A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

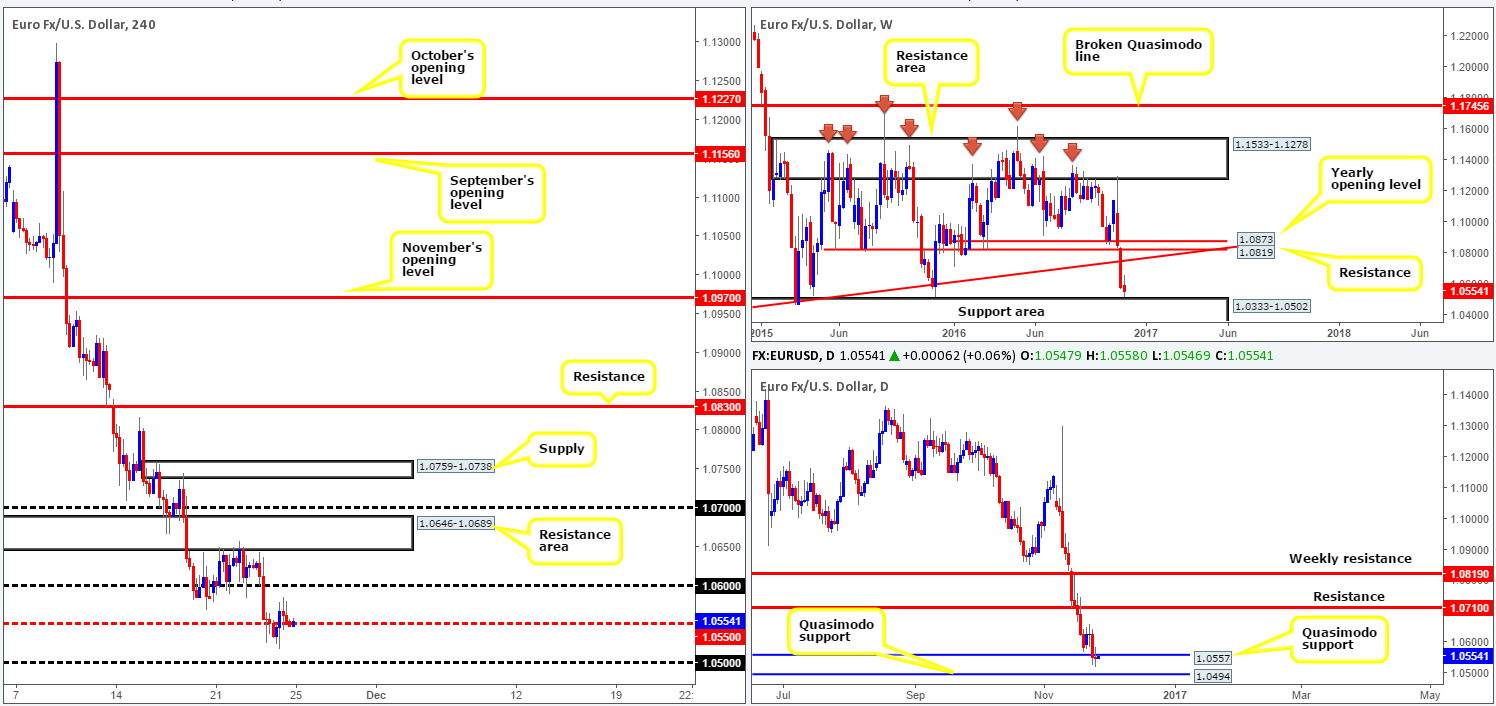

EUR/USD:

EUR/USD prices are little changed this morning, with the market still seen cemented to the 1.0550 neighborhood. In light of this, and the fact that the pair remains beneath the daily Quasimodo resistance level at 1.0557, albeit now in the shape of an indecision candle, much of the following analysis will echo thoughts put forward in Thursday’s report.

Over on the bigger picture, we can see that daily action shows the pathway south to be somewhat free down to 1.0494: another Quasimodo support. Meanwhile, weekly price continues to trade within a whisker of a major support area coming in at 1.0333-1.0502.

Our suggestions: On account of the above points, we have the H4 candles kissing support at 1.0550, the daily candles suggesting a downside move to 1.0494 and the weekly candle positioned nearby the top edge of a support area at 1.0502. The confluence seen molded around the 1.05 handle is, at least in our book of technical setups, enough to permit a pending buy order at 1.0495 with a stop placed below the head of the daily Quasimodo formation at 1.0459.

