A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

As anticipated, the FOMC decided to hike its target rate by 25bps yesterday. In consequence to this, the dollar advanced across the board and sent the shared currency aggressively lower. A number of H4 tech supports were engulfed during this bearish assault, with price concluding the day filling bids around the 1.05 handle.

To our way of seeing things, there are technical signs signaling that the rebound from 1.05 may extend higher this week. Weekly action shows price kissing the top edge of a major support area at 1.0333-1.0502 that stretches as far back as 1997! And, by the same token, daily price is also seen shaking hands with both a support coming in at 1.0520 and a neighboring Quasimodo support seen just below it at 1.0494.

Our suggestions: In spite of the EUR currently entrenched within somewhat of a downtrend at present, our desk feels, given the support structure noted above, a rotation to the upside could be on the cards.

The team has noted two potential setups:

- Wait and see if the unit retests the 1.05 neighborhood again today. Should this come to fruition, a long from 1.0494 could be something to consider, with stops placed below the apex of the daily Quasimodo support (1.0462) at 1.0460.

- On the assumption that the bulls remain in the driving seat from current price and bid the pair above the H4 mid-way resistance point at 1.0550, this would, at least to us, confirm upside strength. To take advantage of this move, one could either buy at market following a H4 close above this line, or conservatively wait and see if price retests 1.0550 as support and buy with lower-timeframe confirmation. This could be either a break above supply followed by a retest, a trendline break/retest or simply a collection of well-defined buying tails around the 1.0550 zone. We search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

Data points to consider: US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: Watch for a H4 close above 1.0550 and then look to trade any retest seen thereafter ([lower-timeframe confirmation required following the retest] stop loss: dependent on where one confirms the area). 1.0494 ([an area that requires no further confirmation] stop loss: 1.0460).

- Sells: Flat (stop loss: N/A).

