Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

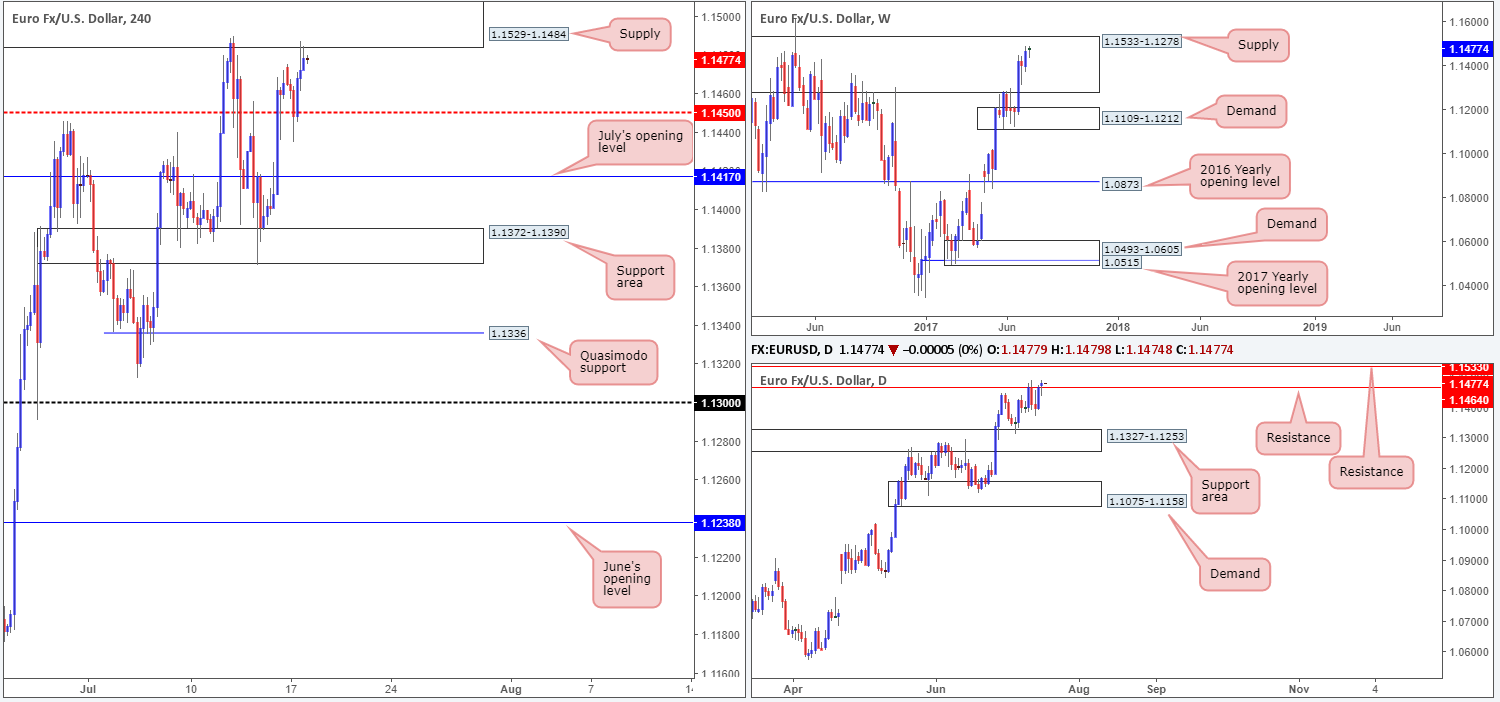

EUR/USD:

Following a somewhat aggressive whipsaw of the H4 mid-level support at 1.1450 amid yesterday’s London open, the single currency is now seen challenging the H4 supply penciled in at 1.1529-1.1484. In Monday’s report, the desk highlighted that this supply zone remains of interest, but would only be labeled a valid sell zone should additional confirmation be seen in the shape of a full, or near-full-bodied bearish H4 candle.

The reasoning behind selecting this supply zone as a potential base to sell from is largely due to the area being positioned within a major weekly supply drawn from 1.1533-1.1278. We also liked the fact that daily price was initially being held lower by a resistance line at 1.1464. However, given yesterday’s candle closed beyond this barrier, this is certainly a concern now since this could, technically speaking, force the unit up to 1.1533: another daily resistance which happens to denote the top edge of the said weekly supply area.

Our suggestions: Despite the recent close above daily resistance, our team still has faith in the current H4 supply. Still, as we mentioned above, we require H4 candle confirmation in the shape of a full, or near-full-bodied bearish candle, before pulling the trigger.

In the event that this trade comes to fruition, we will be looking for price to engulf 1.1450. This will be our cue to reduce risk to breakeven and watch for the candles to shake hands with July’s opening level at 1.1417 to take partial profits.

