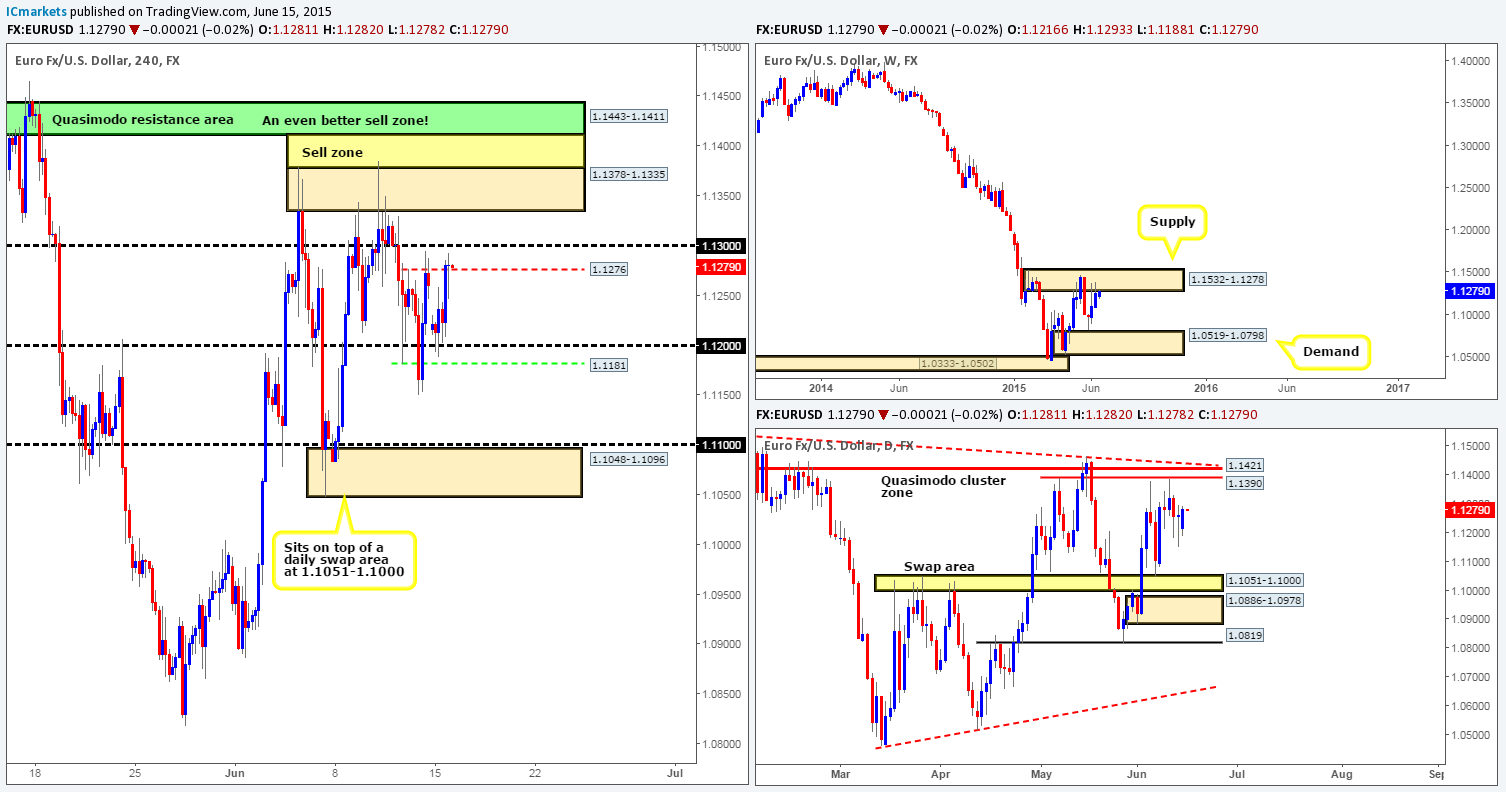

EUR/USD:

Weekly view: The weekly timeframe shows that price is currently nibbling at the underside of a weekly supply area coming in at 1.1532-1.1278.This supply zone is a very significant hurdle in our opinion (held price lower since the 11th May) since if there’s a sustained break above this area, our long-term bias (currently short) on this pair will very likely shift north.