Granted, this does mean, as we mentioned in Monday’s weekly report, buying into the current downside flow brought on by the possibility of a rate hike in December. However, we’re not looking for a full-blown reversal here, simply a well-planned bounce back up to the 1.0557 region as an immediate take-profit zone.

Data points to consider: Little high-impacting EUR or USD data on the docket today.

Levels to watch/live orders:

- Buys: 1.0495 ([pending order] stop loss: 1.0459).

- Sells: Flat (stop loss: N/A).

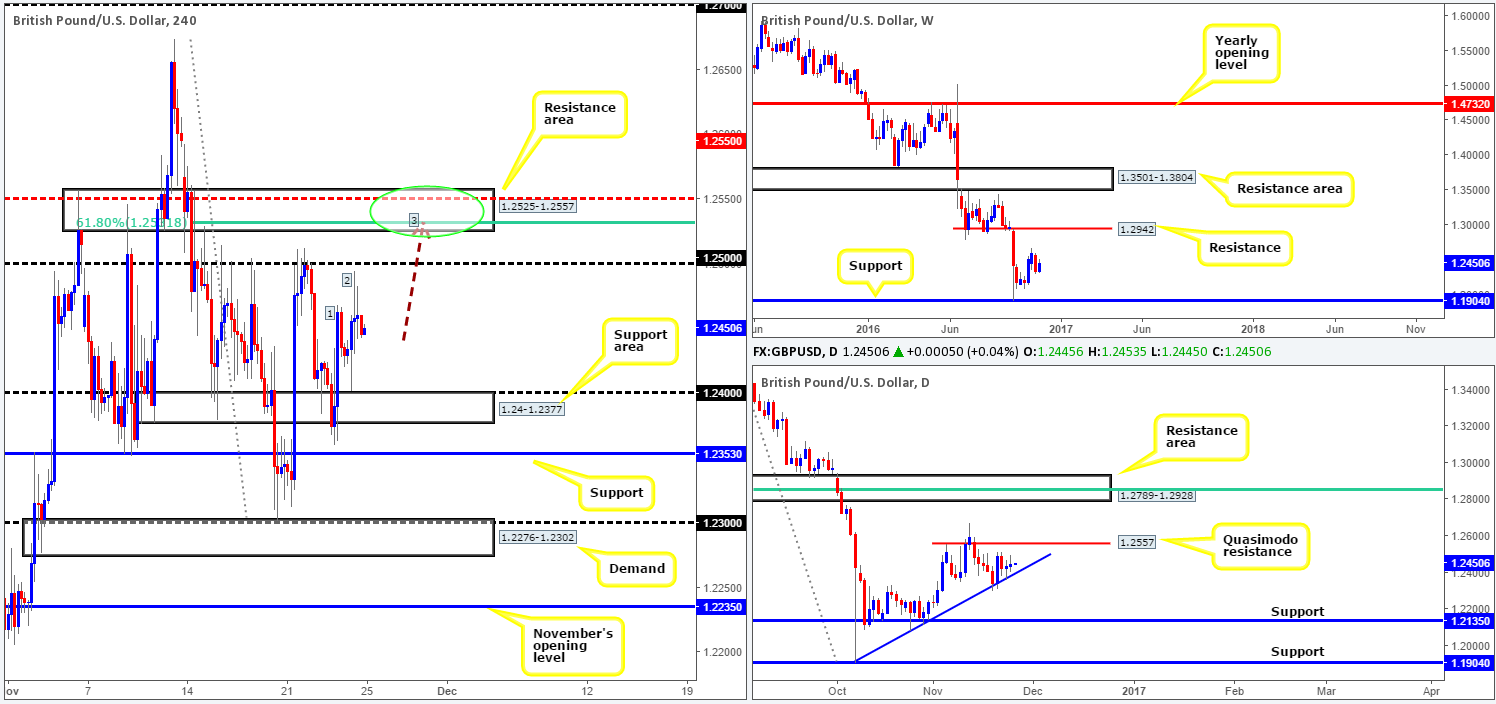

GBP/USD:

In a similar fashion to the EUR/USD, the GBP/USD also ended yesterday relatively unchanged. Nevertheless, cable’s H4 action remains a keen focal point for our desk. The resistance zone drawn from 1.2525-1.2557 is especially striking. The area boasts a H4 61.8% Fib resistance at 1.2531, a H4 mid-way resistance at 1.2550, a potential H4 three-drive approach (waves 1 and 2 are labeled, with the black arrow denoting the next potential third leg) and the top edge of the H4 zone represents the daily Quasimodo resistance at 1.2557. Now, in view of the last point, this does mean there’s a chance that price could fake through our H4 resistance zone, so traders need to be prepared for that. The final key thing to note here is the 1.25 handle. The majority of the market watches these levels, and are, on a regular basis, run for stops, which is exactly what we’re looking to see in this instance.

