Key risk events today:

French Flash Services PMI; French Flash Manufacturing PMI; German Flash Manufacturing PMI; German Flash Services PMI; EUR Flash Manufacturing PMI; EUR Flash Services PMI; US Flash Manufacturing PMI.

EUR/USD:

Europe’s shared currency triggered two-month lows vs. the dollar Tuesday, convincingly crossing beneath 1.12 and June’s opening level at 1.1165 on the H4 timeframe. Ahead of tomorrow’s all-important European Central Bank (ECB) monetary policy announcements, which could see lower interest rates, the possibility of further selling is certainly there according to H4 structure, at least until the candles shake hands with 1.11.

Long-standing weekly demand at 1.1119-1.1295 recently come under increasing pressure, with a break lower potentially in store. The next port of call in terms of support can be seen around the 2016 yearly opening level at 1.0873. A closer reading of price action on the daily timeframe, however, reveals the unit also to be treading water within the walls of demand at 1.1075-1.1171, which happens to be glued to the underside of the current weekly demand area.

Areas of consideration:

The zone marked in yellow between May’s opening level at 1.1211 and the 1.12 handle, which also intersects with a trend line support-turned resistance (extended from the low 1.1181) and a channel resistance (taken from the high 1.1392) is of interest for potential selling opportunities. However, before reaching the said zone, June’s opening level at 1.1165 may serve as resistance and force price action towards the 1.11 neighbourhood. For that reason, should the H4 candles chalk up a notable bearish candlestick configuration at 1.1165 today, a short from here is also a consideration (entry/risk can be determined according to the candlestick’s structure).

Considering long opportunities, the research team particularly favours the point (green) at which 1.11 converges with channel support (etched from the low 1.1207). Here, longer-term flow trades marginally beneath weekly demand, though is still within the parapets of daily demand. Conservative traders may opt to wait and see if a bullish candlestick formation develops before pulling the trigger.