Daily view: From this angle, however, we can see that price is trading in what we like to call a ‘mid-range phase’. Essentially, all this means is that the market is presently trading in no man’s land between a daily Quasimodo cluster zone at 1.1390/1.1421 (located relatively deep within the aforementioned weekly supply area) and a daily swap area seen in yellow at 1.1051-1.1000.

4hr view: For those who read our previous report on the Euro, you may recall us mentioning that we placed a pending buy order at 1.11845, just above the 4hr Quasimodo support level in green at 1.1181. We did this to try and catch any stop hunt below the round number 1.1200. As you can see, a fakeout was seen but price missed our order by a mere five pips, which was a shame really considering price went straight to our target – the 4hr Quasimodo resistance level in red at 1.1276.

In addition to the above, we also said that the aforementioned 4hr Quasimodo resistance level and the round number just above it at 1.1300 is a great place to look for (lower timeframe) confirmed sells. For those who did not read the previous report, we said this simply because of where price is located on the weekly timeframe at the moment (see above – weekly supply). Therefore, given the points made above, our prime focus for today will be on looking for confirmed shorts between 1.1276/1.1300. Should we happen to spot an entry signal short here, our first take-profit target will likely be set around the 1.1237 mark. The second will likely be around the 1.1200 number.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.1276/1.1300 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

