Key risk events today:

China Trade Balance; MPC Member Cunliffe Speaks; Japanese banks closed in observance of Health-Sports Day; US banks closed in observance of Columbus Day; Canadian banks closed in observance of Thanksgiving Day.

EUR/USD:

Weekly gain/loss: +0.54%

Weekly close: 1.1035

Weekly perspective:

EUR/USD bulls remained on the offensive last week, extending the prior week’s recovery ahead of the 2016 yearly opening level at 1.0873, a reasonably notable support/resistance. Aiding the move was the US dollar index, or DXY, extending losses from prominent weekly resistance at 99.62 – boasts history as far back as mid-2015.

To the upside, the next area of resistance on the EUR/USD falls within 1.1119-1.1295. Concerning trend direction, however, the primary downtrend has been in motion since topping in early 2018 at 1.2555. Therefore, the recent recovery could merely be a correction within the overall trend.

Daily perspective:

Channel resistance (extended from the high 1.1412), active since the later part of June, was overthrown Friday, consequently clearing the pathway for a test of nearby resistance in the shape of the 50-day SMA (blue – 1.1048).

Beyond the said SMA, crosshairs are likely fixed on a well-placed resistance level coming in at 1.1110. Having seen this level serve well as support in April through to May, and denote resistance in September, active sellers likely have this barrier on their radars this week.

H4 perspective:

Upbeat risk sentiment and Brexit optimism underpinned the shared currency Friday, adding more than 30 points and recording its third consecutive daily gain.

Leaving the key figure 1.10 unopposed, the H4 candles spun towards the 1.1050 point before mildly pairing gains into the close. Note 1.1050 also brings with it an ABCD correction (light black arrows). Overhead, resistance resides at August’s opening level at 1.1079, which aligns with a 161.8% Fibonacci extension at 1.1076 and an 88.6% Fibonacci retracement ratio at 1.1085 – derived by taking The Golden Ratio, 0.618, square rooting it and square rooting it again to get 0.886. This is also closely shadowed by the 1.11 handle (yellow).

Also, with respect to H4 structure, price broke out north from its bullish flag pattern (1.0957/1.1000) Thursday, which has a measured take-profit target set at 1.11: based on the bullish flag’s preceding move added to the breakout point (heavier black arrows).

Areas of consideration:

Weekly movement advocates additional upside this week, eyeing a resistance area at 1.1119-1.1295. In conjunction with this, daily movement recently engulfed channel resistance, though until the 50-day SMA is cleared which is currently in motion, further buying is problematic. Resistance at 1.1110 is eyed beyond here.

H4 action appears to be responding to a recent ABCD completion off 1.1050ish, with the next downside port located at the 1.10 figure. Beyond here, the 1.11/1.1076 region (yellow) represents the next port of resistance. With daily resistance plotted just ten points north of this area at 1.1110, 1.11/1.1076 could offer a platform for shorts this week. Though do remain aware, price could potentially push as far north as 1.1119, the underside of a weekly resistance area, before turning lower. Therefore, considering the overall trend remains facing a southerly bearing, the 1.1119-1.1076 region offers robust resistance to consider this week.

GBP/USD:

Weekly gain/loss: +2.54%

Weekly close: 1.2644

Weekly perspective:

Sterling enjoyed a stellar end to the week, notching gains in excess of 300 points. Technically, focus has now shifted to the 2019 yearly opening level at 1.2739. Having witnessed this long-term level serve well as both support and resistance since the later part of 2016, the odds favour a reaction materialising from here this week in the event of a test. A violation of this barrier, however, potentially sets the long-term stage for a push to supply at 1.3472-1.3204.

Daily perspective:

The steep ascent over the past couple of days, shaped by near-full-bodied bullish candles, strongly dethroned resistance at 1.2374 (now acting support) and the 1.2582 September 20 high (which could also serve as support going forward). Friday observed a test of the 200-day SMA (orange – 1.2711), which, as evident from the chart, held into the close. Directly above here, Quasimodo resistance is located at 1.2763 as well as resistance pencilled in at 1.2839 and a potential AB=CD correction at 1.2842 (black arrows).

