Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

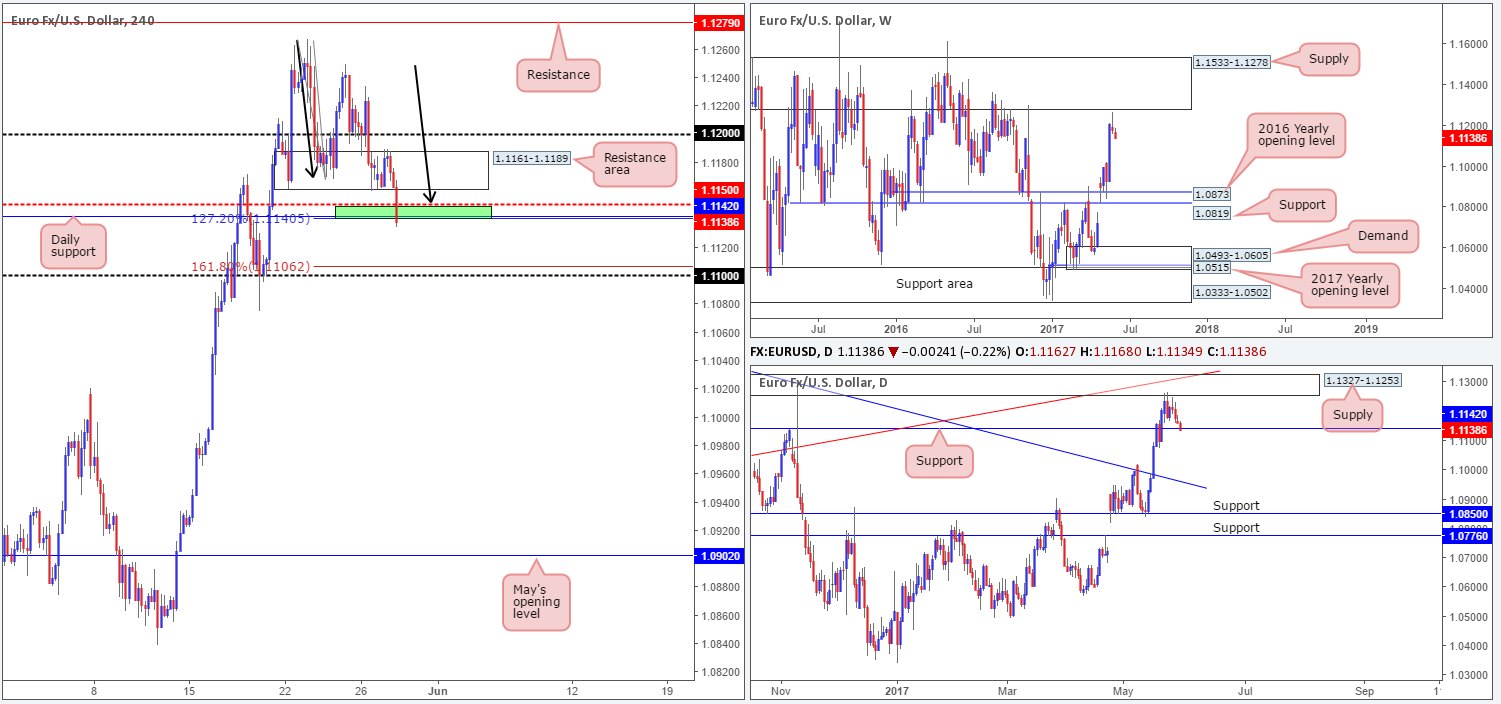

EUR/USD:

In recent hours, the single currency has come under pressure. Without citing sources, there’s speculation around the Greek government preparing to possibly go without the next bailout payment if creditors cannot agree on debt relief. The move, as you can see, forced price beyond our H4 buy zone at 1.1142/1.1150 and has, at the time of writing, clocked a low of 1.1135. The reasons for selecting this area were as follows:

- H4 mid-level support at 1.1150.

