A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

Beginning with a look at the weekly chart this morning, we can see that the shared currency is, at present, flirting with the yearly opening level at 1.0873. Although this line steadied price beautifully three weeks ago, traders still need to be prepared for the likelihood of a fakeout through this level down to nearby support at 1.0819. Looking down to the daily chart, it’s clear to see that the pair is currently treading water within a demand base coming in at 1.0850-1.0887. This area, as you can probably see, houses the aforementioned yearly opening level and sits directly above the aforementioned weekly support.

Hopping over to the H4 candles, local resistance at 1.0943 was tested going into yesterday’s London segment, consequently forcing price beyond the 1.09 handle. 1.09 proved to be a solid resistance for the remainder of the day, aided by a better than expected US jobless claims reading at 1.30pm GMT.

Our suggestions: As 1.09 continues to function as resistance; the next downside target can be seen at 1.0859: a H4 Quasimodo support. For folks who read our previous report you may recall that we built a case for entry at this base. Not only is the line placed deep within the current daily demand area, it is also located less than 20 pips below the yearly opening level mentioned above. Trading from 1.0859 also allows one to employ a tight stop-loss order, which, in our opinion, is best positioned below the current daily demand base at around the 1.0845ish range. Ultimately, we’d be looking to reduce risk to breakeven and take a large portion of the position off the table around the 1.09 neighborhood.

Liquidity may be a tad thin today, though, given that the US banks are closed in observance of Veterans Day.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: 1.0860 ([pending order] stop loss: 1.0845).

- Sells: Flat (stop loss: N/A).

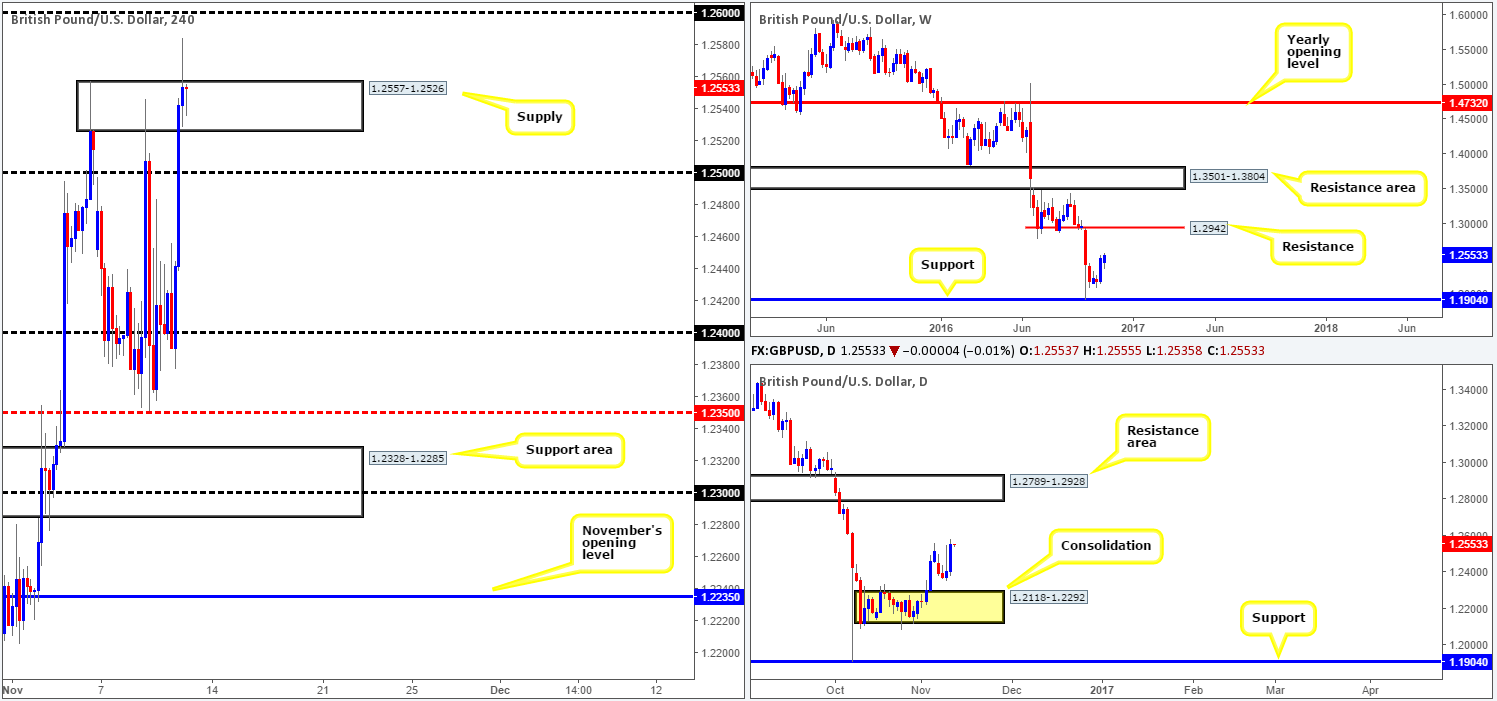

GBP/USD:

Mid-way through yesterday’s London segment cable rocketed north from the 1.24 neighborhood, resulting in price chewing through the 1.25 handle and concluding the day spiking above H4 supply at 1.2557-1.2526. To our way of seeing things there was no clear stimulant for the move.

In light of this recent advance, the H4 candles look poised to extend up to the 1.26 handle today, since both the sellers’ stops have likely been taken out and breakout buyers’ orders filled. The other key thing to note here is that both the weekly and daily candles suggest that there’s room to rally north, considerably further than 1.26! The next upside target on the bigger picture falls in at a daily resistance area drawn from 1.2789-1.2928, shadowed closely by a weekly resistance level at 1.2942. On top of this, let’s keep in mind that over on the monthly chart there’s a huge demand now in play between 1.0438-1.3000.

Our suggestions: An intraday long position could be considered on the condition that a close above and retest of the current H4 supply is seen. Be that as it may, seeing as how the next H4 upside target is 1.26, traders may want to exercise patience here and instead wait for a close above 1.26, before considering longs. We personally feel the better route to take is to hold fire for a close above 1.26, given the upside potential beyond this number.

Liquidity could be a tad thin today, nevertheless, given that the US banks are closed in observance of Veterans Day.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: Looking for the 1.26 handle to be consumed before considering longs in this market.

- Sells: Flat (stop loss: N/A).