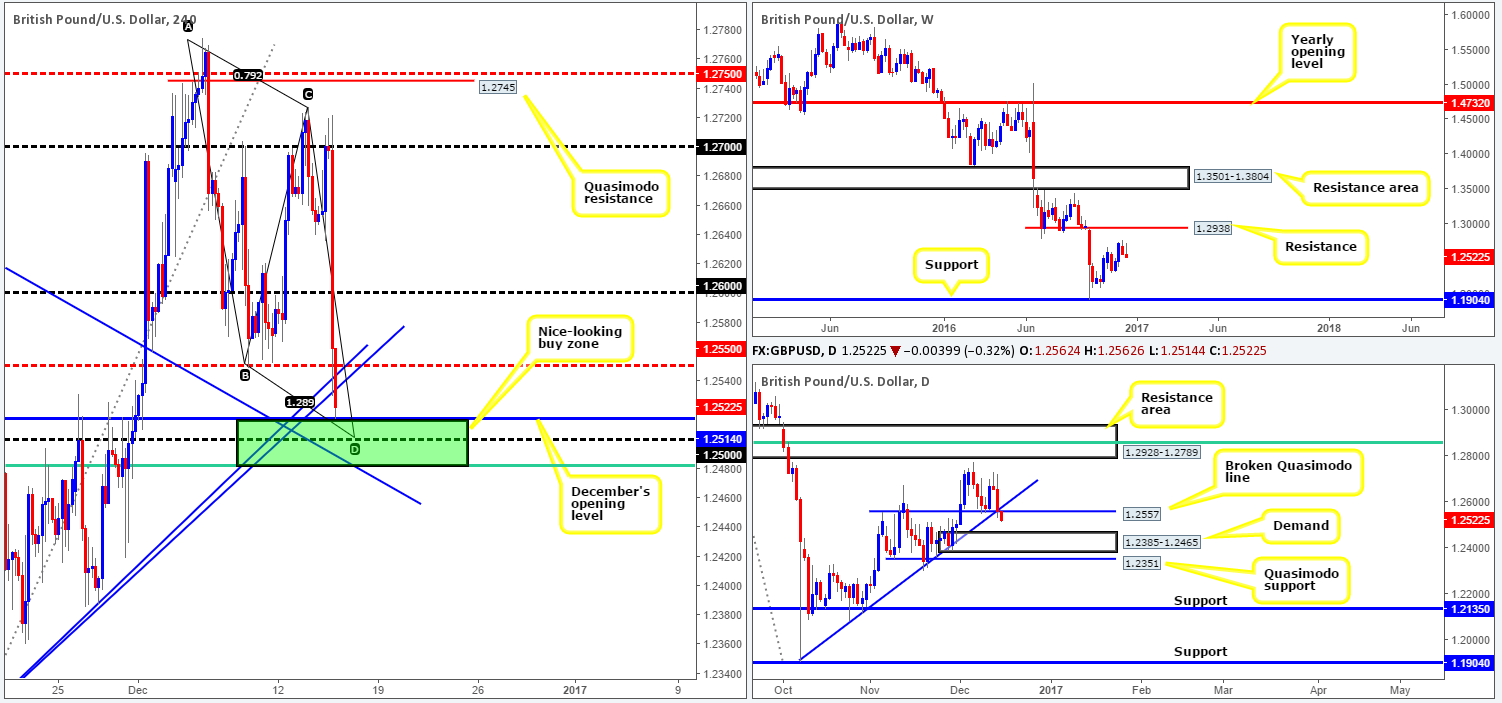

GBP/USD:

Following yesterday’s retest to the underside of the 1.27 handle, the pair underwent a stern downside correction. The move was reinforced by the FOMC raising its Fed funds target rate 25bps to 0.75%. The 1.26 handle, as well as the H4 mid-way support barrier at 1.2550 were both taken out, leaving price free to touch gloves with the top edge of our pre-determined H4 buy zone at 1.2481/1.2514 (green zone) that we highlighted in yesterday’s report.

In spite of the decline in value, we feel that weekly action remains in somewhat of a bullish stance, due to there being room to extend north to check in with resistance drawn from 1.2938. Meanwhile, daily action has penetrated the broken Quasimodo support line at 1.2557 that intersects with a trendline support drawn from the low 1.1904.

Our suggestions: Between December’s opening level at 1.2514 and the H4 61.8% Fib support at 1.2481, we can see that it holds not only a psychological support at 1.25 which converges with a H4 AB=CD bull pattern, there’s also a H4 trendline support extended from the high 1.2673 intersecting with this barrier. Granted, a long from this area does effectively mean that we’re trading in the ‘hope’ that the breach beyond the aforementioned daily broken Quasimodo level is a fakeout and not a continuation move. However, dependent on the time of day, we still believe that this H4 zone holds enough confluence to justify a long position without the need to wait for further confirmation.

Data points to consider: UK retail sales at 9.30am, UK interest rates at 12pm. US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: 1.2505 ([dependent on the time of day, a buy from this region is valid and requires no further confirmation] stop loss 1.2476).

- Sells: Flat (stop loss: N/A).