Our suggestions: While a fakeout above the aforementioned H4 resistance barrier is a possibility, we can still trade from here. Instead of placing a pending sell order and positioning stops just above the zone (not a good idea when a fakeout is likely), waiting for a reasonably sized H4 bearish candle to form within the walls of this region is by far, the safer, more conservative route to take here. This will, of course, not guarantee a winning trade, but will show that sellers have taken an interest here, before we pull the trigger!

Data points to consider: UK growth data (second estimate) scheduled to be released at 9.30am GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2557-1.2525 ([reasonably sized H4 bearish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

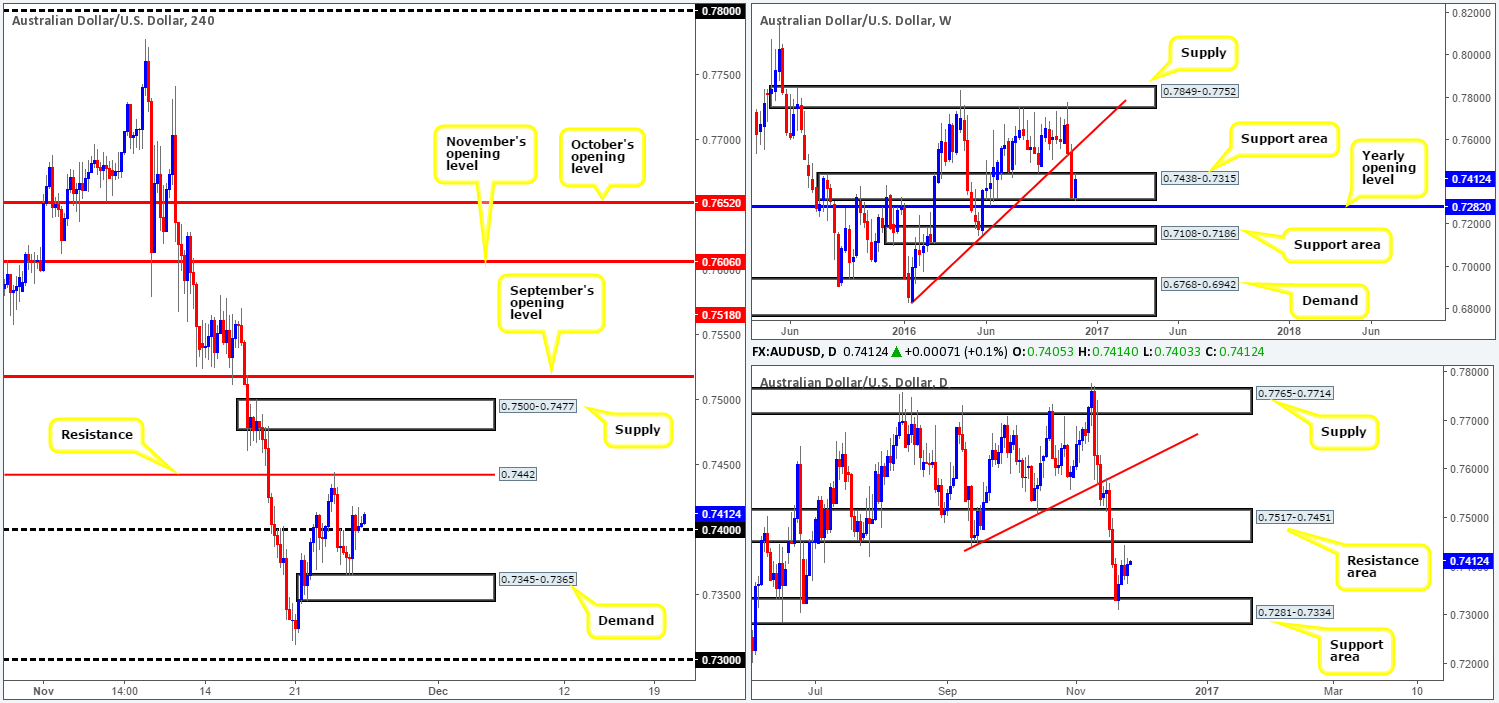

AUD/USD:

Using a top-down approach this morning, weekly bulls are currently seen responding from deep within a support area coming in at 0.7438-0.7315. The next upside objective from this angle falls in at a trendline resistance drawn from the low 0.6827. Looking down to the daily candles, however, price is seen loitering mid-range amid a resistance area at 0.7517-0.7451 and a support area carved from 0.7281-0.7334.

Stepping across to the H4 chart, we can see that the commodity currency closed marginally higher yesterday, with the candles settling above the 0.74 hurdle. For traders looking to enter long from this boundary, we do not see a lot of room to play with as 40 or so pips north sits a H4 resistance at 0.7442: a level which capped upside beautifully on Wednesday.

Our suggestions: Although the weekly structure suggests buying to be the better path to take at the moment, daily as well as H4 price shows nearby resistance! Given this, our team is not comfortable buying this market and has concluded that remaining on the sidelines may very well be the better path to take today.

Data points to consider: Little high-impacting USD data on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

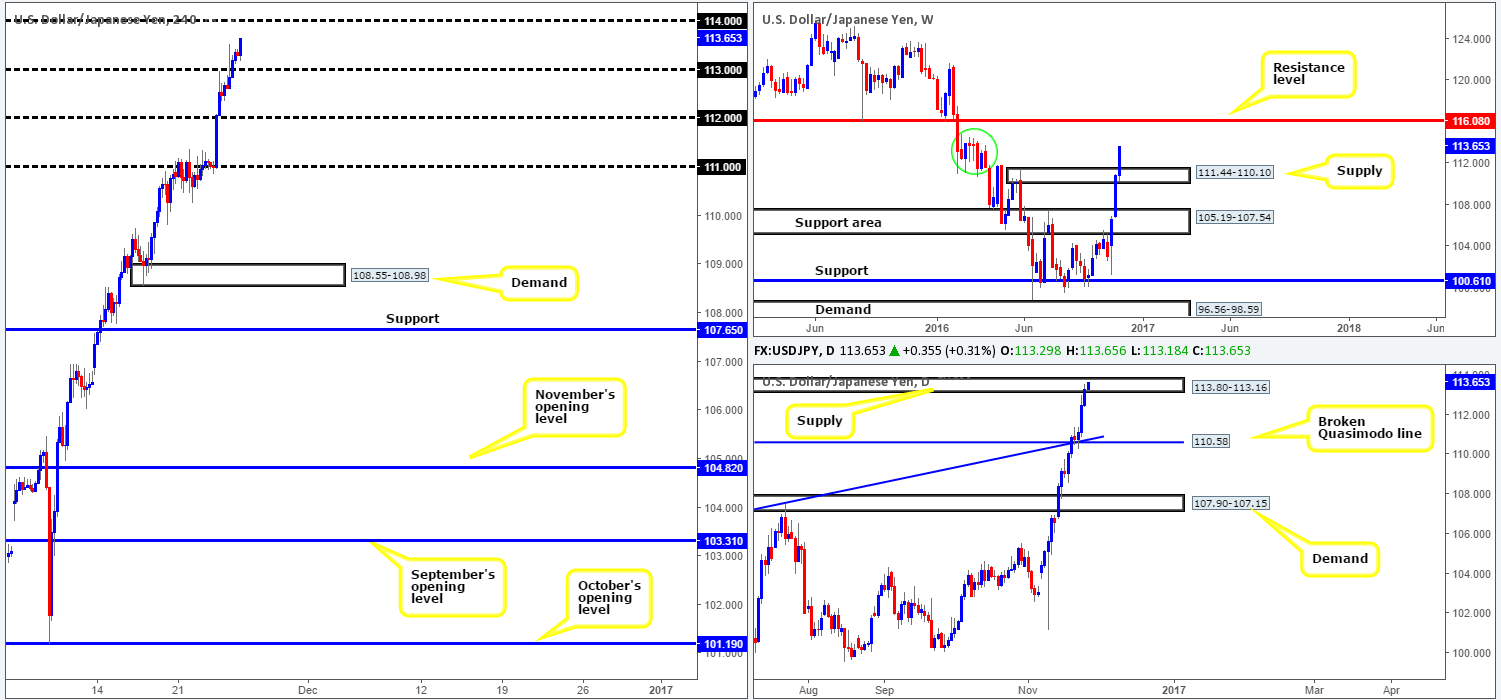

USD/JPY:

The USD/JPY, as you can see, remains trading with a reasonably strong bias to the upside this morning. Following the retest of the daily Quasimodo line at 110.58 on Tuesday, the pair has so far recorded three consecutive daily gains, consequently bringing the unit into the jaws of a daily supply zone coming in at 113.80-113.16. Meanwhile, up on the weekly chart, the current candle looks to be on course to close the session in the green for the third consecutive week. Assuming price can break through the 114.87/111.44 area (green circle), further upside is likely on the weekly chart towards resistance coming in at 116.08.

Our suggestions: In our previous report, we mentioned that should a H4 bearish selling wick that whipsaws through 113 into offers around the daily supply zone be seen, we would consider shorts. Now, this did occur, but the candle body was still bullish, which fortunately pushed us to pass here.

Whilst buying this market is tempting given the recent strength, buying into a daily supply (see above), and also a nearby psychological handle 114, is not really something our team would be comfortable with. Selling from 114 could be something to consider, if H4 price whipsaws above the current daily supply into offers around 114.

Data points to consider: Little high-impacting USD or JPY data on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for a H4 bearish selling wick to form that pierces through the top edge of the daily supply (113.80) into the 114 boundary. This is a signal to short with stops best placed above the wick of the trigger candle.

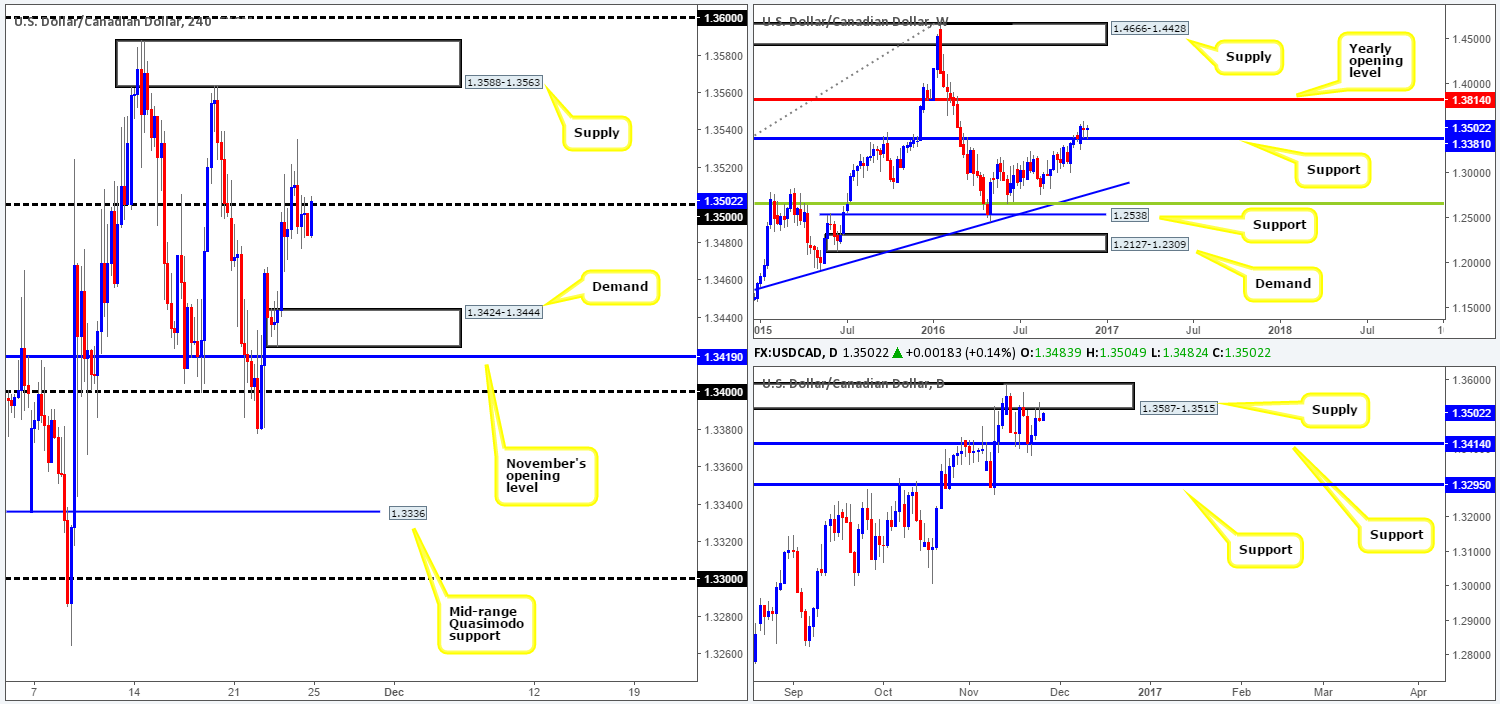

USD/CAD:

On the whole, there was little change seen during yesterday’s sessions. Despite this, price did range around 60 pips and chalk up a relatively nice-looking daily bearish selling wick off the underside of supply coming in at 1.3587-1.3515. This – coupled with the H4 candles currently kissing the underside of the 1.35 handle, could portend a decline in value down to the H4 demand at 1.3424-1.3444, followed closely by November’s opening level at 1.3419. While this could be something that interests you, one still needs to consider the fact that the weekly candle exhibits a bullish stance from a support at 1.3381, with the upside looking clear for a run up to the yearly opening level at 1.3814.

