A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

The EUR/USD, as you can see, failed to sustain gains beyond the key figure 1.10 yesterday, ending with price clocking a low of 1.0970 by the day’s end. As a result of this, the H4 support level at 1.0948 is, once again, now likely the next barrier on the hit list. With this number having been a considerable support/resistance level in the past, and also seen fusing nicely with a H4 mid-way support 1.0950, a H4 trendline support extended from the high 1.1186, a H4 AB=CD bull completion point at 1.0935 and a H4 supply zone seen over on the US dollar index around the 98.58-98.35ish region, this support level is, in our book, worthy of center stage attention today. In addition to this, agreement is being seen across the board on the higher timeframes. Both weekly and daily action shows price connecting with supportive structures (1.0970/1.0909-1.0982).

Our suggestions: Between 1.0935 and 1.0950 is somewhere we expect the shared currency to bounce from. There is, however, still the possibility of a fakeout through this zone, as price may want to test the extremes of the current daily support area before rotating to the upside. Therefore, we would require at least a H4 bullish close from the H4 1.0935/1.0950 zone before a trade can be executed.

Data points to consider today are as follows: US housing data at 12.30pm, followed by FOMC member Dudley taking the stage at 11.45pm GMT.

Levels to watch/live orders:

- Buys: 1.0935/1.0950 region ([H4 bullish candle close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

- Sells: Flat (Stop loss: N/A).

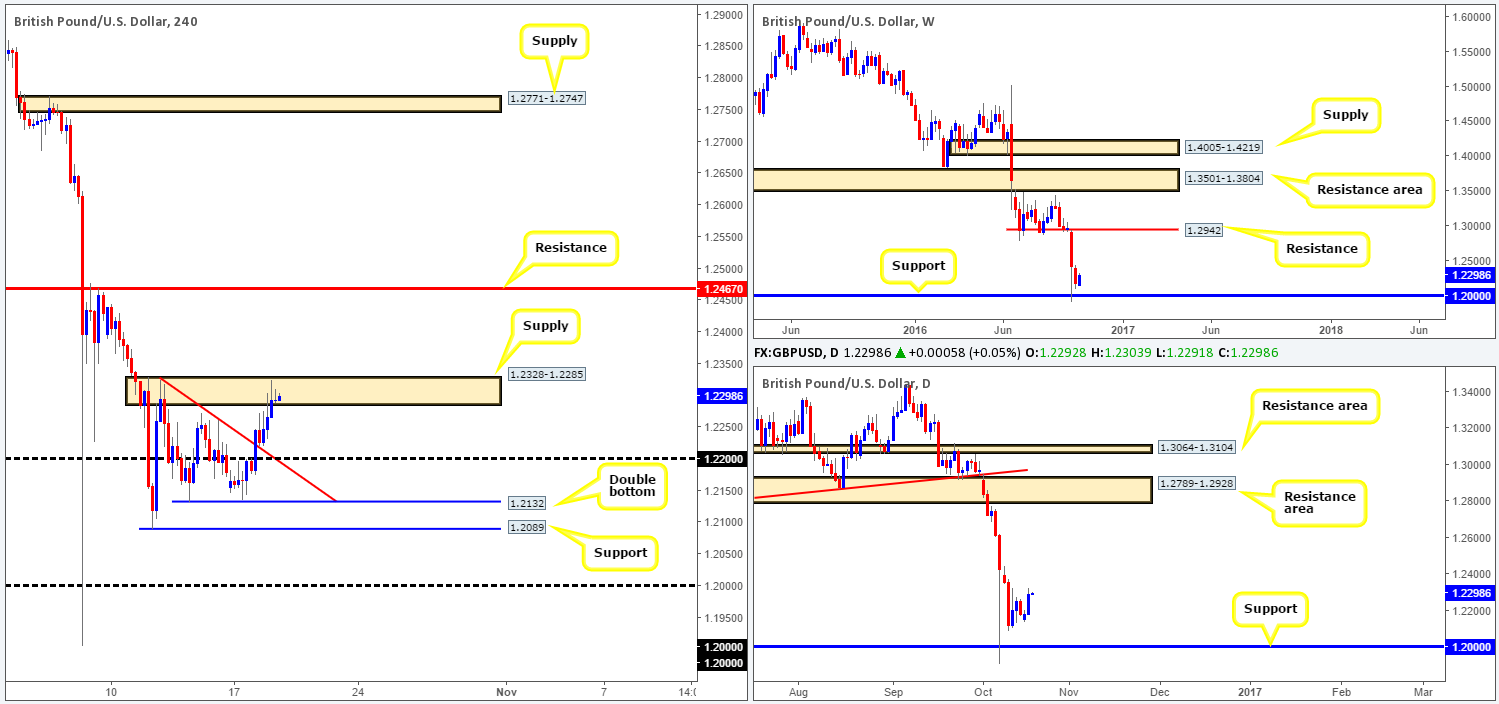

GBP/USD:

The GBP/USD bulls went on the offensive during yesterday’s sessions, bolstered by better than expected UK inflation data. The 1.22 handle, along with the minor H4 trendline resistance taken from the high 1.2324 were taken out, allowing the major to shake hands with H4 supply coming in at 1.2328-1.2285. A break of this zone, as far as we can see, would likely see a renewal of bullish sentiment up to the H4 resistance band drawn from 1.2467. Entering long above the current H4 supply area, however, does not come without risk. Over on the bigger picture, there’s little seen standing in the way of price diving lower to test the 1.20 region. Therefore, we’ll likely pass on any long setups that form beyond H4 supply zone.

Our suggestions: Given that the pair remains entrenched within a downtrend at the moment, we would, dependent on whether a H4 bearish candle close forms and also the time of day, look to trade short from the aforementioned H4 supply zone, targeting 1.22 as our initial take-profit barrier.

On the data front, nevertheless, we have UK employment data at 8.30am and MPC member Haldane speaking at 5pm, along with US housing data at 12.30pm, followed by FOMC member Dudley taking the stage at 11.45pm GMT. As such, remain vigilant during these times!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2328-1.2285 ([H4 bearish candle close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

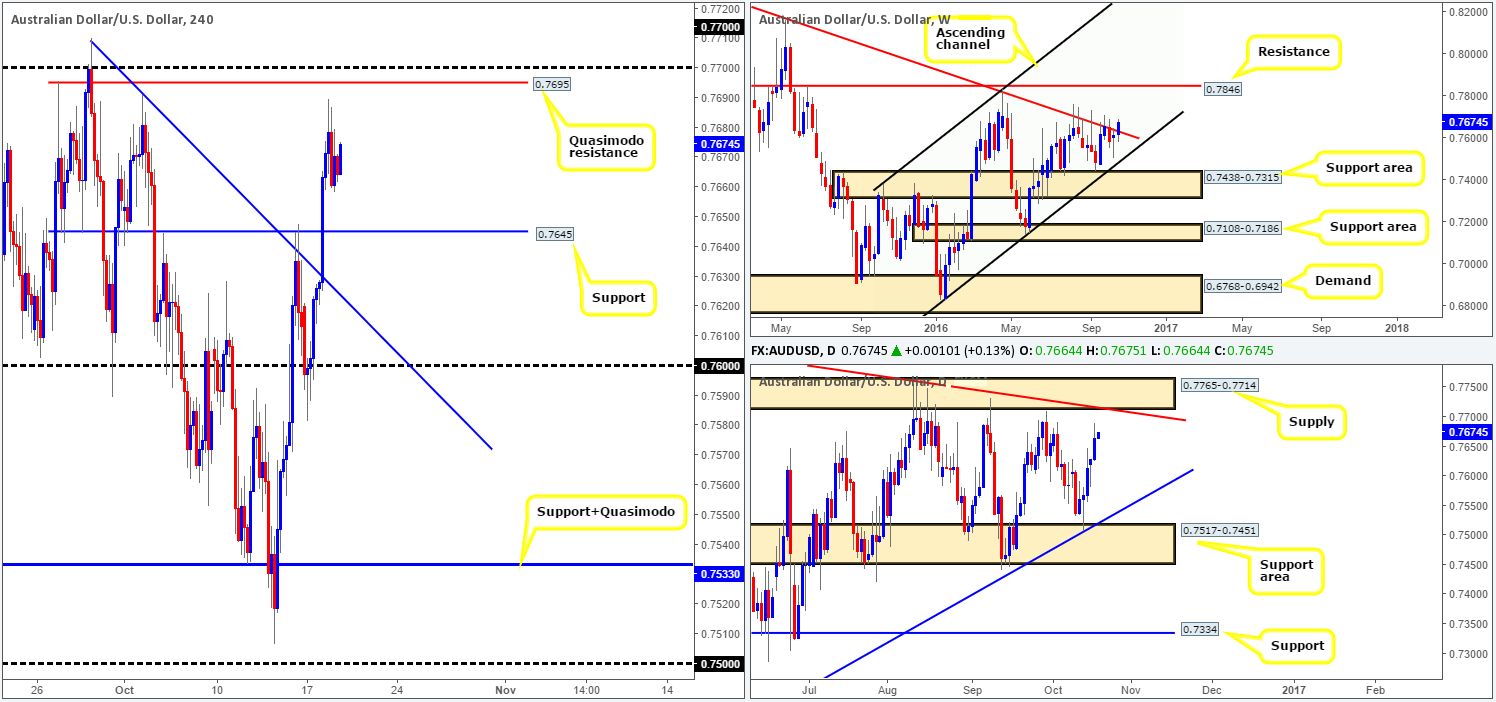

AUD/USD:

The Aussie dollar rallied for a fifth consecutive day yesterday, reaching highs of 0.7689 by the close. Tearing its way through H4 resistance at 0.7645 (now acting support), the pathway north looks to be relatively free for the commodity currency to connect with a H4 Quasimodo resistance band coming in at 0.7695/0.77 handle. This – coupled with daily action nearing the underside of a supply zone at 0.7714 and trendline resistance extended from the high 0.7835, we fail to see the bulls pushing price much beyond the 0.77 handle.

Our suggestions: A short from the aforementioned H4 Quasimodo resistance level is attractive. However, in taking a position from this neighborhood, one has to be prepared to suffer some drawdown, since daily price may want to tag the underside of the above said supply area. Entering at market here, of course, is an option. Nevertheless, given our conservative trading approach, we’re going to wait for a H4 bearish candle to form between 0.7714/0.7695 before taking a short position.

There’s little noteworthy Aussie data on the docket today, so investors will likely focus on the Chinese growth report at 2am, followed by US housing data at 12.30pm and FOMC member Dudley taking the stage at 11.45pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7714/0.7695 ([H4 bearish close required before pulling the trigger] Stop loss: ideally beyond the trigger candle).

