Lower timeframe confirmation: simply means waiting for price action on the lower timeframes to confirm direction within a higher timeframe area. For example, some traders will not enter a trade until an opposing supply or demand area has been consumed, while on the other hand, another group of traders may only need a trendline break to confirm direction. As you can probably imagine, the list is endless. We, however, personally prefer to use the two methods of confirmation mentioned above in our trading.

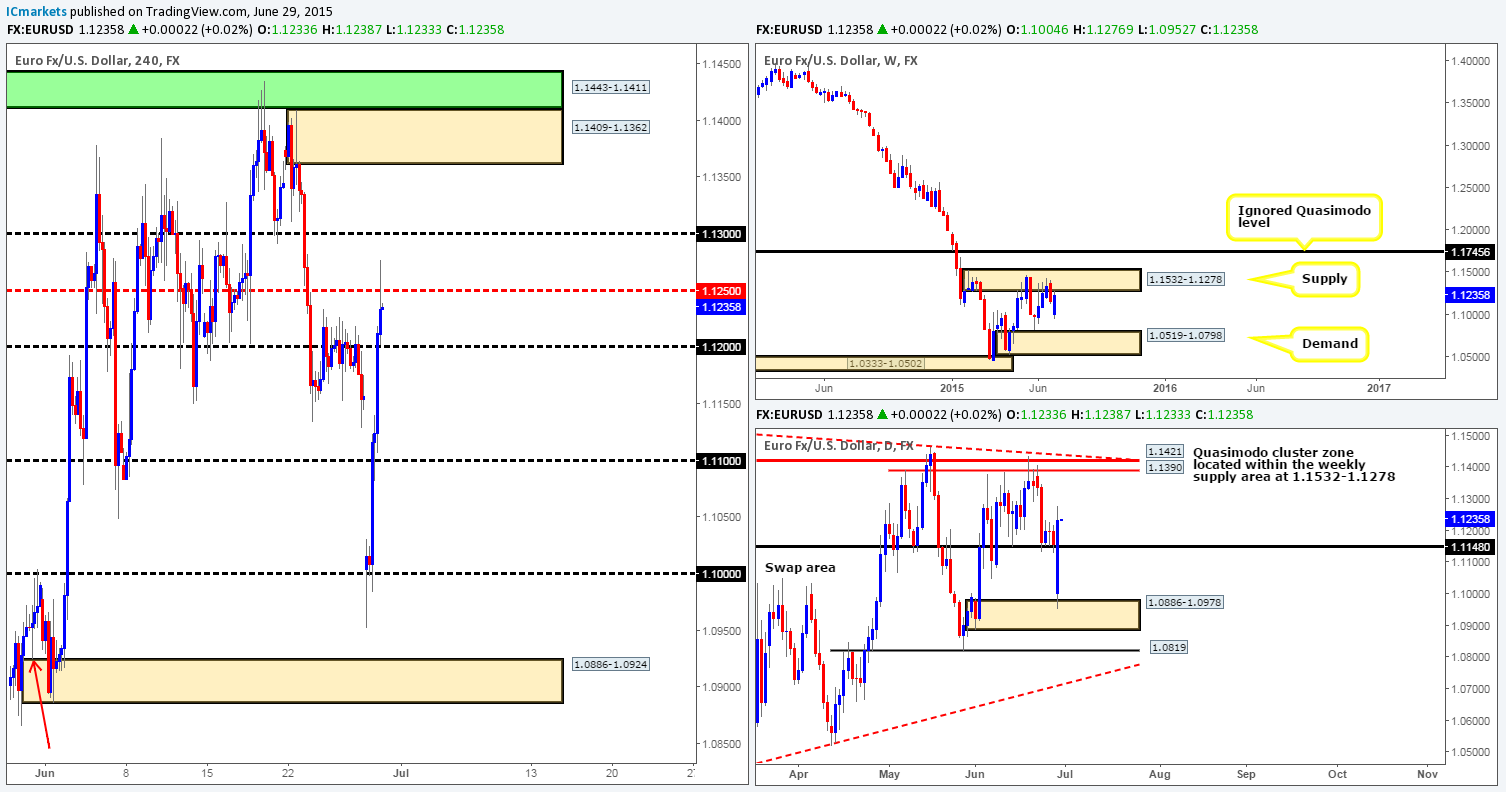

EUR/USD:

The latest coming in from the 4hr timeframe shows that after price shook hands with the 1.1000 level, the buyers literally waited for no one! 1.1100 and 1.1200 were completely obliterated, consequently filling the weekend gap. It was only once price connected with the mid-level number 1.1250 did we see the market begin to slacken.

We have to be honest here; we were not expecting to see this humongous uplift on the Euro this morning. We were actually expecting a further move south! Fundamentally, this recent surge could have been caused by a combination of things – Hope that a deal is still possible for Greece and the SNB’s recent buying of Euros is the most obvious in our opinion.

