A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

During the course of Monday’s sessions, the single currency broke above the H4 trendline resistance extended from the high 1.1366 (along with its merging H4 mid-way resistance at 1.1250) and reached a high of 1.1279 on the day. Evident from the H4 chart, the candles are now retesting the top edge of 1.1250, which is so far holding firm.

Although the pair has increased in value for four consecutive days now from within a daily support area seen at 1.1224-1.1072, more specifically, a double-bottom base at 1.1135 (now a triple bottom), we would be wary buying from here. Not only is weekly price touching gloves with the underside of a major resistance area seen at 1.1533-1.1278, but over on the US dollar index, the unit is trading just ahead of a H4 support area drawn from 95.00/95.10.

Our suggestions: Technically speaking, we do not see anything immediately worth trading in this market. We do feel, however, given the above factors, that price will likely push lower today. Be that as it may, this may not come into view until the London afternoon session. US Consumer Confidence data is scheduled to be released at 2pm, as well as FOMC member Fischer taking the spotlight at 3.15pm (GMT).

Something to also keep in mind here is the daily chart. In the event that a break above the September 15th high at 1.1284 comes into view this week, there’s little active supply seen until the 1.1446-1.1369 region. But again, this would mean one having to enter long into the weekly resistance area mentioned above.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

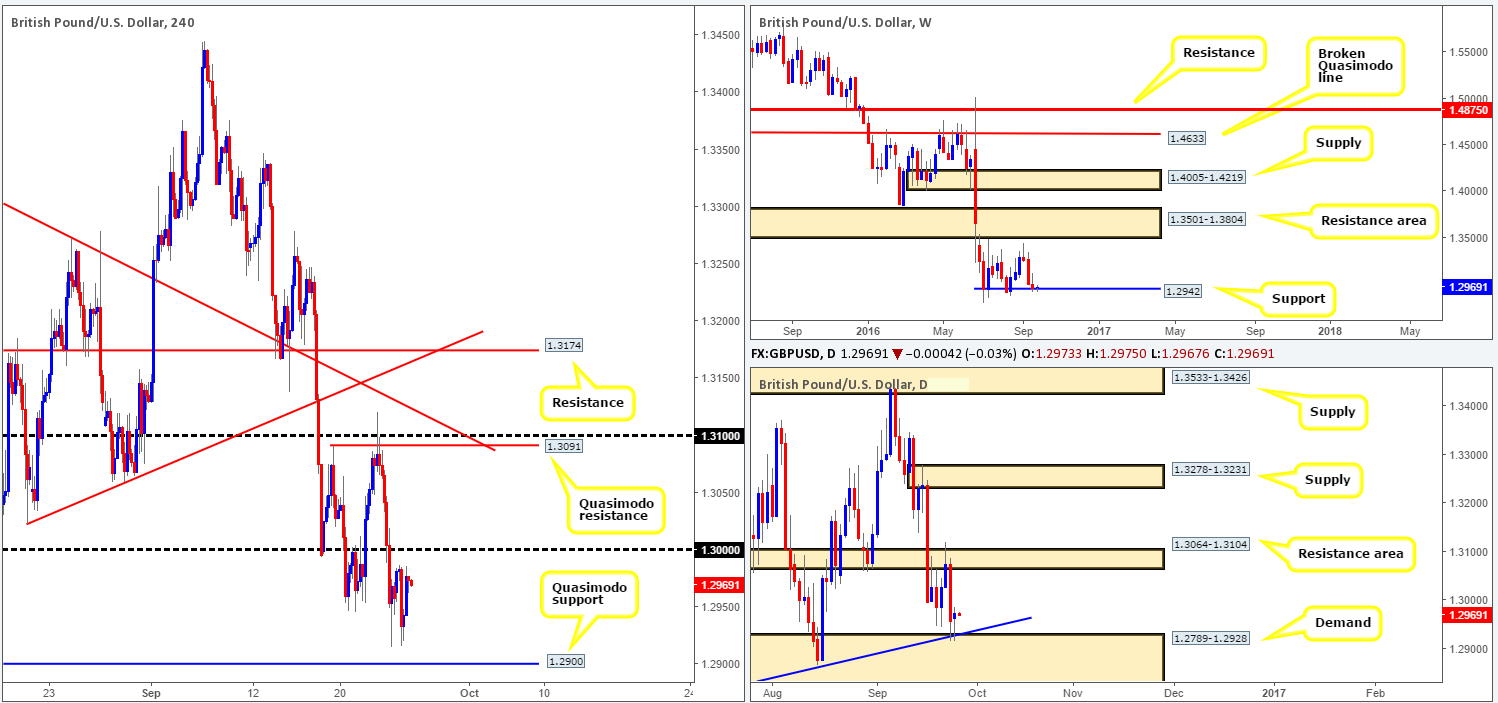

GBP/USD:

