A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

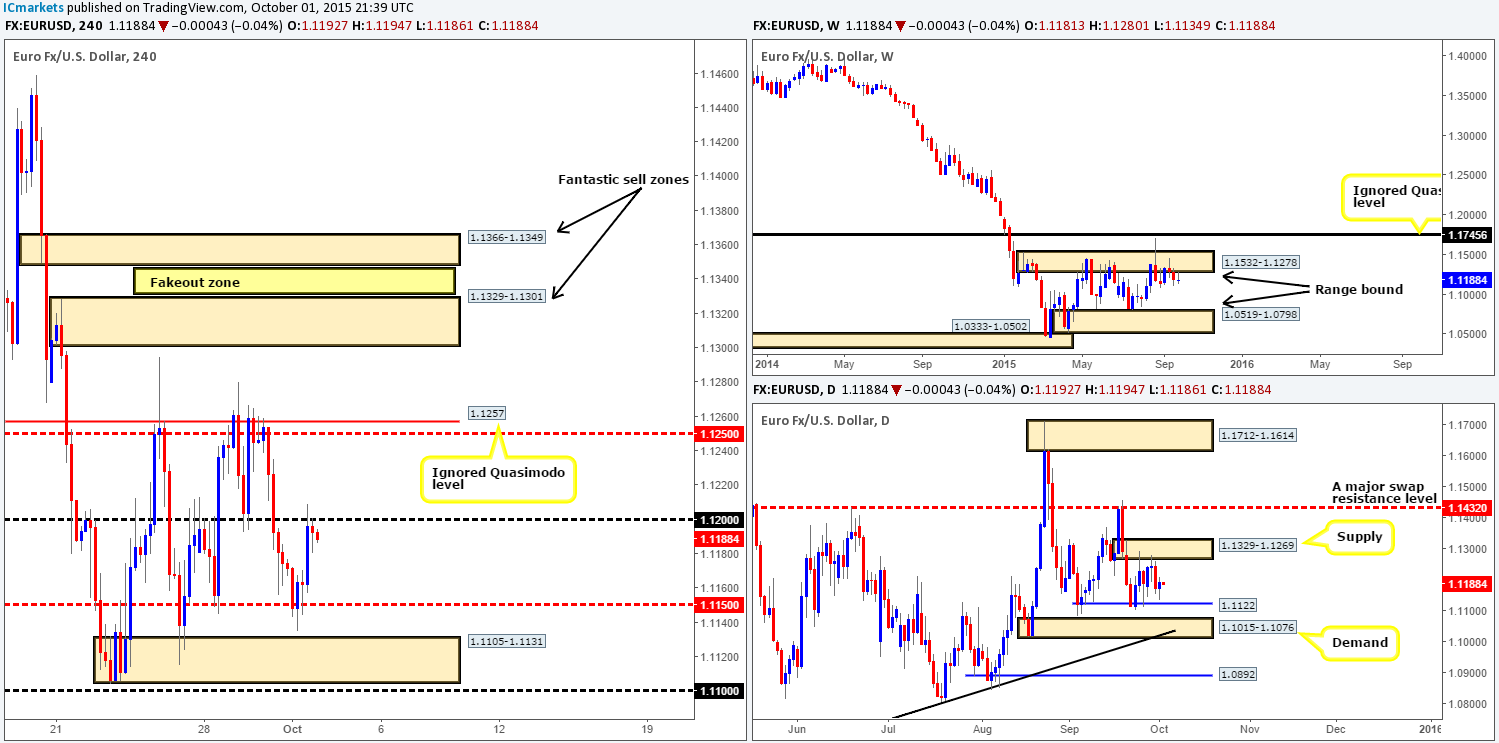

EUR/USD:

As can be seen from the 4hr chart, the EUR continued to trade lower going into the early hours of yesterday’s sessions. This saw price hit and slightly extended beyond the mid-number support 1.1150, just missing demand below at 1.1105-1.1131 by only a few pips. It was around this point, the European/London open, did the market begin finding support. The real movement, however, was seen in the American session. Market action punched higher on the back of slightly negative news out of the U.S, bringing price up to psychological resistance 1.1200 into the close 1.1191.

