Lower timeframe confirmation: is something we use a lot in our analysis. All it simply means is waiting for price action on the lower timeframes to confirm direction within a higher timeframe area. For example, some traders will not enter a trade until an opposing supply or demand area has been consumed, while on the other hand, another group of traders may only need a trendline break to confirm direction. As you can probably imagine, the list is endless. We, however, personally prefer to use the two methods of confirmation mentioned above in our trading.

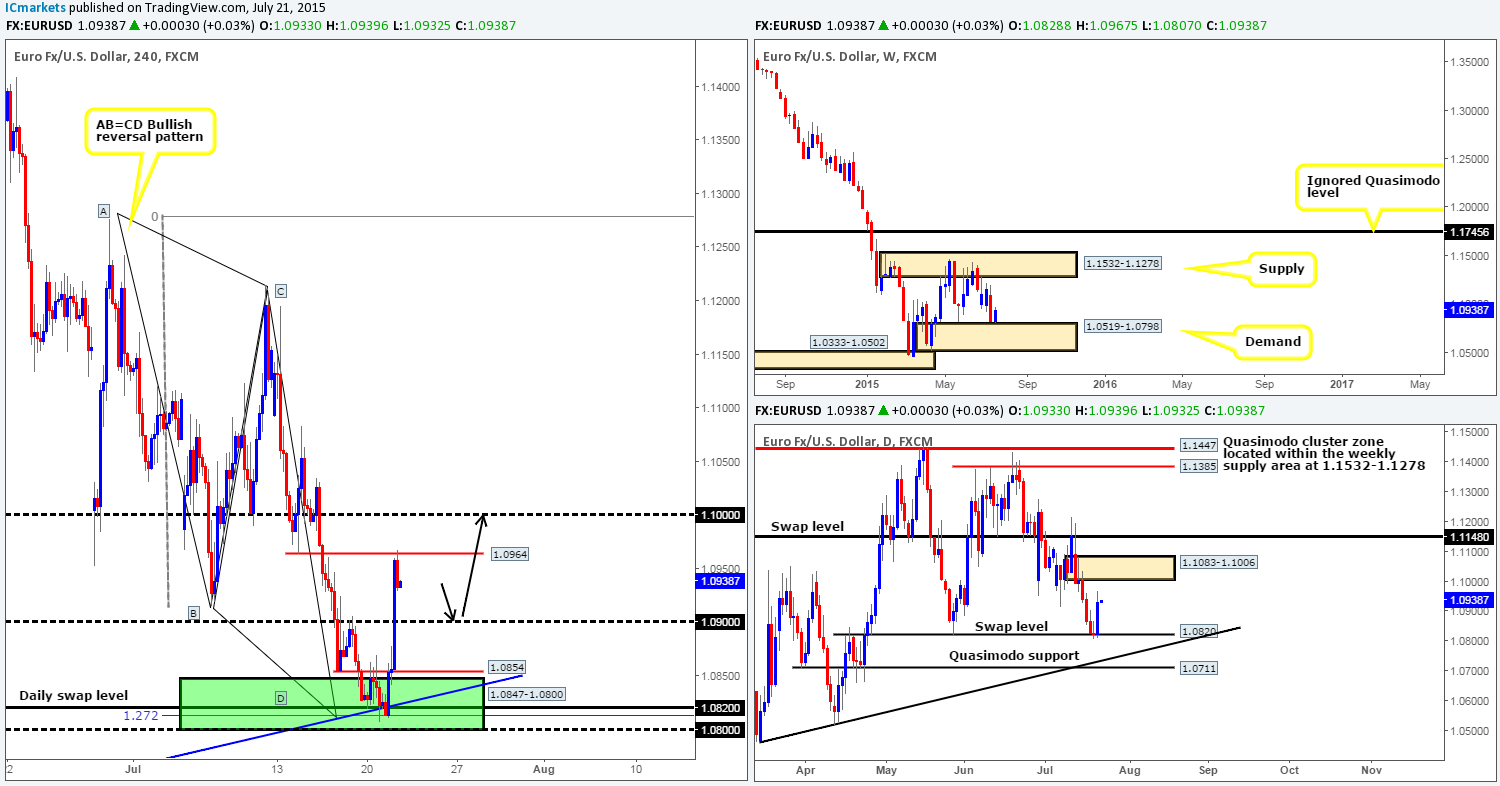

EURUSD:

Going into yesterday’s London session the EUR currency rallied from the heavily confluent 4hr Harmonic AB=CD potential reversal zone (PRZ) at 1.0847-1.0800, which took prices back up to the 4hr swap level at 1.0854. Once the U.S traders begun placing orders, however, this level was broken, and price exploded north, taking out 1.0900 and connecting up with a 4hr swap level coming in at 1.0964, which, as you can see, is currently holding firm for the time being. This recent rally north should not really come as much of a surprise since the 4hr Harmonic AB=CD support boasted heavy confluence from the following structures:

- 4hr trendline taken from the low 1.0461.

- Fibonacci extension 1.272%.

- The daily swap level 1.0820.

- Weekly demand seen at 1.0519-1.0798.

- Round-number support seen a little lower at 1.0800.

