A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

Weekly gain/loss: – 149 pips

Weekly closing price: 1.0635

Recent trade shows that the EUR/USD extended its bounce from the weekly resistance level at 1.0819, and ended the week chalking up a near-full-bodied weekly bearish candle. Provided that the bears remain in the driving seat here, the next weekly support target on tap can be seen at 1.0515: the 2017 yearly opening level which happens to be strengthened by a weekly support area drawn from 1.0333-1.0502.

On the other side of the ledger, however, we have the daily candles battling for position within the walls of a daily demand zone coming in at 1.0589-1.0662. Despite this base managing to hold the market higher since Jan 26 2017, nearby daily resistance at 1.0710 is proving troublesome to overcome and could force candle action beyond the current area this week down to a daily support at 1.0520 (sited 5 pips ahead of the aforementioned 2017 yearly opening level).

Friday’s US consumer sentiment survey came in worse than expected. Although this is considered a high-impacting event, it did not manage to generate much trading. Technically speaking, the H4 chart’s structure is somewhat restricted at the moment. To the downside, price bottomed around a H4 Quasimodo support at 1.0621. Meanwhile, overhead we have a H4 supply at 1.0667-1.0650 that is joined together with a H4 trendline resistance taken from the low 1.0579.

Our suggestions: Based on the higher-timeframe structure, we find it difficult to imagine the H4 candles breaching the current H4 supply today. In fact, on account of the weekly chart’s position, and daily demand looking somewhat vulnerable at this time, the aforementioned H4 Quasimodo support, along with the round number 1.06 and December’s opening level at 1.0590 may be consumed today/early this week.

In the event that we do happen to clock a H4 close below these levels, the next H4 support in the firing range can be seen at the 2017 yearly opening level. This could set the foundation for a reasonable short trade this week if the candles retest the broken levels as resistance and pencil in a H4 bear candle.

Data points to consider: There are no scheduled high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for a H4 close below 1.06/1.0590 and then look to trade any retest seen thereafter ([waiting for a H4 bear candle to form following the retest is advised before pulling the trigger] stop loss: ideally beyond the trigger candle).