Data points to consider: German ZEW economic sentiment at 10am GMT+1.

- Buys: Flat (stop loss: N/A).

- Sells: 1.1529-1.1484 ([waiting for a H4 bearish candle – preferably in the form of a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

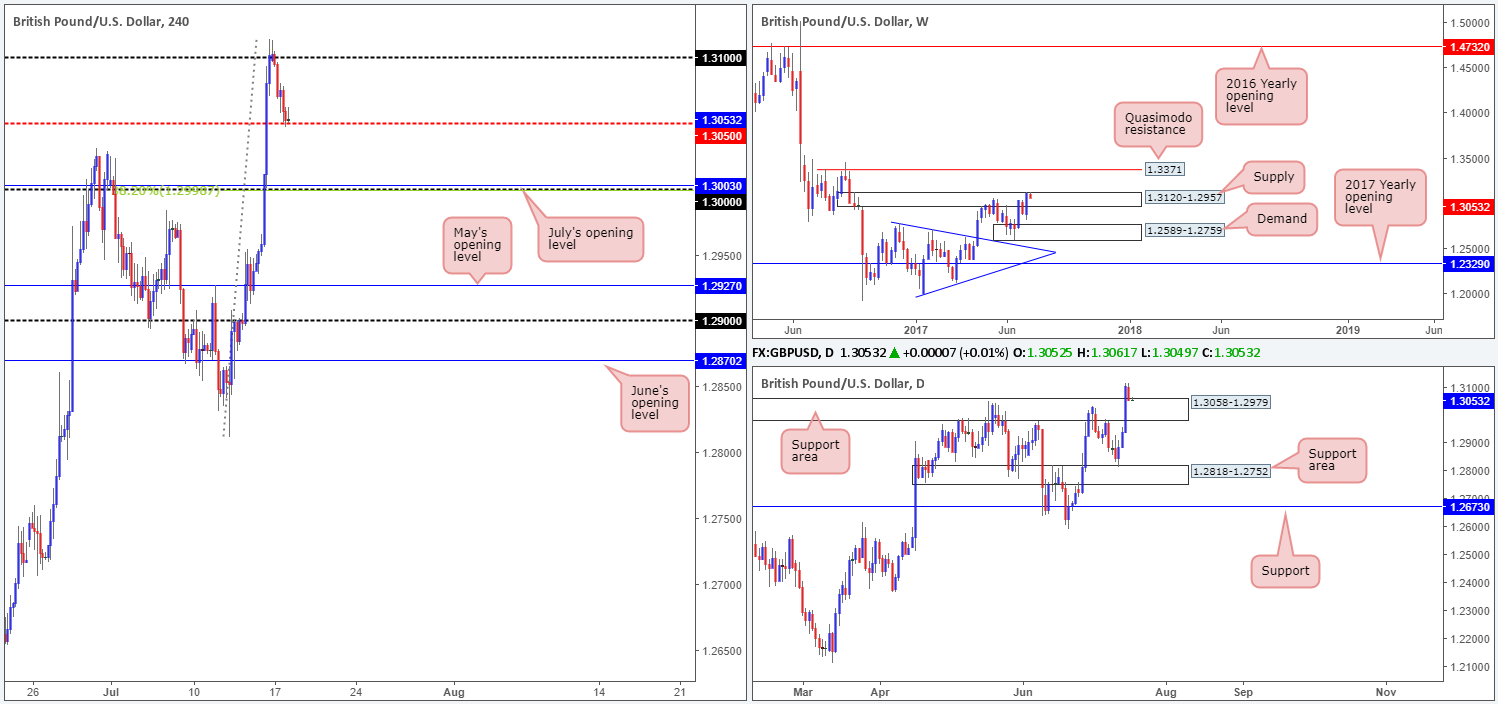

GBP/USD:

In recent trading, the GBP/USD slammed on the brakes and reversed from the 1.31 handle, dragging the pair back down to a mid-level support at 1.3050. With 1.3050 seen supported by the top edge of a daily support area at 1.3058-1.2979, there’s a chance that we could see this level hold firm. Then again, one has to take into account where weekly price is currently trading from: deep within the walls of a supply zone registered at 1.3120-1.2957.

Below 1.3050, however, we have the large psychological level 1.30 on the radar. Not only is this likely to be a watched number by the majority of the market, we can also see that it fuses beautifully with July’s opening level at 1.3003, a H4 38.2% Fib support drawn from the swing low at 1.2811 and is also sited nicely within the aforesaid daily support area.

Our suggestions: With 1.3050 so far not registering much bullish activity, our attention is more drawn to the 1.30 level. A long from this number, of course, still carries risk due to where weekly price is trading from. However, we feel with the H4 confluence surrounding 1.30 and the fact that this line is fixed within a daily support area, a bounce, at the very least, is expected to be seen from here.

