A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

For those who read our previous report on the EUR yesterday you may recall us highlighting the 1.09 region as a suitable location to take a short position from. This was essentially due to higher-timeframe structure. Weekly action recently munched its way through a support at 1.0970 (now acting resistance), likely clearing the river south to attack a major support barrier drawn from 1.0819. On top of this, the daily picture showed the path to be relatively clear for a push down to the above said weekly support hurdle. Unfortunately, we missed this opportunity, so well done to any of our readers who managed to pin down a position from this area yesterday. The H4 mid-way support at 1.0850 would be our initial take-profit target, followed closely by the aforementioned weekly support.

Our suggestions: As of now, we see very little opportunity at current prices. However, should the major retest the underside of 1.09 for a second time, we would, as long as price has not struck 1.0850, consider a short from here (H4 bearish close preferred to confirm this number).

On the data front today, we have the German Ifo business survey being released at 8am, the US CB consumer confidence print at 2pm and also the ECB President Mario Draghi is scheduled to speak at 3.30pm GMT. All events are considered market-moving news, so do remain vigilant during these times!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.09 region ([H4 bearish close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

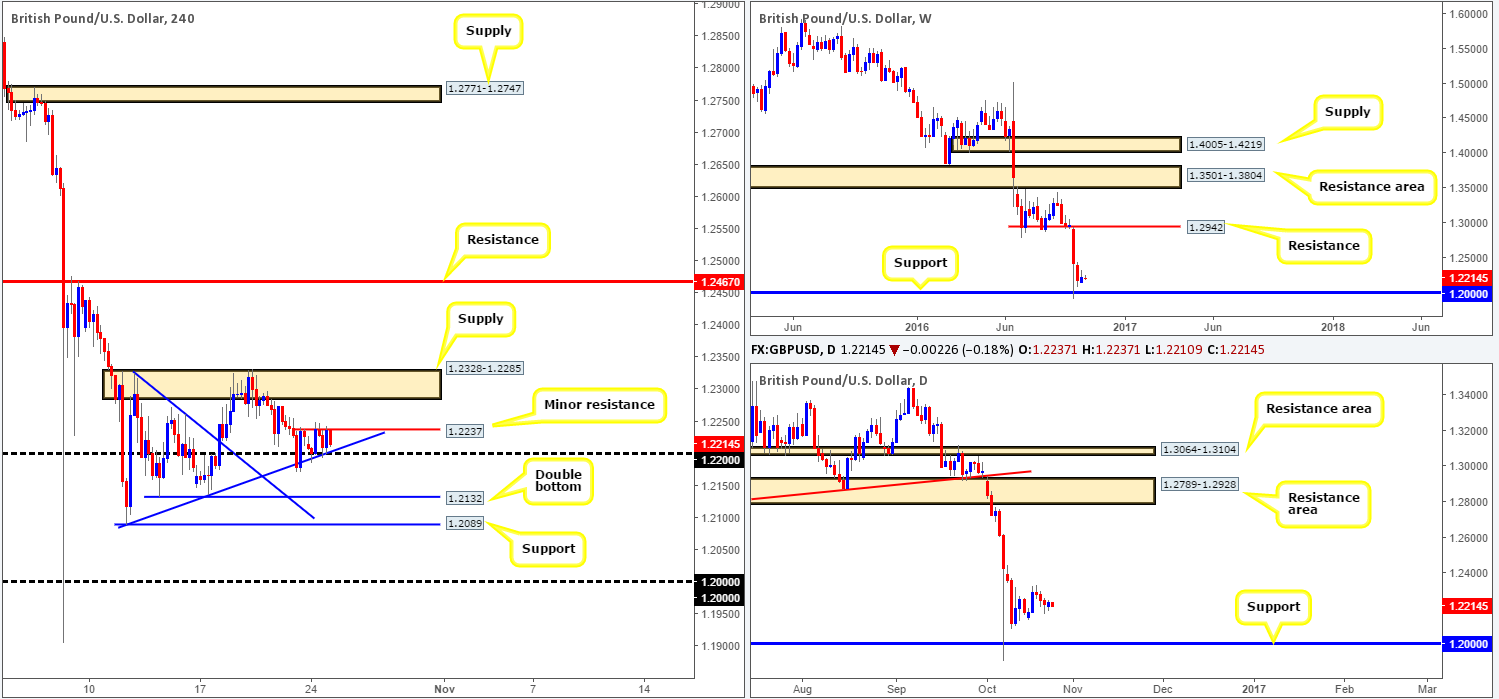

GBP/USD:

For the most part, it was a relatively quiet day for the pound yesterday. Shortly after the market opened, the pair steadied itself around the 1.22 handle (intersects with a H4 trendline support drawn from the low 1.2089) and managed to reach highs of 1.2248 on the day. As of this moment, the buyers and sellers are effectively seen capped between a minor H4 resistance at 1.2237 and the 1.22 level.