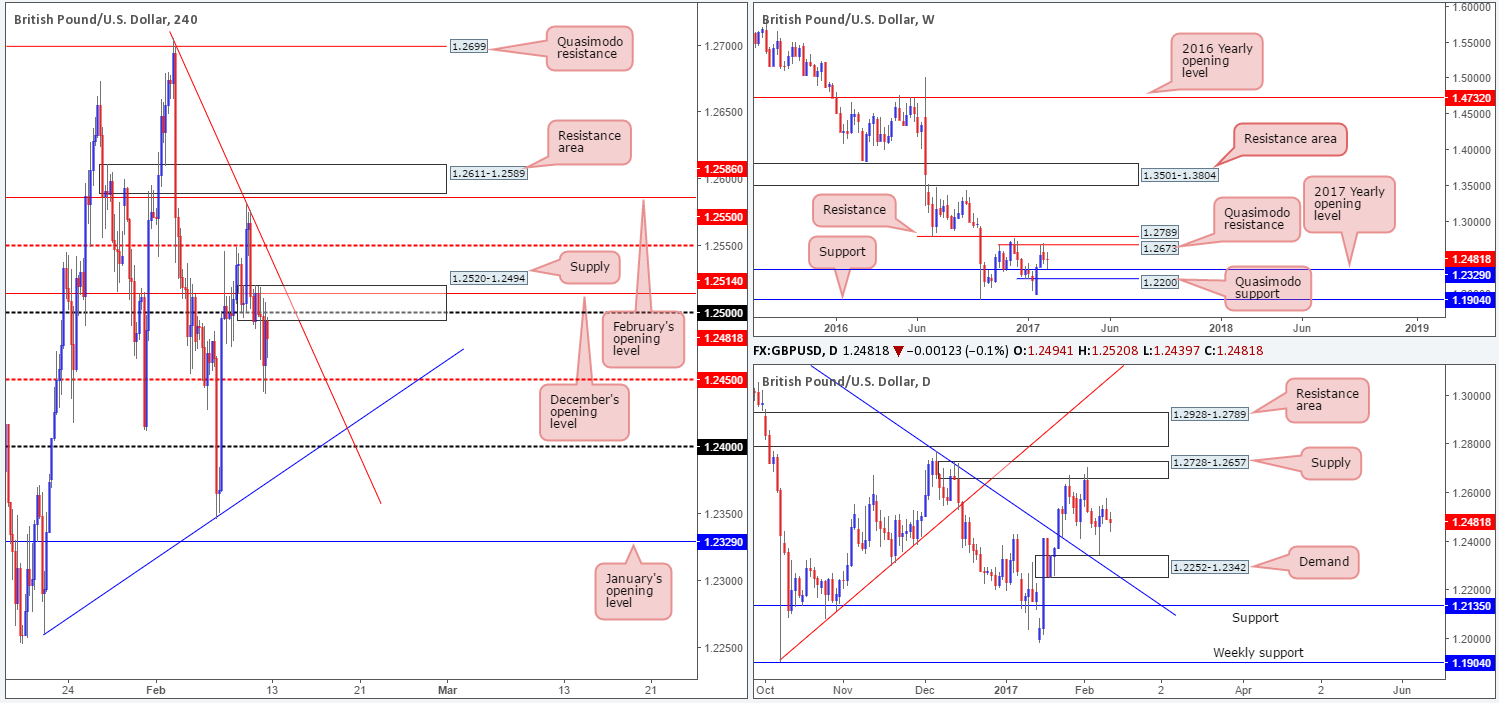

GBP/USD:

Weekly gain/loss: + 3 pips

Weekly closing price: 1.2481

Despite the pair ranging over 230 pips, GBP/USD prices are little changed this week consequently forming a weekly indecision candle into the closing bell. As far as structure goes, the unit is currently seen trading mid-range between the 2017 yearly opening level at 1.2329 and a weekly Quasimodo resistance coming in at 1.2673.

By the same token, a similar pattern is being seen on the daily chart. The daily candles are, at this time, seen loitering between daily demand at 1.2252-1.2342 (bolstered by a daily trendline support stretched from the high 1.3437) and a daily supply penciled in at 1.2728-1.2657.

Friday’s UK manufacturing data came in stronger than expected, which did manage to trigger a round of buying in the market. However, the advance was a short-lived one, with upside capped by December’s opening base at 1.2514/1.25 psychological handle. In a similar fashion to the EUR/USD pair above, H4 structure is also somewhat restricted on the GBP. Overhead, we can see a newly-formed H4 supply at 1.2520-1.2494 that is linked together with December’s opening base and the 1.25 handle. To the downside, nonetheless, price recently caught a fresh bid from the H4 mid-level support at 1.2450.

Our suggestions: As far as we can see, there’s equal opportunity to trade this pair both long and short today. We say this simply because the higher-timeframe structures are, at the time of writing, offering very little guidance on medium-term direction. While one could possibly trade long from 1.2450 today, we favor the current H4 supply given its H4 converging structures (1.25/1.2514 – see above). Be that as it may, to initiate a trade from this barrier, we require a lower-timeframe sell signal to take shape beforehand. This could be either in the form of an engulf of demand followed by a retest as supply, a trendline break/retest or simply a collection of well-defined selling wicks around the H4 supply zone. We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

Data points to consider: There are no scheduled high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2520-1.2494 ([wait for a lower-timeframe signal to form before looking to execute a trade] stop loss: dependent on where one confirms the zone).