Our suggestions: To become buyers in this market, a decisive H4 close is required beyond the 1.36 handle. This move would, as far as we can see, highly likely clear stops from above the daily supply and open the pathway north to H4 resistance at 1.3662. Of course, one could look to trade above the 1.35 to H4 supply at 1.3588-1.3563, but run the risk of an unnecessary loss due to entering long within a daily supply.

In regard to selling, we would still recommend holding fire. Yes. Daily price is trading from the lower edge of a supply zone and the underside of 1.35, but considering the fact that weekly bids are holding firm above the current support, we would not feel comfortable selling this market at the moment.

Data points to consider: Little high-impacting USD data on the docket today.

Levels to watch/live orders:

- Buys: To become buyers, we would ideally like to see 1.36 consumed.

- Sells: Flat (stop loss: N/A).

USD/CHF:

In view of the rather lackluster movement seen during yesterday’s trading, price remains underpinned by the H4 demand at 1.0155-1.0129. With the 1.02 handle seen a few inches away, trading is somewhat restricted as far as structure goes. While we agree, space on the H4 chart is tight, the daily candles show that 1.02 fuses beautifully with a daily Quasimodo resistance level at 1.0198, and is located within a weekly resistance area at 1.0239-1.0131. Therefore, we feel that price is highly likely to produce a reaction from this angle.

Our suggestions: As we mentioned in Thursday’s report, psychological boundaries are typically prone to fakeouts, which makes them rather precarious when considering setting pending orders. Therefore, our desk has come to a consensus that in order to trade from 1.02 today, we’d need confirmation from the lower timeframes (see the top of this report). Ultimately, the current H4 demand would be the first take-profit target, followed by the 1.01 handle.

In addition to the confluence seen around 1.02, traders may have also noticed that this setup correlates beautifully with our pending buy order placed on the EUR at 1.0495 (see above). These two markets are generally inversely correlated, thus given the bearish signal on the Swissy and the bullish setup on the EUR, both levels are high-probability, in our opinion.

Data points to consider: Little high-impacting USD data on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.02 region ([lower timeframe confirmation required prior to pulling the trigger] stop loss: dependent on where one confirms this area).

