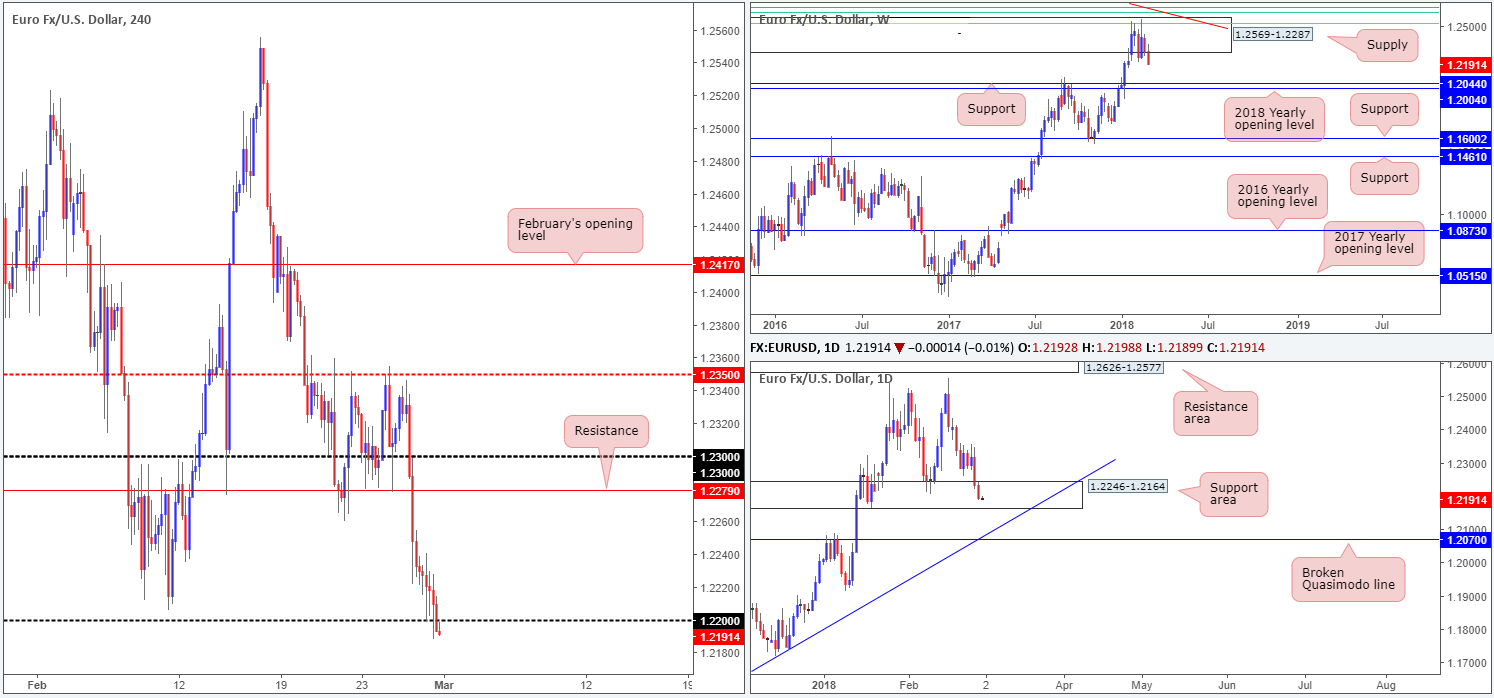

EUR/USD:

Across the board, the Powell-driven dollar continued to flex its financial muscle on Wednesday, climbing above the 90.50 milestone. This eventually saw the EUR/USD conquer the 1.22 handle, and potentially set the stage for a move down to H4 demand plotted at 1.2111-1.2134 (not seen on the screen).

According to the weekly timeframe, the pair could be set for additional losses. The weekly supply zone coming in at 1.2569-1.2287 has managed to cap upside after five solid weeks of consolidation. Downside from here indicates that there’s space for the unit to push as far south as the weekly support level seen at 1.2044. Meanwhile, the story on the daily timeframe reveals that price is seen encased within the walls of a daily support area at 1.2246-1.2164. As yet, there’s been little bullish intent registered from this vicinity. A break lower from here would place the daily trendline support (extended from the low 1.0569) and its intersecting daily broken Quasimodo line at 1.2070 in the spotlight.