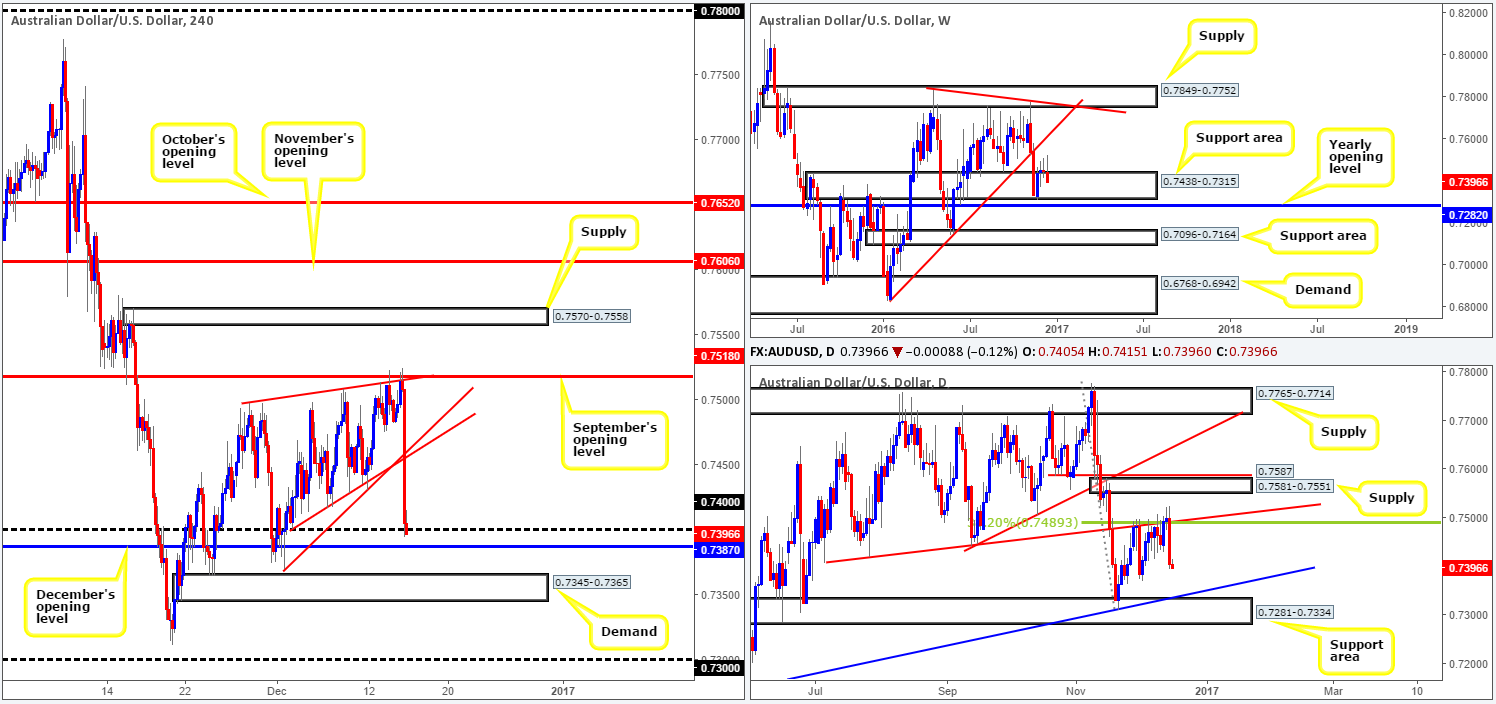

AUD/USD:

The commodity currency fell sharply after the FOMC declared that the Fed funds target rate will increase by 25bps to 0.75%. September’s opening level at 0.7581 proved to be a noteworthy level in this market, providing sellers the perfect base in which to short from during this event. In one fell swoop, the pair lost over 100 pips and settled for the day around the 0.74 handle.

In view of price now seen trading around both the 0.74 handle and December’s opening level at 0.7387, what options are on the table today? Well, the weekly candles, despite yesterday’s selloff, continue to trade within the support area seen at 0.7438-0.7315, while down on the daily chart, further downside is a possibility to the support area at 0.7281-0.7334, which intersects with a trendline support extended from the low 0.7145.

Our suggestions: Trading long from 0.74/December’s opening level may be good for a bounce, seeing as how responsive monthly opening levels have been in the past. However, there is a strong possibility that price could disregard this area and move on to connect with H4 demand below at 0.7345-0.7365, or even the 0.73 handle which sits within the aforementioned daily support area. Therefore, we’ll humbly pass on longs from this barrier. In regard to selling, unfortunately the odds are also against us. With weekly price positioned within a support area and H4 action trading nearby supports, the risk is just too great for our desk.

As far as we can see, technical elements are mixed at the moment leaving us with little choice but to remain flat for now.