For those who read our previous analysis on this pair, you may recall that we planned to enter long at the above said 4hr AB=CD support should lower timeframe confirmation be seen. Fortunately, we managed to spot an entry to get in long at 1.0858 on the 15 minute timeframe just before the U.S open. Our stop is now at breakeven.

Our ultimate target for this trade is the large round number 1.1000, which if you look across to the daily chart, you’ll see it lines up beautifully with a daily supply area at 1.1083-1.1006. However, before price reaches 1.1000, we’re expecting the market to trickle south today from 1.0964 and retest 1.0900 as support (as per the black arrows). This could, if lower timeframe buying confirmation is seen, make for a nice a level to add to our current position.

Levels to watch/live orders:

- Buys: 1.0858 [Live] (Stop loss: Breakeven) 1.0900 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

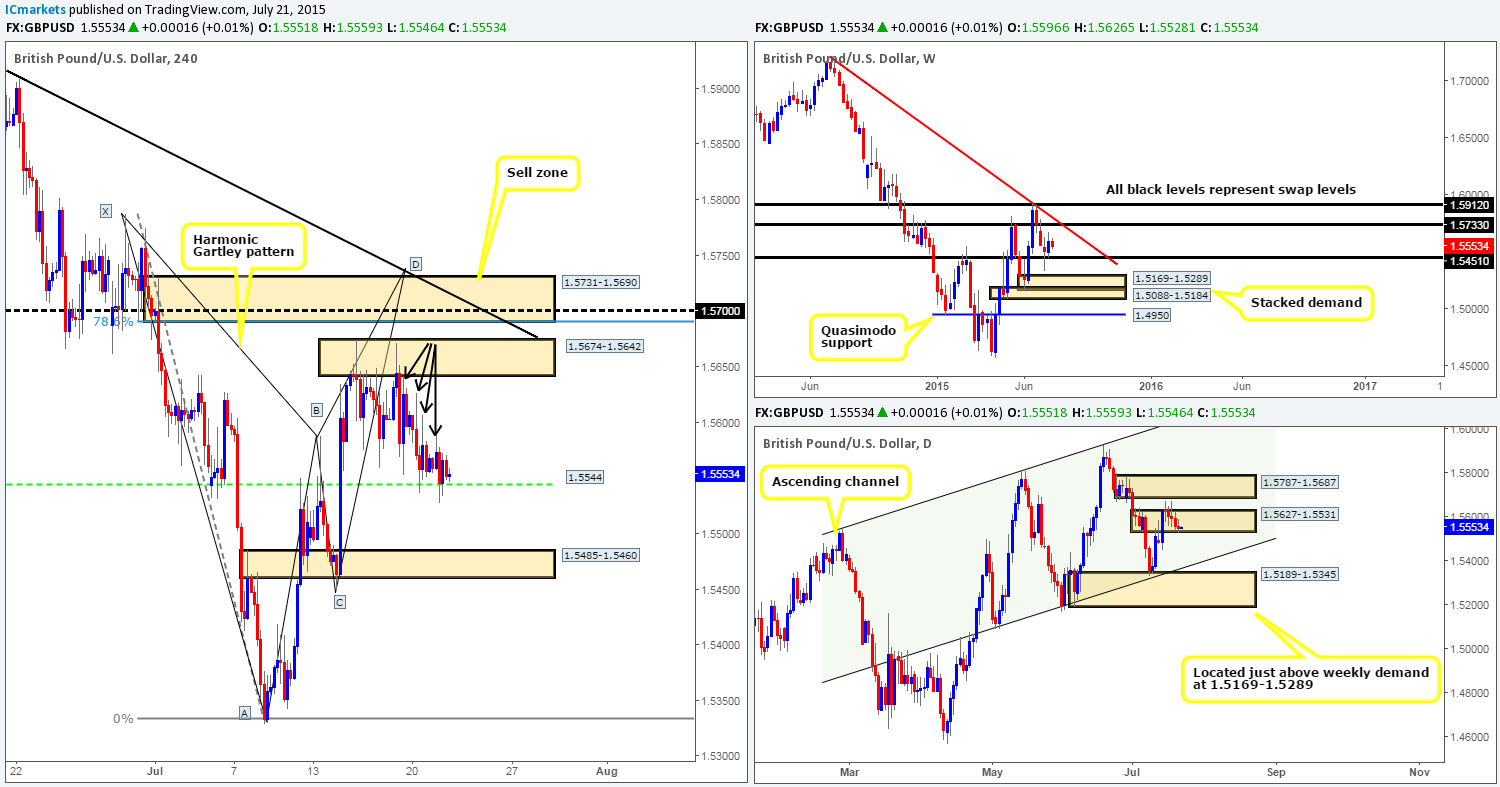

GBP/USD:

Unlike the EUR/USD, the GBP/USD saw very little action during yesterday’s trade. Price remained teasing the top-side of the 4hr swap level sitting at 1.5544. From the 4hr timeframe alone, we feel this pair is currently at boiling point to breakout north. Take a look above current price. The four black arrows marking the following wicks: 1.5606/1.5626/1.5641/1.5589 is where we believe supply has already been consumed, and as such the path north cleared for buying.