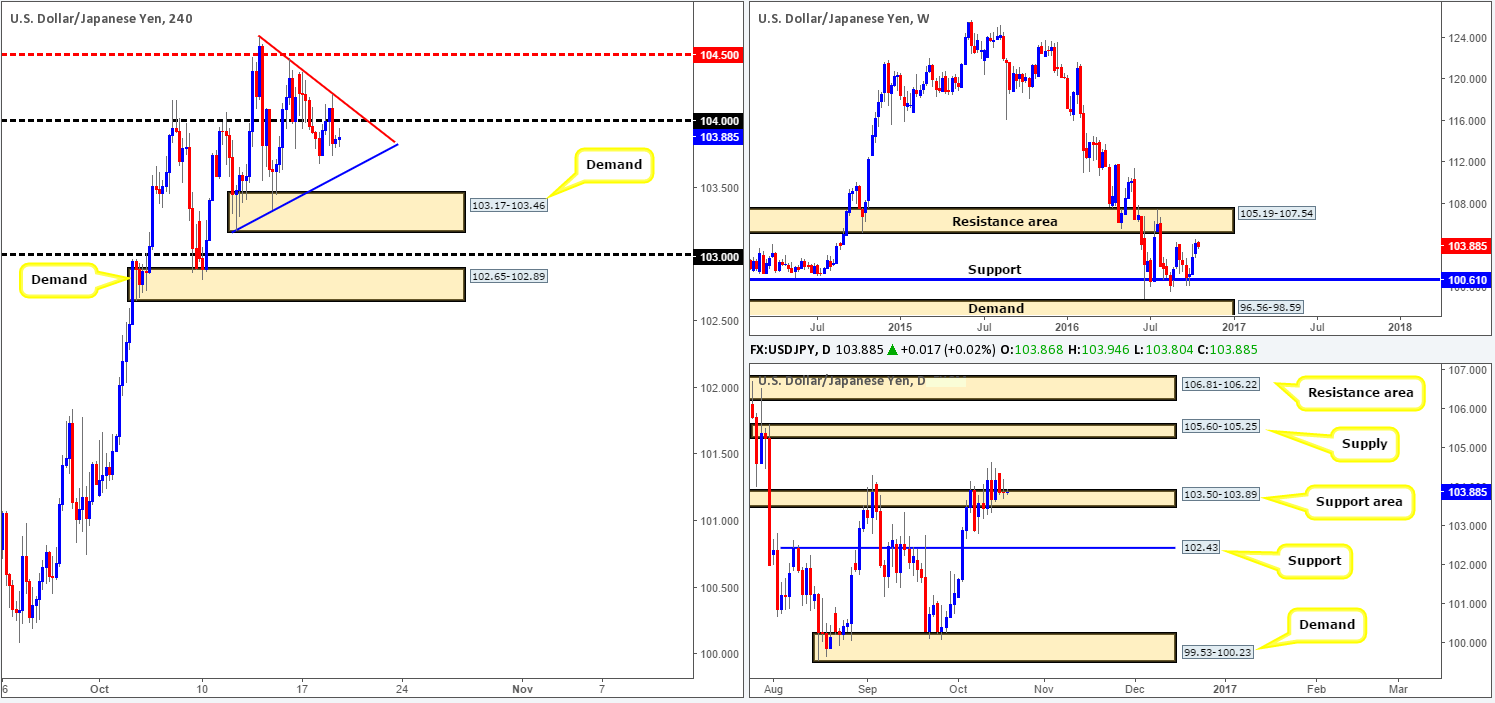

USD/JPY:

As of late, the USD/JPY pair has been seen compressing between two converging H4 trendlines (103.17/104.63), consequently forming a H4 bullish pennant pattern, which, as we’re sure most are already aware, is a continuation setup.

Looking over to the weekly chart, the path north, at least as far as we can see, still looks free up to the underside of a nearby resistance area coming in at 105.19-107.54, following its recent breach of highs chalked up on the 29/08 around the 104.32ish range. Down on the daily chart, the unit continues to find support around the 103.50-103.89 area with the runway north looking clear from here up to supply coming in at 105.60-105.25.

Our suggestions: In light of the current H4 bullish pennant formation, as well as higher-timeframe structures suggesting that further upside may be on the cards, our team will be watching for price to break above the upper edge of the H4 pennant today. Should this come to fruition and price retests the broken line as support, we will look to enter long on the close of a bullish candle, ultimately targeting the 105 region. Also, don’t forget to note that US housing data is scheduled for release at 12.30pm along with FOMC member Dudley taking the stage at 11.45pm GMT.

Levels to watch/live orders:

- Buys: Watch for a close above the current H4 pennant pattern and then look to trade any retest seen thereafter (H4 bullish close required prior to pulling the trigger).

- Sells: Flat (Stop loss: N/A).