Kicking this morning’s analysis off with a look at the weekly timeframe shows price remains treading water around support chiseled in at 1.2942. Although this structure held prices higher back in mid-August, we must take into account that it did fail to reach new highs. This – coupled with the pair currently entrenched within a rather prominent downtrend, there’s a chance that this level may eventually cave in. Sliding down into the daily timeframe, nonetheless, a reasonable buying tail was chalked up during yesterday’s session off trendline support taken from the low 1.2789, which intersects with a demand area at 1.2789-1.2928. As we mentioned in yesterday’s weekly report, a close beyond the above said trendline support could be an early sign that weekly support is failing and the current daily demand is likely to be taken out sometime soon.

Stepping across to the H4 chart, we can see that the candlesticks continue to hover between the key figure 1.30 and the H4 Quasimodo support at 1.2900. While the predominant trend is pointing south, selling from 1.30 is a risky trade in our opinion given the higher-timeframe supports in play right now (see above).

Our suggestions: Rather than looking to trade 1.30 as resistance, we would advise waiting for a close above this level. This would not only confirm buying strength from the current higher-timeframe supports, it would also, according to the H4 chart, likely open the path north up to a H4 Quasimodo resistance at 1.3091 (merges with the 1.31 handle and a H4 trendline resistance taken from the high 1.3371) for a possible buy trade on the retest of 1.30 (H4 bullish close required).

Should a decline in value be seen, the aforementioned H4 Quasimodo support would be the next area on our radar for longs. However, in view of the trend on this pair, we’d need at least a H4 bullish close to from off this boundary prior to us pulling the trigger.

Levels to watch/live orders:

- Buys: 1.29 region [H4 bullish close required] (Stop loss: beyond the trigger candle). Watch for a close above the 1.30 handle and look to trade any retest seen thereafter (H4 bullish close required).

- Sells: Flat (Stop loss: N/A).

