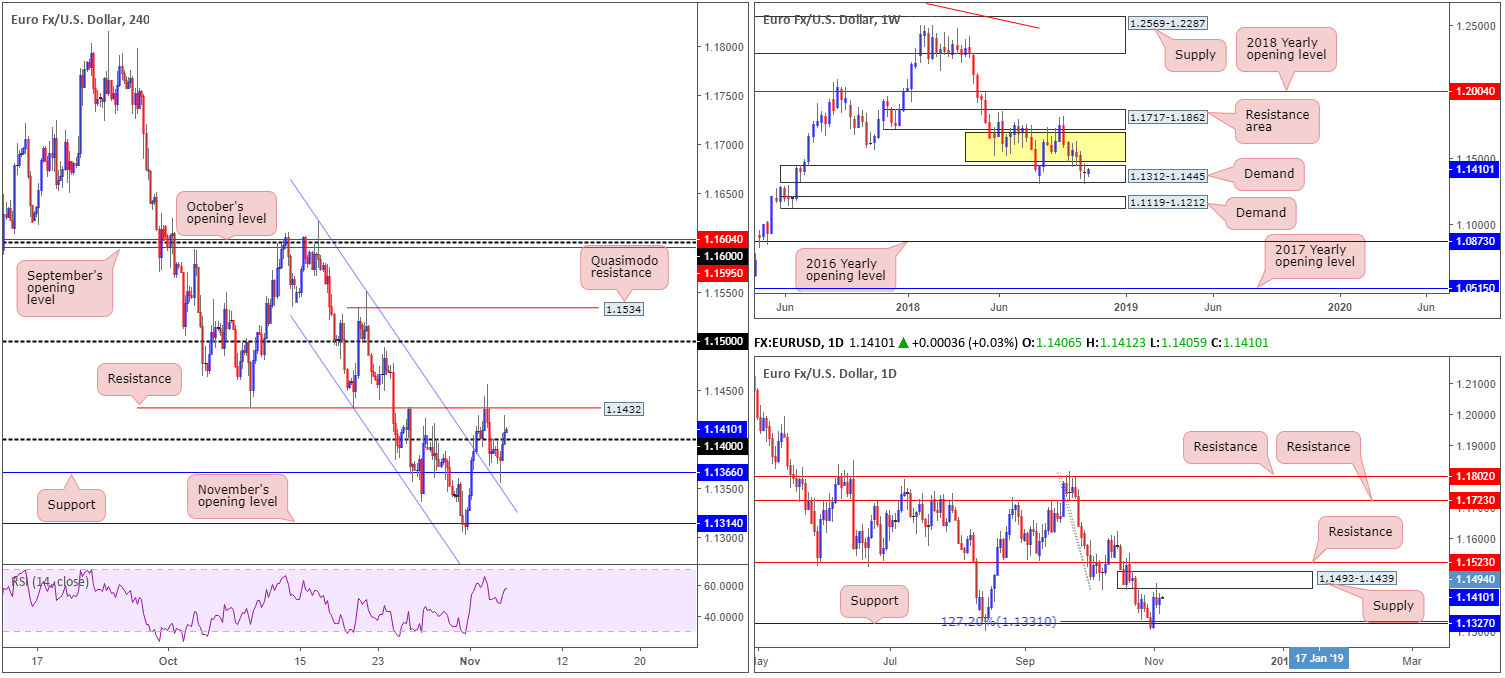

EUR/USD:

At the closing stages of Monday’s session, the single currency settled in positive territory, up 0.18% vs. its US counterpart. On the back of a fading USD across the board, the H4 candles reclaimed 1.14+ status during US hours, following a test of nearby support at 1.1366, which happens to converge closely with a channel resistance-turned support (extended from the high 1.1621). Further buying from here has resistance at 1.1432 on the radar, followed closely by the underside of daily supply drawn from 1.1493-1.1439.

Weekly price, as you can see, remains trading within the walls of demand seen at 1.1312-1.1445. Should buyers regain control from this point, price shows room to extend as far north as a resistance area coming in at 1.1717-1.1862 (capped upside since early June 2018). On the whole, this timeframe is considered range bound (yellow zone). Areas outside of this border fall in at the 2018 yearly opening level drawn from 1.2004 and demand marked at 1.1119-1.1212.