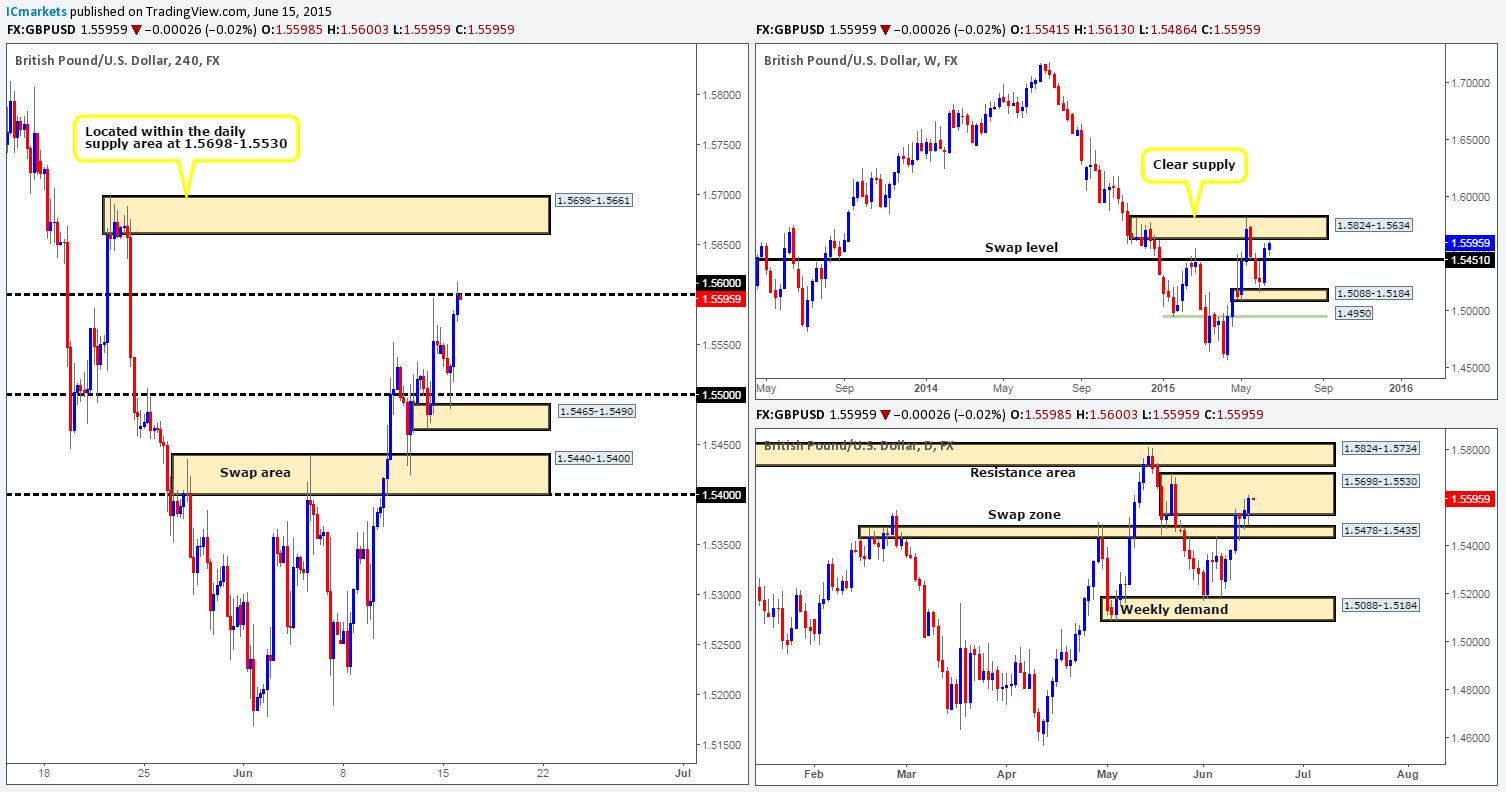

GBP/USD:

Weekly view – Following the close above the weekly swap level 1.5451 last week, the GBP edged higher, consequently placing price within a stone’s throw away from a weekly supply barrier coming in at 1.5824-1.5634.

Daily view: The daily action seen yesterday shows price advanced north from the daily swap zone seen at 1.5478-1.5435. This move drove the pound deeper into a daily supply area seen just above it at 1.5698-1.5530 (located just below the aforementioned weekly supply area). Should we see further buying take place this week, and the current daily supply zone taken out (which is a strong possibility considering last week’s close [see above – weekly view]), then the next objective to reach is the daily resistance area directly above at 1.5824-1.5734 (located deep within the aforementioned weekly supply area).

4hr view: For those who read our previous report on the GBP, you may recall us mentioning to keep an eye on the 4hr demand area at 1.5465-1.5490. This zone, as you can see, was tagged perfectly and rallied directly to our pre-determined target region –1.5600. Unfortunately for us though, we were not able to find any suitable price action on the lower timeframes to take advantage of this move. Well done to any who managed to lock in some green pips here.

Going into today’s sessions, however, 1.5600 will likely play a key role in our decision-making process. If 1.5600 is taken out and retested as support, our team believes the 4hr supply area seen above it at 1.5698-1.5661 (positioned deep within the daily supply area mentioned above at 1.5698-1.5530) would likely be the next zone to reach. At this point in time, we’re not entirely sure if we’d trade this move or not, since we would effectively be entering long into higher timeframe supply (see above). We’d have to see what the lower timeframe price action produced on the retest before making any decisions.

On the flip side, should the 1.5600 number hold today, and we see lower timeframe selling confirmation , we would, with little hesitation enter short, targeting the mid-level number 1.5550 as our first take-profit target.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.5600 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

AUD/USD:

Weekly view – Last week saw buying interest come into the market from within the weekly demand area at 0.7449-0.7678. In the event that the buyers can continue with this intensity going into this week, we see very little stopping price from connecting with the minor weekly swap level at 0.7845. However, judging by the sloppy reaction seen (pink circle – 02/02/15-06/04/15) between these two aforementioned weekly areas a few months earlier, things could potentially get messy here again before we see any decisive move take place. From a long-term perspective, nonetheless, the trend direction on this pair is still very much south in our opinion, and will remain this way until we see a convincing break above 0.8064.

Daily view: From the pits of the daily scale, it appears that price has begun to chisel out a consolidation zone between a small daily supply area at 0.7838-0.7802 (positioned just below a minor weekly swap level at 0.7845), and a daily demand area coming in at 0.7551-0.7624.

4hr view: The 4hr timeframe shows, like the Euro and the GBP, that an advance took place during the course of yesterday’s sessions. However, unlike the Euro and GBP, the AUD remains in a phase of consolidation between the 4hr supply area at 0.7817-0.7775, and a round number 0.7700. As such, most of the following analysis will be the same as the previous.

Trading in between this 75-pip range is certainly a possibility today (potential buys: 0.7705 sells: 0.7770). Nonetheless, we would strongly advise only doing so once you see some sort of confirmation signal from the lower timeframes, since as we recently saw, fakeouts are common within ranging environments such as this. Whether or not this market remains range bound for the entire week is very difficult to say. What we will say though is considering where price is located on the higher timeframe picture (see above) at the moment; we feel that the market will eventually break out north from this consolidation. This, as you can see on the 4hr timeframe, would likely force price to collide with the weekly swap level 0.7845 – a perfect sell zone (green area: 0.7867/0.7845). We firmly believe that this area will at the very least likely see a bounce, and in preparation for this, our team has placed a pending sell order just below this zone at 0.7842 with a stop set above at 0.7875.

