fibonacci retracement level 23.6%. Price can potentially rise to the first resistance level of 1.38485 which is also Fibonacci retracement 127.2% and 61.8% Fibonacci projection and the daily resistance. Our bullish bias is further supported by the Ichimoku cloud indicator as price is trading above it

Areas of consideration :

1st support – 1.37189

1st resistance – 1.38485

USD/JPY

On the H4 timeframe, price is still abiding to the ascending trendline support showing a bullish momentum continuation. Price is currently in between the 1st Support in line with 23.6% Fibonacci retracement and 1st Resistance in line with 78.6% Fibonacci retracement and 127.2% Fibonacci projection. We should watch closely for these levels where price might swing higher or lower.

Areas of consideration:

- H4 1st resistance level 114.457

- H4 1st support level 113.242

AUD/USD:

On the H4, we can see that price is reacting in between the 1st Resistance and 1st Support. We can expect the price to have further downside towards the 2nd support in line with 38.2 % Fibonacci retracement. If price manages to break through the intermediate resistance, we can expect further upside on the price towards 1st resistance in line with 100% Fibonacci projection and 127.2 % Fibonacci retracement.

Areas of consideration:

- H4 1st resistance level 0.75361

- H4 1st support level 0.74605

NZD/USD:

On the H4 timeframe, prices are on a bullish momentum. We see the potential for a pullback from our 1st resistance at 0.71635 which is a graphical overlap and could potentially dip towards our 1st support at 0.70838 which is a graphical overlap and in line with 38.2% Fibonacci retracement. Technical indicators are showing bullish momentum. Alternatively, breaking our 1st resistance at 0.71696 might find prices climbing higher towards our 2nd resistance 0.72180.

Areas of consideration:

- H4 time frame, 1st resistance at 0.71696

- H4 time frame, 1st support at 0.70907

USD/CAD:

On the H4, price is on an upwards trend and is expected to continue with its bullish momentum from 1st support at 1.23710 in line with the 38.2% and 50% Fibonacci retracement to 1st resistance at 1.24037 in line with the 127.2% Fibonacci extension and 100% Fibonacci projection levels. Alternatively, price may head to 2nd resistance from here at 1.23582 in line with our horizontal overlap support before continuing with its bullish momentum. Our bullish bias is further supported by the RSI showing an upwards trend.

Areas of consideration:

- H4 time frame, support at 23710

- H4 time frame, resistance at 24037

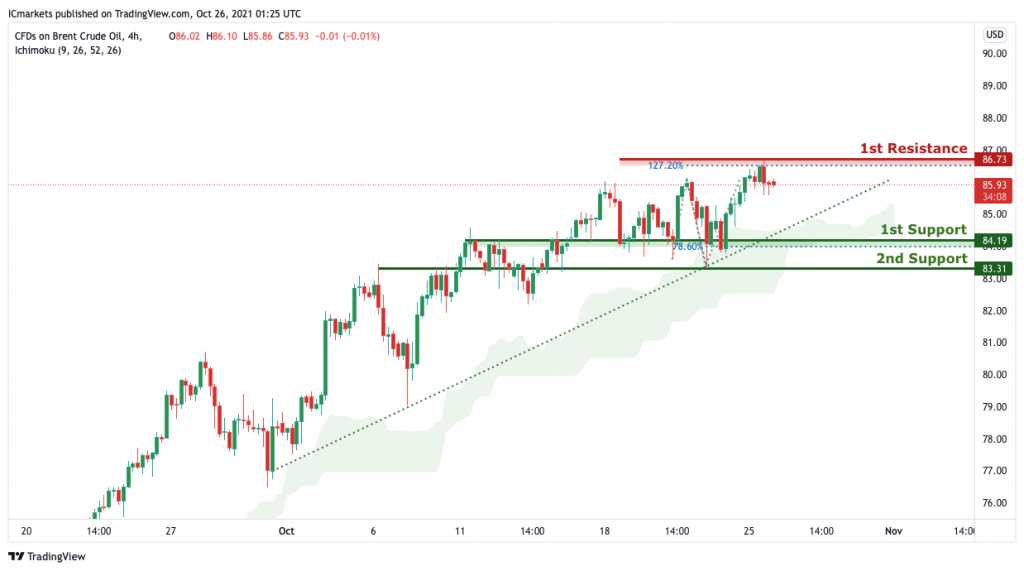

OIL:

On the H4 timeframe, price is currently at our 1st resistance area at 86.73 in line with the 127.2% Fibonacci extension level and graphical swing high resistance. Despite the ichimoku indicator and upwards trend line showing bullish momentum, we are expecting a slide retracement to 1st support at 84.19 in line with the 78.6% Fibonacci retracement level before we see a continuation of the bullish momentum. This bias is due to the fact that price is at an all time high and very strong resistant level. Alternatively, we may see price do a retest 1st resistance.

Areas of consideration:

- H4 time frame, 1st resistance of 873

- H4 time frame, 1st support of 19

Dow Jones Industrial Average:

On the H4, price has just bounced off the 1st support at 35472 in line with the 23.6% Fibonacci retracement level which is also a graphical horizontal overlap support. With the RSI showing a bearish divergence, we are likely to see some bearish momentum from 1st resistance at 35968 in line with our graphical swing high resistance and two 127.2% Fibonacci extension levels taken from different points. Our further bearish bias from 1st resistance can be supported by the stocastics indicator which shows that price is at a resistance. Alternatively, price may break the 1st support and head for 2nd support at 35033 in line with the 50% Fibonacci retracement level.

Areas of consideration:

- 4H resistance at 35968

- 4H support at 35472

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.