Friday 24th November: Technical outlook and review.

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

· A break/retest of supply or demand dependent on which way you’re trading.

· A trendline break/retest.

· Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

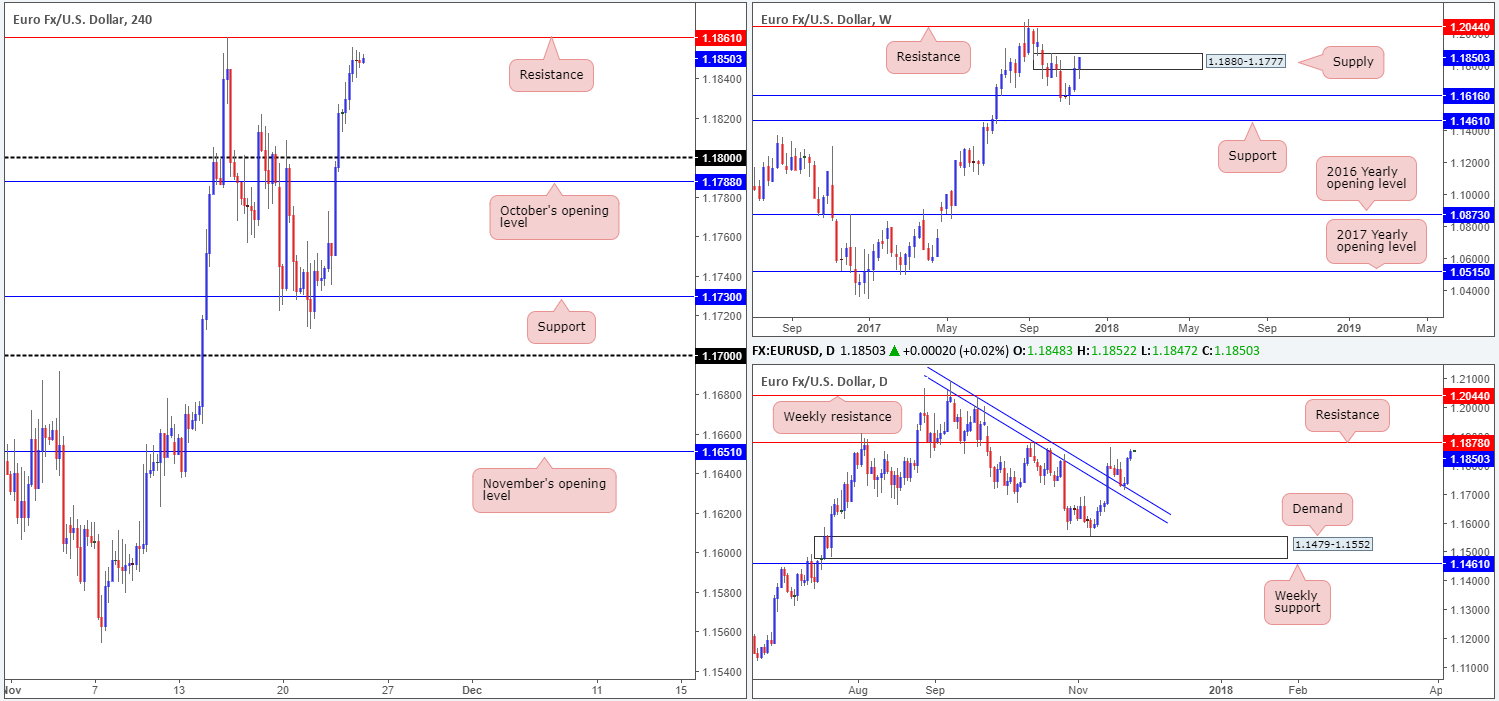

EUR/USD:

The single currency, as you can see, rallied for a third consecutive day on Thursday, reaching a high of 1.1855. Better-than-expected Eurozone manufacturing data provided support for the pair in early London hours, lifting H4 price up to the1.1846 neighborhood. Shortly after, however, price drifted off into a tight consolidation ahead of a H4 resistance at 1.1861, owing to thin volume caused by the US bank holiday.

Suggestions: Alongside the current H4 resistance, we also see a well-appointed daily resistance level pegged at 1.1878, as well as a weekly supply base drawn from 1.1880-1.1777. Considering this fact, from the top edge of the said weekly supply (1.1880) down to the noted H4 resistance at 1.1861, we have tight, yet likely very strong, point of resistance on the horizon.

