Lower timeframe confirmation: is something we use a lot in our analysis. All it simply means is waiting for price action on the lower timeframes to confirm direction within a higher timeframe area. For example, some traders will not enter a trade until an opposing supply or demand area has been consumed, while on the other hand, another group of traders may only need a trendline break to confirm direction. As you can probably imagine, the list is endless. We, however, personally prefer to use the two methods of confirmation mentioned above in our trading.

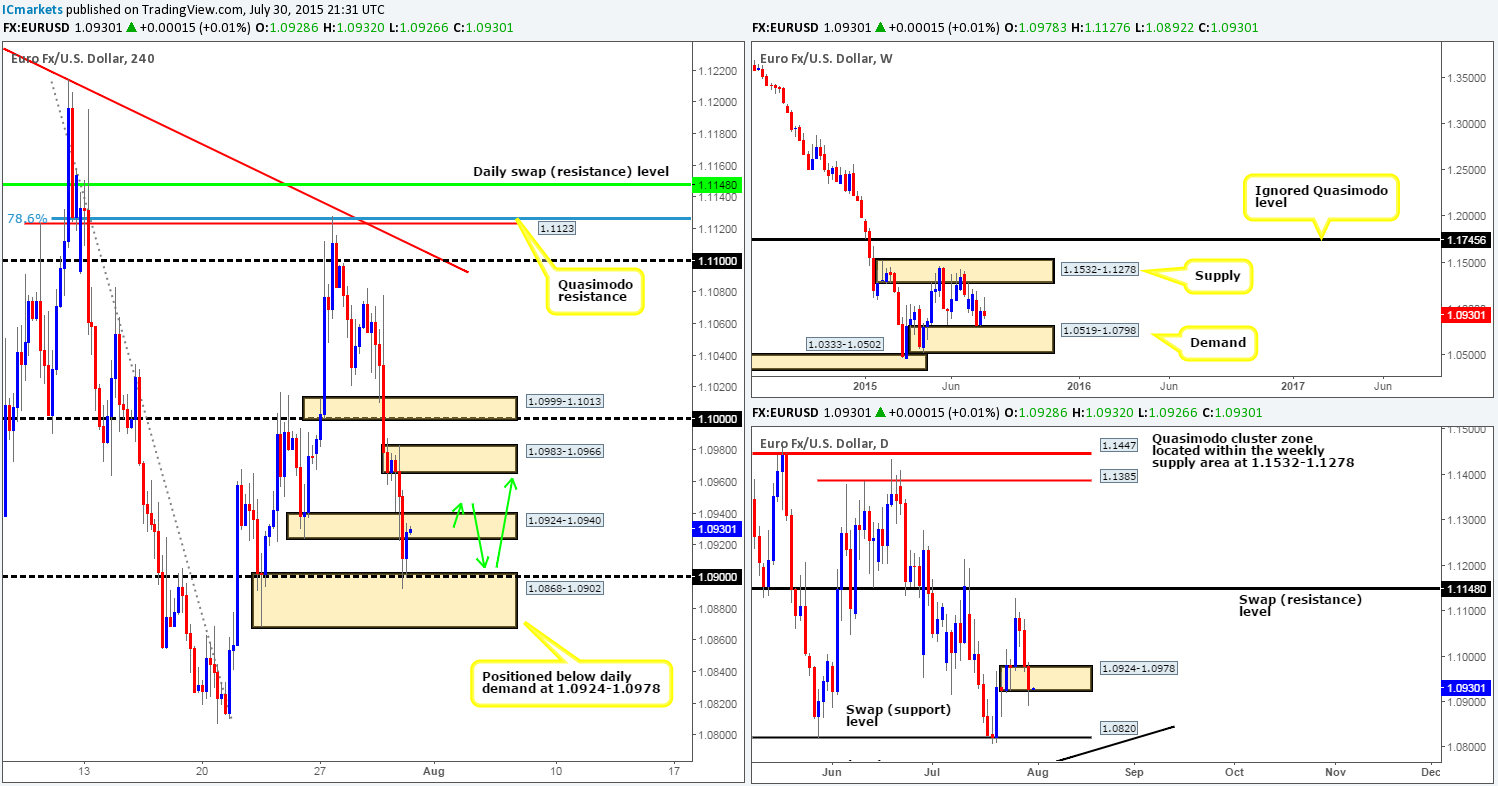

EURUSD:

Using a top-down approach this morning, we can see that the initial upward momentum seen from the weekly demand at 1.0519-1.0798 has really struggled to hold form this week. Daily timeframe action on the other hand, shows that the Euro has declined in value for the third consecutive day during yesterday’s trade, resulting in price spiking/faking below a daily demand area coming in at 1.0924-1.0978.