- H4 AB=CD (see black arrows) 127.2% Fib ext. at 1.1140 taken from the high 1.1268.

- Daily support at 1.1142.

From a technical perspective, the weekly candles indicate that further downside could be on the cards since price is seen trading nearby a formidable supply area coming in at 1.1533-1.1278. What’s also interesting is the recently formed weekly selling wick, also known as a bearish pin bar. In the event that the bears continue to push lower this week, the next downside target can be seen at 1.0873: the 2016 yearly opening line. Down on the daily chart, however, the unit is seen crossing swords with support drawn from 1.1142. This forms part of our H4 buy zone mentioned above.

Our suggestions: Although price has surpassed the aforementioned H4 buy zone, there’s still a possibility that it may hold firm and challenge the underside of the recently broken H4 demand at 1.1161-1.1189 as resistance. Personally, we’re not fond of the recent move down, since a truckload of stops have likely been triggered beneath 1.1142 on the Greece rumors. With that being the case, our team will remain on the sidelines for the time being and reassess market structure going into tomorrow’s open.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

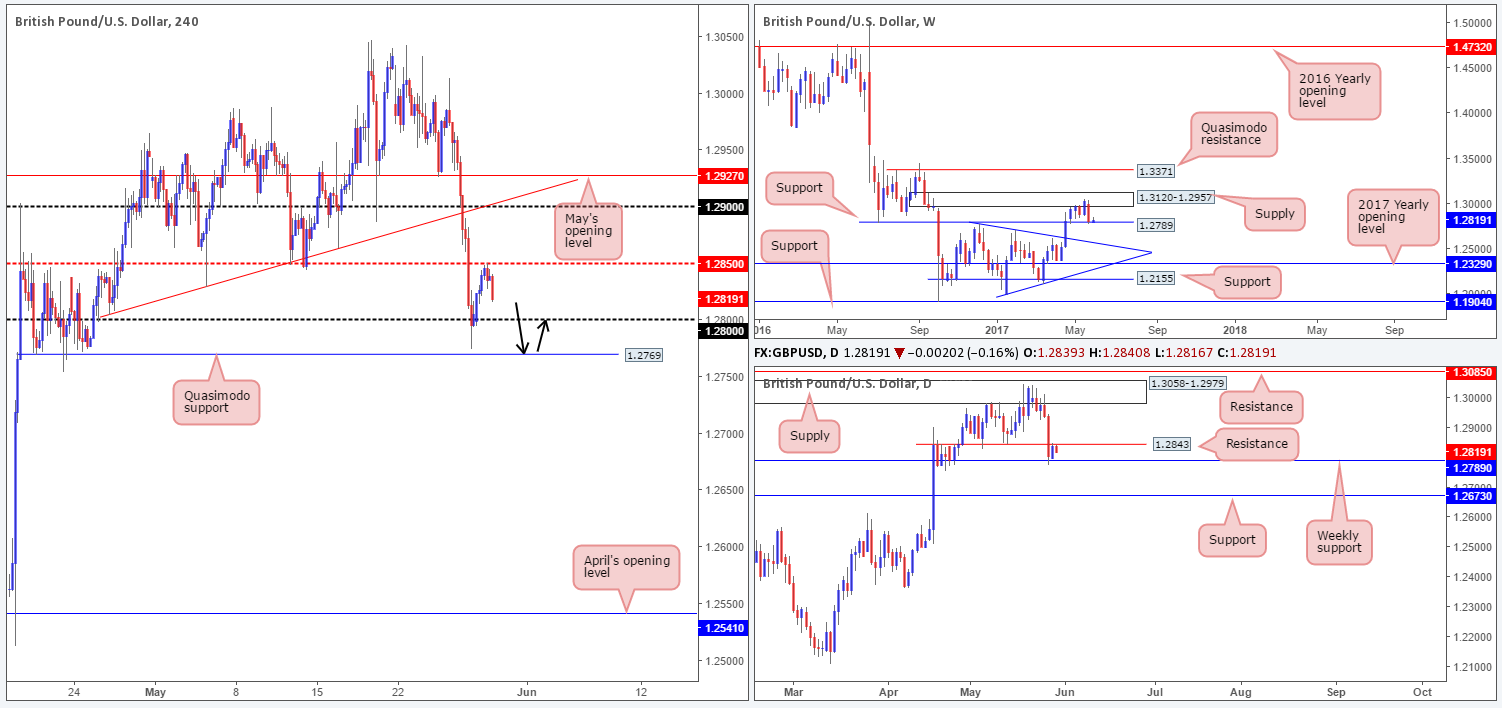

GBP/USD:

Recent action shows that the GBP/USD extended Friday’s bounce from 1.2775 up to the H4 mid-level resistance coming in at 1.2850, which happens to coincide nicely with a daily resistance line at 1.2843. With bids likely weakened around the 1.28 handle the next level on our radar, assuming that this market continues to selloff, is the H4 Quasimodo support at 1.2769.

The stops taken from 1.28 would likely provide enough liquidity for the big boys to begin buying this market at 1.2769. What’s more, let’s remember that we are also trading from a weekly support at 1.2789! Therefore, there is a good chance price will bounce from 1.2769 and at least reach 1.28.

Our suggestions: Based on the above points, our desk believes the aforementioned H4 Quasimodo support level is stable enough to consider a buy trade from, with a stop-loss order placed below the pattern’s apex at 1.2748.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: 1.2769 region ([possible pending order] stop loss: 1.2748).

- Sells: Flat (stop loss: N/A).

