Without a clear understanding of different order types, success within the forex market is unlikely.

Similar to a plumber using a specialised wrench to adjust to different pipe diameters, a trader must know which order to use to communicate efficiently with the broker.

It’s surprising how often newer traders feel equipped to tackle the live market, but lack basic awareness of order types.

Understanding bid/ask prices

- When you enter long, you enter at the ASK price and exit at the BID price.

- When you enter short, you enter at the BID price and exit at the ASK price.

Bid and ask prices are determined through buyers and sellers. The EUR/USD trading at 1.2342/43 provides a ‘bid price’, the level you can sell, at 1.2342, and an ‘ask price’ at 1.2343, the level you can buy. The bid/ask spread (also known as ‘the spread’) is the difference between the bid/ask price, which in the case of the EUR/USD example, is 1 point.

Currency pairs

Currencies are traded (and quoted) in pairs, and are known as ‘currency pairs’.

The EUR/USD, the GBP/USD and the AUD/USD are currency pairs. The ‘base currency’ is the first currency in a quotation, the EUR, GBP and AUD (highlighted in bold) are base currencies. The ‘quote currency’, or ‘counter currency’, is the second value – the US dollar in this case (underlined).

Market orders

As its name implies, a market order is centred around completing an order at the fastest speed at current market prices. The function, for traders looking to enter a long position, offers the best price available at that time from those willing to sell. Conversely, using a market order to sell, a short position, you’ll receive the best price available from those willing to buy.

Market orders are advantageous when you need to get into or out of a trade quickly. However, in a fast-moving market where price can change in seconds, or a market offering wide bid/ask spreads, price can alter substantially between the time the order is placed and the time it’s completed/filled. This is known as slippage. Slippage occurs when an order is filled at a price different to the requested price.

The downside to market orders is traders never know the exact price they’ll receive. Market conditions offering tight bid/ask spreads, however, think major currency pairs, will usually fill at the current bid/ask.

Limit orders

Limit orders allow you to set a specific price, or ‘limit price’, at which you want to buy or sell.

A limit order is a type of order to buy (a buy limit order) or sell (a sell limit order) either at or below or at or above a specified price, respectively. However, a limit order is not guaranteed to execute.

Unlike a market order, a limit order prevents traders buying/selling at an unfavourable price. Another notable difference is liquidity – the degree to which a market can be bought or sold – limit orders provide liquidity and market orders consume liquidity. A limit order cannot cause price to move since it must be executed at a fixed price. A market order can since it is allowed to chase liquidity to ensure a fill. A limit order can stop a move in its tracks though, once executed. Also, between a market order and a limit order, unless using an EA, you must be at the screen to execute a market order, whereas a limit order can, effectively, be set and forgot until triggered.

As an example of a limit order, figure 1.1, the H1 EUR/USD chart, displays two clear-cut levels bounding price action: support at 1.1069 and resistance at 1.1113. In a fast-moving market – an unexpected political event for example – employing a market order to trade either level could fill unfavourably and skew risk/reward. This is where having a limit order set at 1.1113 or 1.1069 guarantees this price, or better.

(FIGURE 1.1)

Buy/Sell stop orders

A buy stop order is an instruction to purchase a currency pair upon hitting a predetermined level higher than current price. Should the level trigger, the order becomes a market order, fillable at the next best available price point. This helps eliminate the risk of missing a price level, usually in the form of a breakout.

An example is the EUR/USD trading at 1.2090 with the expectation of a breakout developing through the round number 1.21. Breakouts can be fast and difficult to catch. For that reason, plotting a buy stop order at 1.2105 is an option. It’s the same for a sell stop order, only inverse.

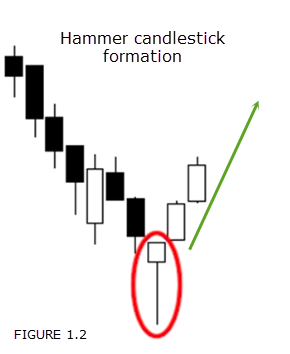

Another common example of where buy/sell stop orders are useful is in trading Japanese candlestick patterns. Take the hammer formation, for example. This, as displayed in figure 1.2, is a bullish candlestick signal where traders generally enter on the break of the high of the pattern using a buy stop entry order, and site protective stop-loss orders below the low of the formation.

Protective stop-loss orders – ‘stop price’

When a position is initiated, usually before initiation, a protective stop-loss order must be determined. The reasons are twofold. Firstly, a protective stop-loss order protects equity. Not every trade will be a winner. In fact, many traders experience more losing trades than winners. Traders position protective stop-loss orders at levels they know the trade is unsuccessful. The second reason is a protective stop-loss order allows the trader to determine capital risk before pulling the trigger.

If you’re long at 1.3256 on the EUR/USD and your trading strategy identifies 1.3236 as a trigger point for an unsuccessful trade, this is where a protective stop-loss order should be located. Once/if price crosses this line, your broker will automatically execute an order to sell at the next best available price, assuming you’re using a stop market order and not a stop limit order.

Understand the type of order you’re submitting

A trader must know which order to forward through to a brokerage firm to receive the desired outcome. Without this knowledge, irrespective of how good the trader/analyst, trading consistently is impossible.

Moving forward, with basic types of orders now hopefully understood, the next step is spending some time researching your brokers order system and familiarising yourself with its submission process on the trading platform. This will stand you in good stead for testing trading strategies on a demo platform and when trading the live market.

[cta id=”19949″ vid=”0″]