To be on the safe side though, our team will not commit UNTIL we have pinned down additional confirmation from the lower-timeframe candles (see the top of this report), as our first take-profit target is likely to be 1.31.

Data points to consider: UK inflation data at 9.30am, BoE Gov. Carney speaks at 2.30pm GMT +1.

Levels to watch/live orders:

- Buys: 1.30 region ([waiting for lower-timeframe confirmation to form is advised] stop loss: dependent on where one confirms this level).

- Sells: Flat (stop loss: N/A).

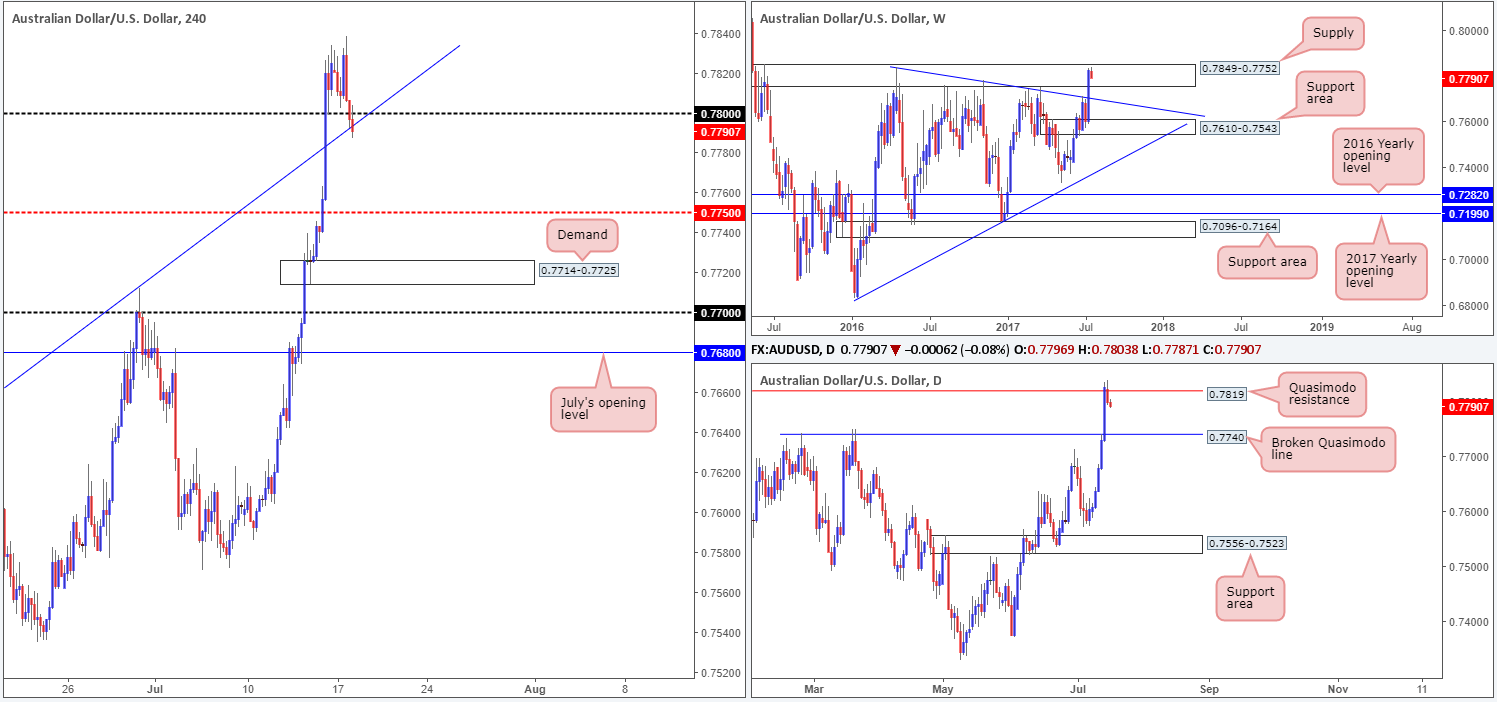

AUD/USD:

A strong session for the commodity currency last week resulted in weekly price aggressively challenging the supply zone seen at 0.7849-0.7752. In spite of this, the sellers are beginning to make an appearance here, which could potentially bring the market down to retest the trendline support extended from the high 0.7835. In conjunction with weekly flow, daily action recently crossed swords with a Quasimodo resistance at 0.7819 and has so far held firm. The next downside target on this scale can be seen at 0.7740: a broken Quasimodo line.

