Monday 9th May: Weekly technical outlook and review.

A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

For us, lower timeframe confirmation starts on the M15 and finishes up on the H1, since most of our higher timeframe areas begin with the H4. Stops usually placed 5-10 pips beyond your confirming structures.

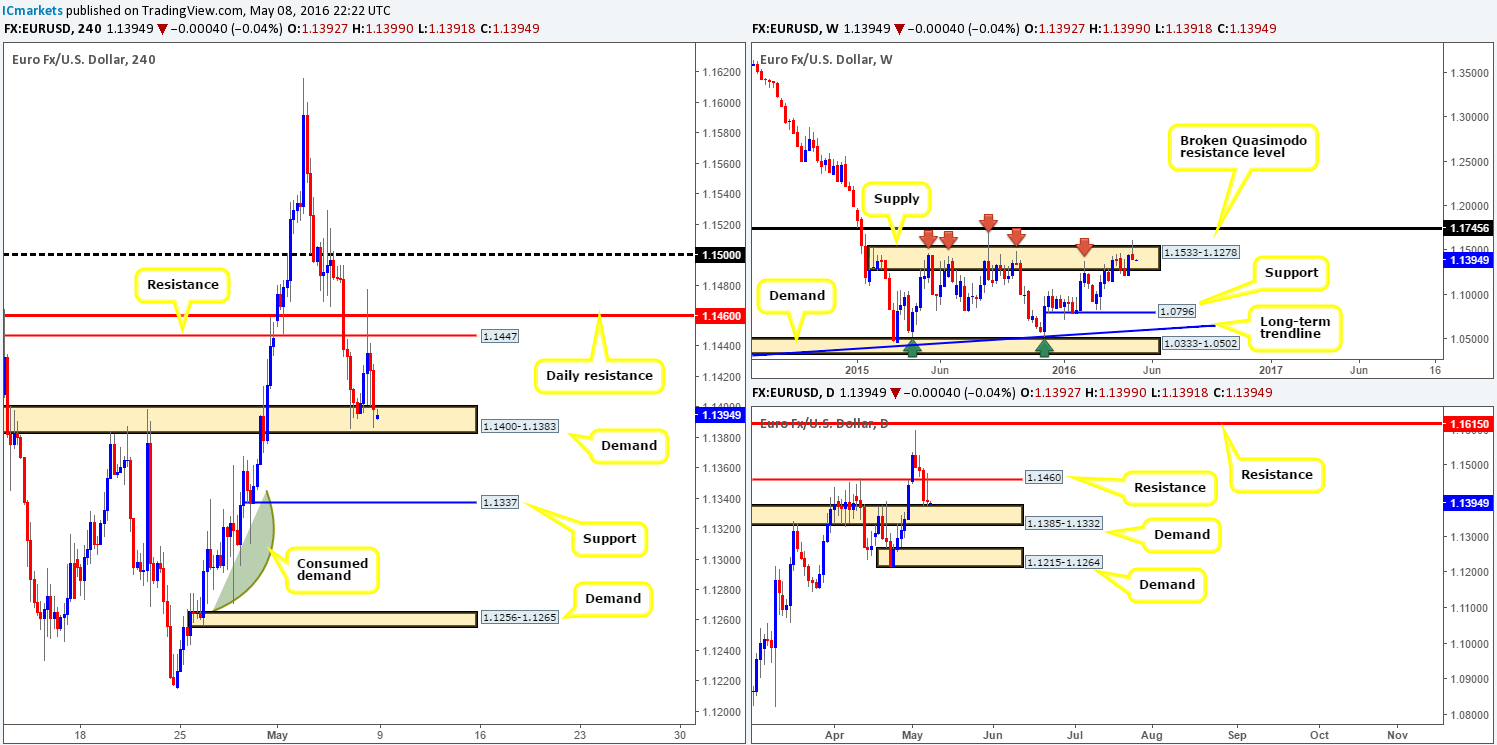

EUR/USD:

Weekly Gain/Loss: – 47 pips

Weekly closing price: 1.1398

Weekly opening price: 1.1392

Weekly view: From the top, we can see that the most recently closed weekly candle formed a beautiful-looking bearish selling wick within the confines of a major area of supply coming in at 1.1533-1.1278. Seeing as how this zone has managed to hold the single currency lower since May 2015, we feel lower prices could be seen in the days ahead. The next logical target from here falls in at support drawn from 1.0796.

Daily view: Before we begin looking to short this market, however, traders need to keep in mind that demand is currently being seen on the daily timeframe at 1.1385-1.1332. The response from this zone on Friday was, as you can see, restrained by overhead resistance logged in at 1.1460, forcing price to chalk up a bearish selling wick going into the week’s end. Granted, some traders may take this as a buy signal – an inverted pin bar, yet taking into account both the daily resistance as well as weekly supply mentioned above, this may not be the safest of candle patterns to trade! As far as we can see, the next area of value beyond the current demand is visible around demand carved from 1.1215-1.1264.