Potential trading zones:

With H4 players recently crossing beneath 1.22 and weekly price reflecting a strong bearish stance, lower prices could very well be the order of the day. Assuming that the current H4 candle closes on or very near its lows, this, to us, would be evidence enough that this unit is likely headed for the aforementioned H4 demand. Do note, however, that by selling here you’d effectively be shorting into a daily support area. Therefore, this should not really be treated as a ‘set-and-forget’ trade.

Data points to consider: US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 1.2111-1.2134; 1.2246-1.2164; 1.2044.

Resistances: 1.22 handle; 1.2569-1.2287.

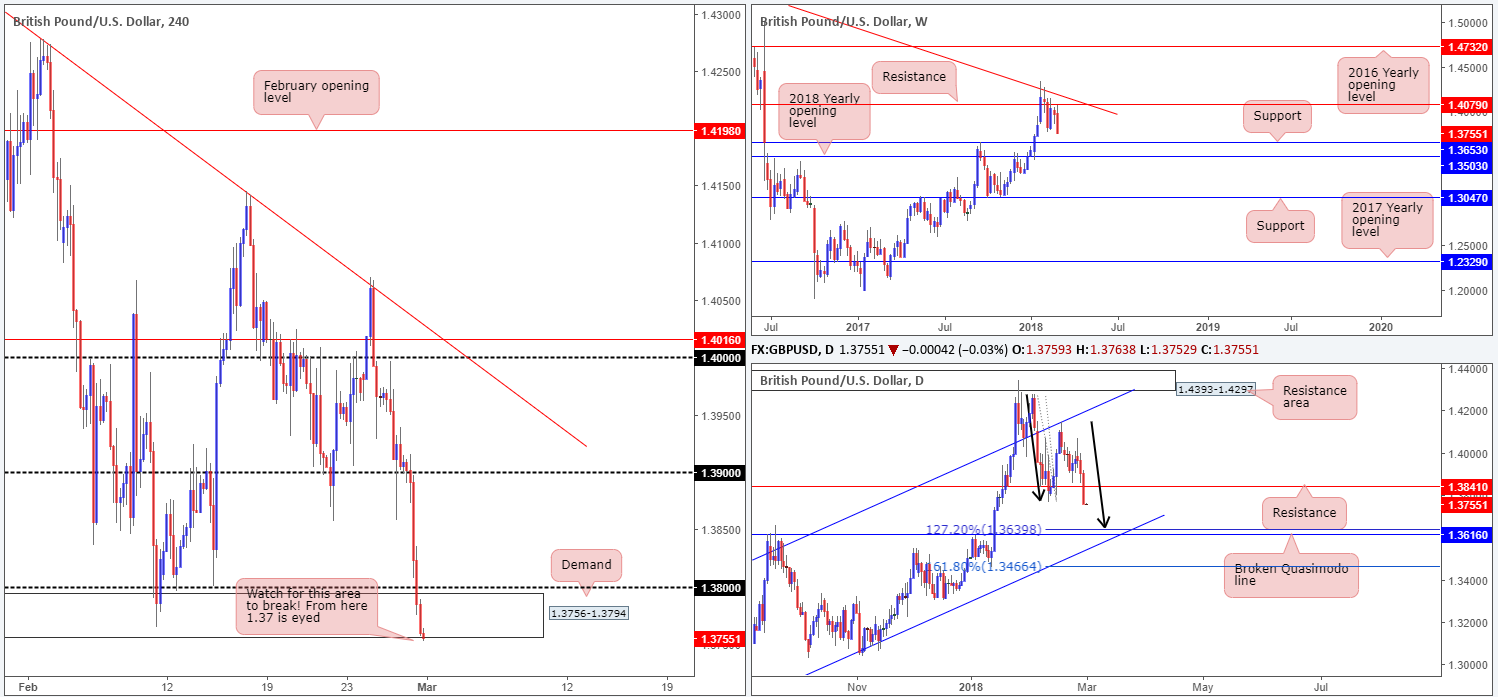

GBP/USD:

The GBP/USD chalked up its third consecutive daily loss on Wednesday on renewed concerns of a hard Brexit. Shaped in the form of a striking full-bodied daily bearish candle, the H4 candles chewed through both the 1.39 and 1.38 handles, and concluded the day closing within the lower limits of a H4 demand at 1.3756-1.3794. As you can see, this area appears somewhat fragile at the time of writing as the unit is seen teasing the lower edge. A violation of this barrier may see additional losses transpire down to the 1.37 neighborhood.

Views from the bigger picture also echo a bearish vibe! Weekly price shows little stopping it from reaching weekly support plotted at 1.3653, while daily movement appears to be on course to shake hands with a daily broken Quasimodo line at 1.3610 that is positioned nearby a daily AB=CD 127.2% Fib ext. point at 1.3639.

Potential trading zones:

Given that the higher timeframes indicate room to push lower, the team’s attention is drawn to the current H4 demand. A H4 close beneath this area, followed up with a successful retest in the shape of a full or near-full-bodied H4 bearish candle would, in our humble opinion, be enough to validate shorts, ultimately targeting the 1.37 area as an initial take-profit zone.

Data points to consider: UK manufacturing PMI at 9.30am; US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 1.37 handle; 1.3616/1.3639; 1.3653.

Resistances: 1.4079; 1.38 handle.

AUD/USD:

A combination of less-than-stellar Chinese manufacturing data along with a strengthening US dollar saw the AUD/USD register its second consecutive daily loss on Wednesday. This has, as you can see, firmly placed the commodity currency beneath its 2018 yearly opening level seen on the weekly timeframe at 0.7801. In addition to this, traders may have also noticed that recent movement has positioned daily price within striking distance of a rather attractive area of support at 0.7699/0.7745 (comprised of a broken Quasimodo line, a support level and a 61.8% daily Fib support).

Looking across to the H4 timeframe, we can see that the pair recently pierced through the lower edge of a H4 demand base coming in at 0.7762-0.7779. With little H4 support seen beneath this angle, the next port of call is likely going to be the 0.77 handle (represents the lower wall of the aforementioned daily support area).

Potential trading zones:

All eyes are on the daily support area. This zone, as highlighted above, houses a combination of strong daily supports, and therefore deserves attention. Ultimately, though, before one looks to commit here, waiting for additional confirmation is advisable as weekly price shows it could push beyond here to a weekly channel support extended from the low 0.6827. A solid daily bullish rotation candle in the form of a full or near-full-bodied base would, from where we’re standing, be sufficient enough to acknowledge that there are active buyers present. This would be a solid cue to begin thinking about buying this market.

Data points to consider: AUD Private capital expenditure q/q at 12.30am; Chinese Caixin manufacturing PMI at 1.45am; US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 0.77 handle; 0.7762-0.7779; 0.7699/0.7745.

Resistances: 0.78 handle.

USD/JPY:

After failing to sustain gains above the H4 mid-level resistance base at 107.50 on Tuesday, the pair underwent a downside correction on Wednesday despite US dollar strength. The 107 handle was recently taken, leaving the pair hovering a few pips ahead of the H4 mid-level support at 106.50/H4 Fib 61.8% support at 108.47 going into the close.

Technically speaking, this recent push lower was likely influenced by a weekly trendline support-turned resistance extended from the low 98.78. As is evident from the weekly chart, however, the past couple of weeks has seen the pair attempt to climb higher from a weekly support area coming in at 105.19-107.54. Also worthy of note at this point is since the beginning of the year, daily action has been compressing within a bearish channel (113.38/108.28).

Potential trading zones:

Although weekly price remains within the walls of a weekly support area, one cannot help noticing that there is a certain bearish vibe present at the moment. And as such, traders may want to consider refraining from entering long, especially on a medium/long-term basis.

