Lower timeframe confirmation: simply means waiting for price action on the lower timeframes to confirm direction within a higher timeframe area. For example, some traders will not enter a trade until an opposing supply or demand area has been consumed, while on the other hand, another group of traders may only need a trendline break to confirm direction. As you can probably imagine, the list is endless. We, however, personally prefer to use the two methods of confirmation mentioned above in our trading.

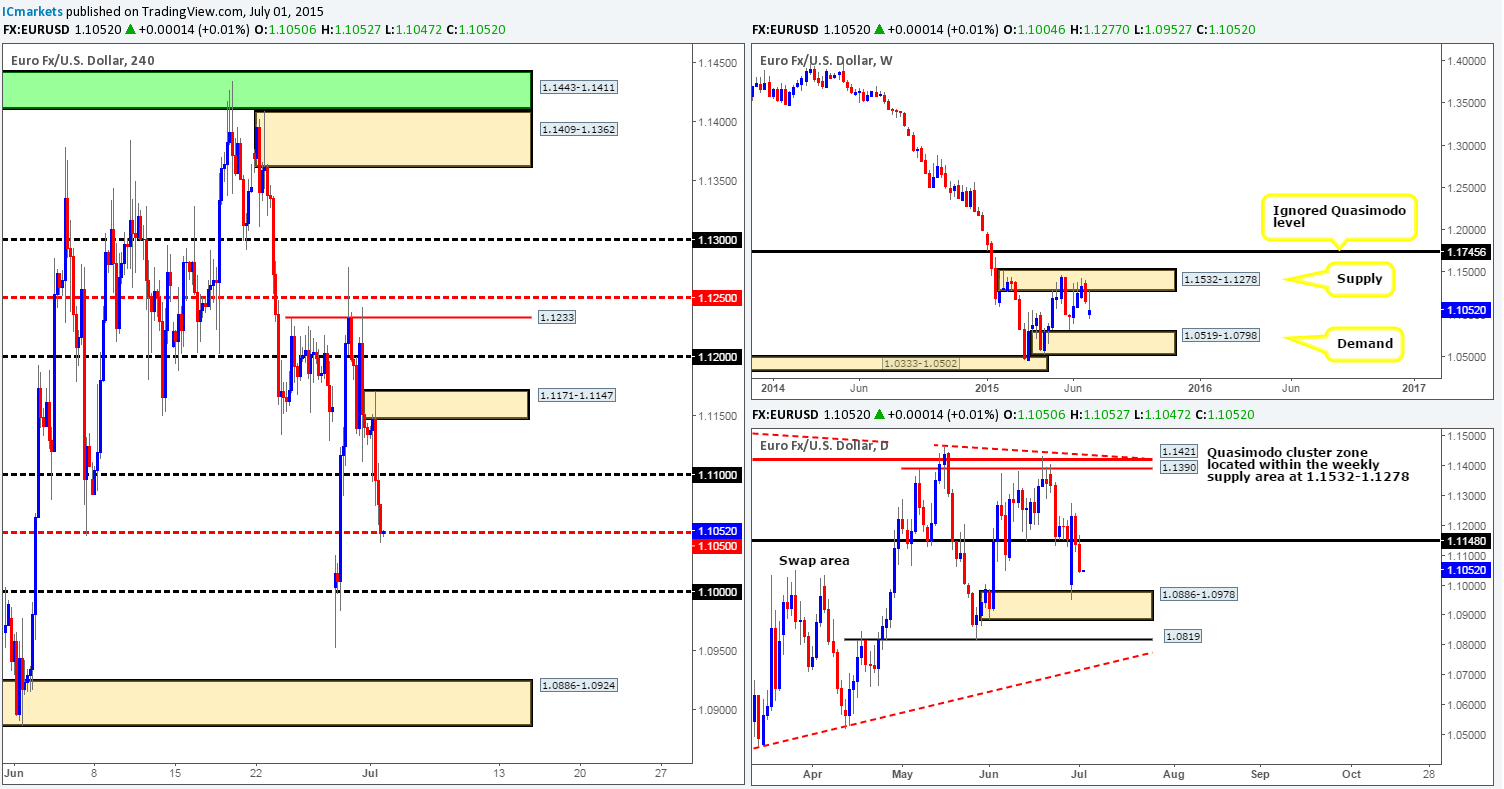

EUR/USD:

Yesterday’s action shows that the psychological barrier 1.1100 was taken out mid-way through the London morning session. This descent was likely spurred on after the Eurogroup teleconference produced no relevant news. EU members have also stated that there will be no new negotiations before the referendum which is set to take place this Sunday. Therefore, the EUR is literally left to the mercy of rumors that will likely continue to flood the wire.