Going down one more to the 4hr timeframe reveals that yesterday’s descent took out the 4hr demand area at 1.0924-1.0940 and connected with another 4hr demand zone sitting just below it at 1.0868-1.0902 (currently supporting price beneath the daily demand just mentioned).

Given the points made above, our approach to this market today will be as follows…

The reaction seen at the current 4hr demand area looks promising but in no means good enough to buy this pair. The reason for this is price is now nibbling at offers sitting within the recently engulfed 4hr demand area 1.0924-1.0940 which is now acting supply. As such, this zone could effectively repel this market today. For us to be permitted to buy this pair, we need to see price drive above current supply, and then retrace and hold within current demand. Once/if we see price holding, then there could be a potential buy opportunity on the lower timeframes (see green arrows). By entering long following a break above supply, we’re essentially trading on the basis that offers at supply have been cleared thus the path north is free to rally up to at least the 4hr supply at 1.0983-1.0966, which would be our take-profit target.

Levels to watch/live orders:

- Buys: 1.0868-1.0902 – watch for price to consume offers at 1.0924-1.0940 before considering a buy entry here.

- Sells: Flat (Stop loss: N/A).

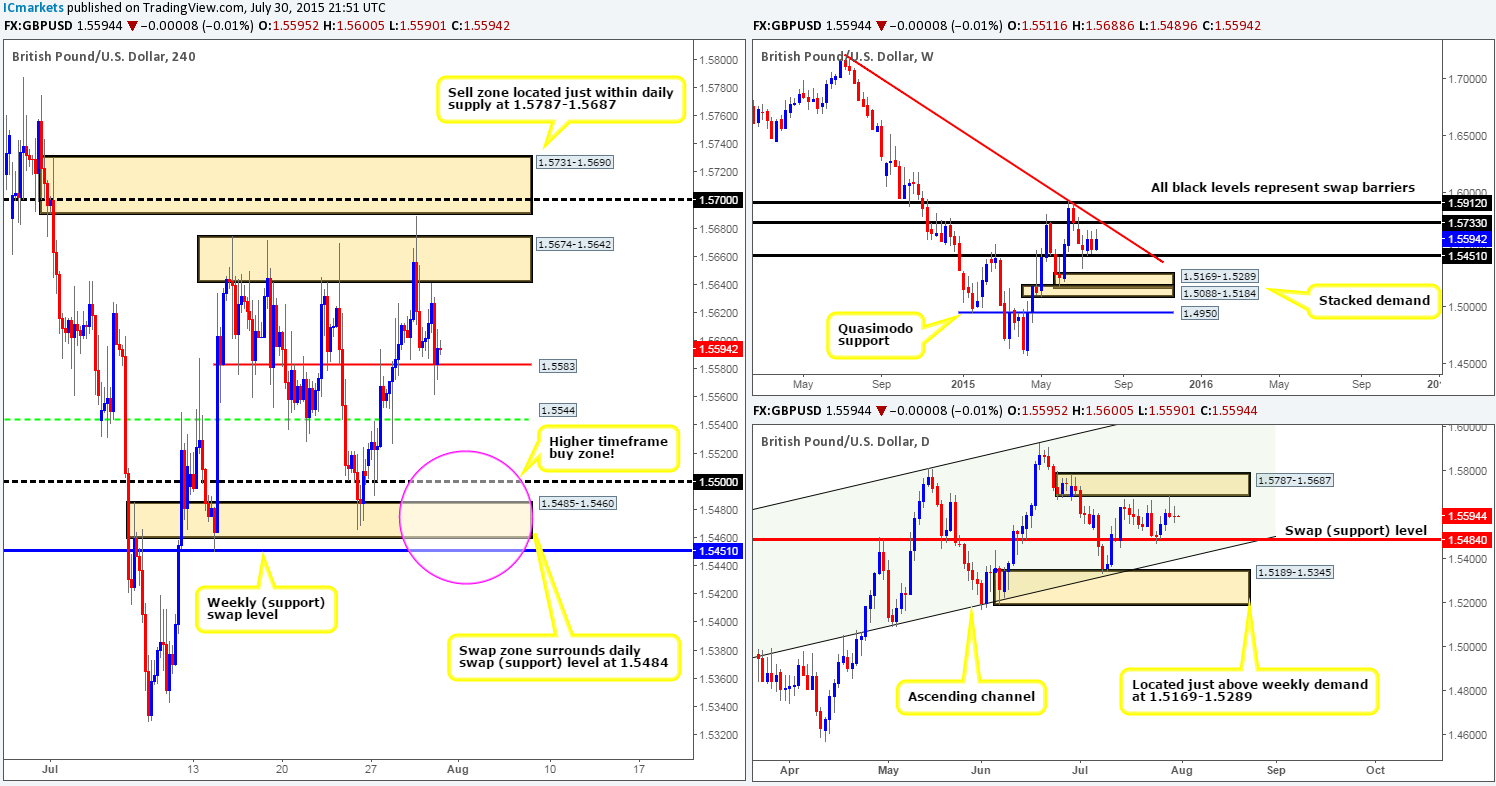

GBP/USD:

During the course of yesterday’s sessions, Cable ran into a strong ceiling of offers the underside of the clearly resilient 4hr resistance base at 1.5674-1.5642, which as a result, sent this market south to marry up with 1.5583 – a 4hr swap (support) level. The rebound from this level, however, is questionable in our opinion and is not something our team would label a high probability buy trade at this point.

Consequent to the above price action, the daily timeframe printed a clear indecision candle amid yesterday’s trade following Wednesday’s bearish pin-bar candle off daily supply at 1.5787-1.5687.

From where we’re standing, we have two choices today, well three, if you consider remaining flat:

- Watch how the lower timeframe price action behaves around 1.5583. If we begin to see strong buying strength come into the market via a pin-bar candle, multiple buying tails or simply support holding firm, we may then consider taking an intraday long position, targeting the 1.5626 mark.