The story on the bigger picture, however, is an interesting one. As we mentioned in Monday’s weekly report, although the majority of market players likely believe the pound could head further south in the future, and we’re not saying it couldn’t, let’s keep in mind that on the monthly chart price has touched base with a major demand, with 1.20 representing the top edge (http://fxtop.com/en/historical-exchange-rates-graph-zoom.php?C1=GBP&C2=USD&A=1&DD1=07&MM1=10&YYYY1=1960&DD2=14&MM2=10&YYYY2=2016&LARGE=1&LANG=en&VAR=0&MM1M=0&MM3M=0&MM1Y=0 ). Looking at both the weekly and daily charts, nonetheless, it shows that not only is there very little standing in the way of a move back down to 1.20, but also that price is currently trending south.

Our suggestions: Seeing as there has been very little change since the week’s open, our outlook for this pair remains the same:

- A long could be considered on the close above the H4 supply area at 1.2328-1.2285. For us personally, we’d require a retest followed up by a reasonably sized H4 bullish close, before we’d look to pull the trigger. First take-profit target beyond here would, at least for us, be the H4 resistance coming in at 1.2467.

- Supposing the market breaches the 1.22 handle, the runway south looks relatively free down to a H4 double-bottom support at 1.2132, followed closely by H4 support at 1.2089. For our team to be permitted authorization to enter short here we would require a retest to the underside of 1.22 along with a reasonably sized H4 bearish close. This is a trade we would deem valid, given that there is room seen on both the weekly and daily charts for price to retest the 1.20 band.

From a fundamental standpoint today, we have the BoE Gov. Mark Carney speaking at 2.35pm, along with the US CB consumer confidence release at 2pm and also the ECB President Mario Draghi is scheduled to speak at 3.30pm GMT.

Levels to watch/live orders:

- Buys: Watch for a close above the H4 supply at 1.2328-1.2285 and then look to trade any retest seen thereafter (H4 bullish close required prior to pulling the trigger).

- Sells: Watch for a close below the 1.22 region and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