With that said though, we’re not seeing much from the weekly timeframe at the moment as price is hovering between two weekly swap levels – 1.5451/1.5733. Nevertheless, as we move down to the daily timeframe, we can see that price is trading deep within a daily supply (now acting demand in our opinion) area at 1.5627-1.5531.

Given the points made above, 1.5544 will play a key role in our decision-making process today. Should 1.5544 continue to hold and lower timeframe buying confirmation presents itself, we’d likely consider taking a long position from here, targeting the 4hr supply area seen at 1.5674-1.5642. In the event that price drives below 1.5544, however, the river south should be ‘ripple free’ so to speak down to a 4hr swap area at 1.5485-1.5460. For us to be given the green light to short following the break lower, nonetheless, we need to see not only a retest of 1.5544 as resistance, but also lower timeframe resistance hold firm.

In closing, we are still also very interested in shorting the 4hr supply area at 1.5731-1.5690 (pending sell order set at 1.5686) should price reach this high, since it converges beautifully with the following structures:

- Bearish Harmonic Gartley pattern which completes just above this 4hr supply area at 1.5739.

- The weekly swap level at 1.5733 is seen two pips above this area of 4hr supply.

- Positioned nicely within daily supply coming in at 1.5787-1.5687.

- Round number resistance seen at 1.5700.

- 4hr downtrend line from the high 1.5928.

Levels to watch/ live orders:

- Buys: 1.5544 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: 1.5686 (Stop loss: 1.5778).

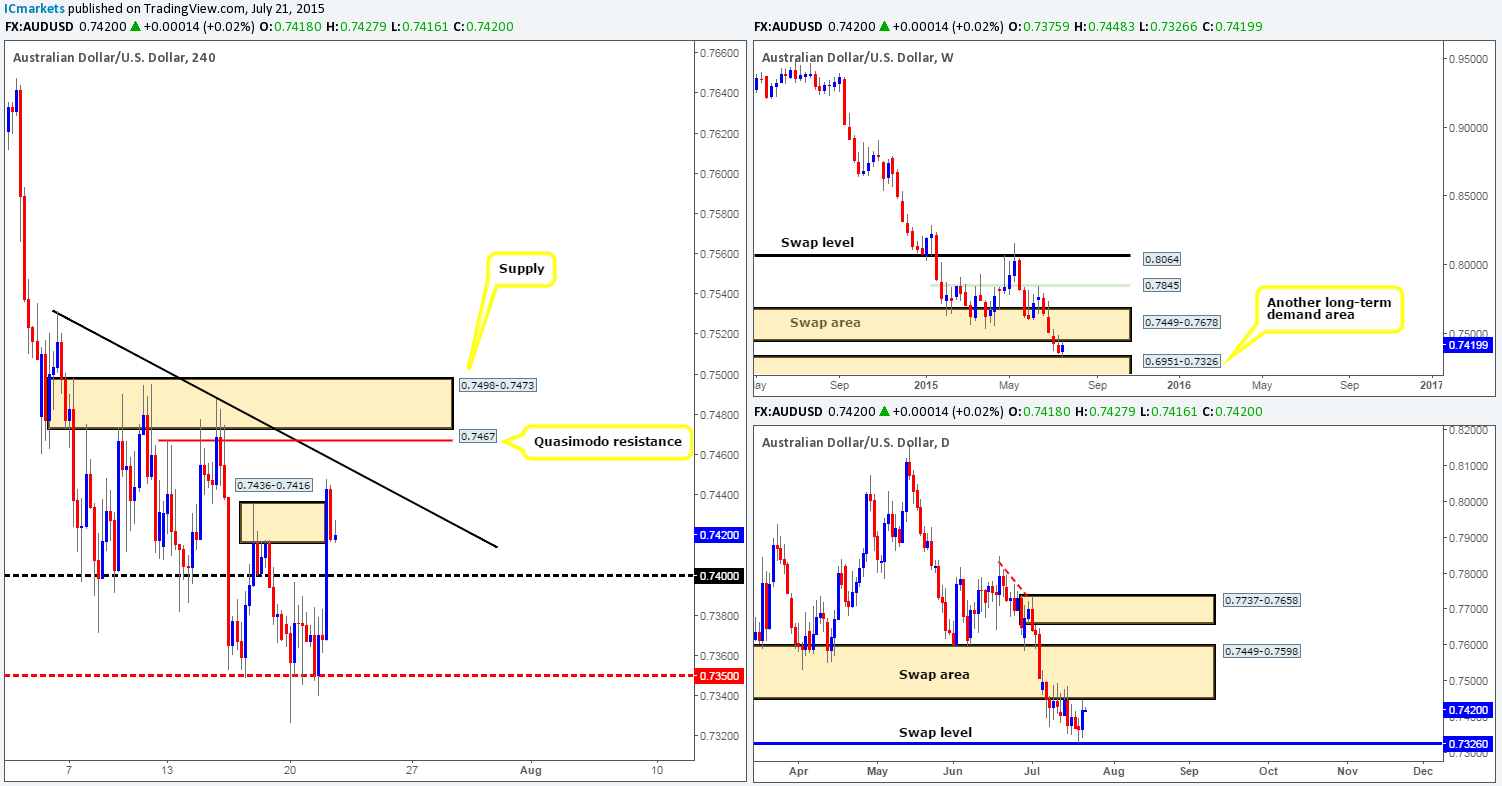

AUD/USD:

Yesterday’s trade saw the Aussie spring board itself north from the mid-level hurdle 0.7350, consequently chewing through offers sitting at both the round number 0.7400 and a 4hr supply zone seen at 0.7436-0.7416.

