How Does Forex Trading Work?

Forex trading is similar to trading share or futures except that when trading forex you are buying or selling one currency against another. One of the key advantage forex trading has over other financial instruments is that relatively small lot sizes can be traded, lot sizes can be as small as 1000 units or one micro lot. Typically forex trading also involves leverage which in some cases can be as high as 1:500, this is very different to trading shares where no leverage is involved. Leverage allows traders to trade with more money than they actually have in their trading account, For example if you had 1:100 leverage you could use a $1,000 deposit to control $100,000 worth of currency. Using leverage can result in an increase in you gains however if not used correctly if can also result in increased losses.

Forex Pricing

Every currency pair consists of a base currency and a term/quoted currency.

The first currency in the pair is the base currency, the second is the quote or term currency.

As an example with the EURUSD currency pair

EUR = Base currency

USD = Term currency

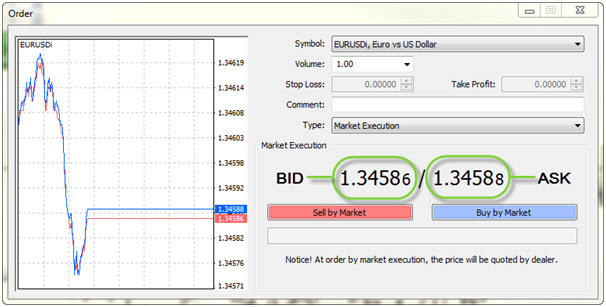

Bid: the rate at which you can sell the base currency. This is the first rate on the deal ticket below (1.34586).

Ask (or offer): The rate at which you can buy the base currency. This is the second rate on the deal ticket and can be found on the right (1.34588).

Spreads

The spread of a currency pair is the difference between the bid and the ask rate.

IC Markets offers some of the tightest spreads of all Forex brokers globally, our EURUSD spread which can be seen on the deal ticket above is currently the lowest global average spread.

| Currency Pair | Minimum Spread (pips) | Average Spread (pips) |

|---|---|---|

| EUR/USD | 0.0 | 0.1 |

| GBP/USD | 0.0 | 0.5 |

| AUD/USD | 0.0 | 0.4 |

| USD/CAD | 0.0 | 0.6 |

| USD/CHF | 0.0 | 0.4 |

| USD/JPY | 0.0 |

0.3 |

Pips

A pip represents the smallest increment that an exchange rate can move. One pip is 0.01 for currency pairs with JPY as the term currency and 0.0001 for all other pairs. IC Markets offers fractional pip pricing which represents a tenth of a pip. This is to improve the spread offered to clients and improve the precision with which they can trade.

Margins

Margin is the amount of money required in your account in order to open a position. Margin is calculated based on the current price of the base currency against USD, the size (volume) of the position and the leverage applied to your trading account. If you do not have sufficient free equity available you will be unable to open a position on the trading platform. The free margin amount shown in the trading platform is the amount you have available to use should you wish to open additional positions.

Margin is calculated using the following formula:

Margin required = (current market price x Volume) / Account leverage

In practice this would be calculated as follows:

If open a position of 0.1 (10000) in EUR/USD at the current market price of 1.35645 and your account has a leverage of 1:400 you would calculated the margin required as follows:

(1.35645 x 10000) / 400 = $33.91

In this example the margin on this position would be $33.91, therefore in order to open a positions of this size you would require at least $33.91 in free margin in your trading account.

Forex Trading Example

Selling EUR/USD

Opening the Position

The price of the EURO against the US Dollar (EUR/USD) is 1.33623/1.33624, you decide to sell 2 standard lots (the equivalent of €200,000) at 1.33623.

The value of your position is €200,000 x 1.33623 = USD $267,246. The leverage on your trading account is 1:100 therefore the margin required to open the position is USD $267,246 / 100 = USD $2,672.46.

Closing the Position

One week later the EURO has fallen against the US Dollar to 1.32128/1.32129, you decide to take your profit by buying back 2 standard lots at 1.32129.

The gross profit on your trade is calculated as follows:

| Calculation | |

|---|---|

| Opening Price | €200,000 x 1.33623 = USD $267,246 |

| Closing Price | €200,000 x 1.32129 = USD $264,259 |

| Gross Profit on Trade | USD $ 2,988 |