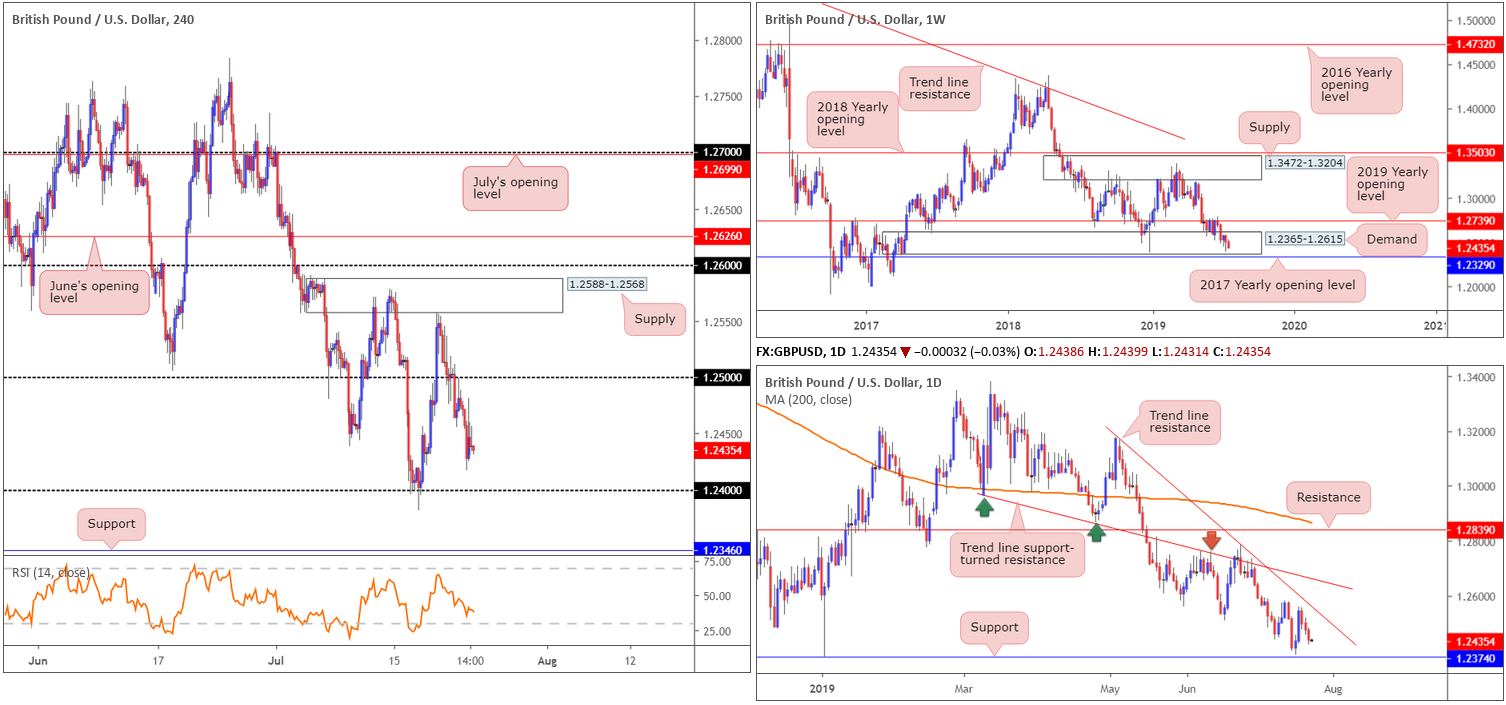

GBP/USD:

Sterling headed lower for a third consecutive session Tuesday in the wake of Boris Johnson’s widely expected confirmation as UK conservative party leader. Since crossing swords with the underside of H4 supply at 1.2588-1.2568 last Thursday, the market has been slowly grinding southbound with 1.24 likely on offer as the next support target today.

Beyond 1.24, H4 action may target support at 1.2346, though daily support exists around 1.2374. Note the daily level is an important barrier, given it held price action higher at the beginning of the year in the shape of a mouth-watering daily hammer formation. Should the market rotate higher before testing 1.2374, nonetheless, daily structure has trend line resistance positioned nearby (extended from the high 1.3176) as the next upside target.

The story on the weekly timeframe shows long-standing demand at 1.2365-1.2615 is under increasing pressure, despite back-to-back buying tails developing over the last couple of weeks. In response to this, traders may want to note the 2017 yearly opening level at 1.2329 as the next possible support.

Areas of consideration:

According to the technical studies presented here, additional downside is likely on the cards at least until 1.24 enters the mix, shadowed closely by daily support at 1.2374. Unfortunately, unless the candles pullback and retest 1.25, selling this market is difficult at current price.

Traders are also urged to exercise caution selling any breakout signal beneath 1.24, due to daily support residing close by at 1.2374.

