- 0.0 Pip Spreads*

- 1: 500 Leverage

- 0.01 Micro Lot Trading

- +2250 Tradable Instruments

- 24/7 DEDICATED SUPPORT

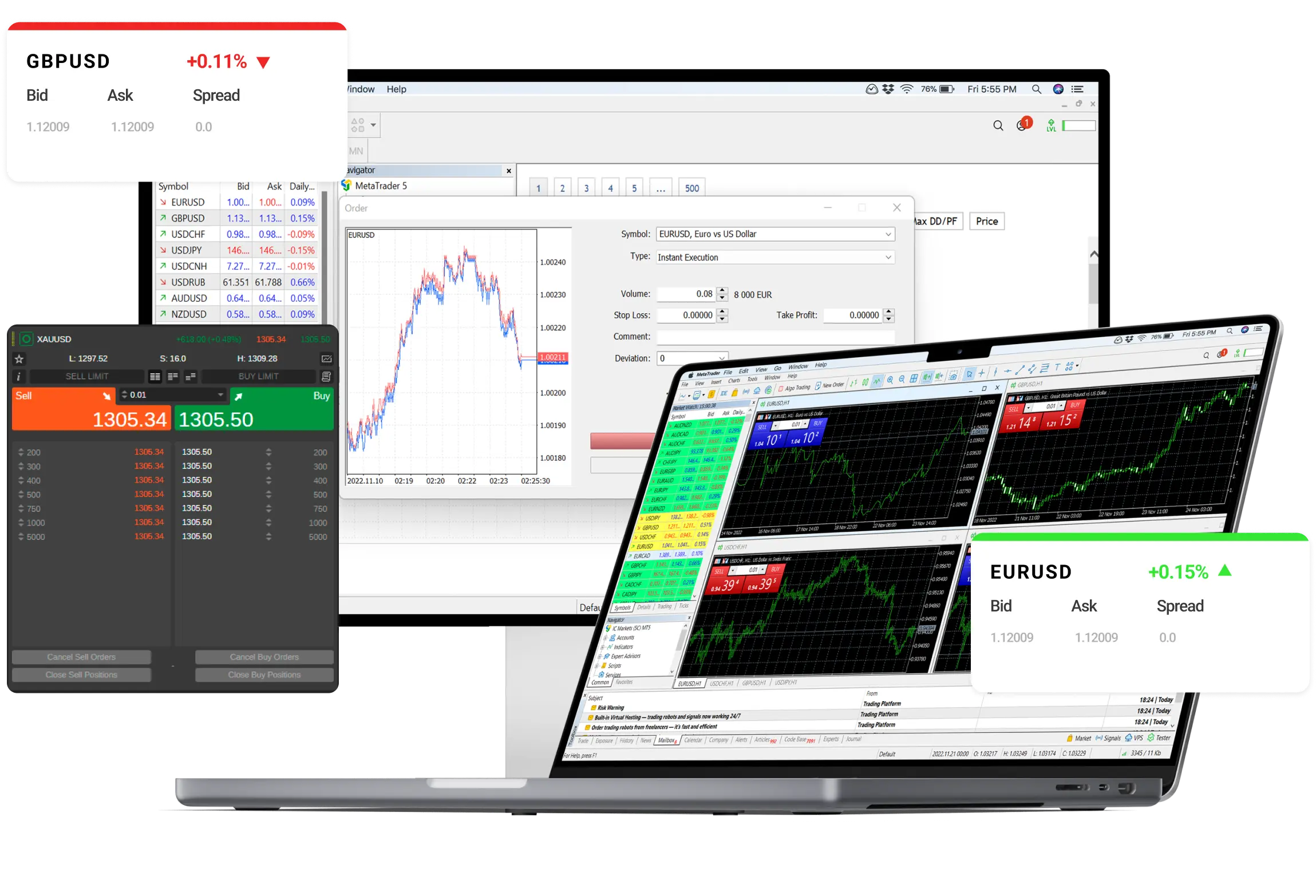

The Raw Spread Advantage

Raw Spreads are the difference you have been waiting for. Trade with spreads from 0.0 pips, no requotes, best possible prices and no restrictions. IC Markets Global is the multi-asset trading platform of choice for high volume traders, scalpers and robots.