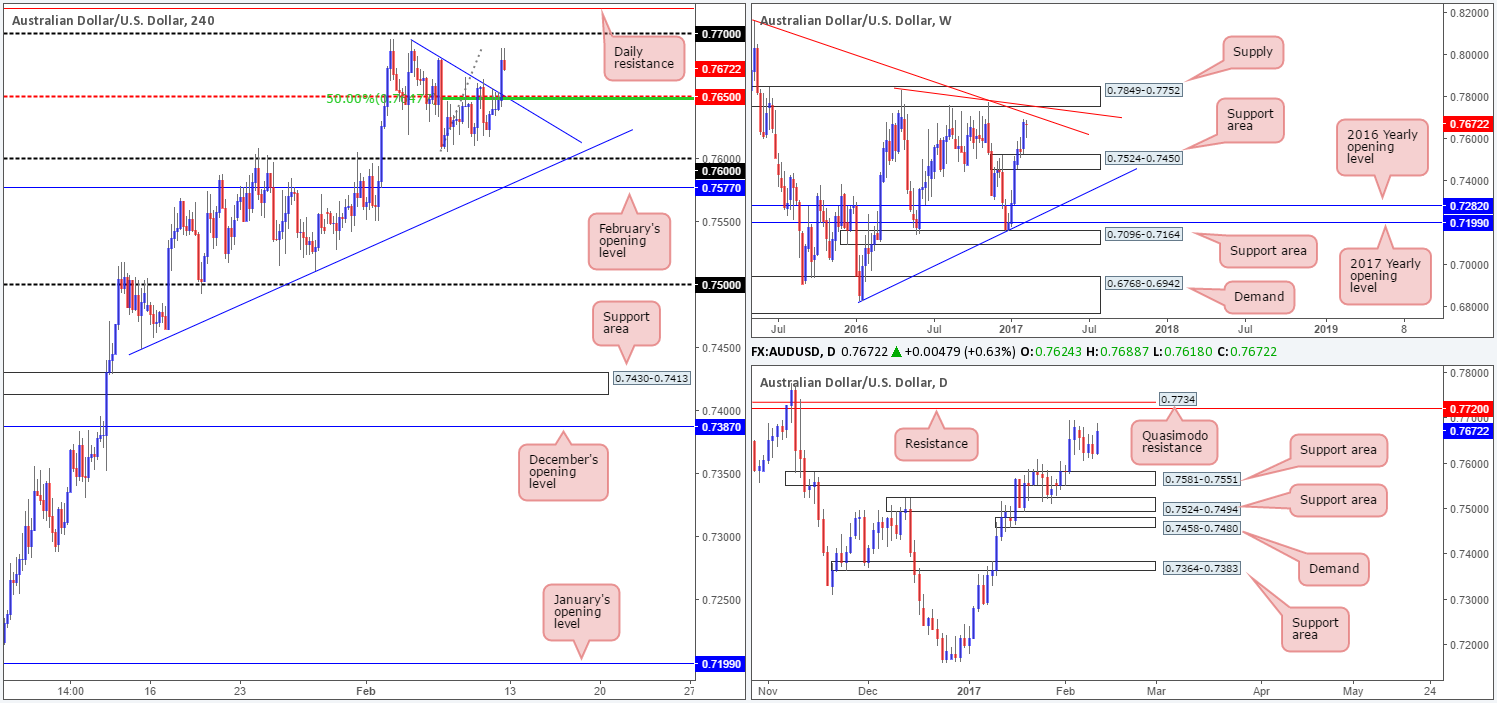

AUD/USD:

Weekly gain/loss: – 7 pips

Weekly closing price: 0.7672

As you can see from the weekly chart, little change was seen during trade last week. On account of this, the pair remains lurking within striking distance of a weekly trendline resistance taken from the high 0.8163, followed closely by a weekly supply zone logged in at 0.7849-0.7752 (bolstered by yet another weekly trendline resistance stretched from the high 0.7835). As such, there’s a possibility that the buying pressure may diminish sometime this week.

Positioned nearby the oncoming weekly trendline resistance (0.8163) is a daily Quasimodo resistance penciled in at 0.7734 and a daily resistance at 0.7720. This, along with the underside of weekly supply at 0.7752 (0.7752/0.7720) defines a strong-looking higher-timeframe sell zone.

A quick recap of Friday’s trade on the H4 shows that the commodity currency gathered momentum going into the US segment. As far as we can see, the move was sparked by a disappointing US consumer sentiment reading, consequently lifting the pair to highs of 0.7688 by the day’s end.

