‘But out of limitations comes creativity’ – Debbie Allen.

Ten years ago, smartphones did not exist. Three decades earlier, no one even owned a computer. Today, however, nearly everybody is connected.

Thanks to this technological advancement, creating an alternative source of income through trading is appealing.

Thanks to this technological advancement, creating an alternative source of income through trading is appealing.

Despite the appeal, many traders, particularly those new to the forex market, erroneously approach trading as a hobby. Be it a part-time endeavour or one’s full-time occupation, forex trading is a serious business, and should always be treated as such.

To help guide those looking to venture into part-time trading, the team here at IC Markets have pulled together and chalked up some notable pointers to get you started:

Education:

Clever marketing strategies concocted by not so well-meaning companies portray trading as an easy stress-free approach to earning boundless wealth. On those grounds, it is naturally tempting to neglect education because, well, trading is easy.

In spite of what you may have heard or read, trading is not a get-rich-quick scheme. Alongside most other professions, it takes a number of years of dedication to reach proficiency, both for the part-time and full-time forex trader.

Fortunately, educational resources are easy to find online. Here at IC Markets, a number of in-depth articles explaining different aspects of the industry are available. Further to this, the research team uploads comprehensive daily reports, tackling both fundamental and technical analysis: https://www.icmarkets.com/blog/.

The right trading style:

The underlying reason behind choosing to become a part-time trader is typically due to time constraints. This means longer-term trading styles and wider perspectives are usually necessary.

Surprisingly, scalping is a possible trading style for part-time traders. A few hours spare in the evening is typically sufficient. Scalpers aim to achieve profits from relatively small price changes, often opening and closing large numbers of trades using the M1, M3 and M5 timeframes, with the goal of catching multiple small wins.

Swing trading is, as its name implies, a medium-term trading style designed to hook market swings that vary from a couple of days to a few weeks. Traders in this class generate the majority of their signals via technical analysis, though fundamental analysis can help form ideas as well. Popular timeframes within this field are the H4 and daily charts. If you’re able to spare a few hours in the evening and occasionally check the charts once during the day, a swing trading style is worth considering.

Position trading, on the other hand, is a longer-term strategy, whereby traders look at daily, weekly and monthly charts to determine long-term trends. A combination of fundamental and technical analysis is often employed, keeping positions open for extended periods of time – think weeks, months and years here. Traders in this category are less concerned with short-term market fluctuations. Should you have only a few hours spare each week to trade, position trading is a worthy contender.

Position traders tend to focus on a number of different major currency pairs due to their use of slower timeframes. Swing traders, however, may prefer to draw in three/four pairs, while scalpers generally focus on one unit.

The right trading strategy:

While having the right trading style is crucial, having an accurate strategy that blends with your personality is just as vital. Although some technicians may disagree, many trading strategies are flexible and can be used with most trading styles. The only discernible difference is frequency, risk and profit distance.

Back testing a strategy is also an exercise successful traders, both full-time and part-time forex traders, depend on. It enables the trader to enter the live market confident, knowing he/she has data to back up their approach.

Bollinger bands:

Created by John A. Bollinger, Bollinger Bands are certainly an option worth considering as a part of your trading strategy, proven to be one of the more robust indicators available in the technical community today.

Bollinger bands are there to determine trend, strength and volatility on all timeframes, serving scalpers, day traders, swing traders and position traders with precise signals.

Bollinger Bands use a 20-day simple moving average (SMA) for the middle band. The upper band is calculated by taking the middle band and adding twice the daily standard deviation to that amount. The lower band is calculated by taking the middle band minus two times the daily standard deviation.

Japanese candlestick formations:

Japanese candlesticks have been a fan favourite for decades. In the right location, a candlestick is a powerful signal.

Japanese candlesticks have been a fan favourite for decades. In the right location, a candlestick is a powerful signal.

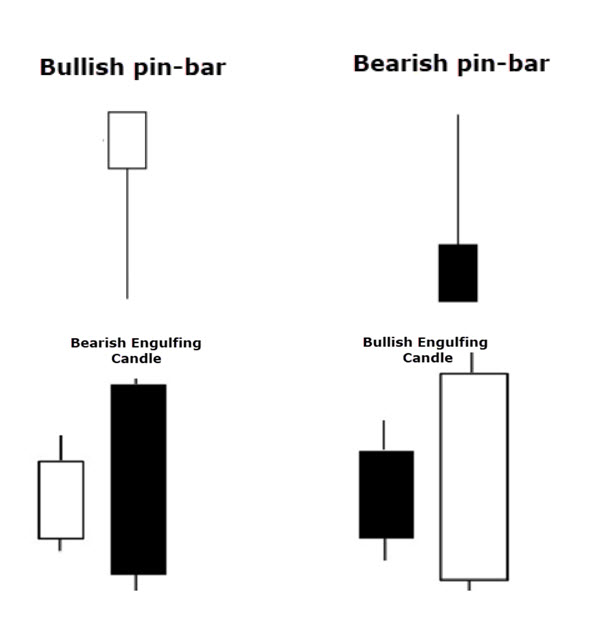

Two of the most popular patterns used today are the pin-bar candle pattern and the engulfing formation.