The close below the 1.1100, as you can see, did in fact give traders a nice retest opportunity. We took a quick look at the lower timeframe price action surrounding this retest, but saw little confirming price action before the EUR plunged into the mid-level number 1.1050.

Agreement is being seen across the board regarding the higher timeframe picture. Both the weekly and daily charts show little support until price reaches the 1.1000 mark, which ties in nicely with the daily demand area seen at 1.0886-1.0978. Therefore, we believe that the EUR may continue to sell off ahead of the NFP release today, and cross swords with 1.1000.

Levels to keep an eye for confirmed price action before/after the NFP are as follows:

Buys:

- Round number 1.1000.

- 4hr demand area at 1.0886-1.0924 (located deep within the aforementioned daily demand area).

Sells:

- Round number 1.1100.

- 4hr supply zone at 1.1171-1.1147 which envelopes the mid-level barrier 1.1150.

Levels to watch/live orders:

- Buys: 1.1000 [Tentative – confirmation required (Stop loss: dependent on where one confirms this level) 1.0886-1.0924 [Tentative – confirmation required (Stop loss: 1.0876).

- Sells: 1.1100 [Tentative – confirmation required (Stop loss: dependent on where one confirms this level) 1.1171-1.1147 [Tentative – confirmation required (Stop loss: 1.1174).