Areas of consideration:

The expectation on the H4 timeframe is still for another higher high to form, according to current market structure (price broke to fresh highs [1.1455] Friday, along with Monday witnessing a lower low take shape off H4 support at 1.1366). Therefore, a break of the current H4 resistance is possible. Well done to any of our readers who managed to enter long from 1.1366 as this was a noted intraday level to watch in Monday’s briefing.

Although we are effectively trading from weekly demand at the moment, it is worth noting the daily supply mentioned above at 1.1493-1.1439 could hinder further upside beyond the current H4 resistance level at 1.1432. For that reason, caution on the long side (medium/long term) is still recommended.

If you’re already long from 1.1366, holding the position until 1.1432/1.1439 is a high-probability play, according to the overall picture. Aside from this, though, neither a long nor short seems attractive at current price, given competing structures seen on the weekly and daily timeframes.

Today’s data points: US congressional elections.

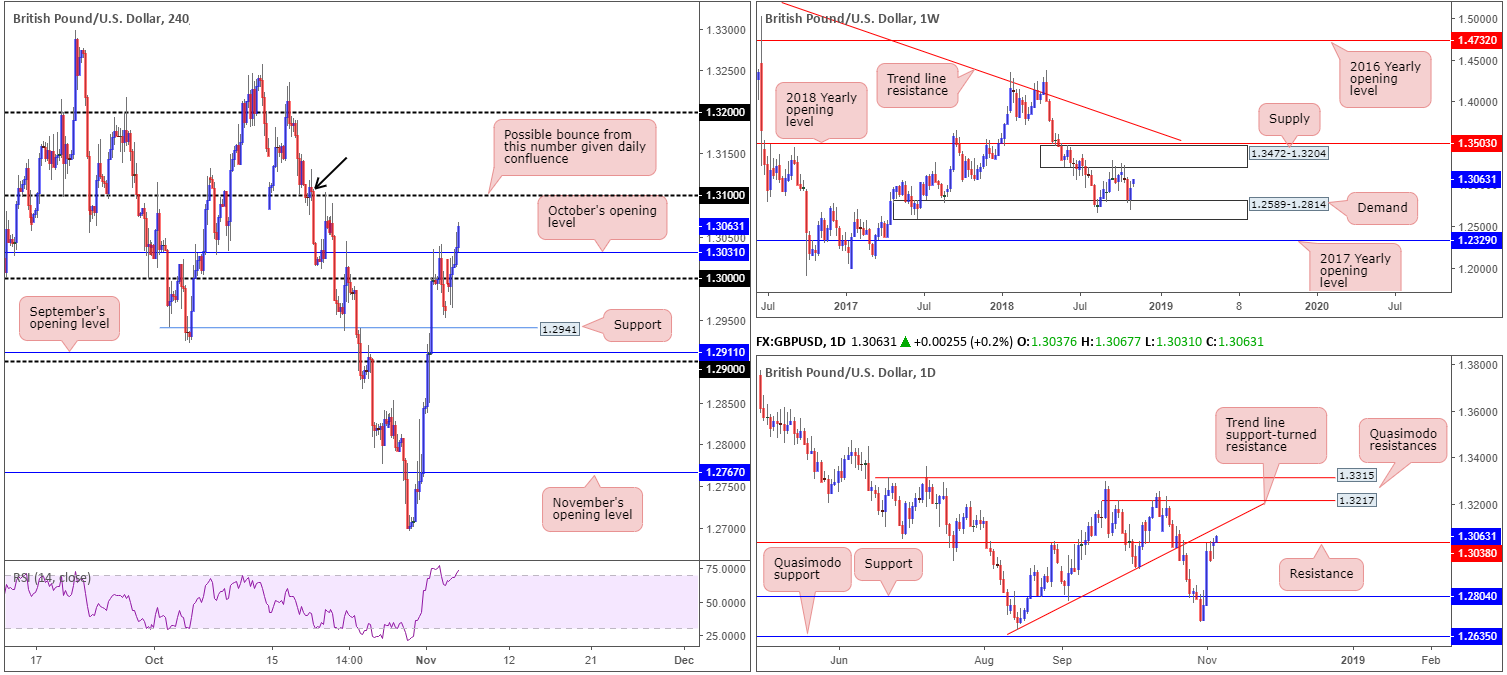

GBP/USD:

Despite below par UK service PMI data and reports the UK government has imposed a 1-week deadline to resolve the remaining key issues on Brexit with the EU, the GBP/USD ended Monday’s segment marginally on the front foot, up 0.11% (open/close).

