A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, andhas really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

For us, lower timeframe confirmation starts on the M15 and finishes up on the H1, since most of our higher timeframe areas begin with the H4.

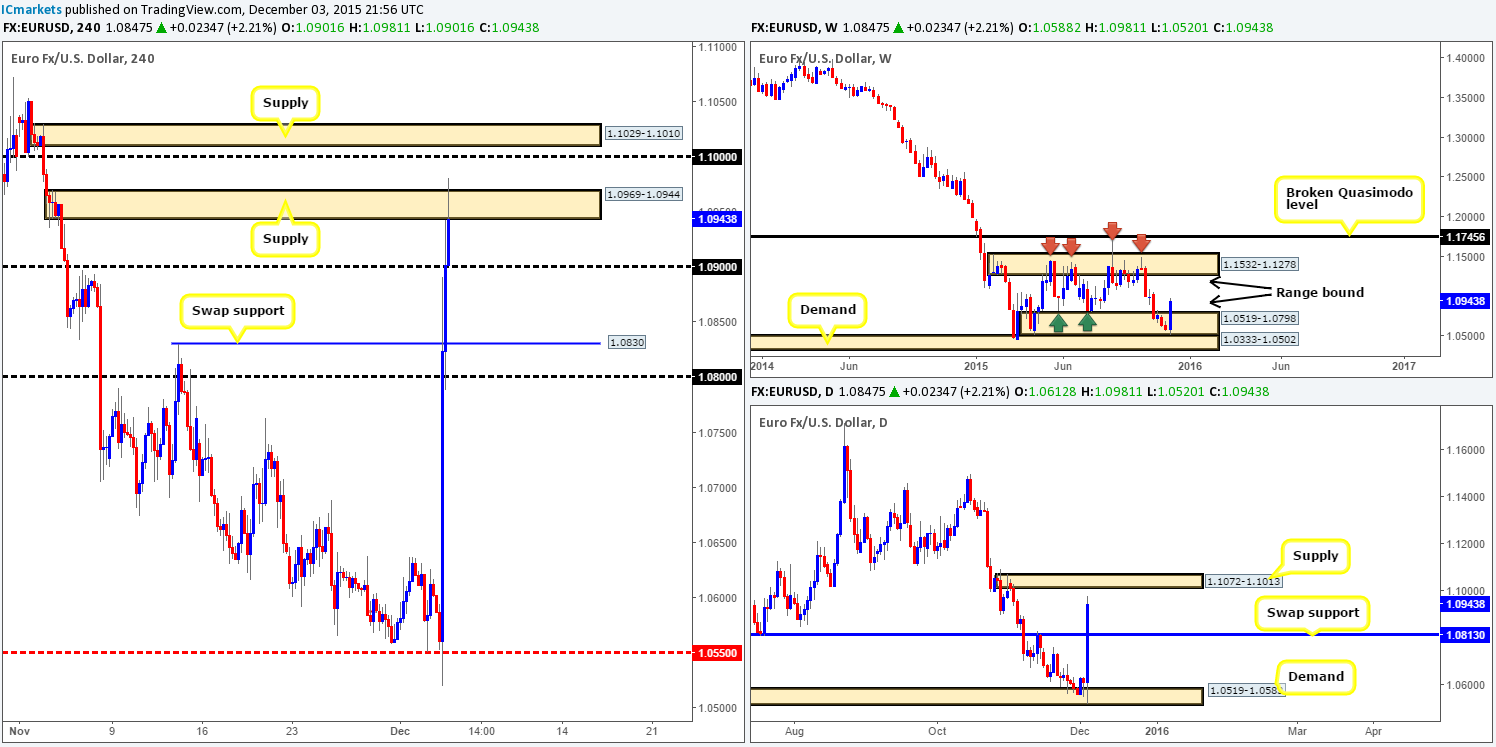

EUR/USD:

Isn’t that a sight for sore eyes! The single currency surged over 460 pips as the ECB surprised the markets yesterday by extending its asset program, but not expanding monthly purchases. On the docket today, however, we have the mighty NFP release which could shake things up further. The question we’d all love the answer to now is can this recent surge in buying be sustained, or is it just a correction in the wider scheme of things?