- In the event that 1.5583 gives way, nonetheless, there could be, if price retested this number as resistance, a potential shorting opportunity, targeting 1.5544 (another 4hr swap [support] level), or even the round number below at 1.5500. We are not intending to go for lower targets from here as price will then be entering into higher timeframe buying territory (Weekly swap [support] level at 1.5451/Daily swap [support] level at 1.5484).

Levels to watch/ live orders:

- Buys: 1.5583 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Watch for 1.5583 to be consumed and then look to enter on any retest seen (lower timeframe confirmation required).

AUD/USD:

The AUD/USD pair, as you can see, saw price take out the round number 0.7300 yesterday, which allowed price to aggressively sell-off consequently reaching new lows on the week at 0.7253.

Now, considering that price is still loitering within a long-term weekly demand at 0.6951-0.7326, and the daily timeframe shows that the daily swap (resistance) level at 0.7326 (which is essentially the upper limit of weekly demand) is able to hold this market lower this week, things are not looking too good for anyone long the Aussie right now.

That being the case, our team is firmly placing ourselves in the sellers’ camp today. Areas we currently have our eye on are as follows:

- The immediate 4hr supply area coming in at 0.7321-0.7303. This zone not only sports round-number resistance just below it at 0.7300, but also boasts a daily swap (resistance) level just above it at 0.7326. Therefore, this is certainly a place that we’d consider jumping in short should the lower timeframe price action be agreeable.

- Failing to see a reaction at the above said 4hr supply area, price would then likely be headed towards an already proven zone of 4hr supply seen at 0.7360-0.7342. This barrier converges with not only the mid-level hurdle 0.7350, but also the 4hr downward descending channel taken from the high 0.7531 and low 0.7371. With that, this would also be another area we consider shorting today as long as we’re able to spot a suitable sell entry on the lower timeframe structure.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7321-0.7303 [Tentative – confirmation required] (Stop loss: 0.7324) 0.7360-0.7342 [Tentative – confirmation required] (Stop loss: 0.7363).

