A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

EUR/USD:

Following Wednesday’s steep descent, the EUR pair was relatively quiet during yesterday’s trade. Price managed to reach lows beyond mid-level support 1.0850 at 1.0833, forming a nice-looking buying tail in the process. To the upside, however, the bulls recorded highs of 1.0897, three pips below psychological resistance 1.0900.

Higher timeframe weekly action shows that price is now nail-bitingly close to kissing the top-side of range demand at 1.0519-1.0798. Down on the daily timeframe, demand at 1.0846-1.0903 was breached, potentially opening the path south to test Quasimodo support at 1.0818.

Now, with heavy market activity expected to be seen later as the mighty NFP takes the limelight, what levels are we looking at today? Well, firstly, we’re not expecting much from the EUR until the above said data hits the line. In fact, 1.0900/1.0850 will likely contain price until that time. Beyond this temporary range, however, we’re going to be watching the following:

On the buy side:

- As we mentioned in yesterday’s analysis, the Quasimodo support at 1.0819 and the psychological support below it at 1.0800 is an area of interest for us. Seeing as how this zone is technically supported by a daily Quasimodo line at 1.0818 and also weekly demand mentioned above at 1.0519-1.0798, these combined 4hr levels deserve a place on this list.

On the sell side:

- Swap resistance at 1.0973 followed closely by large psychological resistance 1.1000. Depending on the numbers released today, price has the potential to bounce from here.

- Mid-level resistance at 1.1050 coupled with supply floating above it at 1.1095-1.1070. Both these barriers boast additional resistance from daily supply coming in at 1.1095-1.1048, so do keep an eye on this combined area today.

To be on the safe side here traders, we would recommend only trading the above said areas should you manage to spot a lower timeframe confirming setup, as the NFP can be a fickle beast!

Levels to watch/live orders:

- Buys: 1.0819/1.0800 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 1.0973/1.1000 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area) 1.1050/1.1095-1.1070 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

GBP/USD:

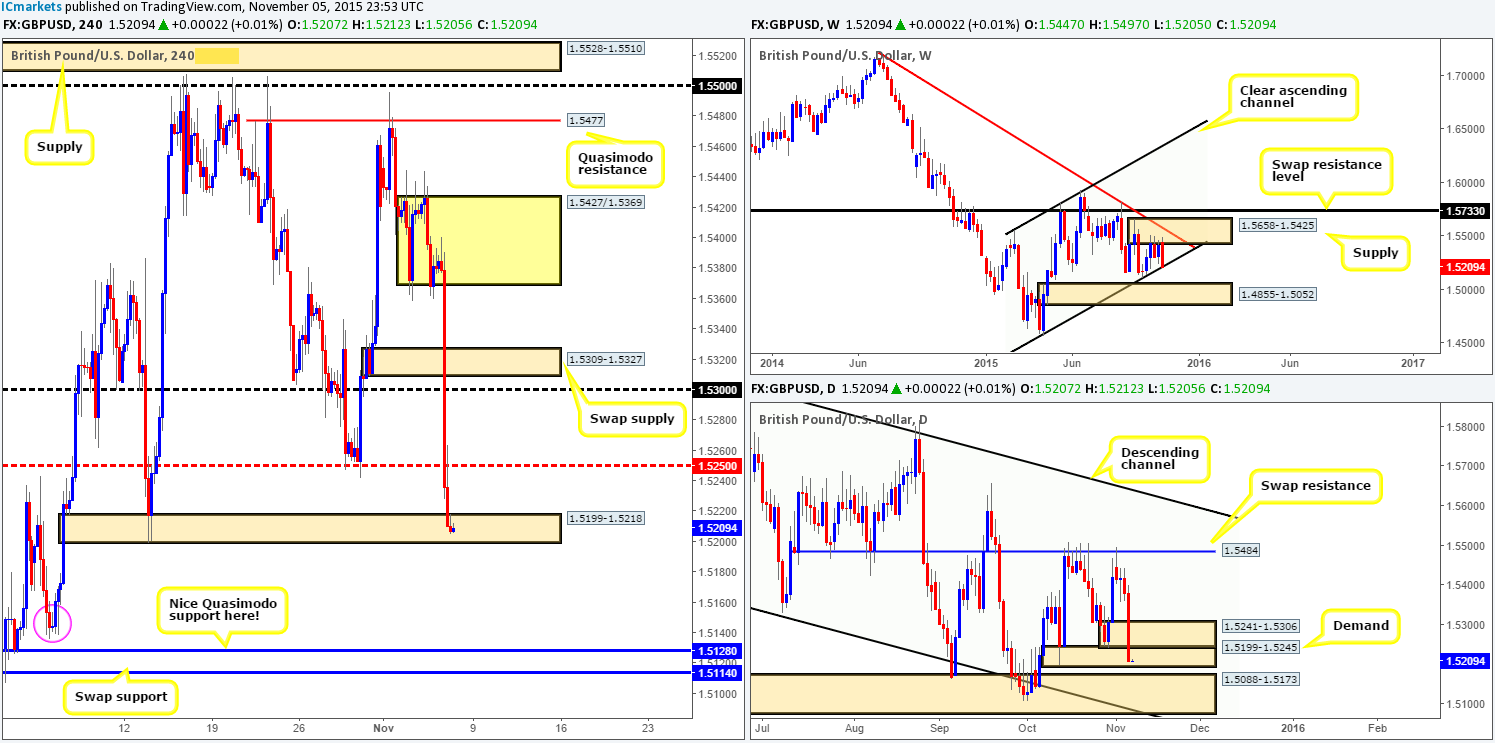

Pound Sterling took a turn for the worst during London’s mid-day trade yesterday following the minutes and Quarterly inflation release. Price tumbled almost 200 pips, breaking out of its present range 1.5427/1.5369, and also below both demand (now supply) at 1.5309-1.5327 and psychological support 1.5300, before somewhat stabilizing within demand at 1.5199-1.5218.

Furthermore, this recent decline has seen price connect with the weekly channel support extended from the low 1.4564, and also forced Cable to breach daily demand at 1.5241-1.5306, and drive into the demand below it at 1.5199-1.5245.

Given the above, we see price meandering within the current 4hr demand zone until the release of the U.S. employment figures later on today.

Following this, we have our eye on the mid-level resistance 1.5250/psychological resistance 1.5300 for a potential bounce. Conversely, to the downside, we’re also watching the Quasimodo support 1.5128/swap support 1.5114. The reason for ignoring the demand circled in pink at 1.5135-1.5153 is simply because the Quasimodo support below it is so close. This may tempt well-funded traders to fake below this area to collect the truckload of sell stops positioned below it to buy into!

Levels to watch/ live orders:

- Buys: 1.5128/1.5114 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 1.5250/1.5300 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

AUD/USD:

Throughout the course of yesterday’s sessions, the AUD, at least technically, saw very little change to report. The market appears to be now capped between a minor swap resistance level falling in at 0.7164 and a support barrier seen at 0.7130. We doubt that price will make an attempt to break the above said levels ahead of the U.S. employment release today.

Dependent on the actual numbers of course, a break below could see price drive lower to connect with psychological support 0.7100, followed closely by demand at 0.7055-0.7077 (sits just above a major swap support level on the daily timeframe at 0.7035). Both areas could be potential buy zones for us today in the event that lower timeframe bullish strength is seen.

Conversely, a push higher, will likely force the Aussie to collide with psychological resistance 0.7200, and also, potentially, the Quasimodo resistance barrier just above it at 0.7218 (both converge around the daily swap resistance level coming in at 0.7204). Confirmed shorts could be a possibility from here today.

Levels to watch/ live orders:

- Buys: 0.7100/0.7055-0.7077 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 0.7200/0.7218 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).