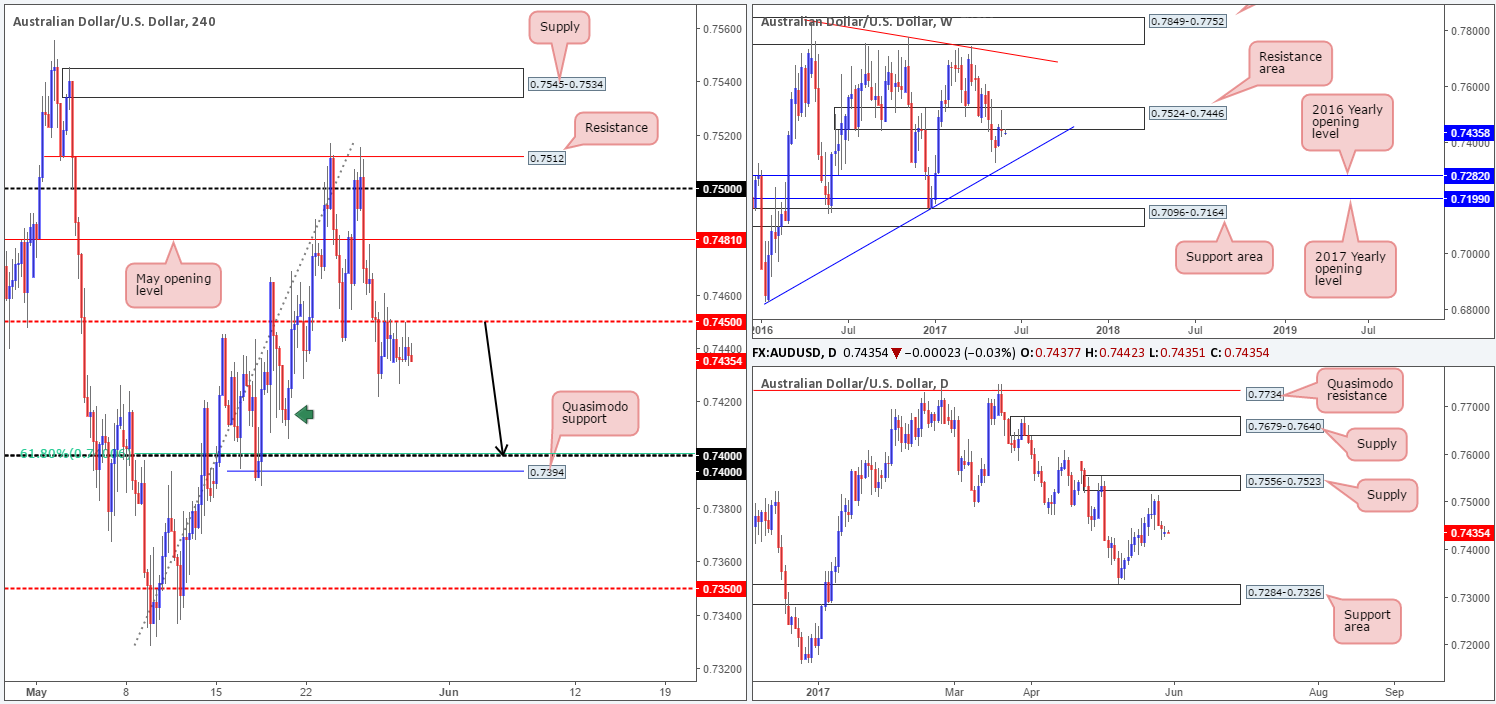

AUD/USD:

While the commodity currency maintained its offered tone below the H4 mid-level resistance pegged at 0.7450 yesterday, price was relatively subdued due to US banks being closed in observance of Memorial Day. However, we did happen to short this pair yesterday at 0.7440. For those who read Monday’s report you may recall our desk mentioning that we’re waiting for a second retest of 0.7450 to be seen. The candle rejection from this line was enough to reassure us that the bears remain in control.

In addition to the above, we also knew that weekly price was trading from a resistance area planted at 0.7524-0.7446. This produced a reasonably strong-looking selling wick last week which could imply further downside may be on the cards. Neighboring support rests in the form of a nearby trendline support etched from the low 0.6827. Also of interest were the daily candles. We do not see much in the way of support on the daily timeframe until we reach the support zone marked at 0.7284-0.7326 (fuses nicely with the aforementioned weekly trendline support).

Our suggestions: Ultimately, we are targeting the 0.74 handle as our initial take-profit target. Granted, we do have a H4 demand lurking nearby marked with a green arrow around 0.7420, which may produce a minor reaction. The more appealing area, however, remains around the 0.74 level, since it merges with a H4 61.8% Fib support taken from the low 0.7328 and a H4 Quasimodo support at 0.7394.

Data points to consider: Australian Building approvals at 2.30am. US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.7440 ([live] stop loss: 0.7463).

USD/JPY:

As can be seen from the H4 chart this morning, yesterday’s trading volume was thin due to US banks being closed in observance of Memorial Day. Despite this, May/April’s opening levels at 111.29/111.41 did a good job of holding back any fresh upside attempts. With little change seen to the structure of this market, much of the following report will echo similar thoughts put forward in Monday’s analysis…

Weekly bears remain in a relatively strong position after pushing aggressively lower from supply registered at 115.50-113.85. We know there’s a lot of ground to cover here, but this move could possibly result in further downside taking shape in the form of a weekly AB=CD correction (see black arrows) that terminates within a weekly support area marked at 105.19-107.54 (stretches all the way back to early 2014). In conjunction with weekly flow, daily price continues to defend the resistance area penciled in at 111.35-112.37. The next area on the hit list falls in at 107.15-107.90: a support zone that’s glued to the top edge of the said weekly support area.

Our suggestions: Although price has bounced from a H4 channel support taken from the low 110.23 (ties in nicely with the 111 handle), we believe this will be short-lived move given what we’ve seen on the bigger picture.

