- English

- ไทย

- Español

- Tiếng Việt

- عربى

- 繁體中文

Spreads From

0.0*

Leverage UP TO

1:1000

Micro Lot Trading

0.01

Tradable Instruments

2250+

Premium Support

24/7

Gold CFDs are contracts that allow you to speculate on the price of gold without owning the physical metal.

Gold CFDs provide flexibility, no expiry dates, and leveraged access to the gold market for a wide range of traders.

Gold Futures vs. Gold CFDs: Side-by-Side Comparison

Exchange–Traded

Gold Futures are traded on centralized exchanges like COMEX for added oversight.

Flexible Position Size

CFDs let you trade micro lots—ideal for small accounts and flexible strategies.

No Expiry Dates

CFD positions don’t expire, so you can hold trades as long as margin allows.

High Leverage

CFDs offer high leverage, allowing greater exposure with less capital.

Suitable for Beginner Traders

CFDs are user-friendly and accessible—perfect for new or casual traders.

Futures Gold Futures

Ideal for long-term investors and institutional

traders.

CFDs Gold CFDs

Better for short-term strategies, lower capital,

and higher flexibility.

How to Trade Gold CFDs for Potential Profit

Trading gold CFDs allows you to make a profit whether the price of gold is going up or down. You don't own the gold; you're just speculating on its price movement.

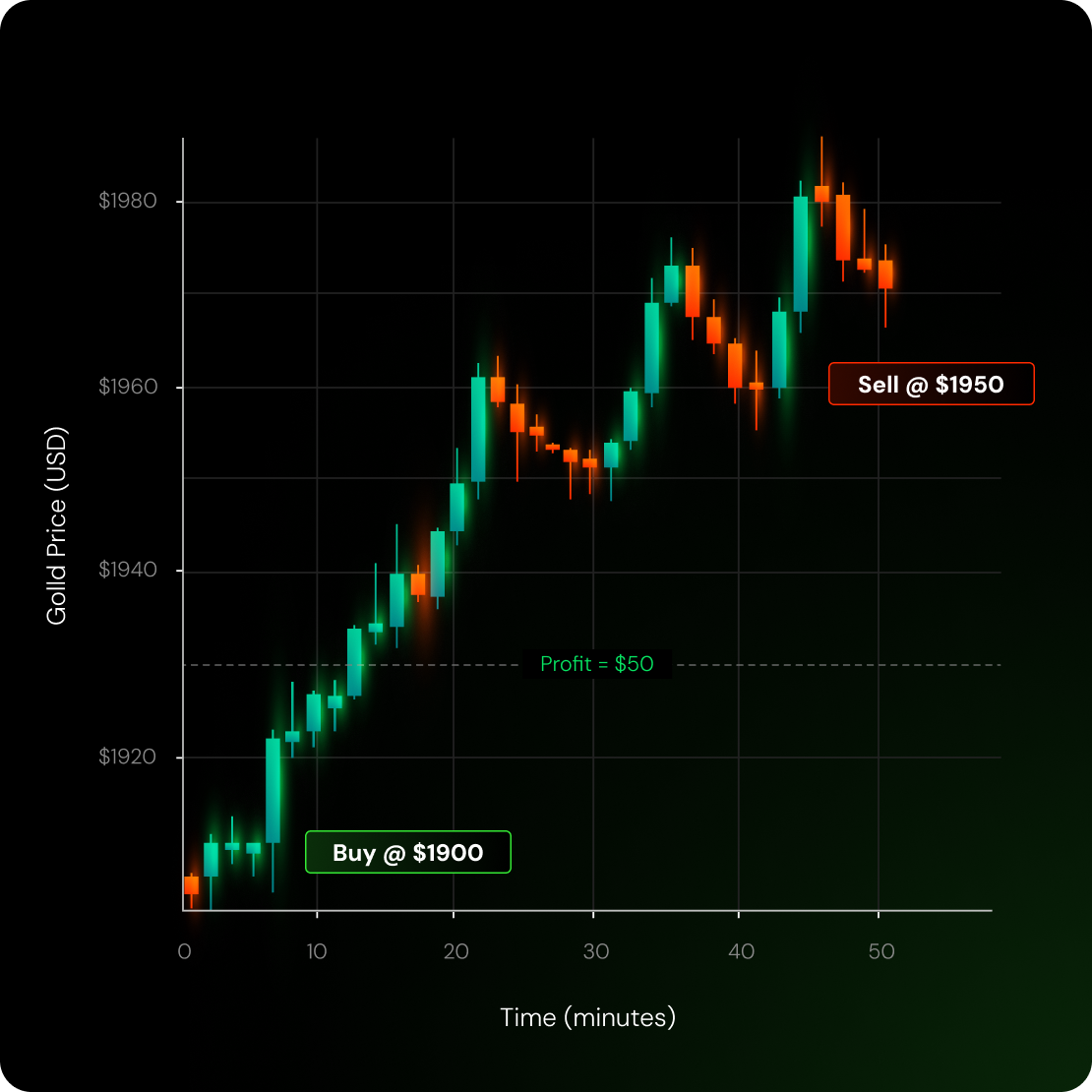

The "Go Long" Strategy (Buying)

This is the most common way to trade. You 'go long' when you expect the price of gold to rise. The goal is to buy at a lower price and sell at a higher price.

How it works:

You expect the price of gold to rise, so you buy Gold CFD at $1,900. When the price goes up, you sell it at $1,950. Your profit is $1,950 (Sell Price) - $1,900 (Buy Price), which equals $50.

The following is a simplified example. You can start trading with a much smaller amount of capital by trading in smaller contract sizes.