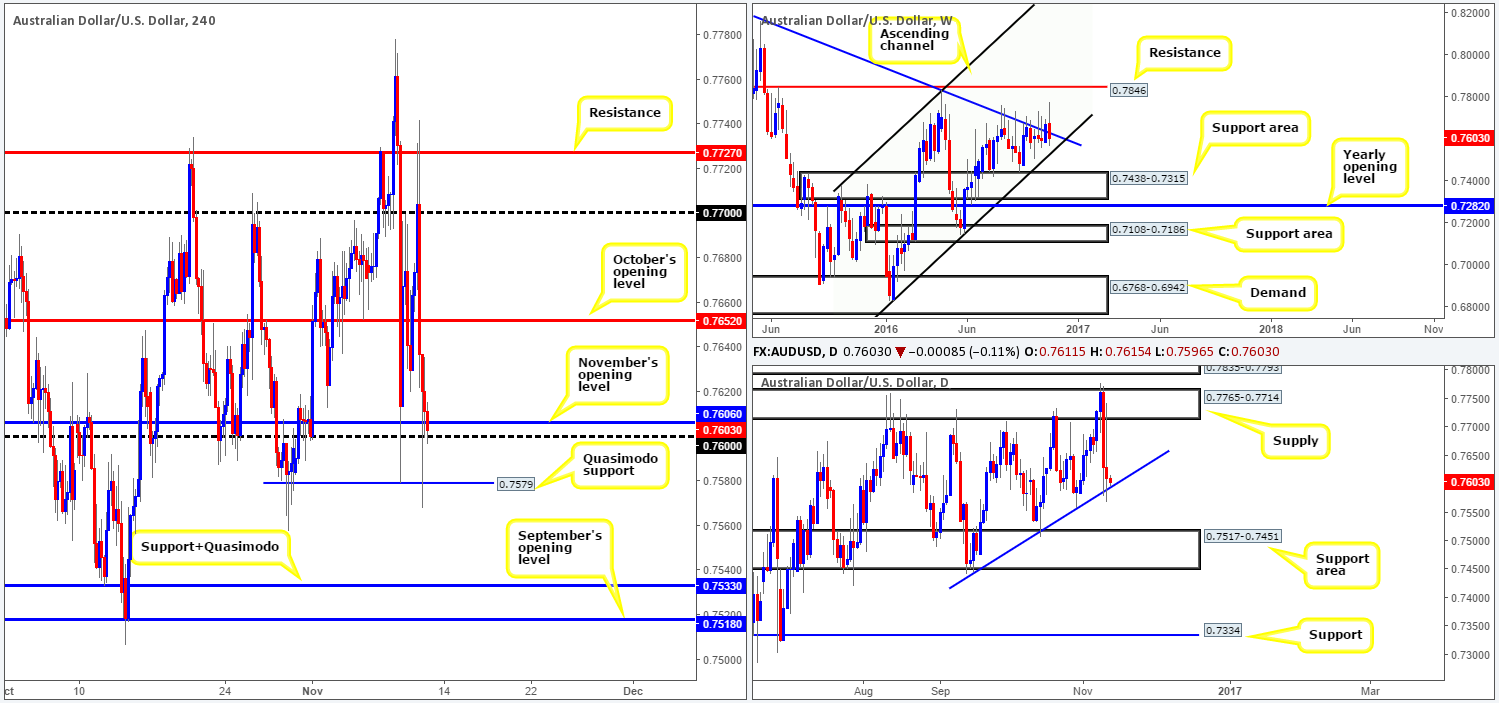

AUD/USD:

The weekly candle looks to be on course to close the week out in the red, possibly forcing price to close back beneath the weekly trendline extended from the high 0.8295. Before the weekly sellers can achieve this, however, daily bids will need to be taken out around the current trendline support drawn from the low 0.7446. The break of this ascending line could see a renewal of bearish sentiment down to 0.7517-0.7451: a support area which fuses nicely with weekly channel support taken from the low 0.6827.

Turning our attention to the H4 chart, we can see that price, as expected, closed above October’s opening level at 0.7652, but failed to retest it as support which was needed to confirm a buy here for our team. The commodity currency continued to extend following the breach, whipsawing through the 0.77 handle and touching gloves with H4 resistance at 0.7727, before collapsing over 150 pips down to lows of 0.7567.

Our suggestions: In view of the H4 candles currently trading from the 0.97 handle/November’s opening level at 0.7606, where does one go from here? Despite the weekly candle stepping back below the aforementioned weekly trendline, we cannot rule out the possibility that H4 buyers may bid the unit up to October’s opening level at 0.7652.

On the other side of the coin, a close below 0.97 and the nearby H4 Quasimodo support at 0.7579, would, at least in our opinion, help validate further downside on the weekly chart, since the next H4 target falls in at 0.7533: a H4 combined support/Quasimodo that sits directly above the aforementioned daily support area.

In light of the above points, our desk has decided to remain on the sidelines for the time being and reevaluate on Monday.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