H4 perspective:

Cable extended its rally Friday following UK Brexit minister Barclay telling ambassadors from the 27 EU member states enough progress had been made with his EU counterpart Michel Barnier for discussions to intensify. The meeting between Barnier and Barclay was framed as ‘constructive’.

Clocking its largest weekly percentage gain vs. the buck in more than 2 years, the GBP/USD reached highs at 1.2706, before mildly trimming gains off the 1.27 handle. North of this psychological threshold, Quasimodo resistance is seen at 1.2725, the weekly resistance is also visible at 1.2739 and the daily Quasimodo resistance at 1.2763 (grey).

Areas of consideration:

Seeing the 200-day SMA recently enter the mix on the daily timeframe and Friday’s reaction to 1.27, this was likely more profit taking than fresh sellers. However, the response will likely garner attention and draw in some sellers today, with protective stop-loss orders above Friday’s high. Knowing this, the grey zone discussed above at 1.2763/1.2725 offers an ideal fakeout zone to run stops above 1.2706. Grey is a possible sell zone, though waiting for H4 price to close back beneath 1.27 after responding from 1.2763/1.2725 is worth considering, given recent momentum.

AUD/USD:

Weekly gain/loss: +0.33%

Weekly close: 0.6790

Weekly perspective:

Latest on the weekly timeframe has price action strengthening its grip of channel support (taken from the low 0.7003), consequently clocking its second successive gain.

As is clear on this scale, however, the primary downtrend has been in motion since early 2018. Buying may lead to a move towards resistance at 0.6828, which is expected to hold. A break of the multi-year low at 0.6670 unbolts the door for a run to 0.6359 (not visible on the screen).

Daily perspective:

Support at 0.6677 remains a dominant structure on the daily timeframe, holding price north in August and more recently at the beginning of October. Last week’s advance struck a monthly peak at 0.6810, marginally toppling the 50-day SMA (blue – 0.6777) and exposing possible resistance around 0.6833.

H4 perspective:

Growing hopes of a trade deal between the two largest economies, the US and China, spurred sentiment Friday. This – coupled with a waning dollar index – saw the AUD/USD pair extend Thursday’s recovery and strike highs at 0.6810. US President Trump announced the US and China have come to a ‘substantial’ phase one trade deal, which might take up to five weeks to be signed.

Technical studies, on the other hand, reveals price action recently shook hands with a resistance area coming in at 0.6818-0.6794. Not only does this area boast reasonable history, within it contains a 61.8% Fibonacci ratio at 0.6809, the round number 0.68 and a 127.2% AB=CD (black arrows) correction at 0.6801. Indicator-based traders may also wish to acknowledge the relative strength index (RSI) is currently testing overbought territory (yellow).

Areas of consideration:

In view of the H4 timeframe’s closing candle out of the aforementioned resistance area (green arrow), a short could be an option. With a protective stop-loss order plotted above the resistance zone, the first take-profit target can be set around the 38.2% Fibonacci ratio at 0.6756, measured from legs A-D (a common take-profit target).

Failure to hold 0.6818-0.6794 could lead to a move towards 0.6833/0.6828: the daily and weekly resistance levels.