Usually, with a move like this, we would anticipate a retrace lower back down to retest 0.7400 as support for a potential buying opportunity, targeting the 4hr down trendline (0.7531). However, with price now seen kissing the underside of higher timeframe supply (swap areas) at the moment (0.7449-0.7678/0.7449-0.7598), it would, in our opinion, be considered risky to buy at 0.7400 in our book.

Therefore, with all of the above taken into consideration our prime focus for today will be on looking for shorts at the following barriers:

- The 4hr down trendline extended from the high 0.7531.

- The 4hr Quasimodo resistance level at 0.7467.

- The 4hr supply area at 0.7498-0.7473.

We are not planning to set pending orders at each of the above said areas. Instead, we’re going to patiently watch the lower timeframe price action once/if price reaches our zones of interest. Should selling strength be seen, we’d then likely consider shorting knowing we’re trading with the overall trend and also with the full backing (swap area supply) of both the weekly and daily timeframes.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7467 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.7498-0.7473 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

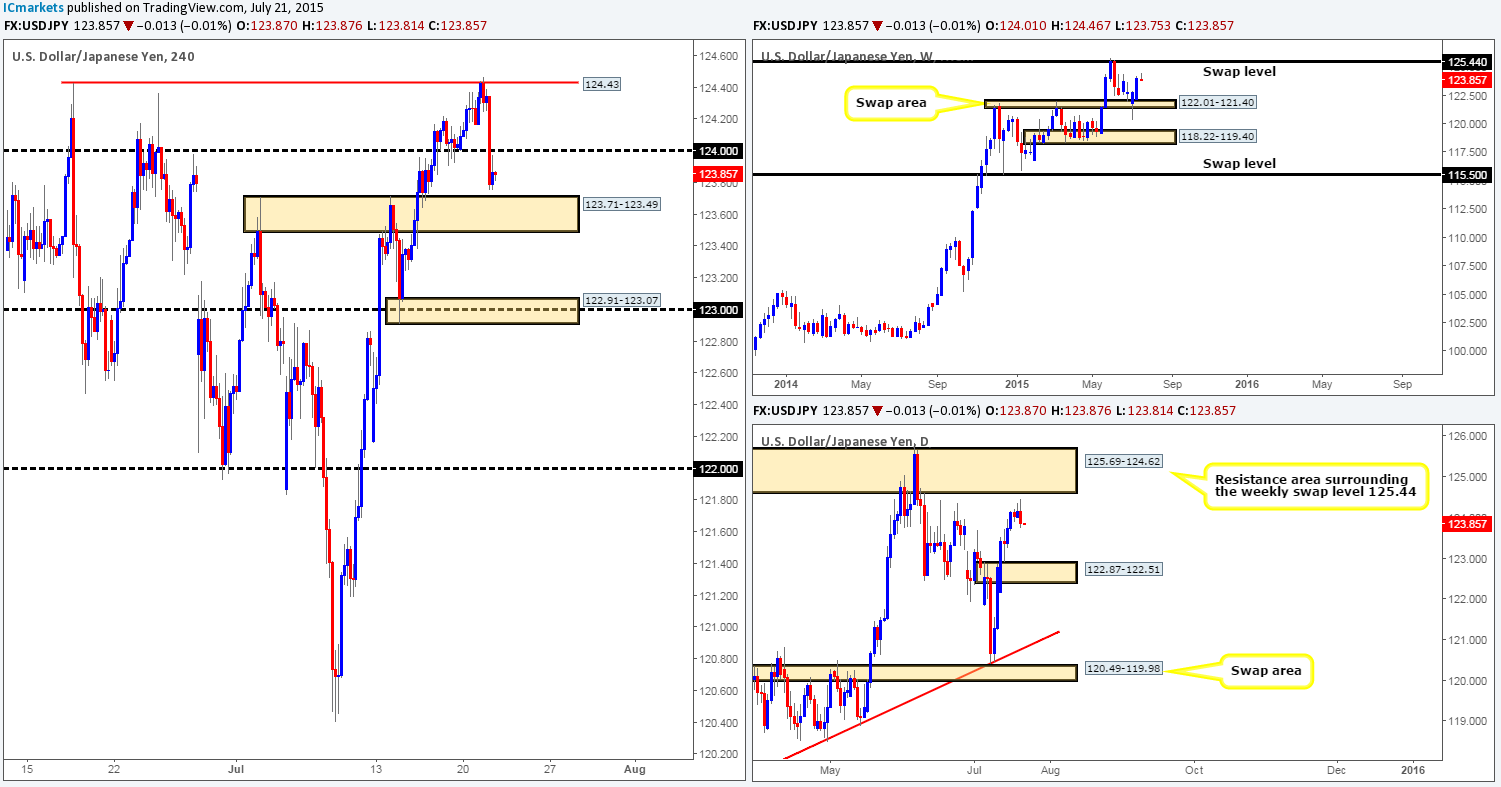

USD/JPY:

The USD/JPY pair, as you can see, fell sharply going into yesterday’s U.S trading session which surpassed 124.00 and came very close to crossing swords with a 4hr swap zone coming in at 123.71-123.49. We have to admit, this sell-off surprised us as there was no high-impacting USD news events on the docket yesterday.

