A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

For us, lower timeframe confirmation starts on the M15 and finishes up on the H1, since most of our higher timeframe areas begin with the H4.

Traders may want to bear in mind that market conditions will likely be thin going forward. Unwarranted and sudden moves could be seen so remain vigilant at all times.

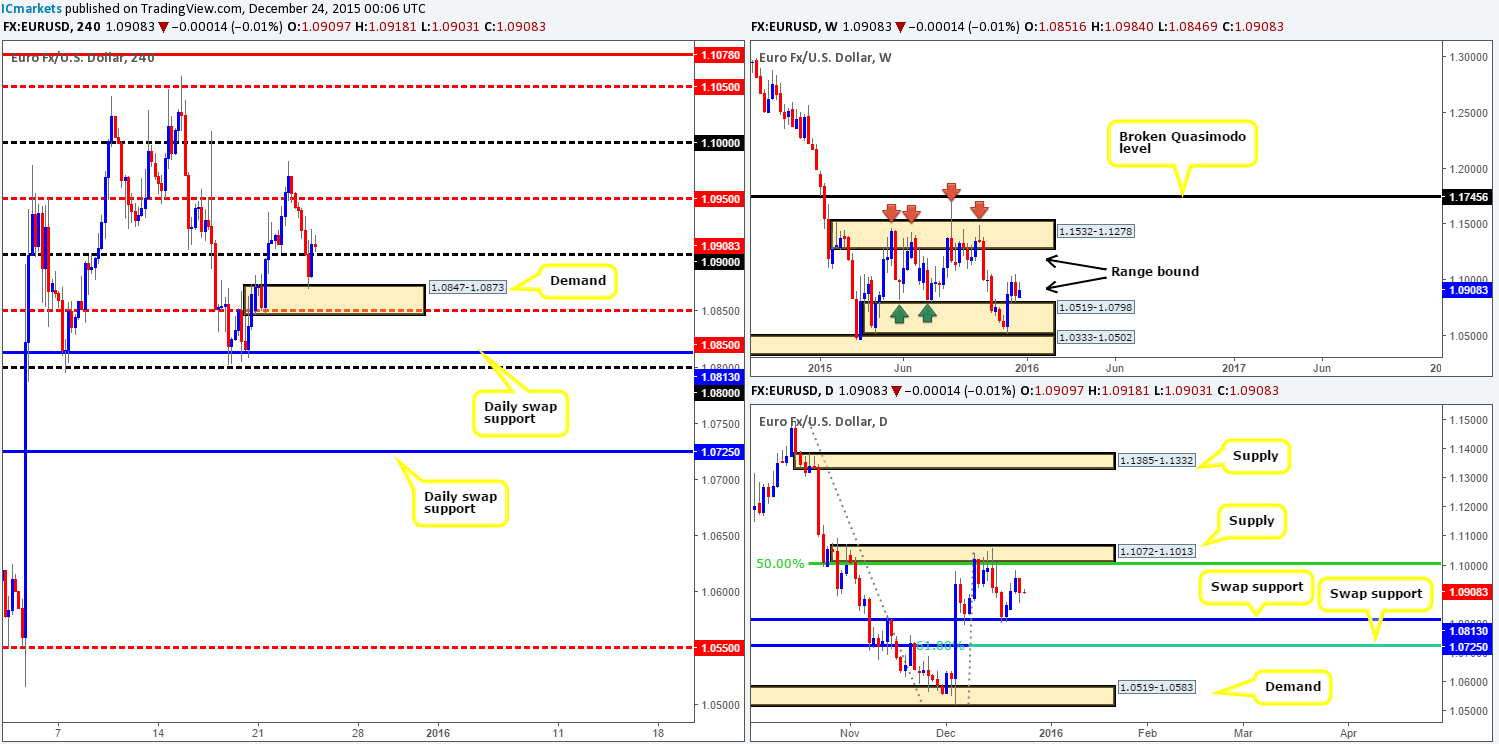

EUR/USD:

Following three consecutive bullish days the EUR sold off yesterday, whipsawing through psychological support 1.0900 into active bids at H4 demand drawn from 1.0847-1.0873. In light of price now hovering above 1.0900, would we consider this a stable platform in which to look for longs from today? As far as we see things, we expect little movement. Germany already closed for the Christmas period and the U.S is closing early. However, should 1.0900 hold firm, there may be an opportunity to buy from here (with strong lower timeframe confirmation) during the Asia/London sessions, targeting the mid-level resistance at 1.0950.