H4 view: Analyzing Friday’s sessions over on the H4 chart shows that the bid-side of this market struck highs of 1.1477 on dollar weakness following a lower-than-expected payrolls number. The EUR quickly lost ground, nonetheless, and headed back into demand seen at 1.1400-1.1383. Well done to any of our readers who managed to take advantage of the bounce seen from this demand, as it was a noted move to watch out for in Friday’s report.

Consequent to a relatively stable open this morning, price remains within the confines of the above said demand. Despite this area and its supporting daily demand zone discussed above at 1.1385-1.1332, we feel weekly sellers may take over this market this week! Therefore, instead of looking to buy from current prices, we’re watching for a close below the current H4 demand. Assuming that this comes to fruition, we’d need to see the unit retest the underside of the recently broken demand as supply together with lower timeframe confirmation to consider shorting here (for confirmation techniques, please see the top of this report). The next downside target as per the H4 chart can be seen at 1.1337 –a small line of demand. This would be our first take-profit target. Beyond this barrier, however, we’re eyeing the small H4 demand chalked up at 1.1256-1.1265, which conveniently sits within daily demand mentioned above at 1.1215-1.1264. The highlighted area (green arc) in between resembles what we believe to be demand consumption, hence our confidence that should price take out 1.1337, the EUR is likely headed lower!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to close below 1.1400-1.1383 and look to trade any retest seen thereafter (lower timeframe confirmation required).

GBP/USD:

Weekly Gain/Loss: – 184 pips

Weekly closing price: 1.4423

Weekly opening price: 1.4412

Weekly view: The sell-side of this market was certainly on top form last week, as prices fell sharply from a broken Quasimodo resistance line fixed at 1.4633. In addition to this, Cable formed a nice-looking bearish engulfing candle suggesting that this market may continue to drive lower. The next downside target in view, as per this timeframe, falls in around a broken Quasimodo support level coming in at 1.4051.

Daily view: Branching lower to the daily chart, this pair is currently seen trading within touching distance of demand penciled in at 1.4297-1.4393 which could potentially halt further selling! The demand itself also looks to be in relatively good condition as well – note the gap north from its base indicating buying strength! The only downside to trading long from here, other than the fact that the weekly is coming off of resistance (see above), is the overhead resistance seen at 1.4470.

H4 view: A quick recap of Friday’s trade shows price spiked to highs of 1.4524 on the back of weak U.S. employment figures, but quickly ran out of gas and pushed lower. As a result, demand at 1.4462-1.4501 (now acting supply) was taken out. With little change seen at this morning’s open, Sterling is presently loitering mid-range between the recently engulfed demand zone at 1.4462-1.4501 and the 1.4400 handle.

This is a trickier pair to trade than the EUR in our opinion. On the one hand, longs could be possible from 1.4400 today given the clear trendline convergence from lows of 1.4005 and 78.6% Fibonacci support at 1.4399, as well as strong-looking demand coming in from the daily timeframe at 1.4297-1.4393. On the other hand, however, as we already know, weekly action is sporting a large bearish engulfing candle from resistance (see above). Seeing as how we do not want to miss out any move from the confluent 1.4400 region, our team has come to a general consensus that should price chalk up a lower timeframe bull setup from here, we would trade long, targeting supply at 1.4462-1.4501 as our first port of call (for confirmation techniques, please see the top of this report), which encapsulates the daily resistance at 1.4470.

Levels to watch/live orders:

- Buys: 1.4400 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

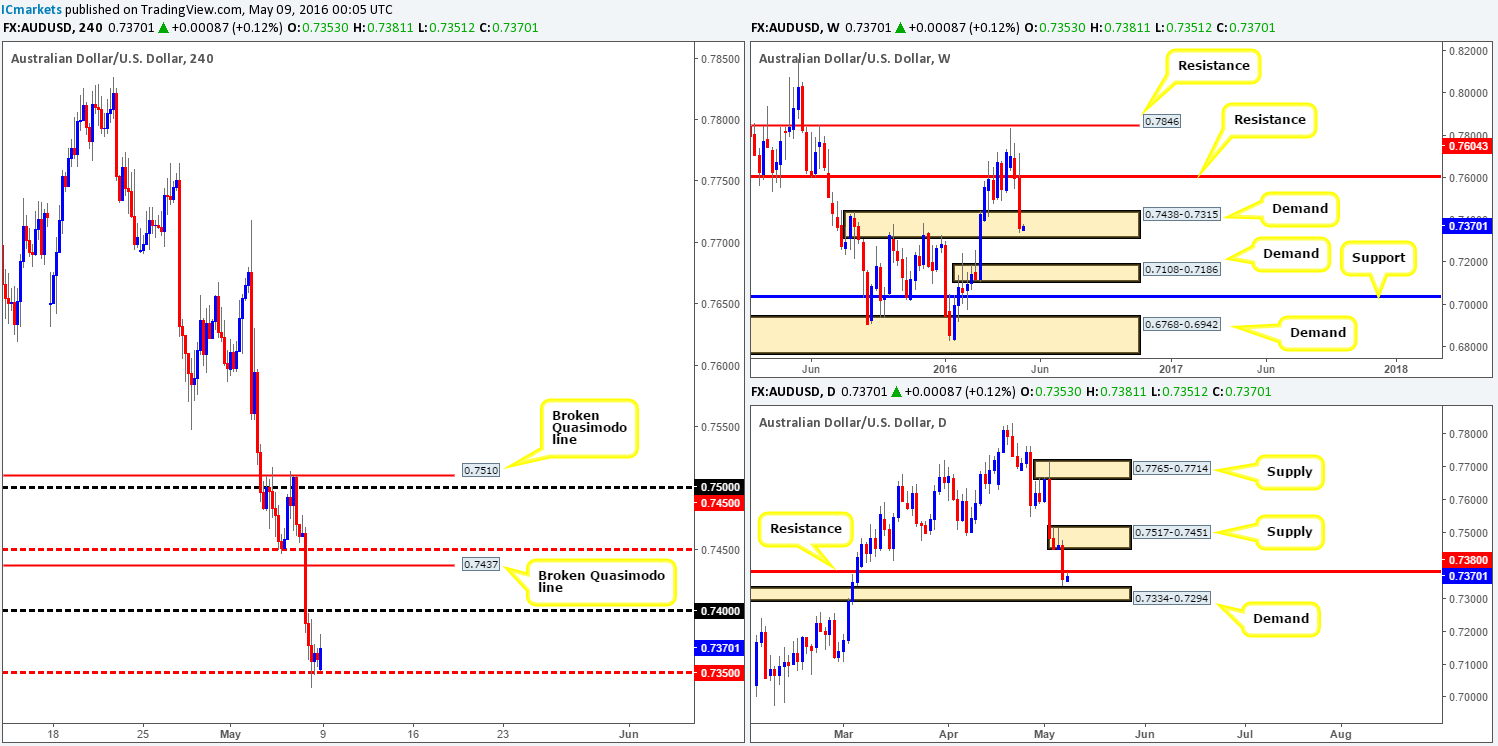

AUD/USD: (Trade update: Stopped out for a loss at 0.7410 – see Friday’s report for details)

Weekly Gain/Loss: – 236 pips

Weekly closing price: 0.7361

Weekly opening price: 0.7353

Weekly view: The Aussie dollar suffered a nasty decline in value last week from resistance drawn in at 0.7604, bringing the commodity currency down into the jaws of demand seen at 0.7438-0.7315. In the event that this zone is taken out this week, the next area of interest can be seen at 0.7108-0.7186 – a small, but very sturdy-looking demand base.

Daily view: From this angle, thanks to Friday’s sell-off, price came within a few pips of connecting with demand carved from 0.7334-0.7294. Buying from this area, at least in our estimation, would be difficult due to a major overhead resistance lurking just above at 0.7380. Now, if price were to close above this line WITHOUT hitting the next supply zone seen at 0.7517-0.7451, longs could be a possibility!

H4 view: After a heavy round of selling on Friday, the H4 closed and opened the week around mid-way support 0.7350. On account of this line being bolstered by daily demand mentioned above at 0.7334-0.7294, as well as weekly demand coming in at 0.7438-0.7315, most would likely agree, at least from a supply/demand perspective, a rally is more likely to be seen. However, as already discussed, there is a line of daily resistance at 0.7380 obstructing price at the moment. Therefore, the most logical path we see right now is to wait for a break/(confirmed) retest trade above 0.7400 (for confirmation techniques, please see the top of this report), targeting the broken Quasimodo line at 0.7437, followed closely by mid-way resistance at 0.7450 (underside of daily supply drawn from 0.7517-0.7451). We know this does not give a lot of room to play with today/this week, but according to the structure as we see it; this is the best this market is offering at the moment.

Levels to watch/live orders:

- Buys: Watch for price to close above 0.7400 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

