As introduced in the previous section, Fibonacci extension levels serve as excellent points for setting profit targets. After all, it’s not enough that you try to pick the best entry levels for your trade. You must also be able to determine how long you plan to hold on to the trade or how long you think the market trend might last.

Just like the Fibonacci retracement levels, the extension levels are also based on the golden ratio determined by Leonardo Fibonacci. When it comes to Fibonacci extensions, the important levels to remember are 0, 0.382, 0.618, 1.000, 1.382, and 1.618.

Again, there is no need to memorize all these figures as the Fibonacci extension tool is also included among most forex trading platforms and charting software. You simply need a working knowledge of how these levels are generated and how you can apply this in coming up with trade ideas.

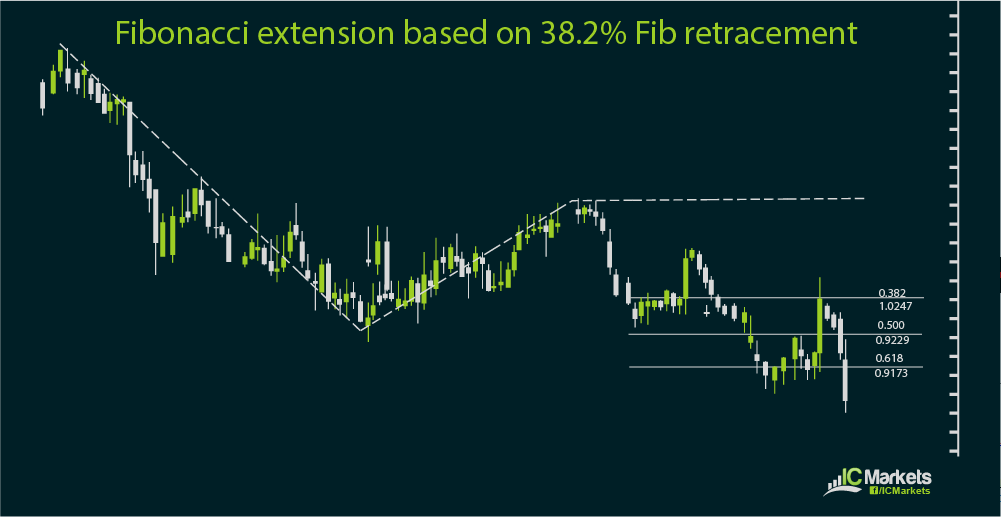

While the Fibonacci retracement only involves connecting two points in price action, which are the swing high and swing low, the Fibonacci extension has a third point to be connected and this is the retracement level where you plan to enter your trade or where price has already bounced. After clicking on the swing high and low, you also have to click on a specific retracement level before the extension levels automatically pop out.

As you’ve probably surmised, the Fibonacci extension levels vary depending on which retracement level you pick.

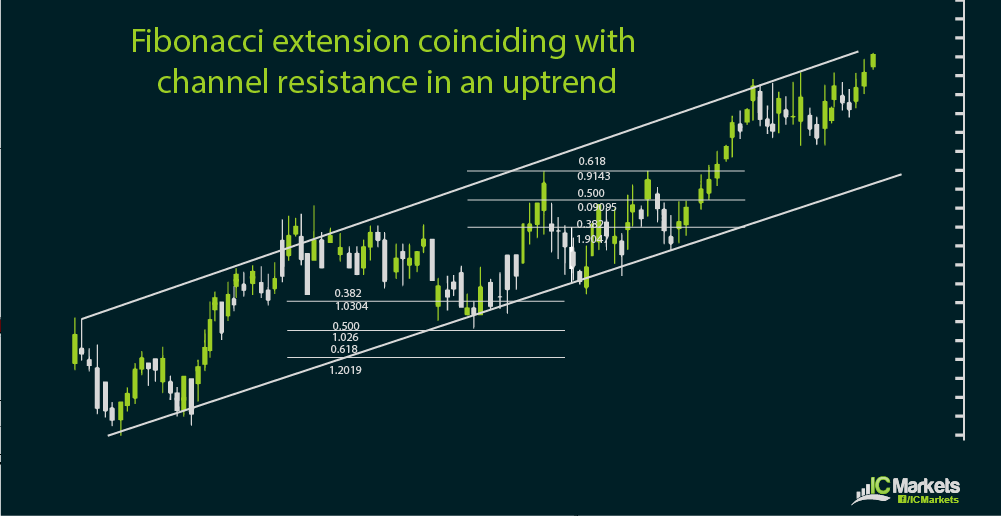

As with Fibonacci retracement levels, there is also no hard and fast rule in determining which extension level would hold best. One can make a choice depending on which level lines up with another kind of inflection point, such psychological levels or pivot points. The intersection of a trend channel with a Fibonacci extension level could also be a take-profit point.

Reversal candlesticks forming right on a Fibonacci extension level could also be a good signal to exit a trade.

Extension levels are a bit trickier to use compared to retracement levels, as price often reacts to extension levels without necessarily reversing the trend afterwards. Price could retreat upon testing an extension level but resume the overall trend later on.

More cautious traders tend to set their profit targets at the 1.000 Fibonacci extension, which is basically the latest high or low in price action. Others favor the extension level that is equal to the retracement level. For many traders, setting definite trade rules like these remove the emotional or subjective component in coming up with trade ideas.

Despite that, the use of Fibonacci extension is common among technical traders, particularly those who also watch Elliott Wave patterns or harmonic price patterns.