Adding to the current bearish tone, we have seen the H4 price cross below the 0.78 handle and breach a trendline support etched from the high 0.7635. Technically speaking, this could lead to a move being seen down to the H4 mid-level support at 0.7750, and possibly even the H4 demand at 0.7714-0.7725.

Our suggestions: With all three timeframes expressing bearish intent, the approach our desk has selected is to wait and see if H4 price can CLOSE below the current H4 trendline support and then see if the unit can retest 0.78 before reaching 0.7750. This – coupled with a reasonably sized H4 bear candle, preferably a full, or near-full-bodied bearish candle, would be enough evidence to sell this market, targeting 0.7750 as an initial take-profit zone.

Data points to consider: Australian Monetary policy meeting minutes at 2.30am GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf the current H4 trendline support and then look to trade any retest seen at 0.78 thereafter ([waiting for a H4 bearish candle – preferably in the form of a full, or near-full-bodied candle – to form following the retest is advised] stop loss: ideally beyond the candle’s wick).

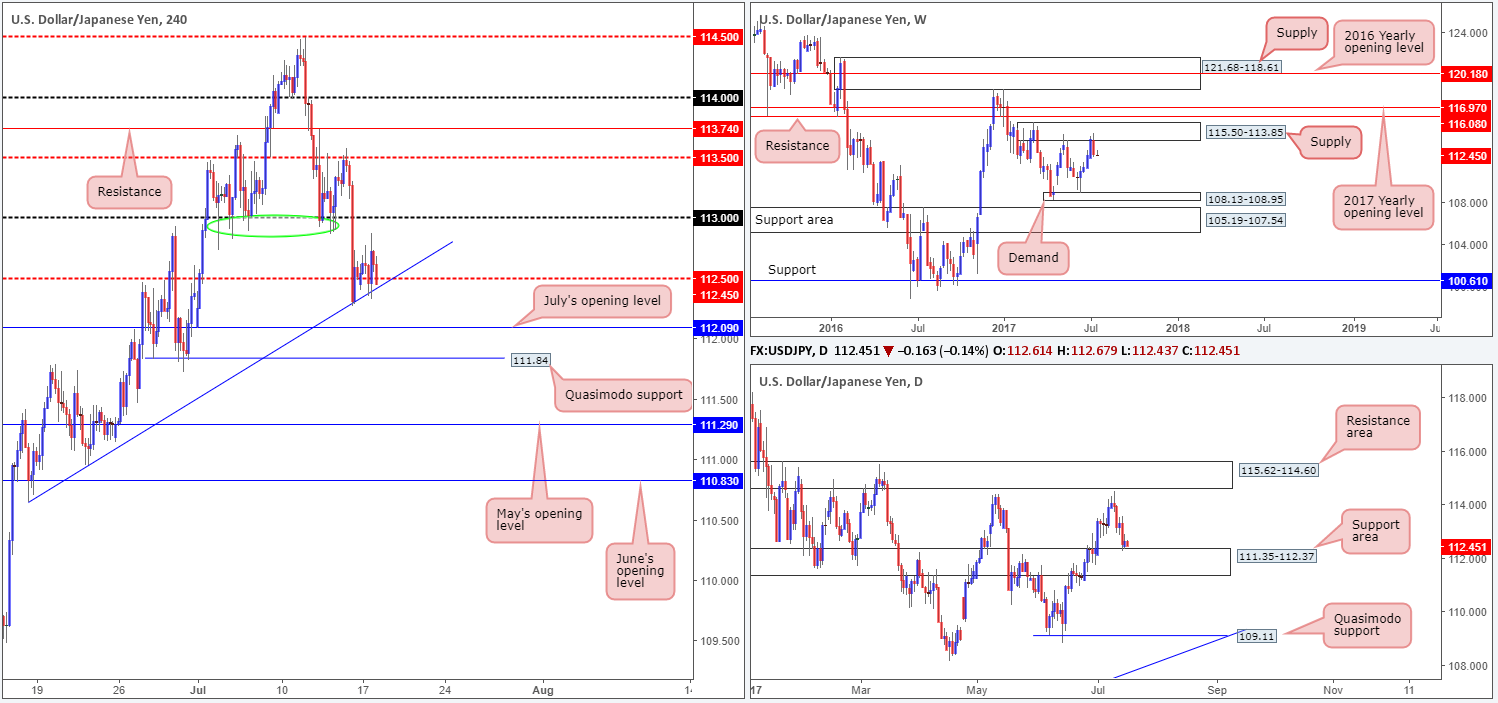