Our technical reading shows H4 price is poised to extend recent gains and possibly grapple with its 1.31 handle. Note 1.31 not only displays a reasonably sound history, it’s also accompanied by a supply marked with a black arrow at 1.3131-1.3093 along with the RSI indicator testing its overbought value. What’s also notable from a technical perspective is daily structure. As we write, the unit is trading above resistance at 1.3038, potentially clearing the river north towards trend line support-turned resistance (taken from the low 1.2661) that merges closely with 1.31 on the H4 scale.

While 1.31 appears attractive for shorts according to H4 and daily structure, weekly price continues to sculpt a range between demand at 1.2589-1.2814 and a supply drawn from 1.3472-1.3204. Of late, the market tested the lower limit of this consolidation and responded in reasonably strong fashion. This places a question mark on 1.31 as a sell level since the weekly timeframe could be heading for the top edge of its range: supply at 1.3472-1.3204 – in other words the 1.32 handle!

Areas of consideration:

On account of the above, two possible scenarios are in the offing:

- A retest of October’s opening level at 1.3031 (H4) as support in the shape of a bullish candlestick configuration (entry/stop parameters can be defined by the candlestick structure), is, in view of the overall picture currently suggesting a move higher, worthy of consideration, with an upside target positioned at 1.31.

- Though weekly price suggests the pair may extend beyond 1.31, a bounce from this region is still promising in view of its surrounding confluence. To be on the safe side, however, waiting for additional candlestick confirmation to form is an option (entry/stop parameters can be defined by the candlestick structure). In terms of targets, the first port of call is October’s opening level at 1.3031, though price could turn higher before this barrier as weekly buyers are also in play (highlighted above). Therefore constant monitoring of the position is recommended.

Today’s data points: US congressional elections.

AUD/USD:

Amidst ongoing US-China trade uncertainty, along with the upcoming RBA rate statement and cash rate decision, the AUD/USD managed to reclaim 0.72 status Monday. Intraday, this move is likely considered a bullish sign for a push towards October’s opening level seen at 0.7229.

While further upside is certainly conceivable, at least from an intraday perspective, traders may want to note the market’s position on the bigger picture. Weekly action, after pushing aggressively to highs of 0.7258 last week, remains flirting with its 2017 yearly opening level at 0.7199: a possible resistance. As for daily price, supply coming in at 0.7241-0.7205 is still in play despite suffering a whipsaw in the form of a bearish pin-bar pattern. A push lower this week will likely bring support at 0.7151 into view that merges nicely with channel resistance-turned support (extended from the high 0.8135).

Areas of consideration:

With both weekly and daily timeframes portending a move lower (in terms of structure that is), the spotlight remains focused on shorts.

Ultimately, traders should be looking for a decisive break of 0.72 to the downside. This – coupled with a retest in the form of a H4 bearish candlestick pattern – would likely be enough to draw in sellers and push for daily support at 0.7151/H4 support at 0.7145 as the initial port of call. Do bear in mind, further selling is possible beyond this region towards the weekly Quasimodo support at 0.7016 (the next downside target on this scale).

Today’s data points: RBA rate statement and cash rate decision; US congressional elections.

