USD/JPY:

On the H4 chart, price has confirmed a bullish momentum breaking the previous high. We are bullish bias- Price is testing the first resistance at 139.373 where the previous swing high sits. If bullish momentum continues, it should bring price toward the second resistance at 140.596 where the 78.6% projection sits. Alternatively, if price reverse, it might pull back to test the first support at 136.455 where the 38.2% fibonacci retracement sits then subsequently the second support at 135.560 where the 50% retracement sits

Areas of consideration:

- H4 time frame, 1st resistance at 139.373

- H4 time frame, 1st support at 136.455

DXY:

On the H4, price seems to be ranging but it is still moving in an ascending trend and is in a bullish momentum. Price has tested the first resistance at 109.440 where the 78.6% Fibonacci projection and the previous swing high sits. If price fails to break this level, it will pull back to test the first support at 108.069 where the 61.8% projection sits and subsequently the second support at 106.235 where the 61.8% retracement sits

Areas of consideration:

- H4 time frame, 1st resistance at 109.440

- H4 time frame, 1st support at 108.069

EUR/USD:

On the H4, prices seem to have formed a triple bottom and have reversed – we are in a slightly bullish bias. Price looks like it’s pulling back to test the first resistance at 1.0118 where the previous swing low and 50% retracement sits and subsequently the second resistance at 1.0274 where the 78.6% retracement and swing high sits. If price fail to test the first resistance, it might pull back to test the first support at 0.9904

Areas of consideration :

- H4 1st resistance at 1.0118

- H4 1st support at 0.9904

GBP/USD:

On the H4, prices seem to be in a bearish momentum and respecting the ichimoku cloud. Prices have broken the 78.6% projection level and is testing the first support, 100% projection at 1.1580 levels. If price fails to break this level, it might look to test the first resistance at 1.1760 level where the 78.6% projection sits then the second resistance at 1.1934 level where the previous swing low and 127.2% extension sits

Areas of consideration:

- H4 1st resistance at 1.176

- H4 1st support at 1.1580

USD/CHF:

On the H4, with prices moving above the ichimoku cloud and breaking the descending trend, we are bullish. Price is currently moving towards the first resistance at 0.9852 where the previous swing high sits. Alternatively, prices could pull back to test the intermediate resistance around the 0.9727 levels where the overlapping support sits, subsequently the first support at 0.96282 where the 23.6% fibonacci retracement and previous swing low sits then the second support at 0.9491 where the 61.8% retracement and 78.6% projection sits

Areas of consideration

- H4 1st support at 0.9626

- H4 1st resistance at 0.9852

XAU/USD (GOLD):

On the H4, with prices below ichimoku cloud and moving within the descending channel, we have a bearish bias that the price may drop to the 1st support at 1697.974, where the previous swing low is. If the price can break this support line, the next support level could be at 1680.875, where the significant swing low is. Alternatively, the price may rise to the 1st resistance at 1720.067, where the overlap resistance and 23.6% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st support at 1697.974

- H4 time frame, 2nd support at 1680.875

AUD/USD:

On the H4, with the price moving below the ichimoku cloud, moving within the descending channel and MACD indicators are below zero, we have a bearish bias that the price may drop from the 1st support at 0.68016, which is in line with the overlap support to the 2nd support at 0.67088, where the swing lows are. Alternatively, the price may rise to the 1st resistance 0.68842, where the overlap resistance and 23.6% fibonacci retracement are. If the price can break this level, the next resistance level could be at 0.69559, where the swing highs are.

Areas of consideration

- H4 1st support at 0.68016

- H4 2nd support at 0.67088

NZD/USD:

On the H4, with price moving within the descending trendline and below the ichimoku indicator, we have a bearish bias that price may drop from the 1st support at 0.60919, where is the 61.8% fibonacci projection to 2nd support at 0.60619, where the swing low and 78.6% fibonacci projection are. Alternatively, price could rise to 1st resistance at 0.61415, which is in line with overlap resistance. If the price can break this level, the next resistance level could be at 0.61906, where the overlap resistance and 61.8% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st support at 0.60919

- H4 time frame, 2nd support at 0.60619

USD/CAD:

On the H4, with the price moving within the ascending channel, above ichimoku cloud, we have a bullish bias that the price may rise from the 1st resistance at 1.31668, where the swing highs are, If the price can break the 1st resistance, we can expect the price rise to the 2nd resistance at 1.32238, where the swing high is. Alternatively, price could pullback from the 1st resistance and drop to the 1st support at 1.30635, where the overlap support and 23.6% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance at 1.31668

- H4 time frame, 2nd resistance at 1.32238

OIL:

On the H4, with price breaking the ascending channel and below ichimoku cloud, we have a bearish bias that the price may drop to the 1st support at 95.949, where the swing lows and 78.6% fibonacci retracement are. If the price can break the 1st support, we can expect the price drop to the 2nd support at 93.319, where the swing low is. Alternatively, the price may pullback to the 1st resistance at 98.946, where the overlap resistance is.