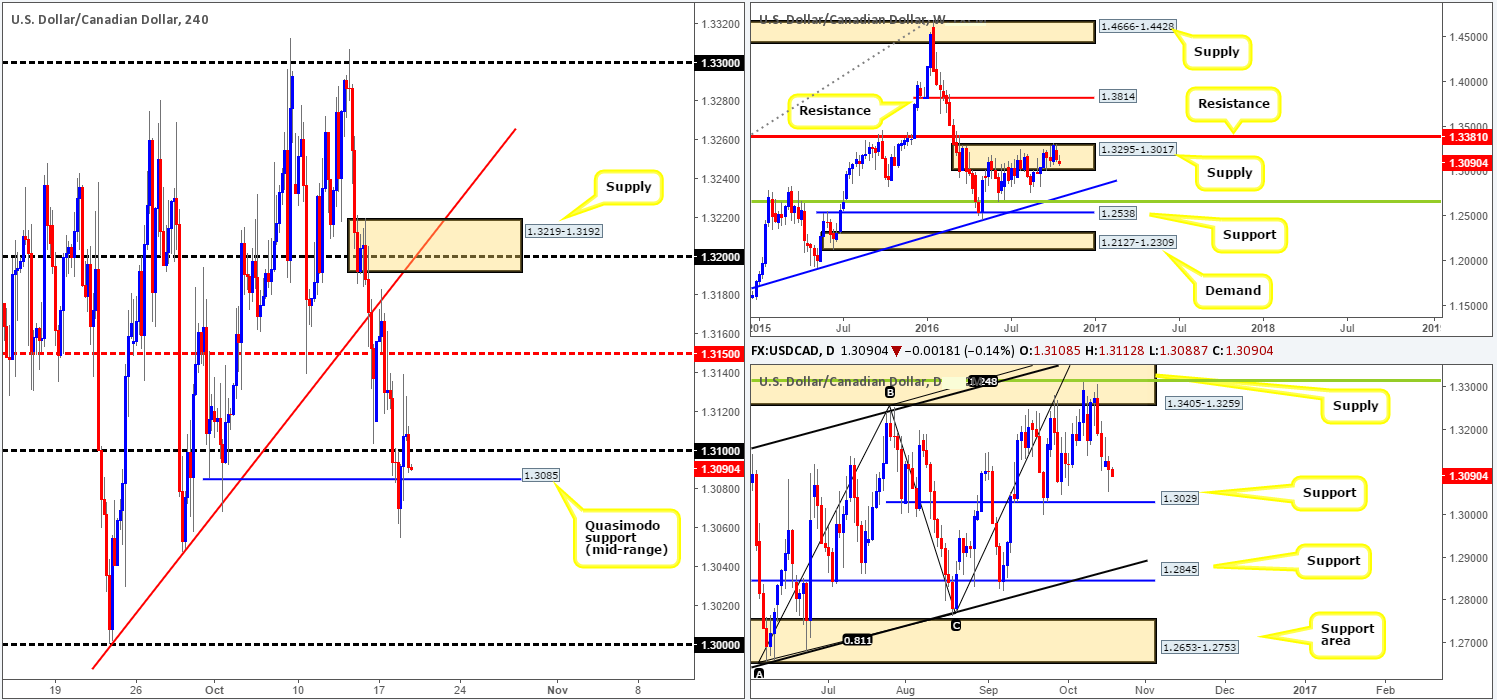

USD/CAD:

Amid yesterday’s trading sessions, the loonie aggressively whipsawed through the H4 broken Quasimodo support at 1.3085, which resulted in price breaking back above the 1.31 handle to tag highs of 1.3139. Despite this, the pair is now, once again, seen trading within touching distance of the aforementioned H4 broken Quasimodo support.

With yesterday’s movement not really affecting structure, we’ll continue watching for a H4 close below 1.3085. Should this come into view, and price follows up with a retest and a H4 bearish close, the market could, according to the higher-timeframe structures, potentially stretch down as far as 1.3029: a daily support level, followed closely by the key figure 1.30.

Fundamentally, investors will likely be focusing on the BoC monetary policy report at 2pm today, followed by a press conference at 3.15pm as well as the BoC Gov. Poloz taking to the stage at 8.15pm. This, along with US housing data at 12.30pm and FOMC member Dudley speaking at 11.45pm GMT makes for a relatively busy day for both currencies!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for a close beyond 1.3085 and look to trade any retest seen thereafter ([H4 bearish close required] Stop loss: ideally beyond the trigger candle).