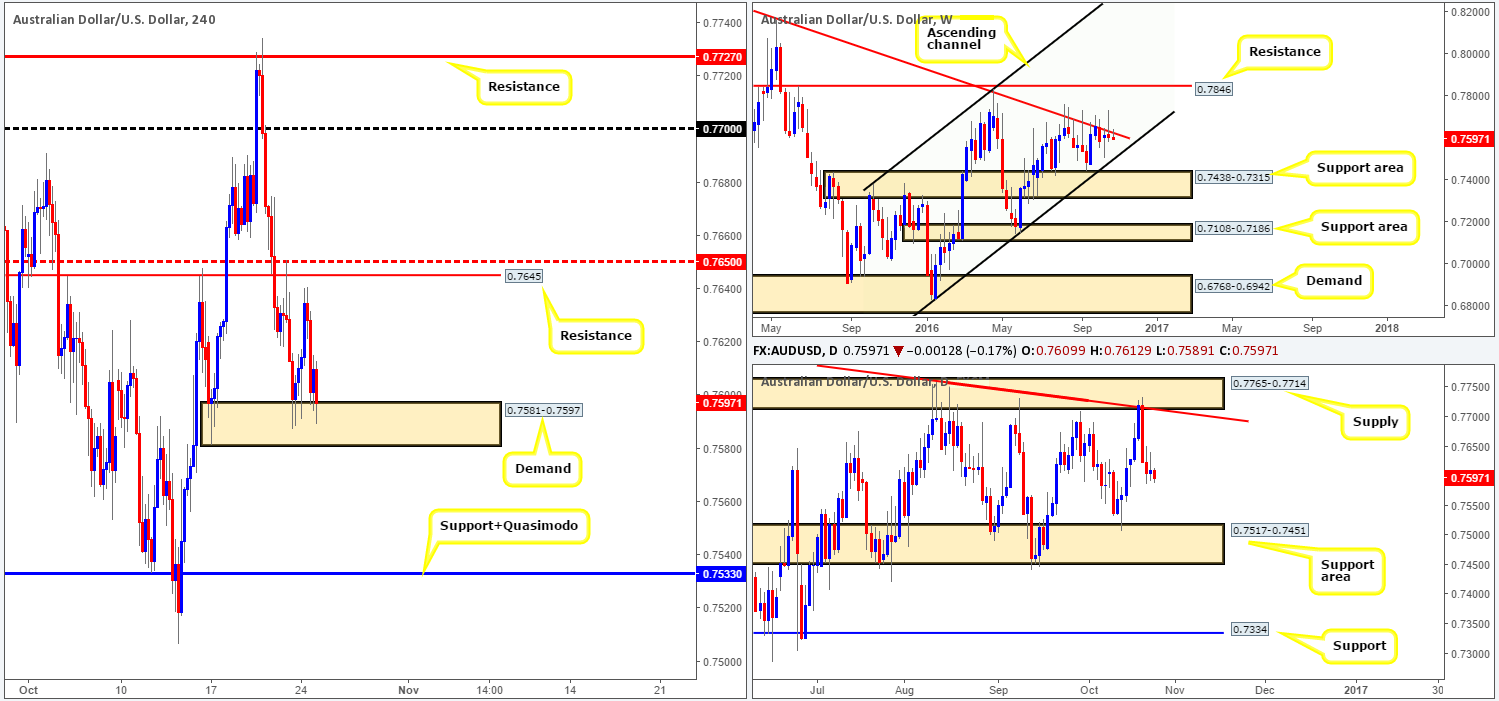

AUD/USD:

Despite the bounce seen from the H4 demand base at 0.7581-0.7597 yesterday, the commodity currency is seen trading pretty much around the same position it was at Friday’s close: at the top edge of this H4 demand area. Traders who strictly follow supply and demand here likely believe that this zone will hold for a second time, and it may very well do just that. However, in light of the weekly candles recently printing a beautiful-looking bearish selling wick that pierced through a trendline resistance extended from the high 0.8295, and daily price showing room for a push down to a support area drawn from 0.7517-0.7451, we personally feel this H4 area is unstable.

Our suggestions: Given the points above, we still have absolutely no interest in buying from the current H4 demand base today. With that being the case, our team has noted that they’re watching for price to CLOSE below this zone, as this would not only confirm bearish strength on the higher-timeframe picture, but also open up the path south for price to challenge the combined H4 support/Quasimodo level at 0.7533, which is conveniently positioned just ahead of the aforementioned daily support area. Should a close below the H4 demand take place, and price follows up with a retest to the underside of this area as supply, we would look to short on the close of any reasonably sized H4 bearish candle.

According to the economic calendar today, there’s no Aussie data scheduled for release. Therefore, focus will likely shift to the US economy, namely the CB consumer confidence print at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for a close below the H4 demand at 0.7581-0.7597 and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

