EURUSD:

EUR/USD is approaching trendline resistance and a break above would confirm the double bottom pattern at 1.0630. However, the currency pair could struggle to rally, since solid resistance lies at 1.0720 and 1.0750.

Only a break above 1.0750 would signal that there might be potential for a larger recovery in EUR/USD.

GBPUSD:

GBP/USD is consolidating within a triangle pattern. However, with plenty of data releases and other events in the upcoming 48 hours, a breakout seems imminent. Since the short-term trend in GBP/USD is positive, a break above 1.25 seems more likely.

This could then pave the way for a move towards 1.26, but immediate resistance is noted at 1.2550. Should the currency pair come under pressure, watch the 1.2420/30 area for key support.

UDJPY:

USD/JPY is moving towards 110 and a break below that level seems increasingly likely. The charts suggest that this would then pave the way for a move to at least 108.50.

While the currency pair is starting to look a bit oversold, there is still potential for a larger decline should 110 support break.

AUDUSD:

The momentum in AUD/USD is increasing and the currency pair is approaching key support at 0.7490. The Aussie Dollar is likely to consolidate there for a while.

However, the short-term outlook for AUD/USD is negative and selling rallies the preferred strategy. Look for decent resistance at 0.7550 and 0.7585/90. Should the currency pair break below 0.7490 support, immediate support is then seen 0.7430, but it would likely extend losses further.

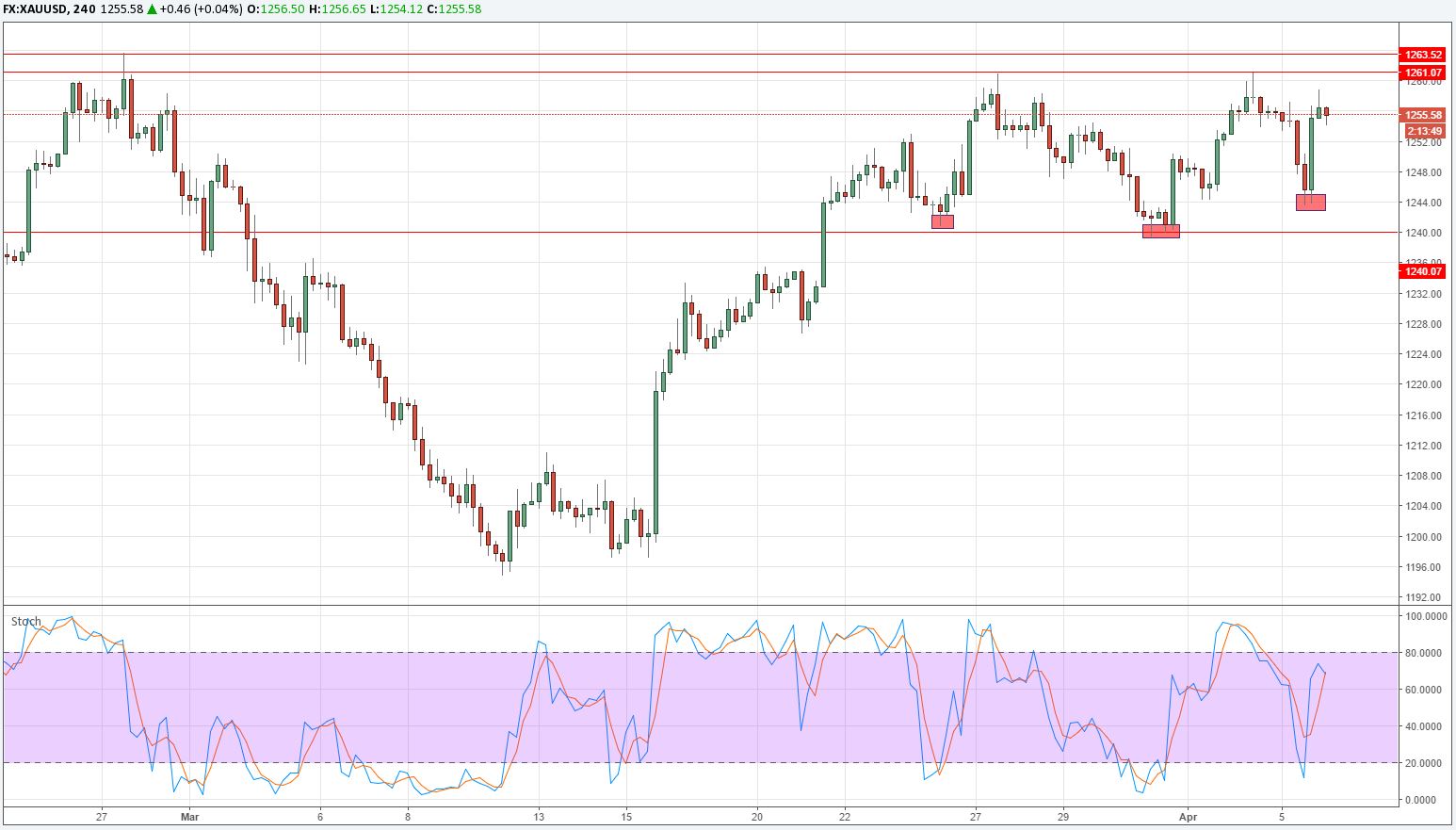

XAUUSD:

Gold fell to 1244 in yesterday's trading session, but the strong bounce from there once again confirms that the metal is still in demand. Resistance between 1261 and 1263 is still a tough one to crack, but a breakout seems increasingly likely.

A move above 1263 would then suggest that the rally could continue to 1300 in the near-term.

EUR/JPY:

EUR/JPY is trading within a descending channel and the outlook remains bearish following the break of 118 support.

Selling rallies is the preferred strategy. Watch for retests of the upper channel line, as well as 118.50 and 118.75.