Technically,this acceleration north took out a bundle of H4 resistances, with price ending the day stabbing above supply seen at 1.0969-1.0944. In addition to this, we can see that weekly action is now trading back within its current range between demand at 1.0519-1.0798 and supply drawn from 1.1532-1.1278. Meanwhile, down on the daily chart, price is now lurking just beneath supply coming in at 1.1072-1.1013. Downside targets from here fall in at the swap support taken from 1.0813.

As a rule, we never trade during news. As such, we’re going to be watching the following H4 areas pre/post-NFP today:

- Large psychological resistance 1.1000. As tasty as this level appears, traders should note the H4 supply lurking above it at 1.1029-1.1010. Furthermore, this supply is positioned nicely within the aforementioned daily supply, so be prepared for some fakeouts here guys (waiting for lower timeframe confirmation highly recommended).

- Psychological supports 1.0900/1.0800 along with the swap support level seen at 1.0830. The 1.0800 figure is the more attractive of the two in our opinion seeing as how it converges nicely with the daily swap (support) level mentioned above at 1.0813. Again, waiting for confirmation here is recommended due to the high possibility of some very nasty fakeouts today.

Levels to watch/live orders:

- Buys:1.0800/1.0830 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this region).

- Sells: 1.1000/1.1029-1.1010 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

GBP/USD:

Like its bigger brother, the EUR/USD, Cable also rallied close to 200 pips yesterday on the back of dollar weakness. As a result, a collection of H4 technical resistances were wiped out, which saw price finish the day aggressively attacking and slightly piercing above supply at 1.5155-1.5130.

In light of the above, where does our team stand in the bigger picture today? High up on the weekly chart, demand at 1.4855-1.5052 is so far holding ground. Conversely, down on the daily chart, current action is seen kissing the underside of a swap supply zone fixed between 1.5198-1.5154.

To sum up, we have both the H4 and daily action at supply, whilst weekly trade is rising from demand – tricky to say the least especially with the NFP taking center stage later on…With that being said though, we do like the look of psychological resistance above at 1.5200 for a small intraday bounce. Historically, this has proven a valid support and resistance, and given both the H4supply consumption spike seen just below it marked with a black arrow at 1.5190 and the fact (buy) stops have likely been taken out from the current H4 supply, we anticipate a drive up to this number. Nevertheless, the NFP could drag this pair in either direction today with force, so given the current circumstances, we would only trade 1.5200 today (with confirmation) pre/post NFP. Good luck!

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.5200 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