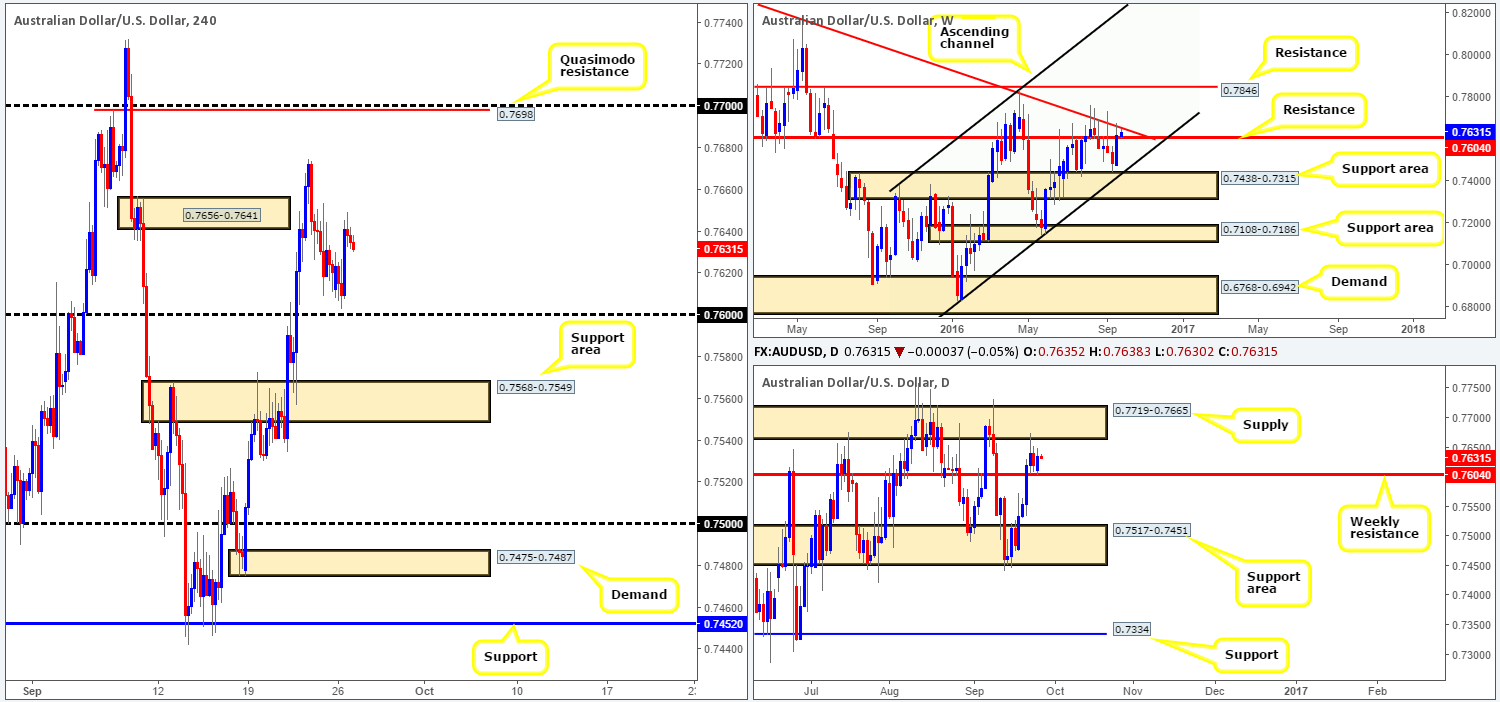

AUD/USD:

In recent sessions, price find a pocket of bids off the top edge of the current weekly resistance level at 0.7604, consequently leaving the 0.76 handle unchallenged. As we discussed in Monday’s weekly report, although weekly action effectively closed above the aforementioned resistance barrier last week by about 20 or so pips, we feel that a more decisive close is required before one can say that this level is consumed. Be that as it may, we still feel that the sellers have a hand in this fight, despite yesterday’s advance. Not only is price hugging a nearby weekly trendline resistance taken from the high 0.8295, it also ties in beautifully with a daily supply zone drawn from 0.7719-0.7665.

Our suggestions: Overall, the structure of this pair has yet to see any significant change. Therefore, we suggest continuing watching the following:

- Watch for a decisive close below the 0.76 handle (represents the weekly resistance level). Supposing that the H4 candles maintain a bearish tone beyond this number, we may consider shorts down to the H4 support area at 0.7568-0.7549, followed by the 0.75 hurdle.

- If 0.76 holds as support, or prices continue to advance from its current position (at the time of writing: 0.7632), we will not be comfortable buying here until we’ve seen a more decisive weekly close (see above in bold). With that being the case, the only resistance we see worthy of consideration above 0.76 right now is 0.7698: a H4 Quasimodo resistance barrier, which unties with the 0.77 handle. Given the confluence seen here and the higher-timeframe structures surrounding this zone, we feel a pending sell order is viable, with stops placed above the apex of this formation at 0.7735.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7697 [pending order] (Stop loss: 0.7735). Watch for a close below the 0.76 handle and look to trade any retest seen thereafter (H4 bearish close required).