Assuming that further selling is seen today and we cross below the 106.50 line, the 106 handle, followed closely by a rather large H4 demand at 104.96-105.69 are the next areas of interest. A short on the break/retest of 106.50, therefore, could be an option today.

Data points to consider: US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 106 handle; 104.96-105.69; 106.50; 105.19-107.54.

Resistances: 107 handle; 107.50; .50; weekly trendline resistance; daily channel resistance.

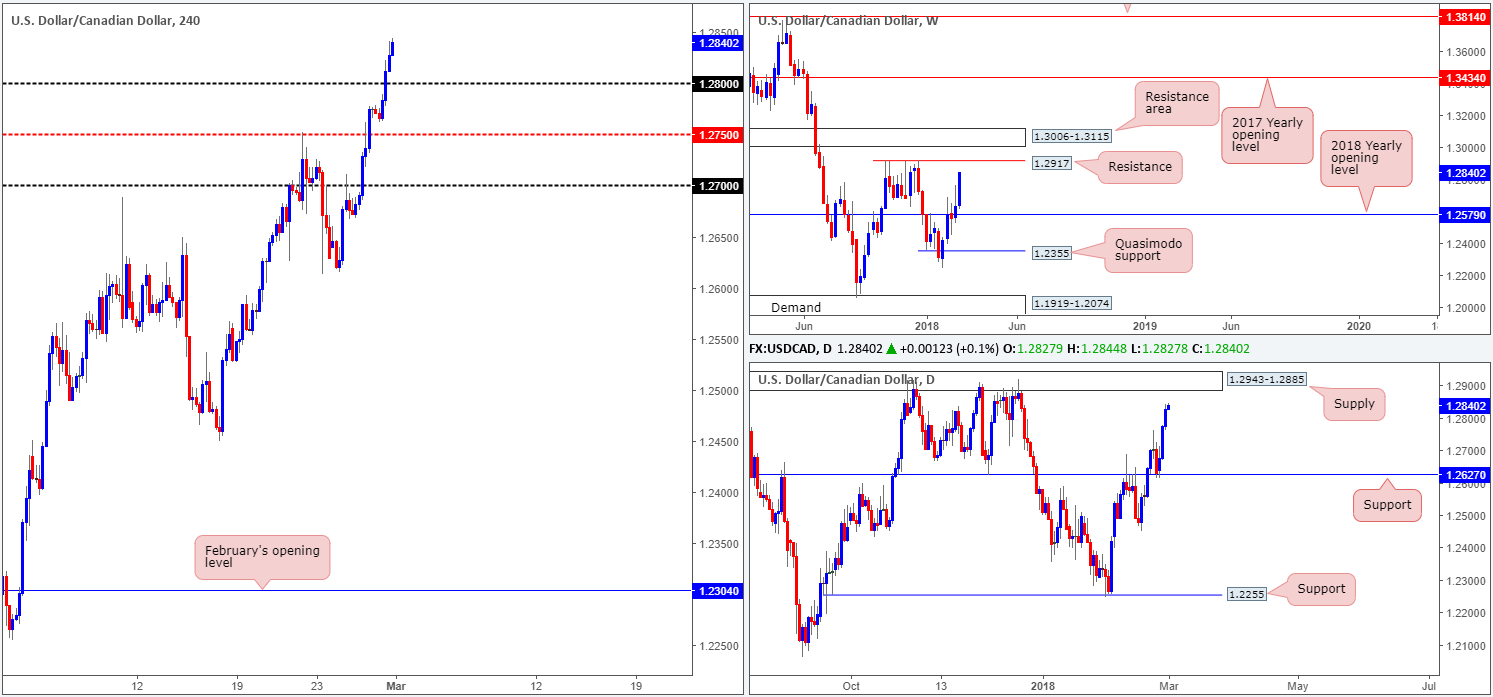

USD/CAD:

USD/CAD extended gains on Wednesday on the back of a robust US dollar, firmly clearing the 1.28 handle and placing a H4 Quasimodo resistance level at 1.2894 in view (not currently seen on the screen).