From a higher timeframe technical perspective, price is now seen kissing the lower limits of a weekly supply area at 1.1532-1.1278. Meanwhile, the daily timeframe shows that yesterday’s push higher broke above a daily swap level at 1.1148, indicating room to move further north up to the daily Quasimodo cluster zone at 1.1421/1.1390 (located relatively deep within the aforementioned weekly supply area). Therefore, with the somewhat conflicting signals here, one has to tread carefully trading this already volatile pair.

Taking the above into consideration, we have decided to stay on the sidelines today as this pair has been very difficult to trade of late. If you are contemplating on taking a trade, we would highly recommend waiting for the lower timeframes to confirm your idea as it could save you from unnecessary losses.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

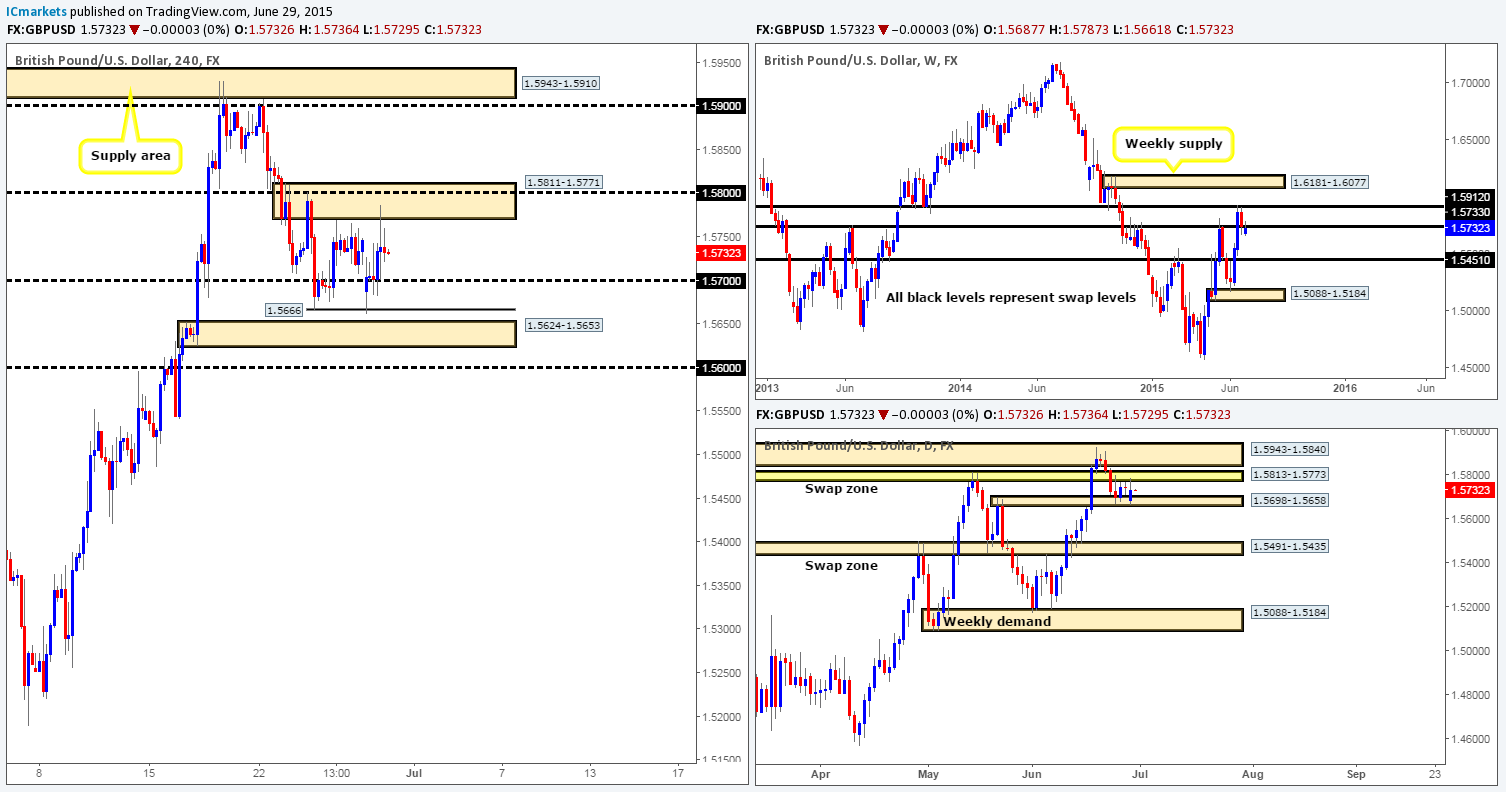

GBP/USD:

For those who read our previous report on the GBP, you may recall us mentioning to watch for a possible gap fill and a retest of 1.5700 as support. As you can see, price did indeed retest 1.5700 which was shortly followed by a burst of fresh buying up to the combined 4hr supply/round number area at 1.5811-1.5771/1.5800 (positioned within the daily swap area at 1.5813-1.5773). We do hope some of our readers managed to lock in some green pips from this intraday move as we completely missed it!

