EUR/USD:

Looking at the weekly chart, we can see that prices are approaching the support area of our ascending channel at 1.200, which coincides with the 50% Fibonacci retracement and 78.6% Fibonacci extension. We could see a further upside to test our resistance area at 1.2300, in line with the graphical swing high resistance and 78.6% Fibonacci extension. On the daily time frame, prices are holding nicely above the ascending trend line and support area at 1.200 which can also be found on the weekly time frame.

On the H4 timeframe, prices bounced nicely off our support level at 1.2000, in line with the levels found on the larger time frames. Currently, prices are trading within our resistance and support area on the H4 time frame. The 1.21088 resistance area coincides with the graphical pullback resistance area and 50% Fibonacci retracement. A break above this resistance area could see a further upside to test our next resistance target at 1.22157, in line with our graphical overlap resistance area. Failure to hold above the 1.20000 support target could see a further drop to our next support level at 1.19567, in line with the graphical swing low support.

Areas of consideration:

- 2000 support area found on H4 time frame

- 21088 resistance level found on H4 time frame

GBP/USD:

Looking at the weekly chart, we can see that prices are approaching our ascending trend line and weekly support area at 1.35000 where we could see a further downside before it reaches our support level, in line with the graphical pullback support area and 38.2% Fibonacci retracement. On the daily time frame, prices are approaching our support area at 1.37500, which coincides with the 78.6% Fibonacci retracement, 61.8% fibonacci extension and ascending trend line. Both time frames echo the same view that we could be seeing further downside before prices reach our support area.

On the H4 timeframe, prices are facing bearish pressure from our resistance area at 1.40000, in line with our graphical pullback resistance area and 38.2% fibonacci retracement. We could see a further drop below this level to test our next support level at 1.38505, which is in line with the horizontal overlap support level and 61.8% fibonacci retracement.

Areas of consideration:

- 40000 resistance area found on H4 time frame

- 38505 support area found on H4 timeframe

AUD/USD:

From the Weekly timeframe, we can see that the price has returned back to the ascending trendline support drawn from 9th March (2020), where we can see a bounce from the trendline. On the Daily timeframe, price is holding under the 38.2% fibonacci retracement, if price continues to stay under this level, we may see a short-term bearish swing towards the trendline support level of 0.76743, in line with 78.6% Fibonacci Retracement, 127% Fibonacci extension and horizontal swing low support . On H4, price has lowered under the 0.78 major level and Daily resistance level towards the 78.6% fibonacci retracement before showing a small bounce. If price continues to push upwards, we may use the -27% fibonacci retracement as target. However, if price breaks beneath 0.77565, we can use the 0.77 level in line with trendline support and 127% fibonacci retracement as the target.

Areas of consideration:

- Weekly time frame show bullish momentum since March (2020)

- Daily timeframe shows bullish momentum with room for short-term pullback.

- H4 shows price above the ascending trendline, do wait for breakout above 0.78207 to enter a long position.

USD/JPY

From the weekly timeframe, prices are taking support from the ascending trendline support, facing resistance from horizontal swing high resistance which coincides with 78.6% fibonacci retracement and 100% fibonacci extension. On the daily timeframe, prices have touched horizontal swing high resistance which coincides with 61.8% fibonacci retracement, facing bearish pressure which might push prices lower towards horizontal pullback support which coincides with 50% fibonacci retracement. On H4, prices have already touched the same daily resistance and might push towards daily support level which coincides with the H4 61.8% fibonacci retracement. Stochastics is also showing that the price is showing bearish pressure against the 94.60 level.

Areas of consideration:

- 153 resistance level on the daily and H4 time frame is a strong resistance level

- On the H4, prices might pullback to 106.054 which coincides with the level on the daily timeframe

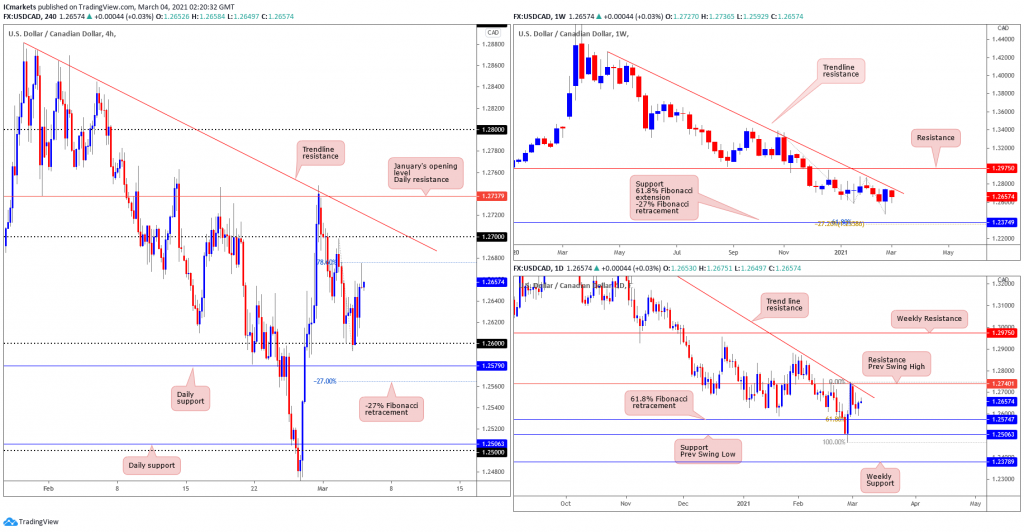

USD/CAD:

Looking at the weekly chart, price has pushed away from the descending trendline, towards its previous low. It is important to note that the long-term picture has pointed the direction down (trend) since March (2020). In the daily time frame, price has managed to reverse from the Trendline resistance, continuing its bearish momentum and may push its way down South towards the 61.8% fibonacci retracement level. And on the H4 timeframe, price has has pushed down away from the 78.6% fibonacci retracement level, we may expect price to reach the 1.2579 level which is in line with the Daily support and before the -27% fibonacci retracement.