From the higher timeframe picture, the recent selling also printed a bearish engulfing candle on the daily timeframe from just below a daily resistance area coming in at 125.69-124.62, which, as you can probably see, surrounds a weekly swap (resistance) level seen at 125.44.

With regards to today’s trading, our team has decided to remain flat since looking to trade this pair when price is sandwiched in between 124.00 and the aforementioned 4hr swap zone could be difficult as the market digests this recent down move on the USD.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

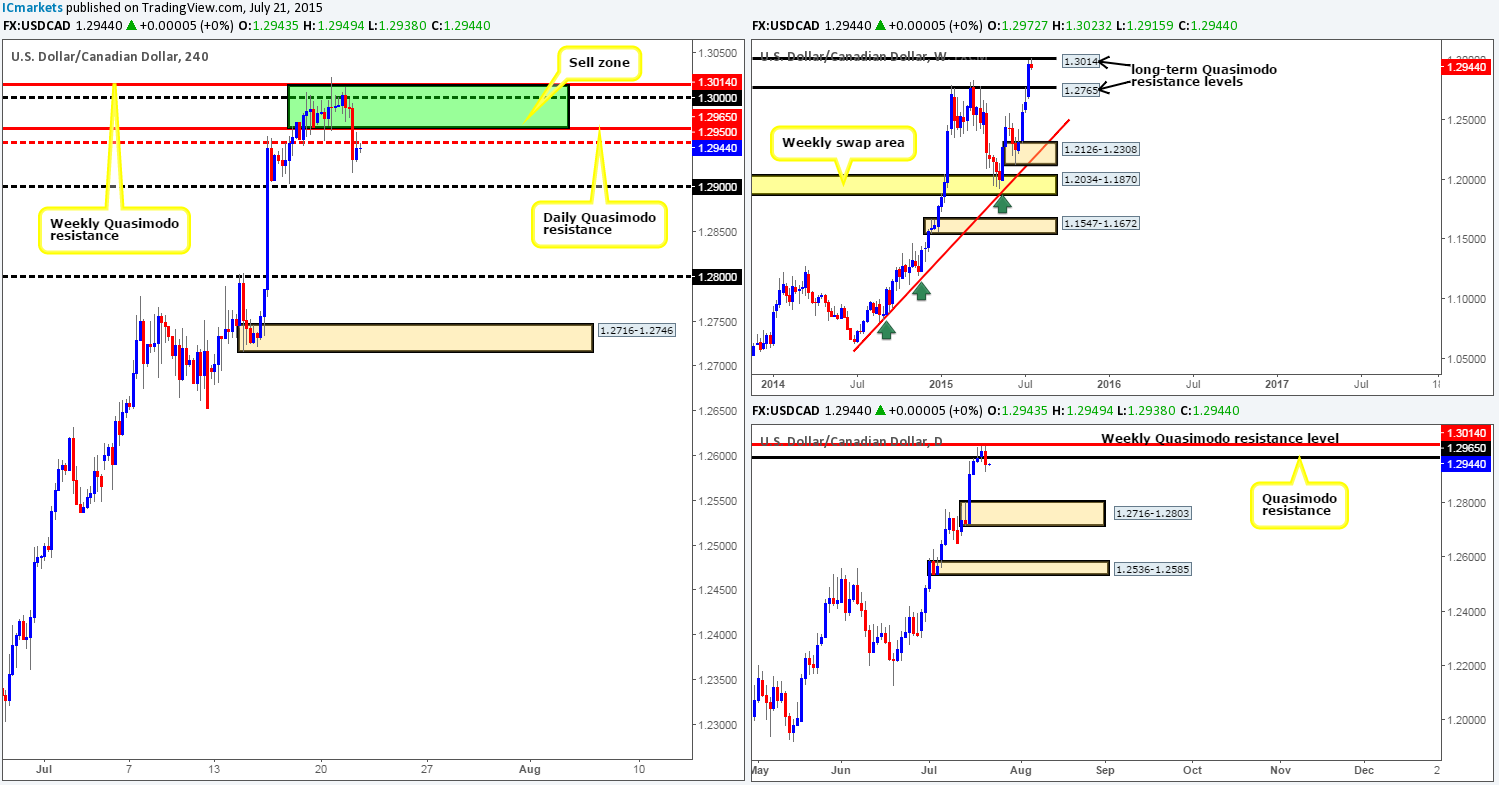

USD/CAD:

For those who read our previous report regarding this pair, you may recall that we mentioned shorting from our 4hr sell zone at 1.3014/1.2965 if 1.2950 was violated. As you can see, this happened during yesterday’s sell off and is, at the time of writing, seen retesting this mid-level number as resistance.

Considering that price is now trading off of a long-term weekly Quasimodo resistance level at 1.3014, and the daily timeframe has just printed a bearish engulfing candle, we believe price may continue to decline in value today/this week.