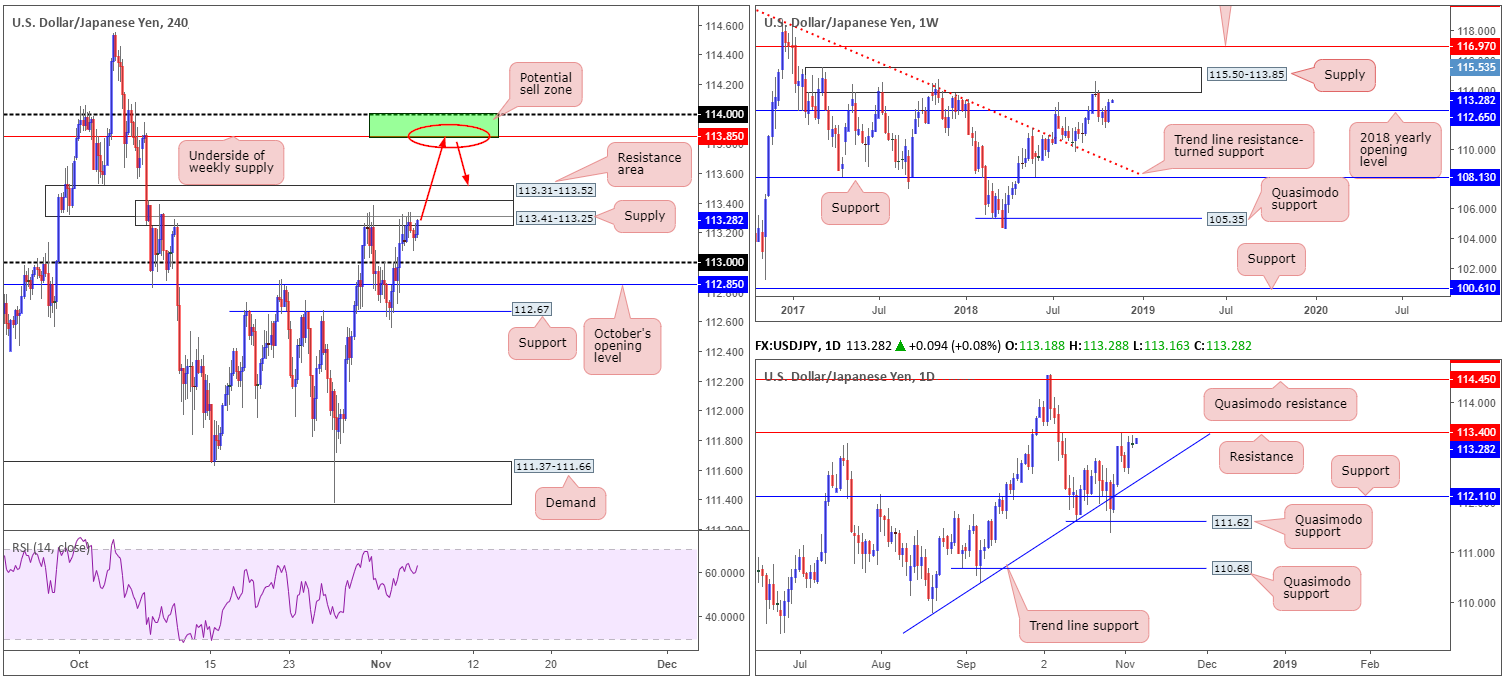

USD/JPY:

Coming from the top this morning, weekly movement recently overthrew its 2018 yearly opening level at 112.65 in strong fashion, leaving the pathway clear to challenge nearby supply at 115.50-113.85. Note this supply has incredibly strong history.

The key observation on the daily timeframe is resistance at 113.40. A break of this level has a reasonably clear run towards Quasimodo resistance at 114.45, whereas a rejection could target trend line support (etched from the low 109.77).

In terms of Monday’s action on the H4 scale, the market witnessed subdued price movement around the underside of a resistance area at 113.31-113.52/supply area at 113.41-113.25, ending the session unchanged (+0.03%). Given these H4 zones house daily resistance at 113.40, weekly buyers likely have their work cut out for them should they wish to challenge weekly supply at 115.50-113.85.

Areas of consideration:

In effect, we have weekly price indicating a move north may be on the cards, while both H4 and daily structure suggest a move lower. At current price, this makes it difficult to decipher direction.