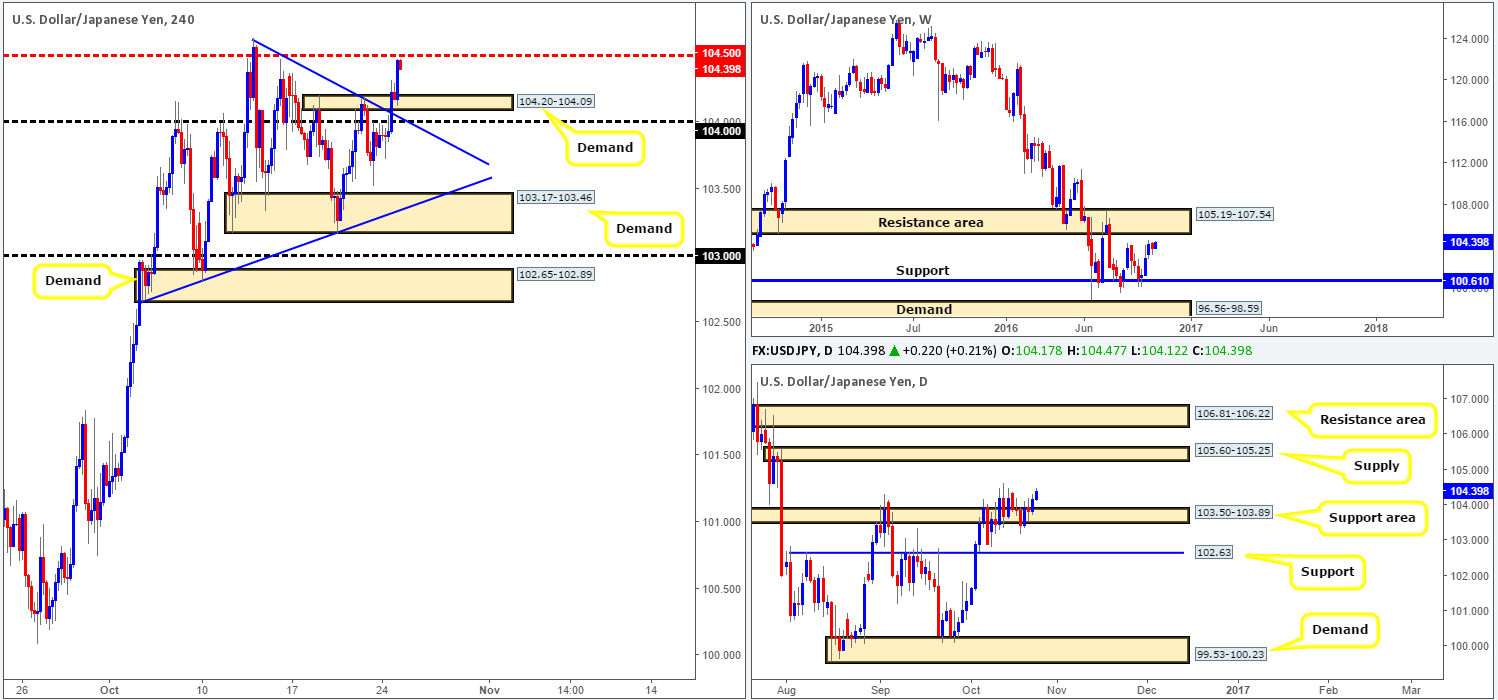

USD/JPY:

Taking it from the top this morning, the weekly picture shows that price looks to be on course to connect with a resistance area fixed at 105.19-107.54, after recently taking out highs chalked up on the 29/08 around the 104.32ish region. Turning over to the daily chart, the candles remain bolstered by the support area seen at 103.50-103.89. The next upside target from this angle falls in at a supply area coming in at 105.60-105.25, which is housed within the lower limits of the aforementioned weekly resistance area.

Following Sunday’s open, the H4 stalled around the underside of the 104 boundary. In spite of this, going into the early hours of US trading, price aggressively rallied through this hurdle, as well as a H4 trendline resistance extended from the high 104.63 and a H4 supply at 104.20-104.09 (now acting demand).

Our suggestions: As we write, the H4 candles are seen trading just ahead of a mid-way resistance seen at 104.50. This barrier, as far as we’re concerned, is now the last line of defense before price strikes the 105 handle, which, by extension, pretty much represents the underside of both the weekly resistance area and daily supply mentioned above. In fact, this would be an ideal place to be looking to short from

Watching for price to close above 104.50 and retest the top edge as support for a possible entry long seems like a reasonable approach, in our opinion. For those who require a little more confirmation other than a retest, one could wait for a lower timeframe buy setup to form (see the top of this report) or a reasonably sized H4 bullish close.

There’s no scheduled economic data due for the JPY today so focus will likely be on the US CB consumer confidence print at 2pm GMT.

Levels to watch/live orders:

- Buys: Watch for a close above the H4 mid-way resistance 104.50 and then look to trade any retest seen thereafter (lower timeframe confirmation required or at the very least a reasonably sized H4 bullish close).

- Sells: Flat (Stop loss: N/A).

USD/CAD:

Comments from the BoC’s Gov. Poloz sent the USD/CAD screaming lower during yesterday’s US session, likely taking out a truckload of stops below the 1.33 neighborhood. As can be seen from the H4 chart, however, price action is seen trading back around the underside of supply at 1.3405-1.3353. Seeing as weekly price recently locked horns with a resistance level coming in at 1.3381 and is also trading deep within a daily supply zone at 1.3405-1.3259, more specifically the daily convergence point which is made up of: a 38.2% Fib resistance level at 1.3315 (green line), the weekly resistance level at 1.3381, a channel resistance taken from the high 1.3241 and an AB=CD completion point around the 1.3376ish range, we find it difficult to imagine price breaking higher from here!

Our suggestions: Our team remains short from 1.3315 with a stop set above the aforementioned daily supply edge at 1.3407. For traders who also believe that the pair is overbought, we would advise waiting for a close below 1.33 to confirm downside. Following this, a retest to the underside of this number along with a reasonably sized H4 bearish candle would, in our view, make for a beautiful shorting opportunity down to 1.32. Should this come to fruition, we will also likely look to pyramid our current position.