With that being the case, our team is watching for a H4 close to form below 111 today. Not only would this imply bearish strength from the higher-timeframe structures, it would also clear the runway south down to at least the H4 mid-level support at 110.50. To take advantage of this potential move, one could either sell the breakout or conservatively wait for price to retest 111 as resistance and sell with lower-timeframe confirmation (see the top of this report). We prefer the latter.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 111 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe signal to form following the retest is advised] stop loss: dependent on where one confirms this level).

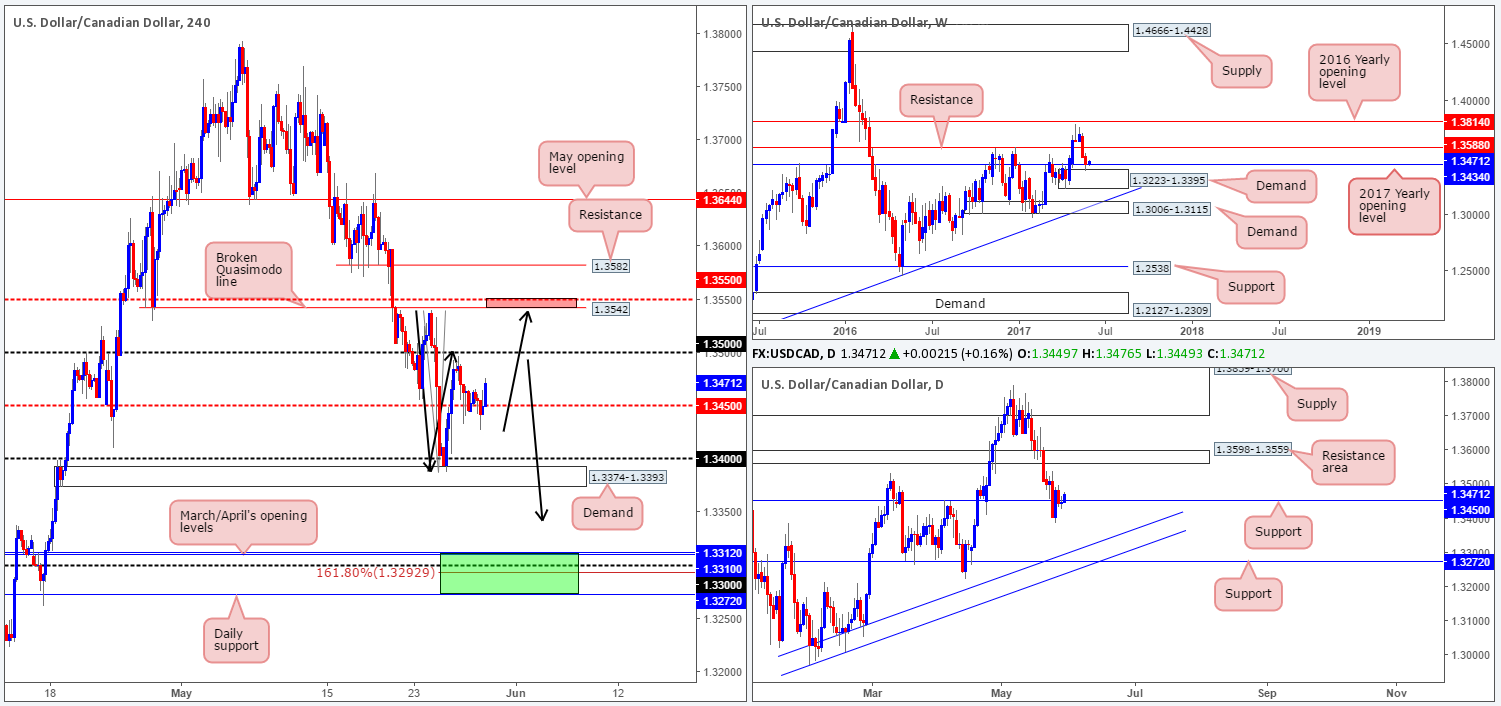

USD/CAD:

Although yesterday’s movement was somewhat muted given the US banks being closed in observance of Memorial Day, there’s some nice-looking H4 price action forming at the moment.