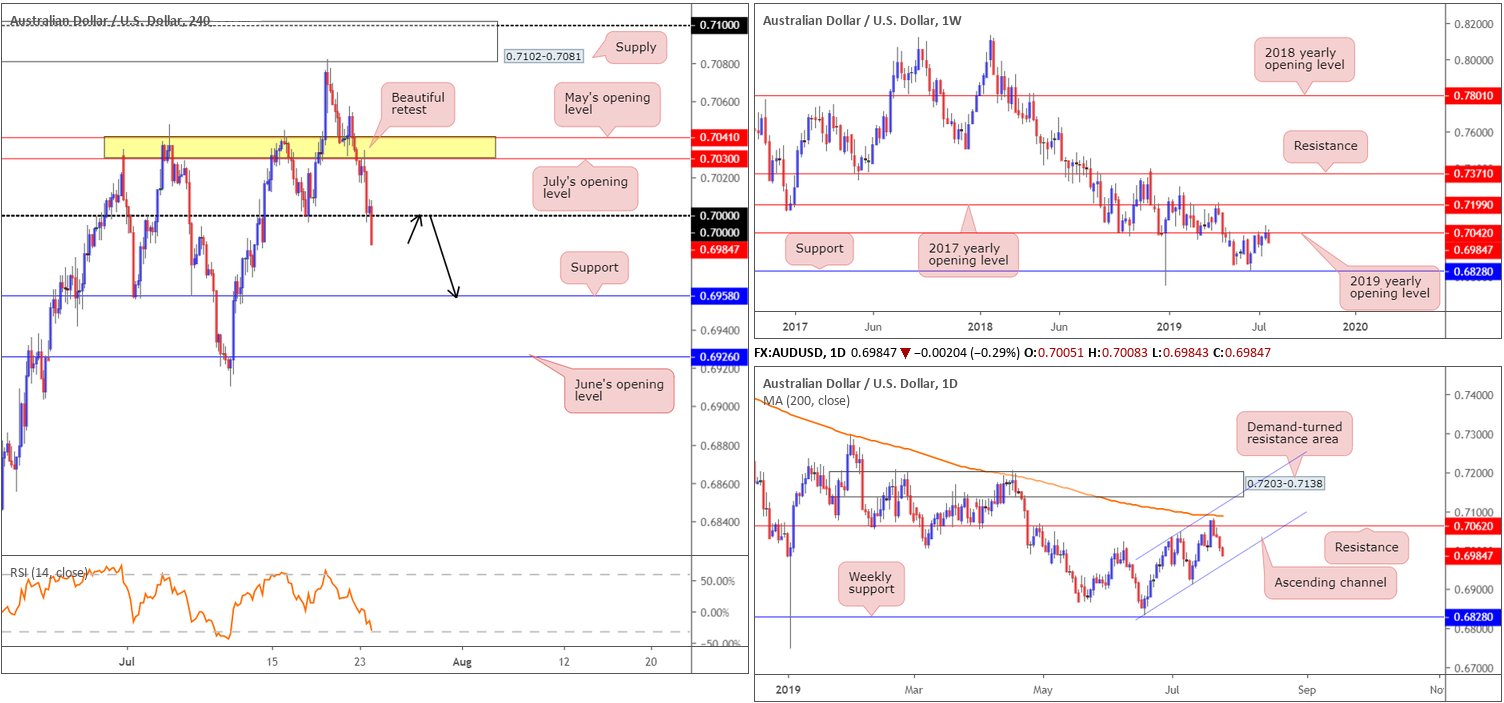

AUD/USD:

Tuesday witnessed the AUD/USD retest the underside of a H4 resistance zone at 0.7041/0.7030 and drive lower. Well done to any of our readers who managed to secure a sell position here as this was a noted move to watch for, targeting 0.70 as the initial take-profit target.

In recent hours, however, the pair steamrolled beneath 0.70 on the back of disappointing Australian PMI data, potentially setting the stage for further downside towards H4 support at 0.6958. According to the higher-timeframe’s position, the break lower should not come as a surprise.

Higher-timeframe flow has weekly activity crossing paths with the 2019 yearly opening level (resistance) at 0.7042. Having seen this base serve well as support on several occasions in the past and hold price action lower early July, active selling from here is not a surprise. The next downside support target can be seen at 0.6828.

From the daily timeframe, Monday’s action concluded by way of a bearish selling wick – almost retesting the underside of resistance at 0.7062 – consequently generating strong selling motion yesterday. Continued selling from current price may lead to a move towards channel support extended from the low 0.6831.

Areas of consideration:

Having all three timeframes propose further selling, a retest at 0.70 as resistance, preferably in the form of a bearish candlestick pattern as this helps position entry and risk levels, could be an option today, targeting H4 support at 0.6958. Given this support aligns closely with daily channel support highlighted above, traders might consider reducing risk to breakeven here and liquidating a portion of the position. Leaving some of the position active is worth the risk as weekly sellers have their downside target set at 0.6828.