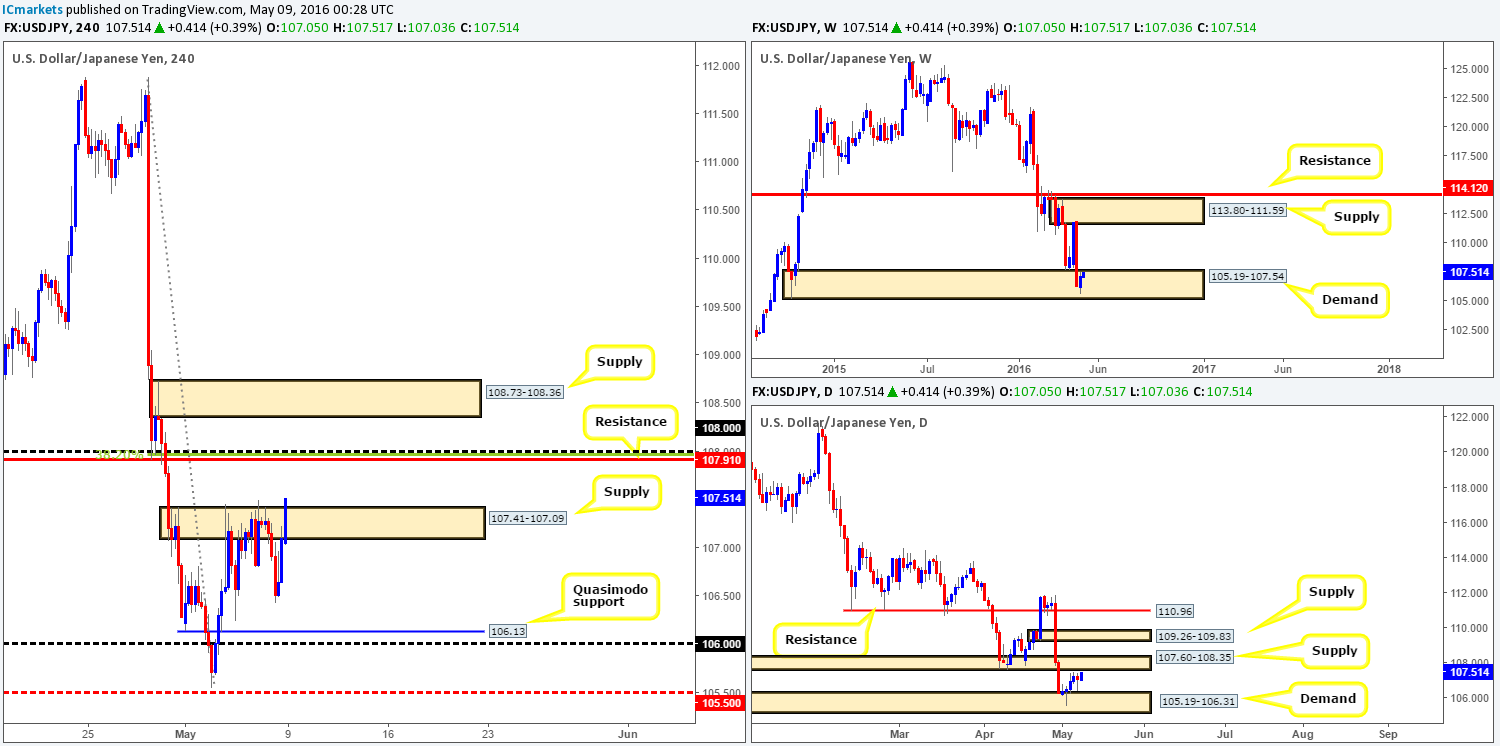

USD/JPY:

Weekly Gain/Loss: + 82 pips

Weekly closing price: 107.10

Weekly opening price: 107.05

Weekly view: Following the steep decline this market witnessed two weeks back, a modest recovery was seen last week from within the confines of demand painted at 105.19-107.54. Supposing that the bulls continue to defend this zone, there is a possibility that this pair may rally back up to retest supply found at 113.80-111.59. Despite this, we must also take into consideration that the USD/JPY has been trending south since it peaked back in June 2015 at 125.85.

Daily view: From the daily scale, however, we can see that candle activity is lurking just below supply taken from 107.60-108.35, which could cause trouble for any buyers long from the aforementioned weekly demand base. Should the sellers fail to muster enough strength to take on weekly buyers here, it’s possible further upside could be seen towards supply at 109.26-109.83.

H4 view: Looking at Friday’s action over on the H4 chart, price continued to be offered from supply drawn in at 107.41-107.09. We feel, however, that the offers are in the process of drying up, potentially opening the flood gates for price to challenge resistance coming in at 107.91. In view of this line fusing with both the psychological resistance 108.00 and a 38.2% Fibonacci resistance at 107.97, as well as being housed within the aforementioned daily supply, a bounce south could be seen from here today. Of course, we would recommend waiting for the lower timeframes to confirm bearish strength resides here, since a fakeout above to supply at 108.73-108.36 could take place, and let’s not forget that by selling here we are potentially going against weekly flow (see above). Now, as for buying this market, we are not going to be looking for longs until price clears supply at 108.73-108.36 as this would, as you can probably see, also clear daily supply at 107.60-108.35 as well.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 107.91 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