Is 1.1880/1.1861 worthy of a short? We believe it is if some form of bearish intent is seen from the area. A full or near-full-bodied H4 bearish candle would be ideal. As for targets, it is a bit difficult to judge at the moment as the unit has yet to complete its approach, but in cases such as this we usually we’d look at the nearest opposing H4 demand as the first take-profit zone.

Data points to consider: German IFO business climate at 9am GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.1880/1.1861 ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

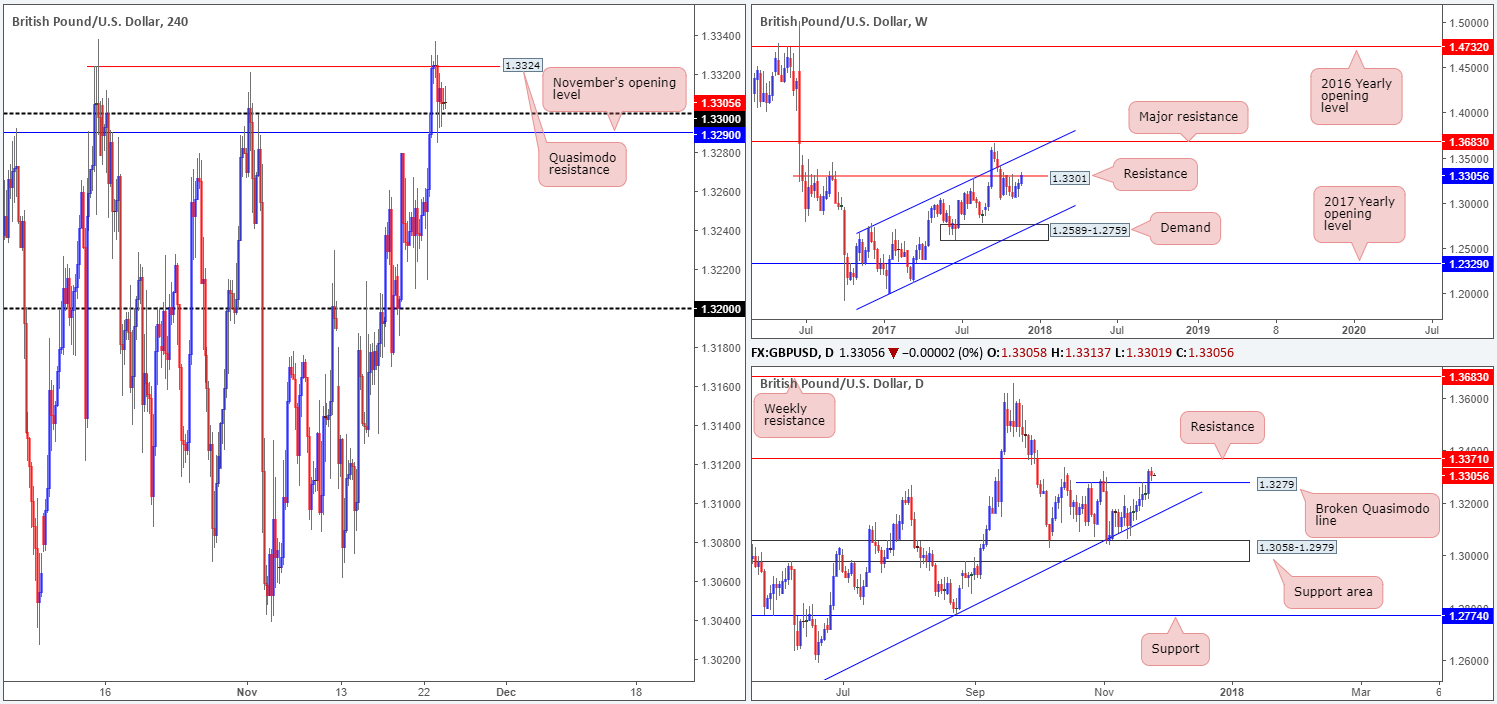

GBP/USD:

The GBP/USD was capped by a H4 Quasimodo resistance level seen at 1.3324 during the course of Thursday’s segment. The H4 candles attempted to head lower but, as you can see, were unable to breach the nearby 1.33 handle/November’s opening level at 1.3290. Following this, price drifted off into a tight consolidation around the 1.33 band, thanks to thin volume caused by the US bank holiday.