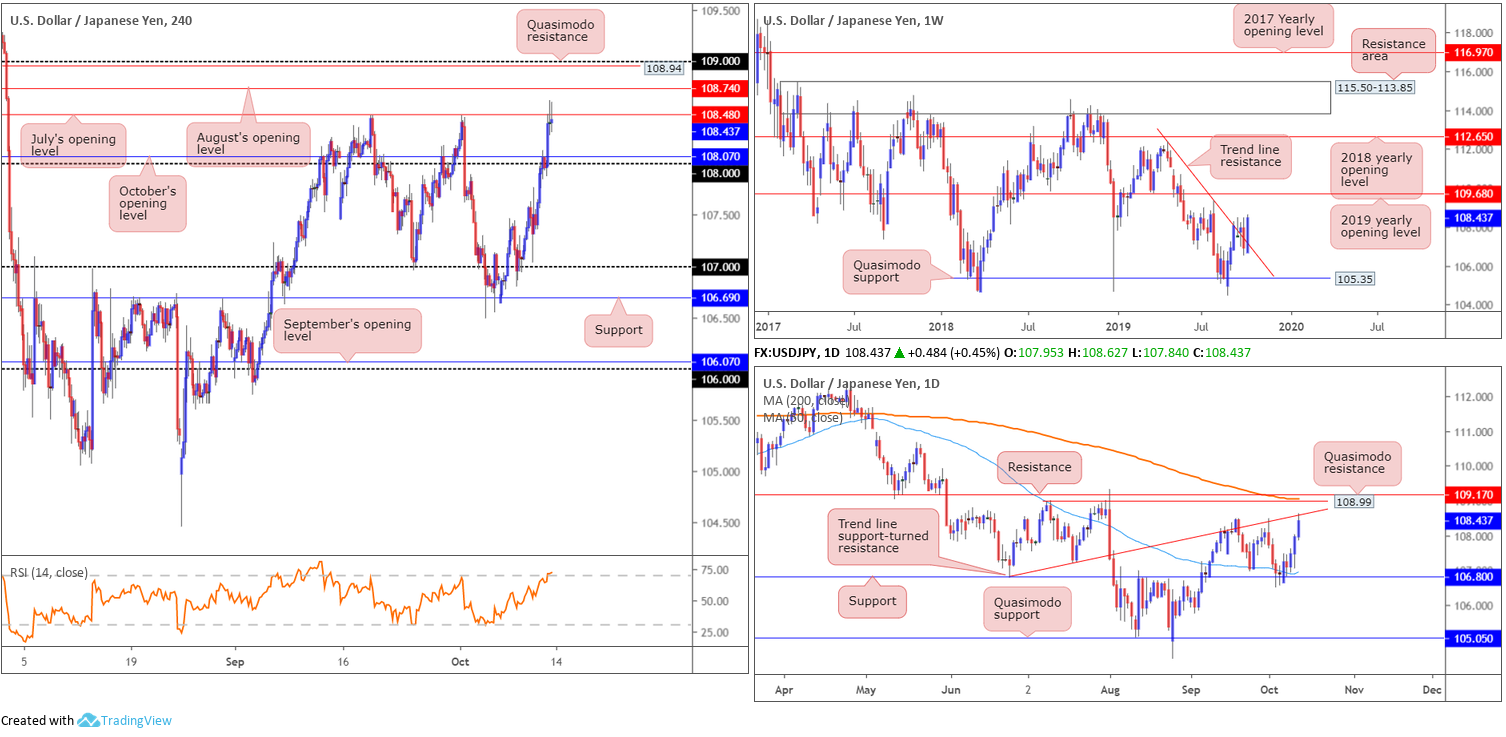

USD/JPY:

Weekly gain/loss: +1.44%

Weekly close: 108.43

Weekly perspective:

Totalling more than 150 points on the week, long-term flow reclaimed the prior week’s losses and firmed north of trend line resistance taken from the high 112.40. Quasimodo support at 105.35 remains the next downside target on this scale, while to the upside, the 2019 yearly opening level falls in as the next obvious resistance at 109.68.

Daily perspective:

Although weekly price appears to be gearing up for additional upside this week, daily price recently crossed swords with a trend line support-turned resistance (taken from the low 106.78), shouldered closely together with Quasimodo resistance at 108.99, the 200-day SMA (orange – 109.06) and resistance coming in at 109.17.

Support at 106.80 along with the 50-day SMA (blue – 106.94), also remain of interest.

H4 perspective:

Demand for the safe-haven Japanese yen contracted for a third successive session Friday amid upbeat market morale fostered by US/China trade and Brexit developments. In recent news, Trump announced the US and China have come to a ‘substantial’ phase one trade deal.

108 and October’s opening level at 108.07 gave way as resistance in the early hours of London, tripping buy stops and prompting a run to July’s opening level at 108.48. Although this line is bolstered by the daily trend line support-turned resistance (extended from the low 106.78, traders are urged to note resistances residing overhead at 108.74, August’s opening level, Quasimodo resistance at 108.94 and the 109 handle.