Spreads from 0.0 pips

- Raw spreads means really from 0.0 pips*

- Our diverse and proprietary liquidity mix keeps spreads tight 24/5

Fast Order Execution

- Average execution speeds of under 40ms***

- Low latency fibre optic and Equinix NY4 server

- Free Low latency collocated VPS available

Institutional Grade Trading

- Real, deep and diverse liquidity you can trade on

- Reduced slippage

- Over 29 Billion USD in FX trades processed daily

-

US$1.39 Trillion

Trading volume - June 2023 -

200,000+

Active Clients Worldwide -

Excellent 4.8/5

Rating on TrustPilot

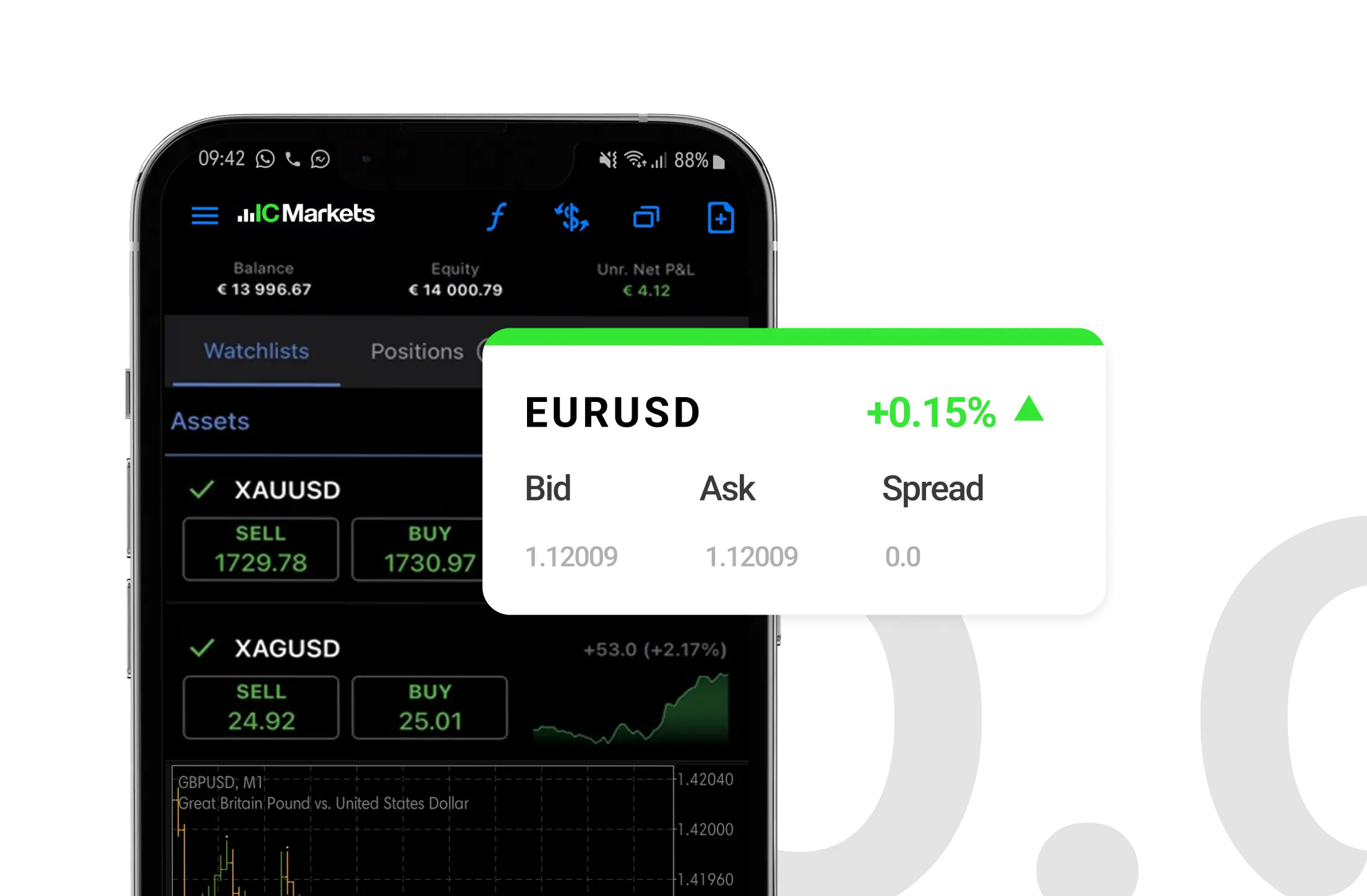

Give your automated trading system the edge

IC Markets Global is the one of the top choices for automated traders. Our order matching engine located in the New York Equinix NY4 data centre processes over 500,000 trades per day with over two thirds of all trades coming from automated trading systems.

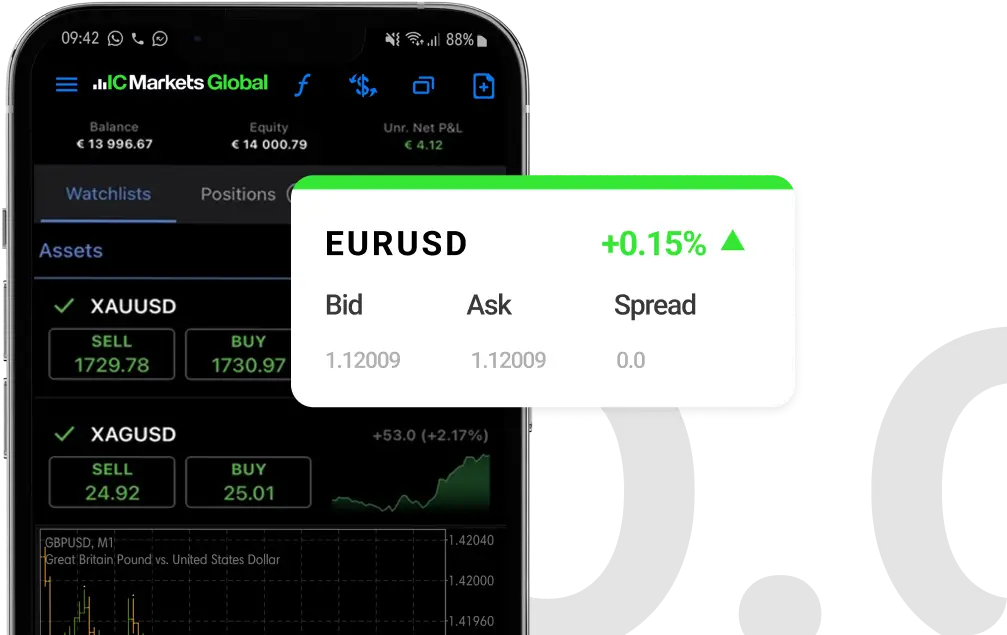

Global Markets at

Your Fingertips

- Forex CFDs 61 products

- Commodities CFDs 24 products

- Stocks CFDs +2100 products

- Index CFDs 25 products

- Bond CFDs 9 products

- Cryptocurrency CFDs 21 products

Our strength is in the numbers

IC Markets Global is one of the largest Forex CFD providers in the world by trading volume.

-

500,000

Trades Per Day -

Equinix NY4

Trading Hub at New York -

60%

Algo trades (% of all trades)

Your money, your way

- Instant Deposit

- Fast Withdrawal

- 0% Commission

For more information on deposits, withdrawals and how to fund your trading account, Go here

Open an account in 4 simple steps

Register

Choose an account type and complete our fast and secure application form

Verify

Use our digital onboarding system for fast verification

Fund

Fund your trading account using a wide range of funding methods

Trade

Start trading on your live account and access +2,100 instruments