Market activity will likely remain steady ahead the mighty NFP release today. Levels/areas to watch for (confirmed) trades around this time are as follows:

Buys:

-

Demand at 1.1105-1.1131. Not only does this area surround daily support at 1.1122, it also sits just below mid-number support at 1.1150, thus making it beautiful structure for a fakeout!

Sells:

- 1.1250/1.1257. This small area sits just below both daily supply at 1.1329-1.1269 and weekly supply at 1.1532-1.1278. Therefore, do expect a fakeout here before trading it.

- 1.1329-1.1301/1.1366-1.1349. The lower area is not only fresh, but also sits within the above said daily/weekly supply zones. The upper zone is also very attractive as it has ‘fakeout’ written all over it. This area, however, lurks just above the aforementioned daily supply, but still remains within the above said weekly zone.

Levels to watch/live orders:

-

Buys: 1.1105-1.1131 [Tentative- confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 1.1250/1.1257 [Tentative- confirmation required] (Stop loss: dependent on where one confirms this area) 1.1329-1.1301/1.1366-1.1349 [Tentative- confirmation required] (Stop loss: dependent on where one confirms these two areas).

GBP/USD:

Following on from our previous report (http://www.icmarkets.com/blog/thursday-1st-october-daily-technical-outlook-and-review/), we can see that price reacted almost to-the-pip off of our pre-determined swap support level at 1.5114, reaching highs of 1.5180 on the day. Well done to any of our readers who managed to lock in some green pips from this move.

The sell-off from 1.5180 has nearly seen price reconnect with 1.5114, which, at least from a technical standpoint, could once again be good for a second entry long into this market today. The reason being is let’s not forget that price is still flirting with weekly channel support (1.4564), and daily action is lurking deep within demand at 1.5088-1.5173.

However, today’s NFP release could alter the technical structure of this pair. As such, the following barriers may also see some action today:

Buys:

-

1.5100. This round number could see some action today from a fake below 1.5114.

-

Also, keep a tab on demand below this round-number figure at 1.5026-1.5059 (positioned below daily demand at 1.5088-1.5173, but is located just within weekly demand at 1.4855-1.5052).

Sells:

-

1.5200. This psychological number has proven itself on three occasions to be worthy resistance this week.

-

Even though 1.5250/1.5300 should also be on your watchlists, we have our eye on the small supply seen above at 1.5363-1.5340, which could be good for a bounce during NFP.

Levels to watch/ live orders:

-

Buys: 1.5114 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level). 1.5100 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 1.5026-1.5059 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 1.5200 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 1.5363-1.5340 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