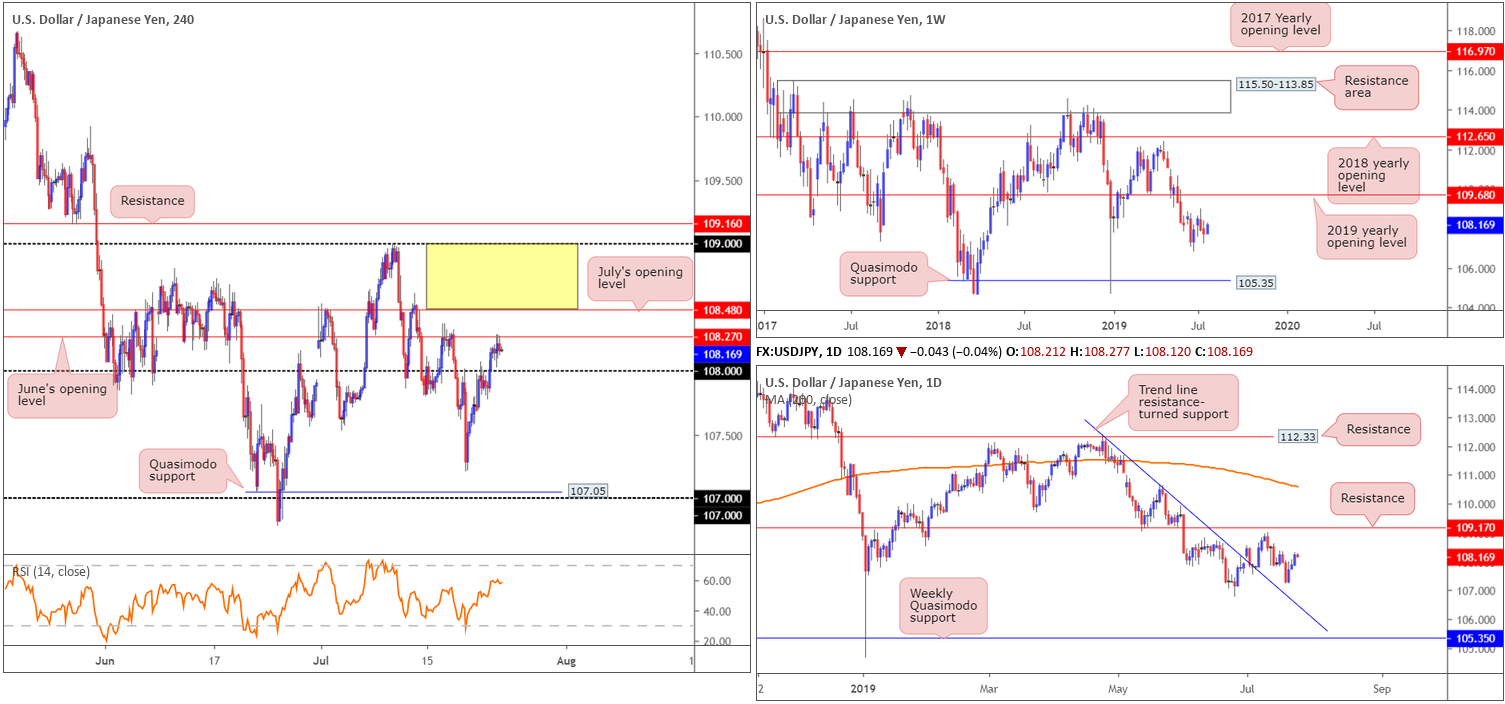

USD/JPY:

In a series of daily gains, USD/JPY remains bid above 108 as we head into Asia Pac hours Wednesday. The broad dollar was firmly bid from 97.44 in the DXY Tuesday and reached a fresh high in Tokyo of 97.75, testing weekly resistance at 97.72.

In terms of USD/JPY technical structure, H4 action is challenging the underside of June’s opening level at 108.27. Overhead, another layer of resistance resides close by at July’s opening level drawn from 108.48, while beyond here (the yellow area), we appear to have some room to manoeuvre towards the 109 handle, closely shadowed by resistance at 109.16.

On a wider perspective, daily action reveals its next upside target sets around 109.17, a point higher than H4 resistance highlighted above. To the downside, nevertheless, the 106.78 June 25 low may offer support, closely followed by trend line resistance-turned support (extended from the high 112.40) and then the weekly Quasimodo support at 105.35.

Areas of consideration:

Although the US dollar index voices strong resistance, higher-timeframe structure on the USD/JPY displays room to explore higher ground. On account of this, long opportunities exist above 108.48 on the H4, targeting 109/109.16. A retest of 108.48 as support is likely welcomed confirmation (entry and risk can be determined according to the rejecting candlestick’s structure).

Upon connecting with 109, traders are urged to close any long positions and consider selling. The round number, coupled with H4 resistance at 109.16 and daily resistance at 109.17, provides traders a strong ceiling in which to short. Traders concerned by the possibility of a fakeout materialising through 109 have the option of waiting and seeing if a H4 bearish candlestick develops before initiating a position. This way, seller intent is visible and entry and risk levels are structured.