Our suggestions: According to the bigger picture, there’s still room for this pair to push a tad higher, at least until we hit daily resistance at 0.7720. With that being said, a long trade from the H4 mid-level support at 0.7650 could be something to think about. The reason being is that it boasts a H4 trendline support etched from the high 0.7695 and a 50.0% retracement support clocked in at 0.7647. If one is considering trade from this zone without waiting for additional confirmation, stops can be positioned beyond the 0.7635 low point. Should price happen to connect with the 0.76 handle beforehand, nevertheless, we would think twice about trading from 0.7650 since at that point the unit will be trading within a few pips of daily resistance at 0.7720, which you may remember forms the underside to a rather strong-looking higher-timeframe sell zone (0.7752/0.7720 – see above). 0.7752/0.7720 is, of course, also somewhere we would consider trading from, but only if a H4 bearish candle forms within the walls of this region beforehand, since by shorting here you’d effectively be selling into a medium-term uptrend.

Data points to consider: There are no scheduled high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: 0.7650 region ([personally, we would wait for a lower-timeframe signal to form [see the top of this report] before looking to execute a trade] stop loss: dependent on where one confirms the zone).

- Sells: 0.7752/0.7720 ([wait for a H4 bear candle to form before pulling the trigger] stop loss: ideally beyond the trigger candle).

USD/JPY:

Weekly gain/loss: + 67 pips

Weekly closing price: 113.22

Over the last week, the weekly price bottomed just ahead of the weekly support area coming in at 111.44-110.10 and was able to achieve a high of 113.85. The next upside hurdle on our radar can be seen at 116.08: a weekly resistance level that’s positioned in close proximity to the 2017 yearly opening level at 116.97. Should things turn sour from here, nevertheless, the next area of interest beyond the current zone is a weekly support area coming in at 105.19-107.54.

In conjunction with the weekly candles, daily price eventually caught a bid from daily demand seen at 111.35-112.37 (located around the top edge of the current weekly support area), which, in our opinion, shows room for the piece to gravitate up to the daily resistance area at 115.62-114.60.

Looking at Friday’s action on the H4 chart, we can see that the unit was incapable of sustaining gains beyond the H4 supply zone at 113.96-113.43, resulting in price trading back down to the 113 psychological handle into the closing bell. In light of the bigger picture (see above) we do not envisage the H4 candlesticks pushing beyond the H4 support area at 112.77-112.55 this week. In spite of this, we have no intention of becoming buyers in this market until the current H4 supply area is consumed.

Our suggestions: Beyond the current H4 supply area, we see room for price to challenge December’s opening base at 114.68, which, as you may have noticed, is positioned within the lower edge of the aforementioned daily resistance area. Should a H4 close take shape above the H4 supply today/early this week, and is followed up with both a retest and a lower-timeframe buy signal (see the top of this report), our desk would look to buy, targeting the 114.68 boundary.

Data points to consider: Japanese prelim GDP data at 11.50pm GMT (Sunday).

Levels to watch/live orders:

- Buys: Watch for a H4 close above 113.96-113.43 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe signal to form following the retest is advised before pulling the trigger] stop loss: dependent on where one confirms this zone).

- Sells: Flat (stop loss: N/A).