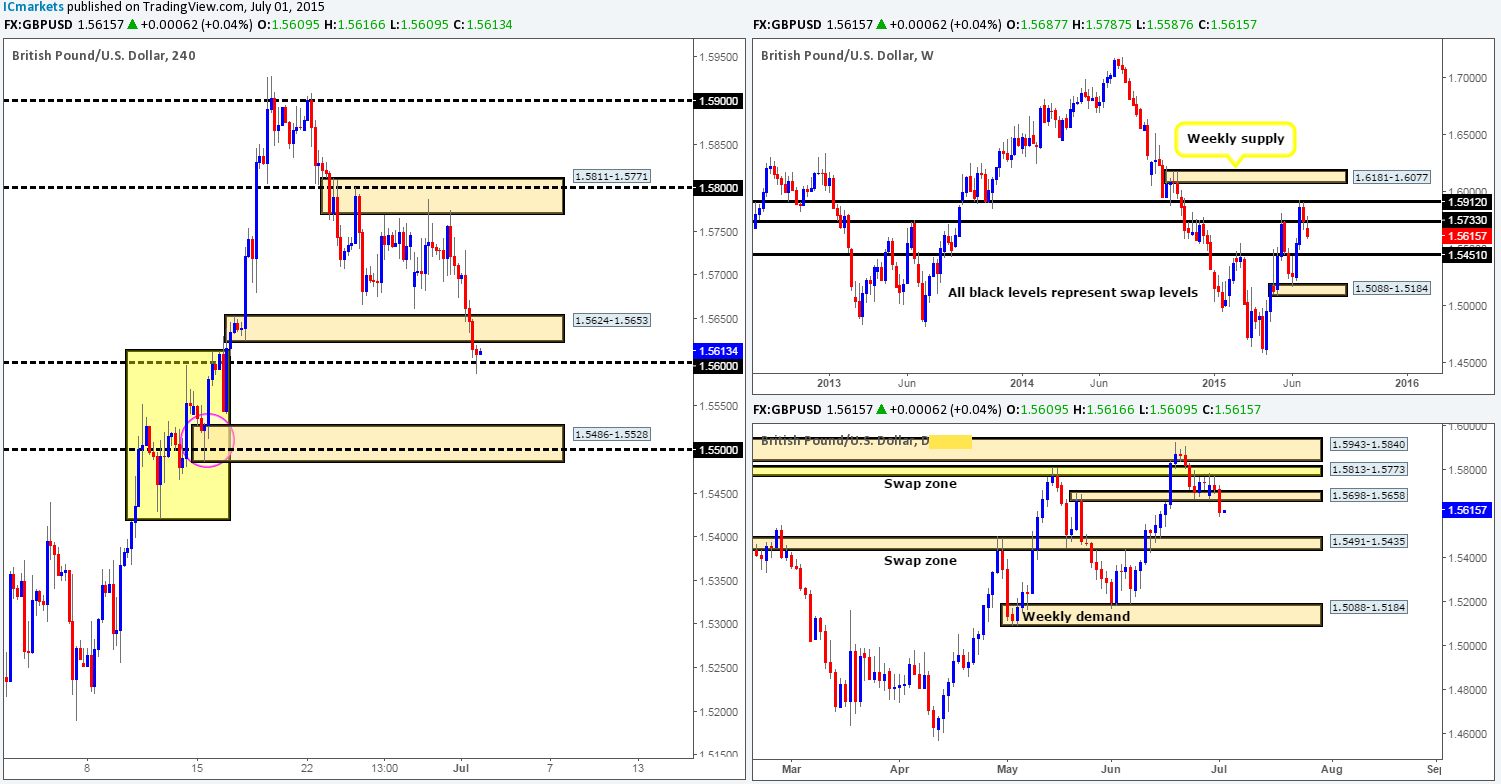

GBP/USD:

Very similar to the EUR, the GBP also sold off during the London open. This saw price wipe out the 4hr demand area coming in at 1.5624-1.5653, and drive itself into the psychological threshold 1.5600, which at the time of writing is holding firm (bullish pin-bar candle just printed).

With the weekly timeframe showing resistive pressure coming in from the underside of a weekly swap level 1.5733, and price only recently closing below a daily swap area of support at 1.5698-1.5658, technically this pair does not look in good shape.

Therefore, we guess it is all up to the 1.5600 number going into today’s sessions. If the buyers can hold out above this level, they will then need to consume any offers remaining within the recently broken 4hr demand area. Should this happen, the bulls may then have a chance here. That said though, with both the weekly and daily charts pointing south at the moment, we would not feel comfortable trading long from here. Conversely, if price breaks through 1.5600, we see further weakness below. The yellow box shows very little active demand (in our opinion) other than the 4hr demand area seen at 1.5486-1.5528, which converges not only with round-number support at 1.5500, but also the daily swap zone at 1.5491-1.5435.

With all of the above taken into account, and the fact that we have the mighty NFP data to look forward to later, we have very little interest in buying this pair. Selling, however, could be a possibility on the break and retest of 1.5600, but let’s see what happens during the course of today’s sessions as price notoriously consolidates ahead of NFP releases.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