Areas of consideration:

Although plotted beneath weekly resistance at 109.68, therefore vulnerable to a whipsaw, 109 is still likely a point of interest for sellers this week. Combining the 109 handle, a H4 Quasimodo resistance at 108.94, a daily Quasimodo resistance at 108.99, the 200-day SMA and another layer of daily resistance at 109.17, this area is certainly worthy of any trader’s watchlist this week. Considering the threat of a fakeout through this area to weekly resistance at 109.68, waiting for a H4 bearish candlestick formation to take shape might be an idea. That way, you have identified seller intent and the candlestick’s structure can be used to base entry and risk levels from.

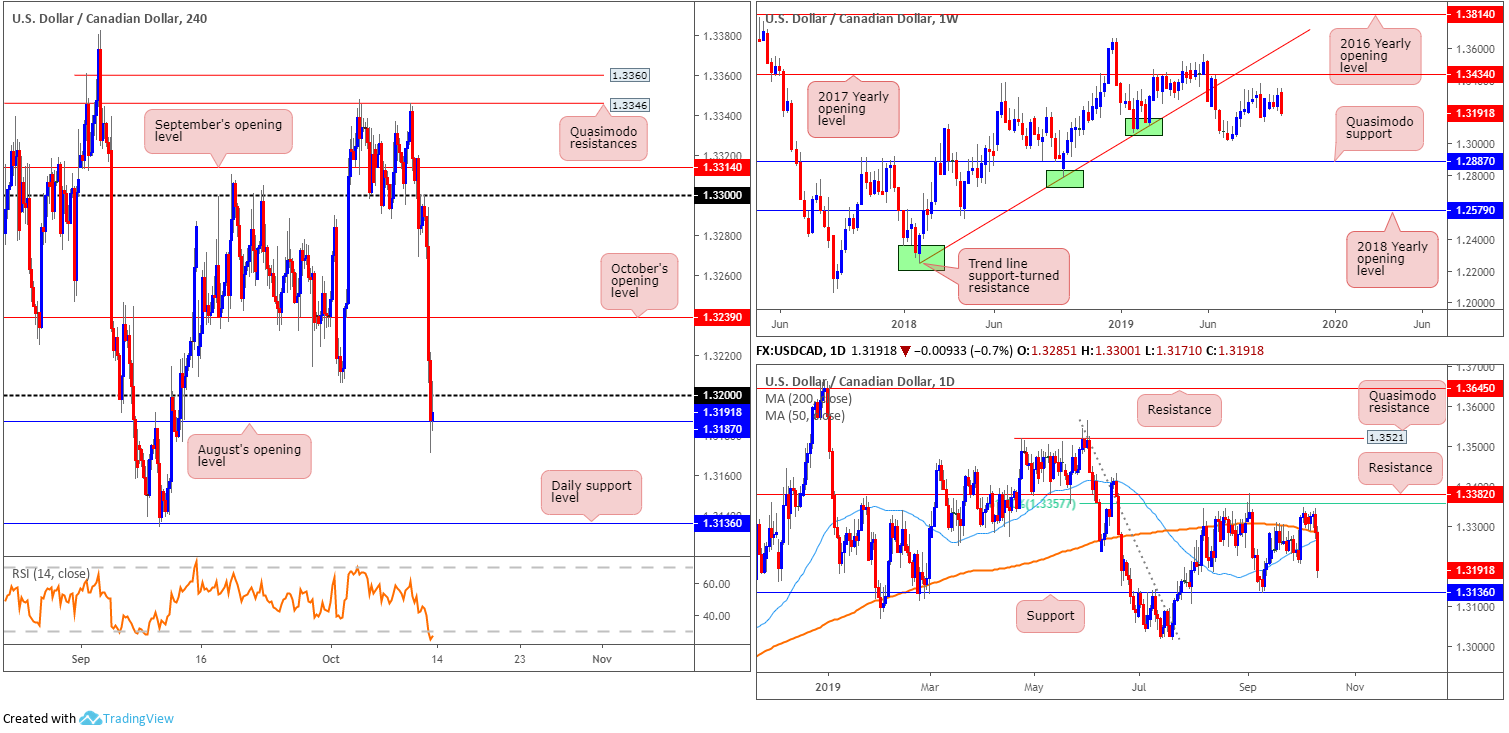

USD/CAD:

Weekly gain/loss: -0.86%

Weekly close: 1.3191

Weekly perspective:

USD/CAD activity witnessed a sharp move to the downside last week, overwhelming the prior week’s bullish outside formation, which may now lead to a possible breakout lower this week.