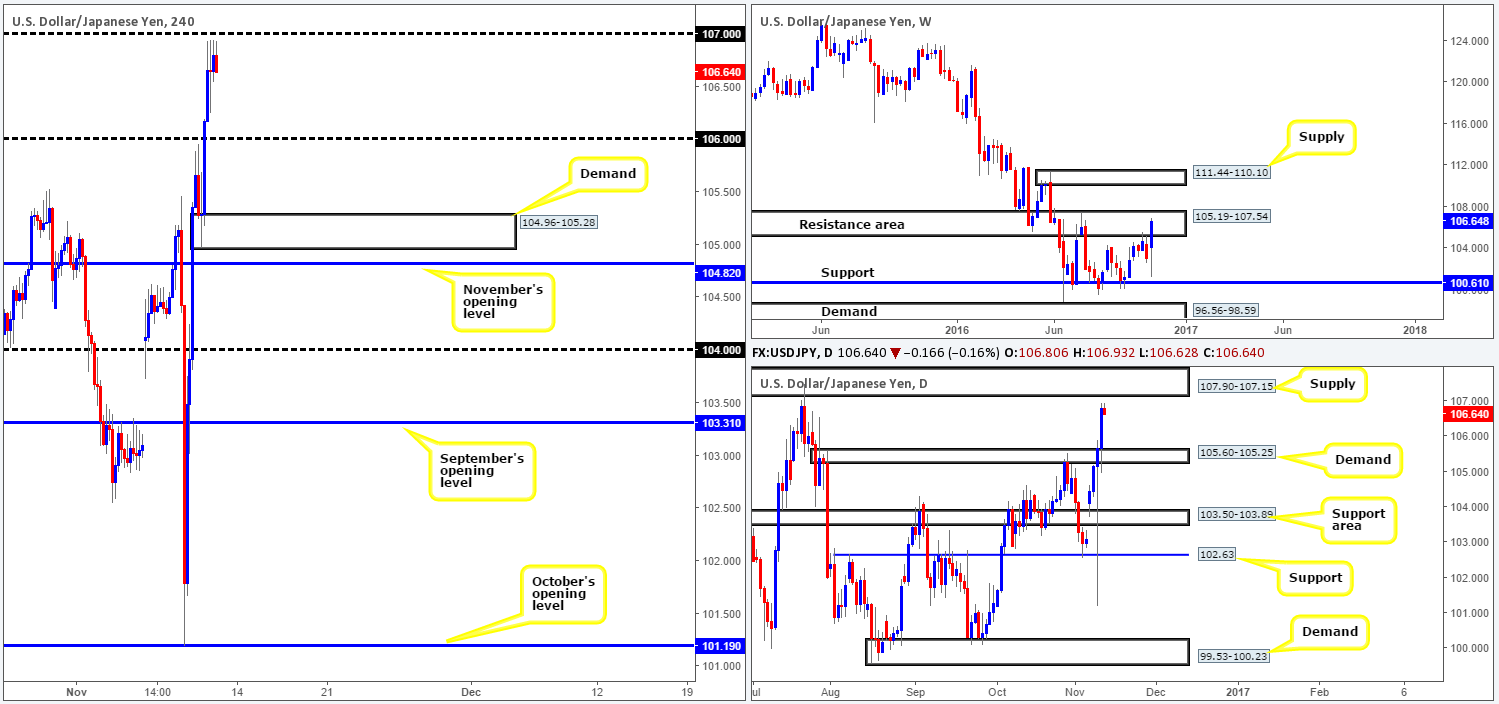

USD/JPY:

Going into the early hours of yesterday’s London session, the bulls came alive following a near-touch of November’s opening level at 104.82 a few hours earlier. The 106 handle was occupied without much of a fight, with price ending the day consolidating just ahead of the 107 handle. Not even a stronger than expected US jobless claims reading could igniting fresh buying momentum from here.

While the H4 candles take a breather, the daily candles show further upside is a possibility to supply coming in at 107.90-107.15, which happens to be lodged within the upper edge of a weekly resistance area carved from 105.19-107.54.

Our suggestions: Given the above factors, our desk has no interest in shorting from the 107 neighborhood. Instead, today’s spotlight will firmly be focused on 107.65 (not seen on the screen): a H4 Quasimodo resistance that is lodged firmly within the above said daily supply, and positioned nine pips above the noted weekly resistance barrier. We would recommend waiting for at least a reasonably sized H4 bearish close to form before trading here due the recent US dollar strength seen in the markets, following Trump’s victory. In closing, liquidity may be a tad thin today given that the US banks are closed in observance of Veterans Day.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 107.65 region ([reasonably sized H4 bearish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