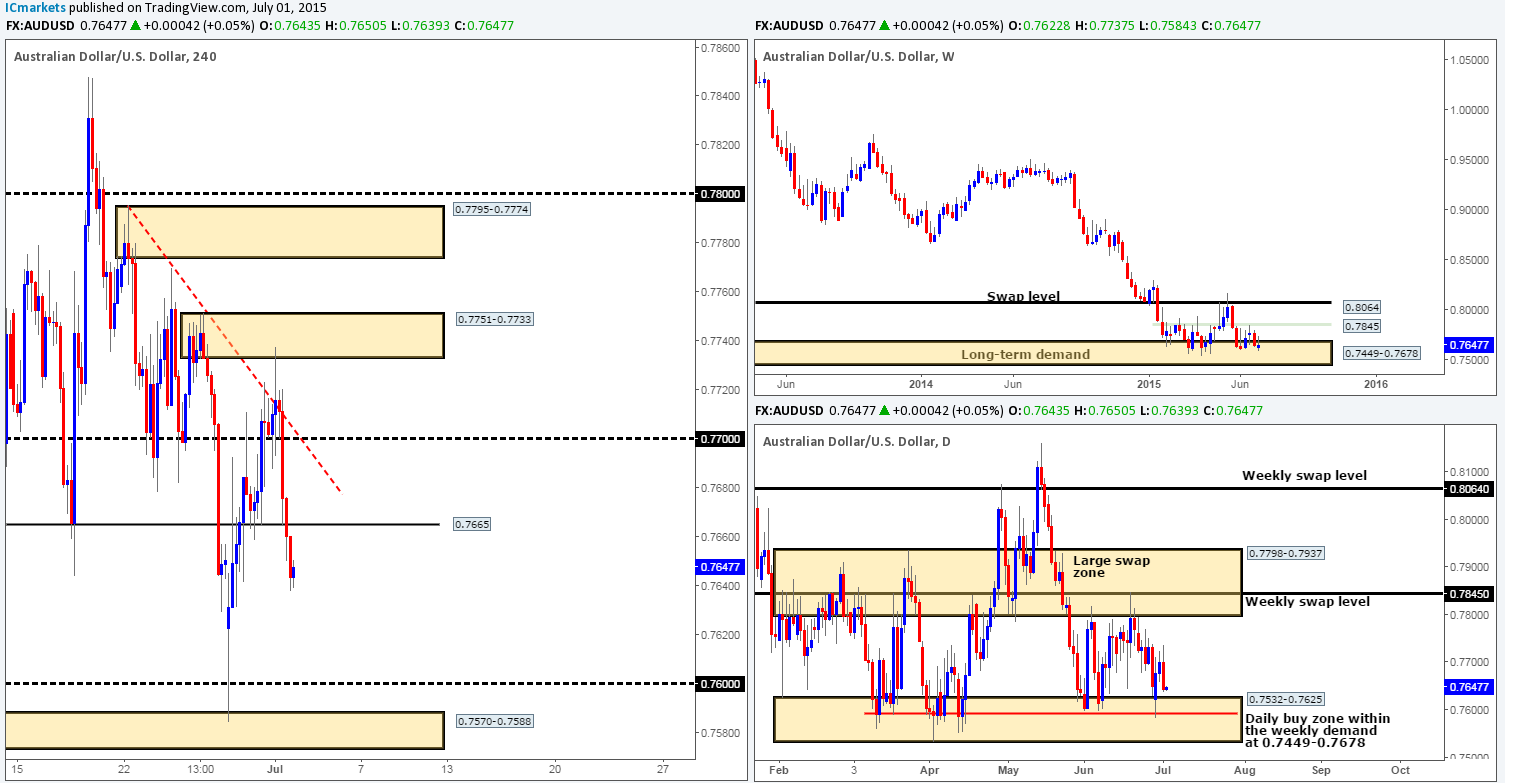

AUD/USD:

For those who read our previous report: http://www.icmarkets.com/blog/wednesday-1st-july-daily-technical-outlook-and-review/ you may recall that we mentioned to watch for a potential intraday buying opportunity from 0.7700 up to the fresh 4hr supply zone coming in at 0.7751-0.7733. As you can see, price did indeed move as we expected, but there was very little confirming price action allowing us to enter unfortunately. Well done to any of our readers who managed to lock in some green pips here!

Following this, price aggressively sold off mid-way through yesterday’s London session, taking out 0.7700 and a 4hr swap level seen at 0.7665. As far as we can see, there is very little support on the 4hr timeframe to stop further selling until price reaches either the round number 0.7600, or the 4hr demand area lurking just below it at 0.7570-0.7588 (located deep within the daily buy zone at 0.7532-0.7625). Therefore until price reaches either of the above areas, we will not be considering longs on this pair. The weekly, along with the daily timeframe, however, shows price positioned around very obvious buy zones (0.7449-0.7678/ 0.7532-0.7625) at the moment, thus adding weight to any longs taken at the above said levels.

Even though we believe there is potential for a sell off, we will also not be initiating any sell trades. The reason for this is simply because our trading plan does not allow us to sell into higher timeframe areas of demand without clear reason to do so, and unfortunately this is not one of those days.

Levels to watch/ live orders:

- Buys: 0.7600 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) 0.7570-0.7588 [Tentative – confirmation required] (Stop loss: 0.7570).

- Sells: Flat (Stop loss: N/A)

USD/JPY:

We mentioned in our previous report: http://www.icmarkets.com/blog/wednesday-1st-july-daily-technical-outlook-and-review/ that we were intending to keep our current live position (121.98) running purely from a price action standpoint. As you can see, price did indeed to continue to march north during the course of yesterday’s sessions, which saw price hit and extend through the 123.00 round number. We have now taken 70% of our long position off the table and moved our stop-loss order to breakeven plus five.

Going forward, we see this pair consolidating ahead of the mighty NFP between 123.00 and the 4hr swap level 123.32. Dependent on the NFP numbers of course; a cut above 123.32 could suggest further upside towards the 124.00 number. This move could be tradable if a retest of 123.32 was seen along with corresponding lower timeframe confirmation – this may be asking too much though on NFP day! On the other hand, a push below 123.00 would likely send the USD plummeting down to at least the small 4hr demand area at 122.44-122.75, which is also a tradable move in our opinion as long as price successfully retests 123.00 and like above displays confirmation from the lower timeframes.

Despite recent reports on YEN save haven, we see this pair breaking higher, purely from the fact that price is trading off of a weekly swap area at 122.01-121.40. This is only our technical opinion here though guys so do take it as such.

Levels to watch/ live orders:

- Buys: 121.98 [Live] (Stop loss: Breakeven).