In support of a buy from 1.0900, we can see that weekly action remains trading from range demand at 1.0519-1.0798. Despite this though, price is now considered mid-range on the daily picture between a swap support at 1.0813 and supply from 1.1072-1.1013, so this market (according to the daily timeframe) could potentially bounce in either direction. Nevertheless, seeing as how we’re only looking for a small intraday bounce today, this should not cause too much of a problem.

Levels to watch/live orders:

- Buys: 1.0900 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

GBP/USD:

As can be seen from the H4 chart, Cable rallied shortly after faking below demand at 1.4811-1.4854, breaking above mid-level resistance 1.4850 and attacking supply coming in at 1.4907-1.4886. For those who read our previous report (http://www.icmarkets.com/blog/wednesday-23rd-december-daily-technical-outlook-and-review/), you may recall that we noted that we were going to be looking for (lower timeframe confirmed) shorts around both of the above said areas. Unfortunately, we could not find any suitable entry to short this market at either.

Should we see price break below 1.4850 and retest this level as resistance today, we may, dependent on the time of day and lower timeframe price action, look to short from here targeting psychological support 1.4800. The reason, we’re confident this pair is headed for lower ground is as follows:

- Stops from below weekly demand at 1.4856-1.5052 were likely taken out recently, thus the path possibly cleared for further selling down to a weekly Quasimodo support at 1.4633.

- Daily demand (now supply) at 1.4856-1.4925 has also been consumed, likely opening the gates for prices to challenge a daily Quasimodo support at 1.4739.

- The whipsaw below H4 demand at 1.4811-1.4854 also likely took out stops, and cleared the runway down to at least psychological support 1.4800.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for 1.4850 to be consumed and look to trade any retest of this level thereafter (confirmation required).