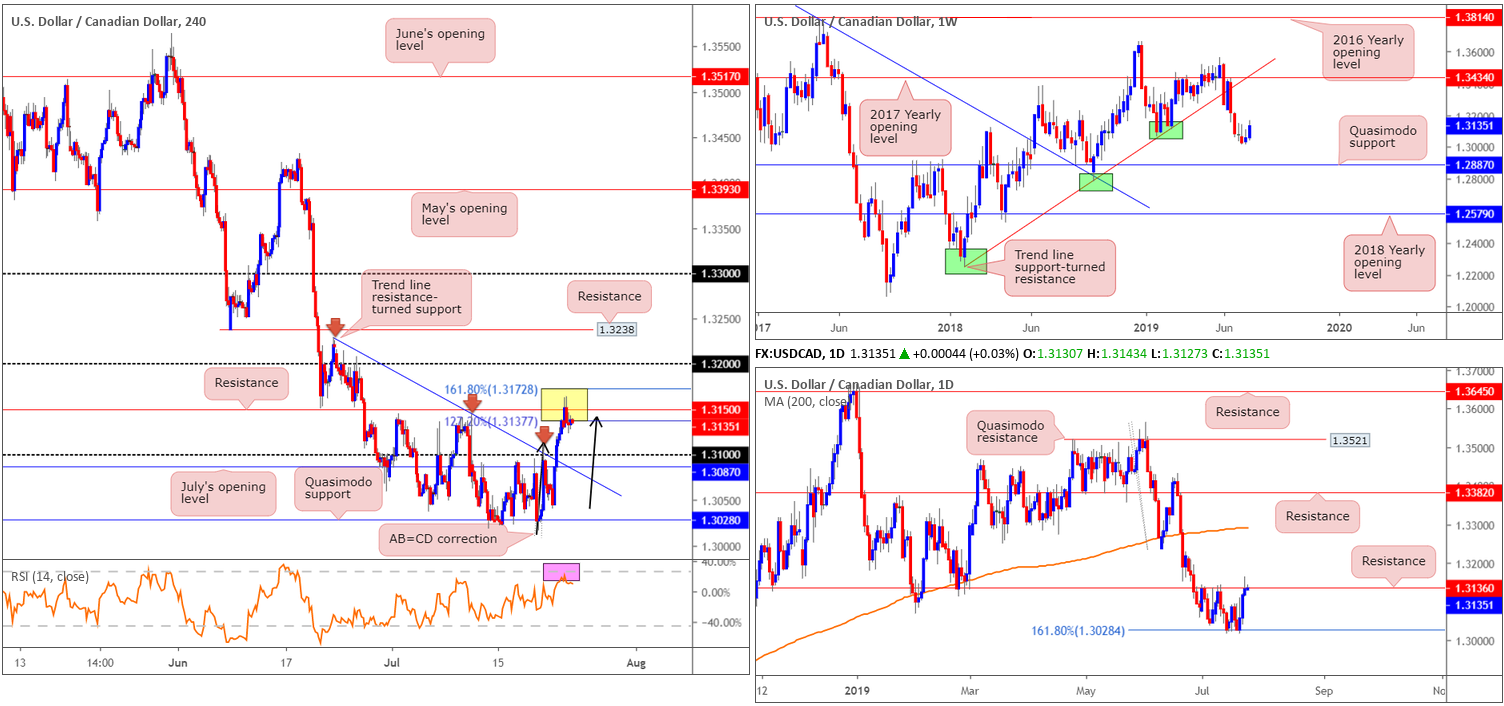

USD/CAD:

Climbing to its highest levels since late June at 1.3164 on the back of broad-based USD bidding, the H4 candles connected with an interesting area of resistance between the 161.8% and 127.2% Fibonacci ext. points at 1.3172/1.3137 (yellow). Here, USD/CAD prices came under mild pressure as the Canadian dollar likely took advantage of rising crude oil prices.

For those who read Tuesday’s briefing you may recall the research team highlighted 1.3172/1.3137 as a potential sell zone. Formed by way of a H4 AB=CD approach, a H4 resistance at 1.3150, daily resistance at 1.3136 and the H4 RSI nearing its overbought value (pink), this area managed to hold price action firm into the close.

Areas of consideration:

Tuesday’s report also went on to say:

Keeping it simple this morning, the research team favours a reaction from the H4 AB=CD reversal zone at 1.3172/1.3137, given its local and higher-timeframe confluence. Entry at the H4 resistance plotted within at 1.3150 is likely eyed, with a protective stop-loss order plotted a couple of points above 1.3172. Considering the first take-profit target, the 1.31 handle is likely to be problematic for sellers, as is July’s opening level at 1.3087 and the intersecting trend line resistance-turned support (1.3229).

For those short from 1.3150, well done. You enter Wednesday’s session in the green, with the expectation of a descent towards 1.31.