Areas of consideration:

- H4 time frame, 1st support at 95.949

- H4 time frame, 2nd support at 93.319

Dow Jones Industrial Average:

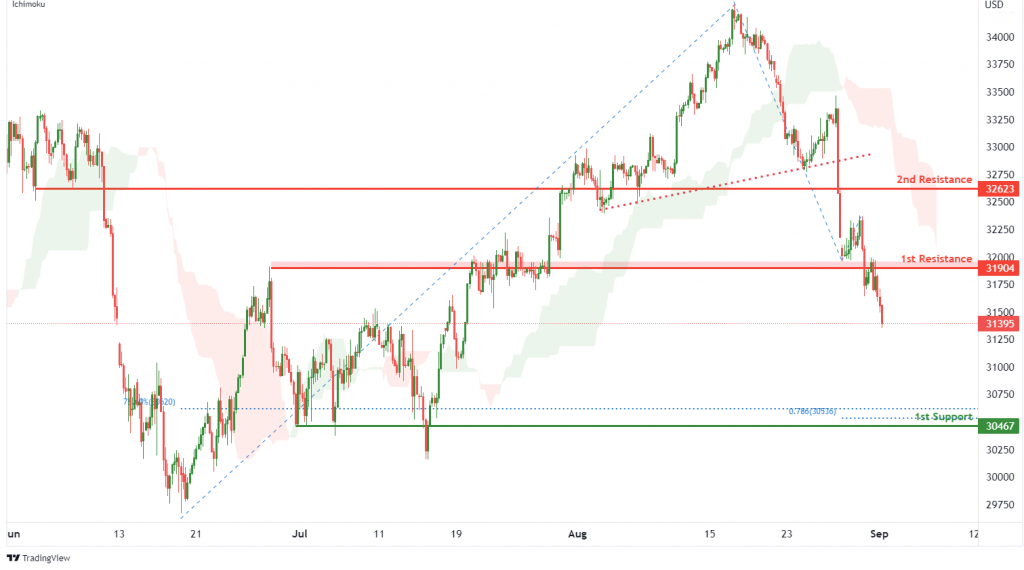

On the H4, with price breaking the ascending trendline and moving below the ichimoku indicator, ,we have a bearish bias that price will drop from 1st resistance at 31904 where the pullback resistance is to 1st support at 30467 where the pullback support, 78.6% fibonacci retracement and 78.6% fibonacci projection are. Alternatively, price could break 1st resistance structure and rise to 2nd resistance at 32623 in line with pullback resistance.

Areas of consideration:

- H4 time frame, 1st resistance of 31904

- H4 time frame, 1st support at 30467

DAX:

On the H4, with price moving within a descending channel and below the ichimoku indicator, we have a bearish bias that price will drop from 1st resistance at 13025.67 where the pullback resistance is to the 1st support at 12399.72 where the swing low support, 61.8% fibonacci projection and 161.8% fibonacci extension are. Alternatively, price could rise to 2nd resistance at 13378.95 where the overlap resistance and 50% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance of 13025.67

- H4 time frame, 1st support at 12399.72

ETHUSD:

On the H4, with price moving below the ichimoku indicator, we have a bearish bias that price will drop from 1st resistance at 1559.82 where the overlap support is to the 1st support at 1419.94 where the swing low support, 61.8% fibonacci projection and 161.8% fibonacci extension are. Alternatively, price could break 1st resistance structure and rise to 2nd resistance at 1655.51 where the pullback resistance, 100% fibonacci projection and 78.6% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance of 1559.82

- H4 time frame, 1st support at 1419.94

BTCUSD:

On the H4, with price moving below an ichimoku indicator, we have a bearish bias that price will drop from 1st resistance at 20708.23 where the pullback resistance, 100% fibonacci projection and 23.6% fibonacci retracement are to the 1st support at 18865.89 where the swing low support, 78.6% fibonacci projection and -61.8% fibonacci expansion are. Take note of intermediate support at 19498.02 where the 127.2% fibonacci extension and swing low support are. Alternatively, price could break 1st resistance structure and rise to 2nd resistance at 22363.07 where the overlap resistance, 100% fibonacci projection and 50% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance of 20708.23

- H4 time frame, 1st support at 18865.89

S&P 500:

On the H4, with prices breaking out of the ascending trendline and moving below the ichimoku indicator, we have a bearish bias that price will drop to 1st support at 3945.01 where the pullback support and 61.8% fibonacci retracement are. Once there is downside confirmation that price has broken 1st support structure, we would expect bearish momentum to carry price to 2nd support at 3722.42 where the swing low support is. Alternatively, price could rise to 1st resistance at 4089.97 where the pullback resistance is.

Areas of consideration:

- H4 time frame, 1st resistance of 4089.97

- H4 time frame, 1st support at 3945.01

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.