Data points to consider: Aussie employment data at 12.30am. US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

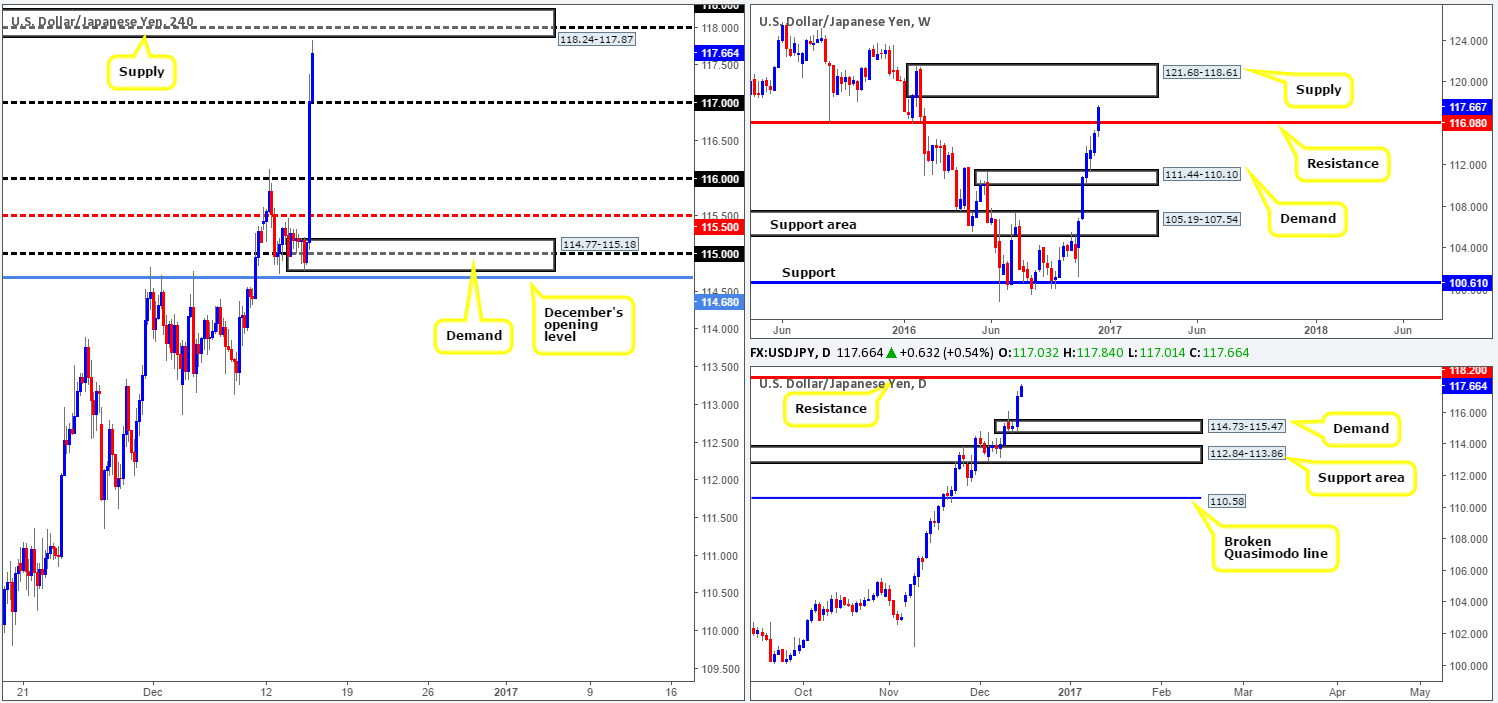

USD/JPY:

The dollar strengthened across the board yesterday after the FOMC raised the Fed funds target rate 25bps to 0.75%. Dragging the USD/JPY along with it, the pair rose close to 200 pips on the day. As we write, nevertheless, price is seen lurking just ahead of a H4 supply area coming in at 118.24-117.87. This zone, as you can probably see, houses the 118 handle, as well as the daily resistance level drawn from 118.20. Therefore, one can likely expect prices to respond from this base today. Be that as it may, traders also need to be prepared for the possibility of a fakeout beyond this area due to a nearby weekly supply area sitting above it at 121.68-118.61.