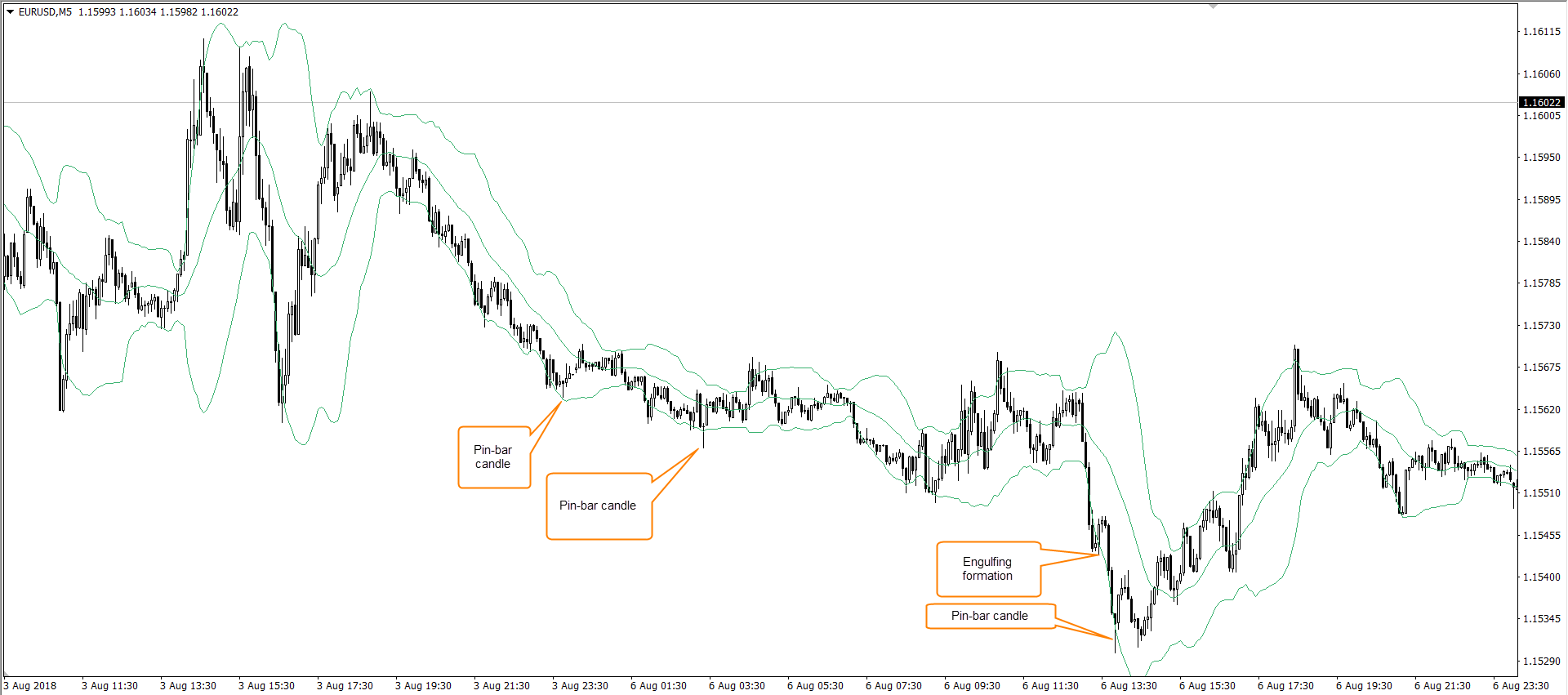

Leaving the Bollinger bands on the chart (below), let’s drill in and try to spot some short-term ‘scalps’ using candlestick signals as entry confirmation.

Four opportunities to trade this market using candlestick confirmation at the lower Bollinger band are visible, with one losing setup.

Using both Bollinger bands and candlestick confirmation is a combined trading strategy, allowing traders to take advantage of both trend and countertrend opportunities. Not only are you trading from high-probability dynamic support/resistance, entry and stop-loss placement is set using the candlestick’s rules of engagement.

Trading part time is POSSIBLE

While the idea of quitting one’s full-time job to become a full-time trader is alluring, trading part time is easier on the mind and provides a good foundation to improve skills before transitioning into full time.

Trading part time also has you not relying on your trading profits, therefore lessening the psychological impact which is an aspect a great deal of traders struggle with.

Key takeaway points:

- Approach part-time forex trading with the correct mindset. Patience, especially for swing and position traders, is key. Another point worth making is to think long term, irrespective of trading style. Experienced traders know there is complete randomness on any particular trade, though over a series of trades there is statistical order.

- Find the right trading style and strategy. Part-time traders are usually unable to monitor the markets during the day and are, therefore, forced to resort to longer-term trading styles. This is, of course, unless you’re a comfortable scalping for a few hours in the evening.

- Use trading apps. Although not stated above, trading apps are beneficial companions for the part-time forex trader. IC Markets offer both MetaTrader 4 and MetaTrader 5 as an application on Android-based devices, giving traders easy access to their accounts wherever they are. The MetaTrader Android application provides access to our market leading spreads and unrivalled execution speeds directly on your Android-based mobile. It features fast one click trading from multiple screens and customisable. layouts. With full access to historical data and advanced charting facilities, you can manage your account, trade our full list of products and use over 30 technical indicators for market analysis.