Now, considering that price is currently crossing swords with not only a long-term weekly swap level at 1.5733, but also trading lower from a daily swap area seen in yellow at 1.5813-1.5773, this market has the potential for further downside in our opinion.

However, from looking at the daily chart alongside the 4hr chart, selling now is not something we’d be comfortable taking part in. there is just too much potential support looming below. Ultimately, we’d need to see both the 4hr demand area at 1.5624-1.5653 and the round number seen just below it at 1.5600 taken out, as this would also likely consume the daily swap area at 1.5698-1.5658 as well, which, as you can see, appears to be providing support to this market at present.

So to sum up, unless we see a clean swoop below 1.5600 today, it is unlikely we’ll be selling this market anytime soon. Regarding longs, however, there may, and we emphasize the word ‘may’ here, be a potential buying opportunity if we see a violation of the aforementioned combined 4hr supply/round number area. The reason we use the word ‘may’ here is simply because at that point, we’d be going up against potential higher timeframe opposition. It will be interesting to see what this pair turns out today.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

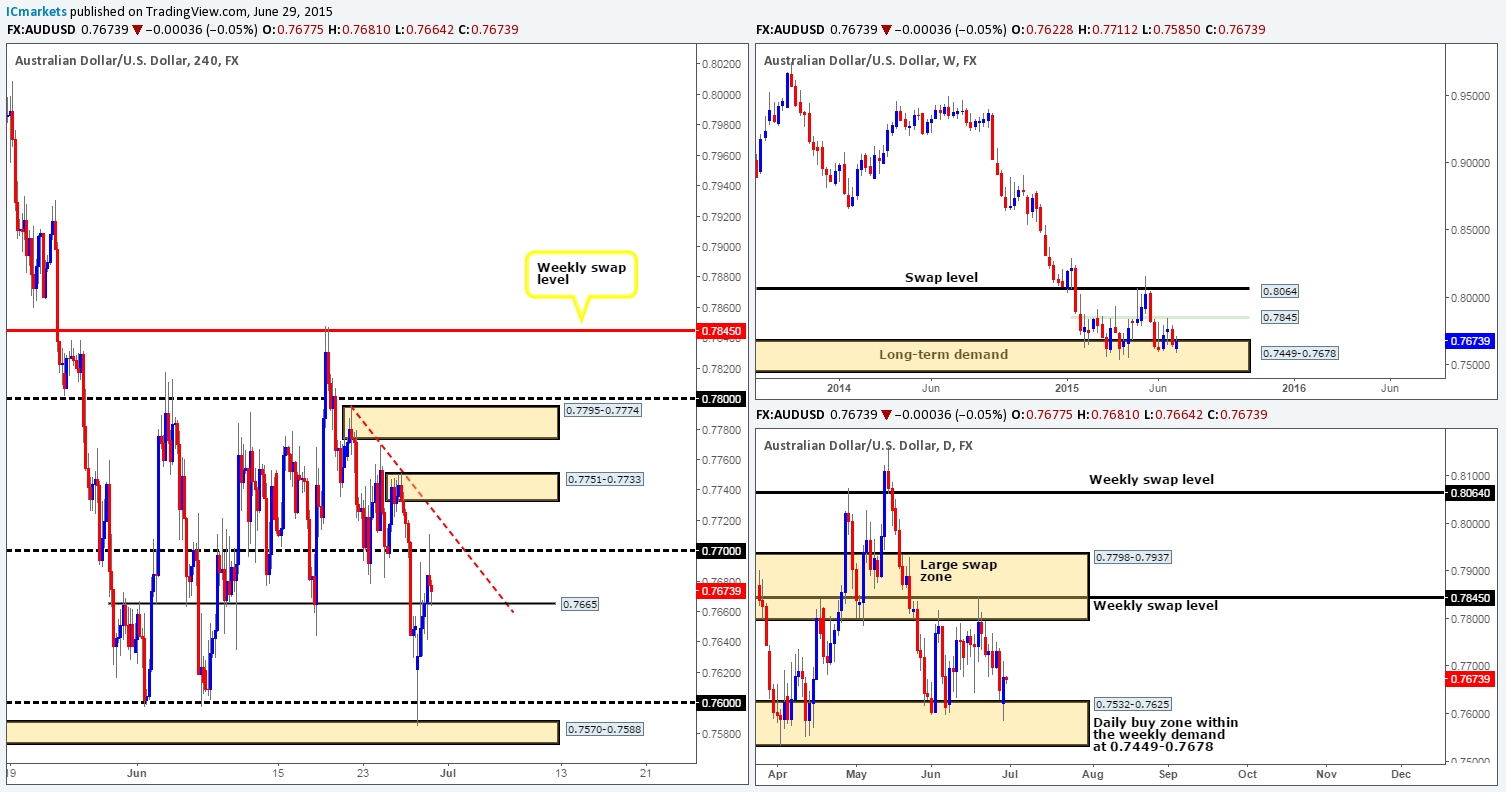

AUD/USD:

Following the rebound from 4hr demand at 0.7570-0.7588, follow-through buying was seen yesterday up to the round number 0.7700, which, as you can see, has forced this market to retest a respected 4hr swap level coming in at 0.7665.

With price currently sitting not only in weekly demand at 0.7449-0.7678, but also a daily buy zone which is conveniently located within this weekly demand at 0.7532-0.7625, it is very possible a move higher from 0.7665 will be seen today.

How far can we expect price to move from here? Well, judging by how aggressive the market spiked above 0.7700 yesterday, we are quite confident that a great deal of traders who attempted to both fade this number and buy the breakout have likely been stopped out, thus potentially clearing the path north up to at least the underside of the 4hr downtrend line taken from the high 0.7795.

Therefore, considering the position of price on the higher timeframe picture (see above), and the fact that we’re seeing a reaction from a relatively strong 4hr swap level at the moment, our objective today is simple. Watch for lower timeframe confirming price action around this 4hr barrier for potential intraday buying opportunities, targeting the aforementioned 4hr downtrend line and, given enough time, the 4hr supply area sitting just above it at 0.7751-0.7733.

Levels to watch/ live orders:

- Buys: 0.7665 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

USD/JPY:

Recent events on 4hr timeframe reveal that there was clearly a strong ceiling of offers sitting around the 123.00 handle which managed to hold this market lower during yesterday’s trade. As a result, price is now currently seen teasing the lower limits of the recently broken 4hr demand area at 122.44-122.75 once again (located just above a daily swap area coming in at 122.40-121.73).

Initially, our team was bullish from this area, but given the recent spike below this zone seen around yesterday’s open, and the fact that the daily timeframe printed an indecision candle going into yesterday’s close 122.52, we feel that this market may drive south to connect up with the 122.00 handle today. It would be here that we’d begin looking for buys into this market for the following reasons:

- A move down to 122.00 would essentially place price at the upper limits of a minor weekly swap area at 122.01-121.40 (see weekly chart).

- Price would then be located extremely deep within the aforementioned daily swap area.

- 122.00 is a number that has been heavily respected as resistance on two occasions in the past. The first was seen a little lower than 122.00 at 121.83 on the 07/12/14. This just showed how much supply was at this area at that time! More recently though, we saw price literally react to-the-pip at 122.01 on the 10/03/2015. This sent the market down a very cool 350 pips!

Waiting for lower timeframe confirming price action around the 122.00 number is highly recommended, since fakeouts tend to occur around psychological hurdles more often than not, and there is nothing worse than price stabbing your stop and bolting to your target.

Levels to watch/ live orders:

- Buys: 122.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this number).

- Sells: Flat (Stop loss: N/A).