To the upside, we have a potential H4 AB=CD bearish pattern (taken from the low 1.3387) taking shape that terminates just ahead of a H4 broken Quasimodo line drawn from 1.3542/H4 mid-level resistance at 1.3550 and a daily resistance area at 1.3598-1.3559. This small (red) area marks a possible zone where price could bounce.

To the downside, we also see a potential H4 AB=CD 161.8% Fib ext. at 1.3292 taken from the high 1.3540. This number helps form a strong-looking (green) buy zone. 1.3272/1.3312: holds the following structures:

- Daily support at 1.3272.

- 1.33 handle.

- March/April’s opening levels at 1.3310/1.3312.

- Daily trendline support confluence (1.2968/1.3027).

- Also of note is the H4 buy zone is seen lodged within the lower limits of the weekly demand at 1.3223-1.3395!

Our suggestions: As you can see, both zones hold a reasonable amount of confluence and have the potential to reverse price. To be on the safe side, however, we would recommend not entering blindly at these areas. Wait for additional confirming in the form a reasonably sized H4 rotation candle, preferably a full-bodied candle, before pulling the trigger.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: 1.3272/1.3312 ([waiting for a reasonably sized H4 bull candle to form – preferably a full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: 1.3550/1.3542 ([waiting for a reasonably sized H4 bear candle to form – preferably a full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