In a similar fashion to the H4 chart, the bigger picture also suggests further upside could be in store. Daily flow, after beautifully retesting daily support at 1.2627, shows upside is relatively free until we bump heads with daily supply fixed at 1.2943-1.2885. This is further emphasized on the weekly timeframe, as the unit boasts little resistance until the 1.2917 level, which happens to be housed within the said daily supply!

Potential trading zones:

Keeping it Simple Simon today, the team believes a retest play could be something to consider. Should H4 price pullback and retest the recently broken 1.28 level, a long from here, assuming the retest holds in the form of a reasonably strong H4 bull candle, is a possibility. As for take-profit targets, the underside of the daily supply area mentioned above at 1.2885 appears the most logical route at this time.

Data points to consider: US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm; Canadian current account at 1.30pm GMT.

Areas worthy of attention:

Supports: 1.28 handle; 1.2627.

Resistances: 1.2943-1.2885; 1.2917; 1.2894.

USD/CHF:

In recent trading, the USD/CHF elbowed its way above the 0.94 handle and shook hands with a H4 Quasimodo resistance level at 0.9454. This level, as you can see, is sited a few pips above a daily resistance level at 0.9444 and also within the walls of a weekly resistance area at 0.9443-0.9515. The weekly zone is considered a heavy-weight base of resistance, in our opinion, with it having been a solid area of support on multiple occasions since late 2015.

Potential trading zones:

Despite a robust US dollar right now, buying this market is challenging given the noted higher-timeframe resistances currently in play. With that being the case, potential shorts from the aforementioned H4 Quasimodo resistance level at 0.9454 could be something to consider today. However, in view of this line boasting little H4 confluence, we would strongly recommend waiting for additional candle confirmation before pulling the trigger! A solid full or near-full-bodied H4 bearish candle would be ideal, and would very likely be enough to drag prices down to at least the 0.94 neighborhood.

Data points to consider: US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 0.94 handle.

Resistances: 0.9454; 0.9444; 0.9443-0.9515.