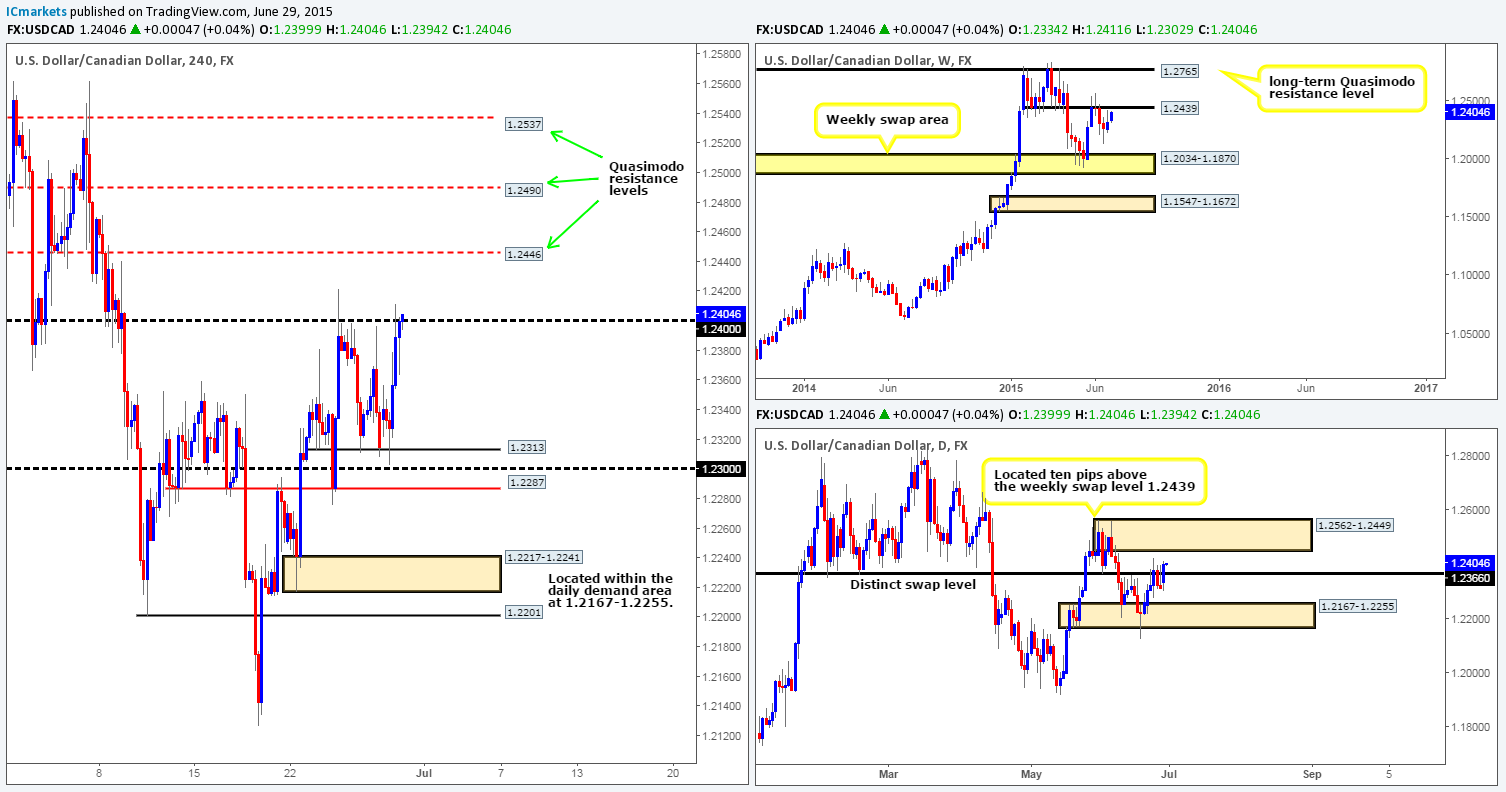

USD/CAD:

For those who read yesterday’s report, you may recall that we mentioned to keep an eye out for a retrace back to the 1.2313 level as this could potentially open up the possibility to a fakeout lower towards the 1.2300/1.2287 region. As you can see, price missed the round number 1.2300 by literally three pips before rallying up to 1.2400, we do hope some of our readers managed to lock in some green pips during this move!

With the weekly timeframe showing price trading only a stone’s throw away from a weekly swap level seen at 1.2439, and price action on the daily timeframe edging closer to connecting with a daily supply area (located only ten pips above the aforementioned weekly swap level) at 1.2562-1.2449, our attention will mostly be driven toward shorts today…

Judging by the reaction seen at 1.2400, selling here would not be something we’d label a high-probability reversal zone. Ultimately, we like to see a 4hr candle close above this number, which in turn would likely pave the way north up to the 4hr Quasimodo resistance level 1.2446. This level, along with the two other Quasimodo resistance levels seen above it (1.2490/1.2537) all have a high probability of seeing a reaction in our opinion, since they are encompassed within the aforementioned daily supply area.

Since it is very difficult to know which level will see the cleanest response, our team has come to a general consensus that it is best to set alerts at each boundary, and watch for lower timeframe confirmed selling action when or indeed if price reaches the aforementioned levels.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2446/1.2490/1.2537 [Tentative – confirmation required] (Stop loss: dependent on where one finds lower timeframe selling confirmation).

USD/CHF:

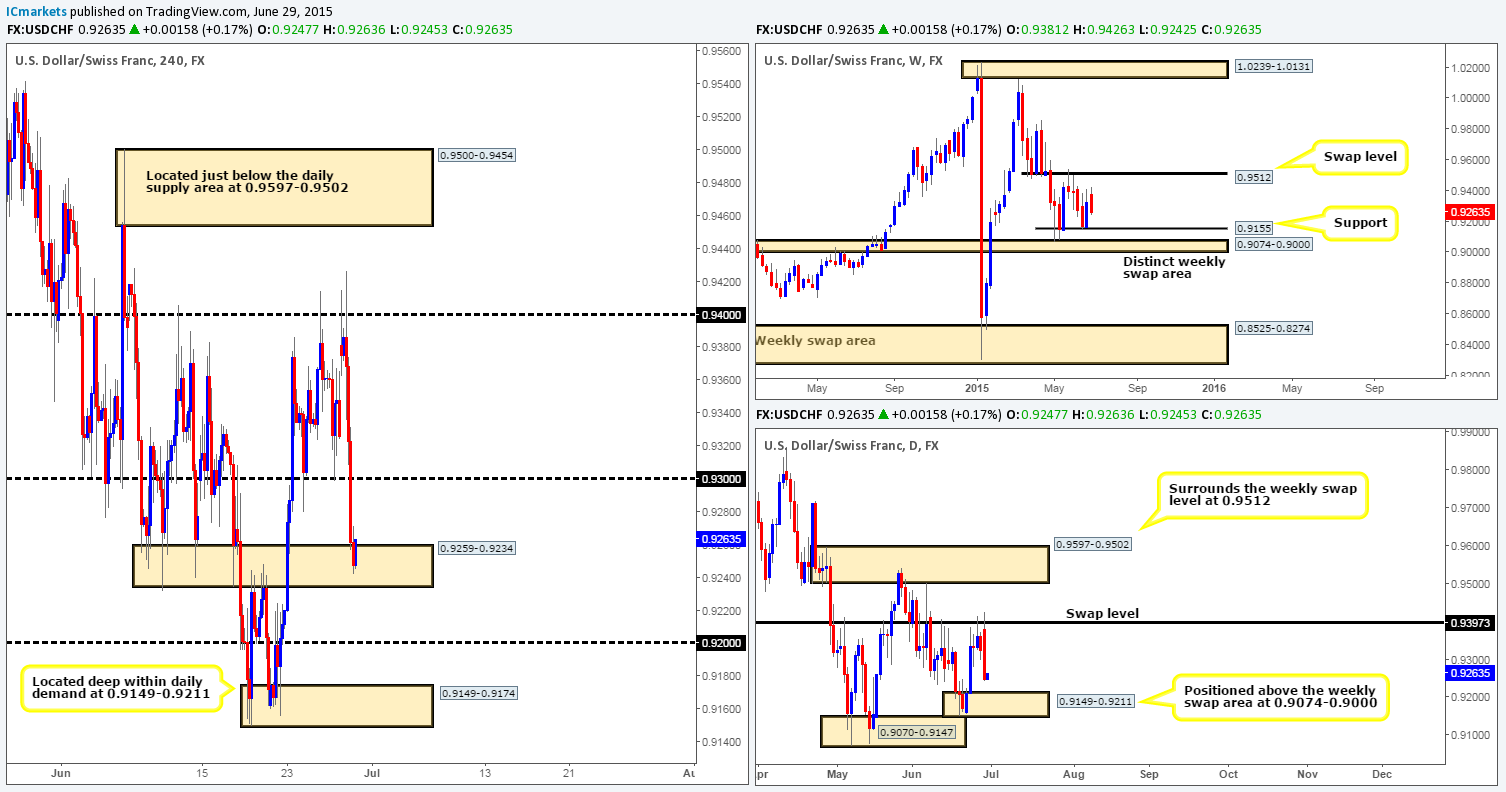

With the EUR/USD rocketing north, it was relatively easy to guess that the USD/CHF would likely dive south, and dive she did! Price absolutely obliterated 0.9300, and slam dunked itself into a 4hr swap area coming in at 0.9259-0.9234.

Given the current location of price on the higher timeframes, we are likely going to pass on any buy signals seen within this present 4hr swap zone. As you can see, both the weekly and daily timeframes are not positioned around any support at the moment, indicating that this market could effectively continue south today.

Should our analysis be correct and further selling is indeed seen, price will likely connect with 0.9200, or even the 4hr demand area seen below it at 0.9149-0.9174. Both of these zones are located within daily demand at 0.9149-0.9211, thus adding weight to any long trades taken from either 4hr barrier. However, due to the current political climate, we are not going to simply place pending buy orders at these zones and hope for the best, lower timeframe confirmation will be required before we think about risking capital on this idea.

Levels to watch/ live orders:

- Buys: 0.9200 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.9149-0.9174 [Tentative – confirmation required] (Stop loss: 0.9146).

- Sells: Flat (Stop loss: N/A).

US 30:

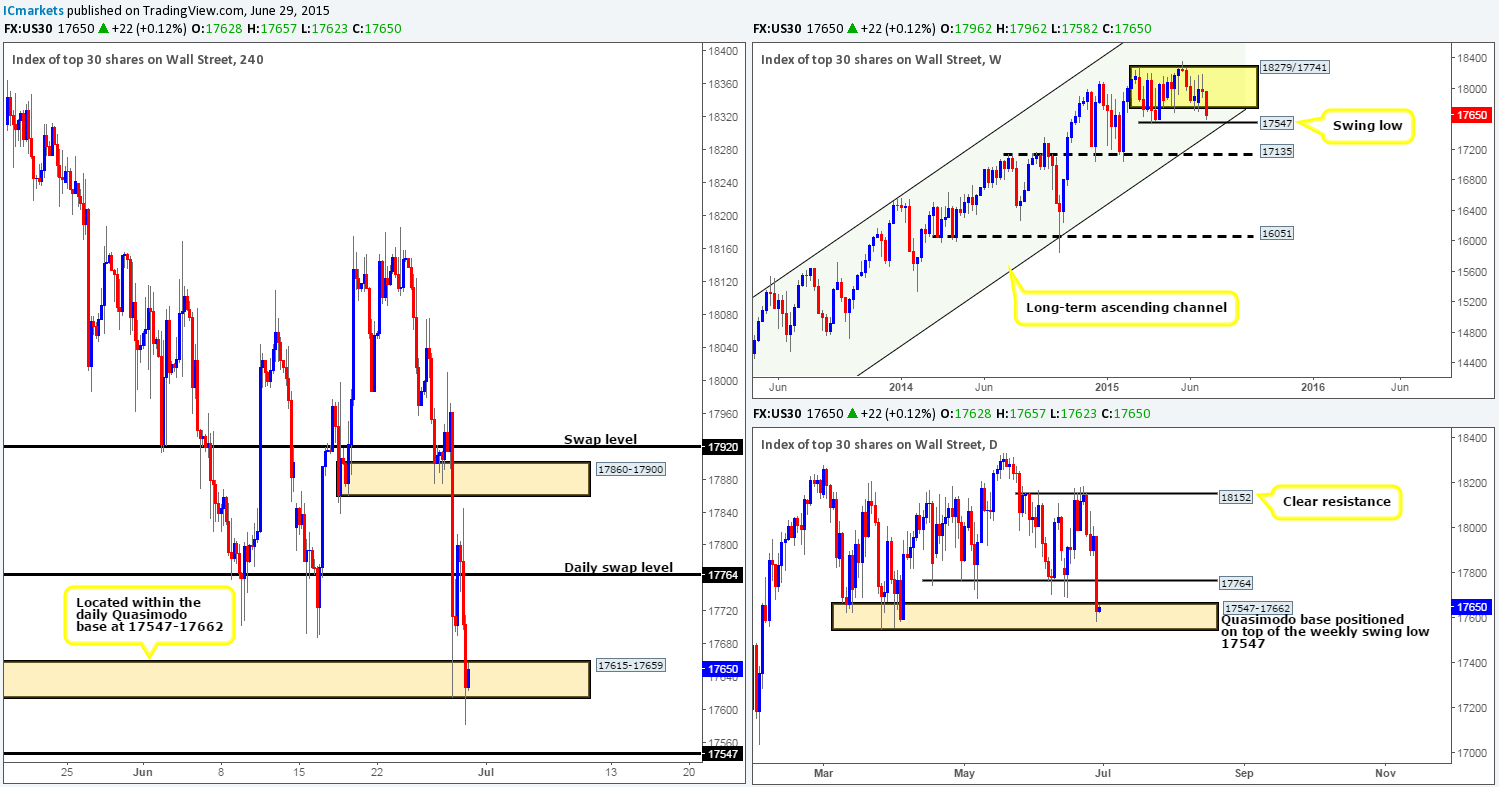

The 4hr timeframe shows that further buying was seen on this index as we entered into the European trading session yesterday. This, as you can see, continued going into the London session consequently closing above the daily swap level 17764. In yesterday’s report we mentioned that if this level was taken out and retested, we’d then begin to look for a lower timeframe confirmed buy entry. On the retest, we found a potential long on the 15 minute timeframe at 17780, which initially begun to push higher. That was until the U.S session got under way and stopped us out. It was careless of us really not to expect some sort of reversal here!

Going forward, the bears continued selling into this market after taking out our stop, resulting in price stabbing through a 4hr demand area at 17615-17659 which may have cleared the path south down to the weekly swing low 17547. However, looking at the daily timeframe, we can see that price is now firmly located within a daily Quasimodo base at 17547-17662, thus in effect, we could see a rally from this area without ever connecting with the aforementioned weekly swing low.

With everything taken into consideration, our team is going to keep a close eye on the lower timeframe price action around the current 4hr demand zone today, specifically the 15 and 30 minute timeframes. If we happen to spot a buy signal, we would confidently take a long position here and place our stop just below the weekly swing low. We know this a rather large stop, but we’d prefer to give any long trade from this region some room to breathe as the potential upside from here could be huge.

Levels to watch/ live orders:

- Buys: 17615-17659 region [Tentative – confirmation required] (Stop loss: 17532).

- Sells: Flat (Stop loss: N/A).