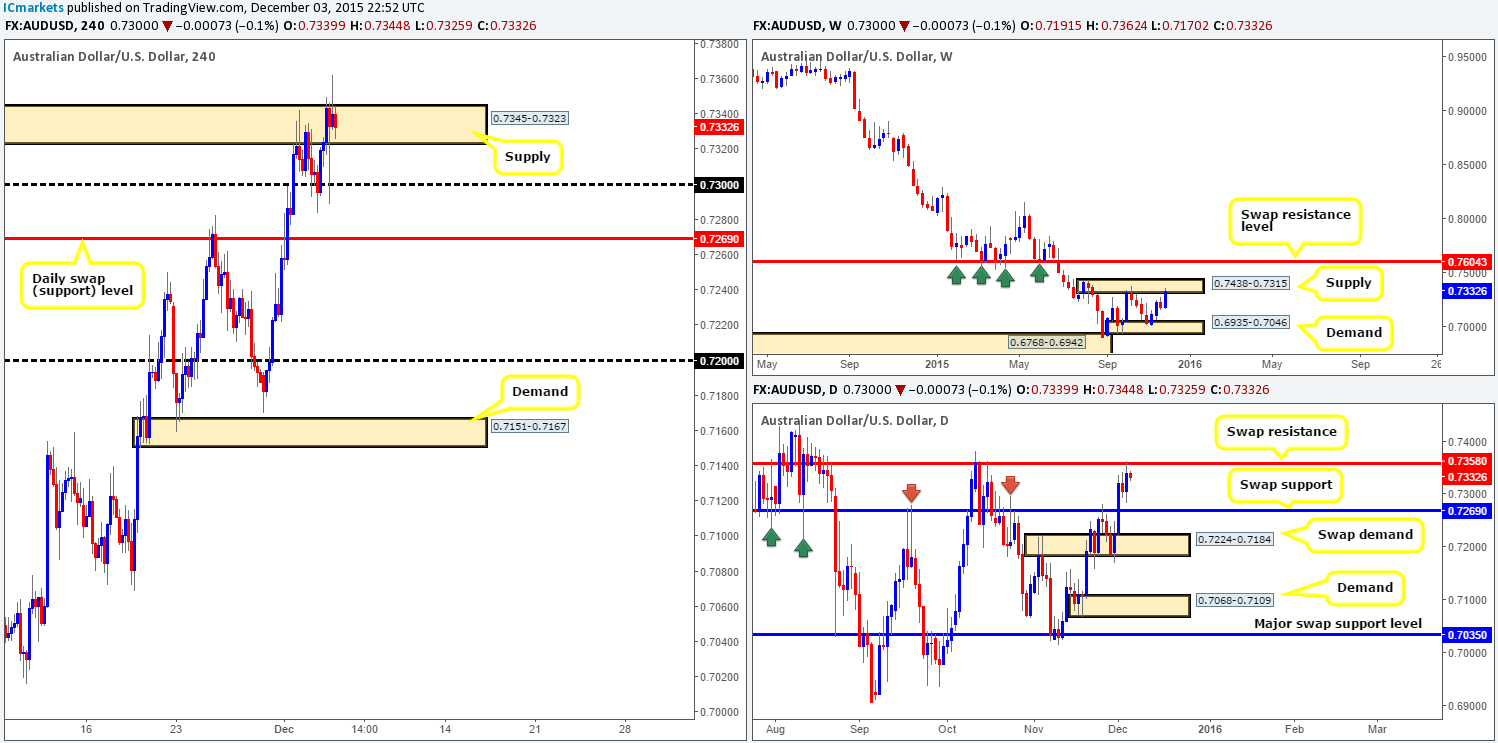

AUD/USD:

For those who read our previous report on this commodity currency (http://www.icmarkets.com/blog/thursday-3rd-december-keep-an-eye-on-the-eurusd-pair-between-1-30pm-and-3pm-gmt-today-high-volatility-expected/), we mentioned that if price should fake above the H4 supply at 0.7345-0.7323 and cross swords with the daily swap (resistance) level at 0.7358, we’d begin looking for a confirmed short into this market. As shown on the H4 chart, this played out perfectly and also gave a confirmed shorting signal on the M15 timeframe with a fake above the high 0.7358. Unfortunately, we missed this move altogether, well done to any of our readers who managed to board this train!

Going forward, at least from a technical standpoint, we see little reason why the Aussie will not continue to weaken today at least down towards psychological support 0.7300. The reasons for why are as follows:

- Weekly action is currently trading around supply at 0.7438-0.7315.

- Down on the daily chart, price is, as we just mentioned, rebounding from a swap resistance level.

- And also, not forgetting the recent fakeout above H4 supply.

However, as far as we can see, there is no clear level to short from right now. This – coupled with the fact that the NFP will more than likely stir things up later on, leaves us with little choice other than to humbly take a back seat on this pair’s action today.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