Our suggestions: Under these circumstances, we would be wary of placing a pending sell order at the current H4 supply area. This, however, does not mean a trade from the H4 zone is not valid. To trade this barrier, we would recommend waiting for at least a H4 bearish candle to form, prior to pressing the sell button. This, of course, will not guarantee a winning trade, but what it would do is confirm bearish intent. The first take-profit target, should a trade come to fruition, would be the 117 neighborhood, hopefully followed by 116!

Data points to consider today: US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 118.24-117.87 ([reasonably sized H4 bearish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

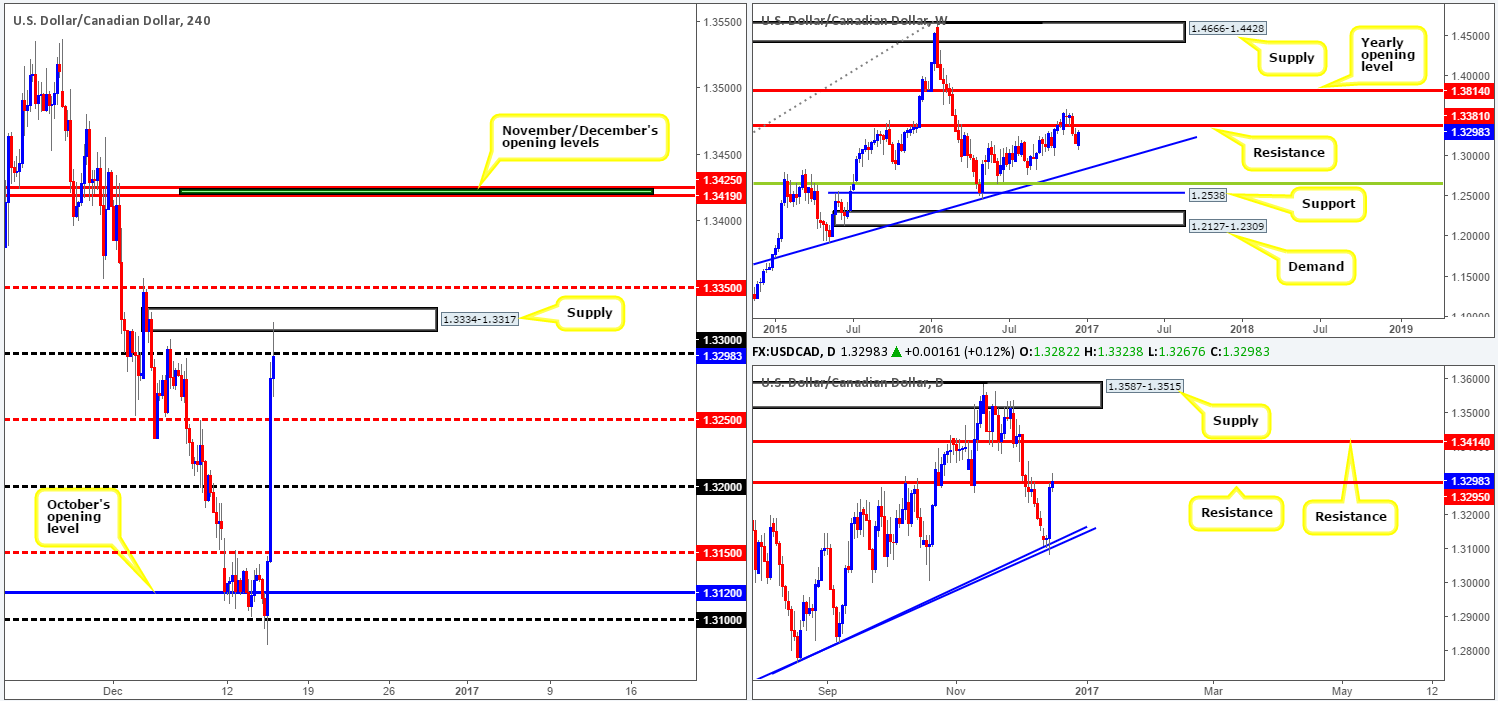

USD/CAD:

Yesterday’s FOMC saw the USD/CAD pair aggressively advance north following a whipsaw through the 1.31 handle. As can be seen from the H4 chart, price rallied over 200 pips and, in the last hour, just shook hands with supply carved from 1.3334-1.3317. Also noteworthy is the daily resistance level at 1.3295 now in play. In spite of the response seen from the current H4 supply base, weekly action indicates that there’s potential for further buying up to resistance coming in at 1.3381. From our perspective, we believe a short could still be considered valid should the current H4 candle close below the 1.33 handle. We’re confident that should this come to fruition price will very likely reach the H4 mid-way support handle chiseled in at 1.3250.