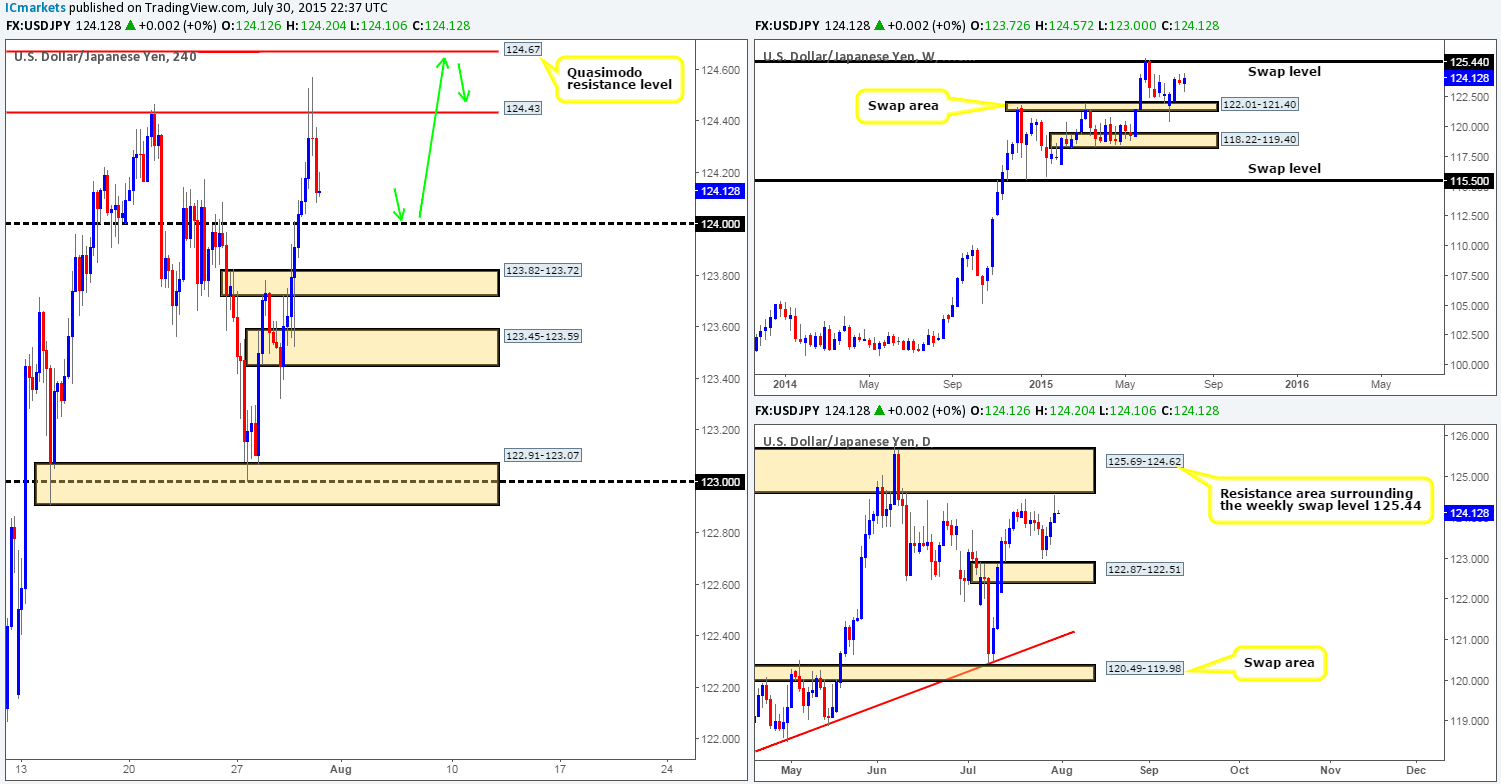

USD/JPY:

Upon reaching the psychological threshold 124.00 yesterday, offers were completely obliterated here with price not even seen retesting this number before rallying north to tie in with a 4hr resistance level coming in at 124.43, which, as you can see, has so far been able to hold this market lower. The recent surge in buying has also seen price NEARLY shake hands with a daily resistance area at 125.69-124.62 falling short by only a few pips.

With price action still showing room for prices to move further north on the weekly timeframe, and the daily timeframe yet to connect with the daily resistance area mentioned above, we still believe that this pair is going to rally north today as we feel it wants to plug into orders sitting around the 4hr Quasimodo resistance level at 124.67, which incidentally, lies just within the aforementioned daily resistance area.

With that, the most likely scenario we see playing out today is that price will continue to sell-off down to round number support 124.00 and pick up any orders left unfilled from the recent break. This will, we believe, push prices north once more, engulfing 124.43 (majority of offers likely consumed here now) and then connecting with the aforementioned 4hr Quasimodo resistance level. In effect then, one could look to enter long at 124.00 today, and liquidate this position once/if price reaches 124.67, where at which point shorts would be more favorable as per the green arrows.