The picture over on the higher timeframes is interesting. Weekly price shows that the unit is trading around a resistance seen at 1.3301, and daily price, after recently breaching the daily Quasimodo resistance level at 1.3279, shows room to push up to daily resistance pegged at 1.3371.

Suggestions: Given the lack of high-impacting events on the economic calendar today, we feel the H4 candles will remain loitering between 1.3324/1.33. Therefore, this may be a market best left on the back burner today.

Data points to consider: No high-impacting news events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

AUD/USD:

For those who read Thursday’s report you may recall that we highlighted a H4 resistance seen at 0.7632, which happened to converge with a H4 AB=CD 161.8% ext. point at 0.7633, along with a H4 trendline resistance taken from the high 0.8103. We also mentioned that although this level boasted strong confluence, it was a somewhat risky sell according to daily structure. This is because the lower edge of a daily supply at 0.7695-0.7657 sits only 25 or so pips above the H4 resistance, and thus could attract a fakeout.

As is evident from the H4 timeframe, nonetheless, the H4 resistance managed to hold firm as price entered into a consolidation phase largely due to the US bank holiday. Despite H4 price clearly finding resistance around the 0.7632 region, we are a little wary here since there were no distinct H4 bearish candles formed during yesterday’s segment.

Suggestions: If you intend on selling 0.7632, the team would still strongly advise waiting for at least a H4 bearish candle to form, preferably in the shape of a full or near-full-bodied candle. This will help avoid a fakeout should it occur.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.7632 region ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