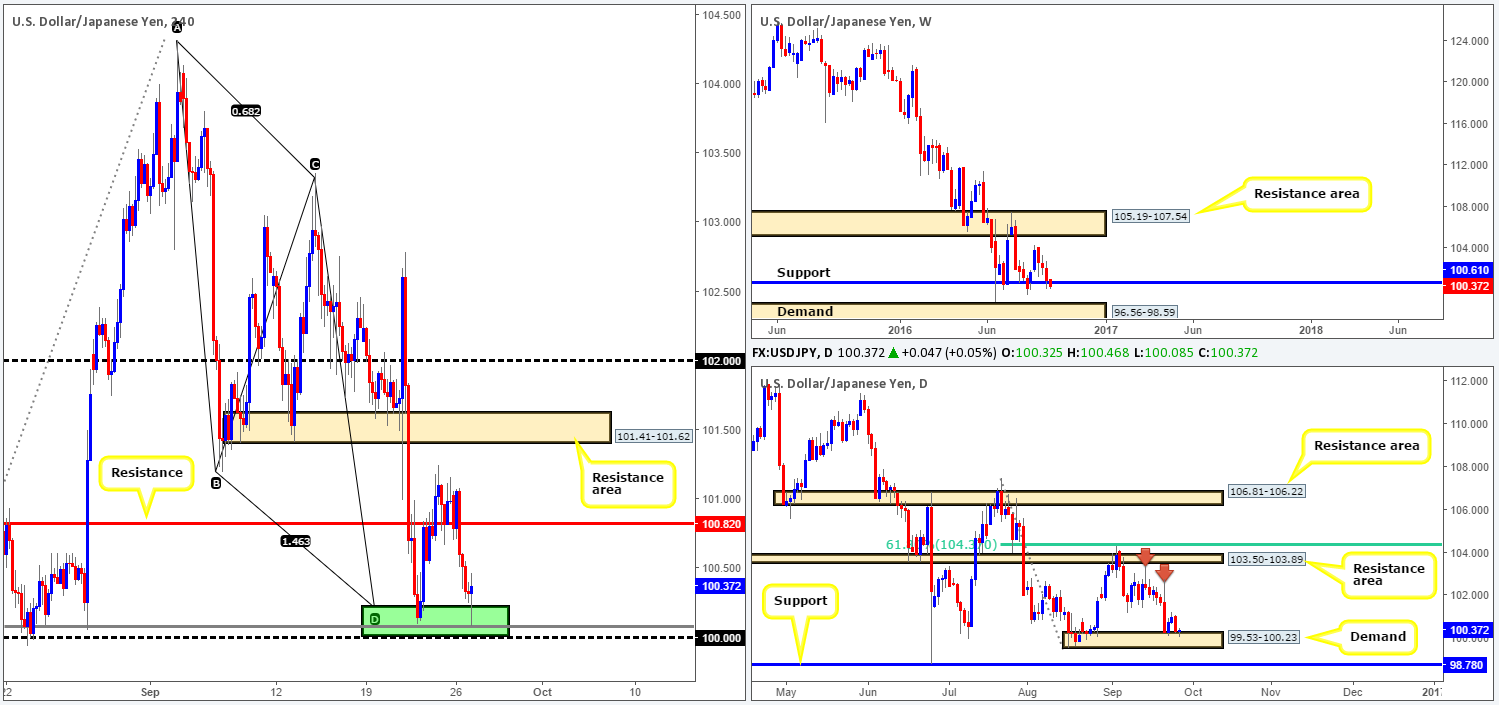

USD/JPY:

(Trade update: Our team took a small loss as we entered long yesterday on the basis of the H4 bullish close off, which was at the time, H4 support at 100.82)

Based on recent action, we can see that prices failed to sustain gains beyond the H4 level 100.82 (now acting resistance), and has consequently forced price to regroup with a previous H4 buy area seen at 100.00/100.21 (green zone). This barrier comprises of a H4 88.6% Fib support at 100.07, a H4 AB=CD completion point at 100.21 and is also seen treading water around the top edge of a daily demand base at 99.53-100.23.

This begs the question, is this buy zone a stable enough area for a second round of buying? Well, given the current daily demand zone and weekly support at 100.61 lurking nearby, we would say it is. However, one must take into account that the predominant trend on this pair is clearly south, so buying without lower timeframe confirmation (see the top of this report) or a H4 bullish close is not something we would recommend.

Levels to watch/live orders:

- Buys: 100.00/100.21 region [H4 bullish close/lower timeframe confirmation required] (Stop loss: beyond the trigger candle/dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