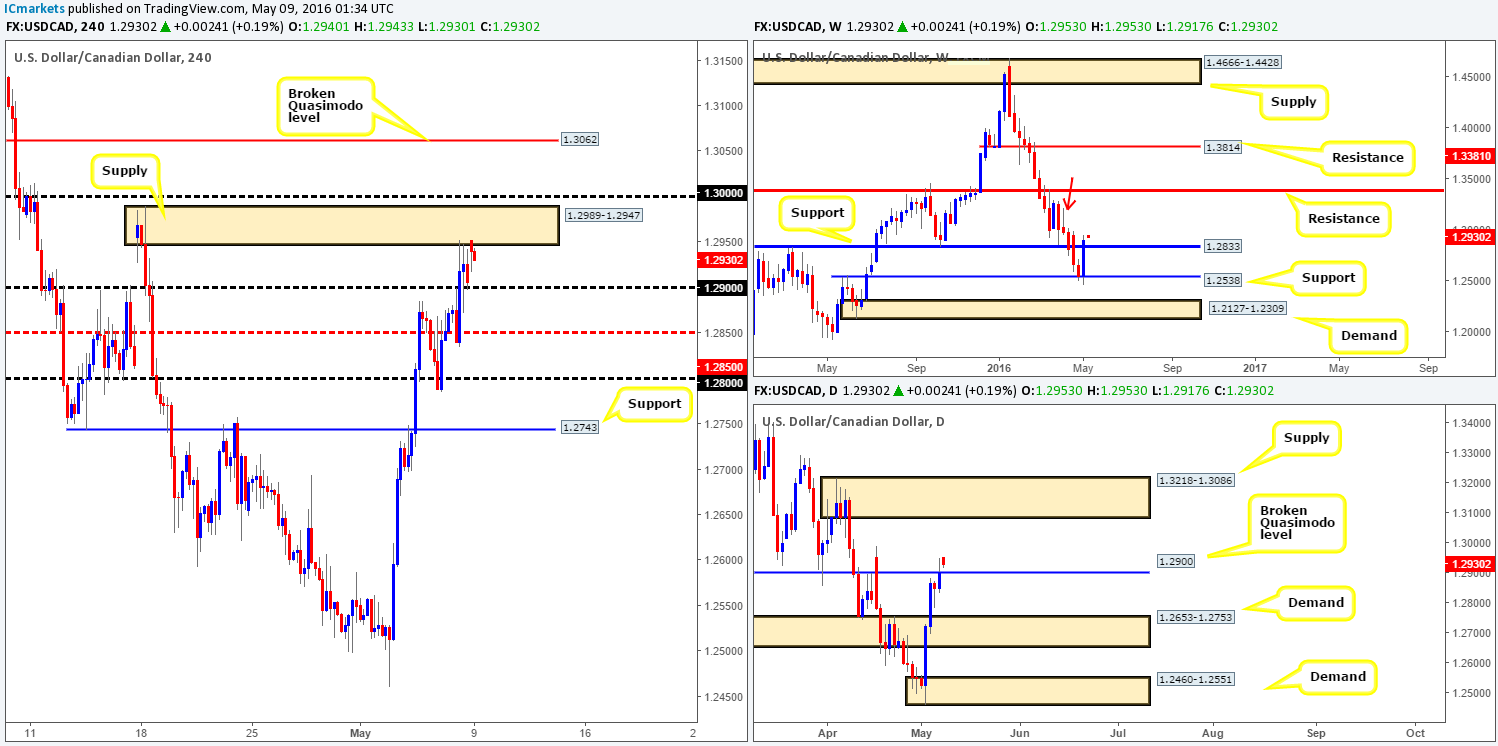

USD/CAD:

Weekly Gain/Loss: + 356 pips

Weekly closing price: 1.2906

Weekly opening price: 1.2950

Weekly view: Last week’s action saw the USD/CAD correct sharply higher from support penciled in at 1.2538, pushing price above resistance seen at 1.2833 (now acting support) by the close. If the bull-side of this market continues to dominate, further upside could be seen towards resistance coming in at 1.3381. There is some supply seen in between these two areas, but not really something that could hamper further buying in our opinion. The reason being simply comes down to the supply consumption wick seen marked with a red arrow at 1.3218.

Daily view: From this angle, we can see that price closed the week a few pips above the broken Quasimodo level at 1.2900. However, after this morning’s relatively large gap north of around forty or so pips this line will likely act as support going forward. With that being the case, the Loonie could advance north up to a sturdy-looking supply zone coming in at 1.3218-1.3086 in the days ahead.

H4 view: The H4 on the other hand is, at the time of writing, seen kissing the underside of supply at 1.2989-1.2947. Sellers defended this level beautifully during the NFP shenanigans on Friday, forcing the U.S. dollar back down to the 1.2900 handle. In light of what we’re currently seeing on the higher-timeframe picture (see above) we do not hold much faith in this supply right now. A more likely scenario that we feel could take place is a whipsaw through this supply to connect with the large psychological resistance 1.3000. Again though, due to what the higher timeframes are suggesting, the bounce from here could be limited!

On account of the above points here is our plan going into the week’s sessions:

- Watch for a reaction at 1.3000. Should the lower timeframes chalk up a suitable setup to short from here, we would likely sell on a scalp and see basis. What we mean this is simply watch how price action behaves once we’re live – for example, if a lower timeframe demand zone holds price repeatedly, we know this is a sign to close up shop…

- Should the H4 close above 1.3000 today/this week, it’s likely the Loonie is then heading up to 1.3062 – a broken Quasimodo line. Therefore, if price retests 1.3000 together with some form of lower timeframe buy signal, a long from number is high probability in our opinion.

In regards to confirmation, this could be in the form of an engulf of supply/demand and subsequent retest, a break/retest of a trendline or simply a collection of buying/selling tails/wicks around a lower-timeframe support/resistance.

