EUR/USD

EUR/USD had a clear break above 1.1640 resistance, but lost momentum ahead of 1.17. Further, there is negative Stochastic divergence on the hourlies.

While the technical outlook for the Euro remains positive, a pullback seems more likely before the rally continues. Initial support is seen at 1.1635/40, followed by stronger support at 1.1585 and the rising trendline from the late June high.

GBP/USD

GBP/USD is currently consolidating within a triangle. Resistance at 1.3020 has proven to be strong, while support ahead of 1.2930 is solid as well.

In the short-term, further range trading seems likely, but with a mild positive bias. Watch for an immediate break out of the triangle pattern.

USD/JPY

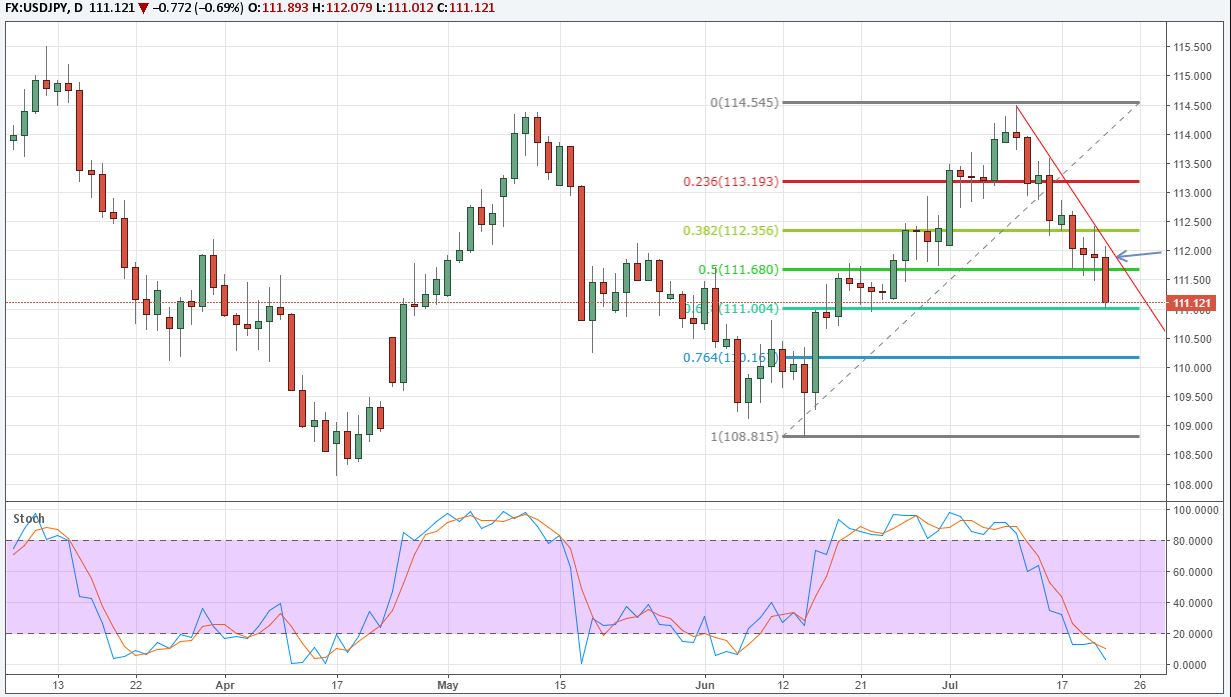

USD/JPY is under renewed pressure and further losses seem likely. The Fibonacci levels of the June/July rally have been respected recently. USD/JPY had a solid bounce off of 111, but the recovery has been rather weak.

Resistance is now seen at the former support level at 111.70. To the downside, a break sub-111 would signal another move towards 110 support.

AUD/USD

AUD/USD is struggling with resistance at 0.80, and it will not be easy to overcome that hurdle. However, the Aussie Dollar is likely to remain bid on any larger dip and traders can expect good support around 0.7840.

To the topside, 0.80 is the next big resistance level, followed by 0.82.

NZD/USD

The charts are suggesting that the New Zealand Dollar is heavily overbought in the short-term.

There is negative Stochastic divergence on the Weekly, with NZD/USD also in overbought territory there. In the near-term, expect a retracement towards 0.7350 before a proper continuation of the uptrend happens.

USD/CAD

USD/CAD is approaching 1.25 support, although the next big level now lies at 1.2460. A break beneath that level would likely accelerate negative momentum and push the pair towards 1.22.

However, USD/CAD is indeed quite oversold in the short-term, and we might see a bounce back towards 1.26 before further losses occur.

WTI

WTI was clearly rejected off $47.30 resistance and is moving towards $45.

A break sub-45 support would confirm the false breakout and pave the way for a retracement towards $42.

XAU/USD

Gold has almost closed the trading day above $1255 on Friday. The precious metal is still very well bid, and a daily close above $1255 signals that the rally could extend to $1280 in the near-term.

To the downside, solid support is now noted at $1243 and $1238.