Retreating more than 100 points south of resistance at 1.3434 (the 2017 yearly opening level), support can be seen in the form of the 1.3015 July 15 low, followed by Quasimodo support stationed at 1.2887.

The primary trend in this market has remained north since bottoming in September 2017. Currently we’re in a secondary downtrend, with the peak set at 1.3661.

Daily perspective:

Support coming in at 1.3136 – holding reasonably significant history – as well as resistance drawn from 1.3382, sited just north of a 61.8% Fibonacci ratio at 1.3357, remain the dominant structures on this timeframe. Equally important, though, are the 200-day SMA (orange – 1.3286) and the 50-day SMA (blue – 1.3264) seen closing in on each other (converging) for a possible crossover scenario (also known as the Golden Cross).

H4 perspective:

Canada’s employment rose by 54,000 in September, driven by gains in full-time work. The unemployment rate also declined 0.2 percentage points to 5.5%, according to Statistics Canada Friday. The release sent the USD/CAD sharply lower, toppling October’s opening level at 1.3239 and eventually the 1.32 handle. The pair received minor respite into the close off August’s opening level at 1.3187, though was hampered by 1.32 acting as resistance.

WTI prices, typically a correlation with the Canadian dollar, also rose Friday, extending the market’s recovery formed just north of support at $50.78.

The retest at the underside of 1.32 into the close may, despite August’s opening level at 1.3187, resemble a signal to sell. This is largely due to the higher timeframes demonstrating scope to press lower this week, with daily support at 1.3136 noted as the next downside hurdle.

Areas of consideration:

Initial thoughts are likely an attempt at shorts off the underside of 1.32, expecting August’s opening level at 1.3187 to give way. This may entice a sell at the open, with a protective stop-loss order plotted above the rejection candle’s high point at 1.3207.

Conservative traders, nevertheless, may prefer to wait and see if the H4 candles engulf 1.3187 (on a closing basis) before taking action. A typical scenario would be a retest motion following the break lower, preferably in the shape of a H4 bearish candlestick pattern (entry and risk can then be determined on the back of the bearish candlestick’s framework).

Irrespective of the entry condition, a logical take-profit target falls in at daily support drawn from 1.3136.