Our suggestions: In the event of a H4 close below 1.33 a short position could be something to consider, targeting 1.3250 as your immediate take-profit target. We would, nonetheless, also recommend reducing risk to breakeven at this point as well, since it is difficult to tell when, or indeed if, weekly buyers will come into the picture.

Data points to consider today: BoC Gov. Poloz speaks at 4.15pm. US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for a H4 close below 1.33 before considering shorts in this market.

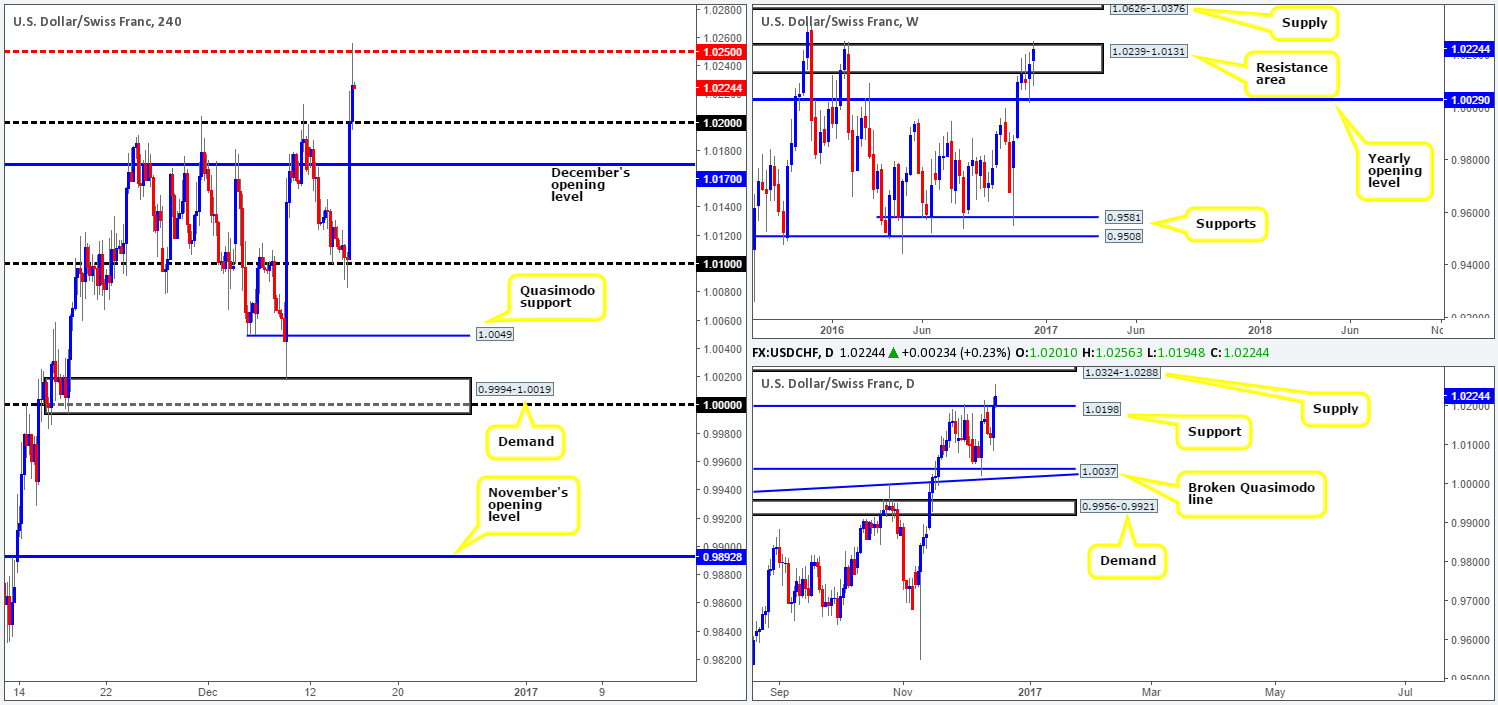

USD/CHF:

The US dollar rose sharply against the Swiss Franc shortly after the FOMC raised the Fed funds target rate 25bps to 0.75%. Following a whipsaw through the 1.01 handle the pair rallied over 100 pips, concluding trade at 1.02. In recent hours, however, price ran through offers at 1.02 and connected with the H4 mid-way resistance point seen at 1.0250.

While 1.0250 is currently holding ground, daily flow signals that further upside could be on the horizon, after a break above the resistance level at 1.0198 (now acting support) was seen. Despite this, weekly price remains trading within the upper edge of a resistance area at 1.0239-1.0131.

Our suggestions: In light of the conflicting signals seen here between the above said timeframes, we feel it may be best to remain flat for the time being and reassess going into Friday’s sessions.

Data points to consider today: US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm. SNB interest-rate statement at 8.30am GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

DOW 30:

US equities tumbled lower yesterday, following the FOMC raising the Fed funds target rate 25bps to 0.75%. Higher interest rates increase borrowing costs for companies, so the knee-jerk reaction lower was to be expected. The selloff, nevertheless, was stopped in its tracks by a H4 demand zone found at 19747-19774, helping the index trim around 50% of FOMC-induced losses going into the closing bell. Traders may also be interested to know that the daily candles chalked up somewhat of a bearish engulfing candle as a result of yesterday’s selloff. Without any form of resistance on the horizon from both the weekly and daily charts, however, this is a difficult candle formation to act on.

Our suggestions: Seeing as how the current H4 demand base has proven itself as somewhere investors would buy from, we will be watching this area for a second retest today. Nevertheless, given the fact that price drove very deep into this zone, likely clearing out a truckload of bids in the process, waiting for the lower timeframes to confirm buying interest would, in our book, be the more logical route to take here. This could be either a break above supply followed by a retest, a trendline break/retest or simply a collection of well-defined buying tails around the H4 demand. We search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

Data points to consider today: US CPI report, Philly Fed manufacturing index and Jobless claims all set to hit the wire at 1.30pm GMT.

Levels to watch/live orders:

- Buys: 19747-19774 ([lower-timeframe confirmation required prior to pulling the trigger] stop loss: dependent on where one confirms the area).

- Sells: Flat (stop loss: N/A).

GOLD:

The precious metal took another hit to the mid-section during yesterday’s session. The FOMC announced that the Fed funds target rate is increasing 25bps to 0.75%, as expected. This, as you’d imagine did not sit too well with the yellow metal, as a rally in the dollar typically follows through with a drop in gold prices.

Weekly action continues to push lower, with the support area at 1205.6-1181.3 (now acting resistance) now a distant memory. The next downside objective on this scale falls in at 1071.3-1097.2: a weekly demand area that claims strong bullish momentum from its base. Along the same vein, the daily candles look set to extend lower to demand coming in at 1108.2-1117.8, after last week’s breach of support at 1169.8 (now acting resistance).

Our suggestions: In light of the H4 candles coming within striking distance of demand at 1125.1-1132.9, and now about to retest the recently broken H4 support area at 1145.1-1150.9 as resistance, where do we go from here? Well, given the higher-timeframe picture (see above), a short from the current H4 resistance area could be an option today. To deem this area a suitable reversal point, nevertheless, a reasonably sized H4 bearish rejection candle is required. The first take-profit target from here, of course, would be the aforementioned H4 demand area. An engulf of this zone, however, would likely open up the gates for price to challenge the above said daily demand zone, which makes for a nicely-placed second take-profit target.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1145.1-1150.9 ([reasonably sized H4 bearish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).