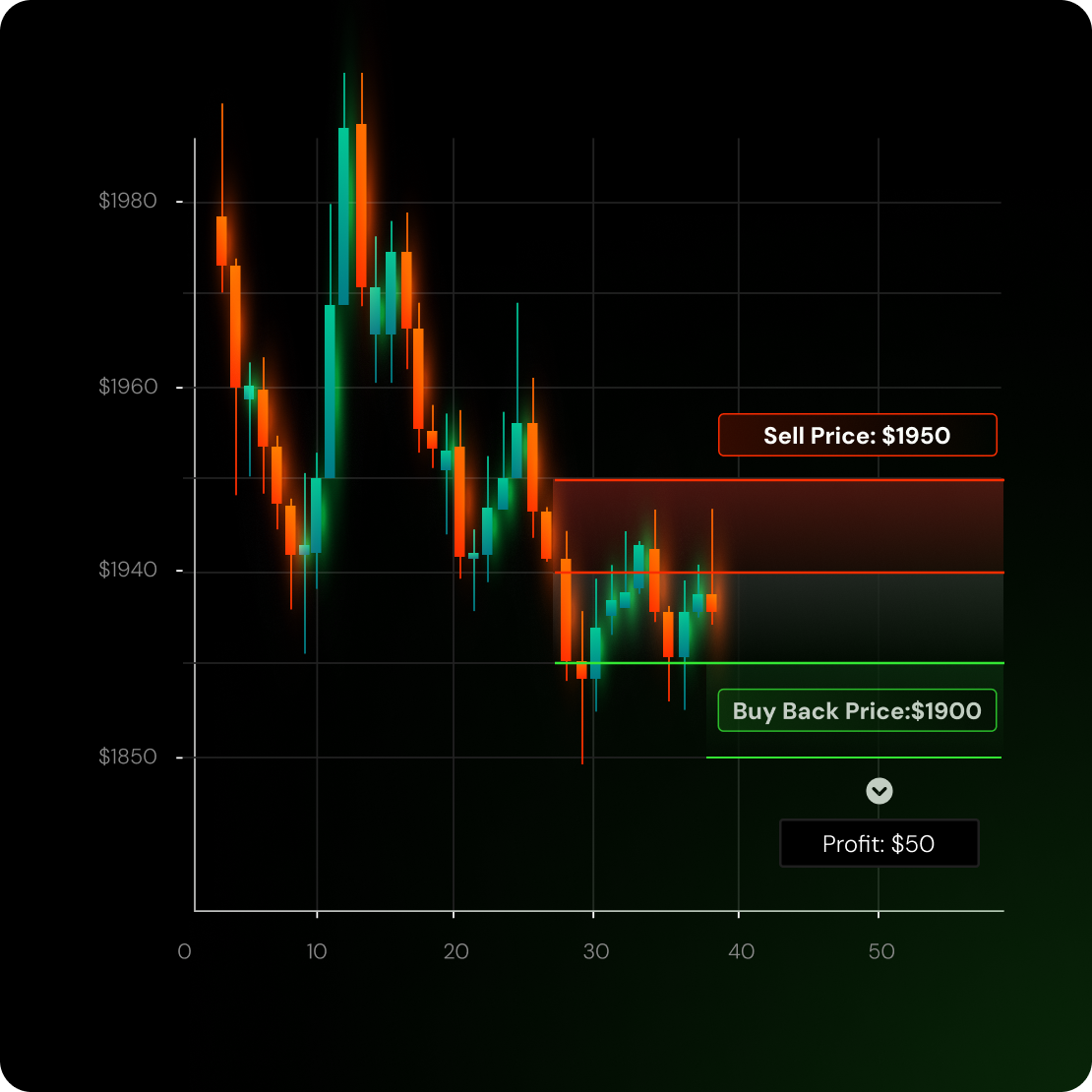

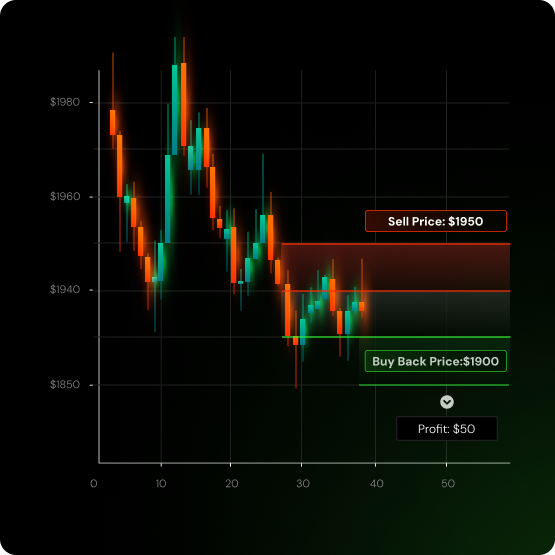

The "Go Short" Strategy (Selling)

This strategy is for when you believe the price of gold will decrease. You aim to profit by selling a CFD at a high price and buying it back later at a lower price.

How it works:

You sell Gold CFD at $1,950. When the price falls, you buy it back at $1,900. Your profit is $1,950 (Sell Price) - $1,900 (Buy-Back Price) = $50.

The following is a simplified example. You can start trading with a much smaller amount of capital by trading in smaller contract sizes.

Explore Gold Trading in a Risk-Free Demo Account

Interested in trading Gold Futures or CFDs but not quite ready to dive in? Open a free demo account to explore the platform, practice your strategies, and get comfortable before going live.

See What Traders Are Saying

Don't just take our word for it—see our Trustpilot reviews and discover why thousands trust IC Markets Global.