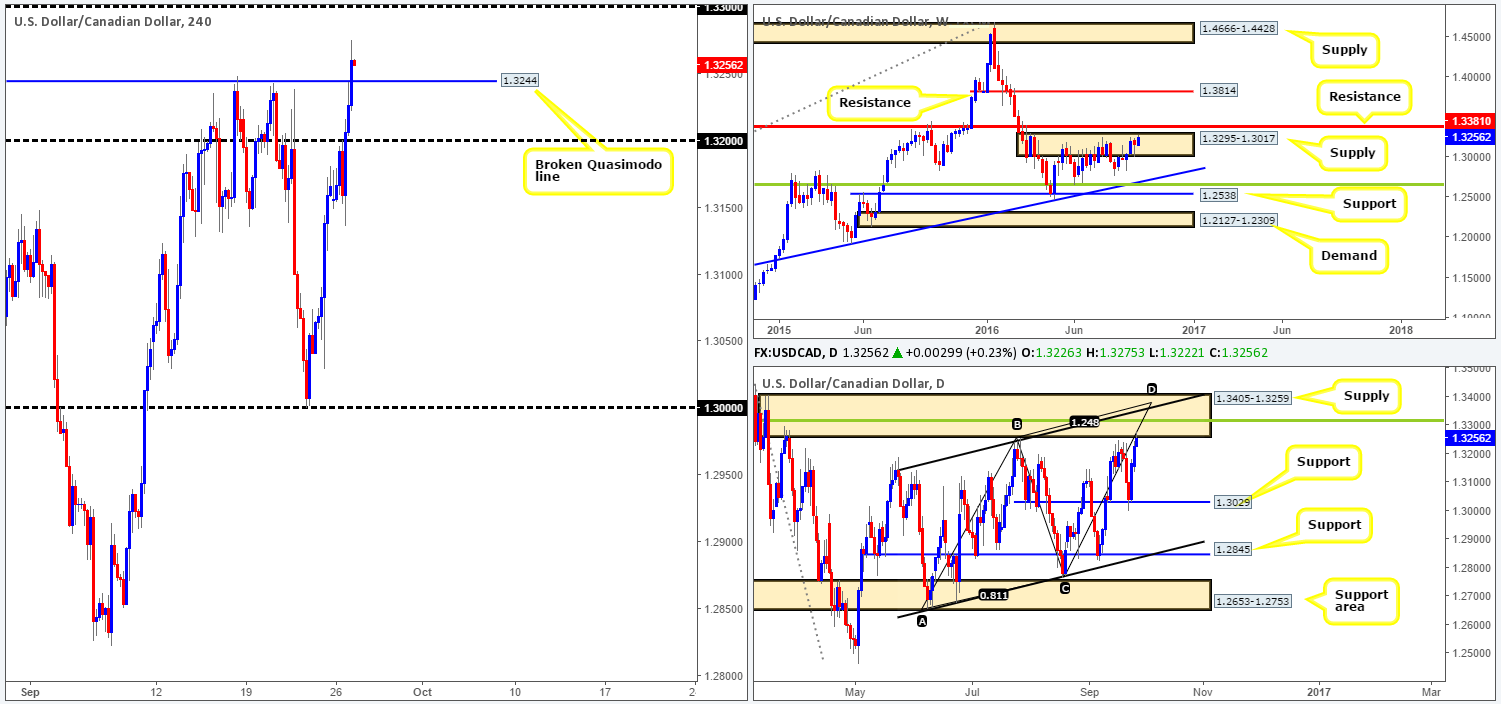

USD/CAD:

Following the week’s open, we saw prices stall at the underside of the 1.32 handle, before eventually breaking through this barrier and crossing swords with a H4 Quasimodo resistance level at 1.3244 going into the close. As we discussed in Monday’s report, despite how well price responded to the above said H4 Quasimodo level recently, our team was not looking to sell from here, since there was a good chance of price faking above this level to tag in offers around the daily supply area at 1.3405-1.3259. And, as we can see, this is exactly what has happened!

However, the region we’re looking to sell from comes in at 1.3310/15, due to a beautiful-looking convergence point seen around this location (a 38.2% Fib resistance level at 1.3315 [green line], a weekly resistance level at 1.3381, a channel resistance taken from the high 1.3241 and an AB=CD completion point around the 1.3376ish range). With that being said, If price reaches the 1.3310/15 region today within the current daily area we’d have no hesitation (apart from if high-impacting news is scheduled for release) in shorting here at market with stops placed above the daily supply zone at 1.3407.

Levels to watch/live orders

- Buys: Flat (Stop loss: N/A).

- Sells: 1.3310/15 region [potential area to look for shorts at market] (Stop loss: 1.3407).