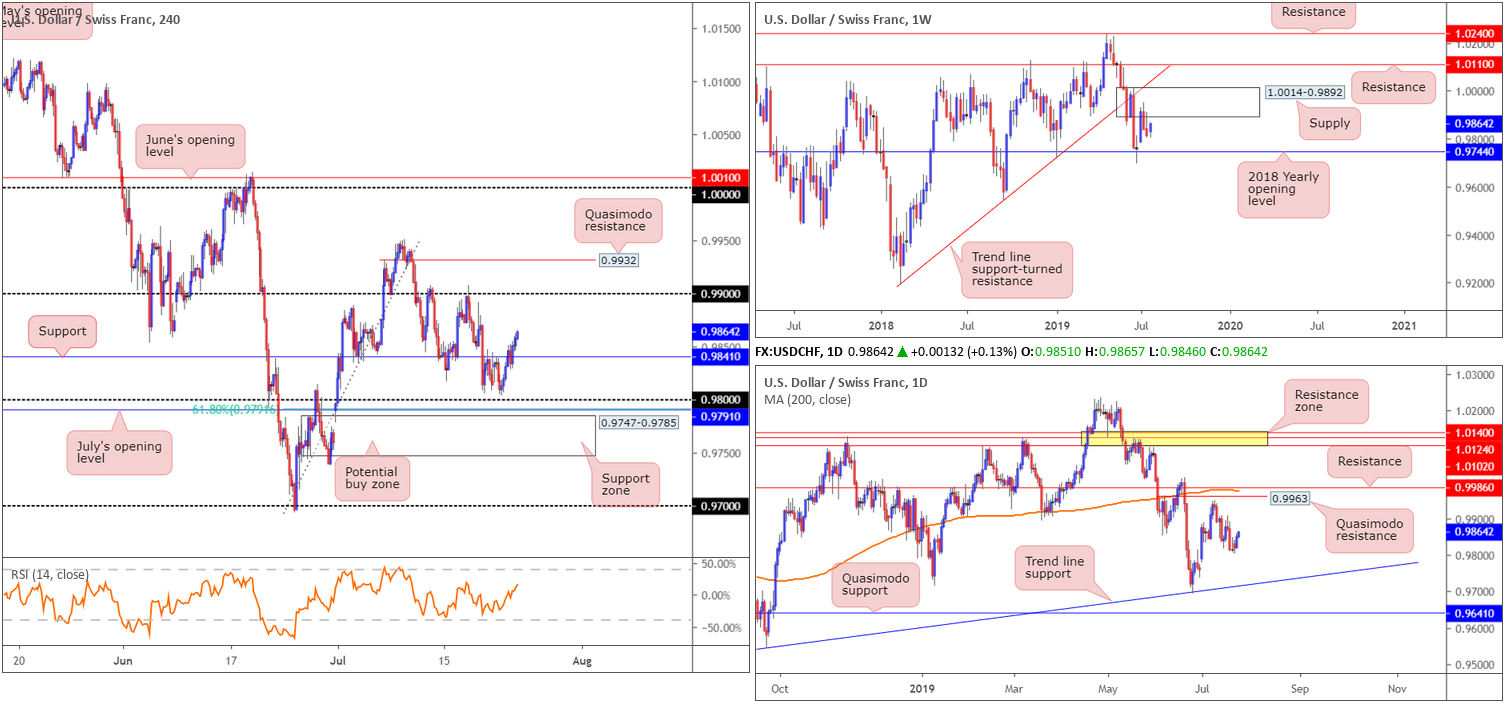

USD/CHF:

Robust demand for the US dollar over the past couple of days helped the USD/CHF find support a few points north of the 0.98 handle and dethrone resistance at 09841 (now serving as support). The 0.99 handle is next in line as resistance on the H4 timeframe, closely trailed by Quasimodo resistance plotted at 0.9932.

Although we’re trading higher at the moment, the research team feel it’s important not to lose sight of the confluence presented around the 0.98 handle. Closely trailed by July’s opening level at 0.9791, a 61.8% Fibonacci retracement value and a support zone at 0.9747-0.9785, the surrounding area offers strong local confluence for a move higher.

On more of a broader perspective, though, little has changed in terms of structure:

From the weekly timeframe, the US dollar surrendered another portion of recent gains off the 2018 yearly opening level at 0.9744 last week, following a rotation lower out of supply at 1.0014-0.9892 by way of a strong bearish selling wick. While this could lead to a revisit of 0.9744, traders may also find use in noting the trend line support-turned resistance (extended from the low 0.9187), closely followed by resistance at 1.0110, should we turn higher this week.

Daily timeframe:

Closer examination of price action on the daily timeframe shows the unit pressing south after failing to test Quasimodo resistance at 0.9963 early July, followed closely by resistance at 0.9986 and the 200-day SMA (orange). To the downside, limited support is in view until reaching trend line support taken from the low 0.9542.

Areas of consideration:

In the event H4 price retests support at 0.9841, preferably in the shape of a bullish candlestick configuration as this aids entry and risk placement, a short-term buying opportunity may be on the cards, targeting the lower edge of weekly supply at 0.9892, followed by the 0.99 handle.

In the event things turn sour and we crack lower, 0.98 will then be in focus for potential longs. Stop-loss placement, in this case, is best positioned beneath the support area mentioned above at 0.9747-0.9785.