Levels to watch/ live orders:

- Buys: 0.7705 [Tentative – confirmation required] (Stop loss: 0.7656).

- Sells: 0.7770 [Tentative – confirmation required] (Stop loss: 0.7821) 0.7842 (Stop loss: 0.7875).

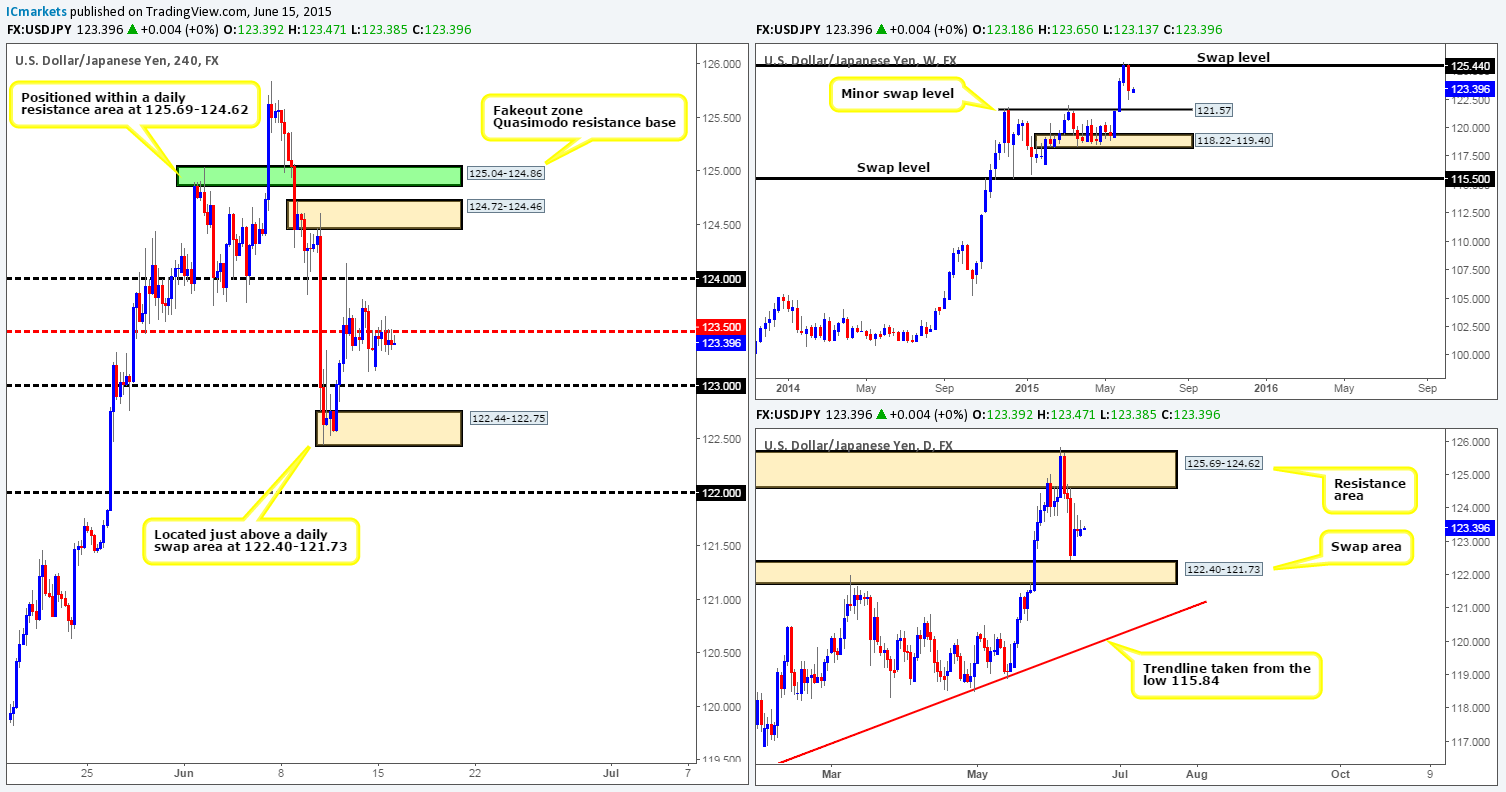

USD/JPY:

Weekly view – Last week’s activity saw the USD/JPY sell off from a weekly swap level at 125.44, consequently wiping out any gains accumulated the week before last. On the assumption that the sellers can continue with this tempo coming into this week, we believe there’s a very good chance that price will greet the minor weekly swap level seen at 121.57. Despite this recent decline in value, however, the long-term uptrend on this pair is still very much intact, and will remain that way in our opinion until the weekly swap level 115.50 is consumed.