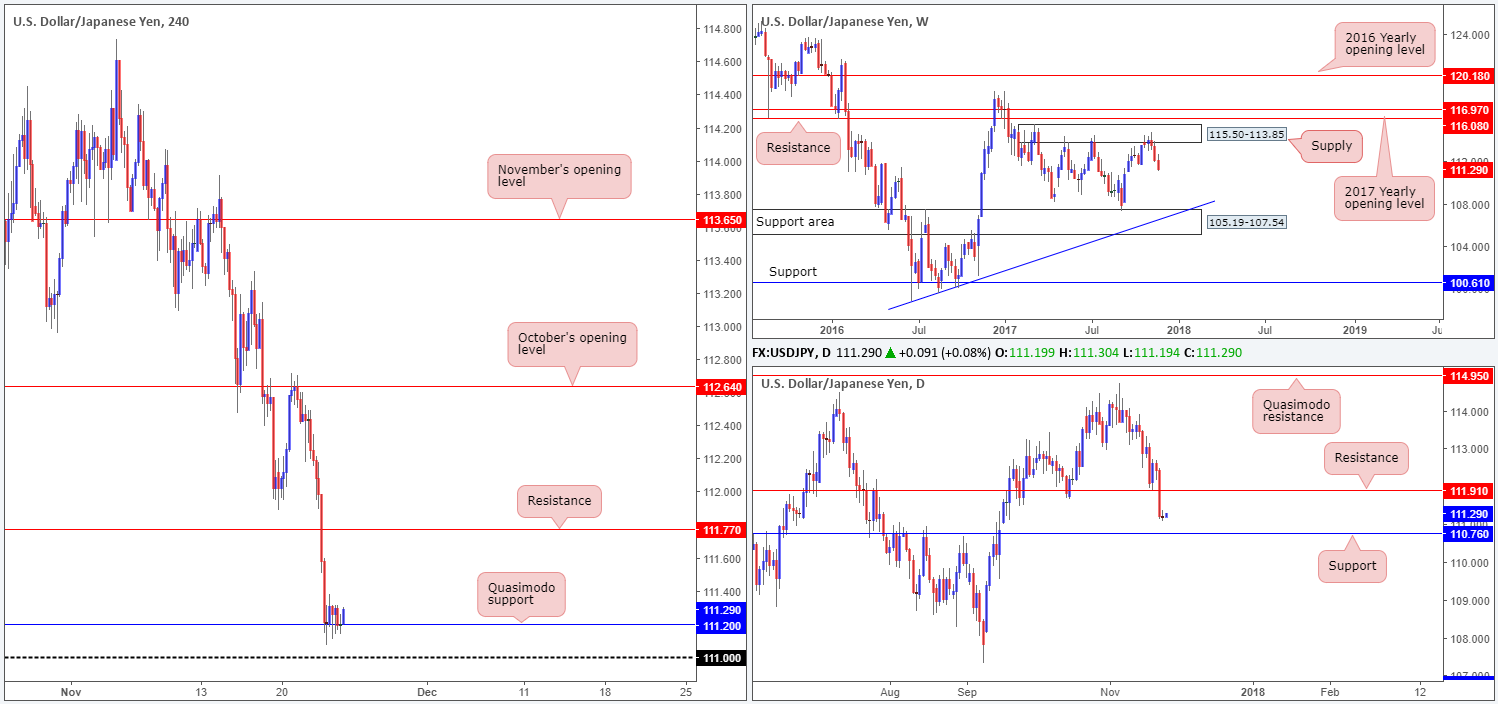

USD/JPY:

Virtually unchanged on the day, the pair spent Thursday’s sessions consolidating around a H4 Quasimodo support at 111.20, positioned only 20 pips above the 111 handle. Volume remained low throughout the day amid the Thanksgiving holiday in the US and the Labor Thanksgiving holiday in Japan.

In view of the yesterday’s lackluster performance, much of the following report will echo a similar outlook put forward in Thursday’s analysis.

Although the pair has somewhat attempted to pare losses from 111.20, further downside is likely on the cards. We say this because daily price shows that the unit can press as far south as the support level at 110.76. On top of this, we know that the market is trading down from its peak 114.73 on the weekly timeframe seen within supply at 115.50-113.85, and there’s little support seen on this scale until the 105.19-107.54 region.

Suggestions: We would not want to be buyers in this market at the moment as according to our technicals, you’d be going up against higher-timeframe flow. Likewise, a sell at current price would mean shorting into both the noted H4 Quasimodo support and 111 handle. Usually, in cases such as this, we’d wait for H4 price to crack below 111 to short, but it would likely prove a pointless wait, seeing as daily support mentioned above at 110.76 is lurking just below.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