- Sells: Flat (Stop loss: N/A).

USD/CAD:

The USD/CAD pair rallied for a third consecutive day during the course of yesterday’s trade, breaking cleanly above our two 4hr Quasimodo resistance levels 1.2490/1.2537 with little to no trouble whatsoever. This move, as you can probably see, also drove price into the jaws of a daily supply area at 1.2666-1.2573, and also saw price push above the weekly swap level 1.2439.

With an incredible amount of wood to chop through on the weekly chart between 1.2439 /1.2765, and the fact that price is currently dancing within daily supply, we could technically be looking at a push lower today and possibly into tomorrow.

With that in mind, we were first drawn to the round number level 1.2600 on the 4hr timeframe for shorts, but after scrolling further left, we found a long-term level visible at 1.2612 which price may use to facilitate a fakeout above the round number to take out buy stops. We have an alert set at 1.2606, which if triggered; we’ll begin watching for lower timeframe selling confirmation to get in on any down move seen. However, let’s not forget that today is NFP and Canada is on vacation which could make this level a difficult beast to trade. The only other option here would be to set a pending sell order and hope for the best which is not really something our team is comfortable doing. It will be interesting to see how this pans out.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2600/1.2612 [Tentative – confirmation required] (Stop loss: dependent on where one finds lower timeframe selling confirmation).

