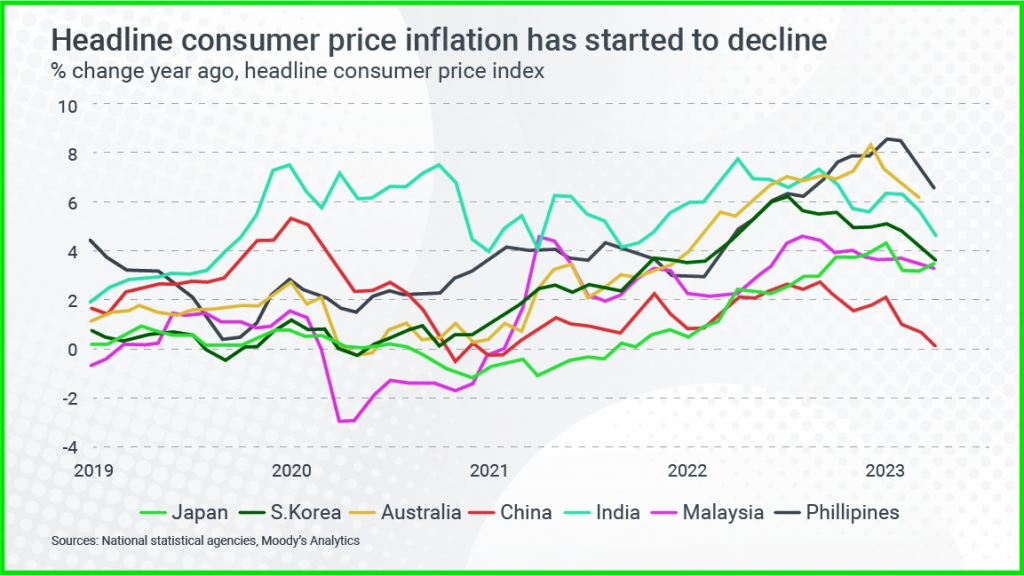

As a rule, central bankers work to an inflation target of between 2-3%, though despite more than 12-months of rate hikes, most G20 countries remain above this range.

According to Steven Cochrane, APAC Chief Economist, Moody’s Analytics, this is putting enormous pressure on central bankers to thread the needle on monetary policy.

Central banks are going to be very cautious and very conservative. I don’t think any central bank wants to make a move to begin easing rates and then realize maybe they moved too early, inflation ticks back up, and then they have to raise rates again. I think that that would be a policy mistake. That would be one factor that might actually lead to recession.

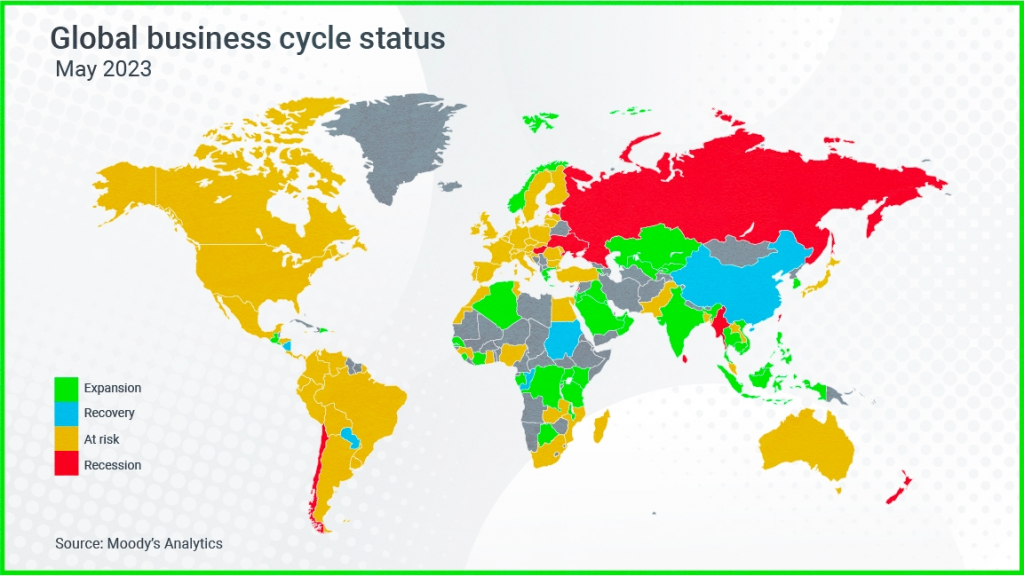

Moody’s Analytics produces a world map in which it identifies countries at risk of recession.

Right now it believes Russia, Taiwan and New Zealand are in recession, with much of Europe, Canada, Australia and the United States at risk of recession.

While Moody’s Analytics puts the US and Europe at risk of recession, Mr Cochrane says strong labour markets in both regions are a factor in staving off a downturn.