Daily view: The daily timeframe on the other hand, shows that buying interest came into the market last Thursday from a just above a long-term daily swap area at 122.40-121.73. This barrier, as you can probably see, remains a key obstacle to a move towards the aforementioned minor weekly swap level sitting just below it.

4hr view: Amid yesterday’s sessions on the 4hr timeframe, the USD/JPY pair barely saw any movement. As a result, much of our previous analysis still holds.

Given that price is currently oscillating below the mid-level number 123.50 at the moment, it is possible a move south could ensue today down towards at least 123.00. That said though, we are, as you can see from above in bold, receiving somewhat mixed signals from the higher timeframes at the moment, making it very difficult to judge direction. Therefore, until we see more conducive higher timeframe action, the best thing we can do today and possibly into the week is watch the following levels of interest for lower timeframe confirming price action, and trade them accordingly.

Buy zones we have on our watch list are as follows:

- The round number 123.00.

- The 4hr demand area at 122.44-122.75 (located just above the aforementioned daily swap area).

Sell zones we have on our watch list are as follows:

- The mid-level number 123.50.

- The round number 124.00.

- The 4hr supply area coming in at 124.72-124.46 (located just below the daily resistance area at 125.69-124.62). Something to note regarding this 4hr supply zone is the 4hr Quasimodo resistance base seen just above it. Keep a close eye on this area as fakeouts above supply (in this case) into obvious Quasimodo bases are very common.

Levels to watch/ live orders:

- Buys: 123.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 122.44-122.75 [Tentative – confirmation required] (Stop loss: 122.38).

- Sells: 123.50 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 124.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 124.72-124.46 [Tentative – confirmation required] (Stop loss: 125.08).

USD/CAD:

Weekly view – During last week’s trading, price sold off from a weekly swap level coming in at 1.2439. Provided that the sellers can continue with this tempo, we feel that there is a good chance that price will connect with the weekly swap area seen in yellow at 1.2034-1.1870. Despite the fact that this market is now in the red so to speak, our long-term bias on this pair remains long, and it will only be once/if we see a break below the aforementioned weekly swap area would our present bias likely shift.

Daily view: The daily timeframe on the other hand shows that buyers begun defending a daily demand barrier at 1.2167-1.2255 from Thursday onwards last week. Nonetheless, until we see a clean break above the near-term daily swap level at 1.2366, it is difficult for us to be bullish on this pair. It will be interesting to see what the 4hr timeframe has to say…

4hr view: Throughout the course of yesterday’s sessions, price remained trading between a 4hr supply area at 1.2351-1.2324 (which has been holding this market lower now since Thursday) and a round number support at 1.2300. However, yesterday’s spike (blue arrow) above the aforementioned 4hr supply area has potentially opened up the gates for price to now challenge the 4hr swap area at 1.2366-1.2394. Therefore, should price continue to hold above 1.2300 today, and we see corresponding lower timeframe buying confirmation, we may consider an intraday long position up to 1.2360 (just below the aforementioned 4hr swap area). Entering long from here, however, even with confirmation is a risky trade in our book since we’re likely going up against higher timeframe opposition (see above in bold), so constantly monitoring any longs taken from this region is HIGHLY recommended. In the event the above does play out, and our target is hit, we’d then exit any longs we may have and begin looking to short this market within the aforementioned 4hr swap area.

On the flip side, should 1.2300 give way today, we see very little active demand in the market until around the mid-level number 1.2250. That said though, we have no intention in selling the break here, if price retests 1.2300 as resistance before hitting 1.2250, we’ll then attempt to short, as long as risk/reward is over 2R, and there is some sort lower timeframe confirming signal such as an engulf of demand, a trendline break or even a simple candlestick reversal pattern.

Levels to watch/ live orders:

- Buys: 1.2300 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: 1.2366-1.2394 [Tentative – confirmation required] (Stop loss: 1.2443).