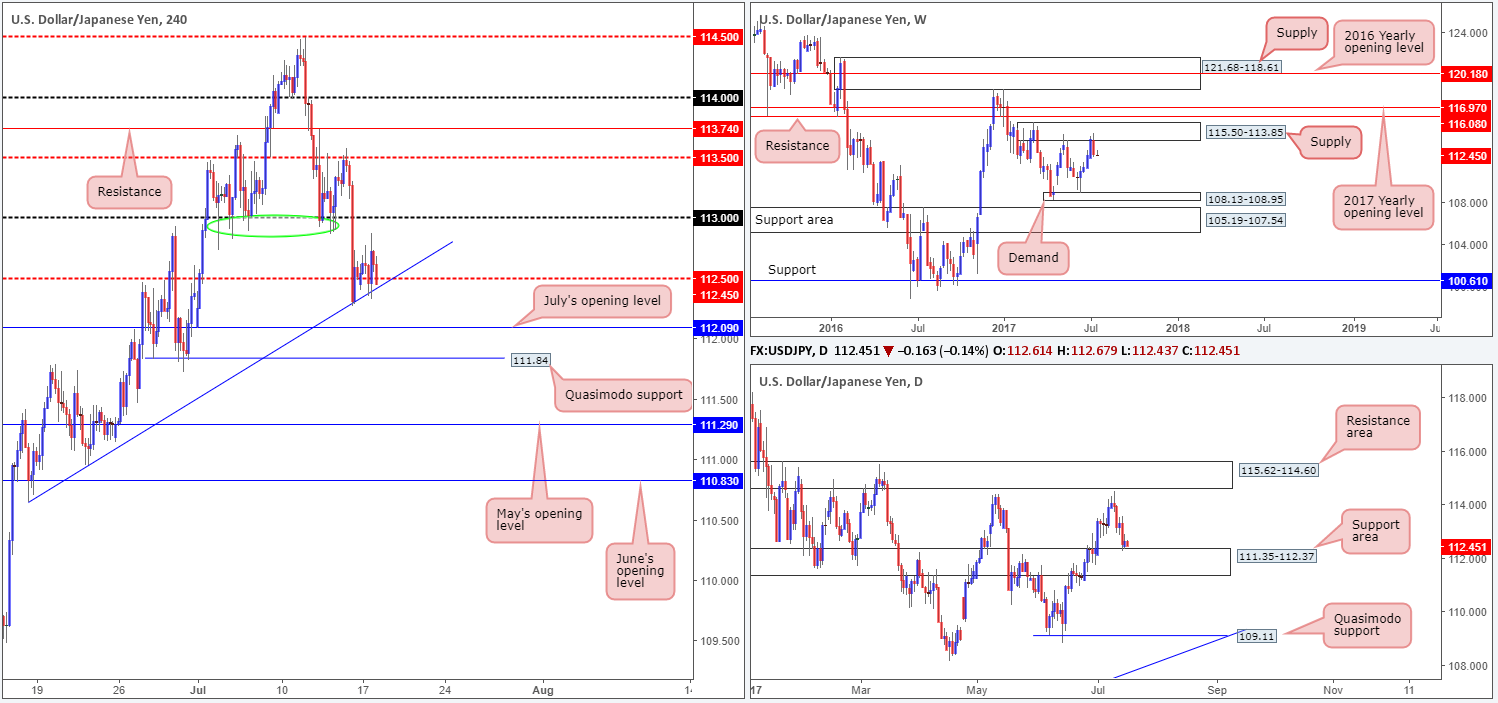

USD/JPY:

Monday’s session, as you can see, took on more of a sober tone in comparison to Friday’s selloff. H4 price remains afloat above the mid-level support at 112.50, which boasts additional support from a H4 trendline taken from the low 110.64 and the top edge of a daily support area at 111.35-112.37.

Given the somewhat lackluster performance yesterday, much of the following report will echo thoughts put forward in Monday’s analysis…

Our suggestions: Buying from 112.50 seems a logical idea if one dismisses the weekly timeframe. The next target from 112.50 is likely to be the 113 band given how well it served as support since the beginning of the month (see the green circle).

While it is tempting to pull the trigger and buy from 112.50, our team is still reluctant to commit, due to weekly price trading from supply at 115.50-113.85. In regard to selling this market, we’re also very hesitant. This is largely because of the current daily support area/H4 mid-level support in motion right now, and how restricted H4 structure is seen below 112.50: July’s opening level at 112.09, followed closely by the Quasimodo support level at 111.84.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