Should 1.2950 continue to hold firm as resistance today, there may be, if lower timeframe selling confirmation is seen, a possible entry short into this market, targeting 1.2900 as the first take-profit target. In the event that price manages to get below 1.2900, we’d then personally look down towards 1.2800 to liquidate our full position, since if you look across to the daily chart, you’ll see it lines up beautifully with a daily demand area seen at 1.2716-1.2803.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2950 [Tentative – confirmation required] (Stop loss: dependent on where one finds confirmation).

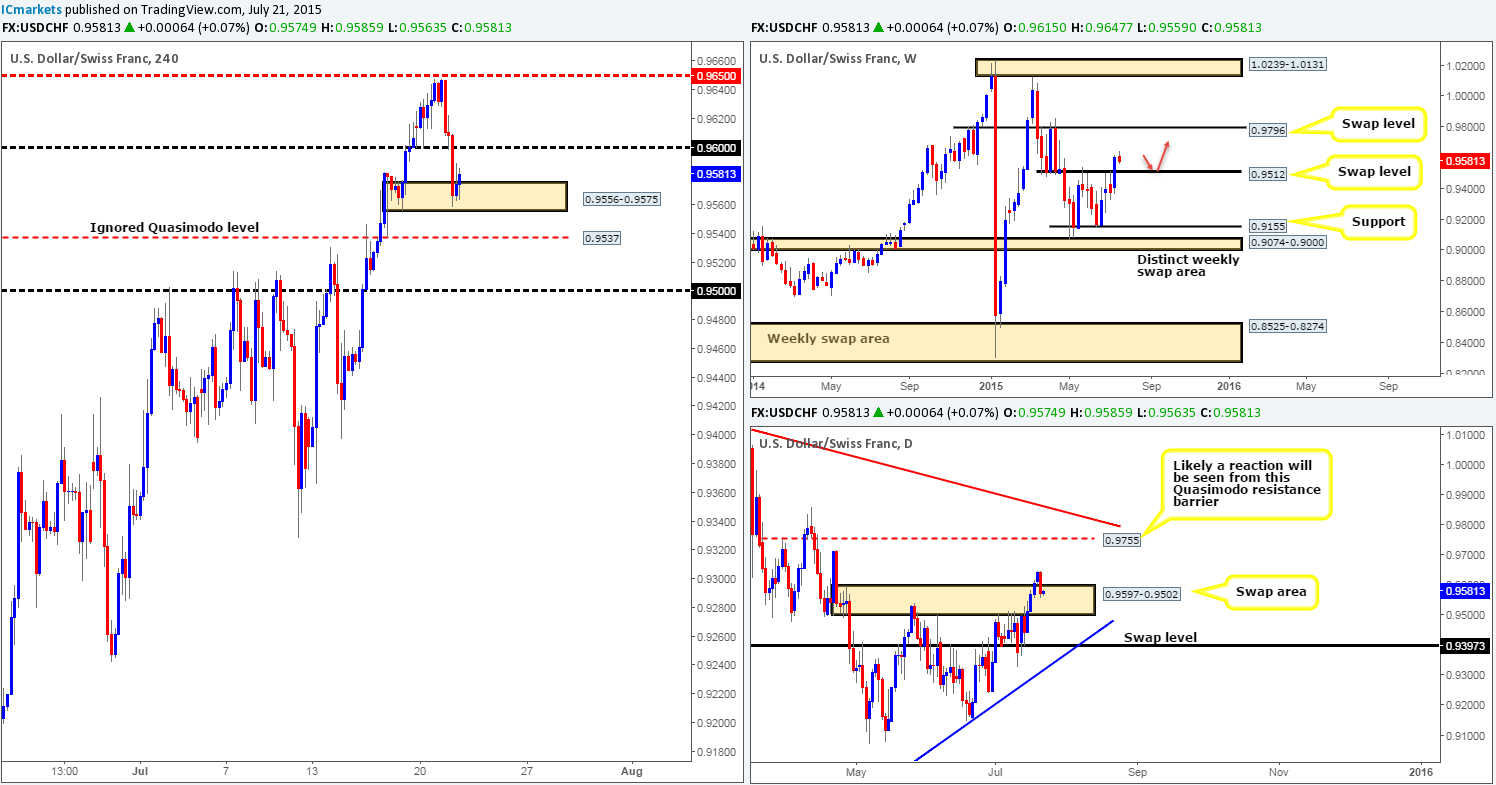

USD/CHF:

Yesterday’s 4hr action saw price cascade lower from just below the mid-level number 0.9650, which, as you can see, took out the round number 0.9600 and dived head first into a fresh 4hr demand area seen at 0.9556-0.9575.

Looking across to the bigger picture, we can see that the weekly timeframe may be setting itself up for a retest of the recently broken weekly swap level at 0.9512 (as per the red arrows). Meanwhile, on the daily timeframe, the buyers and sellers are seen slugging it out within a daily swap (demand) area coming in at 0.9597-0.9502.

With the above taken into consideration, buying from the current 4hr demand area may not be the best path to take for two reasons. The first, round-number resistance at 0.9600 is sitting just above, the second, as per the weekly timeframe, price could theoretically continue driving south, taking out both the current 4hr demand and the ignored 4hr Quasimodo level at 0.9537 until it reaches 0.9500 (a fantastic area to look for confirmed buys), thus effectively retesting the weekly swap level 0.9512. Therefore, unless price manages to reach the 0.9500 region today, we intend to take the safest position of them all, FLAT.