It wouldn’t take much if some shock came along to knock either economy into recession, but as long as we can avoid that shock, we should be able to slip through pretty well and continue this modest growth through this year.

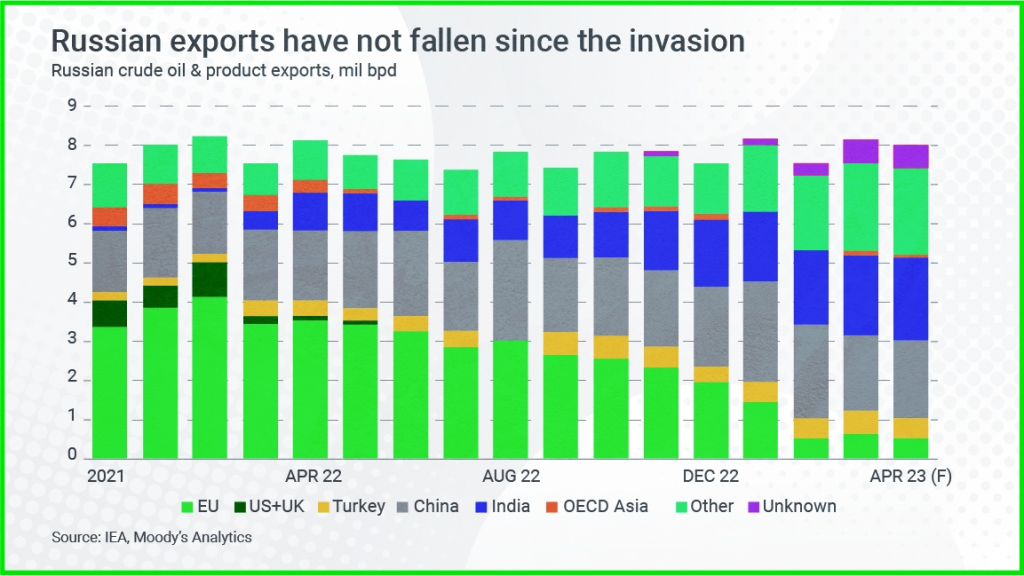

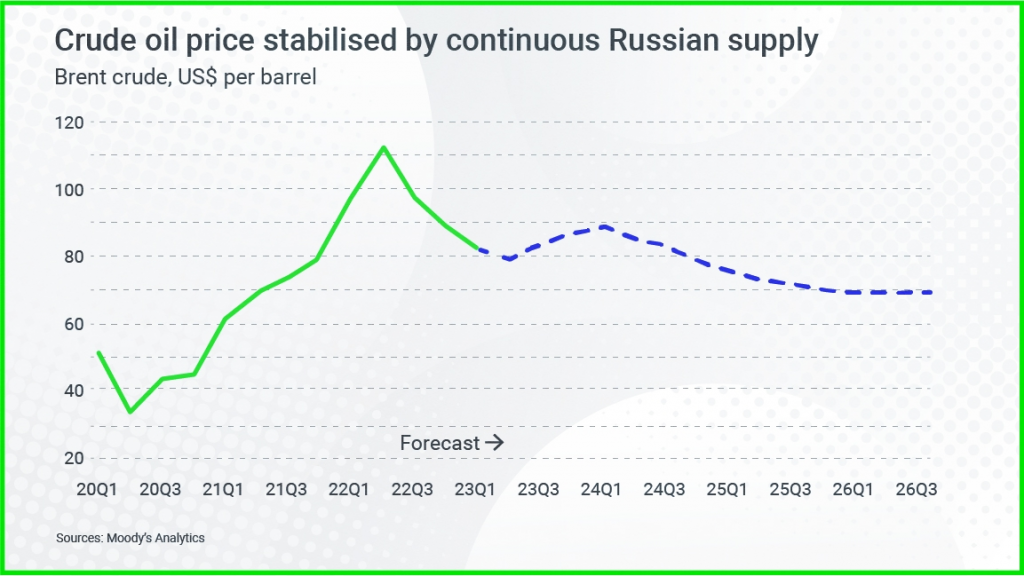

One of the biggest contributors to global inflation over the last 12-18 months has been the price of oil, which surged following Russia’s invasion of Ukraine.

The sanctions imposed on Russia essentially set the price of Russian oil at $65 per barrel, due to the fact that buyers couldn’t insure the shipment above the $65 price point.

Moody’s Analytics’ long term forecast for the price of oil is about $70 per barrel.

Lower oil prices have contributed to the decline in headline inflation across the Asia Pacific region.