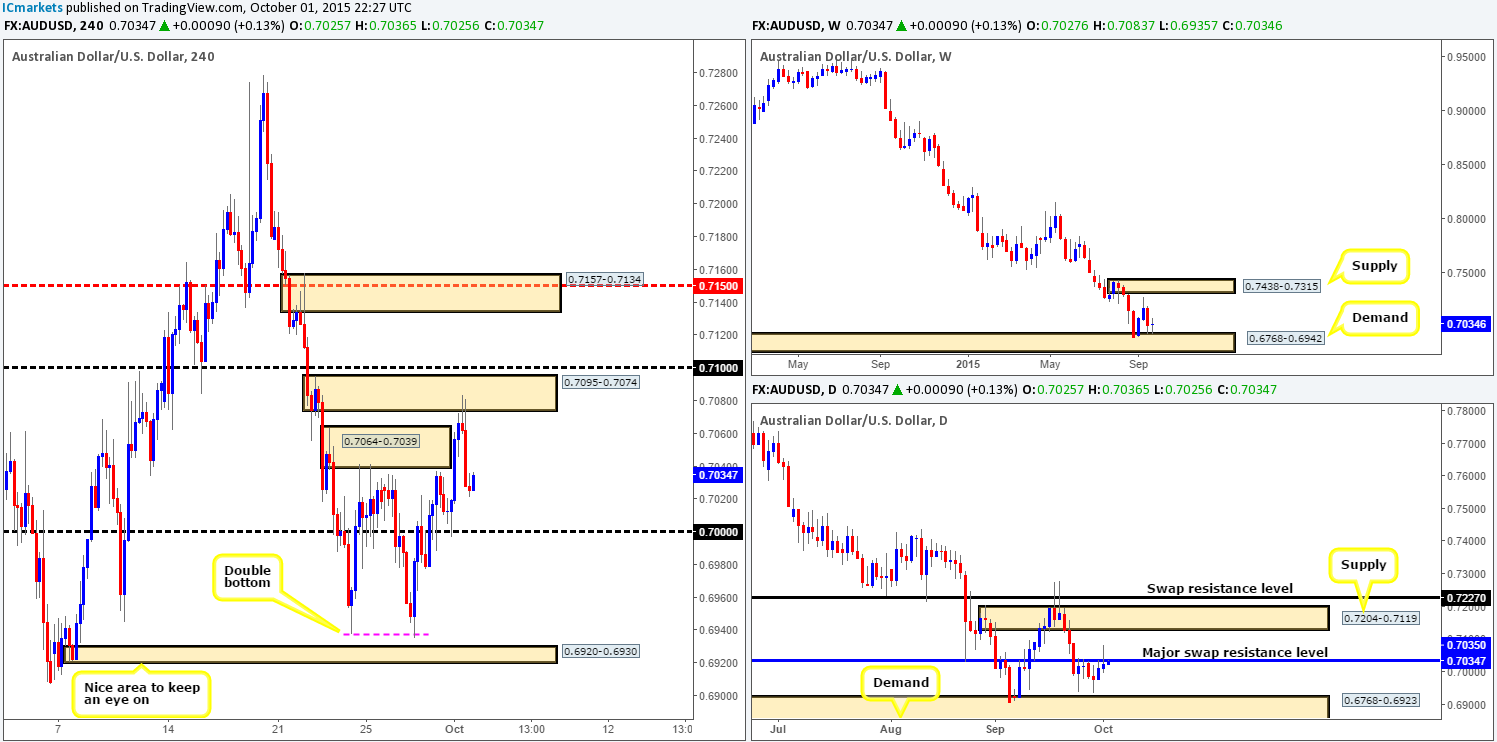

AUD/USD:

It was certainly a volatile day for the AUD/USD pair yesterday. Price Began by pinning the top-side of 0.7000 to perfection and advancing higher during the early hours of trade. This, as you can see, demolished supply coming in at 0.7064-0.7039, and collided beautifully with supply just above drawn from 0.7095-0.7074. It was from here the mood of the market turned sour. Following two selling wicks, the pair aggressively sold off eventually reaching lows of 0.7021 on the day.

Consequent to the above, price printed a beautiful-looking daily pin at the underside of a major swap resistance level at 0.7035. Up on the weekly timeframe, however, market action still remains holding firm above demand taken from 0.6768-0.6942.

With the above taken into account, battle lines going into today’s NFP are as follows:

Buys:

-

0.7000. This number is certainly worth keeping an eye on, since not only was it the (technical) catalyst for yesterday’s rally higher, it also has significant swap level history.

-

0.6920-0.6930. This demand, albeit small, lurks just below a nice-looking double bottom pattern at 0.6937 which, in our book, provides the perfect structure for a fakeout trade.

Sells:

-

Supply at 0.7095-0.7074 proved itself during trade yesterday. However, seeing as this area has likely been weakened from this attack; keep an eye out for a fake above to either 0.7100, or even the supply just above this number at 0.7157-0.7134.

Levels to watch/ live orders:

-

Buys: 0.7000 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.6920-0.6930 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 0.7095-0.7074 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area) 0.7100 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.7157-0.7134 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

USD/JPY:

To our way of seeing things at the moment, this market is technically range bound from the weekly timeframe down to the 4hr:

- The weekly range falls in between 122.01-121.40/118.22-119.25.

- The daily range can be seen between 120.59/118.60-119.26.

- 4hr range comes in between 119.65/120.22.

It is very unlikely we’ll see this market breakout before the mighty NFP strikes its chord. Therefore, be prepared for a rather slow, confined start to the day.