However, since both 124.00 and 124.67 will likely see fakeouts, we would highly recommend waiting for some sort of lower timeframe signal confirming there are traders interested in this level before committing capital to this idea.

Levels to watch/ live orders:

- Buys: 124.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: 124.67 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

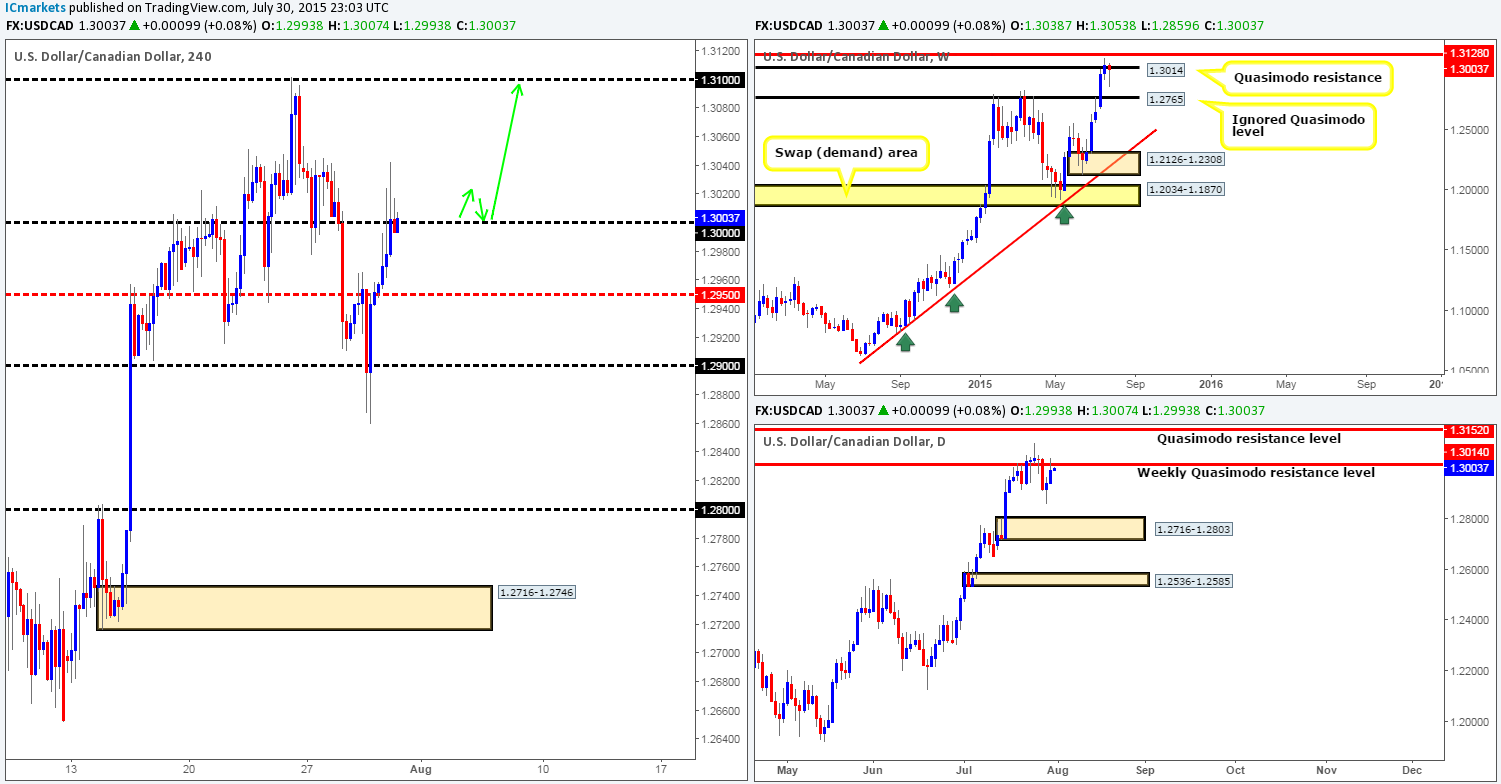

USD/CAD:

Into the early hours of yesterday’s sessions, price closed above the mid-level hurdle 1.2950 which clearly set the tone for the rest of the day, as The U.S dollar continued to appreciate until reaching the large psychological barrier 1.3000. Offers at this level, at the time of writing, still seem to be holding firm here consequently producing a beautiful array of selling tails in the process.