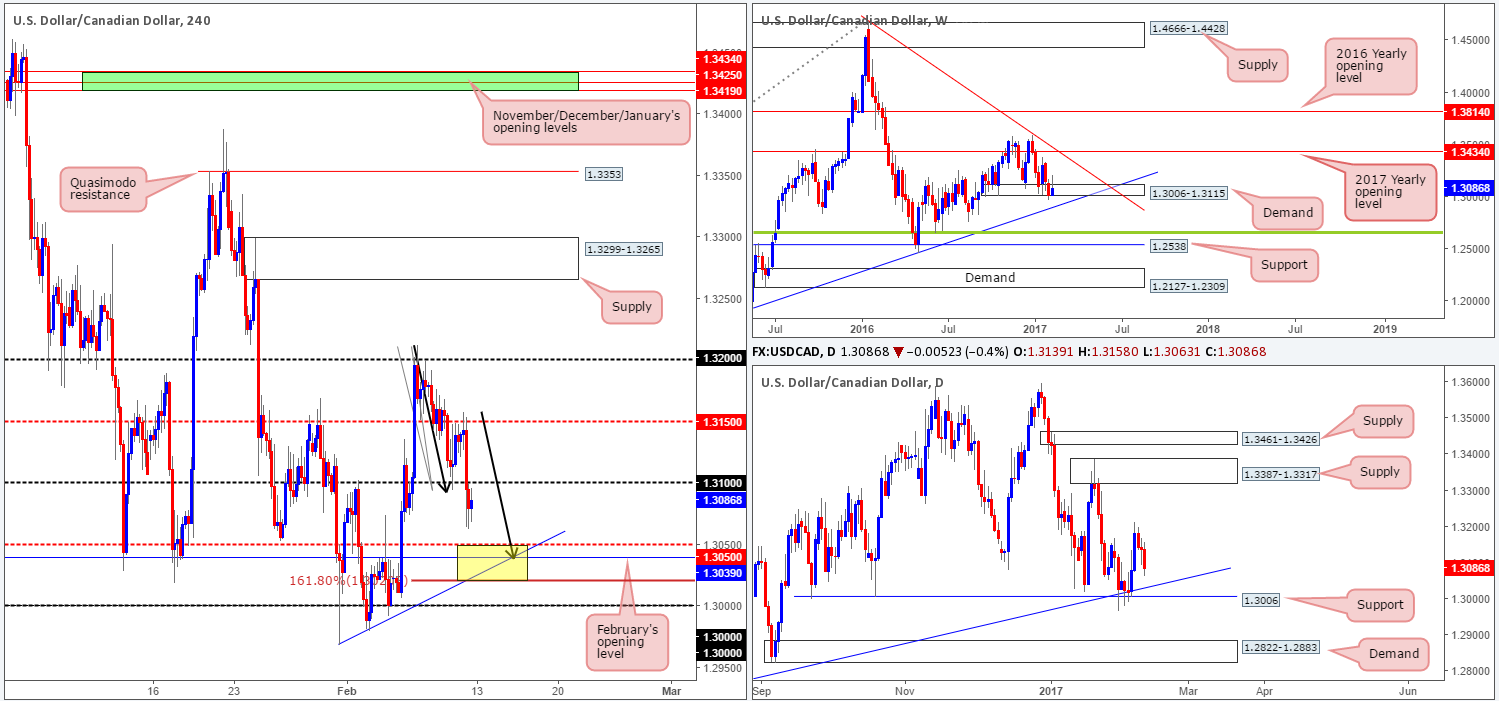

USD/CAD:

Weekly gain/loss: + 67 pips

Weekly closing price: 1.3086

Although weekly demand at 1.3006-1.3115 remains intact right now, there has been very little noteworthy movement registered from this zone over the last two weeks. In the event that the demand base eventually does give way this week, the next support hurdle in view would be the weekly trendline support penciled in from the high 1.1278.

Moving down to the daily timeframe, Tuesday’s action topped at a high of 1.3212 and spent the remainder of the week receding lower. To our way of seeing things, there is very little daily support stopping the daily candles from continuing lower this week down to at least the daily support at 1.3006, which happens to merge closely with a daily trendline support extended from the low 1.2654.

The impact of Friday’s upbeat Canadian job’s report sent the H4 candles screaming lower, engulfing the 1.31 handle and clocking a low of 1.3064. With the 1.31 support now out of the picture, the next H4 downside target can be seen at the H4 mid-way support drawn from 1.3050. 1.3050 is an interesting base as supporting a bounce from this neighborhood we have the following converging structures: February’s opening level at 1.3039, a H4 trendline support taken from the low 1.2968, a H4 AB=CD 161.8% approach terminating around 1.3019 and to top it off there’s also the current daily trendline support intersecting with this H4 buy zone (yellow rectangle).

Our suggestions: While buying from the H4 buy zone noted above at 1.3019/1.3050 may very well be tempting considering its confluence, we still have to remain cognizant of the 1.30 figure seen just below it. This watched number could act as a magnet to price and pull the pair through our H4 buy zone! Therefore, to be on the safe side, we will wait for a reasonably sized H4 bull candle to take shape here before pressing the buy button. This will by no means guarantee a winning trade, but what it will do is show buyer interest within a high-probability reversal zone, and, let’s be honest, we cannot ask for much more than this!

Data points to consider: There are no scheduled high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: 1.3019/1.3050 ([wait for a reasonably sized H4 bull candle to form before pulling the trigger] stop loss: ideally beyond the trigger candle).

- Sells: Flat (stop loss: N/A).