Levels to watch/ live orders:

- Buys: 0.9500 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

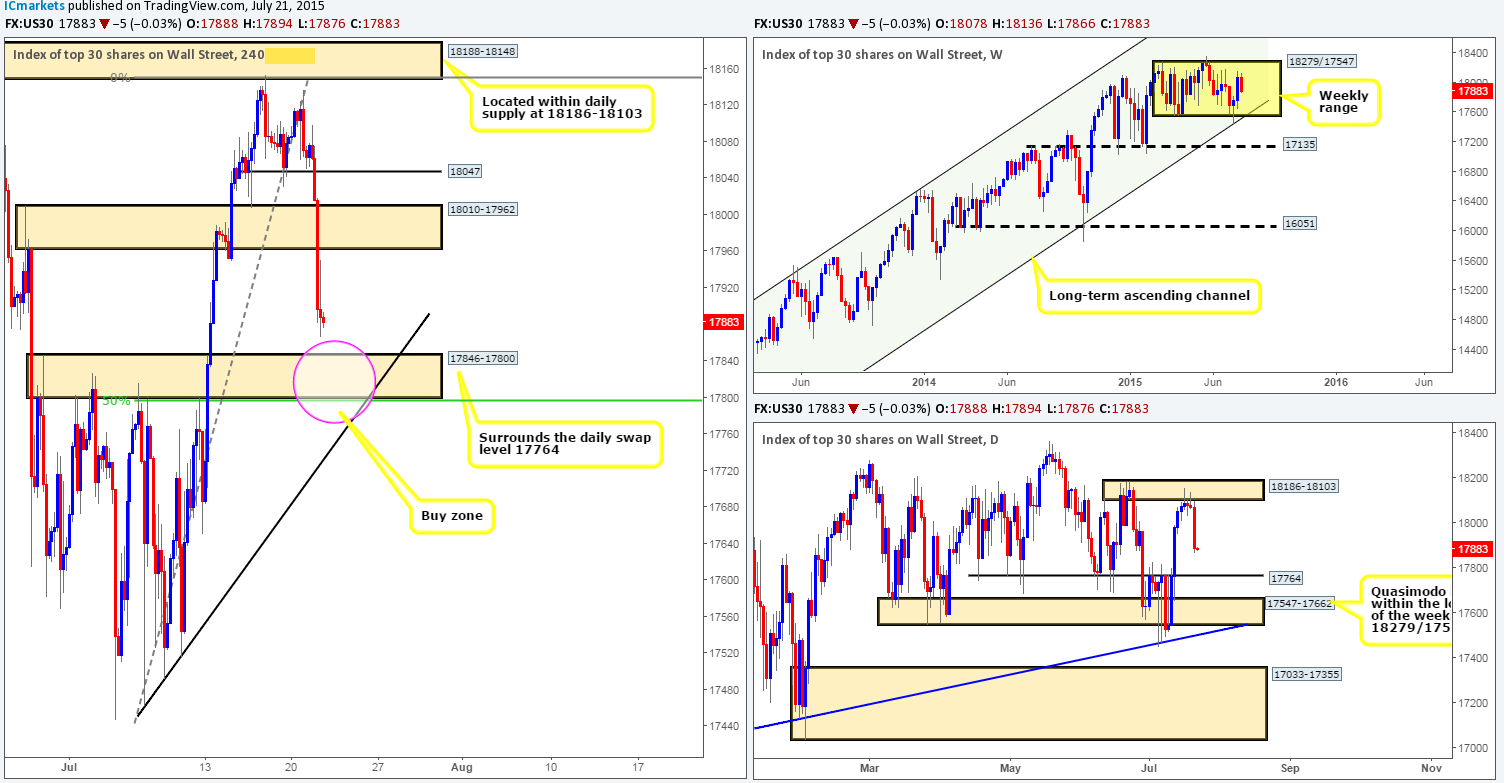

DOW 30:

As price began crossing over into the U.S trading session yesterday, we can see that the DOW took a turn for the worst and plunged 183 points (this figure includes both pre and after-market hours). 4hr support at 18047 and the 4hr swap area seen at 18010-17962 were both taken out during this bearish onslaught, with room still currently left for price to move lower down to a 4hr swap zone at 17846-17800.

Considering that the 4hr swap area at 17846-17800 not only surrounds a daily swap level at 17764, but is also supported by the 50.0% Fibonacci retracement value and a 4hr trendline extended from the low 17462, we believe this could be a nice area to look for (lower timeframe) confirmed longs into this market today should price reach this confluent swap barrier.

Levels to watch/ live orders:

- Buys: 17846-17800 [Tentative – confirmation required] (Stop loss: 17779).

- Sells: Flat (Stop loss: N/A).