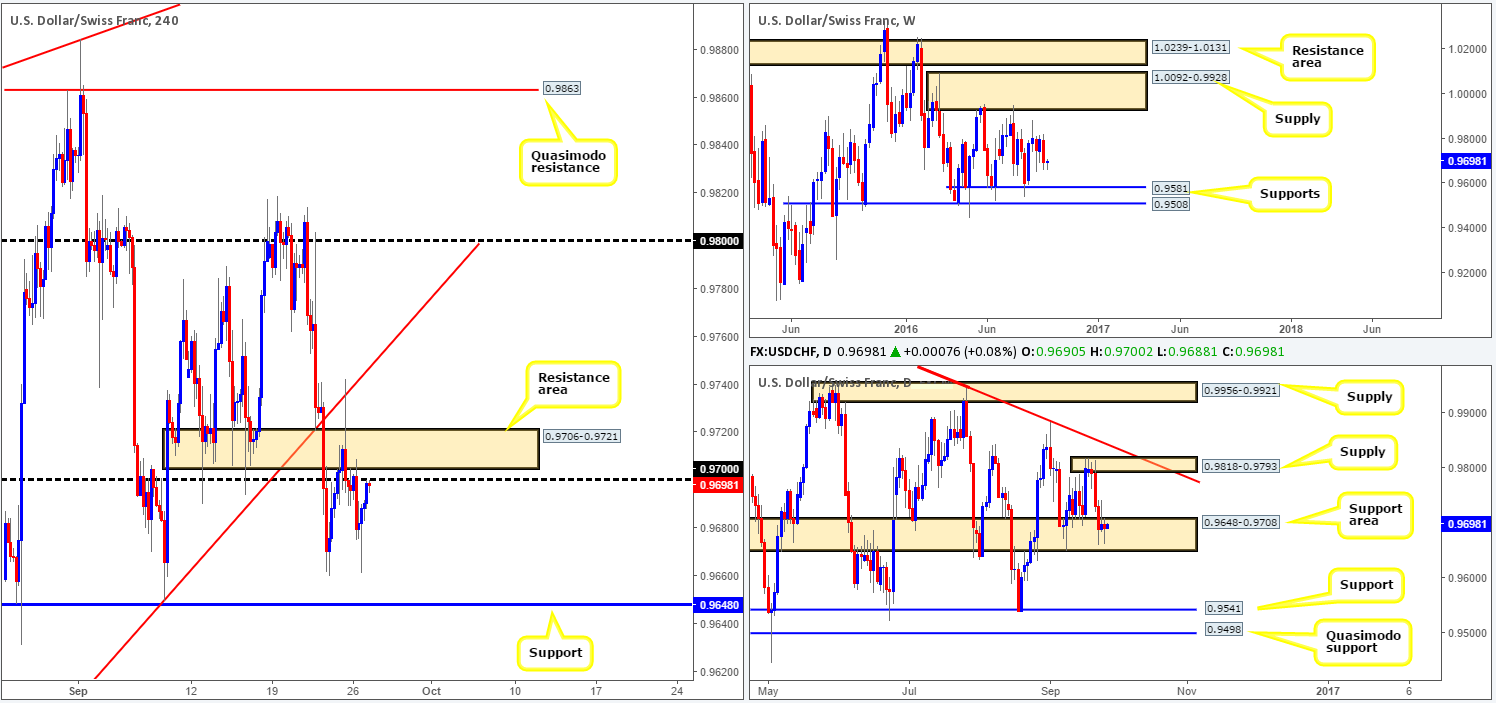

USD/CHF:

Kicking things off with a quick look at the weekly chart this morning, there has been very little change seen on this timeframe for a while now. Since the beginning of May, the USD/CHF pair has been consolidating between a supply zone painted at 1.0092-0.9928 and a support band drawn from 0.9581. In spite of last week’s decline which chalked up a bearish engulfing candle, we feel it’s unlikely that price will breach the lower walls of this range this week. Jumping down into the daily chart, however, price is currently positioned within a support area carved from 0.9648-0.9708. Of particular interest here is the most recently closed daily candle: it’s what candlestick traders would call a pin bar, which is considered to be a buy signal. Should buyers fail to follow through here, nevertheless, the next barrier of interest beyond this zone can be seen at 0.9541: a support level. Meanwhile, a break to the upside from the current base could see prices challenge supply coming in at 0.9818-0.9793.

While the H4 chart did in fact print a bearish close off of the 0.97 handle (a noted signal to sell in Monday’s report), it was just too large for us to consider trading. After prices clocked a low of 0.9661 yesterday, the Swissy began to rotate and eventually closed the day back around the 0.97 neighborhood.

Our suggestions: Given the rather weak response seen from the underside of 0.97 yesterday, our team is wary of looking to sell here now, despite weekly action suggesting further selling may be on the cards. Therefore, opting to stand on the sidelines may very well be the best path to take today.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