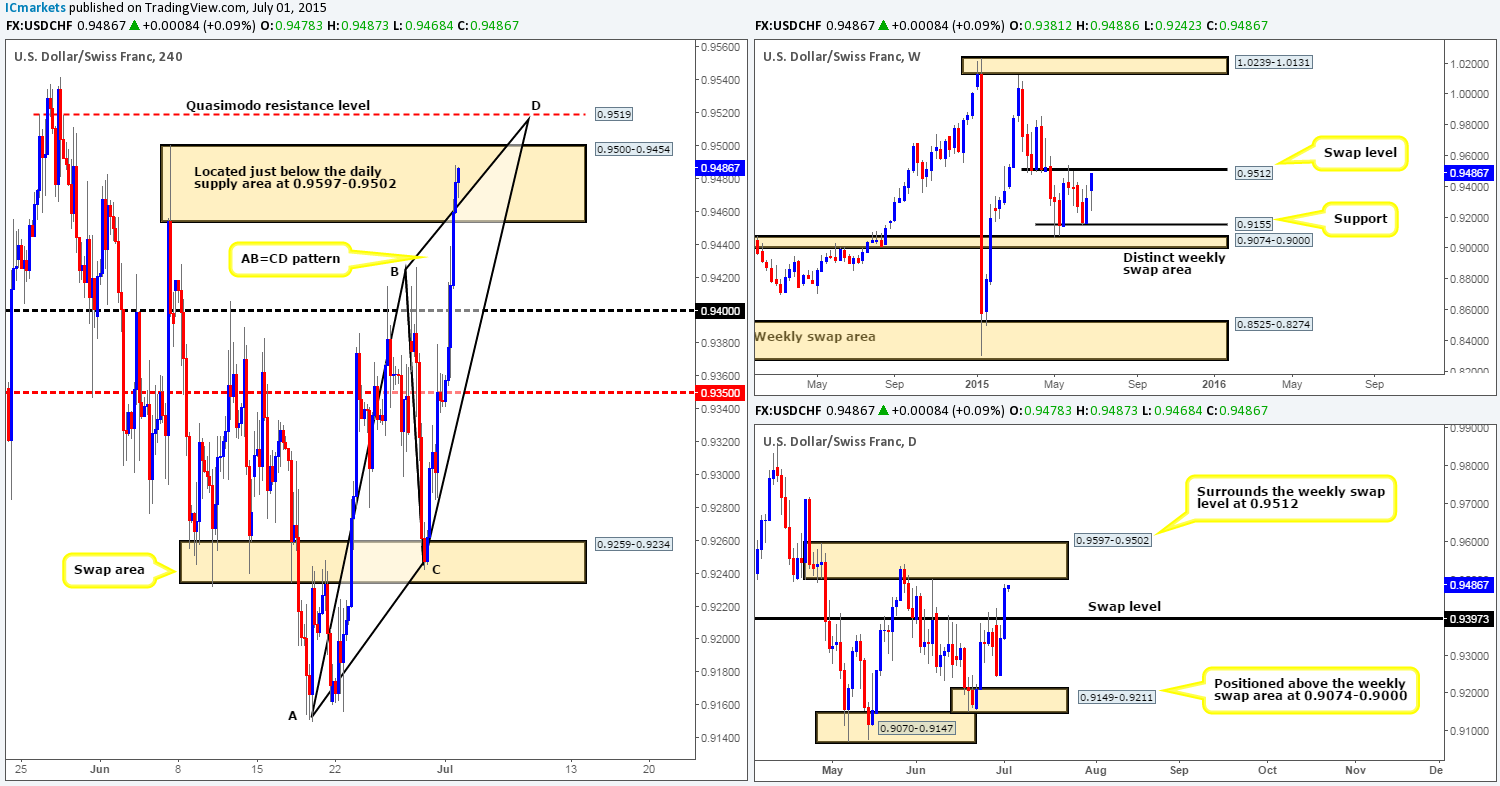

USD/CHF:

The 4hr timeframe shows that as we moved into yesterday’s London session, the bulls continued to march north, chomping their way through the 0.9400 barrier and driving deep into a 4hr supply zone at 0.9500-0.9454 (located just below daily supply at 0.9597-0.9502).

We have no intention of shorting this market within the current 4hr supply area. The reason for why simply comes from the following:

- A 4hr Quasimodo resistance level lurking just above the 4hr supply zone at 0.9519 is just begging for price to fake higher.

- A Harmonic AB=CD pattern completes right at the point of our 4hr Quasimodo resistance level.

- Check out the round number 0.9500 (the upper limit of the 4hr supply area) positioned just below the 4hr Quasimodo level. A push above this hurdle will likely take out buy stops, which well-funded traders will want to sell into.

- Notice from the daily timeframe price has NOT YET connected with daily supply at 0.9597-0.9502, thus leaving room for a further push north.

- As per the weekly timeframe, we can see that price is now only a few pips away from greeting the weekly swap level at 0.9512 (encompassed by the aforementioned daily supply area), again leaving room for further buying.

Technically, we believe this market is ready to drop, but with the mighty NFP due to take center stage later on today, this could invalidate our findings. Therefore, how we plan to approach this is to wait to see how price action on the lower timeframes behave once/if the market reaches 0.9519. If it becomes obvious that weakness is in the air, we’ll likely short this beauty, targeting the 0.9400 number first and foremost as do not forget that this level lines up with a daily swap hurdle coming in around the 0.9397 number.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.9519 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

US 30:

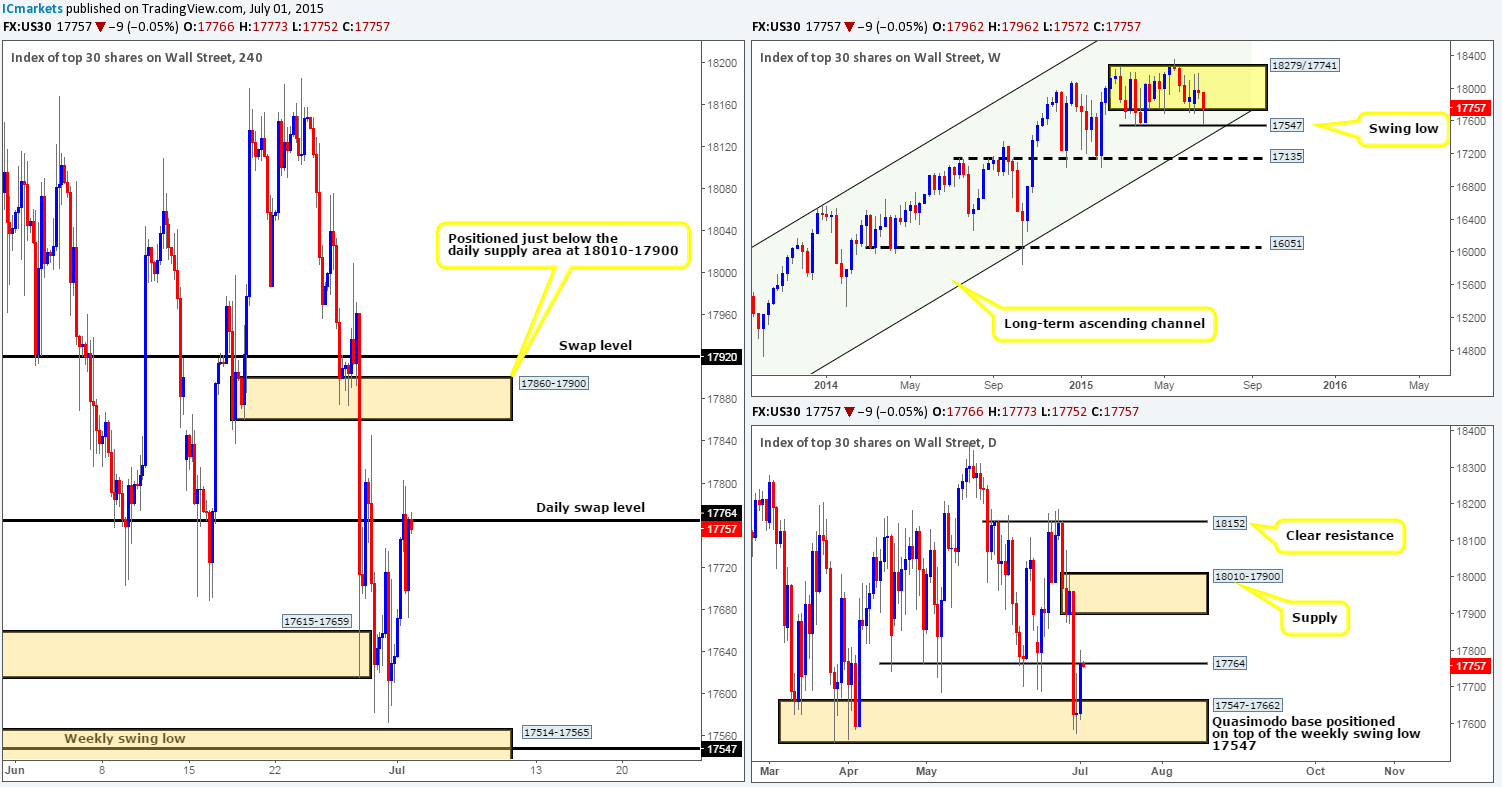

During the course of yesterday’s sessions the DOW index advanced north, resulting in price shaking hands with the daily swap level coming in at 17764. There were clearly offers sitting at this level as price aggressively rebounded down to the 17672 mark, which as you can see was defended going into the U.S afternoon session.

Now, considering that the weekly chart shows price teasing the lower limits of its current range 17741 (see the chart) at the moment, a close above the aforementioned daily swap level today would (in our opinion) not only confirm bullish strength from within the weekly range, but also likely confirm possible upside towards the 4hr swap area at 17860-17900 (located at the underside of the daily supply area seen at 18010-17900). To trade this move, we’ll be looking for a retest of 17764 that displays some sort of buy signal from the lower timeframes. Conversely, should offers remain strong at the current daily swap level; we could see another push south. This time, however, it could travel all the way back down to the 4hr demand area seen at 17514-17565 (surrounds the weekly swing low 17547) given expected NFP volatility. Selling here will require price action confirmation from the lower timeframes which may be difficult to get today.

In closing, the market will not likely see much movement until the NFP strikes its chord, as it’s common to see consolidation ahead of big numbers.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 17764 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

XAU/USD: (Gold)