In view of this, the only area that stands out this morning is the H4 green zone marked between the underside of weekly supply at 113.85 and the round number 114 for potential shorts. A H4 bearish candlestick pattern printed from within here is a high-probability short in terms of the overall market picture (entry/stop parameters can be defined by the candlestick structure). Granted, to reach this area, daily resistance at 113.40 will have to be taken out, though do keep in mind weekly action generally takes precedence over daily flow.

Today’s data points: US congressional elections.

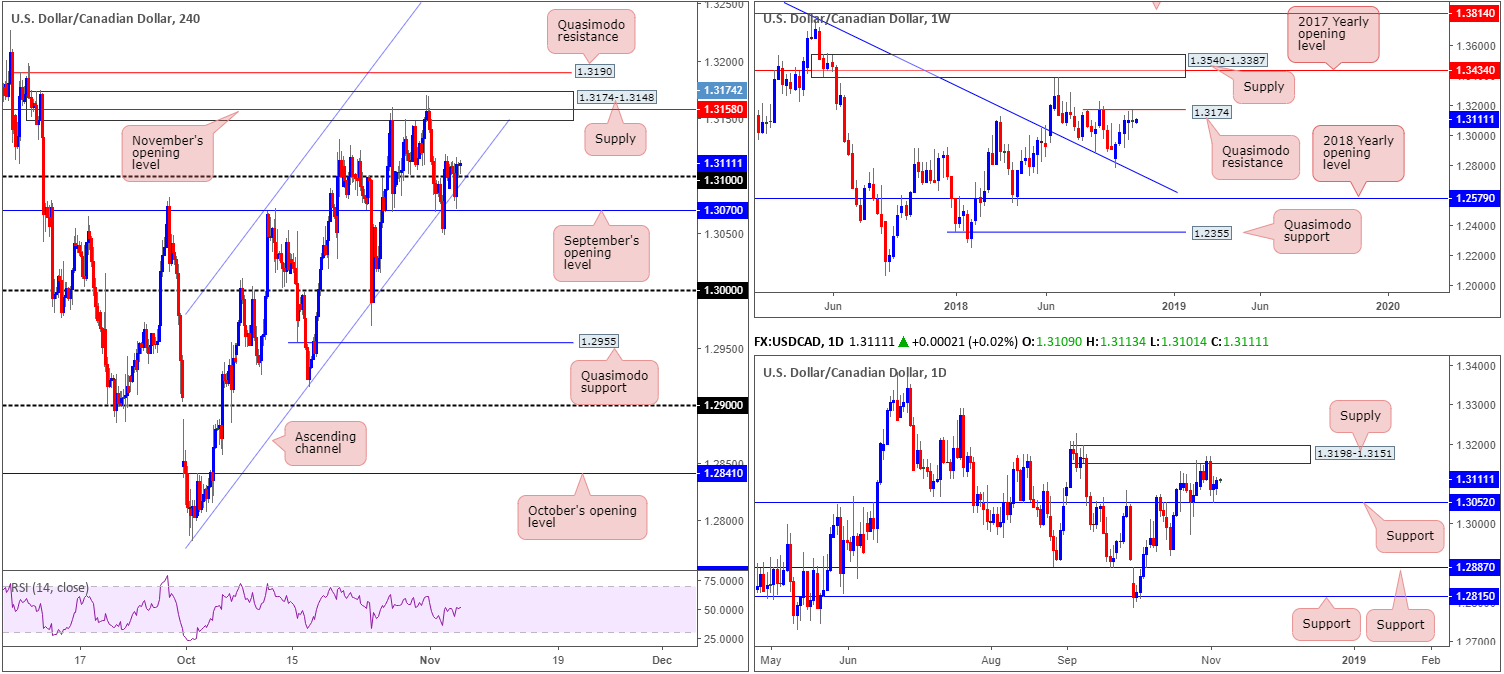

USD/CAD:

Price action employed a mellow tone Monday as the unit circulated above its 1.31 handle. Bolstered by nearby channel support on the H4 timeframe (extended from the low 1.2782) and September’s opening level at 1.3070, the USD/CAD concluded the day mildly in positive territory, up 0.15%. Overhead, traders are likely honing in on November’s opening level at 1.3158, which happens to be encased within supply at 1.3174-1.3148, shadowed closely by a Quasimodo resistance level at 1.3190.