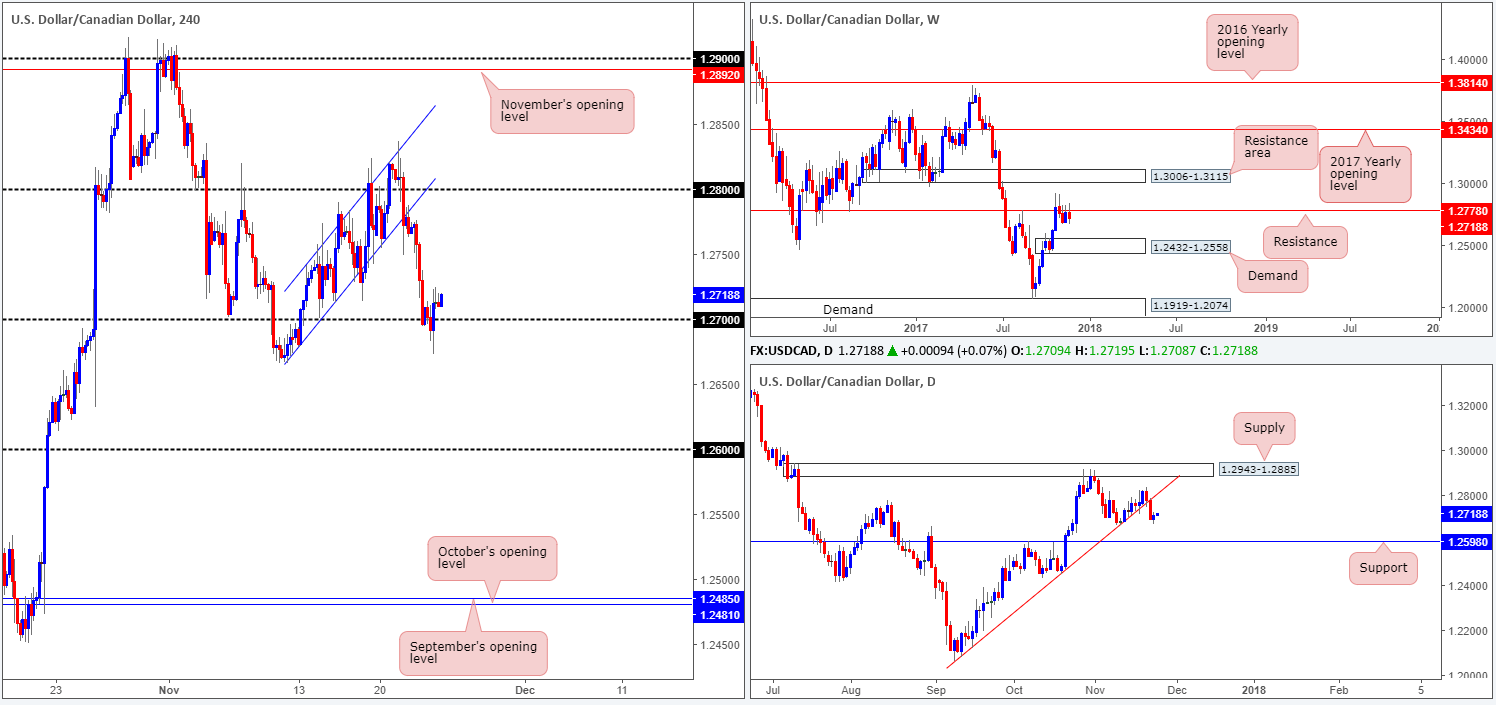

USD/CAD:

Disappointing Canadian retail sales data (m/m) saw the USD/CAD pair reclaim the 1.27 handle and tap a high of 1.2723 on Thursday. As you can see, the pair failed to print much of a follow-through move after this, since US banks were closed in observance of Thanksgiving Day.

Despite the H4 candles regrouping above 1.27, there is, in our opinion, still a clear bearish vibe in this market right now. Furthermore, for those who follow our reports on a regular basis you may recall that we are currently short this market from 1.2764. We liquidated the majority of our position once price came into contact with 1.27 and moved the stop-loss order down to 1.2735.

Why we believe this market exhibits a bearish tone is simply due to weekly price trading from resistance at 1.2778 and daily action showing room to push as far south as support penciled in at 1.2598. This is primarily why we’re holding a portion of our position.

Suggestions: Ultimately, we’re looking for H4 price to break back below 1.27 today as the final take-profit target is set at 1.26, located just two pips ahead of the aforementioned daily support. If you missed the initial sell, you may be given a second chance. A decisive H4 close below 1.27, followed up with a retest and a H4 bearish candle (full or near-full bodied) would, in our experience, be enough to warrant a short down to 1.26.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2764 ([live] stop loss: 1.2735). Watch for H4 price to engulf 1.27 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bearish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

USD/CHF:

It was a relatively quiet day in the USD/CHF market on Thursday, as US desks were unmanned due to the Thanksgiving bank holiday. Despite thin volume, the H4 candles managed to dip lower and challenge the 0.98 handle going into the London morning segment. From that point, the pair spent the day trading on a reasonably healthy bid. In the event that further upside is seen today, the next upside target on the H4 scale can be seen at 0.9837: a resistance level. Meanwhile, over on the bigger picture, both weekly and daily price are seen approaching weekly support penciled in at 0.9770. Therefore, we would be surprised if the current H4 resistance level is breached today, in light of the room seen to move lower on the higher timeframes.

Suggestions: Having seen the higher-timeframe direction pointing south until connecting with 0.9770, a sell around the underside of the current H4 resistance could be an option today. However, given the lack of H4 confluence supporting this level, we would not recommend placing pending orders here. Instead, exercise some patience and wait for the sellers to prove intent. A full or near-full-bodied H4 bearish candle printed from this line would, in our experience, be enough to warrant a short, targeting 0.98 as an initial target, followed then by the weekly support mentioned above at 0.9770.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.9837 region ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