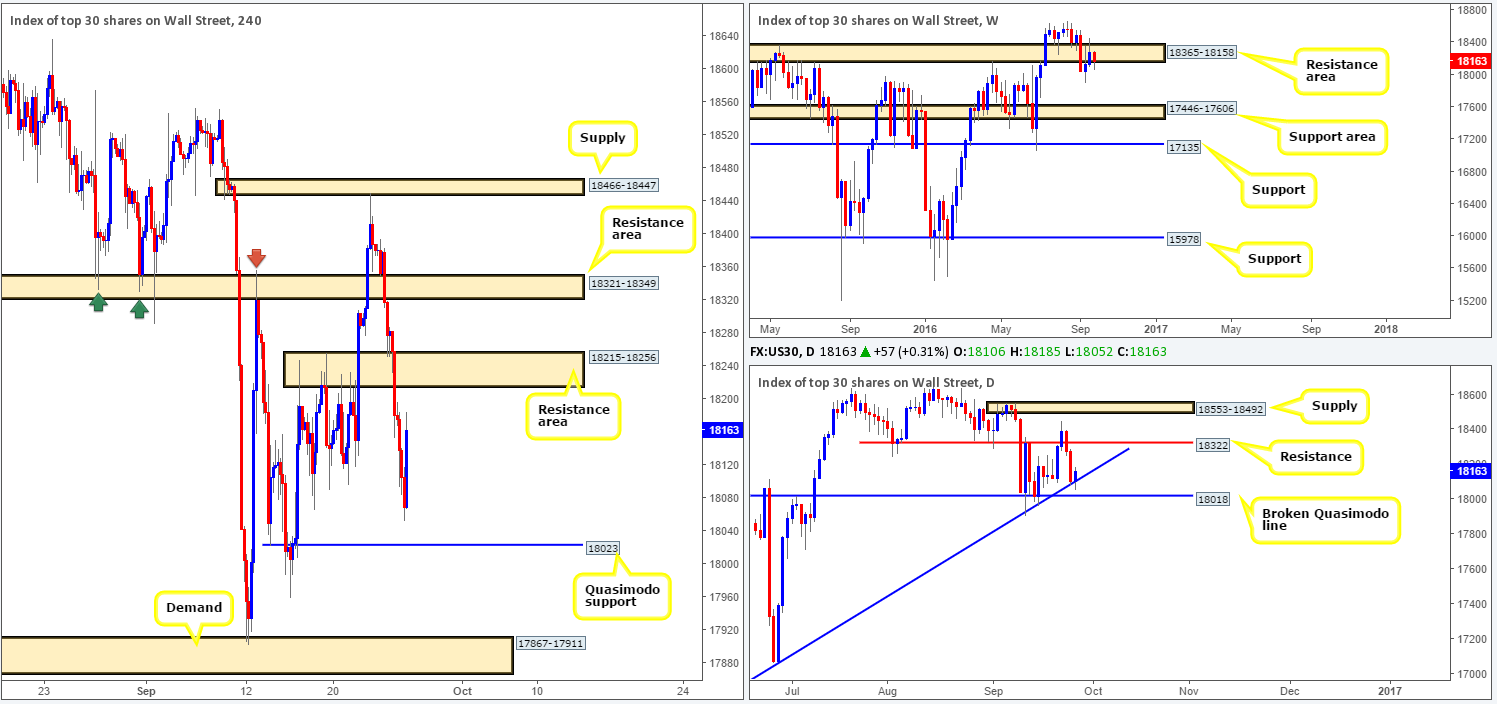

DOW 30:

The US stock market posted its second consecutive daily loss yesterday. H4 price challenged the September 16th low 18066, but, as you can see, failed to push beyond this point. Leaving the H4 Quasimodo support at 18023 unchallenged, the DOW has, in recent hours, aggressively rotated back to the upside and looks all set to test the underside of the H4 resistance area penciled in at 18215-18256.

Looking over to the bigger picture, daily price recently tagged in a trendline support extended from the low 15501, while weekly flow remains lodged within a resistance area seen at 18365-18158. This, of course, leaves traders in a precarious position now: buy into the above said weekly resistance area or sell into the aforementioned daily trendline support?

Our suggestions: In that the current H4 resistance area is not bolstered by a daily resistance level, we’re going to pass on looking for sells around this zone, despite it being housed within the weekly resistance area discussed above. The more prominent area, at least as far as we can see, is the H4 resistance zone planted above the current one at 18321-18349. Not only does this barrier house the daily resistance level at 18322 (the next upside target on the daily timeframe), but it also sits within the top edge of the current weekly resistance area! Therefore, should prices attack this region today and print a reasonably sized H4 bearish close, our team would look to short this market, with stops placed above the trigger candle.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 18321-18349 [H4 bearish close required] (Stop loss: beyond the trigger candle).