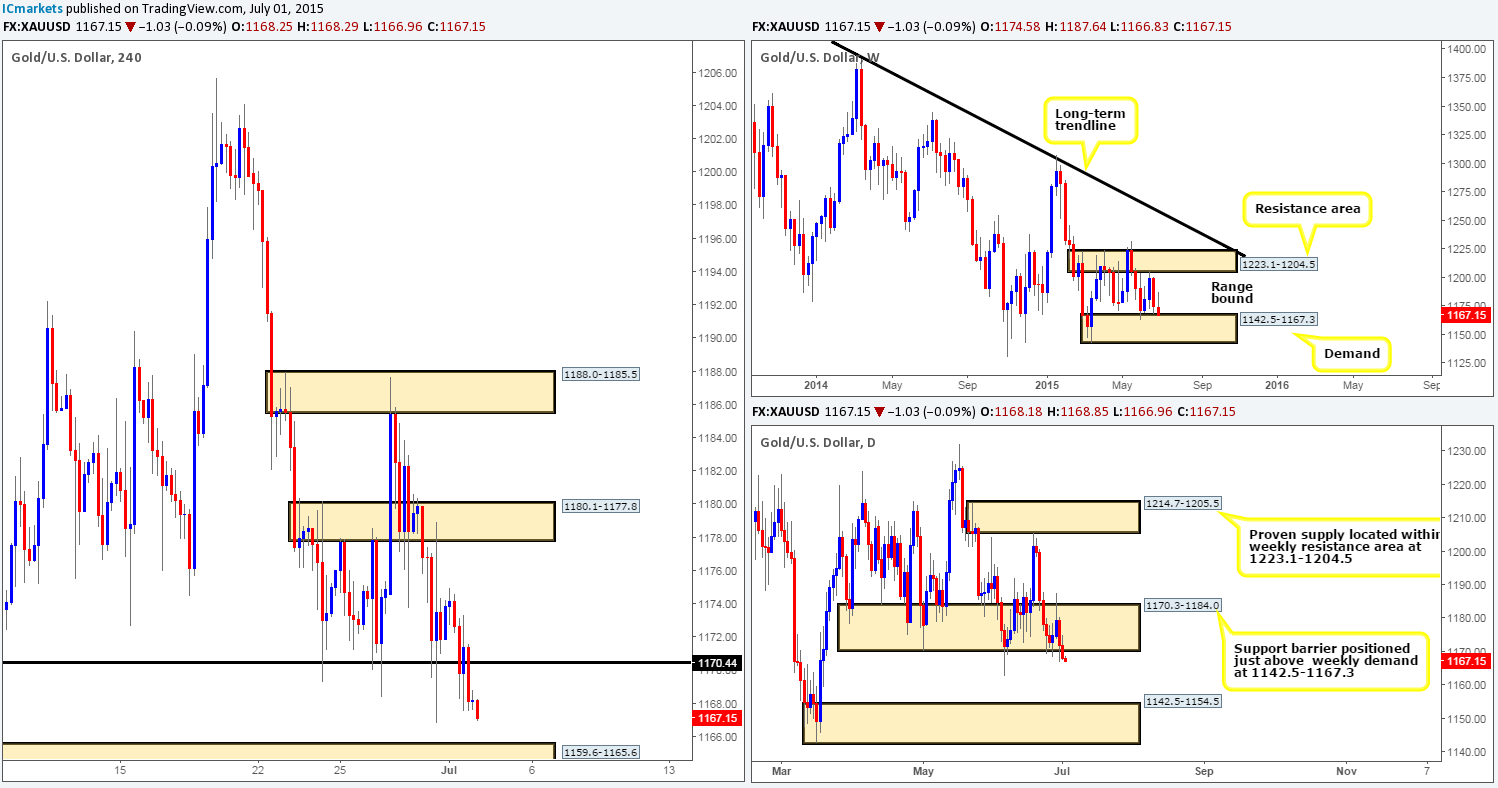

As we entered into the more liquid sessions yesterday, we can see that Gold had no intention of rallying; instead of that we saw price take out the 4hr swap level at 1170.4. With this, the path south is now likely clear down to the 4hr demand area at 1159.6-1165.6. This zone certainly commands respect as it held this market beautifully earlier last month (05/06/15) at 1162.5, so we’re naturally expecting some sort of reaction to be seen here.

From the higher timeframe picture, price closed below the daily support barrier at 1170.3-1184.0, which in turn forced price to cross swords with the weekly demand area seen at 1142.5-1167.3 (see charts).

This, in our opinion is not a straightforward market to trade now. Here’s why, on the one hand we have a close lower on the daily timeframe suggesting further downside towards daily demand at 1142.5-1154.5 (located deep within the aforementioned weekly demand area), and on the other, (the weekly timeframe); price could rally higher from weekly demand. With that in mind, this is what we have noted so far:

- Price could continue lower today and rebound aggressively off of the 4hr demand area at 1159.6-1165.6 (dependent on the NFP number of course). This would insinuate that the break below the daily support barrier could very well be a fakeout to gather liquidity for an eventual push higher from the weekly demand area.

- The 4hr demand area may get demolished, and send price south down to the aforementioned daily demand area. In that case, all eyes will firmly be on the 4hr Quasimodo support level coming in at 1149.6 for a potential long trade (positioned deep within both weekly and daily demand areas mentioned above).

If price reaches the 4hr demand area at 1159.6-1165.6, or either the 4hr Quasimodo support level at 1149.6, we will need to see lower timeframe support hold firm before considering a position in this market. Furthermore, we will be extra cautious due to the NFP announcement today which could effectively invalidate any lower timeframe confirming price action you see, so do stay on guard!

Levels to watch/ live orders:

- Buys: 1159.6-1165.6 [Tentative – confirmation required] (Stop loss: 1158.9) 1149.6 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).