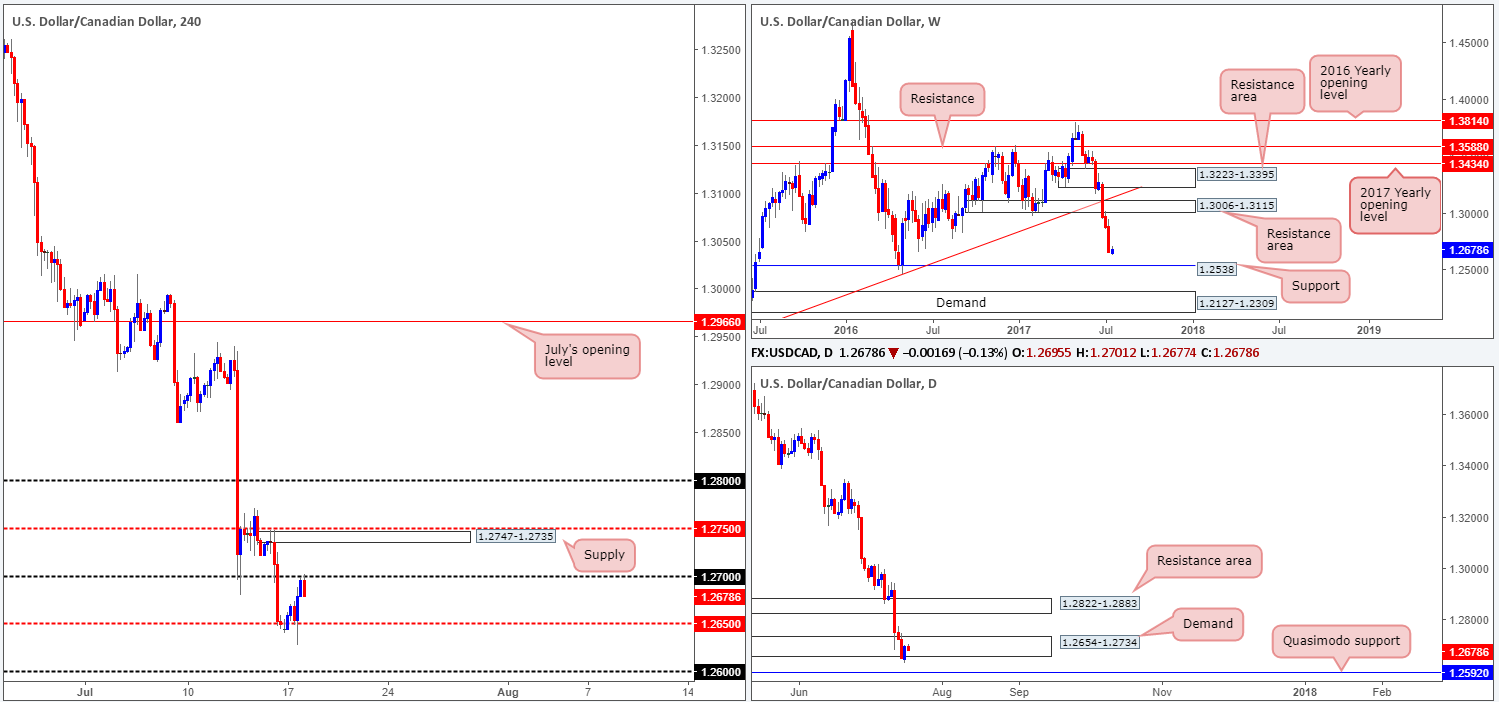

USD/CAD:

After a brief spell beneath daily demand at 1.2654-1.2734, the bulls kicked into action yesterday and ended the day on a somewhat positive note. Be that as it may, as the weekly candles clearly point out, the next area of support does not come into view until we reach 1.2538, thus the odds of further selling being seen this week, in our opinion, is relatively high.

Recently however, the H4 timeframe shows price bounced from 1.27, following a move up from the mid-level support base at 1.2650. We believe that should the current H4 candle close as is, this could be a reasonable location to sell from. Why we believe this to be the case is as follows:

- Daily buyers are likely weakened within the current demand due to the recent breach.

- Weekly price shows little support on the horizon.

- The next downside target on the H4 timeframe, apart from 1.2650, would be the 1.26 handle which is closely positioned to a daily Quasimodo support at 1.2592 (the next downside target beyond the current daily demand).

Our suggestions: A full-bodied H4 bear candle printed off of 1.27 would, in our view, be enough to validate a short entry in this market, with an overall take-profit target set at 1.26.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Sell on the close of the current H4 candle should it close at its lows (stop loss: 1.2703).

USD/CHF:

Since the 5th May, the H4 candles have been consolidating between 0.97/0.9680 (round number/June’s opening level – blue zone) and the 0.96 handle. Of late, however, price has crossed below the 0.96 handle and looks poised to challenge July’s opening level at 0.9580. What’s also noteworthy about this level is that it sits on top of a support area marked in green comprised of a daily support at 0.9546 and the weekly support at 0.9581.

As we have highlighted in numerous reports, this green area is somewhere our team has already bought from in the past and will likely do so again, if a H4 candle action forms a full, or near-full-bodied candle.