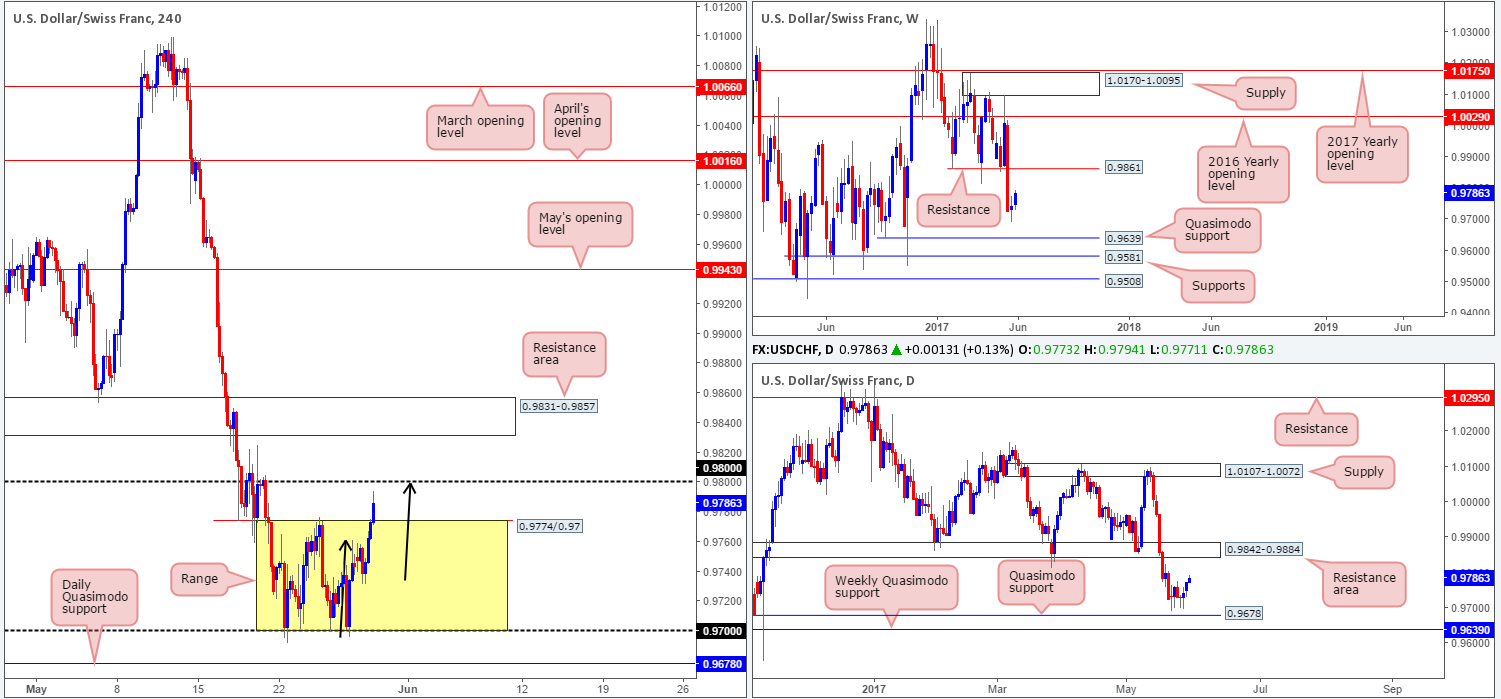

USD/CHF:

Going into the early hours of yesterday’s US session, the Swissy took off north and has managed to breach the top edge of a H4 range fixed between 0.9774/0.97. As you can see, H4 price is nearing the 0.98 handle, which happens to collaborate with an AB=CD bearish completion point (see black arrows). While selling from 0.98 may be tempting, there’s a chance that this psychological hurdle could be demolished. We say this simply because over on the higher timeframes both the weekly and daily charts show room to advance beyond this number, with the closest resistance area not seen until we reach 0.9842-0.9884: a resistance zone that houses a weekly resistance level pegged at 0.9861.

Our suggestions: Personally, we have absolutely no interest in shorting from 0.98 today, despite it having the ability to bounce price. We just would not feel comfortable selling against potential weekly/daily flow! Therefore, for now at least, our desk will remain on the sidelines.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

DOW 30:

As expected, trading volume was thin in the US equity market yesterday due to US banks being closed in observance of Memorial Day. This has left the H4 candles confined between a supply zone marked at 21139-21101 and a support area drawn from 21048-21015. Technically speaking, this is the last remaining supply standing in the way of this instrument achieving fresh highs. Why we believe this is due to weekly price recently breaching the top edge of a range fixed around record highs of 21170 between 20425/21000, and because of the unit recently driving through the resistance area at 21022-20933, which should effectively now act as a support area. With this area consumed, we do not see any structure on this timeframe stopping the index from achieving fresh record highs.

Our suggestions: Although the bulls look incredibly determined at this time, entering long expecting price to reach new highs would still be a risk, in our opinion. Waiting for the H4 supply mentioned above at 21139-21101 to be taken out is likely the safer route, before considering hunting for longs. Therefore, until we see a decisive close above this area, our desk will remain patiently waiting on the sidelines.

Data points to consider: US PCE price index at 1.30pm, US Consumer confidence at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Watching for H4 price to close above H4 supply at 21139-21101 before looking to long this market.

- Sells: Flat (stop loss: N/A).