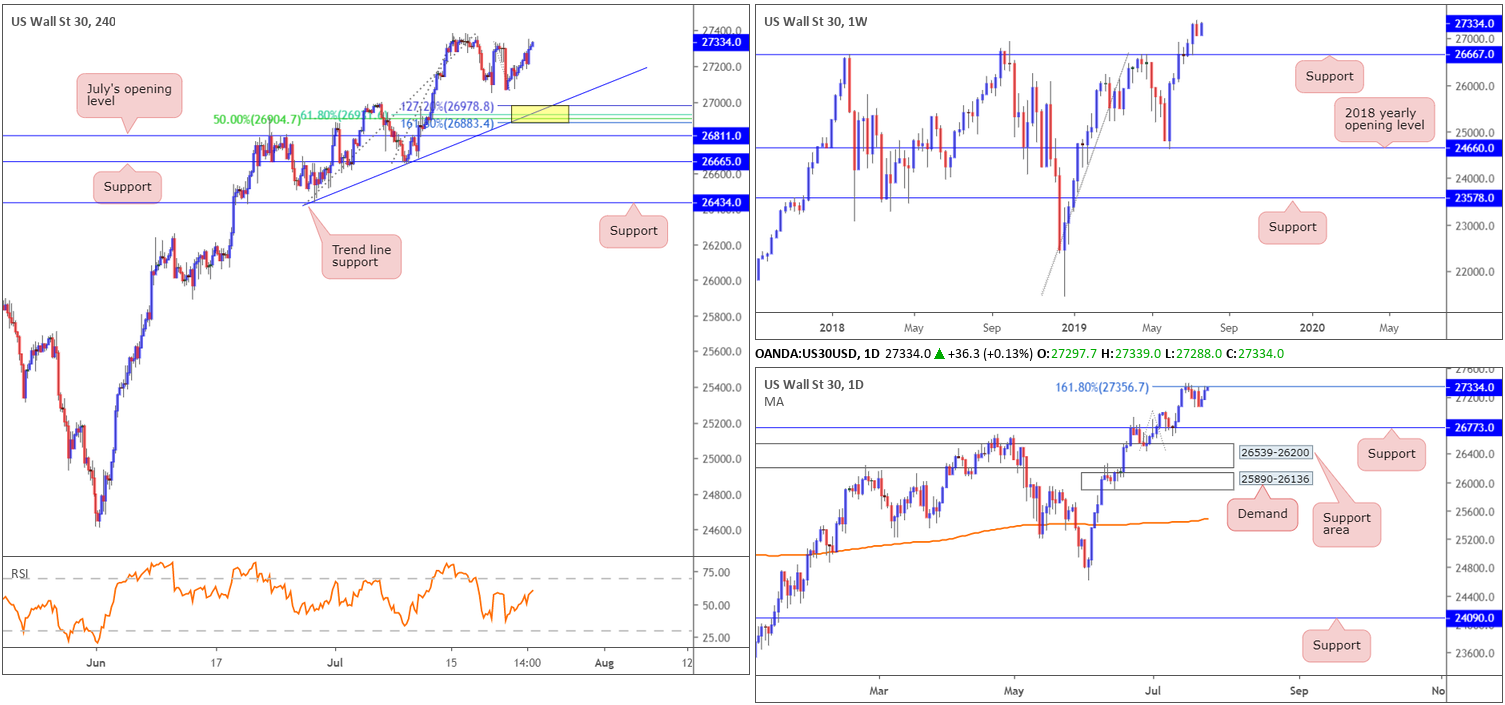

Dow Jones Industrial Average:

Stocks rose Tuesday on news face-to-face talks between US and Chinese trade negotiators would begin next week, along with better-than-expected earnings from Dow Jones Industrial Average components. The Dow added 0.65%; the S&P 500 advanced 0.68% and the tech-heavy Nasdaq 100 rallied 0.63%.

From a technical viewpoint, nonetheless, the candles closed within striking distance of all-time highs at 27388. Although weekly price displays room to extend gains to 28070 (not visible on the screen), a 127.2% Fibonacci ext. point taken from the low 21425, daily movement is defending the underside of 27356: the 161.8% Fibonacci ext. point. Continued selling from here has a downside support target set at 26773, located just north of weekly support at 26667.

In terms of H4 flow, the yellow area marked between the 161.8% and 127.2% Fibonacci ext. points at 26883/26978 is still an option for longs in the event price action dips lower. Note this area merges with a trend line support (taken from the low 26436), a 61.8% Fibonacci retracement at 26930 and a 50.0% support value at 26904.

Areas of consideration:

Should the index shake hands with H4 trend line support and merging Fibonacci levels (see above), a long could be considered, with a stop-loss order fixed beneath 26883. The first take-profit target from this point will depend on the approach, but overall the research team have 27356 on the daily timeframe in sight.

If the unit continues pushing for record highs and engulfs daily resistance at 27356, a long on the retest of this barrier is also an option, targeting the weekly resistance level underlined above at 28070.