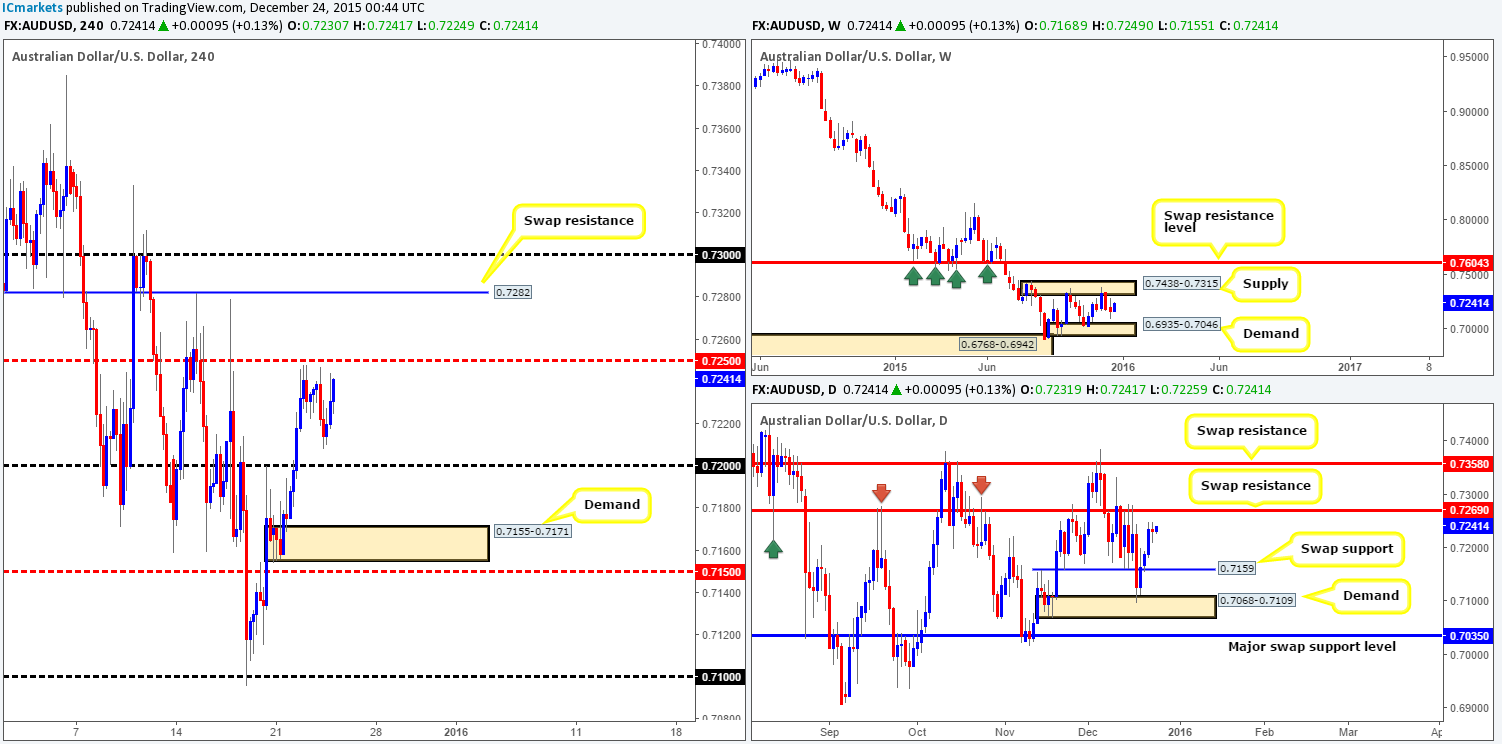

AUD/USD:

Trade was relatively quiet amid yesterday’s sessions, as price continued to linger below the mid-level resistance 0.7250, only managing to reach lows of 0.7207 on the day. Given this lackluster performance, our outlook on this pair remains similar to yesterday’s report.

With both the weekly and daily charts showing room for this market to continue appreciating, and the closest structural resistance being seen on the daily chart coming in at 0.7269 (a swap resistance level), selling at 0.7250 is out of the question for us. Our team has come to a general consensus that we would only consider becoming sellers in this market once price has reached the daily swap (resistance) level just mentioned above.

Regarding longs, however, we have our eye on psychological support 0.7200 as there are likely unfilled buy orders still lurking within this region. Failing that, H4 demand below it at 0.7155-0.7171 (sits neatly on top of the daily swap [support] level at 0.7159) would be our next port of call for longs.

Due to liquidity likely thinning out during the Christmas period, we would strongly advise only trading the above said H4 barriers with lower timeframe confirmation.

Levels to watch/ live orders:

- Buys: 0.7200 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level). 0.7155-0.7171 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