USD/CHF:

Weekly view – Following the rebound seen from the weekly swap level at 0.9512, price continued to extend lower last week. In the event that the buy-side liquidity remains weak in this market, it is likely we’ll see price shake hands with the weekly swap area seen below at 0.9074-0.9000 sometime this week.

Daily view: From this angle, we can see that the buyers continue to struggle to hold out above the daily trendline extended from the low 0.8299. Should a close below this limit be seen, this would likely attract further selling down towards the daily demand area at 0.9077-0.9147 (located just above the aforementioned weekly swap area).

4hr view: The 4hr timeframe shows a clear consolidation has recently been chiseled out between 0.9406-0.9367 and 0.9232-0.9266. Trading in between this 170-pip range is certainly a possibility today (potential buys: 0.9270 sells: 0.9365). With that being said though, we would strongly advise only trading these limits once you have seen some sort of confirmation signal from the lower timeframes, since fakeouts are common within ranging environments such as this.

A fakeout above or below this range is, in our opinion, even more likely on this pair because sitting just outside of this area; we have two very prominent zones which are perfect areas to help facilitate a fakeout – the 4hr Quasimodo resistance level in red at 0.9422, and a 4hr demand at 0.9164-0.9217 (located just above the aforementioned daily demand area). Be sure to have these zones on your watchlists guys!

Levels to watch/ live orders:

- Buys: 0.9270 [Tentative – confirmation required) (Stop loss: 0.9226).

- Sells: 0.9365 [Tentative – confirmation required] (Stop loss: 0.9410).