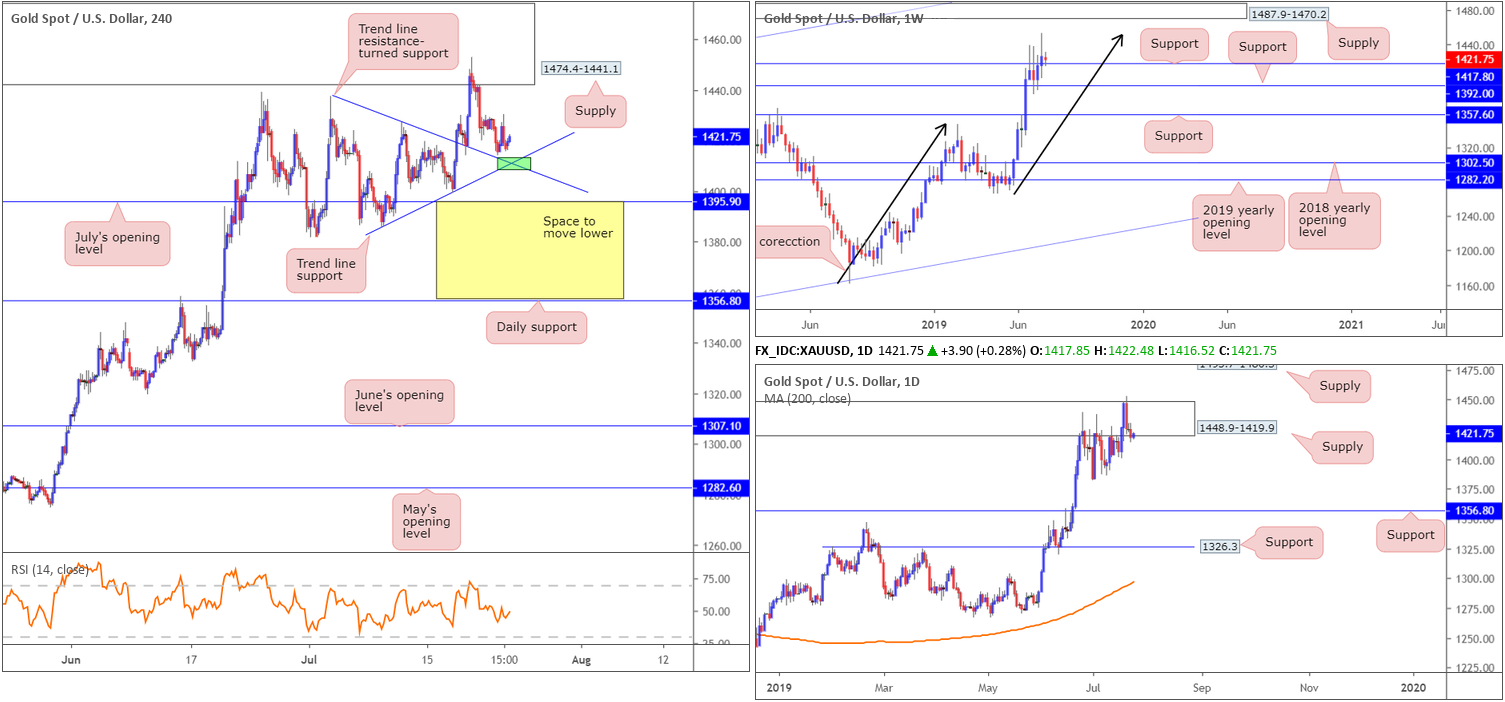

XAU/USD (GOLD):

Bullion, in $ terms, eked out marginal losses Tuesday, as the US dollar index printed its third consecutive daily gain. Overall, though, technical structure on gold remains unchanged going into Wednesday’s sessions.

In recent action, price action drew the H4 candles to within touching distance of two merging trend line supports (1385.5/1437.7 – green). Beyond here, H4 structure offers July’s opening level at 1395.0 as the next support target.

Weekly structure, as highlighted in Monday’s briefing, crossed paths with a 1:1 correction (black arrows) around 1453.2 shaped from the 1160.3 August 13 low last week. As is evident from the chart, selling has so far been reasonably strong from 1453.2, though will it be enough to reclaim 1417.8 – the next downside support on the weekly timeframe?

The technical landscape on the daily timeframe observed a break of the top edge of a supply zone at 1448.9-1419.9 late last week. While this move was likely enough to trip a portion of the stop-loss orders above here, it’s unlikely to have cleared the path north to supply at 1495.7-1480.3 just yet, given Friday’s run south erasing 1.49%. As for downside targets on this scale, the research team notes to be aware of the 1381.9 July 1 low, followed by support at 1356.8.

Areas of consideration:

Given the lack of movement yesterday, the research team feels Tuesday’s outlook holds weight today:

Although weekly price is selling off from its 1:1 correction point at 1453.2, weekly support is also in motion at 1417.8. This weekly support – coupled with the nearby H4 trend line supports mentioned above – is an area buyers may be looking to get involved. Conservative traders, threatened by recent selling, might opt to wait and see if a H4 bullish candlestick configuration develops before pulling the trigger. This helps recognise buyer intent and provides traders with entry and risk levels to work with.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.