This, at least for us anyway, is currently a very tricky pair to trade. On the one hand, price is trading from a weekly Quasimodo resistance level at 1.3014, but on the other, the reaction seen from this barrier has so far not been anything to get excited about. Therefore, we feel that price may be targeting the weekly swap (resistance) level seen above at 1.3128, which may mean 1.3000 is potentially going to give way today. With that, we’re placing short trades on the back burner for the time being and focusing our energy more on the long side of this market.

In the event that price breaks above 1.3000, we’d most certainly consider buying this pair should price retest this number as support, since from there, the path north on the 4hr timeframe appears clear up to the 1.3100 region.

Levels to watch/ live orders:

- Buys: Watch for 1.3000 to be consumed and then look to enter on any retest seen (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

USD/CHF:

Recent events on the USD/CHF pair show that price continued to rally yesterday, reaching as high as the round number 0.9700, where at which point, the sellers made an appearance consequently forming a collection of selling tails.

With the selling tails at round number resistance, this could be enough to bring prices down to 0.9662 or the 4hr demand just below it at 0.9597-0.9625. We are personally not interested in trading short from here, however, simply because we see very little higher timeframe resistance currently in play right now, thus further buying is possible in our opinion up to at least the daily Quasimodo resistance level coming in at 0.9755. Nevertheless, should we see further selling from here; this will be favorable for two reasons:

- This could mark the beginnings of drive three to a possible three-drive bearish reversal pattern forming on the 4hr timeframe. Notice that we have drives one and two complete already (thick-black arrows) – the third drive should take price nicely up to the aforementioned daily Quasimodo resistance level, where we would certainly consider shorting.

- One could look to enter long at either the 4hr swap (support) level at 0.9662, or even the 4hr demand area seen at 0.9597-0.9625 as per the smaller black arrows as price attempts to complete the three-drive pattern. We would advise patience with these buy levels though and only enter should lower timeframe price action also show support stabilizing and holding firm, since there is nothing worse than getting stopped out on a fakeout only to see price steam ahead to your target! On the subject of targets, our overall take-profit target for longs taken at either of the above said 4hr areas would be 0.9755 – the daily Quasimodo resistance level we just discussed above.

Levels to watch/ live orders:

- Buys: 0.9662 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.9597-0.9625 [Tentative – confirmation required] (Stop loss: 0.9592).

- Sells: Flat (Stop loss: N/A).