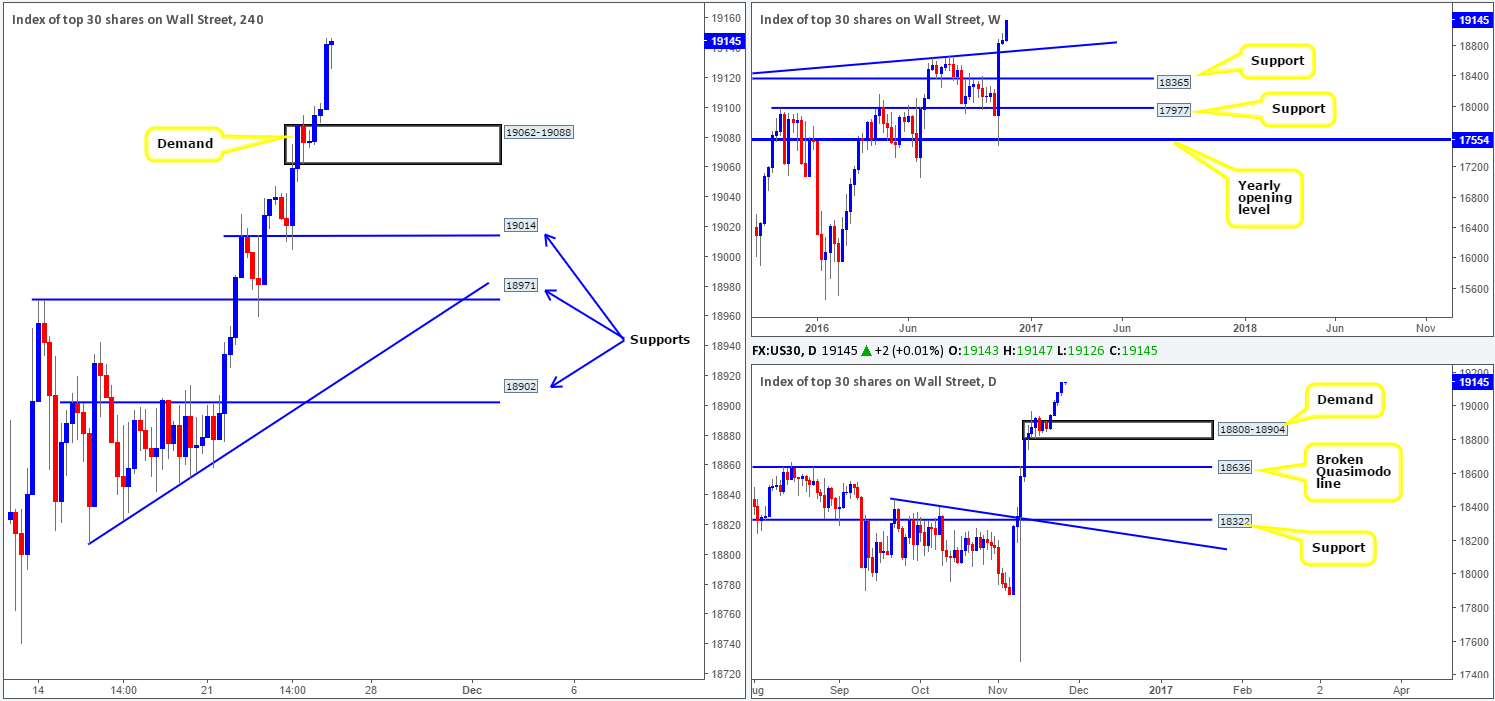

DOW 30:

Equities continued to advance during Thursday’s segment, consequently printing an all-time high of 19147 by the closing bell. Since the beginning of the week, the index has been on spectacular form and shows little sign of slowing down given Thursday’s close. Seeing as there’s absolutely no higher-timeframe resistance seen on the horizon (see weekly and daily charts), today’s spotlight will firmly be focused on the following barriers for possible long positions should the market choose to pullback:

- The newly-formed H4 demand at 19062-19088.

- The H4 support at 19014, which held beautifully on Wednesday.

- The H4 support at 18971, which converges with a H4 trendline support carved from the low 18808 and also held steady on Tuesday.

Our suggestions: In light of our three chosen buy zones, it is difficult to know which will react, if any. Therefore, we need to see evidence that the bulls are interested. One could simply wait for a reasonably sized H4 bull candle to form to confirm this. Or, failing that, you may want to drill down to the lower timeframes and hunt for confirmation there (see the top of this report for ideas on how to pin down an entry using the lower timeframes).

Levels to watch/live orders:

- Buys: 19062-19088 ([reasonably sized H4 bullish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle). 19014 ([reasonably sized H4 bullish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle). 18971 ([reasonably sized H4 bullish close required prior to pulling the trigger] stop loss: ideally beyond the trigger candle).

- Sells: Flat (stop loss: N/A).