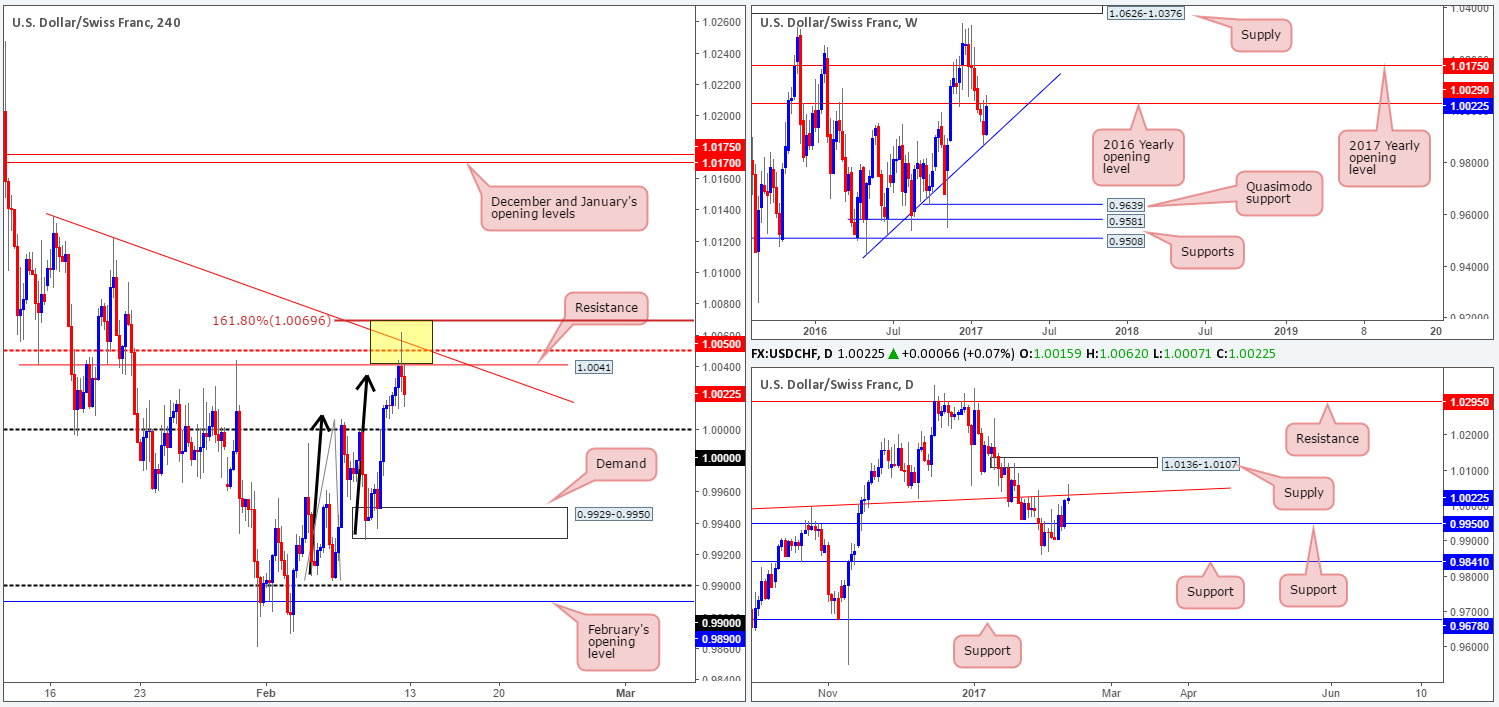

USD/CHF:

Weekly gain/loss: + 109 pips

Weekly closing price: 1.0022

Erasing two weeks of prior losses as well as breaking a six-week bearish phase, we saw the Swissy recover beautifully from a weekly trendline support extended from the low 0.9943 last week. While this could signify that the tables may have turned, it may be worth noting that weekly action also collided with the 2016 yearly opening level at 1.0029 going into the close. In addition to this, down on the daily chart, Friday’s daily candle chalked up a strong-looking daily bearish selling wick off the back of a daily trendline resistance etched from the high 0.9956. With the next downside target not in view until daily support at 0.9950, there’s a strong possibility that the pair may correct itself early this week.