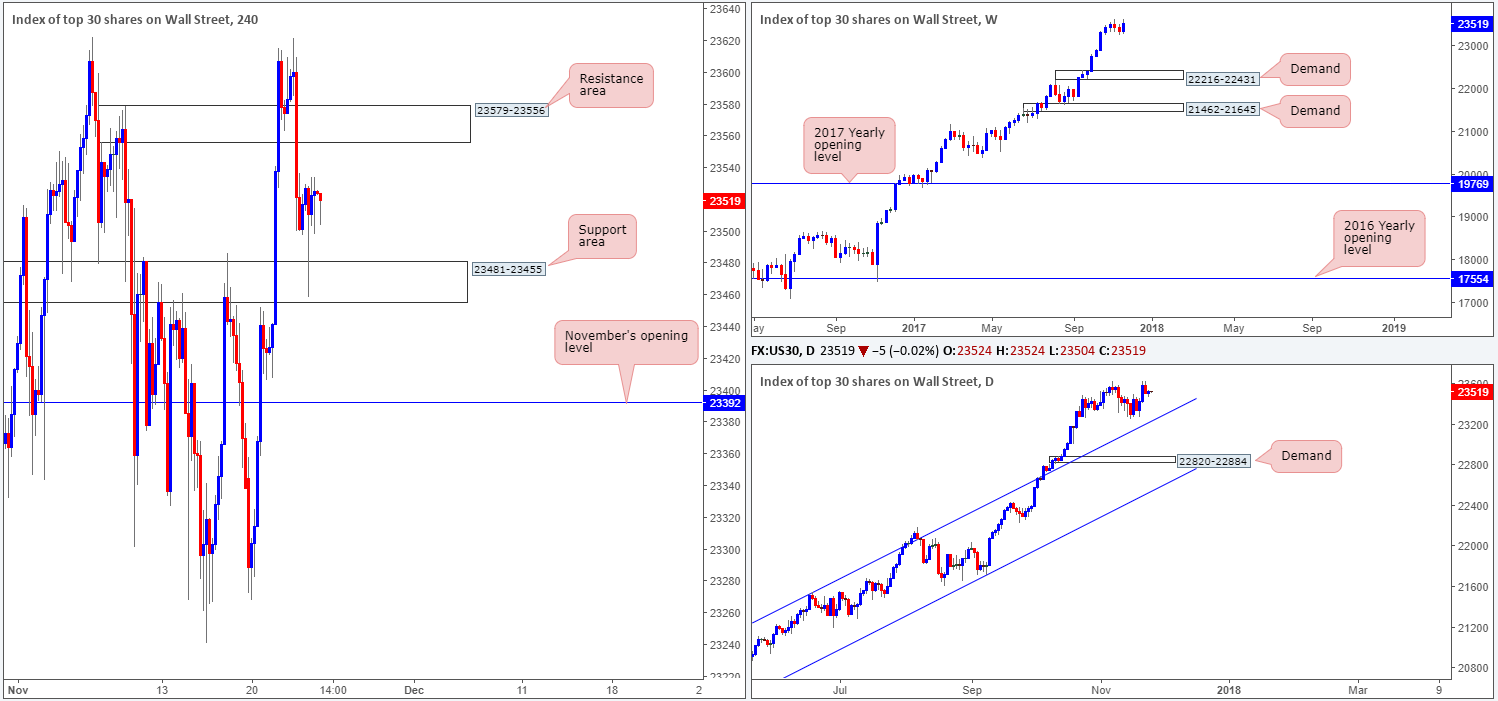

DOW 30:

As anticipated, it was a reasonably quiet day in the US equity markets yesterday, as US traders celebrated Thanksgiving Day. Apart from an abrupt whipsaw down to a H4 support area at 23481-23455 amid early London hours, the index spent the day trading within a tight consolidation.

For the most part, we remain biased to the upside in this market. This is largely due to the strong underlying trend. However, for us to be confident higher prices are on the cards, we would want to see the H4 resistance area printed at 23579-23556 taken out. What would be even better is a retest of this area as support, followed up with a strong H4 bullish rotation candle (preferably full or near-full-bodied).

Suggestions: With a relatively light economic calendar ahead of us, however, we do not see much movement taking shape in this market today. Therefore, unless H4 price gravitates above the noted H4 resistance area (alert set), we will be taking a back seat and reassessing structure on Monday.