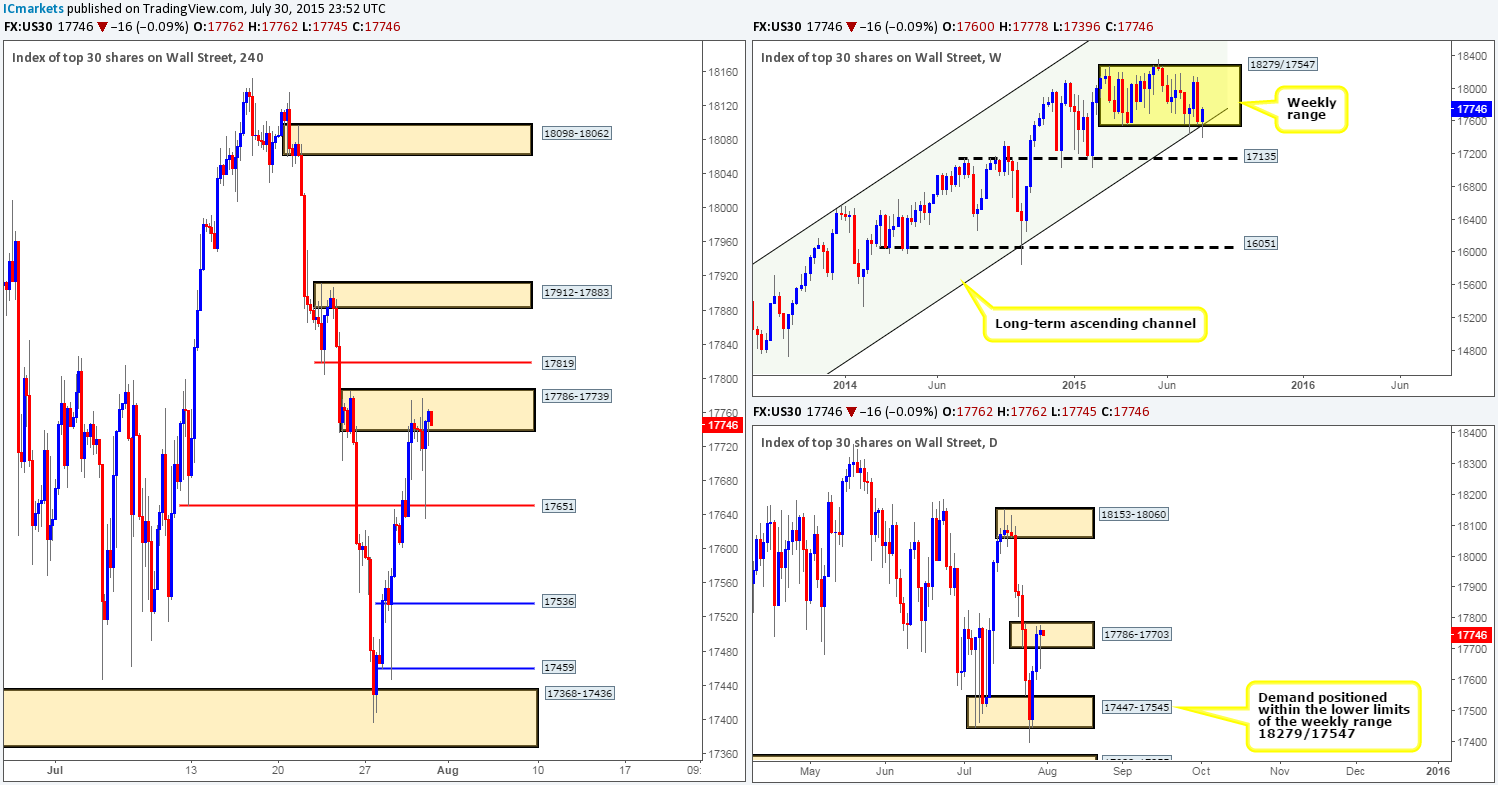

DOW 30:

Yesterday’s trade showed offers started coming into this market from within the 4hr supply zone at 17786-17739 mid-way through the London session, resulting in price aggressively slamming into 17651. Price action was clearly not intent on hanging around this level for long as price was bought from here just as aggressively pushing the DOW back up to within the aforementioned 4hr supply area.

Now, considering that the weekly timeframe is currently showing room for price to appreciate further, and strong supportive pressure is being seen from the 4hr level 17651, we feel that the aforementioned 4hr supply area and its partner supply on the daily timeframe at 17786-17703 may give way today. If this does occur, price will then be likely free to also move north on the daily timeframe up to a daily supply zone coming in at 18153-18060, which we’ll then leave us with possible resistive pressure on the 4hr timeframe from 17819 and the 4hr supply area seen at 17912-17883. Therefore, here is how we intend to approach this market…

- In the event that the current 4hr supply area is consumed, we’ll then be looking for 17819 to be taken out as well. Only then will we be able to look to buy any intraday retest off of this number up to 4hr supply at 17912-17883.

- Once or indeed if price takes out the 4hr supply at 17912-17883, we’ll then be looking to more medium-term long positions, targeting 4hr supply seen at 18098-18062 (lodged within the daily supply area mentioned above at 18153-18060).

Levels to watch/ live orders:

- Buys: Watch for both 17786-17739 and 17819 to be consumed and then look to enter on any retest seen (lower timeframe confirmation required) Watch for 17912-17883 to be consumed and then look to enter on any retest seen (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