Higher up on the curve, weekly price is seen meandering beneath Quasimodo resistance plotted at 1.3174. Daily flow, on the other hand, is sandwiched between supply drawn from 1.3198-1.3151 and support coming in at 1.3052.

Areas of consideration:

The H4 supply zone mentioned above at 1.3174-1.3148 and its neighbouring H4 Quasimodo resistance at 1.3190 are open for possible shorting opportunities today. Not only do we have a weekly Quasimodo resistance at 1.3174 intersecting with the top edge of the H4 supply, there’s also daily supply at 1.3198-1.3151 in view as well (see above).

Irrespective of whether one selects the H4 supply to sell or the H4 Quasimodo, stop-loss order placement above the daily supply edge (1.3198) is a feasible option, though do try to include the 1.32 handle here as well. In terms of take-profit targets, the 1.31 handle is (without seeing the approach) a logical first step.

Today’s data points: US congressional elections.

USD/CHF:

Kicking off with a look over weekly structure, price is seen trading marginally above its 2016 yearly opening level at 1.0029. Note this level boasts incredibly strong history. In 2017 the base held price lower on two occasions and twice already in 2018. Therefore, a move lower from here should not come as much of a surprise.

In terms of where we stand on the daily timeframe, the candles are consolidating between supply at 1.0107-1.0060 and support drawn from 0.9986. Outside of this area, we have Quasimodo resistance positioned at 1.0140 (not visible on the screen) and a support area coming in at 0.9866-0.9830.

A closer look at price action on the H4 timeframe shows parity (1.0000), along with a nearby trend line support surfacing below it (extended from the low 0.9920), entered the fight Friday. Monday’s action, as you can see, though, spent the session hovering just south of November’s opening level at 1.0081. This is likely due to sellers entering the market from daily supply mentioned above at 1.0107-1.0060.

Areas of consideration:

With direction yet to be made clear on the weekly timeframe, and daily action trading from supply, searching for shorting opportunities in this market is an option. The area shaded in green on the H4 timeframe, made up of November’s opening level at 1.0081 and the round number 1.0100, is a zone of interest.

Should H4 action test 1.0100/1.0081, traders have the choice of either entering at market and locating stop-loss orders above daily supply (1.0107), or simply waiting for additional bearish candlestick confirmation before pulling the trigger (entry/stop parameters can be defined by the candlestick structure). As for take-profit targets, 1.0000 appears a logical first base, followed by daily support highlighted above at 0.9986.

Today’s data points: US congressional elections.

Dow Jones Industrial Average:

After firmly taking out a strong area of supply (green zone – black arrow) around the 25522ish region, the H4 candles pulled back and successfully tested November’s opening level at 25095/38.2% H4 Fib support at 25056 during Monday’s session. According to basic market structure, a higher high formation should follow, potentially reaching as far north as resistance plotted at 25815.

25815 is an interesting level given the barrier is located within the lower limits of a weekly resistance zone at 25764-26157. As you can imagine, this adds considerable weight to the H4 base as a viable sell zone.

Areas of consideration:

For those who managed to enter long from November’s opening level at 25095, great work!

The H4 resistance at 25815 is a key level in today’s report. In view of its connection to higher-timeframe structure, a short from here is high probability. To help avoid the possibility of a fakeout, though, waiting for additional candlestick confirmation may be something to consider. Not only will this display bearish intent, it’ll also define entry/stop parameters, as well.

Without seeing the approach, the logical take-profit target from 25815 rests around November’s opening level at 25095. Though this may very well change depending on how price action trades toward 25815.

Today’s data points: US congressional elections.