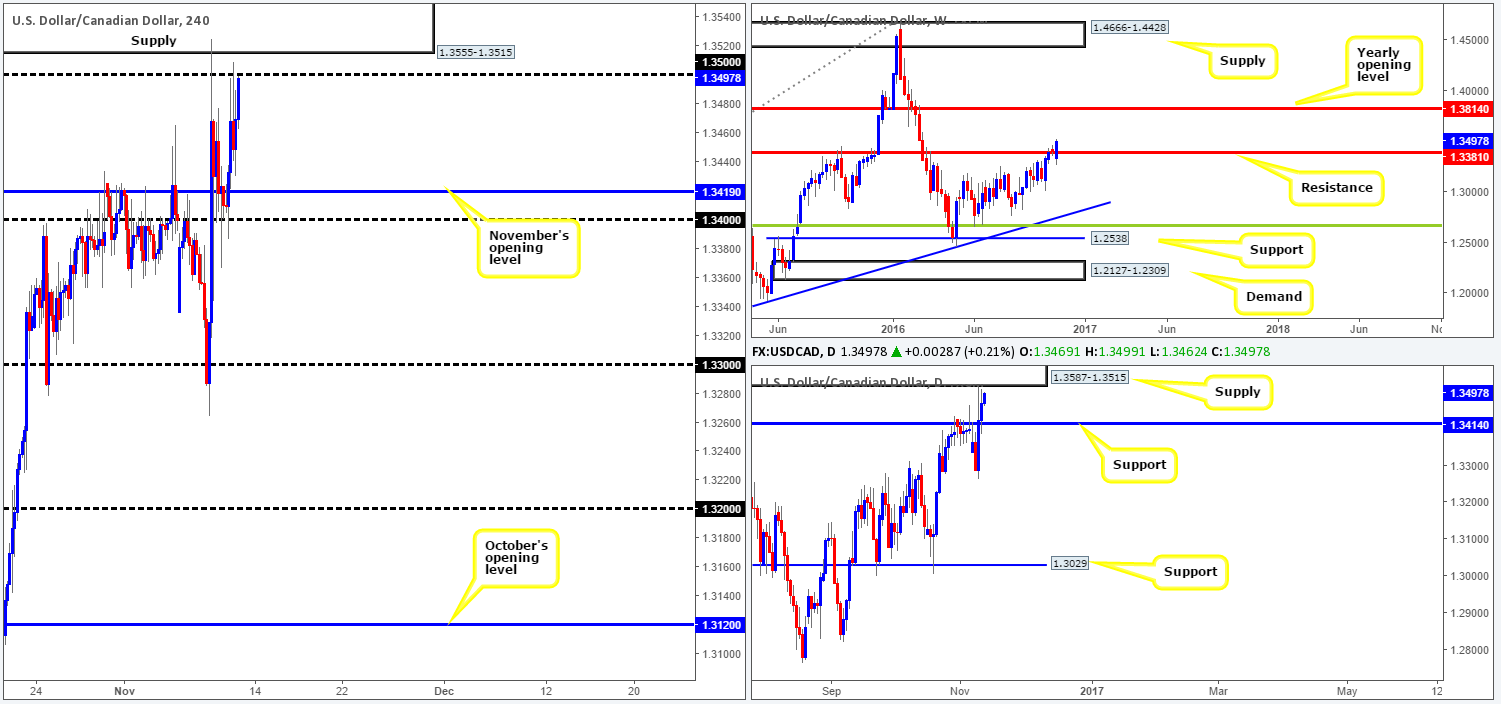

USD/CAD:

Let’s bring this in from the top this morning. Broad US dollar strength has been seen in the markets following Trump’s victory, causing the current weekly candle to break above resistance drawn from 1.3381. Should this dominance continue the yearly opening level at 1.3814 is very likely the next target on the hit list. In spite of this, daily action shows price now teasing the underside of a supply zone coming in at 1.3587-1.3515. This, in our opinion, may very well be the last line of defense stopping price from hitting the above noted yearly opening level.

Stepping over to the H4 chart, the loonie is presently seen testing the 1.35 handle that sits directly below a supply base coming in at 1.3555-1.3515. While a reversal from here is certainly a possibility, there’s a sneaky H4 Quasimodo resistance lurking just above the supply at 1.3564, which has ‘sell me’ written all over it! Think of all those stop-loss orders taken from 1.35 and the H4 supply – this would very likely provide the big boys enough liquidity to sell. On top of this, the H4 Quasimodo is located within the top edge of the aforementioned daily supply!

Our suggestions: In that both the US and Canadian banks are closed today, liquidity may be incredibly thin in this market. We very much doubt price will breach the current H4 supply area during today’s sessions. Nevertheless, should a rally take place and price signals intent to push above the H4 zone, we will, dependent on the time of day, be looking to short from 1.3564 with a small stop placed above the apex of the formation at 1.3590.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT, BoC Gov. Poloz speaks at 3.50pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.3564 ([dependent on the time of day, a market order from here is valid] stop loss: 1.3590).