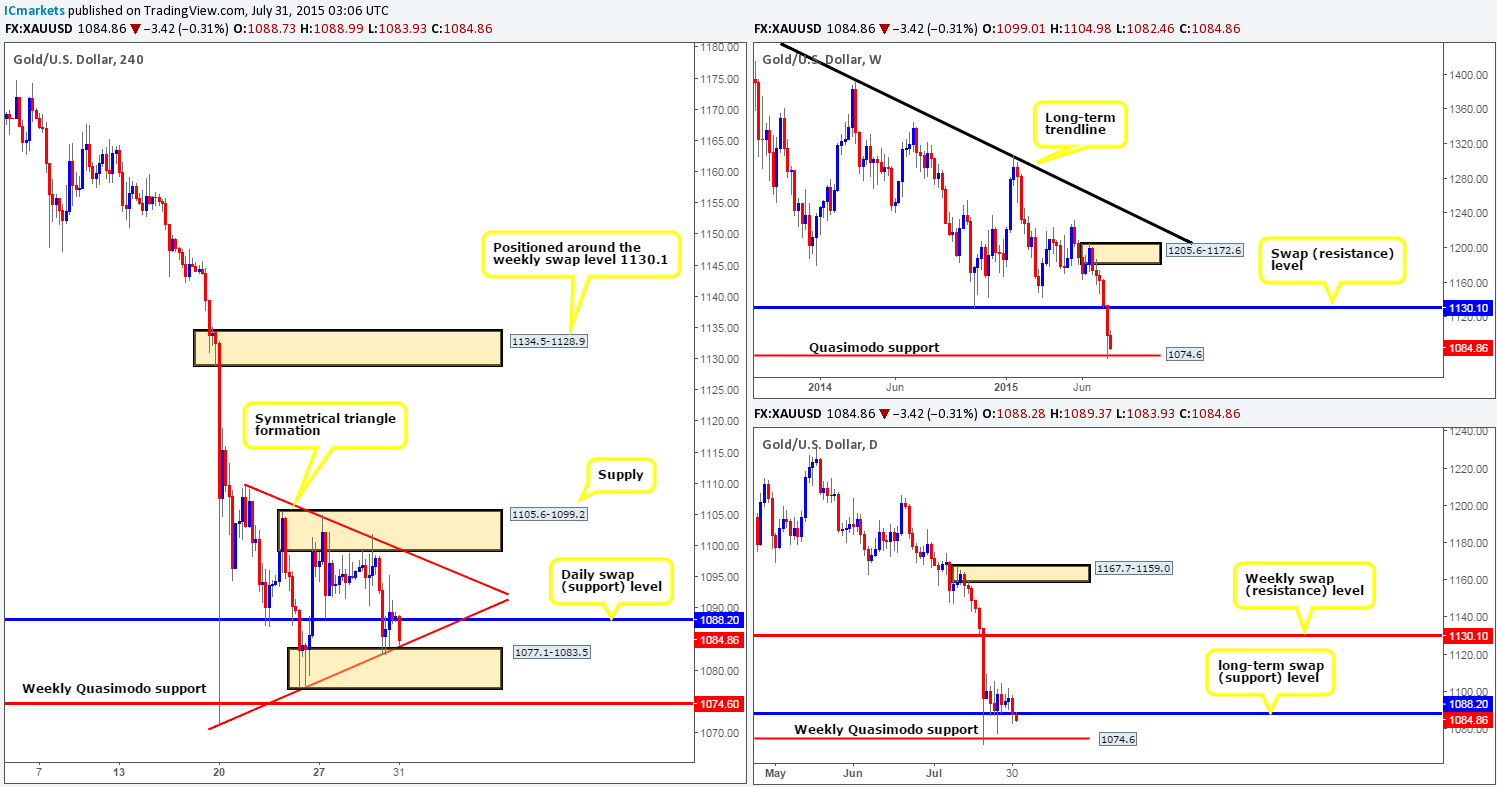

XAU/USD: (Gold)

Beginning from the top this morning, we can still see price is just about holding above the weekly Quasimodo support level at 1074.6, while on the daily timeframe, buyers appear to be struggling to hold the fort around the daily swap (support) level at 1088.7.

Slipping down to the 4hr timeframe, price is now seen compressing within a 4hr symmetrical triangle (high: 1109.8 low:1071.2), that also boasts extra support from 4hr demand at 1077.1-1083.5 and 4hr supply at 1105.6-1099.2.

Given what we know, and considering the fact that today is the last trading day of the week, we are going to keep our objective simple today, in that we’re only going to be looking to trade small intraday bounces off of the limits of the aforementioned 4hr symmetrical triangle. Fakeouts above/below these two colliding barriers is high probability so we would not recommend placing pending orders here. Personally, we’d only consider entering into a position if the lower timeframes showed some sort of lower timeframe strength i.e. support/resistance holding firm – pin bars – buying/selling tails etc…

Levels to watch/ live orders:

- Buys: Watch for buying opportunities at the ascending trendline taken from the low 1071.2 (confirmation required).

- Sells: Watch for selling opportunities at the descending trendline taken from the high 1109.8 (confirmation required).