Fundamentally, there is no Canadian data scheduled to hit the wire today, so traders will likely focus on the US CB consumer confidence release at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.3315 ([live] Stop loss: 1.3407). Watch for a close below the 1.33 handle and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

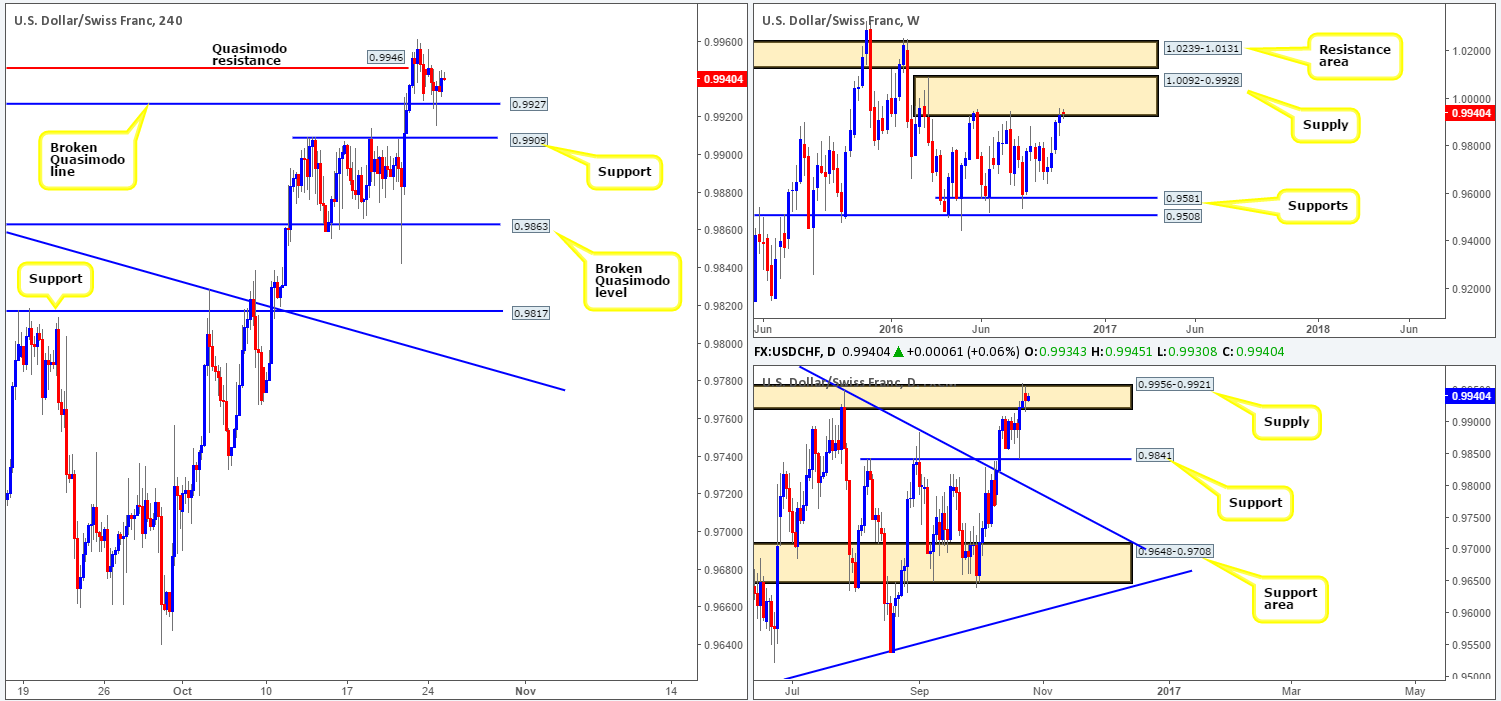

USD/CHF:

Kicking this morning’s analysis off with a quick look at the weekly chart, we can see that the market is currently touching gloves with the underside of a supply zone coming in at 1.0092-0.9928. This supply marks the top edge of a consolidation that has been in play since May 2016, and has proved itself on two separate occasions (16/05-25/07). In conjunction with weekly price, the daily chart also shows the Swissy recently attacked a supply zone coming in at 0.9956-0.9921. The next downside target from this region can be seen at 0.9841: a support level.

On the flip side, over on the H4 chart, the broken Quasimodo line at 0.9927 held firm going into yesterday’s US session. Despite this level holding ground, we feel there is a high probability, given where price is positioned on the higher-timeframe picture (see above), that a break below both this broken Quasimodo line and the support seen just below it at 0.9909 is likely going to take place.

Our suggestions: Watch for a decisive close below the H4 support at 0.9909. To short below here, a retest to the underside of 0.9909 is required followed by a H4 bearish close, with a target objective seen at 0.9863: a H4 broken Quasimodo line at 0.9863 – located just above the daily support mentioned above at 0.9841.

As far as economic data goes, there’s no CHF news scheduled for release today, so attention will likely be focused on the US CB consumer confidence reading at 2pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for a close below the H4 support at 0.9909 and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).