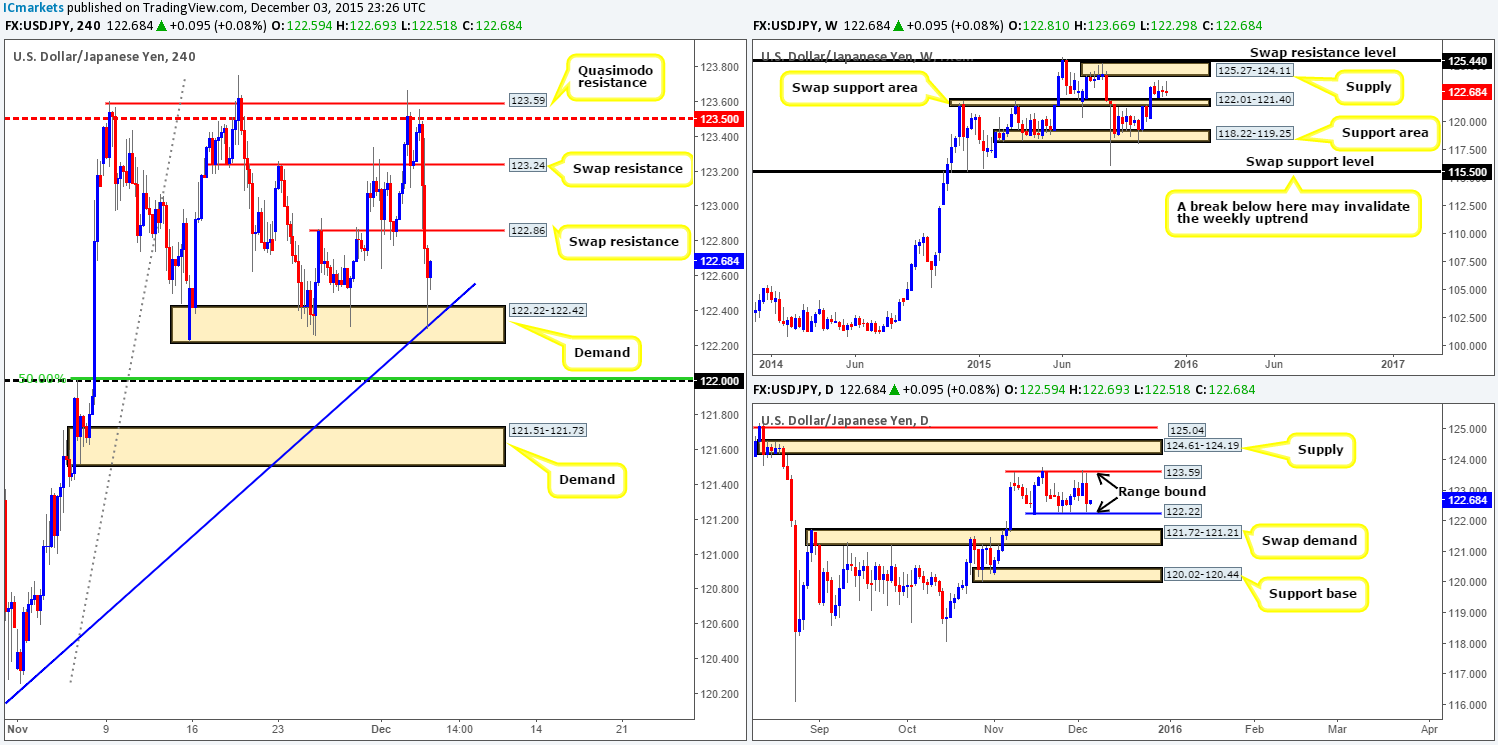

USD/JPY:

In our previous report (http://www.icmarkets.com/blog/thursday-3rd-december-keep-an-eye-on-the-eurusd-pair-between-1-30pm-and-3pm-gmt-today-high-volatility-expected/), we noted that if bids remained strong at 123.24 we may get a second chance to enter short at the H4 Quasimodo resistance level drawn from 123.59. As we can all see, price fell short a mere three pips of this level before the market plummeted south – what a shame! Both H4 swap supports (now resistances) at 123.24/122.86 were taken out during this bearish onslaught, which ended with price bottoming out around H4 demand at 122.22-122.42 (converges beautifully with trendline support [119.62]).

In view of the recent rebound from this demand, where does this fit in on the overall bigger picture? Well, weekly trade is offering little in our opinion other than price trading mid-range between supply at 125.27-124.11, and a swap support area at 122.01-121.40. Down into the pits of the daily timeframe, however, we can see that yesterday’s downward move saw price drive into the lower limits of the current daily range drawn from 122.22.

Given the above points, and the fact that this current H4 demand area is likely getting worn out (bids drying up); there is only two areas we’ll be watching today: psychological support 122.00, followed closely by demand below it at 121.51-121.73. 122.00 is no ordinary psychological number here traders! It boasts 50.0% Fibonacci support at 122.01 and sits on top of the weekly swap (support) area mentioned above at 122.01-121.40, so do keep a close eye on this level for a possible trade today. The demand below it has been placed on our watch list simply due to the possibility of a fakeout into this barrier during NFP.