Our suggestions: Basically, our team is going to be closely watching 0.9546/0.9581 for potential longs today. Should this trade come to realization we’ll be looking for price to close above 0.96. This will, for us at least, be our cue to reduce risk to breakeven and begin trailing the market up to the 0.9680 region: June’s opening level.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: 0.9546/0.9581 ([waiting for a H4 bull candle – preferably a full, or near full-bodied candle – to form is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (Stop loss: N/A).

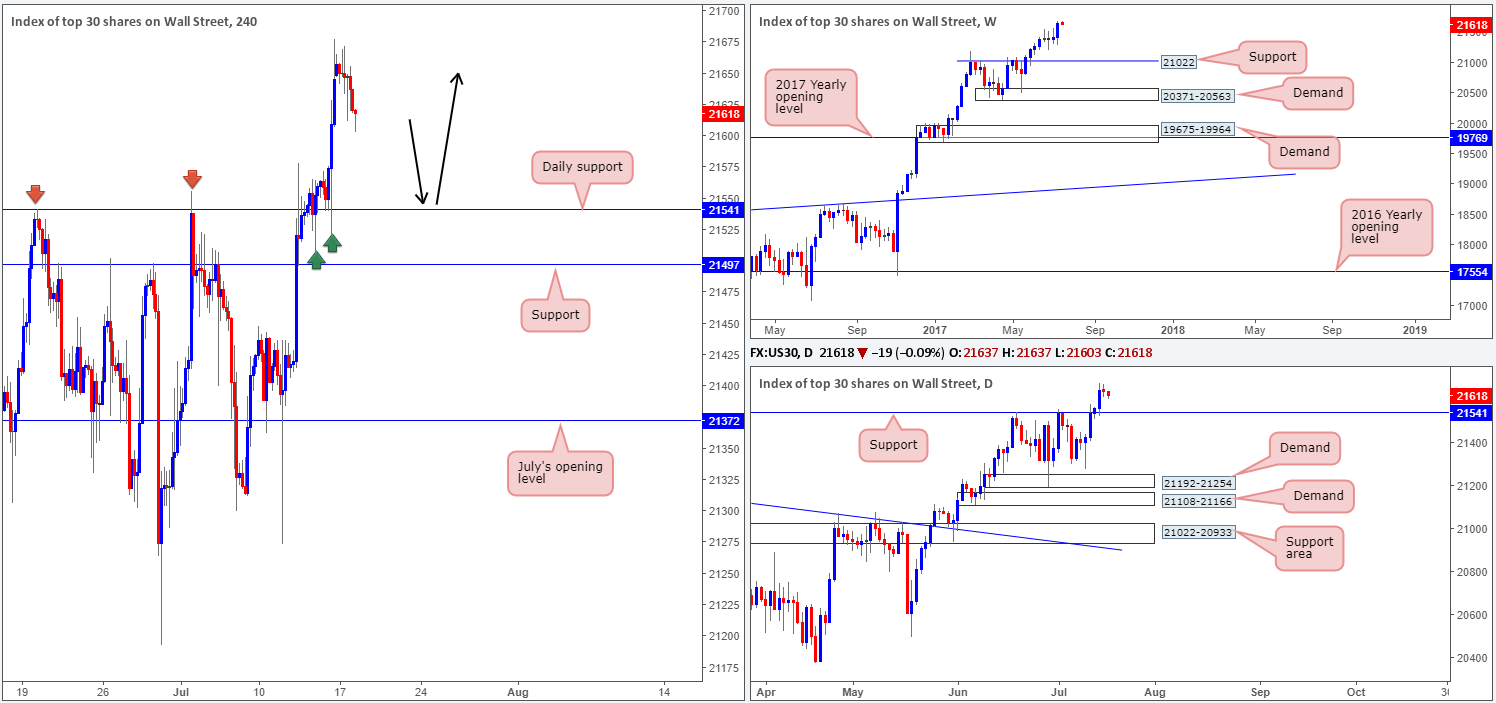

DOW 30:

Following a strong move north on Friday, US equity prices have begun to pull back from a record high of 21677. Now, as far as we’re concerned, the next downside support target in view is the daily support marked at 21541. This level, as signified by the green/red arrows, is a level of significance given how it has responded over the past month. So, therefore, our desk remains watchful of this daily level for potential longs today.