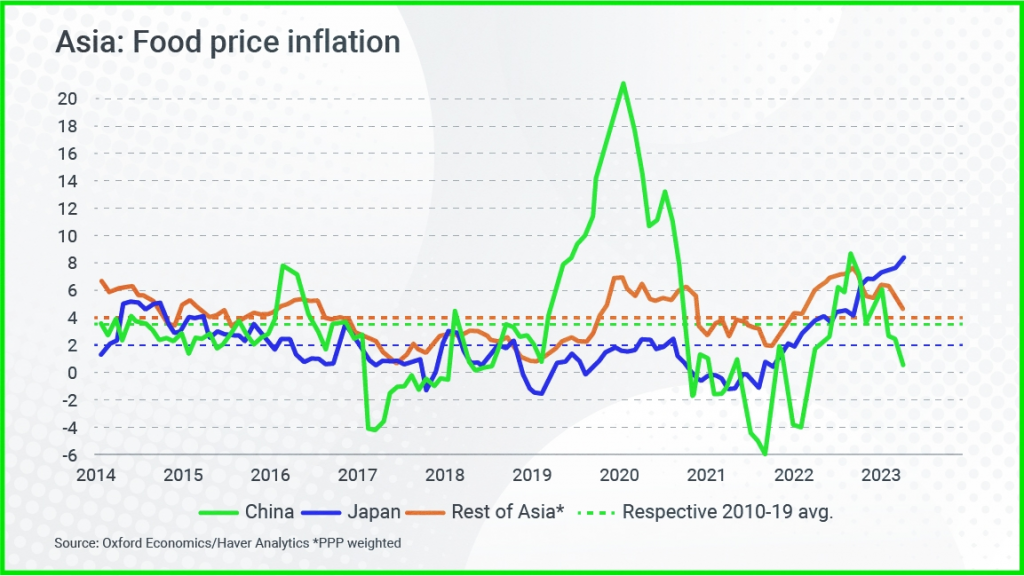

Moody’s Analytics is paying particular attention to food inflation as it seems more sticky than overall topline inflation and remains high in almost every country.

“Food is a smaller piece of the overall budget, but for lower income households, lower income countries, it’s really important. And that’s the fear right now, is that those countries will face a longer period of inflation just because food is a bigger component,” said Cochrane.

Oxford Economics identifies one of the key risks for global inflation is food prices which have the potential to be impacted by the El Nino weather pattern.

The US National Oceanic and Atmospheric Administration puts the chance of an El Nino event at 90% this year.

That would cause hot and dry weather, particularly in South and Southeast Asia. In the past it’s been known to damage harvests and push up food prices.

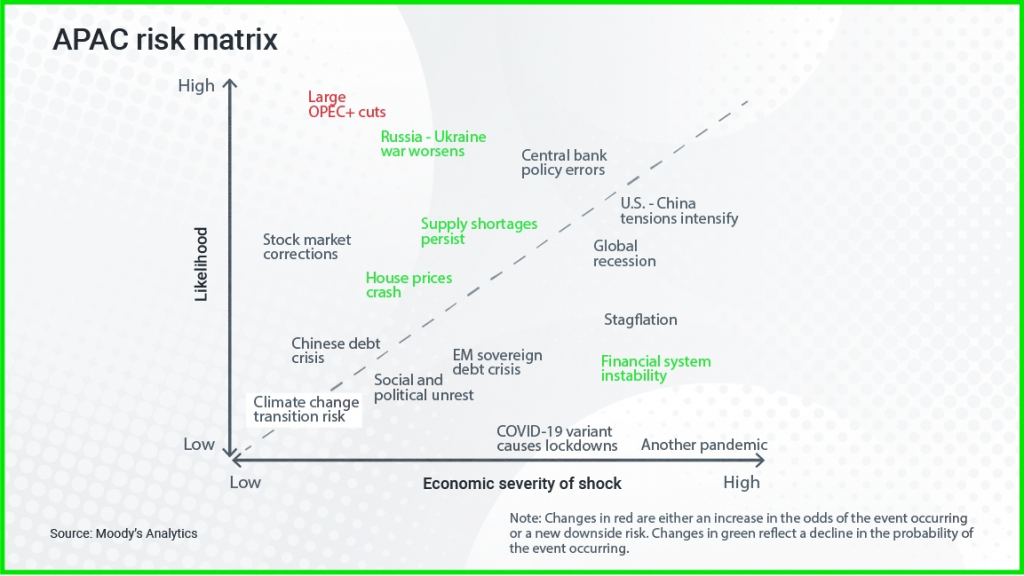

In terms of other risks to inflation, Moody’s Analytics identifies the tensions between the US and China.

“If production begins to move out of China to other places, it could certainly add costs and add friction to the pace of global growth,” said Cochrane.

Inflation creates a headache for policy makers and central bankers. In the words of former US President Ronald Reagan: “Inflation, that’s the price we pay for those government benefits everybody thought were free.”