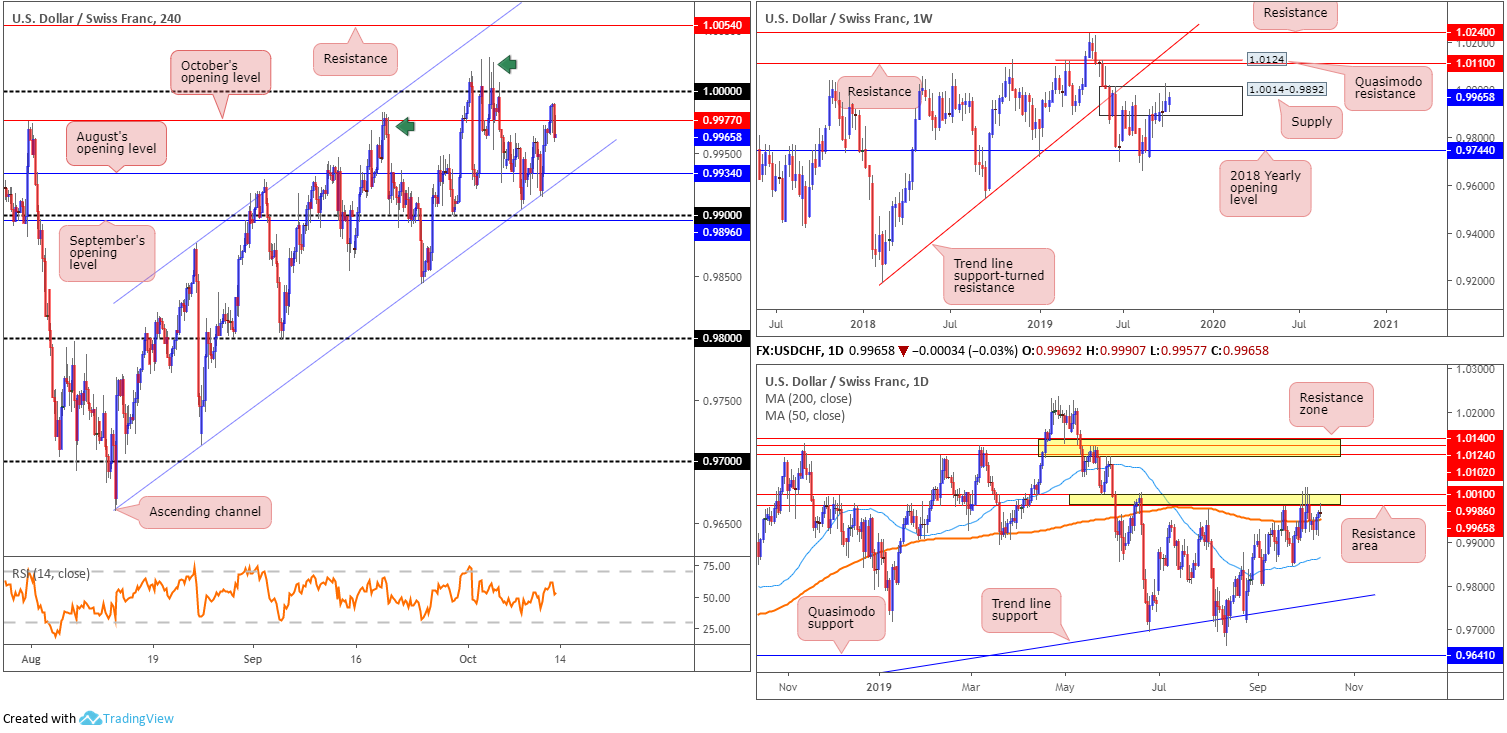

USD/CHF:

Weekly gain/loss: +0.14%

Weekly close: 0.9965

Weekly perspective:

While supply at 1.0014-0.9892 continues to confine price action, sellers are struggling to harvest anything meaningful to the downside. Recent moves struck multi-month peaks at 1.0027, possibly tripping some buy stops and weakening sellers. Therefore, resistance coming in at 1.0110, which happens to merge closely with Quasimodo resistance at 1.0124, may enter the mix over the coming weeks.

According to the primary trend, price reflects a somewhat bullish tone. However, do remain cognisant we have been rangebound since the later part of 2015 (0.9444/1.0240).

Daily perspective:

The resistance area marked yellow at 1.0010/0.9986 remains a prominent structure on this timeframe. Try as it might, recent action attempted to dethrone this area, leaving behind a collection of upper shadows. The retracement from the said zone has been meagre, nonetheless, likely influenced by the 200-day SMA lurking close by (orange – 0.9952).

A close above 1.0010/0.9986 may be viewed as a bullish indicator, suggesting a run towards a resistance area at 1.0140/1.0102, and also signifying a weekly close above supply mentioned at 1.0014-0.9892 could be on the way.

H4 perspective:

USD/CHF action wrapped up Friday unmoved, despite ranging more than 30 points.

Since mid-August, the pair has been compressing within an ascending channel formation (0.9659/0.9877). Although the vibe on the higher timeframes emphasise more of a bullish scenario, buyers appear to be weakening on the H4. The two highs marked with green arrows at 0.9983 and 1.0027 both failed to reach the opposing channel resistance, suggesting lack of buying interest and a possible break of the channel formation this week.

Key levels going forward are the 1.0000 barrier (parity) and the 0.99 handle. A decisive break of either figure will likely portend future direction. Above 1.0000, resistance is seen at 1.0054, whereas sub 0.99 the 0.9843 September 24 low is in sight, followed by the 0.98 region.