On account of the above, here are the numbers we’re going to be watching during/post NFP:

Buys:

-

119.21/119.00. This area – a Quasimodo/round-number combination, This has been the ‘floor’ of this market the past few weeks and is certainly a zone you’d want logged on your watchlists going into today’s trade.

Sells:

-

The mid-level number 120.50, which converges nicely with the 61.8% Fibonacci level at 120.46.

-

120.71 is a perfect level to be faked into should 120.50 fail today.

-

Supply at 121.40-121.07.

Levels to watch/ live orders:

-

Buys: 119.21/119.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 120.50 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 120.71 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 121.40-121.07 [Tentative – confirmation required] (Stop loss: 121.43).

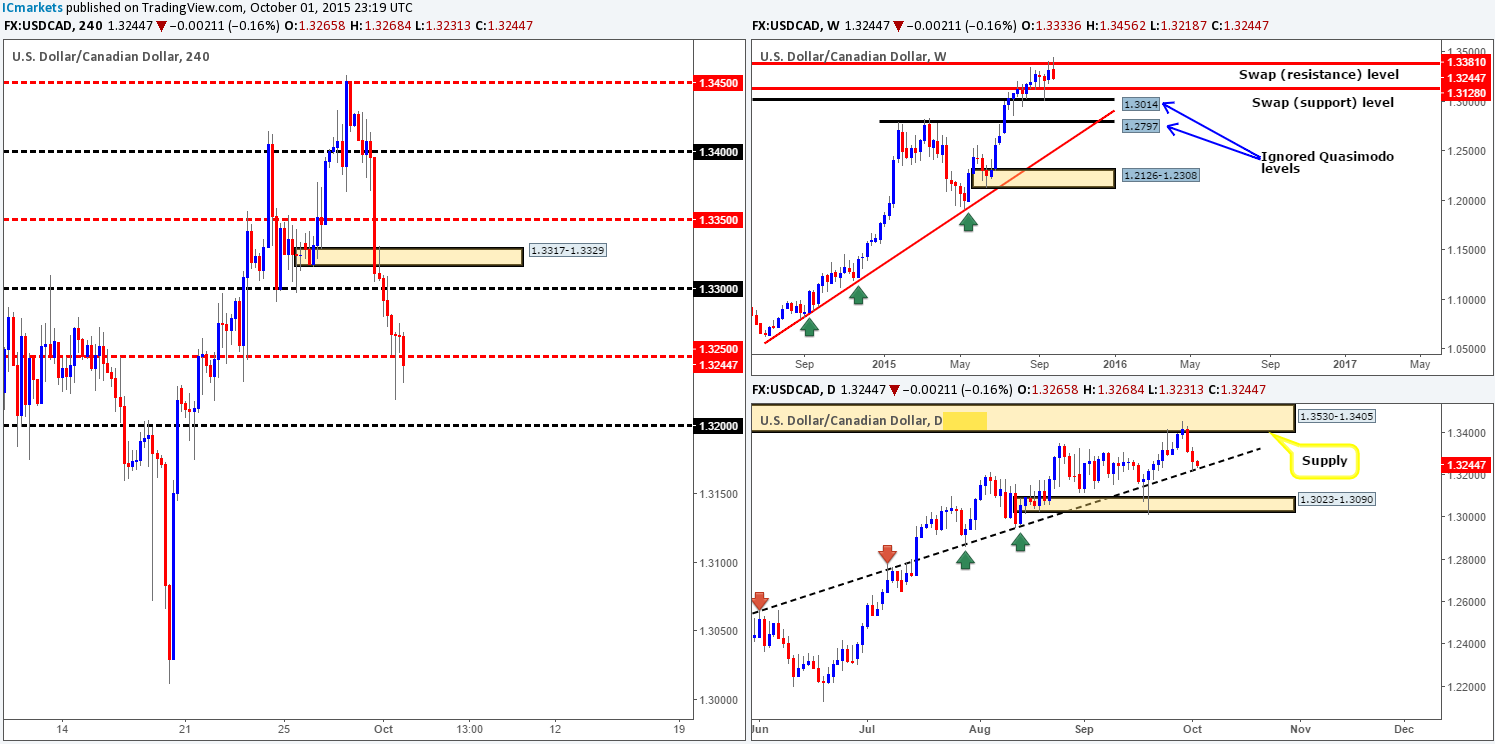

USD/CAD:

Following the aggressive sell-off seen on Wednesday, this pair continued to drive lower into yesterday’s sessions as the Oil market saw an increase in value. As a result, psychological support 1.3300 was taken out and price went on to connect with mid-level support 1.3250, which, at the time of writing, looks exceedingly weak.