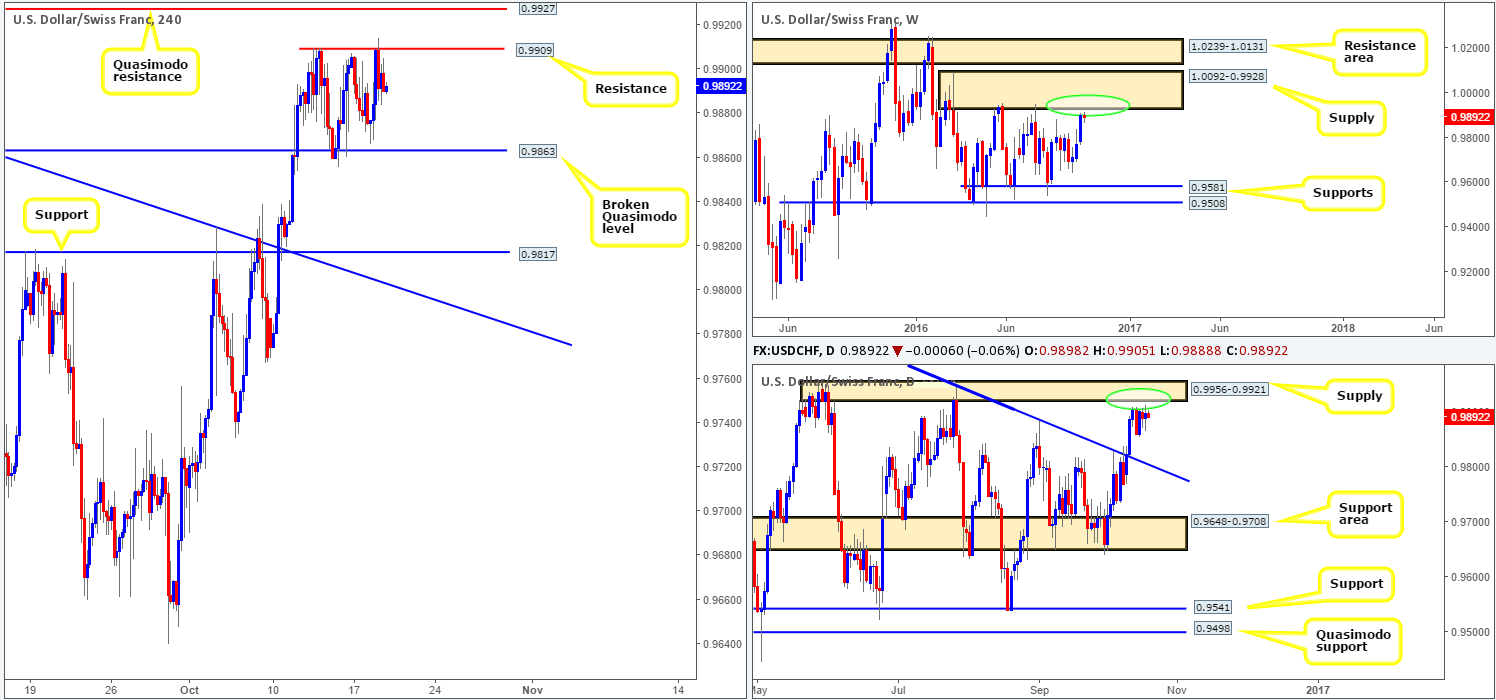

USD/CHF:

Up to now, the Swissy has been consolidating between a H4 broken Quasimodo support line at 0.9863 and a H4 resistance at 0.9909. In spite of this, our team has absolutely no interest in trying to trade the edges of this range. The focus, for now, remains on the H4 Quasimodo resistance barrier penciled in at 0.9927. This is, as we highlighted in yesterday’s report, due to its connection with the underside of both the weekly supply at 0.9928 and daily supply at 0.9921 (see the two green circles).

Our suggestions: In that the USD/CHF remains relatively unchanged as far as structure is concerned, we still have a pending sell order set at 0.9926 with a stop placed above the top edge of daily supply (0.9956) at 0.9960. In the event that the order is filled today, we’ll be looking for price to close beyond 0.99 and work its way back down to the aforementioned H4 broken Quasimodo line support.

News events to keep an eye on today are US housing data at 12.30pm and FOMC member Dudley speaking at 11.45pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.9926 ([pending order] Stop loss: 0.9960).