Levels to watch/live orders:

- Buys: Watch for price to close above 1.3000 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: 1.3000 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

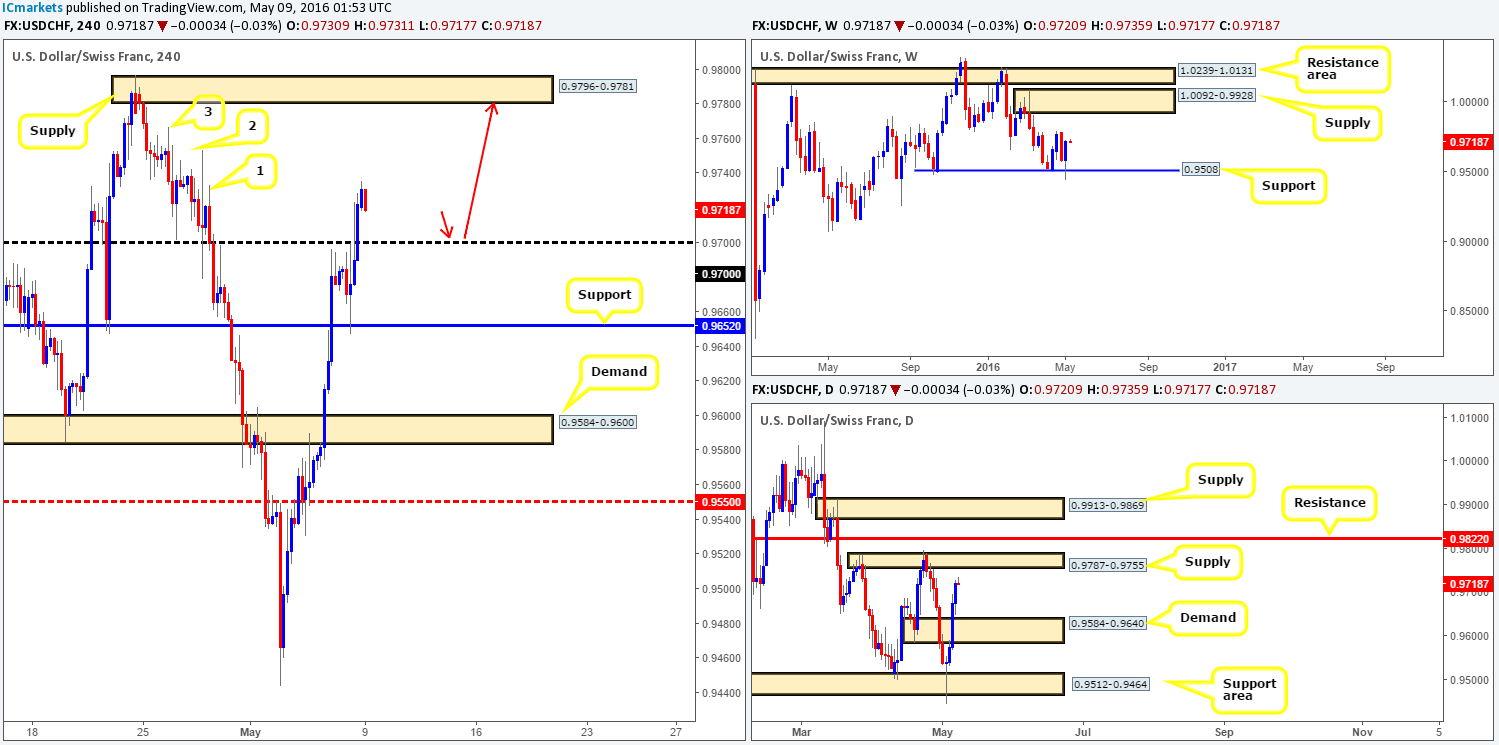

USD/CHF:

Weekly Gain/Loss: + 138 pips

Weekly closing price: 0.9722

Weekly opening price: 0.9720

Weekly view: A stronger than expected rebound was seen from support penciled in at 0.9508 last week, extending price to highs of 0.9728 by the week’s end. Subject to bids remaining strong here, we see little overhead resistance until supply formed at 1.0092-0.9928. Let’s take a look lower down the scale to see if the lower timeframes agree with such direction…

Daily view: Breaking into the daily timeframe, last week’s rally has placed the Swissy within shooting distance of a supply zone carved from 0.9787-0.9755. As such, the upside potential seen on the weekly chart may begin to suffer once price connects with this zone! It will be interesting to see what the H4 makes of the higher-timeframe structures…

H4 view: From this viewpoint, things look a lot clearer. During the last few hours of trade on Friday, offers were removed from the 0.9700 handle and price edged higher. As we mentioned in Friday’s report, we felt 0.9700 was on the brink of breaking down for the following reasons:

- The higher-timeframe picture has ‘buy me’ written all over it (see above).

- There’s little active supply seen above 0.9700 (supply consumption wicks [1-3] 0.9766/0.9753/0.9733) until H4 supply coming in at 0.9796-0.9781 (positioned within the extremes of the daily supply mentioned above at 0.9787-0.9755).

Be that as it may, should we witness a retest of 0.9700 today followed by some sort of lower timeframe buy signal, we’d look to long this market targeting the aforementioned H4 supply. In regards to confirmation, this could be in the form of an engulf of supply and subsequent retest as demand, a break/retest of a trendline or simply a collection of buying tails around a lower-timeframe support.