Areas of consideration:

- H4 may push further down South to 1.2579 which is the Daily support and touching distance from the -27% fibonacci retracement.

- Weekly, Daily and H4 timeframe are all showing bearish momentum.

USD/CHF:

USD/CHF is showing room for limited upside on the weekly chart, as we see price approaching the 0.93000 weekly resistance level, in line with our -27.2% Fibonacci retracement, 161.8% Fibonacci extension and weekly descending trendline resistance. On the daily chart, we also see price making a further rise up to test the 0.93000 weekly resistance level. We could potentially see price test this important weekly resistance level to look out for.

On the H4 chart, price is now testing the 0.91800 resistance area, which is in line with our 100% and 161.8% Fibonacci extension levels. It is worth noting that the MACD is above the 0 line, showing bullish pressure in line with our analysis. A break and close above the 0.91800 resistance area could see price rising further to test the 0.93000 weekly resistance level. Otherwise, should price hold under the 0.91800 resistance area, we could see a reversal where price could push further down south to test the support levels at 0.90800 instead.

Areas of consideration:

- USD/CHF is showing room for limited upside on the weekly and daily charts

- 93000 weekly resistance level is a key level to watch.

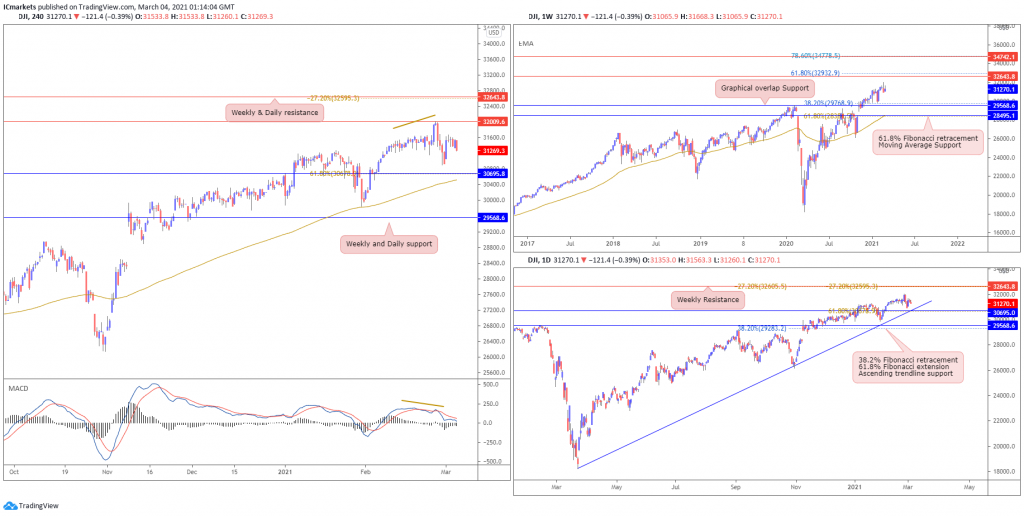

Dow Jones Industrial Average:

On the weekly chart, price continues to hold between 32643 resistance and 29568 support. Despite price holding above the long term moving average, there remains no strong levels for entry for now. On the Daily, price continues to hold very strongly above ascending trendline support. With price coming back to test the ascending support at 30662, it is possible that traders could see a bounce above this support and should be careful when deciding to trade any short term pullbacks as the bullish momentum still remains strong.

On the H4, price also still holding between 32009 resistance and weekly support at 30695. Despite technical indicators calling for further bullish upside, there remains no clear levels for entry on the intraday and there is also a bearish divergence that has been confirmed on the MACD. Traders should continue to watch resistance at 32009 and support at 30695 closely on the sidelines for any signs of market reaction.

Areas of consideration:

- MACD indicator confirms a bearish divergence

XAU/USD (GOLD):

On the weekly timeframe, gold pushed lower breaking previous supports. Price has also broken below long term moving average. Price could very well ride the bearish momentum and drift lower towards 1670 support which is in line with key 61.8% Fibonacci retracement level. On the daily chart, we see pricetrading sideways and is currently holding between 1774 resistance and 1670 support.

On the 4H timeframe price drifted lower and is forming an impending double bottom batten above support at 1707. With stochastics on support where price bounced in the past, a short term intraday bounce towards 1740 resistance could be likely before seeing any chance of a drop. However, should price fail to hold above 1707 support, traders can also expect price to drop towards next weekly support at 1670 level.

Areas of consideration:

- 1707 intraday support to hold short term intraday bounce

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.