Our suggestions: A H4 retest of 21541 – coupled with a reasonably sized H4 bull candle, preferably a full, or near-full-bodied candle, would be enough evidence for us to confirm a long position as valid. In regard to take-profit targets, at this point we are quite open as we have yet to see what structure forms on approach to this number. Overall though, we do want to try and trail this market in an attempt to join the current uptrend.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: 21541 ([waiting for a H4 bull candle – preferably a full, or near full-bodied candle – to form is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

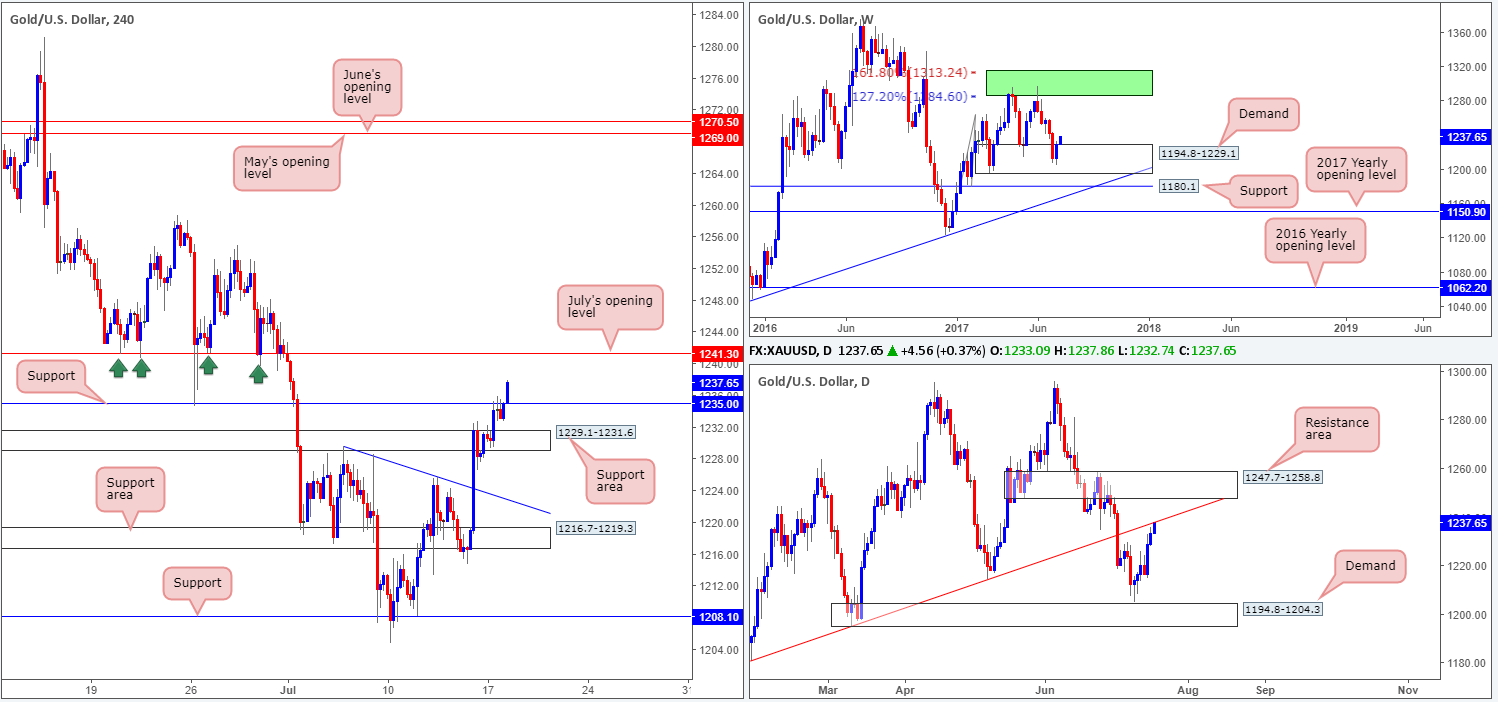

GOLD:

Kicking this morning’s analysis off with a look at the weekly timeframe shows that the buyers are gathering momentum from demand at 1194.8-1229.1. While this may be encouraging for potential buyers, it might be worth noting that daily price is currently seen touching gloves with a trendline resistance extended from the low 1180.4.

Over on the H4 candles, the market looks poised to challenge July’s opening level seen nearby at 1241.3. In view of how well July’s opening level held as support back in June (see green arrows), and considering that it’s positioned nearby the aforementioned daily trendline resistance, we feel price will very likely respond from this angle.

Our suggestions: Shorting from 1241.3, nonetheless, is still a very chancy trade given where weekly price is trading from right now. To confirm bearish intent at the noted H4 level, we would strongly recommend waiting for the lower-timeframe candles to show signs that the bears have interest in this level (see the top of this report).

Ultimately, if this trade comes to fruition we would keep a close eye on the H4 support at 1235.0. Any signs of bullish strength from here would likely force us to cut the trade short, since getting caught on the wrong side of weekly flow will not do your account any favors!

- Buys: Flat (stop loss: N/A).

- Sells: 1241.3 region ([waiting for lower-timeframe confirmation to form is advised] stop loss: dependent on where one confirms this level).