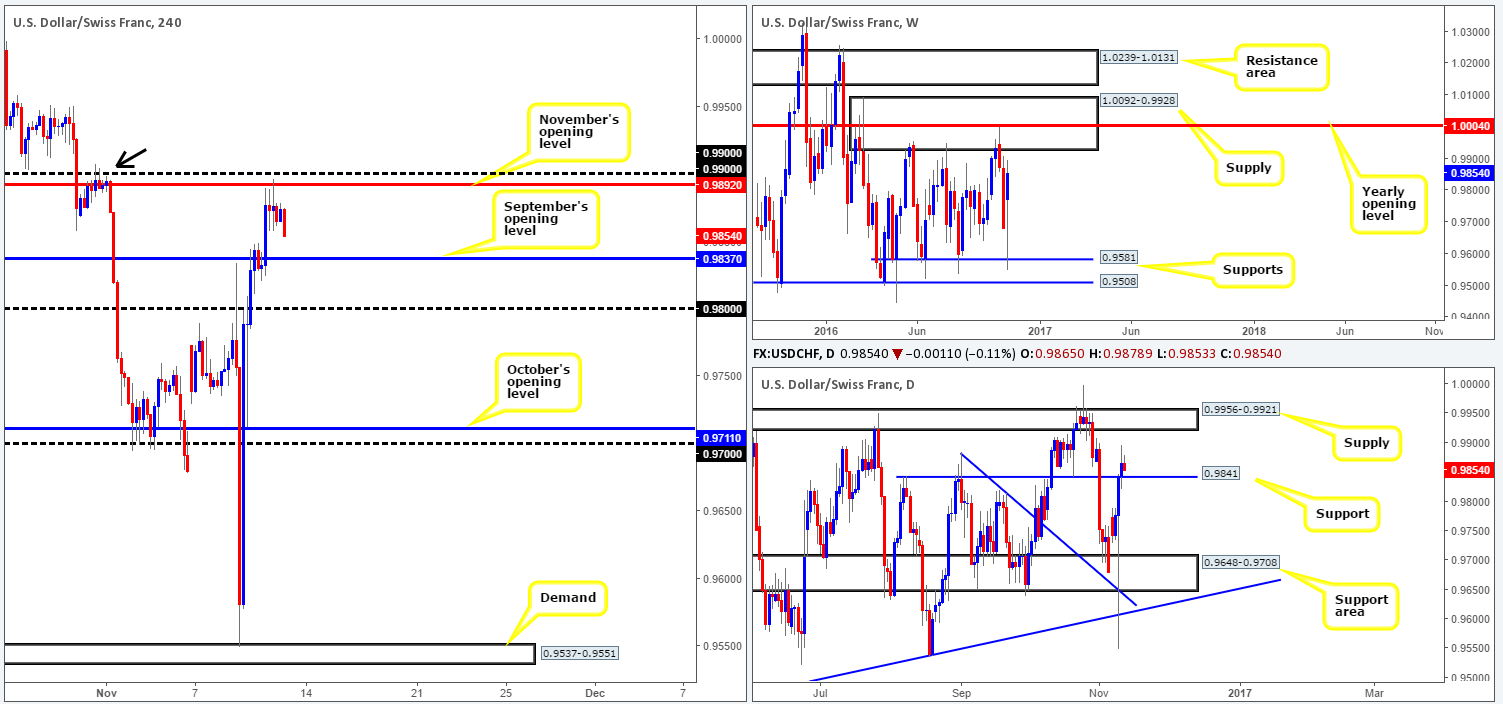

USD/CHF:

As London buyers entered the fray yesterday, September’s opening level at 0.9837 was vigorously taken out, leaving price action free to cross swords with November’s opening barrier at 0.9892. The other key thing to note here is that November’s level is bolstered by a H4 supply marked with a black arrow at 0.9907-0.9888, and, of course, the 0.99 handle. Since the beginning of the US segment, November’s opening base was, and continues to be well offered, suggesting we may see September’s line retested as support today.

Looking over to the weekly chart, price is seen trading within shouting distance of a supply area coming in at 1.0092-0.9928 that houses the yearly opening level at 1.0004. Sliding down to the daily chart, resistance at 0.9841 was engulfed during yesterday’s session, potentially clearing the freeway up to supply chalked in at 0.9956-0.9921.

Our suggestions: Selling from the 0.99 neighborhood is appealing given its H4 confluence. However, by doing so traders would need to be prepared for the possibility of a 20-pip (or so) fakeout up to the underside of both the weekly supply at 0.9928 and daily supply at 0.9921. As such, we’d preferably like to see a nice-looking H4 bearish selling wick pierce through 0.99 and touch base with the above said higher-timeframe structures. Only then would our desk consider throwing in a sell order, targeting September’s opening hurdle. Finally, liquidity may be a tad thin today given that the US banks are closed in observance of Veterans Day.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.99 region ([H4 bearish close – preferably a selling wick – required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