Judging how violent the NFP can be at times, we would only consider trading the above said areas pre/post NFP and with the assistance of lower timeframe confirming action.

Levels to watch/ live orders:

- Buys: 122.00 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level). 121.51-121.73 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

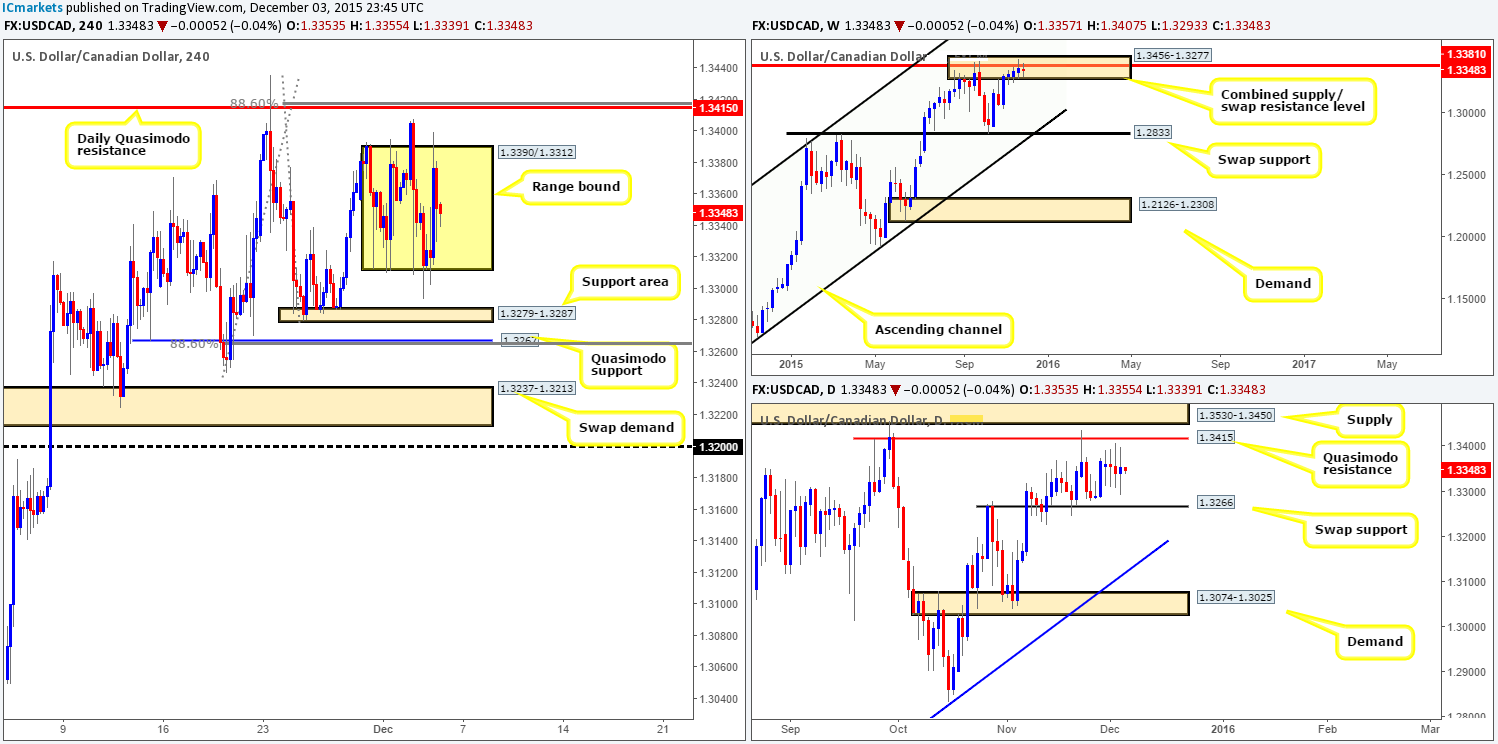

USD/CAD:

In spite of another day’s volatility, the USD/CADremains confined between 1.3390/1.3312. As a consequence, our outlook for this pair will be similar to the previous report and the one before that!