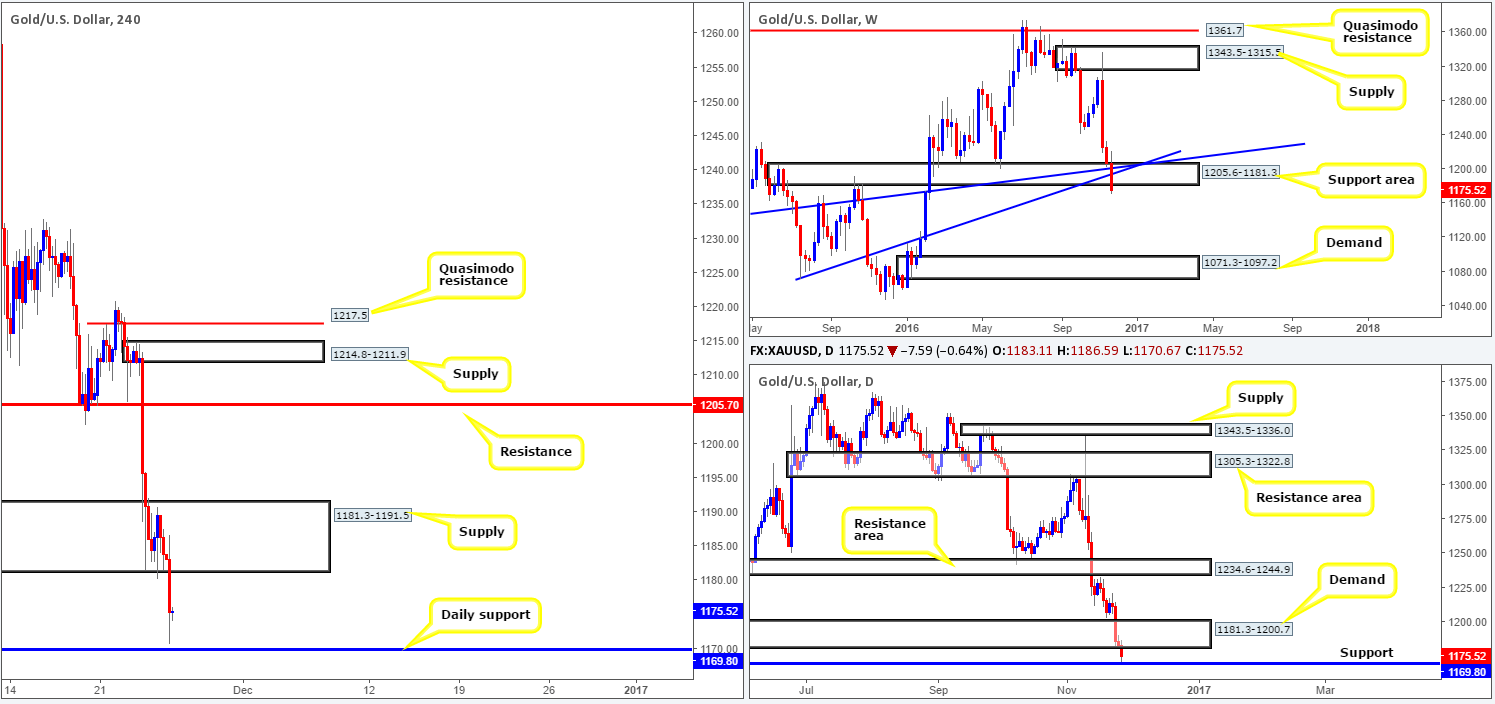

GOLD:

Coming in from the top this morning, the weekly candle, as you can probably see, recently pressed through the support area coming in at 1205.6-1181.3. Although this breach is considered a bearish signal, it may be worth waiting for the week to close before presuming that this barrier is consumed. A close below here could open up the trail down to demand coming in at 1071.3-1097.2.

In recent hours, daily action pushed through demand seen at 1181.3-1200.7 (located within the lower extremes of the above noted weekly support area), and has come within reaching distance of support fixed at 1169.8 that boasts strong history.

Ultimately, before our team is convinced that bullion is heading lower, we’d need to see the week close below the current daily support. This would not only confirm bearish strength on the break of the current weekly support area, but it would also open up the runway south down to daily demand at 1108.2-1117.8.

Our suggestions: Right now, we do not see much to hang our hat on. A long from the daily support is risky since weekly price has just breached a support area. Likewise, selling into daily support is not something our desk would recommend. Therefore, we feel that opting to stand on the sidelines here may very well be the best path to take today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).