XAU/USD: (Gold)

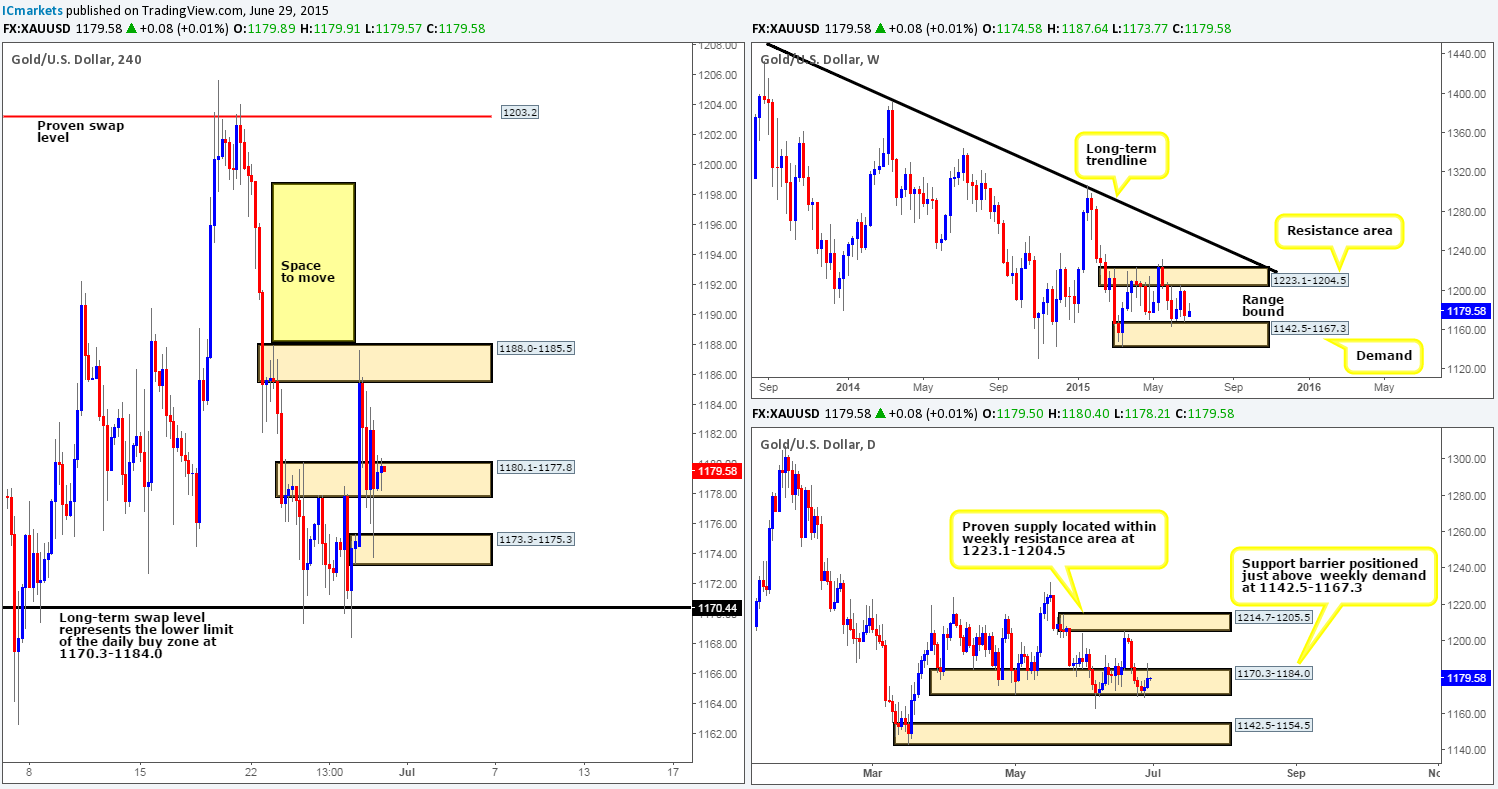

Throughout yesterday’s sessions, gold spent much of its time teasing the lower limits of a 4hr swap area at 1180.1-1177.8, which as you can see held with the support of a small 4hr decision-point demand area at 1173.3-1175.3. This – coupled with the fact that price is trading from not only within a daily buy zone at 1170.3-1184.0, but also just above a weekly demand structure at 1142.5-1167.3 (lower limit of the current weekly range), opens up the possibility to an eventual push higher.

In the event that our analysis is correct, buying this market now could be a possibility as long logical buying confirmation from the lower timeframes is supporting this trade. As of now though, we do not see anything telling us to enter long. Therefore, we have to be prepared for possibility that we may miss out on the possible run up to the 4hr supply zone at 1188.0-1185.5. In all honesty though, we would not be too disappointed in missing this trade, as we’re more interested in entering long following a break above the aforementioned 4hr supply area. Just look at the space price has to run once clear of supply, it is certainly a pretty sight!

Levels to watch/ live orders:

- Buys: 1180.1-1177.8 [Tentative – confirmation required] (Stop loss: Dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).