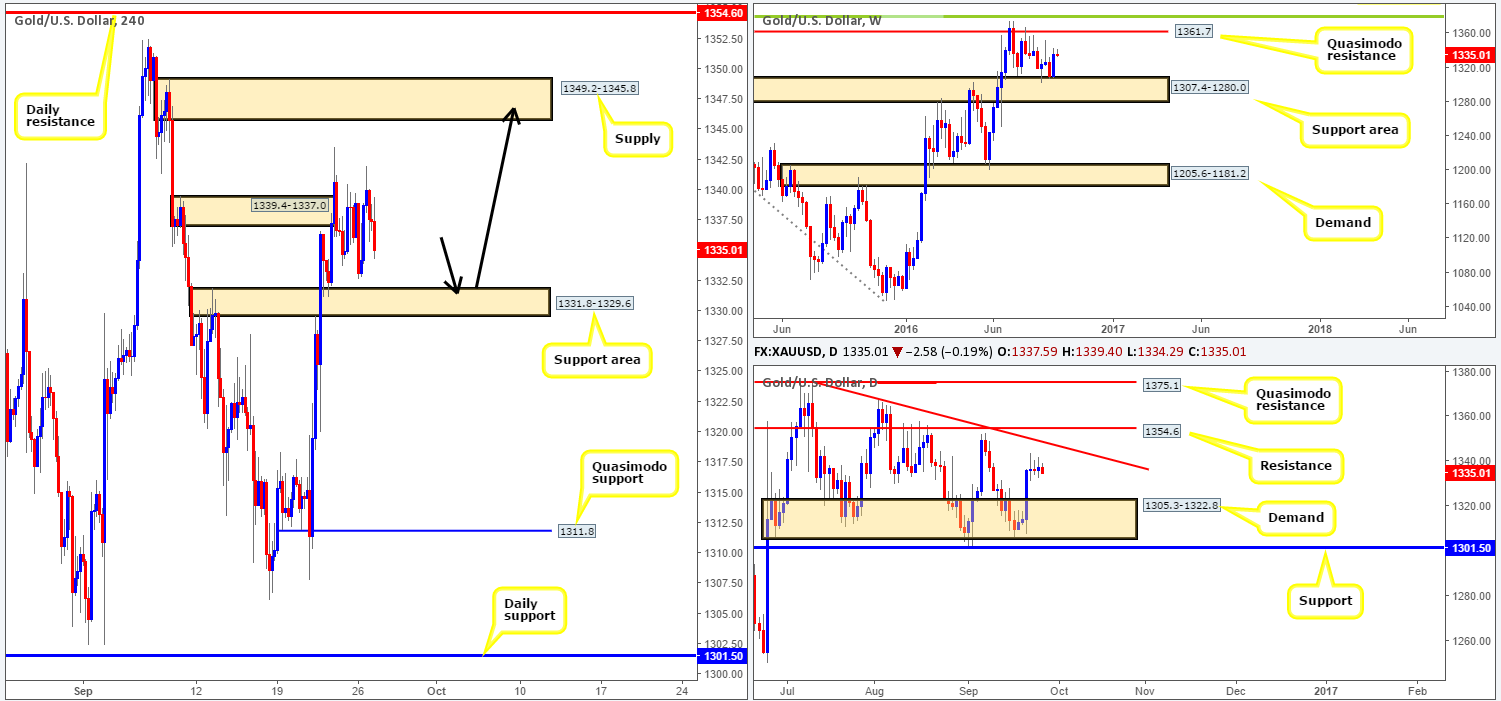

GOLD:

Following the break above the H4 supply zone marked at 1339.4-1337.0 last Thursday, the yellow metal has been seesawing between the 1340.6/1333.6ish range. As a result of this, our team still remains in favor of price bouncing from the H4 support area coming in at 1331.8-1329.6 and reaching the H4 supply band at 1349.2-1345.8. Those that have been following our previous reports will already know why that is. But for those who haven’t here’s our reasoning:

- Weekly price reflecting a bullish stance off the support area seen at 1307.4-1280.0.

- Daily action seems all set to extend further north this week up to at least the trendline resistance extended from the high 1375.0, and with a little bit of luck, the resistance planted at 1354.6.

- Sellers around the H4 supply at 1339.4-1337.0 have likely been well and truly chewed up!

Our suggestions: We recommend waiting for at least a H4 bullish candle close to form off of the H4 support area at 1331.8-1329.6 prior to pulling the trigger, since a fakeout through this zone is possible. In regard to targets, we really only have one in mind here and that is the H4 supply zone mentioned above at 1349.2-1345.8, as it unties beautifully with the aforementioned daily trendline resistance.

Levels to watch/live orders:

- Buys: 1331.8-1329.6 [H4 bullish close required] (Stop loss: beyond the trigger candle).

- Sells: Flat (Stop loss: N/A).