Swinging across to the H4 scale, it seems that we missed a stunning setup here on Friday at a H4 sell zone (marked in yellow) comprising of: a H4 trendline resistance taken from the high 1.0136, a H4 mid-level resistance at 1.0050, a H4 resistance at 1.0041 (marking the lower edge of the zone), a H4 AB=CD 161.8% approach (denoting the top edge of the zone at 1.0069) and also let’s not forget the daily trend line resistance that’s currently in play! As you can see, the pair struck a high of 1.0062 going into Friday’s US segment, and from here went on to pare earlier gains made during the European/London session to a low of 1.0014.

Our suggestions: Unless the unit retests the above noted H4 sell zone today and produces a reasonably sized H4 bear candle, we will likely be remaining on the sidelines. However, there’s one caveat here. Should parity come into play beforehand and then price retests the H4 sell zone, we would likely look to pass as this could signal bullish strength and a possible overthrow of the higher-timeframe resistance mentioned above.

Data points to consider: There are no scheduled high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.0069/1.0041 ([wait for a reasonably sized H4 bear candle to form before pulling the trigger] stop loss: ideally beyond the trigger candle).

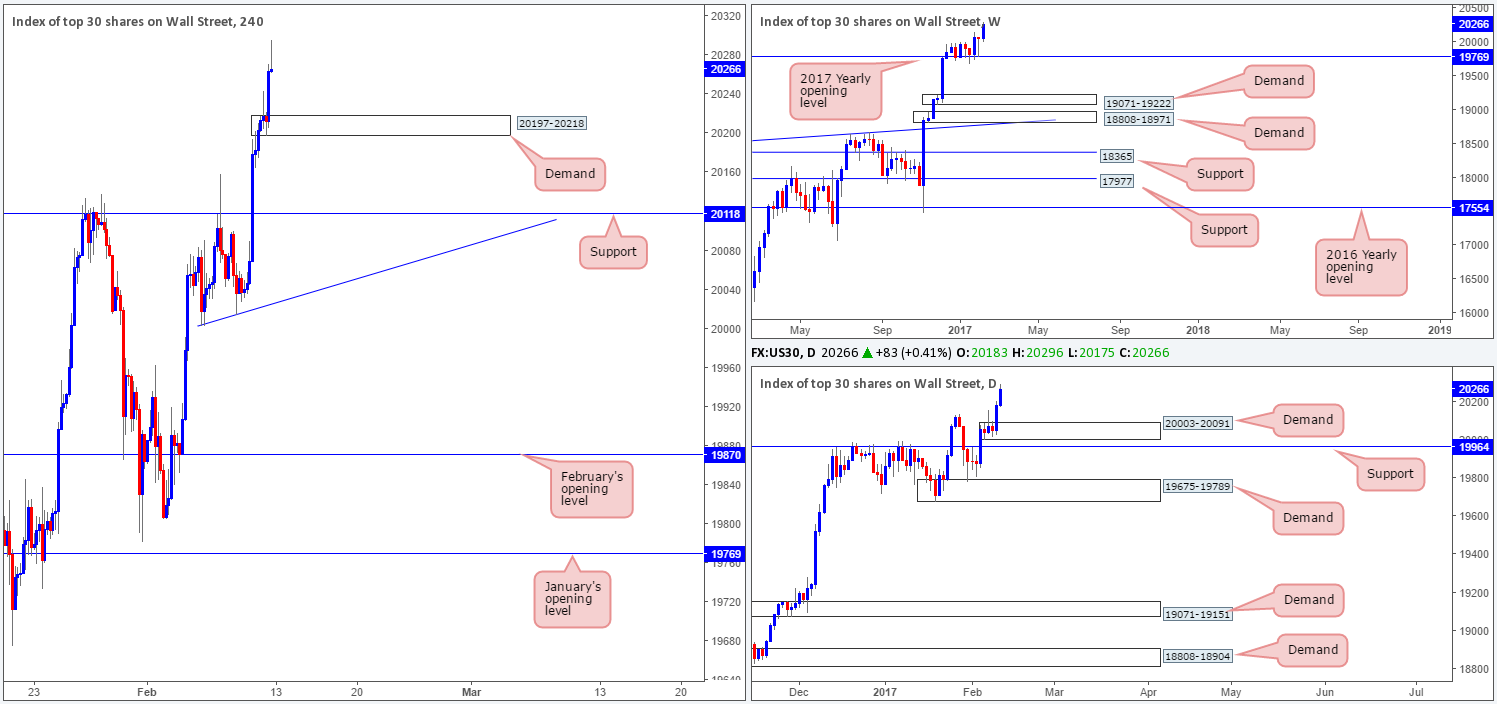

DOW 30:

Weekly gain/loss: + 210 points

Weekly closing price: 20266

As can be seen from the weekly chart, a healthy round of buy orders flowed into the market last week following the previous week’s strong-looking bullish tail printed just ahead of the 2017 yearly opening level at 19769. With equities now trading at record highs, where do we go from here? Well, given that there is absolutely no weekly resistance levels in sight, the best we can do for the time being is continue looking to ‘buy the dips’. The closest higher-timeframe area can be seen at 20003-20091: a daily demand that is positioned directly above a daily support barrier at 19964.

Working our way across to the H4 chart, the index concluded the week forming a H4 bearish selling wick. Although this candle signals a potential selloff may be on the cards, we would be very wary of shorting this unit in light of the recent buying. The only area of interest on the H4 this morning is seen positioned at 20197-20218: a H4 demand hurdle.

Our suggestions: While the current H4 demand boasts little higher-timeframe (structural) convergence, let’s bear in mind that it has formed in-line with the current uptrend. For that reason, we feel it is worthy of attention. Trading this area without additional confirmation, nevertheless, is not something our desk would be comfortable with. Waiting for a reasonably sized H4 bull candle to print before pressing the buy button would, in our opinion, be the safer route to take here.

Data points to consider: There are no scheduled high-impacting news events on the docket today that will likely affect the US equity market.

Levels to watch/live orders:

- Buys: 20197-20218 ([wait for a H4 bull candle to form before looking to execute a trade] stop loss: ideally beyond the trigger candle).

- Sells: Flat (stop loss: N/A).

GOLD:

Weekly gain/loss: + $12.4

Weekly closing price: 1232.2

From the weekly chart, we can see that the yellow metal printed its second consecutive weekly bull candle last week, enabling the unit to cross swords with a weekly resistance level penciled in at 1241.2. With an upside rejection being seen from this perimeter, it’s possible that bullion may look to shake hands with the weekly support boundary seen below at 1180.1 in the near future.

While the weekly timeframe looks primed for further selling this week, down on the daily chart the daily support area at 1232.9-1224.5 is still seen in motion. As such, it will take a decisive close beyond this support barrier before our team is convinced that the bears are in fact in control.

For those who read Thursday’s report you may recall our desk highlighting a short position we took from 1239.6, with a stop logged in at 1245.4. As mentioned in Friday’s report, we liquidated 70% of the position around the H4 demand area at 1227.6-1230.5 and reduced risk to breakeven. Our next port of call for profit taking is still seen at February’s opening base drawn from 1211.5. However, before this can be achieved, price will have to overcome the H4 demand area seen at 1221.5-1224.8 which held firm going into the early hours of Friday’s session.

Our suggestions: In view of daily action trading from a daily support area at 1232.9-1224.5, there’s a possibility that the remaining 30% of our position may be tapped at breakeven. What is quite notable from a technical perspective, however, is the possible H4 AB=CD pattern (see black arrows) that may be at hand, terminating at the H4 161.8% ext. at 1207.8. Notice that it not only bottoms nearby the February opening level at 1211.5, it is also located nearby a H4 trendline support etched from the low 1145.9 (1207.8/1211.5 zone). Not only is this a reasonable area to take profits but it’s also a platform in which one could potentially hunt for long opportunities. With this area lacking higher-timeframe (structural) convergence, however, we would require a H4 bull candle to form here in order to validate this area before pulling the trigger.

Levels to watch/live orders:

- Buys: 1207.8/1211.5 ([wait for a H4 bull candle to form before looking to execute a trade] stop loss: ideally beyond the trigger candle).

- Sells: 1239.6 ([live order] stop loss: breakeven).