XAU/USD (Gold):

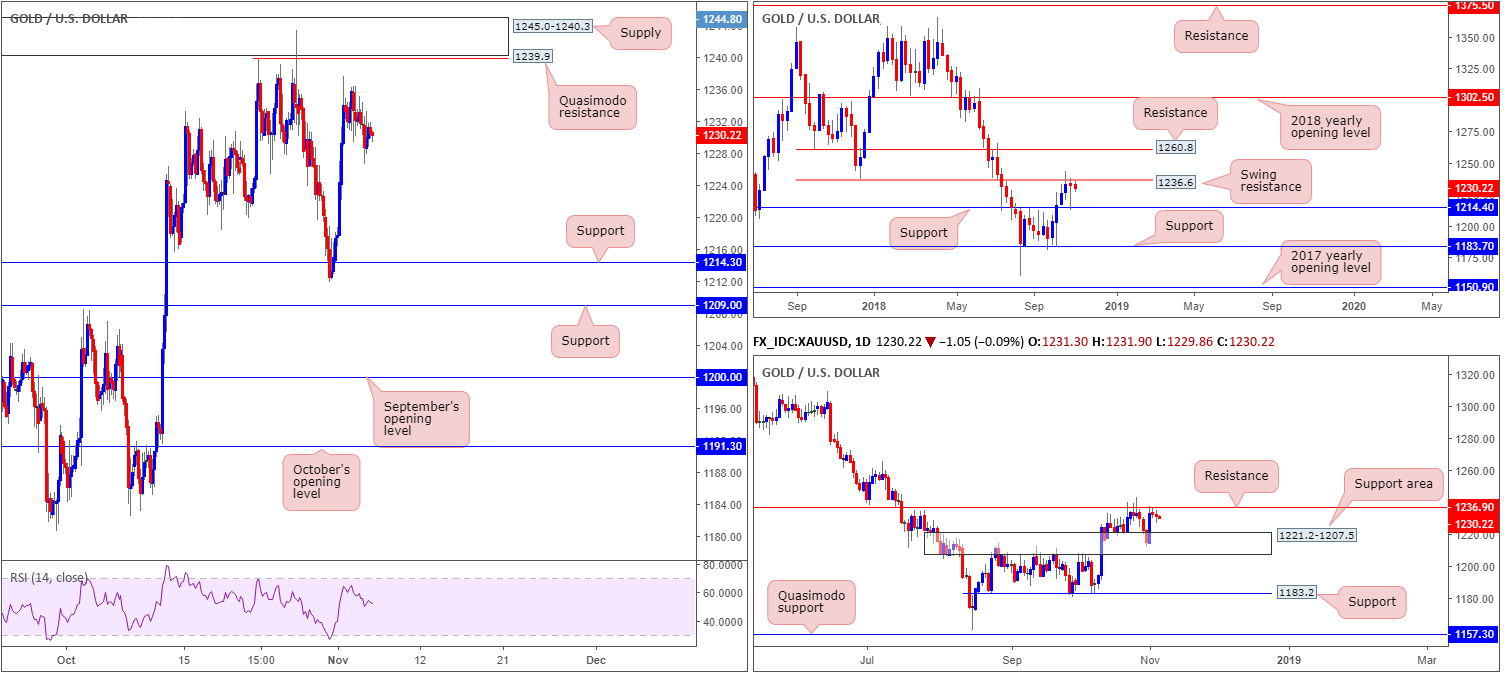

Longer term, the price of gold is sandwiched between swing resistance at 1236.6 and support at 1214.4. Outside of this border, resistance at 1260.8 is in view, and support coming in at 1183.7.

A similar scenario is present on the daily timeframe. The yellow metal is seen consolidating between a support area at 1221.2-1207.5 (weekly support resides within this area) and resistance at 1236.9 (positioned a few pips above the weekly swing resistance level).

On the H4 timeframe, our technical studies show the candles trading just south of a Quasimodo resistance level at 1239.9, followed closely by supply at 1245.0-1240.3. Note these two areas converge closely with daily resistance at 1236.9 and the weekly swing resistance at 1236.6.

Areas of consideration:

With hefty resistance observed on the higher timeframes around the 1236ish neighbourhood, selling from the noted H4 zones is certainly something to consider, targeting the top edge of the daily support area at 1221.2 as the initial port of call.

Entry without additional candlestick confirmation will likely entail the traders entering short from 1239.9 and positioning stops above 1245.0. For conservative traders looking for a confirmed entry, waiting for a H4 bearish candlestick structure to form not only helps display bearish intent, it’ll also define entry/stop parameters, as well.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.