Levels to watch/live orders:

- Buys: 0.9700 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

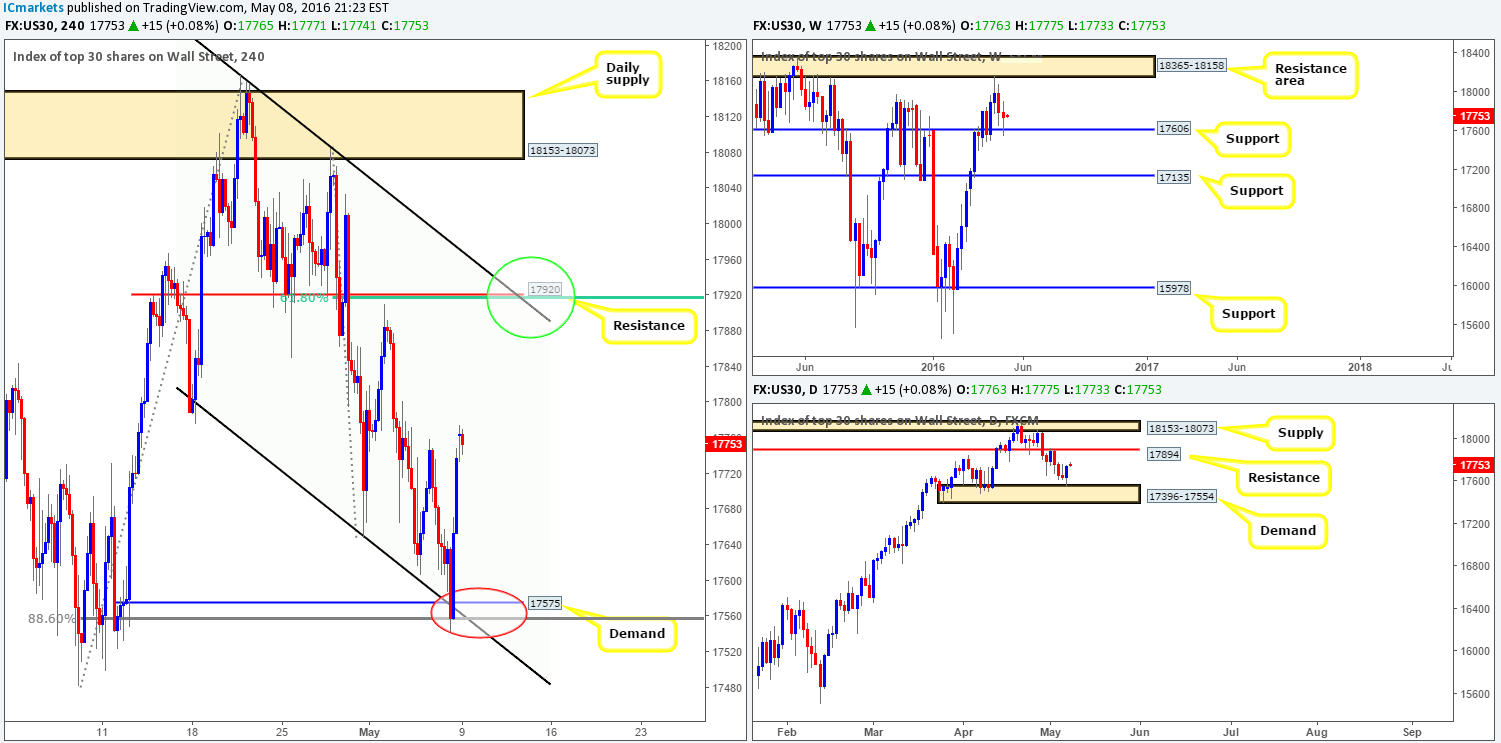

DOW 30:

Weekly Gain/Loss: – 53 points

Weekly closing price: 17738

Weekly opening price: 17763

Weekly view: The previous week’s trading saw the DOW range around 360 points (high/low), but only managed to close 53 points lower into the weekend. As can be seen from the chart, active bids defended support at 17606 forcing price to form a relatively clear indecision candle. Now, from this line, assuming that bids remain stable of course, we could see U.S. stocks rally higher this week back up to the resistance area drawn from 18365-18158.

Daily view: In-line with weekly structure, daily price shows that demand seen at 17396-17554 gave weight to the above said weekly support, which was hit to-the-point on Friday! On top of this, there’s also room seen to move north up to resistance coming in at 17894.

H4 view: For those who read Friday’s report (see link below), you may recall that our team placed a pending buy order at 17576 with a stop set below at 17518. The rationale behind this trade idea, other than the bullish higher- timeframe structure, was demand at 17575 bolstered by a channel support extended from the 17790 region, together with a deep 88.6% Fibonacci support band at 17557 (red circle). We cashed in 70% of our position just before the week’s close and moved the stop to breakeven. Well done to any of our readers who managed to board this rocket before it took off!

Concerning the remaining 30% of our position, we intend on holding to see if price reaches the daily resistance level we discussed above at 17894. By that time, price will be trading within shouting distance of resistance seen at 17920 (green circle) which also boasts strong confluence, so a short may be something to consider here!

Levels to watch/live orders:

- Buys: 17576 [LIVE] (Stop loss: Breakeven).

- Sells: Flat (Stop loss: N/A).