Alongside the current H4 range, price continues to loiter within the weekly combined supply/ swap resistance area at 1.3456-1.3277/1.3381, and daily action printed its fourth consecutive indecision candle whilst also loitering between Quasimodo resistance at 1.3415 and a swap support barrier at 1.3266.

As we mentioned yesterday, although the current H4 range is large enough to profit trading the extremes, we’ll humbly pass and look beyond to the more confluent zones to trade. Here’s why:

Above the H4 range lurks a daily Quasimodo resistance level mentioned above at 1.3415. Not only has this barrier proven itself already by holding this market lower on the 23/11/15, it also coincides nicely with both the aforementioned combined weekly supply/ swap resistance area and the 88.6% Fibonacci level at 1.3416 (waiting for lower timeframe confirmation is recommended before selling here due to the possibility of a fakeout during NFP). Therefore, this will be our base for sells today.

Beneath the H4 range, nonetheless, there is a clear H4 support area at 1.3279-1.3287, which despite how well it has held price recently, this support area is also not somewhere we’d consider safe to buy from due to the Quasimodo support below it at 1.3267. Reason being is this Quasimodo level converges with the 88.6% Fibonacci level at 1.3265 and also the daily swap (support) at 1.3266. As such, this is the zone we’d feel most comfortable to buy from (confirmation still advised due not only where price is positioned on the weekly timeframe [see above] but also because of today’s NFP release) during today’s trade.

Levels to watch/ live orders:

- Buys:1.3267 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells:1.3415 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

USD/CHF:

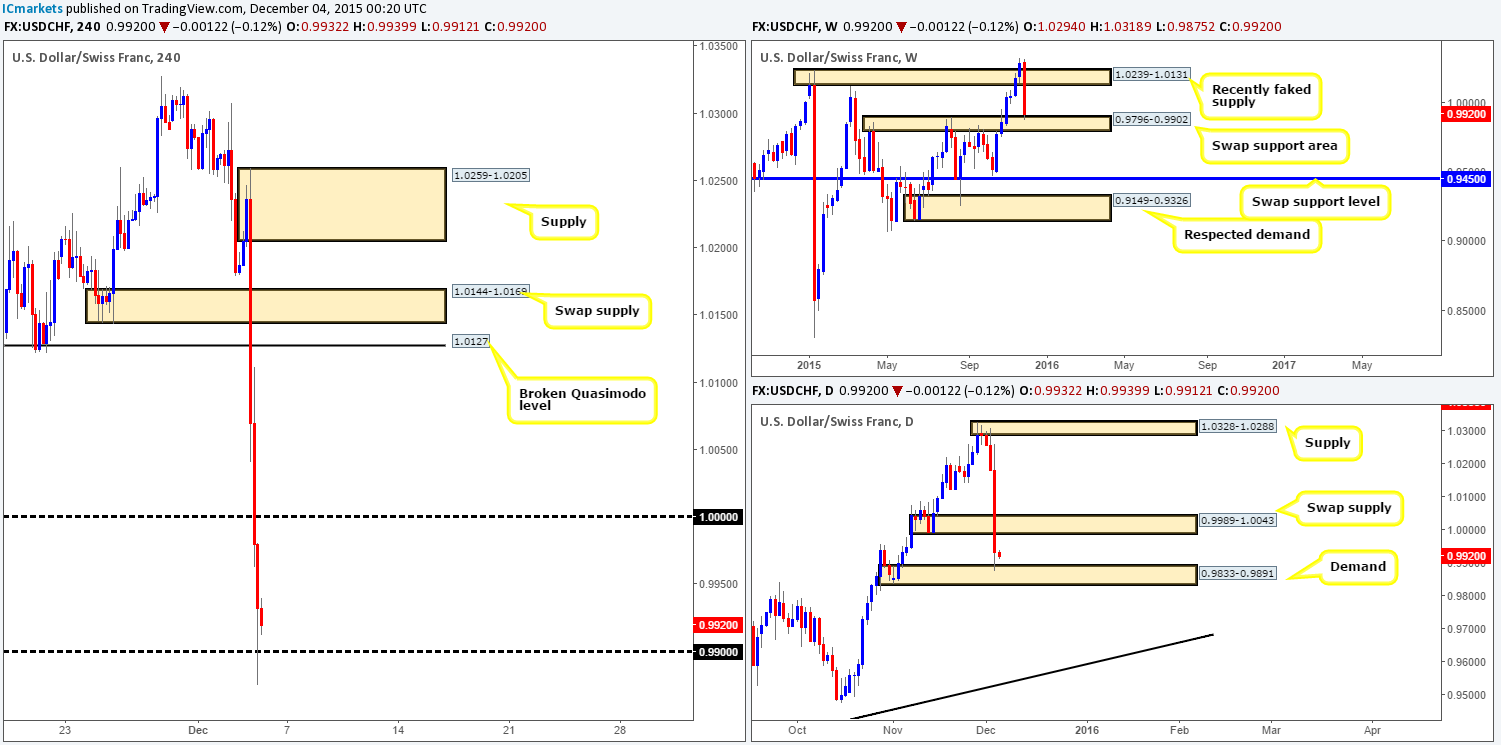

The USD/CHF pair, as you can see, looks as though it was pushed off the edge of cliff yesterday! This sharp sell-off was triggered following the ECB’s decision to cut rates and to extend the purchasing program. A humongous amount of H4 technical supports were taken out during this bearish onslaught, including parity, with price ending the day filling bids around psychological support drawn from 0.9900.

With price still seen holding above 0.9900, let’s see how the land lies on the higher timeframe picture… The recent descent has pushed weekly action into the jaws of a swap support area coming in at 0.9796-0.9902, whilst down on the daily chart, price is now kissing the top-side of demand at 0.9833-0.9891.

Therefore, at least technically anyway, our team is biased to the buy-side of this market today. Fundamentally, however, the NFP is due to hit the scene later on which could effectively push this pair either way. In light of this, and the points made above, we have decided to keep a close eye on lower timeframe action around 0.9900 today. Assuming we’re able to spot a lower timeframe buy setup before the NFP hits the line; we’ll take the trade for a quick intraday bounce. In addition to this, do keep a tab on parity pre/post NFP. This is a huge number which attracts a great deal of attention, and the recent break below it has likely left a collection of unfilled sell orders around this hurdle (waiting for confirmation here is highly recommended) just waiting to be filled.

Levels to watch/ live orders:

- Buys: 1.0900 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: 1.0000 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