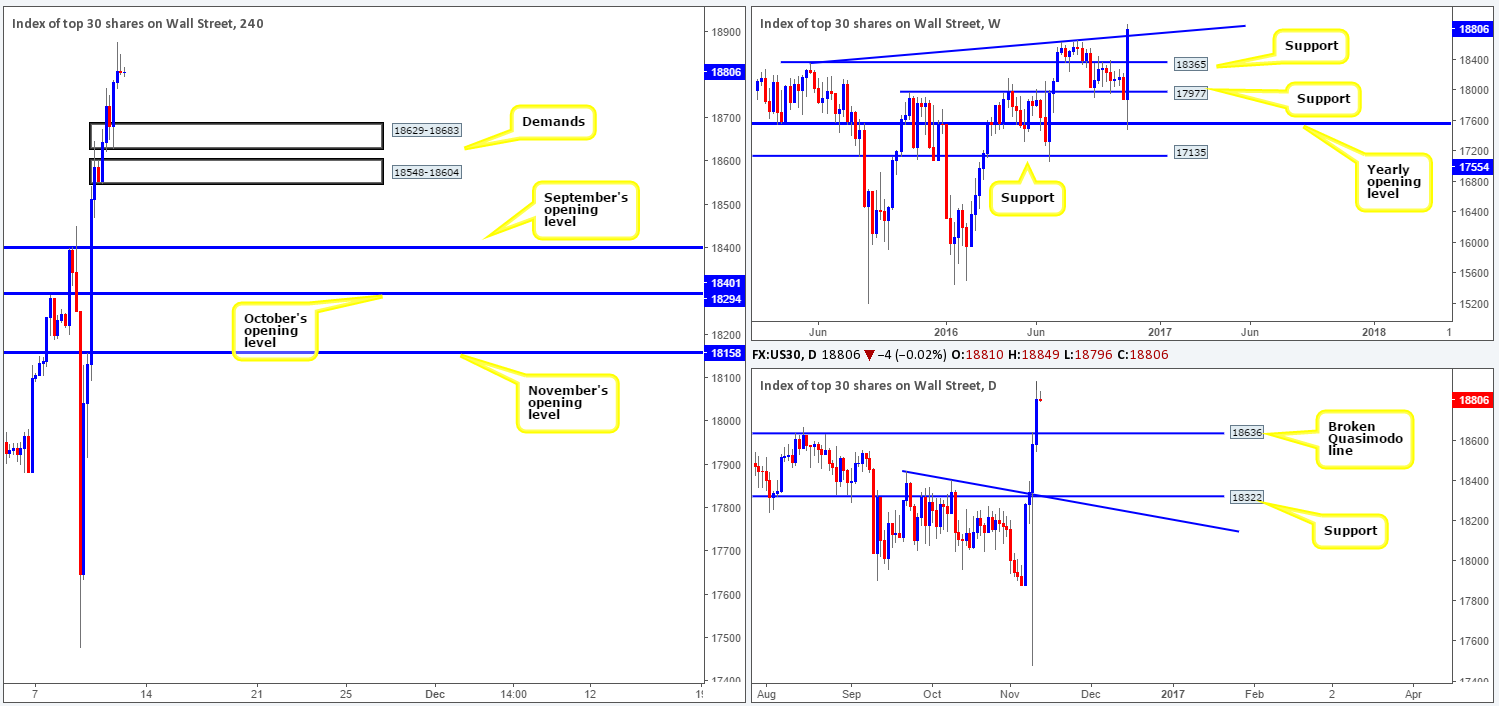

DOW 30:

Kicking this morning’s analysis off with a look at the weekly chart shows price spiked down to the yearly opening level at 17554, and has been on a tear from this point since Trump’s victory. As of now, the index has chalked up a fresh weekly high of 18877, and recently breached a trendline resistance extended from the high 18365. What this recent advance also did was smash through a daily Quasimodo resistance at 18636, now an acting support barrier.

In conjunction with weekly price, we can see the H4 demand at 18629-18683 intersects beautifully with the aforementioned weekly trendline support, boosting its appeal for longs. Additionally, the H4 demand was formed upon the break of a major high at 18668, further enhancing its legitimacy.

Our suggestions: Put simply, we feel the equity market is due for a pullback and the above said H4 demand could very well be the place to look to buy the dip from. Traders still want to tread carefully here, however, since a nearby H4 demand lurks just below it at 18548-18604, which was formed following the break of the daily Quasimodo resistance level at 18636.

Liquidity may be a tad thin today given that the US banks are closed in observance of Veterans Day.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: 18629-18683 ([reasonably sized H4 bullish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

- Sells: Flat (stop loss: N/A).