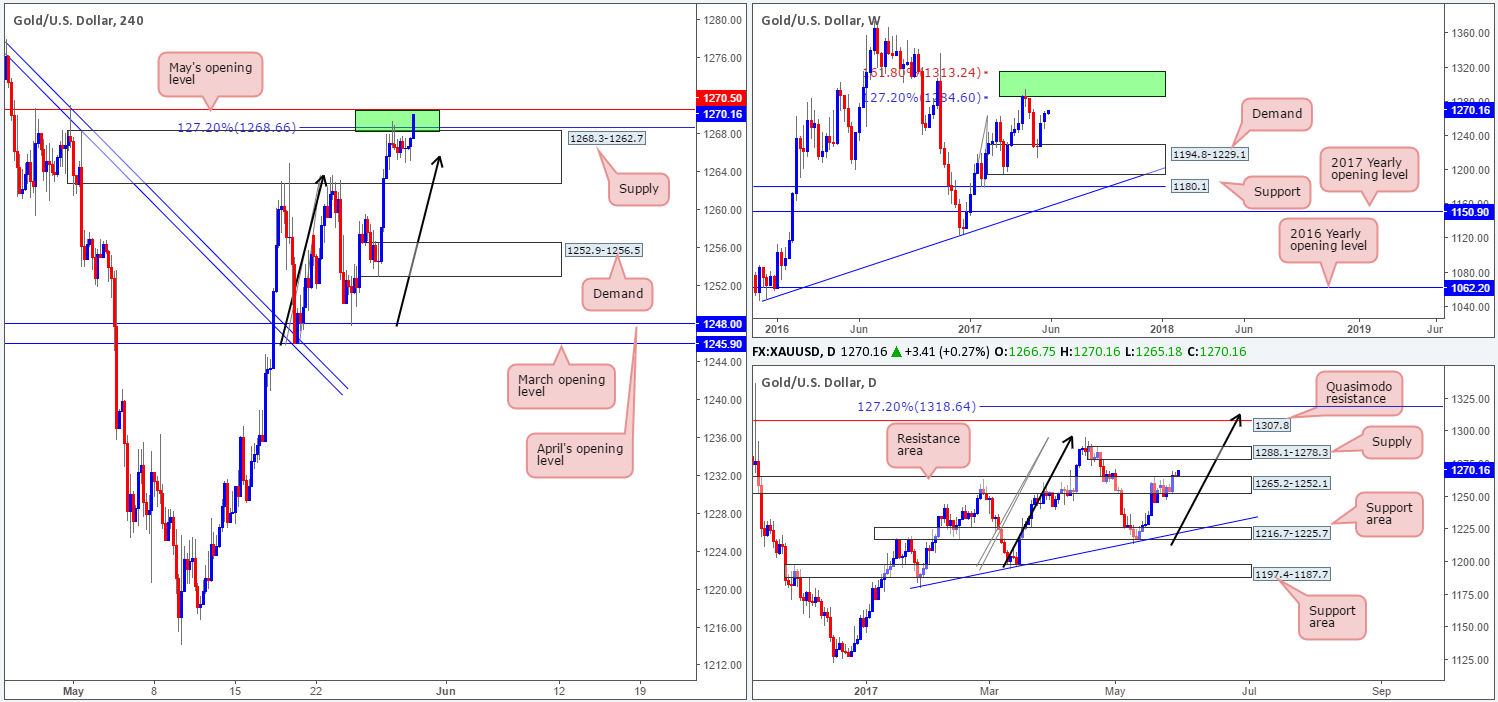

GOLD:

While yesterday’s sessions were relatively quiet given both the UK and US banks being closed, the bulls are currently showing some grit as we write. Between the top edge of a H4 supply zone at 1268.3, the H4 AB=CD 127.2% Fib ext. at 1268.6 (taken from the low 1245.9) and May’s opening level at 1270.5, this small green area is under pressure.

Should this area be consumed, it’s highly likely that the yellow metal will head to daily supply seen at 1288.1-1278.3, and possibly higher since there’s a potential daily AB=CD bearish pattern that terminates a tad beyond a daily Quasimodo resistance at 1307.8. Also of interest is the two weekly Fibonacci extensions 161.8/127.2% at 1313.7/1285.2 taken from the low 1188.1 (green zone – next upside target on the weekly timeframe), which hold the said daily Quasimodo within.

Our suggestions: Despite this current H4 sell zone, our team is reluctant to pull the trigger here when both the weekly and daily charts show room to advance. With that being the case, we will humbly take a step back today, and look to reassess going into tomorrow’s open.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).