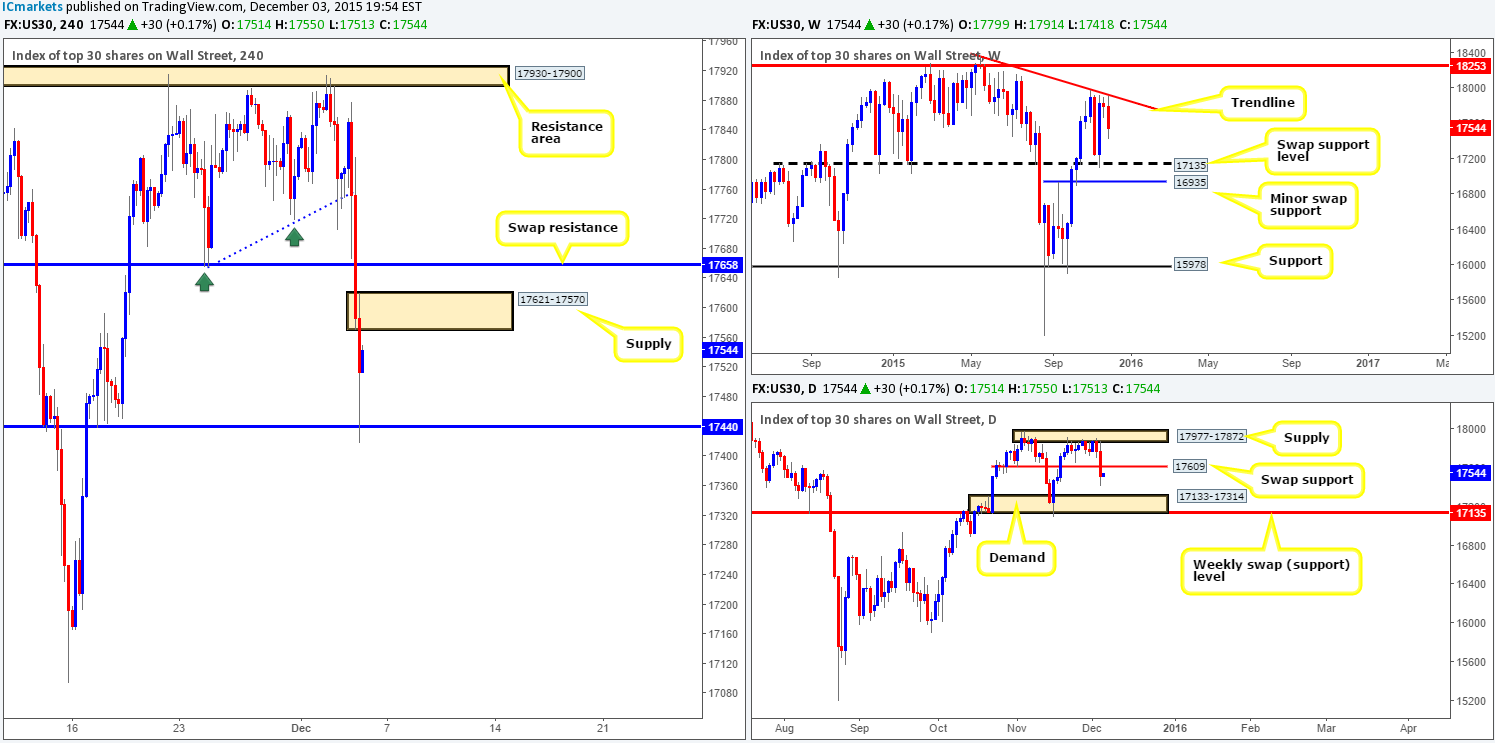

DOW 30 (Trade update: Final 20% of our short position taken from 17895 was closed out at 17638 yesterday)

Following the brief correction from the H4 trendline support extended from the low 17655, the DOW snowballed south yesterday. This, as you can see, wiped out H4 swap support (now resistance) at 17658 and connected with H4 support coming in at 17440 by the day’s end.

Given the response seen from this current support and the fact that we see H4 supply looming just above at 17621-17570, where do we go from here? Well, over on the weekly chart, we can see that there’s room to continue driving lower towards swap support at 17135. What is more, daily action recently closed below a swap support (now resistance) at 17609, thus potentially opening the gates for prices to challenge demand drawn from 17133-17314 (sits directly on top of the aforementioned weekly swap [support] level).

Therefore, with the higher timeframes suggesting further downside could be on the cards, the H4 supply mentioned above at 17621-17570, followed by the swap resistance above it at 17658 are our potential reversal zones listed for today. Waiting for lower timeframe confirmation at both areas is recommended since there is a high probability a fakeout will take place here. Furthermore, trading either area is considered extremely risky during the NFP release today with or without confirmation!

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells:17621-17570 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area). 17658 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

XAU/USD: (Gold)

During the course of yesterday’s sessions Gold recovered amid U.S. dollar weakness, consequently pushing up to the H4 channel resistance taken from the high 1098.0. Directly above this line, however, sits a strong-looking H4 supply area seen at 1066.0-1070.4 (surrounds a daily swap [resistance] level at 1068.8), which if hit today, could repel this market. Although this supply, coupled with the daily swap resistance, is beginning to shape up nicely, we mustn’t forget that above this area lurks a broken weekly Quasimodo level at 1074.6, which could tempt well-funded traders to fake higher! Therefore, for us to be permitted to short here, we’d need to see lower timeframe resistances hold firm and stabilize prices.

In view of the above, technically, our team is biased to short-side of this market for the time being. Despite this, traders may also want to keep in mind that it’s NFP day today and usually, at least for us anyway, our technicals do not stand up to well against the brute force usually seen from this news release. That being the case, we will stand down during such time and only trade the above said H4 area pre/post NFP. Good luck today traders!

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells:1066.0-1070.4 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).