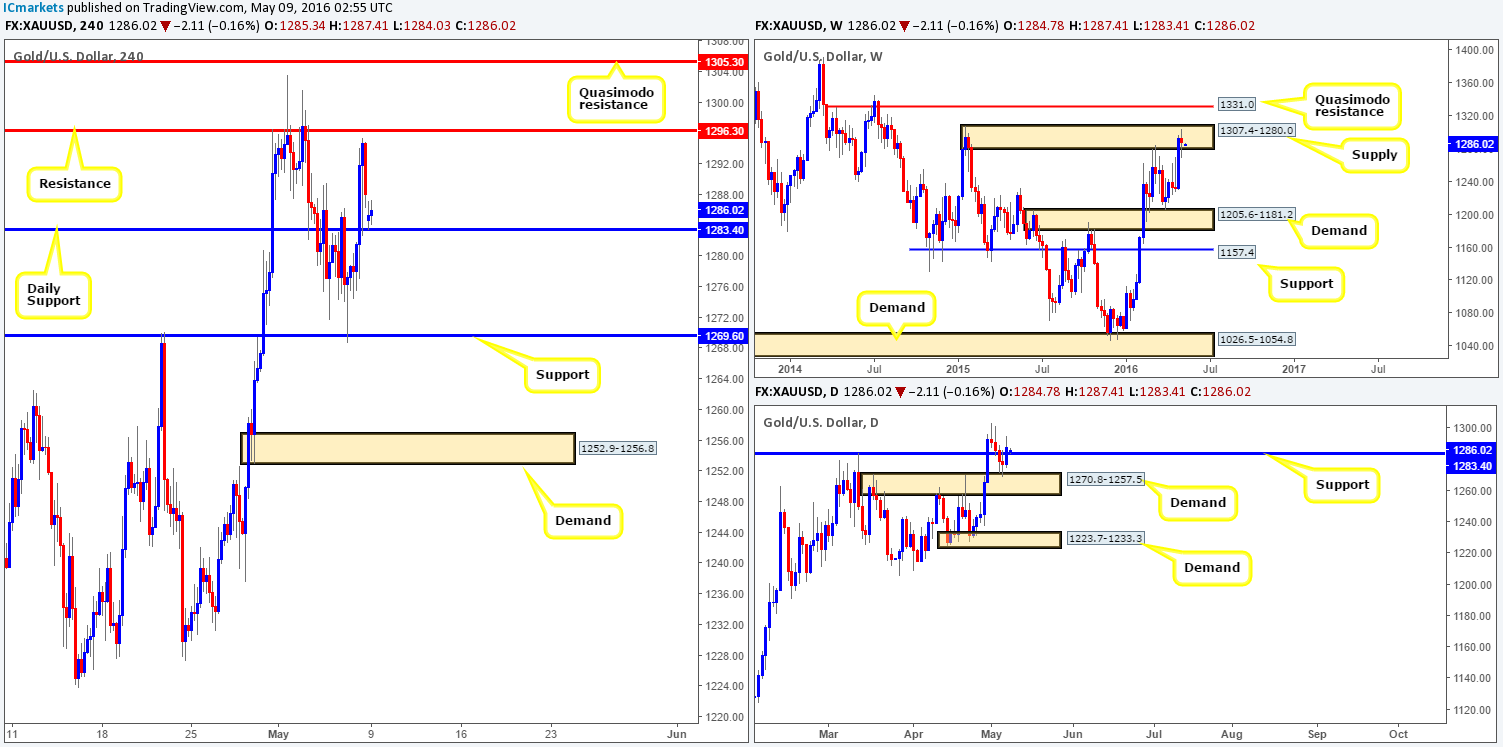

GOLD:

Weekly Gain/Loss: – $5.20

Weekly closing price: 1288.1

Weekly opening price: 1284.7

Weekly view: Despite Gold residing within supply last week at 1307.4-1280.0, there was only around a $5 change in value seen. Given that the U.S. dollar index also shows steady support around the 92.621 region, we’re surprised that price formed an indecision candle! In the event that the yellow metal is further bid this week, keep an eyeball on the Quasimodo resistance line seen at 1331.0.

Daily view: Turning our attention to the daily timeframe, demand at 1270.8-1257.5 was clearly well-bid from Wednesday onwards last week. In spite of being positioned within weekly supply right now, daily bids were able to close price above resistance at 1283.4 (now acting support) on Friday. Could this be a sign that offers are weakening within the weekly supply?

H4 view: The weaker than expected payrolls number, as you can see from the chart, pushed the precious metal higher on Friday coming so very close to colliding with resistance at 1296.3. In view of today’s opening gap, price is now seen trading from the above said daily support line. This level is KEY today! A break below could indicate that weekly sellers are gaining control, whereas a rejection of this barrier may suggest daily/H4 buyers have the upper hand.

Now, although a reasonable rejection from the daily support could imply buying this market may be the way to go today, we are going to pass on longs UNTIL the weekly supply is taken out! If, on the other hand, a close below the current daily support is seen, the river south should be ripple free down to the H4 support at 1269.6 (essentially the top-side of daily demand at 1270.8-1257.5. For us to be given the green light to short following a close lower, nonetheless, we’d need to see Gold retest this line as resistance together with a lower timeframe sell signal (for confirmation techniques, please see the top of this report).

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to close below 1283.4 and look to trade any retest seen thereafter (lower timeframe confirmation required).