Areas of consideration:

While there are a number of support and resistances plotted between 1.0000 and 0.99 on the H4 scale, which could be traded on an intraday basis, medium-term focus is on the two said psychological boundaries. A decisive close beyond either number offers the trader a potential trading opportunity, targeting the levels highlighted above in bold.

Conservative traders may opt to wait for a retest of the broken level before taking action, whereas more aggressive traders may simply buy/sell the breakout candle and position stop-losses accordingly.

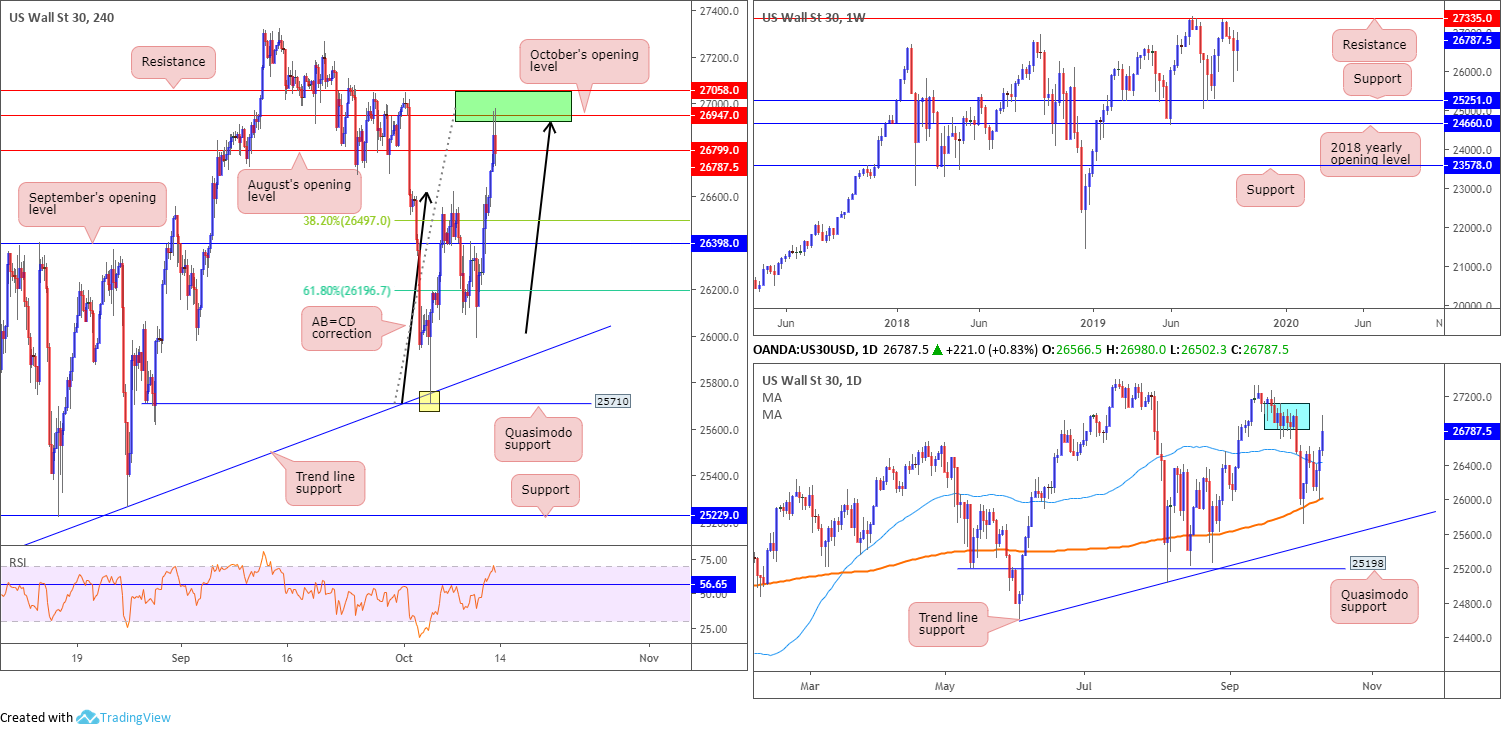

Dow Jones Industrial Average:

Weekly gain/loss: +0.99%

Weekly close: 26787

Weekly perspective:

Finishing the week in positive territory and breaking a three-week bearish phase, long-term action is now poised to approach resistance at 27335. Note this barrier is sited only a few points south of the all-time high 27388. Levels of support remain fixed at 25251 and the 2018 yearly opening level at 24660.