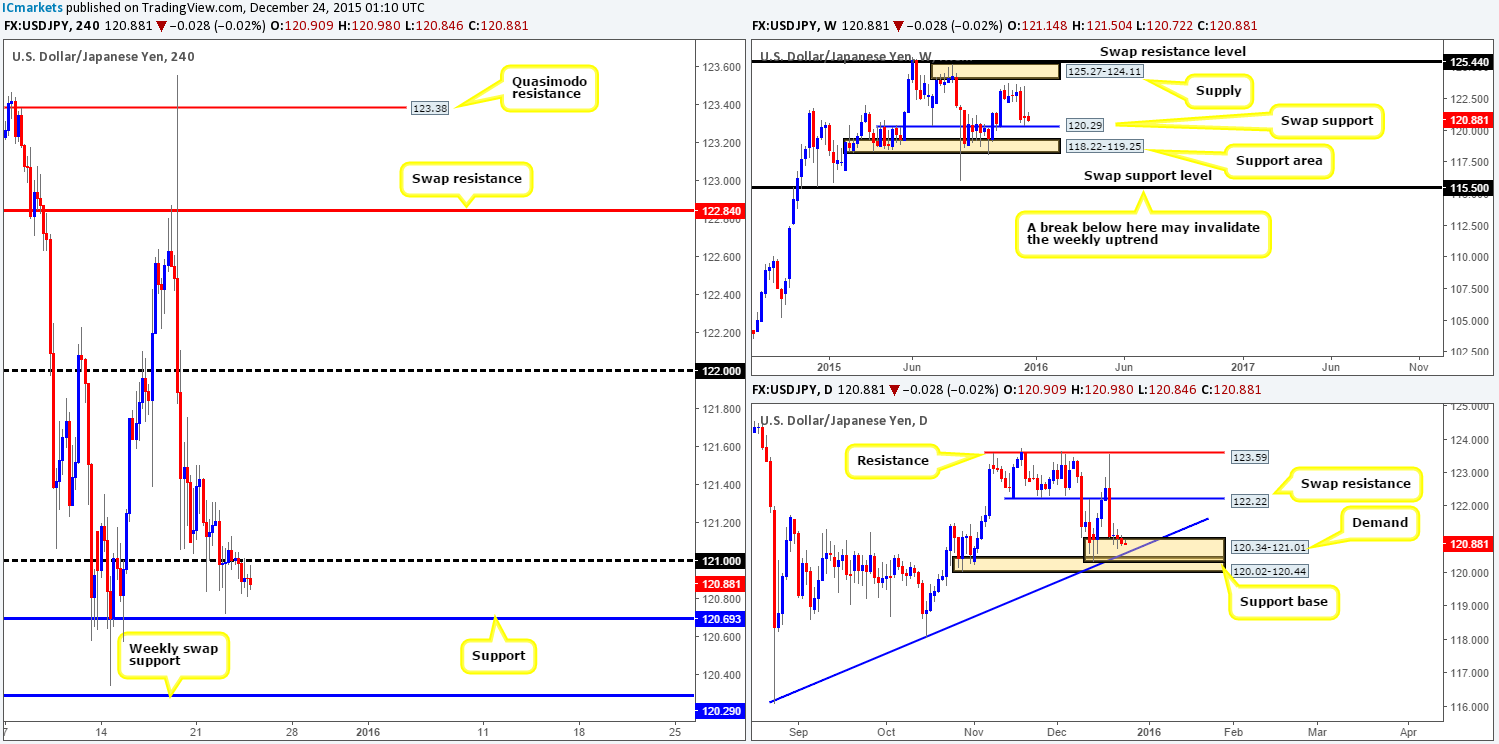

USD/JPY:

It was quite a sluggish session for the USD/JPY yesterday. Price closed below psychological support 121.00 and held as resistance for the remainder of the day. This, as a result, could possibly force this pair down to H4 support at 120.69 sometime today. Should this come to fruition, we feel this line will likely hold this market higher, potentially bouncing prices back up to at least 121.00.

The reason for our confidence in 120.69 stems from it sitting nicely within daily demand drawn from 120.34-121.01 which converges with a daily trendline support from the low 116.07. So why, when we have daily confluence here, do we only expect a bounce from 120.69? Well, despite the fact that liquidity is likely going to slow this market down, the main reason comes from the possibility of daily action faking below the above said daily demand into a daily support base lurking just beneath it at 120.02-120.44. Furthermore, this support base houses a weekly swap (support) level at 120.29, so the temptation for well-funded traders to drive prices lower is certainly there!

Therefore, to sum up, we are going to be watching for a (lower timeframe) confirmed bounce from 120.69 today. Over the Christmas period, nevertheless, we’re also going to keep tabs on the 120.29 region for possible longs into this market. Depending on when this level is hit and the H4 approach, we may consider entering at market from here due to the confluence seen in this area (see above in bold).

Levels to watch/ live orders:

- Buys: 120.69 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level). 120.29 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).