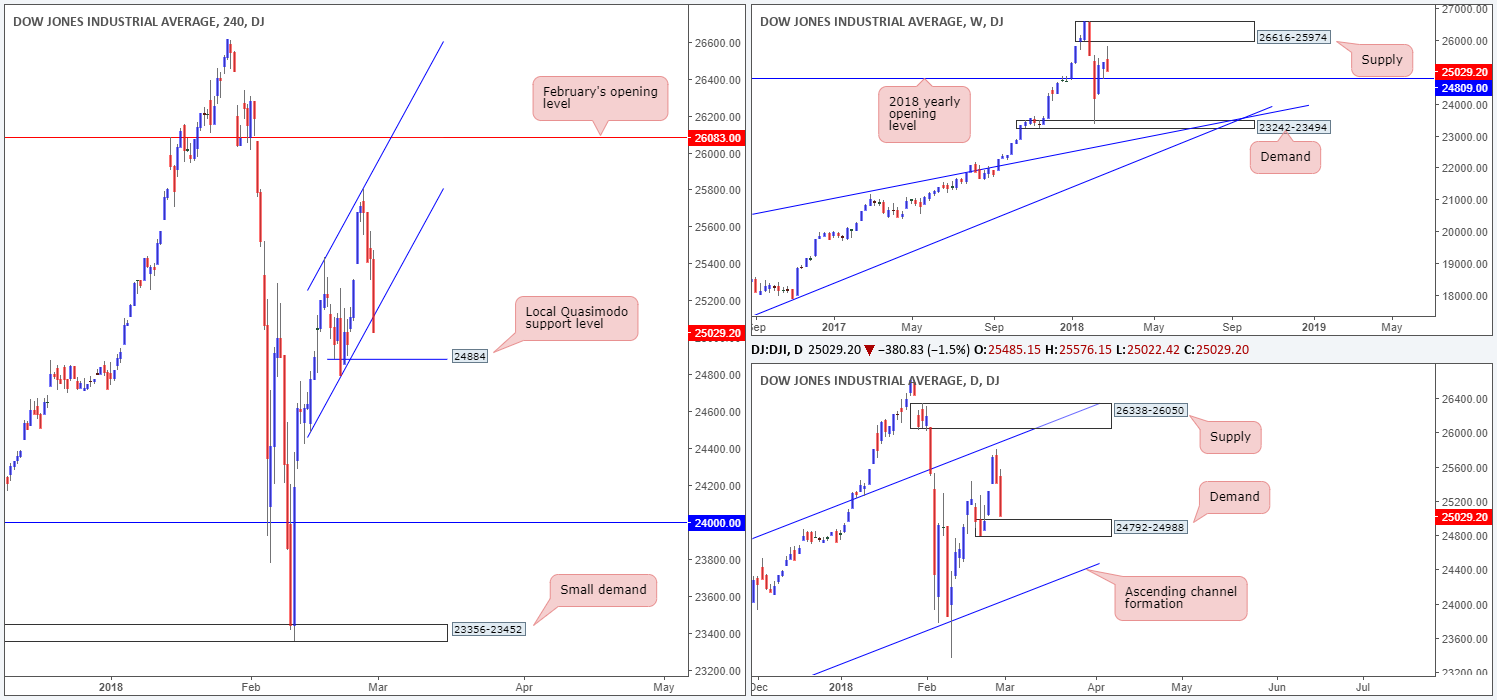

DOW 30:

US equity indexes plunged for a second consecutive day on Wednesday, with the DJIA and S&P500 both registering losses in excess of 1%. Yesterday’s downside move was, we believe, due to continued speculation of a faster pace in interest rate hikes under the new Federal Reserve Chairman Jerome Powell.

From a technical perspective, recent movement could bring weekly price back down to the 2018 yearly opening level at 24809. Support, however, could be found before this level in the form of a daily demand base coming in at 24792-24988, which actually encapsulates the noted 2018 line. H4 flow, on the other hand, shows that the index breached a H4 ascending channel formation in the shape of a full-bodied H4 bearish candle. This strong close places the nearby local H4 Quasimodo support level at 24884 on the radar (located within the aforesaid daily demand).

Potential trading zones:

The H4 Quasimodo support at 24884 is certainly an area one should have logged down – even more so considering that it is placed within the current daily demand zone. Trading from this level also allows one to position stops beneath the current daily demand, which clears all major supports. In regard to profit taking, we would keep a close eye on how price action reacts once/if it reconnects with the underside of the H4 channel. From thereon, the next port of call would be the underside of weekly supply at 26616-25974: the next upside target above the 2018 yearly level.

Data points to consider: US core PCE price index M/M and weekly unemployment claims at 1.30pm; US ISM manufacturing PMI along with Fed Chairman Powell testifying at 3pm GMT.

Areas worthy of attention:

Supports: 24884; 24792-24988; 24809.

Resistances: H4 channel resistance; 26616-25974.

GOLD:

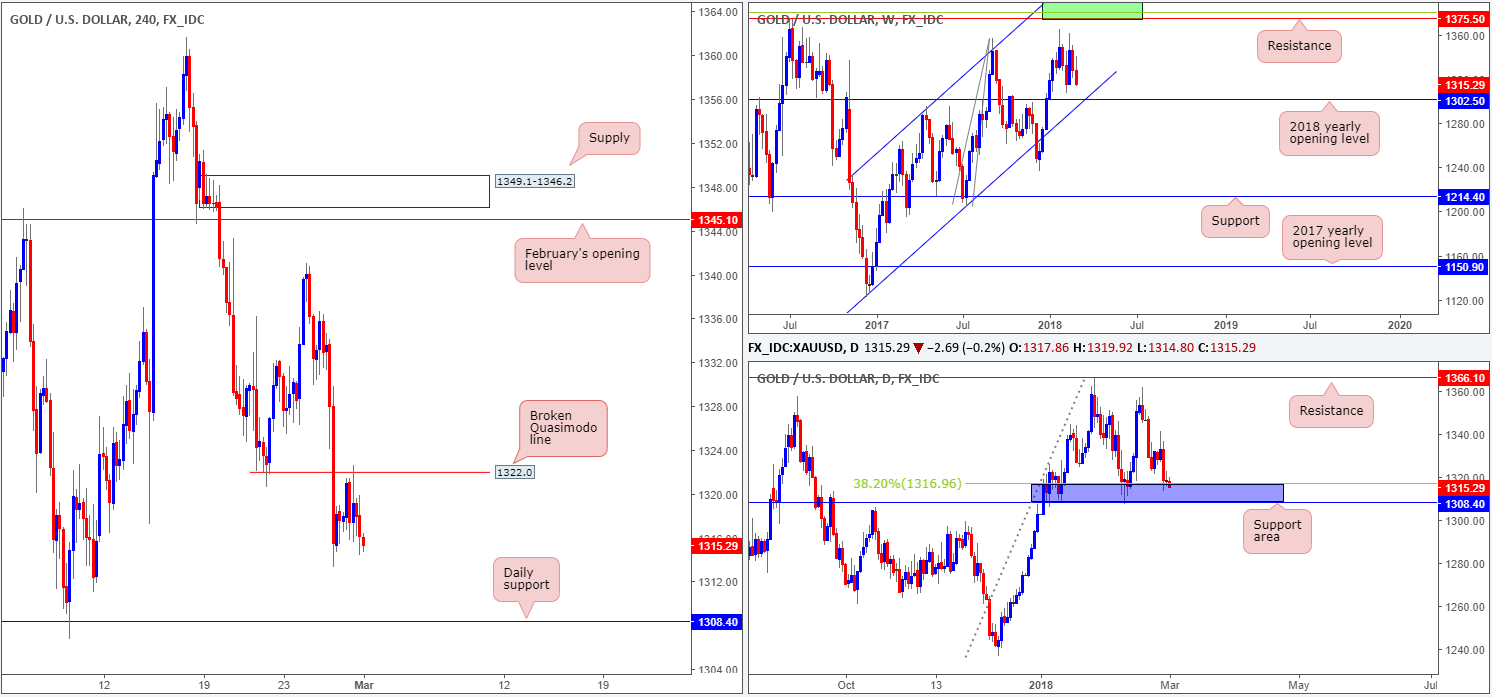

The Powell-driven dollar continued to flex its financial influence on Wednesday, allowing the price of gold to respect a H4 broken Quasimodo line at 1322.0. For those who read our reports on a regular basis you may recall that we highlighted 1322.0 as a potential line for shorts. Well done to any of our readers who managed to take advantage here.

Further selling, according to weekly structure, is possible. The next downside target on that scale falls in at 1302.5 (2018 yearly opening level), which combines with a weekly channel support extended from the low 1122.8. Meanwhile, down on the daily timeframe, the recent bout of selling has brought the candles into a daily support area marked in blue at 1308.4-1316.9 (comprised of a daily support and 38.2% Fib support level). As you can see, there remains a clear difference of opinion in terms of higher-timeframe flows at the moment.

Potential trading zones:

For those who remain short from 1322.0, stops should really be at the breakeven point by now and partial profits locked in. The next take-profit target is the daily support noted at 1308.4, followed closely by the 2018 yearly line.

Apart from the current short in play, we do not really see much else to hang our hat on at this time.

Areas worthy of attention:

Supports: 1308.4/1316.9; 1302.5; weekly channel support.

Resistances: 1332.0.

This site has been designed for informational and educational purposes only and does not constitute an offer to sell nor a solicitation of an offer to buy any products which may be referenced upon the site. The services and information provided through this site are for personal, non-commercial, educational use and display. IC Markets does not provide personal trading advice through this site and does not represent that the products or services discussed are suitable for any trader. Traders are advised not to rely on any information contained in the site in the process of making a fully informed decision.

This site may include market analysis. All ideas, opinions, and/or forecasts, expressed or implied herein, information, charts or examples contained in the lessons, are for informational and educational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.