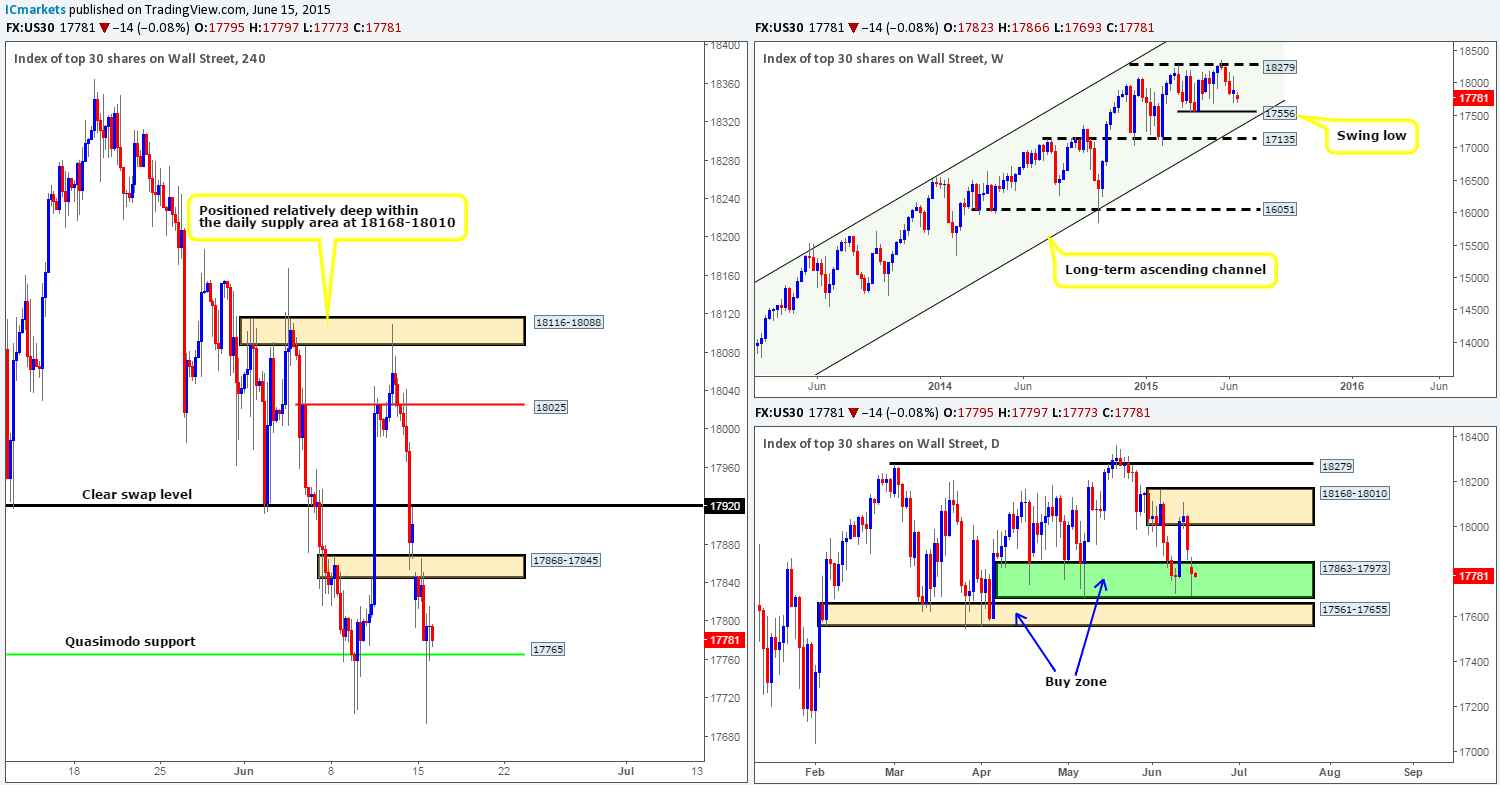

US 30:

Weekly view – Following the two-week sell off from 18279, the buyers finally made an appearance last week around the 17703 mark, consequently printing a poorly formed weekly indecision candle. At the time of writing though, it is very difficult to say which way the market may head this week. It could rally back up to test 18279, or it could just as well continue south down towards the weekly swing low 17556. From a longer-term perspective, however, the overall uptrend on this index is still very strong, and will remain this way in our opinion until we see a convincing push below 16051.

Daily view: The daily timeframe shows price is currently trading within a daily buy zone seen in green at 17863-17973. If the market holds within this zone, it is very likely we’ll witness price rally back up to shake hands with the daily supply area at 18168-18010 again. On the other hand, if this daily buy zone gives way, price will immediately enter into the jaws of another daily buy zone sitting directly below it at 17561-17655.

4hr view: Recent action on this scale reveals price did indeed fill the weekend gap and drop from the 4hr swap area at 17868-17845. For those who read our previous report on the DOW, you may recall that we mentioned to keep a close eye on lower timeframe price action at this area for shorting opportunities. Fortunately, our team found a perfectly confirmed entry on the 5 minute timeframe at 17859, and literally let it run down to the 4hr Quasimodo support level seen in green at 17765 (located deep within the daily buy zone mentioned above at 17863-17973). As you can imagine the risk/reward on this trade was fantastic!

Going into today’s sessions, nevertheless, we can see price is currently holding firm above the aforementioned 4hr Quasimodo support level. As such, our attention will be mostly driven toward longs today since based on where price is located on the daily timeframe at the moment (see above); this is the direction this market will likely take this week. If we manage to find confirming price action on the lower timeframe picture around the 4hr Quasimodo level, we’d confidently enter long, targeting 17837 as our first-take-profit area.

Levels to watch/ live orders:

- Buys: 17765 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

XAU/USD (Gold)