Technically, this recent movement has pulled price into an ascending daily trendline drawn from 1.2562. However, let’s not get too excited. The weekly timeframe shows that there’s still room for this market to continue lower down to at least swap support coming in at 1.3128.

With the above in mind, we see this market heading lower down to at least 1.3200 today. Nevertheless, as the NFP is set to take the limelight later on today, technicals will likely take a back seat. Be that as it may, we still plan on keeping a watch on the following Levels/areas going in to today’s trade:

Buys:

-

1.3200 has been a well-respected support and resistance for quite some time, so it’s well-worth keeping a tab on.

Sells:

-

1.3300 has, like 1.3200, also been a well-respected support and resistance level. Despite this, do be prepared for a fake above this number into the swap supply zone at 1.3317-1.3329.

Levels to watch/ live orders:

-

Buys: 1.3200 [Tentative – confirmation required] (Stop loss: dependent on where one finds confirmation).

-

Sells: 1.3300 [Tentative – confirmation required] (Stop loss: dependent on where one finds confirmation) 1.3317-1.3329 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

USD/CHF:

Recent action shows that The USD/CHF pair continued to climb higher before finding active offers sitting just below supply coming in at 0.9815-0.9793. Now, under normal trading conditions, we would be all over this supply zone, due to it surrounding a weekly swap (resistance) level at 0.9796. However, today’s upcoming sessions are not what we’d consider to be normal trading conditions. The NFP data release could very well blast price through this zone like a hot knife through butter!

There will not likely be much action to report ahead of the NFP, so here is a list of levels/areas we currently have noted to watch amid this notoriously volatile release:

Buys:

-

0.9750. Although this number is close, it is still a worthy support to keep a tab on due to the respect it has commanded over the past month or so.

-

0.9700. This psychological figure is certainly one to watch today since this is origin of the recent up move.

-

Demand at 0.9641-0.9666. A perfect to-the-pip rebound was seen from this barrier on the 24/09/15, indicating strong bids may still reside here.

Sells:

-

As we mentioned above, we do have an interest in supply at 0.9815-0.9793 since it surrounds the aforementioned weekly swap (resistance) level, and also coincides nicely with 0.9800.

Levels to watch/ live orders:

-

Buys: 0.9750 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.9700 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.9641-0.9666 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 0.9815-0.9793 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