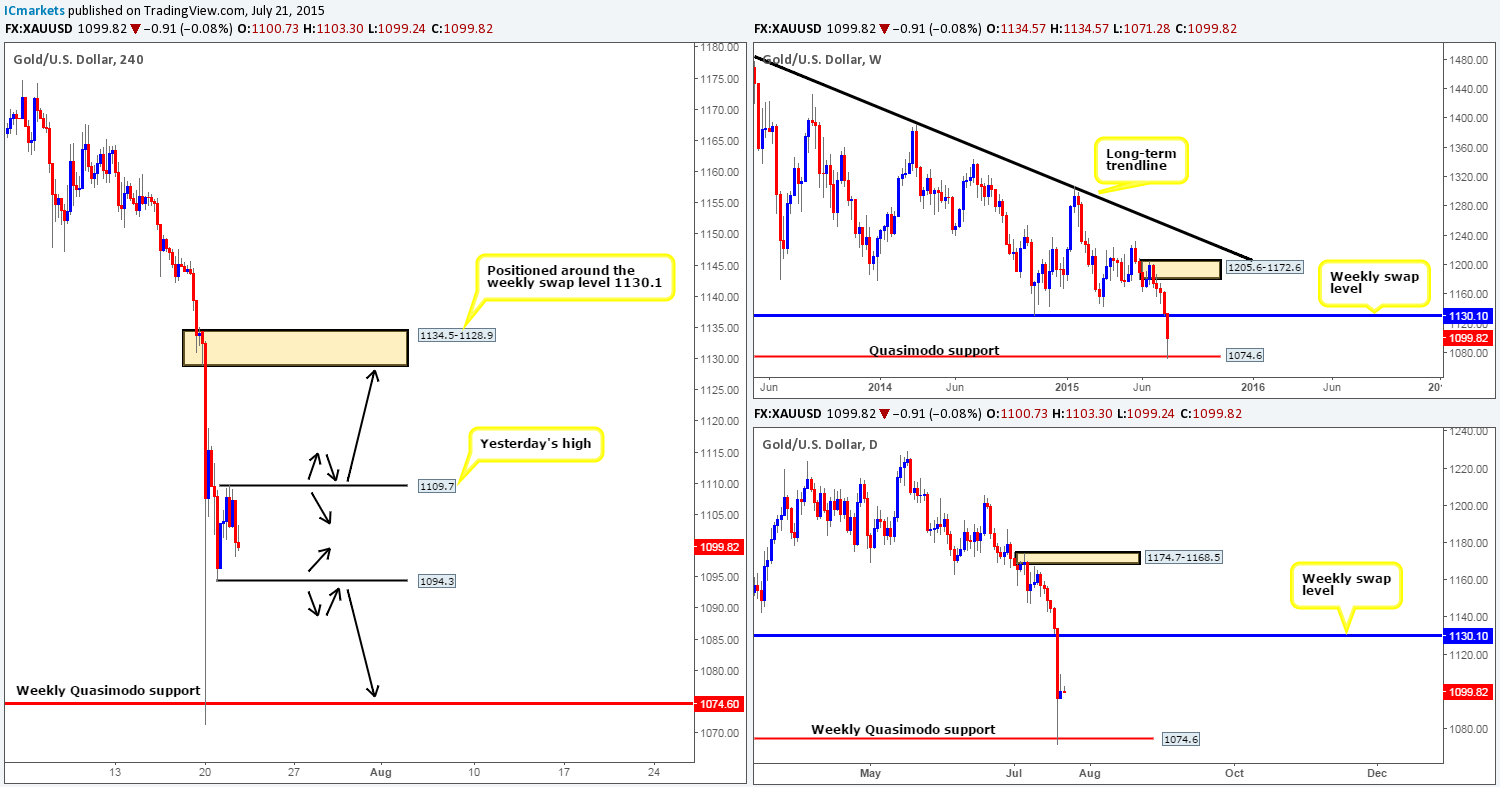

XAU/USD: (Gold)

Following the humongous drop in value Gold saw on Monday, price has been somewhat stagnant, drawing resistance from 1109.7 which is now yesterday’s high, and support from 1094.3.

Taking into consideration that the higher timeframe picture shows supportive pressure coming in from a long-term weekly Quasimodo support level coming in at 1074.6, our team has the following noted for today’s sessions:

- Price could attack yesterday’s high 1109.7, which could provide a nice base to look for an intraday bounce south (lower timeframe confirmation is required).

- In the event that 1109.7 is consumed, this would, in effect, be our cue to begin watching for price to retest this number as support, since the path north would then likely be free up to 4hr supply at 1134.5-1128.9 (located near the weekly swap level seen at 1130.1). Waiting for lower timeframe confirming price action is advised here, but not necessary.

- The low 1094.3 could also provide a nice base in which to look for intraday confirmed longs from. This level, however, would be a dangerous place to simply set a pending buy order as there would be a high chance your stop would be taken should a fake lower be seen – wait for lower timeframe confirmation before risking capital here.

- Finally, assuming 1094.3 is violated; this could stimulate a decline back down towards the aforementioned weekly Quasimodo support level. Nevertheless, our team would only be interested in trading this move if 1094.3 was retested as resistance and showed some sort of selling signal such as a trendline break, or an engulf of minor demand etc… Furthermore, be aware that by selling here, you could effectively be going against weekly opposition from the weekly Quasimodo support barrier.

Levels to watch/ live orders:

- Buys: 1094.3 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: 1109.7 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).