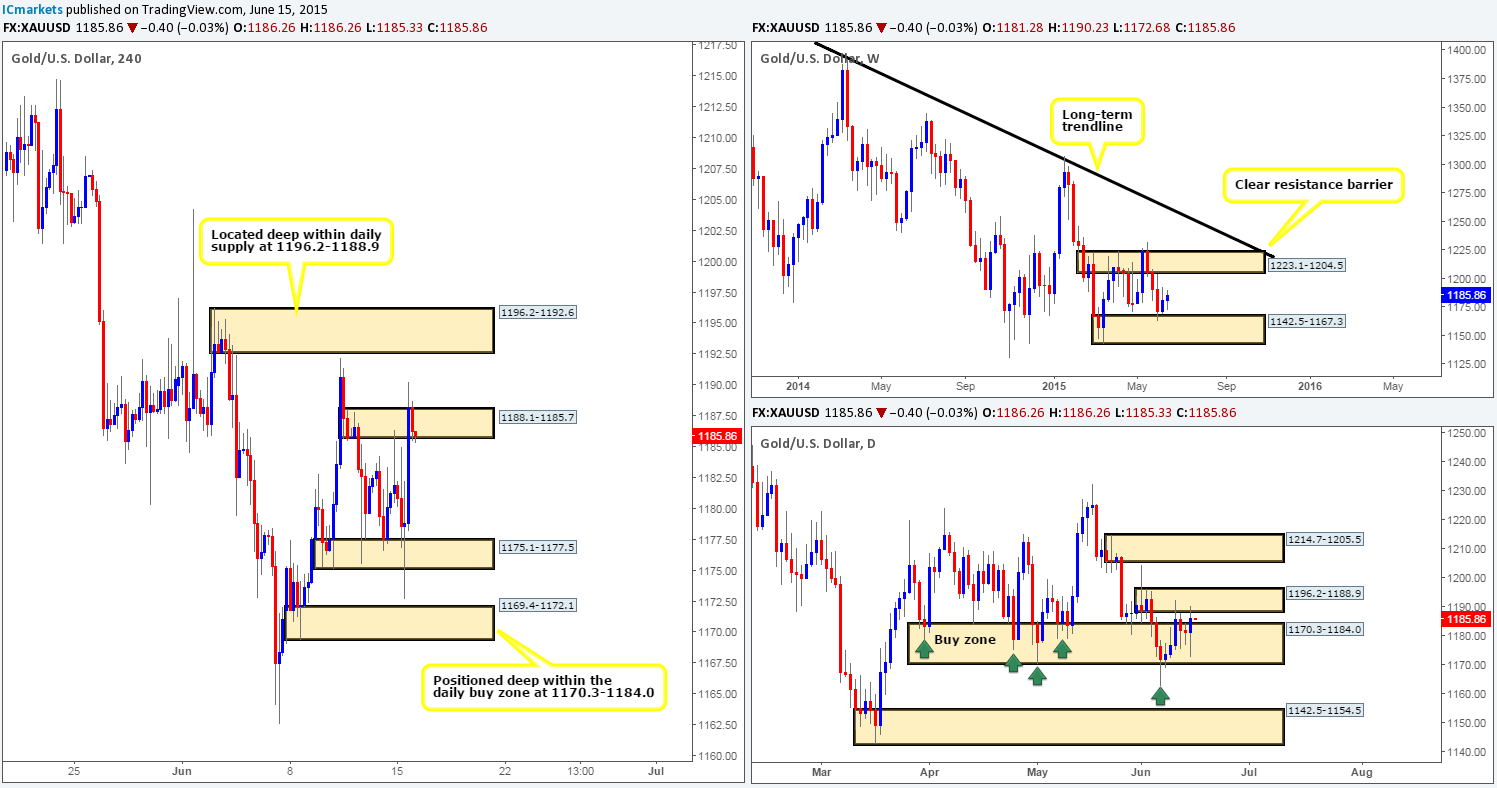

Weekly view – Following last week’s rebound from the weekly demand area sitting at 1142.5-1167.3, the buyers have so far been able to hold this market higher. If the buyers continue to show strength here, we may see further upside in this market, potentially pushing gold back up to the weekly supply area seen at 1223.1-1204.5.

From a long-term perspective, however, gold is still trending south in our opinion, and It will only be once/if we see a close above the weekly trendline extended from the high 1488.0 would we begin to feel that this market may be reversing.

Daily view: For the past week and a half the buyers and sellers have been seen battling for position between two compact daily areas – a daily buy zone at 1170.3-1184.0, and a small daily supply area at 1196.2-1188.9. Should we see a break below the aforementioned daily buy zone this week, the next objective to reach will likely be the daily demand area coming in at 1142.5-1154.5 (located deep within the aforementioned weekly demand area). On the other hand, if a break above the aforementioned daily supply area takes place (most likely to happen considering the position of price on the weekly timeframe – see above), the path north will likely be free up to a daily supply area seen at 1214.7-1205.5 (located within the aforementioned weekly supply area).

4hr view: The gold market was relatively volatile throughout yesterday’s sessions. Price aggressively spiked below 4hr demand at 1175.1-1177.5 and rallied north just as aggressively towards 4hr supply at 1188.1-1185.7, which, as you can see, was also violated going into yesterday’s close 1186.2.

A ton of buy stops were likely triggered above this 4hr supply zone, and as such, has more than likely provided well-funded traders liquidity to short into. Therefore, if our analysis is correct and buy-side liquidity remained weak on the push north, we may see gold sell off today back down towards the aforementioned 4hr demand area. That being said though, we have no intention in jumping in this market right away, we would much prefer to see the lower timeframes show selling strength before risking capital to this idea, since let’s not forget that by selling here, we would effectively be selling against potential buying opposition from the weekly demand area (see above), so please trade this one carefully guys!

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1188.1-1185.7 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this zone).