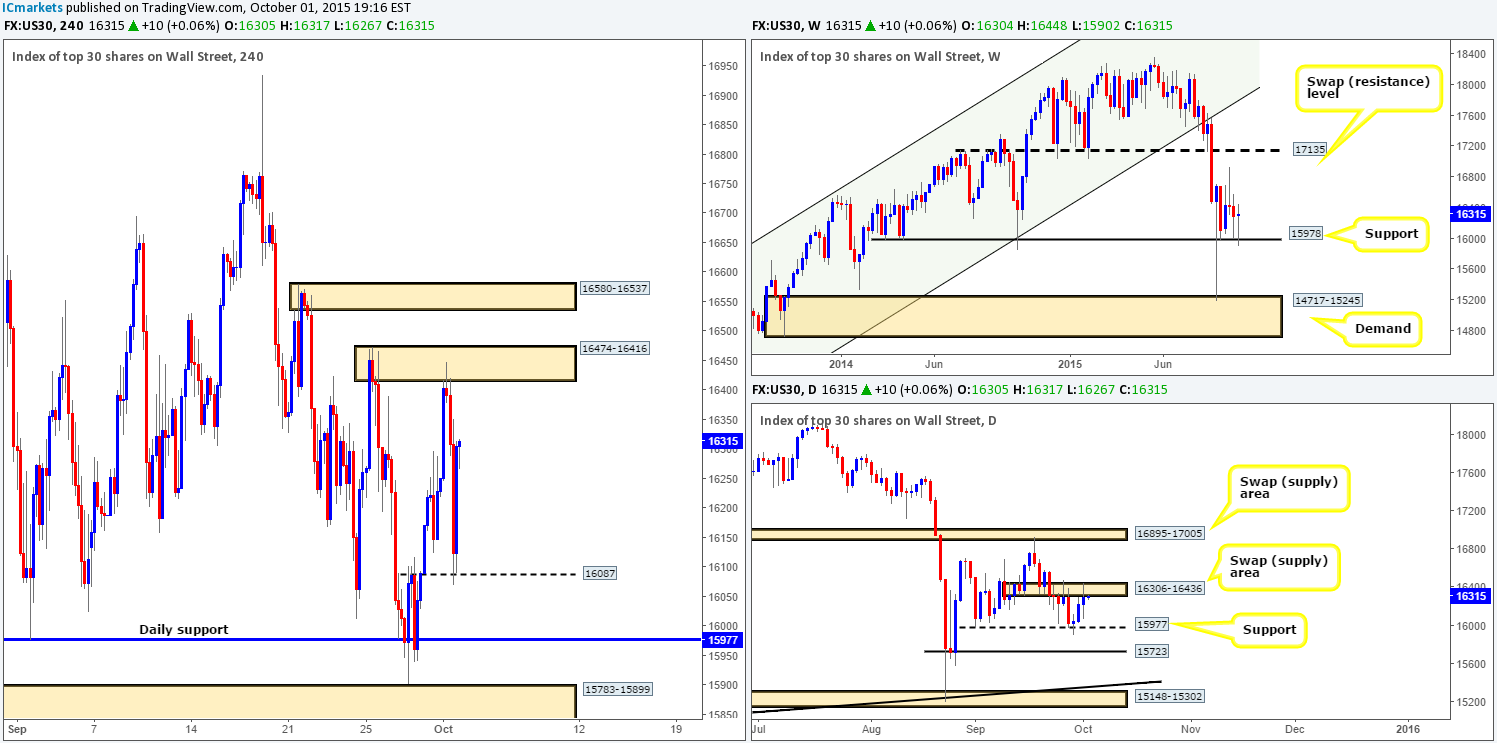

DOW 30:

Coming at you directly from the weekly timeframe this morning shows support at 15978 continues to hold firm. Meanwhile, down on the daily timeframe, price is now flirting with the underside of a swap supply area at 16306-16436.

From the pits of the 4hr timeframe, however, we can see that price is floating in between yesterday’s traded zones – supply at 16474-16416 and a minor swap support level seen at 16087. Technically, this a very difficult market to trade for us due to the somewhat conflicting signals being seen on the bigger picture right now (see above). On top of this, let’s not forget the commonly brutal NFP is due later on today!

With the above in mind, here are some levels we currently have noted that may rebound price (confirmation strictly required at each level here traders):

Buys:

-

The swap support level 16087.

-

Daily support 15977.

-

Demand at 15783-15899.

Sells:

-

Supply at 16474-16416.

-

Supply at 16580-16537.

Levels to watch/ live orders:

-

Buys: 16087 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 15977 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 15783-15899 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

-

Sells: 16474-16416 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area) 16580-16537 [Tentative – confirmation required] (Stop loss: 16600).