Data points to consider: No high-impacting events on the docket today.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 23579-23556 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bullish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

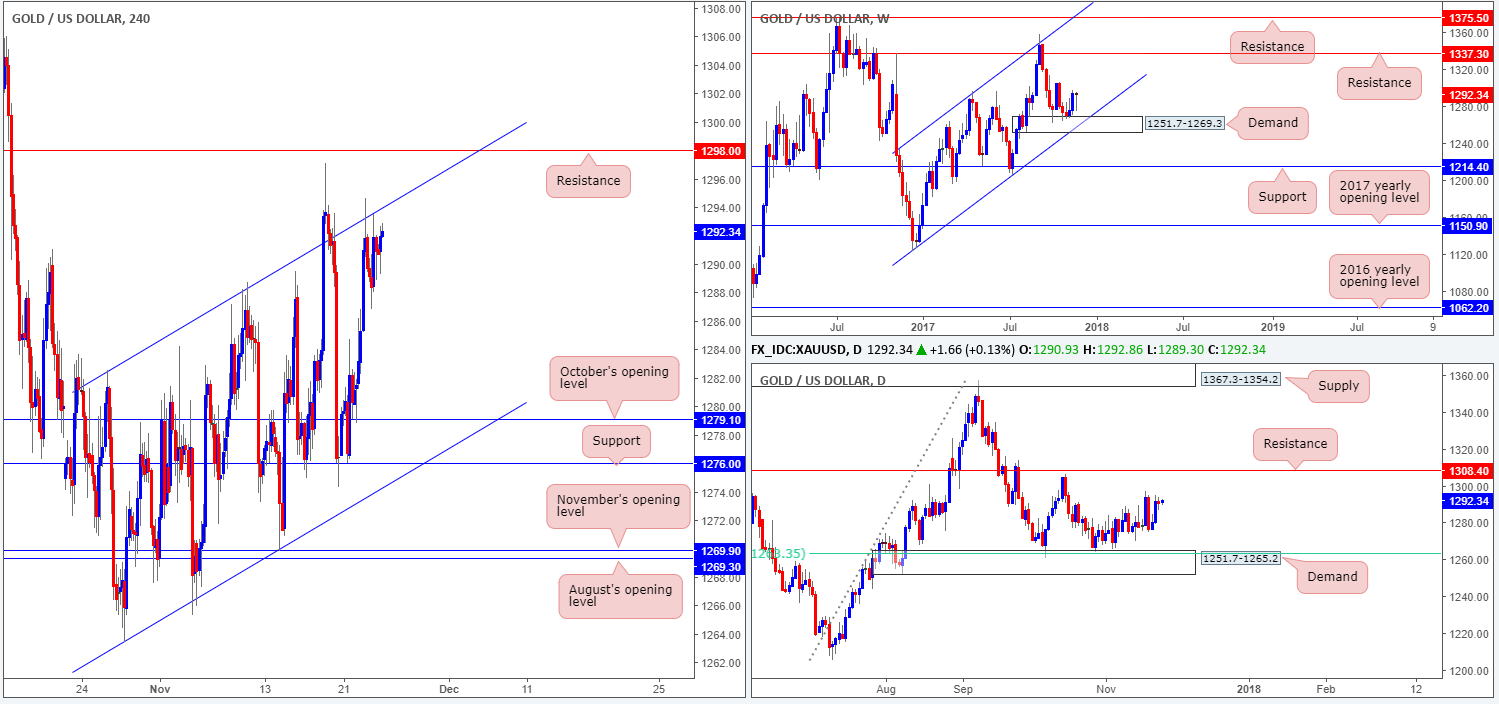

GOLD:

In view of lackluster dollar movement on Thursday, the yellow metal was equally colorless, up just 0.04%. As such, much of the following report will replicate much of what we highlighted in yesterday’s outlook.

As you can see, H4 price remains capped by the H4 channel resistance penciled in from the high 1282.5. Directly above this ascending resistance, we can see that there’s a nearby H4 resistance lurking at 1298.0.

After connecting with daily demand at 1251.7-1265.2 (housed within the lower limits of a weekly demand base seen at 1251.7-1269.3) in late October, the gold market has since been grinding north. The next upside objective on the daily scale can be seen at 1308.4: a resistance level that boasts a reasonably strong history.

Knowing that the metal is somewhat bolstered by higher-timeframe demands at the moment, a sell in this market might be considered a risky move. Whilst we would agree that there is certainly a strong risk present, selling from the H4 channel resistance mentioned above still shows promise since there is little H4 support in view until October’s opening level coming in at 1279.1.

From our perspective though, a sell in this market is just not worth the risk, knowing that you’re potentially selling into a bunch of higher-timeframe buyers!

Suggestions: Opting to stand on the sidelines would, in our opinion, be the better, and, let’s face it, much safer path to take today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).