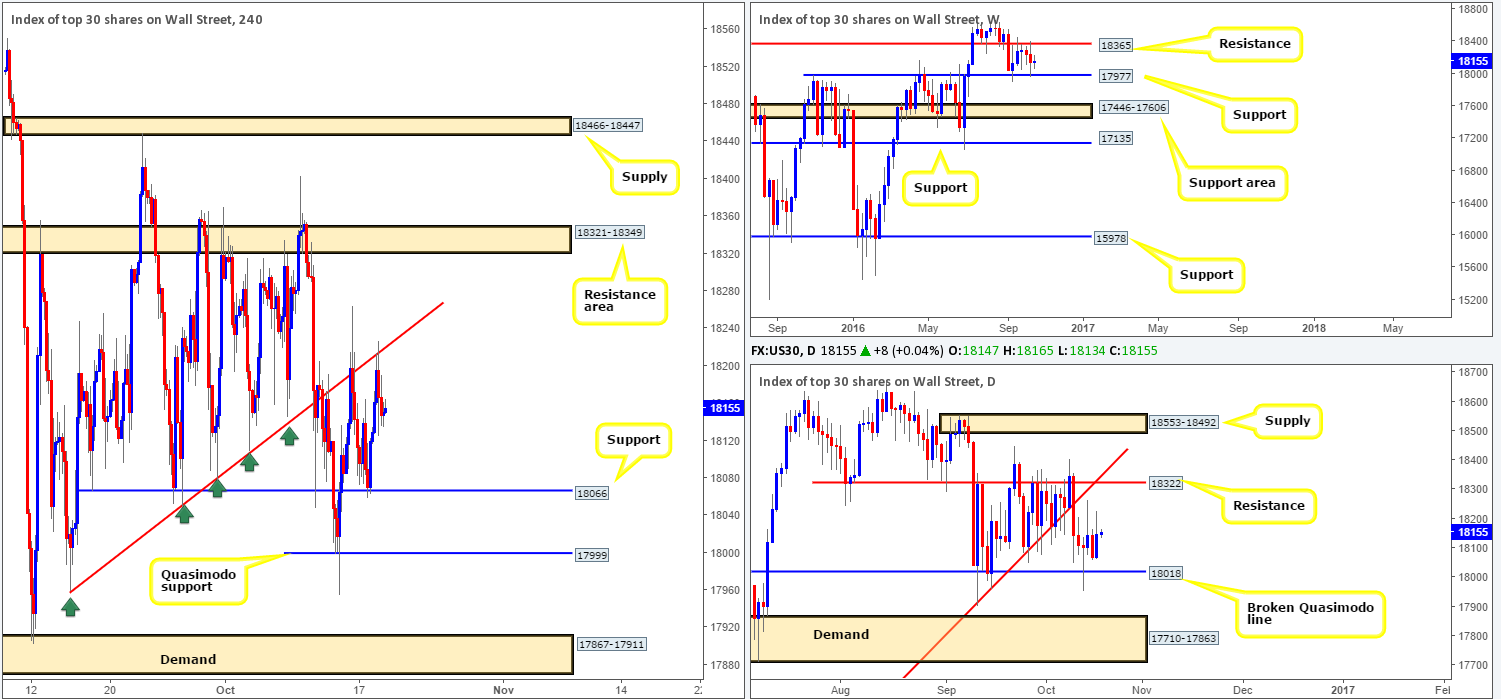

DOW 30:

Looking at the weekly timeframe this morning, we can see that the candles are well and truly sandwiched at the moment between a resistance coming in at 18365 and a support level drawn from 17977. Turning our attention to the daily chart, the broken Quasimodo level at 18018 provided equities support on the 13th Oct, and has, as you can see, remained above this barrier since. The next upside target from this angle stands at 18322: a resistance level.

Recent H4 action extended its bounce north from support at 18066, propelling the DOW up to a trendline resistance extended from the low 17959. Trading from this H4 trendline, although it has worked on a number of occasions now, is risky (in our view) due to it boasting little confluence from the higher-timeframe structures.

Our suggestions: Given the above points, the only areas we have interest in at the moment is the H4 Quasimodo support at 17999 and the H4 resistance area at 18321-18349. The Quasimodo is attractive because it fuses with nearby weekly support at 17977 and also the daily broken Quasimodo line at 18018.The resistance zone, however, is equally attractive since it houses a daily resistance level at 18322 and is located just below weekly resistance at 18365.

However, to avoid being stopped out by a whipsaw, we’d recommend waiting for a H4 close to take shape at both areas highlighted in bold prior to risking capital.

Levels to watch/live orders:

- Buys: 17999 ([H4 bullish candle required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

- Sells: 18321-18349 ([H4 bearish close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

GOLD:

Looking at this market from the weekly timeframe, the precious metal looks on course to retest the underside of the recently broken support area at 1307.4-1280.0. Given the velocity of this break, there are likely a collection of unfilled sell orders still lurking within this zone, thus making it an interesting resistance base. The story on the daily chart shows that the price of gold found support from demand coming in at 1234.6-1244.9, which has, at least in our opinion, the potential to push prices back up to resistance at 1301.5 (located within the aforementioned weekly resistance area).

Stepping across to the H4 chart, bullion is seen trading just ahead of a supply zone visible at 1268.1-1265.0. With that being the case, buying the unit now might not be such a good idea, no matter what the higher-timeframe structures suggest.

It is certainly a tricky market to read at the moment. Personally, to become buyers, we’d need to see the H4 supply zone at 1277.1-1272.4 taken out. However, this would still be considered a risky buy as by that point price would be trading within striking distance of the weekly resistance area mentioned above at 1307.4-1280.0. In regard to selling, we’d require price to close below the H4 demand base seen at 1234.6-1241.3, which sits within the current daily demand area mentioned above. A close below this region would likely open the doors down to daily demand at 1206.8-1217.5 (positioned just above the weekly support area at 1205.6-1181.2).

Our suggestions: As can be seen from the analysis above, movement is somewhat restricted from a technical perspective. With that being said, our team will continue to watch price from the sidelines for the time being.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).