Despite a minor setback to 21452, the primary trend in this market remains facing northbound.

Daily perspective:

Latest on the daily timeframe saw price tunnel through the 50-day SMA (blue – 26431) after finding support off the 200-day SMA (orange – 26017). The move exposed supply between 27110-26813 (blue – positioned just south of weekly resistance at 27335), which entered the fold Friday and sported a mild end-of-day upper shadow.

H4 perspective:

Friday witnessed an advance in price following US President Donald Trump stating China and the US reached the first phase of a substantial trade deal. The Dow Jones Industrial Average added 319.92 points, or 1.21%; the S&P 500 also added 32.14 points, or 1.09%, and the tech-heavy Nasdaq 100 gained 103.51 points, or 1.34%.

For those who read Friday’s technical briefing you may recall the following piece:

The area between H4 resistance at 27058, October’s opening level at 26947 and a H4 AB=CD correction (black arrows) marked in green is likely a zone of interest for sellers today/next week. Even more so knowing the H4 sell zone is housed within daily supply at 27110-26813. However, given the area is susceptible to a fakeout to weekly resistance at 27335, traders may consider waiting for additional candlestick confirmation to form before pulling the trigger. That way, seller intent is visible and additional entry and risk levels are available to trade.

As evident from the chart, price responded from the H4 zone going into the close and printed a reasonably attractive bearish candle that closed nearby its lows.

Areas of consideration:

The H4 rotation out of the said H4 resistance area is likely enough to entice sellers into the market today, with protective stop-loss orders placed either above 27058 or Friday’s high 26980, and the first target set at the 38.2% Fibonacci ratio of legs A-D at 26497. Target points beyond here are seen at September’s opening level drawn from 26398 and the 61.8% Fibonacci ratio at 26196.

XAU/USD (GOLD):

Weekly gain/loss: -1.06%

Weekly close: 1488.6

Weekly perspective:

The support area at 1487.9-1470.2 appears to be running out of steam following the break of its lower edge two weeks ago, with resistance at 1536.9 remaining in a dominant position. Two layers of support are seen at 1392.0 and 1417.8 in the event we push for lower ground this week.

In terms of the longer-term primary trend, however, the yellow metal has been trading northbound since the later part of 2015.

Daily perspective:

The story on the daily timeframe shows a bullish flag has been in motion since early September (1557.1/1485.3), though the current recovery from the lower limit of the formation was unable to test the upper boundary. Last week saw the unit cross beneath its 50-day SMA (blue – 1506.7), consequently opening downside to a possible test of a support area coming in at 1448.9-1419.9 (which happens to have its upper edge bolstered by a 38.2% Fibonacci ratio 1448.5).

H4 perspective:

Risk perception continued to guide bullion Friday, slumping to a low of 1474.2. Support at 1485.3 suffered a minor whipsaw as a result of recent movement, which brought in buyers off the 127.2% Fibonacci extension at 1477.8 and lifted the H4 candles marginally north of 1485.3 into the close. This may, as long as buyers remain buoyant, set the stage for an intraday rally towards a port of resistance in yellow at 1519.9-1512.1. However, entering long in this market at the moment, with buyers lacking on the weekly timeframe and daily flow portending further selling, is a chancy move.

Areas of consideration:

The primary trend, clearly visible on the weekly timeframe, appears in good shape. However, the current weekly support area looks to be waning. This highlights the option for a run to the daily support area at 1448.9-1419.9 and converging channel support (the lower edge of the current bullish flag) for a possible opportunity to join the primary trend.

Medium term, however, buyers will likely struggle to reach the H4 resistance area at 1519.9-1512.1, though if further buying is seen, followed by a retest at H4 support 1485.3, a long may still be worthy of consideration (entry and risk can be set according to the rejection candle’s frame).

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.