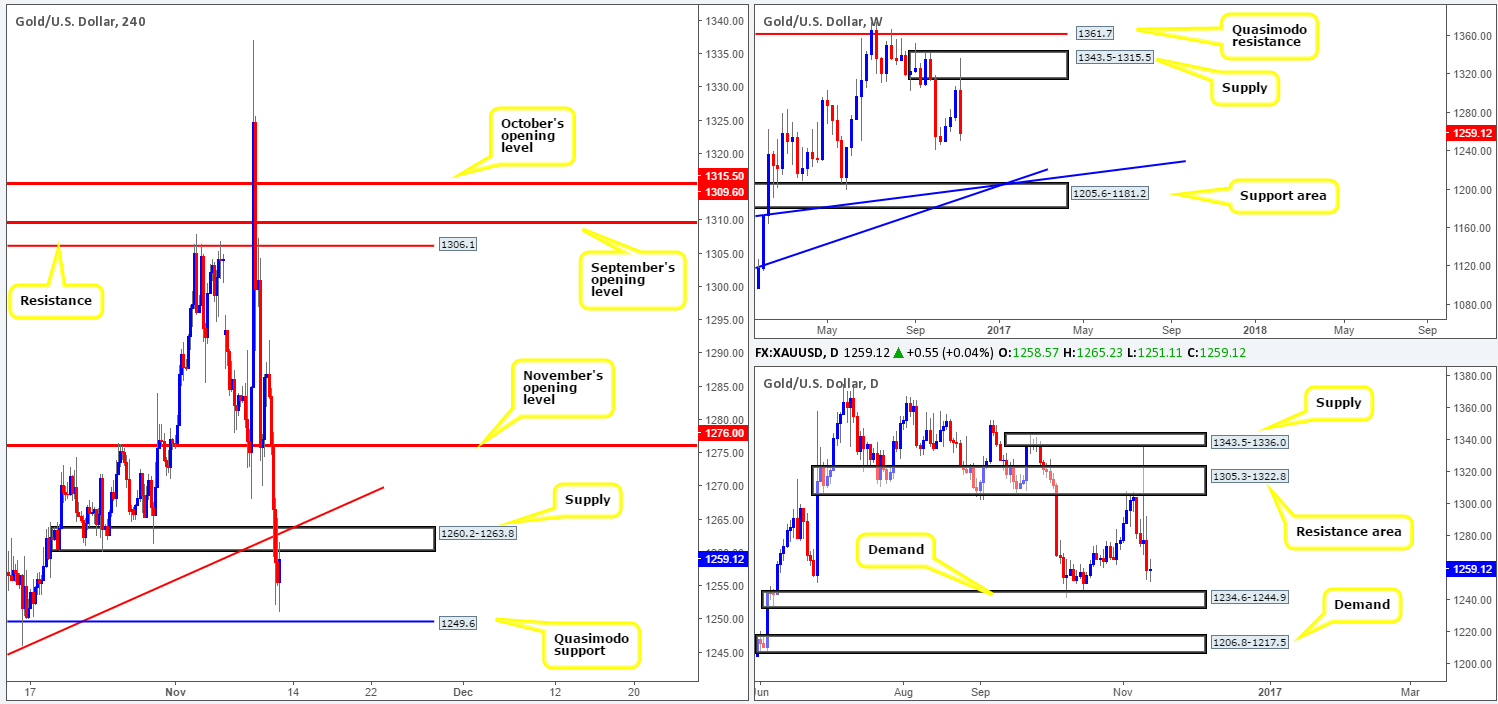

GOLD:

Across the board, we can see the US dollar benefitting heavily from the recent Trump win, consequently sending the yellow metal lower. Up on the weekly chart, gold beautifully spiked a supply zone coming in at 1343.5-1315.5, and has deteriorated since. Apart from the 3rd Oct low at 1241.2, the trail appears reasonably clear down to a support area drawn from 1205.6-1181.2 (reinforced by two trendline supports [1130.1/1071.2]). Driving down into the pits of the daily timeframe, nevertheless, shows price is currently hovering above a demand base penciled in at 1234.6-1244.9, which actually supports the 3/10 weekly low!

The steep decline seen in this market over the past week sent bullion below a H4 demand during the course of yesterday’s sessions, which, as you can see, is now being retested as supply. Seeing as how this area ties in nicely with a H4 trendline resistance carved from the low 1241.2, and both the higher-timeframe charts show possibility for additional downside, a short from this area is certainly interesting.

Our suggestions: Keep a close eye on lower timeframe action around the current H4 supply base (see the top of this report for ideas on how to enter using lower timeframe price) for a possible shorting opportunity, targeting the H4 Quasimodo support at 1249.6 as your immediate take-profit level.

Do, however, keep in mind that US banks are closed in observance of Veterans Day today. This could cause liquidity to thin out.

Data points to consider: US Prelim UoM Consumer sentiment release at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1260.2-1263.8 ([lower timeframe confirmation required prior to pulling the trigger] stop loss: dependent on where one confirms this zone).