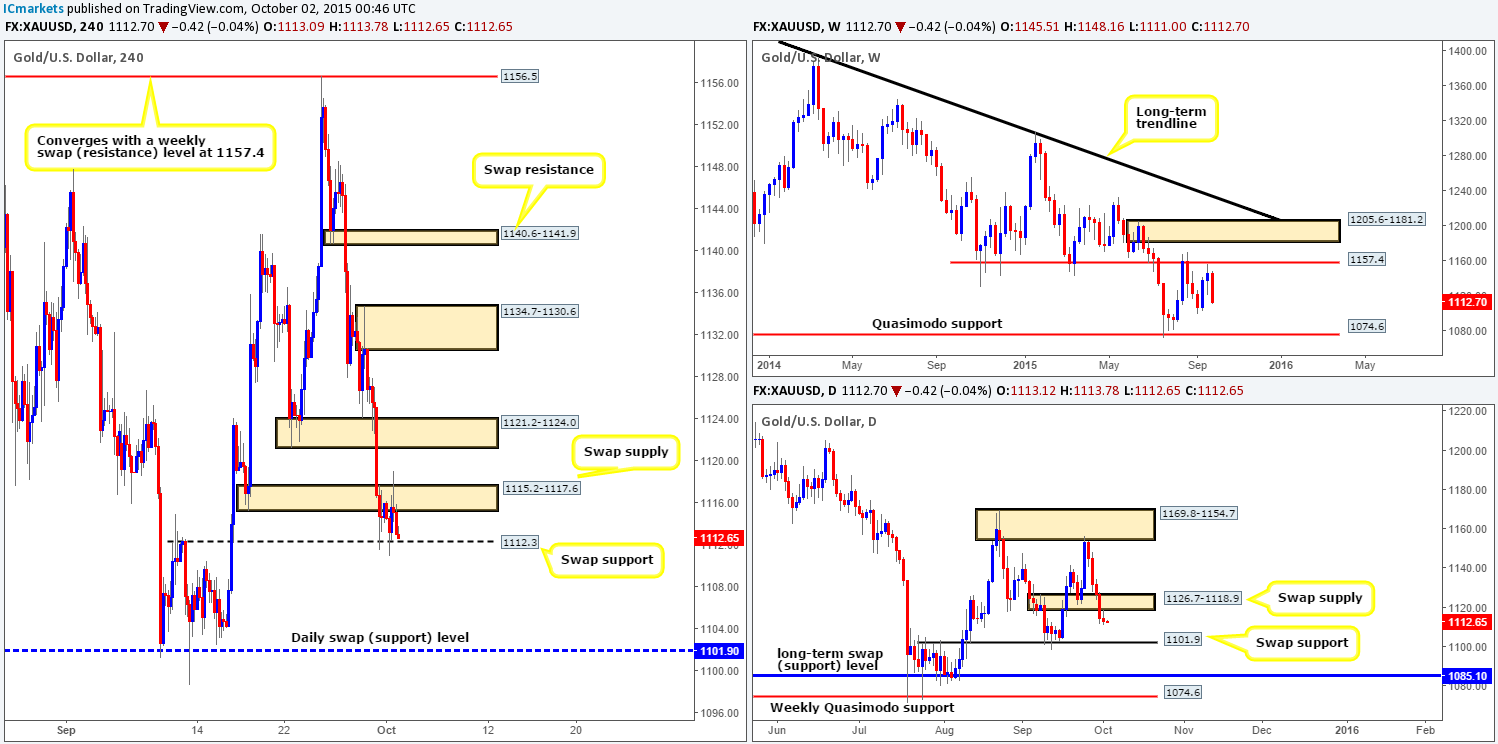

XAU/USD: (Gold)

This morning’s analysis will kick-off with a look at the weekly timeframe, which shows Gold tumbling lower from last week’s retest of 1157.4 – a swap resistance level. Scrolling down to the daily timeframe, however, a swap demand area at 1126.7-1118.9 was recently taken out and retested as supply. The next downside target from this region falls in around a swap support level at 1101.9.

Yesterday’s 4hr action, as you can see, reveals that price spent the day confined between a recently broken demand area at 1115.2-1117.6 (now supply) and a swap support level at 1112.3. Ultimately, we see market activity remaining within this consolidation ahead of today’s NFP release.

A breakout following the NFP is highly likely in our opinion. As such, do keep a tab on the following levels/areas for confirmed trading opportunities:

Buys:

-

Daily swap support level at 1101.9.

Sells:

-

4hr swap (supply) zone at 1121.2-1124.0.

-

4hr supply at 1134.7-1130.6.

Levels to watch/ live orders:

-

Buys: 1101.9 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

-

Sells: 1121.2-1124.0 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area) 1134.7-1130.6 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).